U.S. Dollar Higher As Fed Minutes Indicate More Rate Hikes

17 Agosto 2022 - 11:35PM

RTTF2

The U.S. dollar was higher against its major counterparts in the

Asian session on Thursday, after the minutes of the Federal

Reserve's latest policy meeting showed that the central bank is

prepared to continue raising interest rates in the coming months,

but indicated a slowdown in the pace of hikes "at some point."

The minutes from the Fed's July meeting showed that rates would

remain higher for longer in order to tame inflation.

Fed officials observed that inflation remained unacceptably high

and there was little evidence that it would recede yet.

Participants believed that it would be necessary to move to a

"restrictive stance of policy" due to inflation remaining well

above the Fed's objective.

Asian stock markets are mostly lower, tracking a sell-off on

Wall Street overnight, even as the Fed minutes signalled a less

aggressive rate-hike stance amid risks to the outlook.

The greenback edged up to 135.43 against the yen and 0.9541

against the franc, up from its early lows of 134.74 and 0.9498,

respectively. The greenback is seen finding resistance around 136.5

against the yen and 0.98 against the franc.

The greenback touched 1.1994 against the pound, its highest

level since July 26. The currency is likely to challenge resistance

around the 1.18 level.

Against the euro, the greenback was up at 1.0146. On the upside,

0.99 is likely seen as its next resistance level.

The greenback firmed to 10-day highs of 1.2947 against the

loonie, 0.6899 against the aussie and 0.6247 against the kiwi,

rebounding from its previous lows of 1.2908, 0.6951 and 0.6287,

respectively. The next possible resistance for the greenback is

seen around 1.32 against the loonie, 0.66 against the aussie and

0.60 against the kiwi.

Looking ahead, Eurozone final inflation data for July will be

published in the European session.

U.S. weekly jobless claims for the week ended August 13, Canada

industrial product and raw materials price indexes, as well as U.S.

existing home sales and leading index, all for July, are due out in

the New York session.

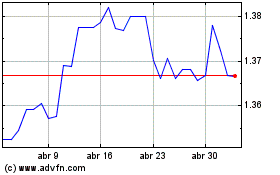

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024