Anglo American 1st Half Earnings Fall Less Than Expected

28 Julio 2022 - 2:14AM

Noticias Dow Jones

By Jaime Llinares Taboada

Anglo American PLC on Thursday reported lower earnings for the

first half of the year, but the results were better than expected

by analysts.

The multinational mining company generated underlying earnings

before interest, taxes, depreciation and amortization of $8.70

billion in the first half of 2022, down from $12.14 billion a year

earlier. This was above the Vuma market consensus of $8.56 billion,

based on 10 analysts' estimates.

Underlying earnings per share fell 28% to $3.11, also beating

the $2.86 consensus.

Net profit dropped 29% to $3.68 billion.

Anglo American declared an interim dividend of $1.24 a share,

down from last year when it paid an ordinary dividend of $1.71, a

special dividend of $0.80 and a share buyback of $0.80.

"Attributable free cash flow of $1.6 billion was driven largely

by strong prices in the first quarter that declined towards the end

of the period in tandem with increasing cost inflation," Chief

Executive Duncan Wanblad said.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

July 28, 2022 02:59 ET (06:59 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

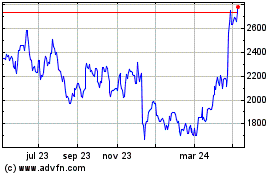

Anglo American (LSE:AAL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

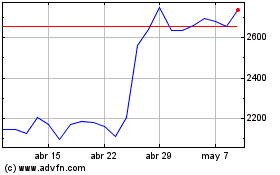

Anglo American (LSE:AAL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024