U.S. Dollar Higher Ahead Of Nonfarm Payrolls Data

08 Julio 2022 - 1:49AM

RTTF2

The U.S. dollar climbed against its most major rivals in the

European session on Friday, ahead of the nonfarm payrolls data that

is expected to support the likelihood of another 75 basis point

rate hike later this month.

Market participants are expecting employment to rise by 268,000

jobs in June, down from a gain of 390,000 jobs in May.

The unemployment rate is forecast to stay unchanged at 3.6

percent.

Money markets are assigning a 94 percent possibility for a rate

hike of 75 basis points at the Fed meeting due on July 26-27.

Governor Christopher Waller and St. Louis Fed President James

Bullard said on Thursday that they would prefer another 75

basis-point interest rate increase later this month but played down

recessionary fears.

The greenback was up at 1.0072 against the euro, its strongest

level since December 2, 2002. Against the franc, it approached a

fresh 3-week high of 0.9797. The greenback may face resistance

around 0.97 against the euro and 0.995 against the franc.

The greenback rebounded to 1.1920 against the pound, after

hitting a 3-day low of 1.2056 at 9:10 pm ET. The greenback is seen

challenging resistance around the 1.17 level.

The greenback rose to 0.6142 against the kiwi, 1.3025 against

the loonie and 0.6802 against the aussie, off its previous low of

0.6193, 3-day lows of 1.2953 and 0.6861, respectively. Next likely

resistance for the greenback is seen around 0.60 against the kiwi,

1.32 against the loonie and 0.67 against the aussie.

In contrast, the greenback held steady against the yen,

following a 2-day low of 135.32 it reached at 11 pm ET. The pair

was worth 135.97 at yesterday's close.

Looking ahead, U.S. and Canadian jobs data for June and U.S.

wholesale inventories and consumer credit for May will be out in

the New York session.

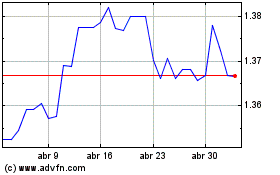

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024