TIDM88E

RNS Number : 4234X

88 Energy Limited

26 April 2023

QUARTERLY ACTIVITIES REPORT

For the quarter ended 31 March 2023

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) (88 Energy or

the Company) provides the following report for the quarter ended 31

March 2023.

Highlights

Project Phoenix (75% WI)

-- Hickory-1 exploration well spudded on 9 March 2023 and was

drilled to Total Depth (TD) of 10,650 feet with completion of a

succesful wireline and coring program. Initial summary of results

include:

Ø Initial petrophysical interpretation confirmed presence of

multiple hydrocarbon-bearing pay zones across all pre-drill

targets

Ø New Upper SFS reservoir identified, not previously intersected

by nearby wells and with abundant oil shows in cuttings

Ø Estimated net pay calculated from wireline data of

approximately 450 feet over all pay zones

Ø Total porosity across all pay zones averaged 9-12%, including

key zones identified for potential testing in the Upper and Lower

SFS with 11-16% total porosity

Ø Pre-drill expectations met or exceeded:

ü Reservoir quality (higher porosity in SFS and BFF)

ü Thickness (higher total gross and net reservoir, higher total

net pay)

-- Formation of the Toolik River Unit over the western and

central zones of Project Phoenix lease area was approved by the the

Alaskan Department of Natural Resources

-- Subsequent to quarter end, activities in relation to Hickory-1:

Ø Hickory-1 was cased and suspended with planning for 2023/2024

winter season flow testing commencing as well as post-well analysis

of cores and wireline data

Ø All samples have been transported to labs for further

investigation and analysis.

Ø Nordic Calista Rig-2 has been demobilised with operations

completed on budget.

Project Leonis (100% WI)

-- Subsequent to quarter end, the adjudication process was

completed and formal award notices issued to 88 Energy by the

Alaskan Department of Natural Resources (DNR) covering the entire

Project Leonis lease area

-- Integrated petrophysical and seismic study underway including

reprocessing of Storms 3D data

Project Longhorn (73% WI)

-- Production over the quarter averaged 425 BOE per day gross (72% oil)

-- Quarterly cash flow distribution of A$0.3M received in March

2023 which was net of final CAPEX payments for the two workovers

completed in Q4 2022

Corporate

-- Share placement completed on 6 February 2023, raising gross proceeds of A$17.5M

-- Cash balance of A$26.3M and zero debt (as at 31 March 2023)

Project Phoenix (75% WI)

Project Phoenix is focused on the oil-bearing conventional

reservoirs identified during the drilling and logging of Icewine-1

and recently flow tested by Pantheon Resources. Project Phoenix is

strategically located on the Dalton Highway as seen on the image

adjacent, with the Trans-Alaskan Pipeline System running through

the acreage.

Figure 1: Project Phoenix' Hickory-1 well adjacent to Dalton

Highway

Hickory-1 Exploration Well

The Hickory-1 well was designed to appraise up to six

conventional reservoirs within the SMD, SFS, BFF and KUP plays,

targeting pre-well estimated 647 million barrels of oil(1) .

Hickory-1 spud on 9 March 2023, was drilled to a Total Depth

(TD) of 10,650 feet and, after quarter end, successfully completed

the wireline and coring program to achieve all primary and

secondary target pre-drill objectives:

ü Validated the presence of multiple hydrocarbon-bearing zones

accross all pre-drill targets;

ü Obtained data to optimally design and plan a targeted flow

test of Hickory-1 next season; and

ü In addtion, new Upper SFS Reservoir was identified with oil

shows in cuttings and core.

Wireline program results:

Ø Pre-drill expectations were met or exceeded:

-- Reservoir quality (higher porosity in SFS and BFF); and

-- Thickness (higher total gross and net reservoir and higher total net pay);

Ø Estimated gross pay of over 2,000 feet;

Ø Calculated net pay of approximately 450 feet over all zones;

and

Ø Average total porosity across all pay zones of 9-12%,

including key zones identified for potential testing in the SFS and

Upper SFS with porosity of 11-16%.

Figure 2: SWC sample retrieved from Hickory-1 showing

fluorescence

Subsequent to quarter end, Hickory-1 exploration well operations

concluded for the current winter season. Hickory-1 was cased and

suspended in mid-April 2023 in preparation for undertaking the

planned flow test program in the 2023/2024 winter season and Nordic

Calista Rig-2 was demobilised after a successful drilling campaign.

The first phase of Hickory-1, the drilling and wireline program has

met or exceeded the Company's targeted pre-drill outcomes and was

completed on budget.

The Company will undertake a detailed evaluation of all data

obtained from the Hickory-1 drilling and wireline program to

optimally plan and design Phase 2, the flow test of up to 4

reservoirs. Initial planning suggests a 'work-over' rig will be

required to complete these operations with discussions underway to

secure a rig for the 2023/24 season. The Company will provide

further analysis and updates, as well as details of the flow

testing program, when this information is available over the coming

months.

Cautionary Statement: The estimated quantities of petroleum that

may be potentially recovered by the application of a future

development project relate to undiscovered accumulations. These

estimates have both an associated risk of discovery and a risk of

development. Further exploration, appraisal and evaluation are

required to determine the existence of a significant quantity of

potentially movable hydrocarbons .

1. Mean unrisked resource - Net Entitlement to 88 Energy. Refer

announcement released to ASX on 23 August 2022

Toolik River Unit Approval

On 7 December 2022, 88 Energy announced that the Project Phoenix

Joint Venture ("JV") had put forward a Unit application covering

leases within the Project Phoenix acreage area. Following

consideration of the Unit application, the DNR confirmed its

decision to approve the formation of the Toolik River Unit covering

leases in the western and central areas of Project Phoenix (refer

to 88E ASX announcement dated 28 February 2023). The Unit approval

has extended those leases beyond their primary term, with the Unit

Plan of Exploration through to February 2028. Unitisation provides

an efficient, integrated approach to exploration, delineation, and

development of the numerous identified and potential

reservoirs.

Project Leonis (100% WI)

On 9 November 2022, 88 Energy's wholly-owned subsidiary,

Captivate Energy Alaska, Inc. ( Captivate ), was declared the

highest bidder for select acreage offered as part of the North

Slope Areawide 2022 Oil and Gas lease sale. The Company's new

acreage will be known as Project Leonis (the Project ) comprising

ten leases covering approximately 25,430 contiguous acres.

Figure 3: New Acreage awarded, named Project Leonis in relation

to exiting 88E acreage

After quarter end, the DNR, Oil and Gas Division, completed its

adjudication process and formally issued award notices to Captivate

covering the entire Project Leonis lease area. The Project is

superbly located adjacent to TAPS, the Dalton Highway, and close to

services at Deadhorse and Prudhoe Bay, enhancing future potential

development and commercialisation.

The Project Leonis lease area is fully covered by the Storms 3D

seismic data suite and contains the exploration well, Hemi Springs

Unit #3 (drilled by ARCO in 1985). Historical drilling targeted the

deep Kuparuk and Ivishak reservoirs, the main producing intervals

in the giant northern fields at that time. Review of the Hemi

Springs Unit #3 well indicated over 200 feet (net) of low

resistivity bypassed log pay within the USB reservoir, with good

porosity and oil shows observed across the zone. Nearby oil fields

- Orion, Polaris, West Sak and Milne Point - readily demonstrate

successful development of the USB reservoir.

Integrated petrophysical and seismic study has commenced

including reprocessing of Storms 3D data.

Project Peregrine (100% WI)

In March 2023, 88 Energy completed a strategic review of the

Project Peregrine acreage and made the decision to relinquish six

blocks that were considered to have limited prospectivity,

providing an annual saving of approximately A$320,000.

The Project Peregrine resources are split across 3 prospects:

Merlin (Nanushuk Topset), Harrier (Nanushuk Topsets) and Harrier

Deep (Torok Bottomsets). The focus at Project Peregrine moving

forward will be on the untested Harrier prospect (N14 and N15

targets) and the N14 south reservoir target. The N14 corresponds

with ConocoPhillips' Harpoon prospect 15 miles to the north of the

Project Peregrine leases. The N14 south target is the remaining

target in the Merlin prospect and may be accessible from the

Merlin-1 location. The northern leases are modelled to have better

porosity and permeability and are closer to infrastructure.

An update to the Peregrine prospective resources is ongoing and

expected to be completed around mid-2023.

The Company is also currently assessing possible forward

work-programs, subject to potential farm-out.

Figure 4: Project Peregrine Acreage and proximity to Umiat

leases

Yukon (100% WI)

88 Energy is currently conducting a strategic review of the

prospectivity and commerciality of the Yukon acreage that sits on

the boundary of Federal and State lands, below Point Thomson. The

Yukon acreage is considered non-core within 88 Energy's Alaskan

portfolio, given the lower potential size of the resources,

relatively high cost to explore, and anticipated cost to develop.

The review will include an assessment of near-acreage opportunities

that are currently being considered by adjacent leaseholders.

Project Longhorn (73% WI)

Production from the Longhorn wells averaged 425 BOE per day

gross (72% oil) during the quarter, peaking at 620 BOE per day

gross.

Received a quarterly cash distribution from Project Longhorn in

March of A$0.3M, which was net of CAPEX payments for the two

workovers completed in Q4 2022.

Four workovers and at least five new drilling targets remain on

the acreage, with the forward work programme and timing for future

capital investments to be determined by the Joint Venture in Q2

2023.

Corporate

On 6 February 2023, 88 Energy successfully raised A$17.5M

(c.GBP10.1M) before costs from domestic and international

institutional and sophisticated investors (the Placement). This was

achieved through the issue of 1,842,105,263 fully paid ordinary

shares in the Company at an issue price of A$0.0095 (GBP0.0055) per

new ordinary share.

Funds raised under the Placement, coupled with existing cash

reserves, are for use towards Project Phoenix Hickory-1 exploration

well costs, Project Leonis acreage payment, portfolio expansion

opportunities and ongoing working capital and general and

administration overheads.

Euroz Hartleys Limited acted as Sole Lead Manager and Sole

Bookrunner to the Placement. Cenkos Securities Plc acted as 88

Energy's Nominated Adviser and Sole Broker to the Placement in the

United Kingdom. Inyati Capital Pty Ltd (Inyati) acted as Co-Manager

to the Placement. Commission for the Placement was 6% (plus GST) of

total funds raised across Euroz Hartleys Limited, Inyati Capital

Pty Ltd and Cenkos Securities Plc. In addition, the Company issued

75,000,000 Unlisted Options in total to the Placement managers

(exercisable at A$0.02 on or before the date which is 3 years from

the date of issue)

Finance

The ASX Appendix 5B attached to this quarterly report contains

the Company's cash flow statement for the quarter. The material

cash flows for the period were:

-- Exploration and evaluation expenditure of A$4.8M (December

2022 quarter: A$3.3M), primarily associated with the Hickory-1

exploration well.

o JV partners provided contributions of A$1.5M towards

Hickory-1.

-- Lease rental payments of A$0.6M, primarily related to renewal

of Project Peregrine leases.

-- Administration, staff, and other costs of A$1.5M.

o Including fees paid to Directors and consulting fees paid to

Directors of A$0.3M.

-- Project Longhorn quarterly cash distribution receipt of

A$0.3M, which included final CAPEX payments for the two workovers

completed in Q4 2022.

-- Refund of the Alaska State bond related to Merlin-2 of

A$0.6M.

At quarter end, the Company had cash reserves of A$26.3M and

zero debt (excluding typical trade creditors).

Information required by ASX Listing Rule 5.4.3

Project Name Location Interest Interest

Net at beginning at end

Area of Quarter of Quarter

(acres)

--------------

Onshore, North Slope

Project Phoenix Alaska 62,324 75% 75%

------------------- ------------------------ ---------- -------------- ------------

Project Icewine Onshore, North Slope

West Alaska 121,996 75% 75%

------------------- ------------------------ ---------- -------------- ------------

Onshore, North Slope

Project Peregrine Alaska (NPR-A) 125,735 100% 100%

------------------- ------------------------ ---------- -------------- ------------

Onshore, Permian Basin

Project Longhorn Texas 964 73% 73%

------------------- ------------------------ ---------- -------------- ------------

Onshore, North Slope

Project Leonis Alaska 25,431 100% 100%

------------------- ------------------------ ---------- -------------- ------------

Onshore, North Slope

Umiat Unit Alaska (NPR-A) 17,633 100% 100%

------------------- ------------------------ ---------- -------------- ------------

Onshore, North Slope

Yukon Leases Alaska 15,235 100% 100%

------------------- ------------------------ ---------- -------------- ------------

Pursuant to the requirements of the ASX Listing Rules Chapter 5

and the AIM Rules for Companies, the technical information and

resource reporting contained in this announcement was prepared by,

or under the supervision of, Dr Stephen Staley, who is a

Non-Executive Director of the Company. Dr Staley has more than 35

years' experience in the petroleum industry, is a Fellow of the

Geological Society of London, and a qualified Geologist /

Geophysicist who has sufficient experience that is relevant to the

style and nature of the oil prospects under consideration and to

the activities discussed in this document. Dr Staley has reviewed

the information and supporting documentation referred to in this

announcement and considers the prospective resource estimates to be

fairly represented and consents to its release in the form and

context in which it appears. His academic qualifications and

industry memberships appear on the Company's website and both

comply with the criteria for "Competence" under clause 3.1 of the

Valmin Code 2015. Terminology and standards adopted by the Society

of Petroleum Engineers "Petroleum Resources Management System" have

been applied in producing this document.

This announcement has been authorised by the Board.

Media and Investor Relations:

88 Energy Ltd

Ashley Gilbert, Managing Director

Tel: +61 8 9485 0990

Email:investor-relations@88energy.com

Fivemark Partners, Investor and

Media Relations

Michael Vaughan Tel: +61 422 602 720

EurozHartleys Ltd

Dale Bryan Tel: + 61 8 9268 2829

Cenkos Securities Plc Tel: +44 (0)20 7397 8900

Derrick Lee Tel: +44 (0)131 220 6939

Pearl Kellie Tel: +44 (0)131 220 9775

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

Name of entity

-----------------------------------------------------

88 Energy Limited

ABN Quarter ended ("current quarter")

--------------- ----------------------------------

80 072 964 179 31 March 2023

----------------------------------

Consolidated statement of cash Current quarter Year to date

flows (3 months)

$A'000 $A'000

1. Cash flows from operating

activities

1.1 Receipts from customers - -

1.2 Payments for

(a) exploration & evaluation - -

(b) development - -

(c) production - -

(d) staff costs (884) (884)

(e) administration and corporate

costs (573) (573)

1.3 Dividends received (see - -

note 3)

1.4 Interest received 17 17

1.5 Interest and other costs - -

of finance paid

1.6 Income taxes paid - -

1.7 Government grants and tax - -

incentives

1.8 Other - -

---------------- -------------

Net cash from / (used in)

1.9 operating activities (1,440) (1,440)

----------------- ------------------------------------ ---------------- -------------

2. Cash flows from investing

activities

2.1 Payments to acquire or for:

(a) entities - -

(b) tenements (602) (602)

(c) property, plant and - -

equipment

(d) exploration & evaluation (4,775) (4,775)

(e) investments - -

(f) other non-current assets - -

2.2 Proceeds from the disposal

of:

(a) entities - -

(b) tenements - -

(c) property, plant and - -

equipment

(d) investments - -

(e) other non-current assets - -

2.3 Cash flows from loans to - -

other entities

2.4 Dividends received (see - -

note 3)

2.5 Other - Joint Venture Contributions 1,462 1,462

Other - Distribution from

Project Longhorn 329 329

Other - Return of Bond 585 585

---------------- -------------

Net cash from / (used in)

2.6 investing activities (3,001) (3,001)

----------------- ------------------------------------ ---------------- -------------

3. Cash flows from financing

activities

Proceeds from issues of

equity securities (excluding

3.1 convertible debt securities) 17,500 17,500

3.2 Proceeds from issue of convertible - -

debt securities

3.3 Proceeds from exercise of - -

options

Transaction costs related

to issues of equity securities

3.4 or convertible debt securities (1,160) (1,160)

3.5 Proceeds from borrowings - -

3.6 Repayment of borrowings - -

3.7 Transaction costs related - -

to loans and borrowings

3.8 Dividends paid - -

3.9 Other (provide details if - -

material)

---------------- -------------

Net cash from / (used in)

3.10 financing activities 16,340 16,340

----------------- ------------------------------------ ---------------- -------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 14,123 14,123

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (1,440) (1,440)

Net cash from / (used in)

investing activities (item

4.3 2.6 above) (3,001) (3,001)

Net cash from / (used in)

financing activities (item

4.4 3.10 above) 16,340 16,340

Effect of movement in exchange

4.5 rates on cash held 288 288

---------------- -------------

Cash and cash equivalents

4.6 at end of period 26,310 26,310

----------------- ------------------------------------ ---------------- -------------

5. Reconciliation of cash and Current quarter Previous quarter

cash equivalents $A'000 $A'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 26,310 26,310

5.2 Call deposits - -

5.3 Bank overdrafts - -

5.4 Other (provide details) - -

---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 26,310 26,310

----------------- ----------------------------------- ---------------- -----------------

6. Payments to related parties of the entity Current quarter

and their associates $A'000

Aggregate amount of payments to related

parties and their associates included in

6.1 item 1 310

----------------

6.2 Aggregate amount of payments to related -

parties and their associates included in

item 2

----------------

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly

activity report must include a description of, and an explanation

for, such payments.

6.1 Payments relate to Director and consulting fees paid to

Directors. All transactions involving directors and associates were

on normal commercial terms.

7. Financing facilities Total facility Amount drawn

Note: the term "facility' amount at quarter at quarter end

includes all forms of financing end $US'000

arrangements available to $US'000

the entity.

Add notes as necessary for

an understanding of the sources

of finance available to the

entity.

7.1 Loan facilities - -

------------------- ----------------

7.2 Credit standby arrangements - -

------------------- ----------------

7.3 Other (please specify) - -

------------------- ----------------

7.4 Total financing facilities - -

------------------- ----------------

7.5 Unused financing facilities available at -

quarter end

----------------

7.6 Include in the box below a description of each facility

above, including the lender, interest rate, maturity date

and whether it is secured or unsecured. If any additional

financing facilities have been entered into or are proposed

to be entered into after quarter end, include a note providing

details of those facilities as well.

----------------- ------------------------------------------------------------------------

8. Estimated cash available for future operating $A'000

activities

Net cash from / (used in) operating activities

8.1 (item 1.9) (1,440)

8.2 (Payments for exploration & evaluation classified (4,775)

as investing activities) (item 2.1(d))

8.3 Total relevant outgoings (item 8.1 + item (6,215)

8.2)

8.4 Cash and cash equivalents at quarter end 26,310

(item 4.6)

8.5 Unused finance facilities available at quarter -

end (item 7.5)

--------

8.6 Total available funding (item 8.4 + item 26,310

8.5)

--------

Estimated quarters of funding available

8.7 (item 8.6 divided by item 8.3) 4.2

--------

Note: if the entity has reported positive relevant outgoings

(ie a net cash inflow) in item 8.3, answer item 8.7 as

"N/A". Otherwise, a figure for the estimated quarters

of funding available must be included in item 8.7.

8.8 If item 8.7 is less than 2 quarters, please provide answers

to the following questions:

8.8.1 Does the entity expect that it will continue to

have the current level of net operating cash flows for

the time being and, if not, why not?

-------------------------------------------------------------------

Answer:

-------------------------------------------------------------------

8.8.2 Has the entity taken any steps, or does it propose

to take any steps, to raise further cash to fund its operations

and, if so, what are those steps and how likely does it

believe that they will be successful?

-------------------------------------------------------------------

Answer:

-------------------------------------------------------------------

8.8.3 Does the entity expect to be able to continue its

operations and to meet its business objectives and, if

so, on what basis?

-------------------------------------------------------------------

Answer:

-------------------------------------------------------------------

Note: where item 8.7 is less than 2 quarters, all of

questions 8.8.1, 8.8.2 and 8.8.3 above must be answered.

----------------- -------------------------------------------------------------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 26 April 2023

Authorised by: By the Board

(Name of body or officer authorising release - see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity

report provide a basis for informing the market about the entity's

activities for the past quarter, how they have been financed and

the effect this has had on its cash position. An entity that wishes

to disclose additional information over and above the minimum

required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 6: Exploration for and Evaluation of

Mineral Resources and AASB 107: Statement of Cash Flows apply to

this report. If this quarterly cash flow report has been prepared

in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent

standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market

by your board of directors, you can insert here: "By the board". If

it has been authorised for release to the market by a committee of

your board of directors, you can insert here: "By the [name of

board committee - eg Audit and Risk Committee]". If it has been

authorised for release to the market by a disclosure committee, you

can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market

by your board of directors and you wish to hold yourself out as

complying with recommendation 4.2 of the ASX Corporate Governance

Council's Corporate Governance Principles and Recommendations, the

board should have received a declaration from its CEO and CFO that,

in their opinion, the financial records of the entity have been

properly maintained, that this report complies with the appropriate

accounting standards and gives a true and fair view of the cash

flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLUVASROSUSUAR

(END) Dow Jones Newswires

April 26, 2023 02:00 ET (06:00 GMT)

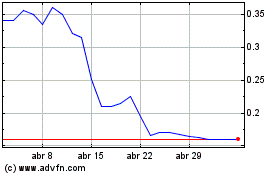

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024