TIDM88E

RNS Number : 8914W

88 Energy Limited

23 August 2022

23 August 2022

88 Energy Limited

Project Icewine East Prospective Resource Estimate

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) ( 88 Energy or

the Company ) in compliance with ASX Listing Rules provides the

following update in relation to the Prospective Resource estimate

for Project Icewine East, as previously announced by 88 Energy on

10 August 2022 ("Icewine East Update"). Please refer to the Icewine

East Update for information on Project Icewine East Prospective

Resource estimates.

Following the Icewine East Update, 88 Energy now has two

separate independent Prospective resource estimates for Project

Icewine, as follows;

-- Project Icewine East: prepared by Lee Keeling and Associates; and

-- Project Icewine West: prepared by ERCE Equipoise Pte Ltd

which was announced by the Company on 10 November 2020 ("Icewine

West Update"). Please refer to the Icewine West Update for further

details on the resource estimates for Project Icewine West.

The two independent prospective resource estimates cover

separate and independently mapped resources.

Prospective Resources Estimate - Icewine East

The assessed maiden gross and net Prospective Resource estimates

associated with 88 Energy's Icewine East acreage (75% net working

interest) are summarised below.

Icewine East: Alaska North Unrisked Gross Prospective Oil Resources

Slope (MMstb) (4,5)

Prospects (Probabilistic Low (1U) Best (2U) High (3U) Mean COS

Method) (3)

----------

Shelf Margin Delta (SMD A,

B & C) 70 224 518 231 81%

========== ========== ========== ====== =====

Slope Fan Set (SFS) 37 134 345 141 50%

============================ ========== ========== ========== ====== =====

Basin Floor Fan (BFF) 119 543 1,480 569 50%

============================ ========== ========== ========== ====== =====

Kuparuk (KUP) 39 88 156 89 72%

============================ ========== ========== ========== ====== =====

1,030

Prospects Total 265 988 2,499 (2)

---------------------------- ---------- ---------- ---------- ------ -----

Icewine East: Alaska North Unrisked Net Entitlement to 88E (1) Prospective

Slope Oil Resources (MMstb) (4,5)

Prospects (Probabilistic Low (1U) Best (2U) High (3U) Mean COS

Method) (3)

-----------

Shelf Margin Delta (SMD A,

B & C) 44 140 326 145 81%

=========== ============ =========== ========= =====

Slope Fan Set (SFS) 24 84 217 89 50%

============================ =========== ============ =========== ========= =====

Basin Floor Fan (BFF) 75 341 930 358 50%

============================ =========== ============ =========== ========= =====

Kuparuk (KUP) 24 56 98 56 72%

============================ =========== ============ =========== ========= =====

Prospects Total 167 621 1,570 647 (2)

---------------------------- ----------- ------------ ----------- --------- -----

1. 88 Energy net resources have been calculated using a 75.227%

working interest and a 16.5% royalty.

2. The unrisked means, which have been arithmetically summed,

are not representative of expected total from the prospects and

implies a success case in all reservoir intervals. 88 Energy

cautions that the arithmetically summed 1U estimate may be a

conservative estimate and the arithmetically summed 3U estimate may

be optimistic when compared to a statistical aggregation of

probability distributions.

3. COS represents the geological chance of success as assessed

by 88 Energy and reviewed and endorsed by LKA.

4. Prospects are subject to a phase risk (oil vs gas). Chance of

oil has been assessed as 100% for all targets except for the

Kuparuk Formation which has been assessed as 70%. Phase risk has

not been applied to the unrisked numbers.

5. The Prospective Resources have not been adjusted for the

chance of development. Quantifying the chance of development (COD)

requires consideration of both economic and other contingencies,

such as legal, regulatory, market access, political, social

license, internal and external approvals and commitment to project

finance and development timing. As many of these factors are

outside the knowledge of LKA they must be used with caution.

Cautionary Statement: The estimated quantities of petroleum that

may potentially be recovered by the application of a future

development project(s) relate to undiscovered accumulations. These

estimates have both an associated risk of discovery and a risk of

development. Further exploration appraisal and evaluation is

required to determine the existence of a significant quantity of

potentially recoverable hydrocarbons.

The data used to compile the independent prospective resource

report includes reprocessed 2D seismic data, basin modelling,

petrophysical analysis of publicly available wells and historical

geological records. The data was compiled and interpreted by 88E

and was reviewed, validated and in some cases modified

independently by LKA.

LKA's methodology for determining Prospective Resources for

Project Peregrine

LKA has determined Prospective Resources by examining the areas

of consistent bright amplitude that were mapped by independent

consultants to 88E, Jordan and Pay, using the reprocessed 2D

seismic data within the Icewine East area. Parameters including

potential pool area and thickness, porosity, hydrocarbon

saturation, oil expansion and recovery factor were estimated on a

probabilistic low, mid and high basis. The Prospective Resources

distributions were then aggregated into four (4) prospects, on the

basis that one (1) well could effectively test all the mapped

prospective intervals. The unrisked prospective resources estimates

(and associated geological chance of success) were modelled using

Monte-Carlo analysis on the assumption there was no economic

minimum and that volumes and risks of each of the prospective

intervals within each prospect were independent.

The Prospective Resources have not been adjusted for phase risk

or chance of development. 88 Energy and LKA have considered the

chance of discovering oil over gas to be 100% for all targets

except for the Kuparuk Formation which was assessed to be 70%.

Chance of development has not been estimated.

Please refer to the disclaimers attached as Schedule 1 of this

ASX release for more information on the prospective resource

report.

About LKA

LKA is a U.S. based independently owned petroleum Reserves and

Resources auditor and engineering consultants, providing expert

consultancy services to the upstream oil and gas industry since

1957. LKA technical staff include a wide range of professionally

qualified engineers and geologists, who provide geoscience,

reservoir, facilities and cost engineering and economic/commercial

expertise in conventional and unconventional projects. Examples of

current clients are noted on their website (

https://www.lkaengineers.com/clients/ ) and include independent oil

and gas operators, international, state and federal government

agencies, bank and financial institutions, as well as legal and

accounting firms.

This announcement has been authorised by the Board.

Media and Investor Relations:

88 Energy Ltd

Ashley Gilbert, Managing Director

Tel: +61 8 9485 0990

Email:investor-relations@88energy.com

Fivemark Partners , Investor and Media Relations

Michael Vaughan Tel: +61 422 602 720

EurozHartleys Ltd

Dale Bryan Tel: + 61 8 9268 2829

Cenkos Securities

Neil McDonald / Derrick Lee Tel: + 44 131 220 6939

Pursuant to the requirements of the ASX Listing Rules Chapter 5

and the AIM Rules for Companies, the technical information and

resource reporting contained in this announcement was prepared by,

or under the supervision of, Dr Stephen Staley, who is a

Non-Executive Director of the Company. Dr Staley has more than 35

years' experience in the petroleum industry, is a Fellow of the

Geological Society of London, and a qualified

Geologist/Geophysicist who has sufficient experience that is

relevant to the style and nature of the oil prospects under

consideration and to the activities discussed in this document. Dr

Staley has reviewed the information and supporting documentation

referred to in this announcement and considers the resource and

reserve estimates to be fairly represented and consents to its

release in the form and context in which it appears. His academic

qualifications and industry memberships appear on the Company's

website and both comply with the criteria for "Competence" under

clause 3.1 of the Valmin Code 2015. Terminology and standards

adopted by the Society of Petroleum Engineers "Petroleum Resources

Management System" have been applied in producing this

document.

SCHEDULE 1

Disclaimers:

Cautionary Statement for Prospective Resource Estimates - With

respect to the Prospective Resource estimates contained within this

report, it should be noted that the estimated quantities of gas

that may potentially be recovered by the future application of a

development project relate to undiscovered accumulations. These

estimates have an associated risk of discovery and risk of

development. Further exploration and appraisal is required to

determine the existence of a significant quantity of potentially

moveable hydrocarbons.

Hydrocarbon Resource Estimates - The Prospective Resource

estimates for Project Icewine East presented in this report are

prepared as at 9 August 2022. The Prospective Resource estimates

are quoted on an unrisked basis together with the geological chance

of success for each prospect. The unrisked mean total presented in

the table is not representative of the expected total from the 4

prospects and assumes a success case in all reservoir intervals. 88

Energy and LKA have considered the chance of discovering oil over

gas to be 100% for all targets except for the Kuparuk Formation

which was assessed to be 70%. Chance of development has not been

estimated. Quantifying the chance of development (COD) requires

consideration of both economic contingencies and other

contingencies, such as legal, regulatory, market access, political,

social license, internal and external approvals and commitment to

project finance and development timing. As many of these factors

are outside the knowledge of LKA they must be used with

caution.

Government Royalty and Overriding Royalty Interests - The

Project Icewine East leases ("Leases") are situated in the State

Lands of the North Slope of Alaska and are administered by the

Alaskan Department of Natural Resources - Oil and Gas Division

(DNR). All leases issued by DNR are subject to a royalty and 88E's

Leases are subject to a 12.5% government royalty. In addition, the

Leases are subject to an overriding royalty of 4.0% payable to

non-related parties of the Company. The net economic interest to

88E has therefore been calculated as 62.81% and the Net Entitlement

Prospective Resources have been adjusted to reflect this.

Competent Person Statement Information - In this report

information relating to hydrocarbon resource estimates have been

supplied by LKA, and the company has stated in the Report that it

has been prepared in accordance with the definitions and guidelines

set forth in the Petroleum Resources Management System, 2018,

approved by the Society of Petroleum Engineers and have been

prepared using probabilistic methods. Lee Keeling & Associates,

Inc., the independent resource reviewer named in this document, has

consented to the inclusion of information relevant to their review

in the form and context in which it appears. Dr Stephen Staley, who

is a Non-Executive Director of the Company, has more than 37 years'

experience in the petroleum industry, is a Fellow of the Geological

Society of London, and a qualified Geologist/Geophysicist who has

sufficient experience that is relevant to the style and nature of

the oil prospects under consideration and to the activities

discussed in this document. Dr Staley has reviewed the information

and supporting documentation referred to in this announcement and

considers the prospective resource estimates to be fairly

represented and consents to its release in the form and context in

which it appears. His academic qualifications and industry

memberships appear on the Company's website and both comply with

the criteria for "Competence" under clause 3.1 of the Valmin Code

2015. Terminology and standards adopted by the Society of Petroleum

Engineers "Petroleum Resources Management System" have been applied

in producing this document.

Forward looking statements - This document may include forward

looking statements. Forward looking statements include, are not

necessarily limited to, statements concerning 88E's planned

operation program and other statements that are not historic facts.

When used in this document, the words such as "could", "plan",

"estimate", "expect", "intend", "may", "potential", "should" and

similar expressions are forward looking statements. Although 88E

believes the expectations reflected in these are reasonable, such

statements involve risks and uncertainties, and no assurance can be

given that actual results will be consistent with these

forward-looking statements. The entity confirms that it is not

aware of any new information or data that materially affects the

information included in this announcement and that all material

assumptions and technical parameters underpinning this announcement

continue to apply and have not materially changed.

SCHEDULE 2

Definitions and Glossary of Key Terms:

SPE definition: Prospective Resource

Prospective resources are estimated volumes associated with

undiscovered accumulations. These represent quantities of petroleum

which are estimated, as of a given date, to be potentially

recoverable from oil and gas deposits identified on the basis of

indirect evidence but which have not yet been drilled. This class

represents a higher risk than contingent resources since the risk

of discovery is also added. For prospective resources to become

classified as contingent resources, hydrocarbons must be

discovered, the accumulations must be further evaluated and an

estimate of quantities that would be recoverable under appropriate

development project(s) prepared.

Glossary of Key Terms

1U Denotes the unrisked low estimate qualifying

as Prospective Resources.

2U Denotes the unrisked best estimate qualifying

as Prospective Resources

-------------------------------------------------

3U Denotes the unrisked high estimate qualifying

as Prospective Resources

-------------------------------------------------

BOE Barrels of oil equivalent

-------------------------------------------------

Bnbbl Billion barrels of oil

-------------------------------------------------

Chance Chance equals 1-risk. Generally synonymous

with likelihood.

-------------------------------------------------

Chance of Development The estimated probability that a known

accumulation, once discovered, will be

commercially developed.

-------------------------------------------------

Entitlement That portion of future production (and

thus resources) legally accruing to an

entity under the terms of the development

and production contract or license.

-------------------------------------------------

Mean The sum of a set of numerical values

divided by the number of values in the

set.

-------------------------------------------------

MMbbl Million barrels of oil

-------------------------------------------------

Prospect A project associated with a potential

accumulation that is sufficiently well

defined to represent a viable drilling

target.

-------------------------------------------------

Prospective Resources Those quantities of petroleum that are

estimated, as of a given date, to be

potentially recoverable from undiscovered

accumulations.

-------------------------------------------------

Reservoir A subsurface rock formation that contains

an individual and separate natural accumulation

of petroleum that is confined by impermeable

barriers, pressure systems, or fluid

regimes (conventional reservoirs), or

is confined by hydraulic fracture barriers

or fluid regimes (unconventional reservoirs).

-------------------------------------------------

Royalty A type of entitlement interest in a resource

that is free and clear of the costs and

expenses of development and production

to the royalty interest owner. A royalty

is commonly retained by a resources owner

(lessor/host) when granting rights to

a producer (lessee/contractor) to develop

and produce that resource. Depending

on the specific terms defining the royalty,

the payment obligation may be expressed

in monetary terms as a portion of the

proceeds of production or as a right

to take a portion of production in-kind.

The royalty terms may also provide the

option to switch between forms of payment

at discretion of the royalty owner

-------------------------------------------------

Working Interest An entity's equity interest in a project

before reduction for royalties or production

share owed to others under the applicable

fiscal terms.

-------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCZZGZRKFRGZZG

(END) Dow Jones Newswires

August 23, 2022 02:00 ET (06:00 GMT)

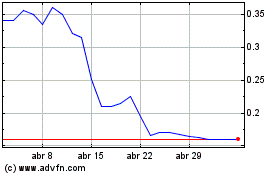

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024