TIDM88E

RNS Number : 0355I

88 Energy Limited

12 April 2022

This announcement contains inside information

12 April 2022

88 Energy Limited

Project Longhorn - Texas Oil and Gas Production Update

Highlights

-- Project Longhorn production in excess of 400 BOE per day

gross (approx. 70% oil) at end of March.

-- Over 30% increase in production rates since the acquisition completed in mid-February 2022.

-- Successful completion of first planned capital-efficient work-over in March.

-- Second work-over currently underway and a third to be executed immediately thereafter.

-- 88 Energy benefiting from recent increases to oil price,

further strengthening the cash returns from the high-margin oil

production within the Project Longhorn portfolio.

-- First cash distribution received in March (approx. A$0.6 million net of OPEX / CAPEX).

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) ( 88 Energy or

the Company ) is pleased to provide an update on operations at its

recently acquired Project Longhorn conventional oil and gas

production assets in the proven Permian Basin, onshore Texas, U.S.

88 Energy has a circa 73% average net working interest in these

established production assets, which have independently certified

net 2P reserves of 2.05 MMBOE.

In March 2022, the Operator of the Longhorn production assets,

Lonestar I, LLC , successfully completed the first of a series of

capital-efficient work-overs planned after the completion of the

Longhorn acquisition. This work-over was completed on time and on

budget and has delivered an immediate increase to the total oil and

gas production rates of the project.

Production from the Longhorn wells exceeded 400 BOE per day

gross (over 300 BOE per day net and approx. 70% oil) at the end of

March 2022. This represents an increase of over 30% since the

completion of the acquisition in mid-February 2022. The production

increase provides additional direct exposure to the higher WTI oil

price environment and accelerates pay-back on both the acquisition

of the assets and the capital investment in the work-overs.

Project Longhorn has exceptionally low operating costs (lifting

costs), which provides high margins from production. First cash

receipts from Project Longhorn were received by 88 Energy in March

2022, which comprised a payment of approximately A$0.6 million (net

to 88 Energy and net of OPEX/CAPEX).

Project Longhorn remains on track to complete the targeted seven

capital development activities this year, which is expected to

approximately double current production rates by the end of

CY2022.

The acquisition of Project Longhorn in Q1 CY2022 represents 88

Energy's first move into producing oil and gas assets and is in

line with the Company's strategy to build a successful exploration

and production company. This initial step has been undertaken in a

measured fashion via the purchase of a non-operated working

interest with a single basin focus. Project Longhorn contains well

understood geology with low technical risk and provides near-term

upside via low-cost field development opportunities.

88 Energy Managing Director and CEO, Ashley Gilbert,

commented:

"88 Energy is pleased with the production performance at Project

Longhorn, especially in this high oil price environment. We are

also highly encouraged by the successful delivery by the Operator

of the first planned work-over, as well as the continued progress

of the agreed capital development program for 2022. This program is

expected to result in strong cash flow outcomes and further direct

exposure to the current high energy prices."

"88 Energy is in a solid financial position, with zero debt and

a healthy cash balance that is expected to be further strengthened

with projected cash flows from Project Longhorn's Texas production

assets."

Project Longhorn - conventional onshore oil and gas in Texas

88 Energy acquired the Project Longhorn assets in February 2022.

Longhorn is located in the attractive and proven Permian Basin, and

consists of a total landholding exceeding 1,300 net acres. The

assets comprise 9 leases with 32 producing wells and associated

infrastructure. Lonestar I, LLC retains an approximate 24% net

working interest in the assets and, through an affiliate will

remain Operator. The remaining working interests are retained by

pre-existing joint venture partners.

As part of the acquisition, 88 Energy has agreed to a low-cost

work program for CY2022 that includes seven work-overs. These

initiatives are expected to approximately double production rates

by the end of CY2022.

The acquisition of a working interest in Project Longhorn

delivers 88 Energy immediate cashflow, as well as further low-cost

capital development upside providing appealing forecast

economics:

-- Gross capital development activities costing: from US$0.7

million to US$1.4 million depending on the type of drilling or

work-over performed.

-- Target development IRRs: 75% to 400% depending on the type of drilling or work-over performed.

-- Target capital expenditure payback: 7-18 months depending on

the type of drilling and completion performed and future oil

prices.

-- Target break-even WTI oil price: US$21/bbl - US$28/bbl

depending on the type of drilling or work-over performed.

Gross (100%) and Net Entitlement Reserves to 88 Energy (73%

average net working interest) have been independently assessed by

Odin Reservoir Consultants Pty Ltd as at 31 December 2021 as

follows:

Table 1: Project Longhorn Reserves (barrels of oil equivalent;

millions)

1P 2P 3P 1P 2P 3P

====== ====== ====== ===== ===== =====

2.78 3.46 4.00 1.64 2.05 2.33

====== ====== ====== ===== ===== =====

Further information related to these Reserves is provided in

Appendix 1 of the announcement notified by the Company on 21

February 2022.

Reserves Cautionary Statement

Oil and gas reserves and resource estimates are expressions of

judgment based on knowledge, experience and industry practice.

Estimates that were valid when originally calculated may alter

significantly when new information or techniques become available.

Additionally, by their very nature, reserve and resource estimates

are imprecise and depend to some extent on interpretations, which

may prove to be inaccurate. As further information becomes

available through additional drilling and analysis, the estimates

are likely to change. This may result in alterations to development

and production plans which may, in turn, adversely impact the

Company's operations. Reserves estimates and estimates of future

net revenues are, by nature, forward looking statements and subject

to the same risks as other forward-looking statements.

A image showing the Project Longhorn location can be viewed in

the pdf version of this announcement, which is available on the

Company's website www.88energy.com :

Media and Investor Relations:

88 Energy Ltd

Ashley Gilbert, Managing Director

Tel: +61 8 9485 0990

Email:investor-relations@88energy.com

Finlay Thomson, Investor Relations Tel: +44 7976 248471

Fivemark Partners , Investor and Tel: +61 410 276 744

Media Relations Tel: +61 422 602 720

Andrew Edge / Michael Vaughan

EurozHartleys Ltd Tel: +61 8 9268 2829

Dale Bryan

Cenkos Securities Tel: +44 131 220 6939

Neil McDonald / Derrick Lee

Glossary

Bbl = barrels Mbo/Mbbl = thousand barrels of

Bcf = billion cubic feet oil

Bcfg = billion cubic feet of gas MMbo/MMbbl = million barrels of

Boe = barrels of oil equivalent oil

Bopd = barrels of oil per day Mboe = thousand barrels of oil

Btu = British Thermal Units equivalent

mcfg = thousand cubic of gas MMboe = million barrels of oil

mmcfg = million cubic feet of equivalent

gas Mcf = thousand cubic feet

mcfgpd = thousand cubic feet of MMcf = million cubic feet

gas per day mmbtu = million British Thermal

mmcf = million cubic feet Units

psi = pounds per square inch

UoM = unit of measure

WTI = West Texas Intermediate

crude oil price, quoted in US$

per barrel

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDZZGMDGMNGZZZ

(END) Dow Jones Newswires

April 12, 2022 02:01 ET (06:01 GMT)

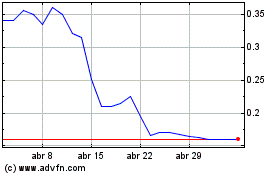

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024