TIDM88E

RNS Number : 4950V

88 Energy Limited

10 August 2022

This announcement contains inside information

10 August 2022

88 Energy Limited

Half Year Financials Release

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) ( 88 Energy or

the Company ) is pleased to advise of the release of its financial

results for the half-year ending 30 June 2022.

A copy of the Company's Interim Report, extracts from which are

set out below, has been lodged on the ASX and is also available on

the Company's website at www.88energy.com .

Media and Investor Relations:

88 Energy Ltd

Ashley Gilbert, Managing Director

Tel: +61 8 9485 0990

Email:investor-relations@88energy.com

Finlay Thomson , Investor Relations Tel: +44 7976 248471

Fivemark Partners , Investor and Tel: +61 410 276 744

Media Relations Tel: +61 422 602 720

Andrew Edge / Michael Vaughan

EurozHartleys Ltd Tel: +61 8 9268 2829

Dale Bryan

Cenkos Securities Tel: +44 131 220 6939

Neil McDonald / Derrick Lee

OPERATING AND FINANCIAL REVIEW

During the period, the Group has continued its principal

exploration activities in Alaska and in February 2022 acquired a

73% non - operated working interest in production assets located in

the Texas Permian Basin through the 75% investment in Bighorn

Energy LLC.

Project Icewine

88 Energy progressed further studies and analysis across the

Icewine East acreage, which included completing the mapping of the

Shelf Margin Delta (SMD), Slope Fan Set (SFS) and Basin Floor Fan

(BFF) play fairways onto the Project Icewine East acreage. In May

2022, the Company announced that Jordan & Pay completed an

independent evaluation of the play fairways, utilising available

well information from presentations publicly released by

neighbouring project proponent, Pantheon Resources plc (AIM:PANR)

(Pantheon). This was coupled with internal Company data (including

Icewine-1 and Icewine-2 well logs and existing 2D seismic) and

concluded that all Pantheon reservoir units (SMD, SFS, BFF)

extended onto the Project Icewine acreage.

The Company also commissioned an in-depth petrophysical

re-evaluation of Icewine-1 and the broader Icewine East area by

independent petrophysical consultants (Stimulation Petrophysics

Consulting, LLC and Snowfall Energy LLC). The consultants focussed

on assessing Icewine-1 logs against intervals that flowed oil in

Pantheon's acreage to the north. Pleasingly, a comparison of the

tested interval in Alkaid-1 against a similar interval in Icewine-1

indicated favourable potential for a flow test of the same zone in

the Icewine East acreage.

Pantheon's wells - Alkaid-1, Talitha-A and Theta West-1 - all

flowed 35 to 40 API oil from multiple Brookian reservoirs.

Pantheon's testing has confirmed reservoir deliverability of light,

sweet oil (see Pantheon releases of 7 February and 21 February

2022), which 88 Energy believes is positive for the prospectivity

of the adjacent Project Icewine acreage. Data from the Talitha-A

and Theta West-1 wells are not yet publicly available and as a

result, only a qualitative comparison of these logs against

Icewine-1 logs have been carried out to date.

Given the favourable petrophysical comparison between Icewine-1

and Alkaid-1, the Company is optimistic that a production test in

the Icewine East acreage could potentially yield a similar or

better result than seen during the testing of Alkaid-1. The Company

also notes Pantheon's announcement of 7 July 2022 that it has

spudded a horizontal production well in Alkaid, named Alkaid#2, to

prove up the development concept (see also Pantheon release of 24

January 2022 and Figure 2).

At the end of June, the Company signed a licensing agreement

with SAE for the use of SAE's Franklin Bluffs 3D seismic survey

data (FB3D). The FB3D seismic data was acquired in 2015 by SAE and

covers approximately 86 square miles, predominantly over the

Icewine East acreage. More importantly, the FB3D extends across an

area where the SMD, SFS and BFF play fairways have been

independently mapped on the Icewine East acreage.

The FB3D data will assist the Company with carrying out its

forthcoming analysis, including Amplitude-variation-with-offset

analysis ( AVO analysis ) and simultaneous seismic inversion. These

studies will aid the Company in defining 'sweet spots' for each

play and determining optimal drilling locations for future

exploration and appraisal wells.

88 Energy's initial license fee included US$2.0 in cash and

US$1.0 million in fully paid new ordinary shares in 88 Energy

(approximately 181 million shares at an issue price of A$0.008 per

share, being the closing price of 88 Energy shares on the ASX on 24

June 2022).

Other activities that the Company undertook in 2022 include:

-- Finalised the maiden Project Icewine East prospective resource estimate in August 2022.

-- Planning operations for 2023, which are targeted to include

an exploration well to be drilled in the Icewine East acreage, and

at least one flow test from the multiple Brookian reservoirs that

have been mapped on the Icewine East acreage. These are the same

reservoirs that nearby Pantheon wells - Alkaid-1, Talitha-A and

Theta West-1 - have flowed 35 to 40 API oil.

Project Peregrine

The Merlin-2 well was designed to appraise the N20, N19 and N18

horizons which were encountered in the Merlin-1 well drilled in

2021. The well was spudded on 7th Match 2022 and reached Total

Depth (TD) of 7,334 feet on 22nd March 2022. All three Nanushuk

targets (N20, N19 and N18) were penetrated during drilling, with

Logging While Drilling (LWD) data and physical cuttings collected

throughout the Merlin-2 program. Observations of LWD logs and drill

cuttings collected during drilling revealed target intervals were

thicker than those encountered in Merlin-1. Plugging, abandonment

and demobilisation of the Merlin-2 well was completed in April

2022

The results of Merlin-2 were largely consistent with the

Merlin-1 exploration well drilled in 2021. Strong fluorescence, oil

sheen, petroliferous odour and cut noted in the drilling cuttings,

elevated C2-C5 mud gas readings over the target zones with total

gas significantly above background gas readings and also evidence

from the reservoir sampling tool of moveable hydrocarbons.

Both Merlin wells were drilled on sparse, vintage 2D seismic

data, which provides a narrow field of view of the reservoir and

limited optionality on drilling locations. 88 Energy will assess

the merits of a future 3D seismic acquisition program or an in-fill

2D program in order to define optimal play fairways and determine

the potential commerciality of the Project Peregrine acreage. The

Company has commenced detailed analysis of all data obtained from

the Merlin-2 drilling program and will evaluate potential future

appraisal activities within the Project Peregrine acreage, which

include independent drilling locations such as the Harrier-1

prospect to test the N14 and N15 horizons.

The Company also commenced an independent NPRA basin modelling

study to further improve 88 Energy's understanding of the

geological history and how it pertains to the Nanushuk reservoir

quality across Project Peregrine. Coupled with petrographic studies

of Merlin side-wall cores, the modelling will utilise available

maximum Brookian uplift / erosion and burial depth data to produce

qualitative reservoir risk maps of the Nanushuk Formation which,

will help inform how the Project Peregrine reservoir quality varies

Northward, away from the Merlin-1 and 2 locations. This study is

anticipated to be completed by Q3, 2022.

Yukon Leases

The Yukon Leases contain the 82 million barrel(1) Cascade

Prospect, which was intersected peripherally by Yukon Gold-1 and

classified as a historic oil discovery.

The Company continues to complete due diligence and commercial

assessment of a joint development with near-by resource owners.

Umiat Oil Field (100% WI)

In Q1 2021, 88 Energy acquired the Umiat Oil Field. As part of

the acquisition, the Company received the Umiat data pack which

includes Umiat 3D seismic data. The Umiat 3D survey abuts the

southern edge of the Project Peregrine lease blocks. Integrating

the Linc/Malamute seismic interpretation has provided a better

understanding of the Peregrine reservoir geometries to the north as

well as enriching the Company's petrophysical database with

additional well control (Umiat-8 and Umiat-23H).

Internal reinterpretation of modern 3D seismic is suggestive of

untested reservoirs at Umiat. Prospects have been mapped in the

footwall of the Umiat structure as well as downdip from the proven

oil zone in the hanging wall. Initial internal volumetric

calculations suggest there may be multi-million barrels of

potentially recoverable oil combined in the hanging wall and

footwall. Both prospects are deeper than the current reserves at

Umiat which the Company expects will have a positive impact on

producibility.

Initial development studies, focusing on the potential

integration of Ultra Low Sulphur Diesel (ULSD) production, suggests

that this development option adds further value to a future Umiat

development, considering the high cost of diesel (US$6-7/gal) on

the North Slope of Alaska.

A separate Umiat-23H well performance review concluded that this

well significantly underperformed due to poor drilling and

completion techniques. This well was drilled in 2014 by a previous

owner and flowed at a sustained rate of 200 BOPD with no water, and

a maximum rate of 800 BOPD. Further review of the historical data

includes a more conventional trajectory and completion design for a

5,000ft horizontal section that was modelled to produce at

stabilised rates of between 800 and 1,600 BOPD. The Company

believes an opportunity exists for the optimisation of historic

subsurface development plans.

During the period, the Company commenced discussions with an

Alaskan drilling operator regarding use of a new light weight rig

and optimised operations to drill a cost-effective exploration well

designed to unlock further upside in Umiat.

Project Longhorn (73% WI)

On 21 February 2022, 88 Energy executed a binding Securities

Purchase Agreement (SPA) for the acquisition of a 73% average net

working interest in established conventional oil and gas production

assets in the proven Permian Basin, onshore Texas, U.S. The oil and

gas assets, collectively known as Project Longhorn contain

certified net 2P reserves of 2.05MMBOE. The purchase price for the

acquisition was US$9.7M, consisting of US$7.2M cash and US$2.5M in

88 Energy shares (98.1 million shares at an issue price of A$0.035

per share).

The acquisition represents the Company's first move into

producing oil and gas assets and is in line with Company's strategy

to build a successful oil and gas exploration and production

Company. The Project Longhorn assets are in the attractive Permian

Basin, with 1,300 net acres and well understood geology with low

technical risk. The assets purchase consisted of 9 leases with 32

producing wells and associated infrastructure. Most of the existing

production wells have been in operation for several years. Lonestar

I, LLC retained a 24% net working interest in the assets and,

through an affiliate, remained as Operator, with the remaining

working interests retained by existing Joint Venture partners.

The Company has been pleased with the progress at Project

Longhorn as Lonestar has successfully completed the first three of

seven planned capital-efficient work-overs scheduled in 2022. These

were completed on time and on budget and have delivered a

significant increase to the total oil and gas production rates of

Project Longhorn. Following the three completed workovers, daily

production from the Longhorn wells is anticipated to settle at

around 500 BOE per day gross (over 365 BOE per day net, of which

approximately 70% is oil) in Q3 2022, which represents an overall

output increase of 70% since the completion of the acquisition in

mid-February 2022. The production increase provides additional

direct exposure to the higher WTI oil and gas price environment and

accelerates payback on both the acquisition of the assets and the

capital investment in the work-overs. During the period to date,

the Company has received A$1.9M of cash flow distributions from

Project Longhorn.

Given the success of the initial three work-overs this year, as

well as the continued high oil and gas price environment, in June

2022, the joint venture participants agreed to accelerate the

capital development program and the completion of the remaining

four planned work-overs this year. As part of this agreement, 88

Energy has agreed to part fund its share of the anticipated US$3.5

million (net) in development capital through the issuance of US$3.0

million in 88 Energy shares (approximately 544 million shares at an

issue price of A$0.008 per share, being the closing price of 88

Energy shares on the ASX on 24 June 2022) to Lonestar, to fund

Longhorn's working capital contributions.

Project Longhorn is now scheduled to complete the targeted seven

capital development activities earlier than planned during Q4

2022.

Table 1: Project Longhorn Reserves (barrels of oil equivalent;

millions)

GROSS RESERVES NET 88 ENERGY REVENUE ENTITLEMENT

1P 2P 3P 1P 2P 3P

----- ----- ------------ ----------- -----------

2.78 3.46 4.00 1.64 2.05 2.33

----- ----- ------------ ----------- -----------

Corporate

On 19 January 2022, the Company advised that its application to

join the OTCQB Market in the United States had been accepted and

the Company's shares were listed for trading under the code EEENF.

The OTCQB Venture Market is for entrepreneurial and development

stage US and international companies and 88 Energy sought OTCQB

quotation to provide North American investors with enhanced

accessibility and liquidity in trading the Company's shares. The

quotation delivered 88 Energy access to one of the largest

investment markets in the world at relatively nominal cost

(compared to traditional major exchanges) and with practically no

additional compliance requirements. The OTCQB Market has robust

financial reporting and corporate governance regulations which are

effectively satisfied by the Company, through its ongoing

compliance with ASX Listing rules and AIM rules.

On 14 February 2022, the Company advised that it had

successfully completed an oversubscribed bookbuild to domestic and

international institutional investors to raise A$32.1M before costs

(the Placement). This was achieved through the issue of 918,650,793

fully paid ordinary shares in the Company at an issue price of

A$0.035 (equivalent to GBP0.018) per New Ordinary Share. The funds

raised under the Placement, together with the Company's existing

cash reserves were used to fund the Merlin-2 well drilling and

appraisal activities including cost overruns, as well as new

venture portfolio expansion opportunities, and working capital.

Merlin-2, like many other global projects, experienced cost

pressures including COVID-19 supply chain issues, labour

constraints and global commodity price increases (diesel, steel

etc.) that placed pressure on original budgeted costs. Euroz

Hartleys Limited acted as Sole Lead Manager and Sole Bookrunner to

the Placement. Cenkos Securities Plc acted as 88 Energy's Nominated

Adviser and Sole Broker to the Placement in the United Kingdom.

Inyati Capital Pty Ltd (Inyati) acted as Co-Manager to the

Placement. Commission for the Placement was 6% (plus GST) of total

funds raised across Euroz Harleys Limited, Inyati Capital Pty Ltd

and Cenkos Securities Plc. In addition, the Company issued

36,000,000 Unlisted Options (exercisable at $0.06 on or before the

date which is 3 years from the date of issue) to the managers of

the Placement.

Financial

For the period ended 30 June 2022 the Company recorded a loss of

$67.3 million (30 June 2021: $445,446 profit). The loss was largely

attributable to the impairment of the Merlin 1 and Merlin 2 wells

of $67.62 million.

No dividends were paid or declared by the Company during the

period.

As at 30 June 2022, the Group had cash on hand of $10.5 million

(31 December 2021: $32.31 million) and no debt. Net assets totalled

A$119 million (31 December 2021: $139.84 million). The decline in

net assets is largely due to impairment of exploration &

evaluation assets and also the decrease in cash on hand with cash

being used primarily to fund the Merlin 2 activities. The

investment in Bighorn Energy increased Net Assets to the amount of

A$22.1 million.

Events after the period

Other than as disclosed below, there were no significant events

occurring after balance date requiring disclosure.

The Company announced its maiden, independently certified

prospective resource estimate for Project Icewine East. The total

prospective resource was estimated at 1.03 billion barrels of oil

by Lee Keeling & Associates, Inc (LAK) with substantial oil

volumes noted across all mapped play fairways, in particular the

Seabee - Lower Basin Floor (BFF) and the Shelf Margin Delta (SMB

reservoirs). LKA are an independent US based expert petroleum and

engineering consulting firm who have significant and recent

experience in providing resource estimates globally as well as more

specifically in Alaska. The initial total prospective resource

follows a period of review of an extensive data set that included

seismic data, well logs from Icewine-1 and nearby wells adjacent to

the Icewine East acreage, recent petrophysical analysis and

mapping.

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE HALF YEARED 30 JUNE 2022

Note

30 June 30 June

2022 2021

$ $

Revenue and other income 3(a) 3,921 4,331,646

Share of profit/(loss) from equity accounted

investment 8(b) 3,437,184 -

Administration expenses 3(b) (1,779,839) (1,794,435)

Occupancy expenses (26,073) (37,408)

Employee benefit expenses 3(c) (1,177,132) (704,958)

Share based payment expense 3(d) (487,739) (153,747)

Depreciation and amortisation expense (29,416) (55,606)

Finance cost (4,308) (1,160,411)

Realised/unrealised gain/(loss) on foreign

exchange 394,343 (11,295)

Other income /(expenses) (7,608) 31,660

Exploration & Evaluation Impairment 3(e) (67,623,823)

--------------- ------------

Profit/(loss) before income tax (67,300,490) 445,446

Income tax benefit/(expense) - -

--------------- ------------

Net profit/(loss) attributable to members

of the parent (67,300,490) 445,446

=============== ============

Other comprehensive income for the period

Other comprehensive income that may be recycled

to profit or loss in subsequent periods:

Exchange differences on translation of foreign

operations 4,816,795 2,061,695

--------------- ------------

Total comprehensive profit/(loss) for the

period (62,483,695) 2,507,141

=============== ============

Basic and diluted profit/(loss) per share (0.004) 0.00003

The consolidated statement of profit or loss and other

comprehensive income should be read in conjunction with the

accompanying notes.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2022

Note

30 June 31 December

2022 2021

$ $

ASSETS

Current Assets

Cash and cash equivalents 5 10,469,843 32,317,887

Other receivables 6 1,009,487 935,930

Other Current Asset - 10,224,959

------------- -------------

Total Current Assets 11,479,330 43,478,776

============= =============

Non-Current Assets

Plant and equipment 11,664 9,675

Exploration and evaluation expenditure 7 90,081,683 101,357,767

Other assets 953,179 936,536

Equity accounted investments 8 (a) 22,151,413 -

------------- -------------

Total Non-Current Assets 113,197,939 102,303,978

------------- -------------

TOTAL ASSETS 124,677,269 145,782,754

============= =============

LIABILITIES

Current Liabilities

Provisions 188,518 146,270

Trade and other payables 9 5,061,518 5,796,350

------------- -------------

Total Current Liabilities 5,250,036 5,942,620

------------- -------------

TOTAL LIABILITIES 5,250,036 5,942,620

============= =============

NET ASSETS 119,427,233 139,840,134

============= =============

EQUITY

Issued and fully paid shares 10(a) 327,142,111 285,809,214

Reserves 10(b) 28,628,936 23,074,244

Accumulated losses (236,343,814) (169,043,324)

------------- -------------

TOTAL EQUITY 119,427,233 139,840,134

============= =============

The consolidated statement of financial position should be read

in conjunction with the accompanying notes.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE HALF YEAR ENDED 30 JUNE 2022

Issued Reserves Accumulated Total

and fully losses equity

paid shares $ $ $

$

Balance at 1 January 2021 208,963,513 16,580,975 (166,633,135) 58,911,353

Profit for the period - - 445,446 445,446

Other comprehensive income - 2,061,695 - 2,061,695

------------- ----------- -------------- -------------

Total comprehensive profit

for the period, net of tax - 2,061,695 445,446 2,507,141

Shares issued during the

period 33,683,839 - - 33,683,839

Equity raising costs (791,025) - - (791,025)

Share based payments - 153,747 - 153,747

------------- ----------- -------------- -------------

Balance at 30 June 2021 241,856,327 18,796,417 (166,187,690) 94,465,054

------------- ----------- -------------- -------------

Balance at 1 January 2022 285,809,214 23,074,244 (169,043,324) 139,840,134

Loss for the period - - (67,300,490) (67,300,490)

Other comprehensive income - 4,816,795 - 4,816,795

------------- ----------- -------------- -------------

Total comprehensive loss

for the period, net of tax - 4,816,795 (67,300,490) (62,483,695)

Shares issued during the

period 43,624,106 - - 43,624,106

Equity raising costs (2,041,051) - - (2,041,015)

Share based payments and

options valuation (250,158) 737,897 - 487,739

------------- ----------- -------------- -------------

Balance at 30 June 2022 327,142,111 28,628,936 (236,343,814) 119,427,233

------------- ----------- -------------- -------------

The consolidated statement of changes in equity should be read

in conjunction with the accompanying notes.

CONSOLIDATED STATEMENT OF CASH FLOW

FOR THE HALF YEAR ENDED 30 JUNE 2022

30 June 30 June

2022 2021

$ $

Cash flows from operating activities

Interest 2,481 -

Interest Paid - (1,052,616)

Payments to suppliers and employees (3,081,727) (2,364,182)

Net cash outflows used in operating activities (3,079,246) (3,416,798)

------------ ------------

Cash flows from investing activities

Payments for equity accounted investments (10,693,565) -

Payments for exploration and evaluation activities (41,556,424) (31,218,286)

Contributions from JV Partners in relation to

Exploration 831,275 13,675,903

Payments for bonds - (387,270)

Proceeds sale of tax credits - 24,233,263

Distribution from Equity Accounted Investments 1,920,935 -

------------ ------------

Net cash inflows / (outflows) used in investing

activities (49,497,779) 6,303,610

------------ ------------

Cash flows from financing activities

Proceeds from issue of shares 32,152,778 18,557,500

Share issue costs (2,151,520) (884,143)

Payment of borrowings - (20,909,692)

------------ ------------

Net cash inflows/(outflows) from financing activities 30,001,258 (3,236,335)

------------ ------------

Net increase/(decrease) in cash and cash equivalents (22,575,768) (349,523)

Net foreign exchange differences 727,724 266,675

Cash and cash equivalents at beginning of period 32,317,887 14,845,347

------------ ------------

Cash and cash equivalents at end of period 10,469,843 14,762,499

------------ ------------

The consolidated statement of cash flows should be read in

conjunction with the accompanying notes.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKKBBQBKKKFD

(END) Dow Jones Newswires

August 10, 2022 02:00 ET (06:00 GMT)

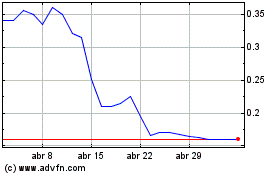

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024