TIDM88E

RNS Number : 1019Y

88 Energy Limited

02 May 2023

This announcement contains inside information

88 Energy Limited

AGM Voting Status and Letter to Shareholders

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) (88 Energy or

the Company) advises of the current status of proxy voting for its

upcoming Annual General Meeting (AGM) to be held on Thursday 11 May

2023.

As at 2 May 2023, the current tally of proxy votes received is

only 795 million shares, which represents less than 4% of the 88

Energy share register.

On the current proxy tally, Resolution 1 (Approval of

Remuneration Report) and Resolution 2 (Re--election of Ms Joanne

Kendrick as a Non-Executive Director) would both fail and

Resolution 6 (Conditional Spill Motion) would succeed. The

consequences if Resolution 1 fails and Resolution 6 succeeds is

that the Company will be required to call a Spill Meeting within 90

days with all Non-Executive Directors vacating their positions on

the 88 Energy Board and, if they choose to stand again, will be

considered for re-election at that Spill Meeting. The position of

the Managing Director will not be directly impacted by any Spill

Meeting.

The existing 88 Energy Board comprises four members, with three

having only been appointed since Q2 2021 (including the Managing

Director). Over the past two years, the new Board has moved to

reset the business and embark upon a markedly different strategy to

that under the previous 88 Energy team. This has delivered

significant positive change in the underlying fundamentals of 88

Energy including the capital allocation framework. For further

information please refer to the Letter to Shareholders below.

The conduct of a Spill Meeting, particularly if it results in a

significant change to the Board, has the potential to be highly

disruptive and impact on 88 Energy's ability to execute its

targeted medium-term work programs, including the flow testing of

Hickory-1. There is no guarantee that planned and communicated work

programs would be executed under a newly comprised Board. Existing

networks and relationships with key stakeholders are also likely to

be diminished as a result.

The Board believes that 88 Energy is poised for significant

potential success over the next 12 months. To not exercise your

right to vote as a shareholder leaves the direction of the Company

in the hands of a relatively small group of shareholders, which may

not be representative of the underlying majority view of all

shareholders.

The Board urges all shareholders to exercise their rights as a

shareholder and vote on the resolutions of the AGM. It is the

strong recommendation of the Board that shareholders vote FOR

Resolutions 1 to 5, and AGAINST Resolution 6.

Shareholders can access all relevant information and vote online

at www.investorvote.com.au using the 6-digit control number 182503

and provide your SRN/HIN and postcode or country of residence to

log in.

If you require further assistance, please contact Computershare

by calling +61 (03) 9415 4000 or 1300 850 505 (within

Australia).

Letter to Shareholders from the Non-Executive Chairman and

Managing Director

Dear Shareholders,

Approximately two years ago the 88 Energy business commenced a

significant reset, which included a significant overhaul of the

Board and senior management team. This renewal saw the appointment

of the two of us, Philip Byrne and Ashley Gilbert, to the roles of

Non-Executive Chairman (August 2021) and Managing Director/CEO (May

2021), respectively.

Joanne Kendrick was also appointed as a Non-Executive Director

in August 2021. Joanne is a petroleum engineer with over 25 years'

experience in the global oil and gas sector and a successful track

record of growing ASX companies to multiples of their previous

value at the executive level. We also strengthened our technical

teams including with the appointment of Robert Benkovic as Chief

Operating Officer (COO), who also brings over 25 years' experience

as a petroleum engineer.

This reset of the business has seen new thinking and a fresh

approach. This has resulted in diversification of the Company's

portfolio, including the acquisition of production assets, as well

as a sharper focus on basing investment decisions on the strongest

possible technical data analysis coupled with long-term commercial

achievability as a function of proximity to infrastructure and

services.

Under the stewardship of the refreshed team the key achievements

over the past 24 months include:

-- Balance sheet clean-up that saw the sale of Alaskan tax

credits facilitating the repayment of all debt (US$16.0 million) in

June 2021.

-- Acquisition of the Company's first ever production asset

which generated A$4.3 million in net cash flow during 2022.

-- Drilling of the Hickory-1 exploration well at Project Phoenix

in 2023. This is singularly the Company's most successful

exploration well ever, including over 400 feet in net pay. Up to

four zones are planned to be flow tested during the upcoming

Alaskan winter season (Q4 2023) and is a clear example of enhanced

outcomes from our more technically-driven strategy.

-- Reduction in drilling execution costs, with Hickory-1 being

our lowest cost exploration well ever despite broader inflationary

and supply pressures.

-- Unitisation of the Project Phoenix acreage, extending the

life of the leases by 10 years and enabling the Company to continue

to assess its commercial potential and monetise.

-- Fostered stronger relationships with key stakeholders

including the Alaskan government and regulatory bodies, as well as

our Alaskan O&G peers.

-- Diversified the Alaskan exploration portfolio with the

securing of the highly prospective Project Leonis acreage with

interpreted missed pay that is currently under assessment.

-- Reduction in non-operational overheads from A$7.2 million in

2021 to A$5.9 million in 2022 (net of impairments and foreign

exchange).

-- Invested in greater technical personnel and expertise, at a

relatively modest increase in salary costs from US$1.8m in 2020 to

US$2.3m in 2022.

-- Evolution with industry standards including implementation of

dedicated ESG programs , with carbon offsets, gender diversity,

implementation of stronger and externally advised remuneration

practices, and tightening of internal policies and governance

procedures.

The table below summarises the current position of the business

relative to that which existed around Q2 2021 when renewal to the

current Board composition commenced.

Focus area Q2 2021 Delivered by current

Board

-------------------------------------- ------------------ ---------------------

Balance sheet US$16.0m in debt No debt

-------------------------------------- ------------------ ---------------------

Production - cash inflows Nil A$4.3m in 2022

-------------------------------------- ------------------ ---------------------

Targeted, impactful & cost-effective Merlin-1: US$30m+ Hickory-1: US$13.5m

exploration gross

-------------------------------------- ------------------ ---------------------

Reduction in non-operational A$7.2m in 2021 A$5.9m in 2022

overheads

-------------------------------------- ------------------ ---------------------

Focus on technical data delivering Merlin-1 net pay Hickory-1 net pay

results of 41 ft of over 400 ft

-------------------------------------- ------------------ ---------------------

Planned flow tests None Up to 4 zones

-------------------------------------- ------------------ ---------------------

Active project areas 3 6

-------------------------------------- ------------------ ---------------------

ESG programs and policies None Implemented

-------------------------------------- ------------------ ---------------------

Tax credit value realisation Idle Sold for US$18.7m

-------------------------------------- ------------------ ---------------------

Alaskan 3D seismic database 650 sq km 1,585 sq km

-------------------------------------- ------------------ ---------------------

Improved technical decision Merlin-1 drilled Hickory-1 drilled

making on 2D on 3D

-------------------------------------- ------------------ ---------------------

Technical experience of Board 1 Board member 3 Board members

-------------------------------------- ------------------ ---------------------

We are the first to acknowledge that, even with these

achievements, it has not all been plain sailing. The historical

Project Peregrine drilling programs did not deliver the outcomes

hoped and we appreciate many shareholders were disappointed, as we

were.

However, we believe that the advancement and execution of the

Hickory-1 well over the last nine months best represents 88

Energy's strategic approach under the current team. We are very

excited about flow testing this well planned for Q4 CY2023 with

multiple primary and secondary target zones showing excellent

potential.

Finally, we want to again address the question of why we did not

seek to flow test Hickory-1 during the recently concluded Alaskan

field season. This decision was made, and communicated to

shareholders, during the planning phase of Hickory-1. It was made

in order to allow our technical team and advisors sufficient time

to analyse the well data as well as comprehensively design and

optimise the flow test program (both in terms of program cost and

objectives). Lessons learnt from other operators on the North Slope

suggest this decision, and underlying approach, is absolutely the

best one.

Our call to action prior to the upcoming AGM is to encourage you

to exercise your rights as a shareholder and vote on the

resolutions of the meeting. Shareholders can access all relevant

information and vote online at www.investorvote.com.au using the

6-digit control number 182503 and provide your SRN/HIN and postcode

or country of residence to log in.

If you require further assistance, please contact Computershare

by calling +61 (03) 9415 4000 or 1300 850 505 (within

Australia).

The recommendation of the 88 Energy Board is to vote FOR

Resolutions 1 to 5, and AGAINST Resolution 6.

We greatly appreciate your ongoing support and look forward to

the journey ahead.

Philip Byrne Ashley Gilbert

Non-Executive Chairman Managing Director and CEO

88 Energy Limited 88 Energy Limited

This announcement has been authorised by the Board.

Media and Investor Relations:

88 Energy Ltd

Ashley Gilbert, Managing Director

Tel: +61 8 9485 0990

Email:investor-relations@88energy.com

Finlay Thomson , Investor Relations Tel: +44 7976 248471

Fivemark Partners , Investor and Media Relations

Michael Vaughan Tel: +61 422 602 720

EurozHartleys Ltd

Dale Bryan Tel: + 61 8 9268 2829

Cenkos Securities Tel: + 44 131 220 6939

Neil McDonald / Derrick Lee

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUUAWRONUVRRR

(END) Dow Jones Newswires

May 02, 2023 04:20 ET (08:20 GMT)

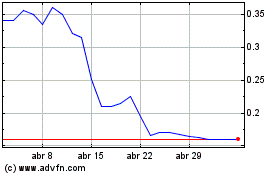

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024