TIDMABDN

RNS Number : 3261V

abrdn PLC

09 August 2022

abrdn plc

Half year results 2022

Part 3 of 3

9 August 2022

5. Supplementary information

5.1 Alternative performance measures APM

We assess our performance using a variety of measures that are

not defined under IFRS and are therefore termed alternative

performance measures (APMs). The APMs that we use may not be

directly comparable with similarly named measures used by other

companies. We have presented below reconciliations from these APMs

to the most appropriate measure prepared in accordance with IFRS.

All APMs should be read together with the condensed consolidated

income statement, condensed consolidated statement of financial

position and condensed consolidated statement of cash flows, which

are presented in the Financial information section of this report

and related metrics. Adjusted operating profit excludes certain

items which are likely to be recurring such as restructuring costs,

amortisation of certain intangibles, dividends from significant

listed investments and the share of profit or loss from joint

ventures.

Definition Purpose

------------------------------------------------------------------ ---------------------

Adjusted operating profit APM

A d justed operating profit before tax is the Adjusted operating

Group's key APM. Adjusted operating profit includes profit has replaced

the results of the Group's three growth vectors: adjusted profit

Investments, Adviser and Personal, along with before

Corporate/strategic. tax as the Group's

It excludes the Group's adjusted net financing key APM. Adjusted

costs and investment return, and discontinued operating

operations. profit reporting

Adjusted operating profit also excludes the impact provides

of the following items: further analysis of

* Restructuring costs and corporate transaction the results reported

expenses. Restructuring includes the impact of major under IFRS and the

regulatory change. Directors believe it

helps to give

shareholders

* Amortisation and impairment of intangible assets a fuller

acquired in business combinations and through the understanding

purchase of customer contracts. of the performance

of the business by

identifying and

* Profit or loss arising on the disposal of a analysing

subsidiary, joint venture or equity accounted adjusting items.

associate. Segment reporting

used

in management

* Change in fair value of/dividends from significant information

listed investments. is reported to the

level of adjusted

operating

* Share of profit or loss from associates and joint profit.

ventures.

* Impairment loss/reversal of impairment loss

recognised on investments in associates and joint

ventures accounted for using the equity method.

* Fair value movements in contingent consideration.

* Items which are one-off and, due to their size or

nature, are not indicative of the long-term operating

performance of the Group.

Further details are included in Note 4.9 of the

Financial information section.

------------------------------------------------------------------ ---------------------

Fee based revenue APM

Fee based revenue includes revenue we generate Fee based revenue is

from asset management charges (AMCs), platform a component of

charges, treasury income and other transactional adjusted

charges. AMCs are earned on products such as mutual operating profit and

funds, and are calculated as a percentage fee provides the basis

based on the assets held. Investment risk on these for reporting of the

products rests principally with the client, with fee revenue yield

our major indirect exposure to rising or falling financial

markets coming from higher or lower AMCs. Fee ratio. Fee based

based revenue is shown net of costs of sale, such revenue

as commissions and similar charges. is also used to

calculate

the cost/income

ratio.

------------------------------------------------------------------ ---------------------

Adjusted operating expenses APM

Adjusted operating expenses is a component of Adjusted operating

adjusted operating profit and relates to the day-to-day expenses is a

expenses of managing our business. Adjusted operating component

expenses excludes restructuring and corporate of adjusted operating

transaction expenses. Adjusted operating expenses profit and is used

also excludes amortisation and impairment of intangible to calculate the

assets acquired in business combinations and through cost/income

the purchase of customer contracts. ratio.

------------------------------------------------------------------ ---------------------

Adjusted profit before tax APM

In addition to the results included in adjusted Adjusted profit

operating profit above, adjusted profit before

before tax includes adjusted net financing costs tax is a key input

and investment return. to the adjusted

earnings

per share measure.

------------------------------------------------------------------ ---------------------

Adjusted net financing costs and investment return

APM

Adjusted net financing costs and investment return Adjusted net

relates to the return from the net assets of the financing

shareholder business, net of costs of financing. costs and investment

This includes the net assets in defined benefit return is a component

staff pension plans and net assets relating to of adjusted profit

the financing of subordinated liabilities. before tax.

Cost/income ratio APM

This is an efficiency measure that is calculated This ratio is used

as adjusted operating expenses divided by fee by management to

based revenue in the period. assess

efficiency and

reported

to the Board and

executive

leadership team.

Fee revenue yield (bps) APM

The fee revenue yield is calculated as annualised The average revenue

fee based revenue (excluding performance fees, yield on fee based

interactive investor and revenue for which there business is a measure

are no attributable assets) divided by monthly that illustrates the

average fee based assets. interactive investor average margin being

is excluded from the calculation of Personal and earned on the assets

total fee revenue yield as fees charged for this that we manage,

business are primarily from subscriptions and administer

trading transactions. or advise our clients

on excluding

interactive

investor.

Adjusted diluted earnings per

share APM

Adjusted diluted earnings per share is calculated Earnings per share

on adjusted profit after tax. The weighted average is a commonly used

number of ordinary shares in issue is adjusted financial metric

during the period to assume the conversion of which

all dilutive potential ordinary shares, such as can be used to

share options granted to employees. measure

Details on the calculation of adjusted diluted the profitability and

earnings per share are set out in Note 4.8 of capital efficiency

the Financial information section. of a company over

time.

We also calculate

adjusted

diluted earnings per

share to illustrate

the impact of

adjusting

items on the metric.

This ratio is used

by management to

assess

performance and

reported

to the Board and

executive

leadership team.

Adjusted capital generation APM

Adjusted capital generation is part of the analysis This measure aims to

of movements in IFPR regulatory capital. Adjusted show how adjusted

capital generation is calculated as adjusted profit profit

after tax less returns relating to pension schemes contributes to

in surplus and interest paid on other equity, regulatory

which do not benefit regulatory capital. It also capital, and

includes dividends from associates, joint ventures therefore

and significant listed investments. provides insight into

our ability to

generate

capital that is

deployed

to support value for

shareholders.

------------------------------------------------------------------ ---------------------

Adjusted diluted capital generation

per share APM

This ratio is a

measure

Adjusted diluted capital generation per share used to assess

is calculated as adjusted capital generation divided performance

by the weighted average number of diluted ordinary for remuneration

shares outstanding. purposes.

------------------------------------------------------------------ ---------------------

Cash and liquid resources APM

Cash and liquid resources are IFRS cash and cash The purpose of this

equivalents (netted down for overdrafts), money measure is to

market instruments and holdings in money market demonstrate

funds. It also includes surplus cash that has how much cash and

been invested in liquid assets such as high quality invested

corporate bonds, gilts and pooled investment funds. assets we hold and

Seed capital and co-investments are excluded. can be readily

accessed.

------------------------------------------------------------------ ---------------------

5.1.1 Adjusted operating profit and adjusted profit

Reconciliation of adjusted operating profit and adjusted profit

to IFRS profit by component

The key components of adjusted operating profit are fee based

revenue and adjusted operating expenses. These components provide a

meaningful analysis of our adjusted results. The table below

provides a reconciliation of movements between adjusted operating

profit component measures and relevant IFRS terms. A reconciliation

of Fee based revenue to the IFRS item Revenue from contracts with

customers is provided in Note 4.4 of the Financial information

section.

Presentation Adjusting Adjusted

IFRS term IFRS differences items profit Adjusted profit term

H1 2022 GBPm GBPm GBPm GBPm

---------------------------- ----- ------------ --------- -------- ----------------------

Net operating revenue 696 - - 696 Fee based revenue

Total administrative Adjusted operating

and other expenses (706) (22) 147 (581) expenses(1)

---------------------------- ----- ------------ --------- -------- ----------------------

Adjusted operating

(10) (22) 147 115 profit

---------------------------- ----- ------------ --------- -------- ----------------------

Net gains or losses Adjusted net financing

on financial instruments costs and investment

and other income (298) 8 274 (16) return

Finance costs (15) 14 1 - N/A

Profit on disposal

of interests in associates 6 - (6) - N/A

Share of profit or

loss from associates

and joint ventures 6 - (6) - N/A

Impairment of interests

in associates (9) - 9 - N/A

Adjusted profit

Loss before tax (320) - 419 99 before tax

---------------------------- ----- ------------ --------- -------- ----------------------

Total tax expense 31 - (44) (13) Tax on adjusted profit

---------------------------- ----- ------------ --------- -------- ----------------------

Adjusted profit

Loss for the period (289) - 375 86 after tax

---------------------------- ----- ------------ --------- -------- ----------------------

1. Adjusted operating expenses includes staff and other related

costs of GBP303m compared with IFRS staff costs and other

employee-related costs of GBP266m. The difference primarily relates

to the inclusion of contractor, temporary agency staff and

recruitment and training costs of GBP14m (IFRS basis: Reported

within other administrative expenses) and losses on funds to hedge

deferred bonus awards of GBP8m (IFRS basis: Reported within other

net gains on financial instruments and other income) within staff

and other related costs. IFRS staff costs and other

employee-related costs includes the benefit from the net interest

credit relating to the staff pension schemes of GBP15m (Adjusted

profit basis: Reported within adjusted net financing costs and

investment return).

Presentation Adjusting Adjusted

IFRS term IFRS differences items profit Adjusted profit term

H1 2021 GBPm GBPm GBPm GBPm

---------------------------- ----- ------------ --------- -------- ----------------------

Net operating revenue 777 3 (25) 755 Fee based revenue

Total administrative Adjusted operating

and other expenses (759) (7) 171 (595) expenses

---------------------------- ----- ------------ --------- -------- ----------------------

Adjusted operating

18 (4) 146 160 profit

---------------------------- ----- ------------ --------- -------- ----------------------

Net gains or losses Adjusted net financing

on financial instruments costs and investment

and other income (9) (11) 23 3 return

Finance costs (15) 15 - - N/A

Profit on disposal

of subsidiaries and

other operations 84 - (84) - N/A

Profit on disposal

of interests in associates 68 - (68) - N/A

Share of profit or

loss from associates

and joint ventures (33) - 33 - N/A

Adjusted profit

Profit before tax 113 - 50 163 before tax

---------------------------- ----- ------------ --------- -------- ----------------------

Total tax expense (11) - (2) (13) Tax on adjusted profit

---------------------------- ----- ------------ --------- -------- ----------------------

Adjusted profit

Profit for the period 102 - 48 150 after tax

---------------------------- ----- ------------ --------- -------- ----------------------

Presentation differences primarily relate to amounts presented

in a different line item of the consolidated income statement.

5.1.2 Cost/income ratio

H1 2022 H1 2021

----------------------------------- -------- -------

Adjusted operating expenses (GBPm) (581) (595)

Fee based revenue (GBPm) 696 755

Cost/income ratio (%) 83 79

----------------------------------- -------- -------

5.1.3 Fee revenue yield (bps)

Average AUMA Fee based revenue Fee revenue yield

(GBPbn) (GBPm) (bps)

---------------- ------------------- -------------------

H1 2022 H1 2021 H1 2022 H1 2021 H1 2022 H1 2021

--------------------------------- ------- ------- --------- -------- --------- --------

Institutional and Wholesale(1) 239.4 249.4 446 490 37.1 39.4

Insurance 184.3 202.0 90 101 9.9 10.1

--------------------------------- ------- ------- --------- -------- --------- --------

Investments(1) 423.7 451.4 536 591 25.3 26.3

Adviser 72.3 69.0 92 87 25.5 25.3

Personal Wealth(1) 13.8 13.7 45 41 60.0 55.9

Parmenion(2) - 7.2 - 14 - 38.1

Eliminations (11.8) (10.9) N/A N/A N/A N/A

--------------------------------- ------- ------- --------- -------- --------- --------

Fee revenue yield(1) 498.0 530.4 673 733 26.9 27.6

--------------------------------- ------- ------- --------- -------- --------- --------

interactive investor(3) 13 -

Performance fees 10 22

--------------------------------- ------- ------- --------- -------- --------- --------

Fee based revenue 696 755

--------------------------------- ------- ------- --------- -------- --------- --------

Analysis of Institutional and Wholesale by asset class(1)

Fee based revenue Fee revenue yield

Average AUM (GBPbn) (GBPm) (bps)

H1 2022 H1 2021 H1 2022 H1 2021 H1 2022 H1 2021

---------------------------- ---------- --------- --------- -------- --------- --------

Equities 60.7 69.7 193 225 64.0 64.8

Fixed income 43.4 47.4 60 67 27.9 28.7

Multi-asset 33.4 34.4 52 58 31.5 34.1

Private equity 12.3 11.0 25 31 40.5 56.1

Real assets 40.9 34.2 89 82 44.0 48.5

Alternatives 21.9 20.0 14 12 12.9 12.6

Quantitative 6.2 6.0 2 2 6.5 6.5

Liquidity 20.6 26.7 6 10 6.0 7.8

---------------------------- ---------- --------- --------- -------- --------- --------

Institutional and Wholesale 239.4 249.4 441 487 37.1 39.4

---------------------------- ---------- --------- --------- -------- --------- --------

1. Institutional and Wholesale fee revenue yield excludes

revenue of GBP5m (H1 2021: GBP3m) and Personal Wealth fee revenue

yield excludes revenue of GBP4m (H1 2021: GBP3m) for which there

are no attributable assets.

2. Parmenion is included in the Corporate/strategic vector. The

sale of Parmenion completed on 30 June 2021 and the fee revenue

yield reflects the position as at the date of disposal.

3. interactive investor is excluded from the calculation of

Personal and total fee revenue yield as fees charged for this

business are primarily from subscriptions and trading

transactions.

5.1.4 Additional ii information

The results for ii are included in the Group's results following

the completion of the acquisition on 27 May 2022. The adjusted

operating profit for ii for the one month to 30 June 2022 of GBP6m

is included in our overall H1 2022 adjusted operating profit of

GBP115m.

The tables below provides detail of the performance of ii for

the full six months ended 30 June 2022 and the full 12 months ended

31 December 2021 to provide a fuller understanding of the

performance of this business. Adjusted operating profit has also

been presented excluding losses relating to Share Limited to

provide a more meaningful comparison to the go-forward

position.

FY 2021 FY 2021

H1 2022 12 months 12 months

6 months GBPm GBPm

Excl Incl

Analysis of ii profit GBPm Share(1) Share(1)

---------------------------- ---------- ----------- -----------

Fee based revenue 75 128 135

Adjusted operating expenses (42) (83) (99)

---------------------------- ---------- ----------- -----------

Adjusted operating profit 33 45 36

---------------------------- ---------- ----------- -----------

The FY 2021 adjusted operating profit of GBP36m included losses

relating to Share Limited of GBP9m while part of this business was

wound down. Excluding losses from Share Limited, the FY 2021

adjusted operating profit was GBP45m. The H1 2022 impact was

GBPnil.

FY 2021 FY 2021

H1 2022 12 months 12 months

6 months GBPm GBPm

Excl Incl

Analysis of ii fee based revenue GBPm Share(1) Share(1)

------------------------------------------ ---------- ----------- -----------

Trading transactions 34 79 84

Account fees (subscription based revenue) 27 48 50

Treasury income 17 9 9

Less: Cost of sales (3) (8) (8)

------------------------------------------ ---------- ----------- -----------

Fee based revenue 75 128 135

------------------------------------------ ---------- ----------- -----------

1. Losses were incurred in Share Limited and its subsidiaries

(Share) as part of this business was wound down.

5.1.5 Adjusted capital generation

The table below provides a reconciliation of movements between

adjusted profit after tax and adjusted capital generation. A

reconciliation of adjusted profit after tax to IFRS profit/loss for

the period is included earlier in this section.

H1 2022 H1 2021

GBPm GBPm

------------------------------------------------------- ------- -------

Adjusted profit after tax 86 150

Less net interest credit relating to the staff pension

schemes (15) (9)

Less interest paid on other equity (6) -

Add dividends received from associates, joint ventures

and significant listed investments 42 35

------------------------------------------------------- ------- -------

Adjusted capital generation 107 176

------------------------------------------------------- ------- -------

Net interest credit relating to the staff pension schemes

The net interest credit relating to the staff pension schemes is

the contribution to adjusted profit before tax from defined benefit

pension schemes which are in surplus.

Dividends received from associates, joint ventures and

significant listed investments

An analysis is provided below:

H1 2022 H1 2021

GBPm GBPm

--------------------------------------------------- ------- -------

Phoenix 26 35

HDFC Life 1 -

HDFC Asset Management 15 -

Dividends received from associates, joint ventures

and significant listed investme nts 42 35

--------------------------------------------------- ------- -------

The table below provides detail of dividend coverage on an

adjusted capital generation basis.

H1 2022 H1 2021

Adjusted capital generation (GBPm) 107 176

Interim dividend (GBPm) 153 154

------------------------------------------------------- ------- -------

Dividend cover on an adjusted capital generation basis

(times) 0.70 1.14

------------------------------------------------------- ------- -------

5.1.6 Adjusted diluted capital generation per share

A reconciliation of adjusted capital generation to adjusted

profit after tax is included in 5.1.5 above.

H1 2022 H1 2021

Adjusted capital generation (GBPm) 107 176

Weighted average number of diluted ordinary shares

outstanding (millions) - Note 4.8 2,130(1) 2,156

------------------------------------------------------ -------- -------

Adjusted diluted capital generation per share (pence) 5.0 8.2

------------------------------------------------------ -------- -------

1. In accordance with IAS 33, no share options and awards have

been treated as dilutive for the six months ended 30 June 2022 due

to the loss attributable to equity holders of abrdn plc in that

period. See Note 4.8 for further details.

5.1.7 Cash and liquid resources

The table below provides a reconciliation between IFRS cash and

cash equivalents and cash and liquid resources. Seed capital and

co-investments are excluded.

H1 2022 FY 2021

GBPbn GBPbn

--------------------------------------------------------- ------- -------

Cash and cash equivalents per the condensed consolidated

statement of financial position 1.4 1.9

Bank overdrafts (0.1) (0.1)

Debt securities excluding third party interests(2) 0.3 1.1

Corporate funds held in absolute return funds 0.2 0.2

Other(3) (0.1) -

--------------------------------------------------------- ------- -------

Cash and liquid resources 1.7 3.1

--------------------------------------------------------- ------- -------

2. Excludes GBP71m (FY 2021: GBP76m) relating to seeding.

3. Cash collateral, cash held for charitable funds and cash held

in employee benefit trusts are excluded from cash and liquid

resources.

5.2 Investment performance

Definition Purpose

--------------------------------------------------------- ---------------------------

Investment performance

Investment performance has been aggregated using As an asset managing

a money weighted average of our assets under business this measure

management which are outperforming their respective demonstrates our ability

benchmark. Calculations for investment performance to generate investment

are made gross of fees with the exception of returns for our clients.

those for which the stated comparator is net

of fees. Benchmarks differ by fund and are defined

in the relevant investment management agreement

or prospectus, as appropriate. The investment

performance calculation covers all funds that

aim to outperform a benchmark, with certain

assets excluded where this measure of performance

is not appropriate or expected, such as private

markets and execution only mandates, as well

as replication tracker funds which aim to perform

in line with a given index.

--------------------------------------------------------- ---------------------------

1 year 3 years 5 years

---------------- ---------------- ----------------

% of AUM ahead of benchmark H1 2022 FY 2021 H1 2022 FY 2021 H1 2022 FY 2021

---------------------------- ------- ------- ------- ------- ------- -------

Equities 30 36 51 72 34 61

Fixed income 44 59 63 82 76 87

Multi-asset 53 41 54 39 50 44

Real assets 87 83 75 52 69 50

Alternatives 97 87 100 98 100 98

Quantitative 21 98 45 44 57 68

Liquidity 82 88 85 87 70 84

---------------------------- ------- ------- ------- ------- ------- -------

Total 53 57 63 67 61 67

---------------------------- ------- ------- ------- ------- ------- -------

5.3 Assets under management and administration and flows

Definition Purpose

---------------------------------------------------- ---------------------------

AUMA

AUMA is a measure of the total assets we manage, The amount of funds

administer or advise on behalf of our clients. that we manage, administer

It includes assets under management (AUM), assets or advise directly impacts

under administration (AUA) and assets under the level of fee based

advice (AUAdv). revenue that we receive.

AUM is a measure of the total assets that we

manage on behalf of individual and institutional

clients. AUM also includes fee generating assets

managed for corporate purposes.

AUA is a measure of the total assets we administer

for clients through platform products such as

ISAs, SIPPs and general trading accounts.

AUAdv is a measure of the total assets we advise

our clients on, for which there is an ongoing

charge.

---------------------------------------------------- ---------------------------

Net flows

Net flows represent gross flows less redemptions. The level of net flows

Gross flows are new funds from clients. Redemptions that we generate directly

are the money withdrawn by clients during the impacts the level of

period. fee based revenue that

we receive.

---------------------------------------------------- ---------------------------

5.3.1 Analysis of AUMA

Closing

Opening AUMA

AUMA at Market at

1 Jan Gross and other Corporate 30 Jun

2022 inflows Redemptions Net flows movements(2) actions(3) 2022

6 months ended 30 June

2022 GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

----------------------- -------- -------- ----------- --------- ------------- ----------- -------

Institutional 174.0 7.7 (16.8) (9.1) (4.1) - 160.8

Wholesale 79.1 8.9 (10.8) (1.9) (5.7) - 71.5

Insurance 210.5 8.8 (35.1) (26.3) (30.2) - 154.0

----------------------- -------- -------- ----------- --------- ------------- ----------- -------

Investments 463.6 25.4 (62.7) (37.3) (40.0) - 386.3

Adviser 76.2 4.0 (2.6) 1.4 (9.3) - 68.3

interactive investor - 0.6 (0.4) 0.2 (3.3) 55.4 52.3

Personal Wealth 14.4 0.8 (0.7) 0.1 (1.2) - 13.3

----------------------- -------- -------- ----------- --------- ------------- ----------- -------

Personal(1) 14.4 1.4 (1.1) 0.3 (4.5) 55.4 65.6

Eliminations(1) (12.1) (1.4) 1.1 (0.3) 1.5 (0.9) (11.8)

----------------------- -------- -------- ----------- --------- ------------- ----------- -------

Total AUMA 542.1 29.4 (65.3) (35.9) (52.3) 54.5 508.4

----------------------- -------- -------- ----------- --------- ------------- ----------- -------

Closing

Opening AUMA

AUMA at Market at

1 Jan Gross and other Corporate 30 Jun

2021 inflows Redemptions Net flows movements actions(4) 2021

6 months ended 30 June

2021 GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

----------------------- -------- -------- ----------- --------- ---------- ----------- -------

Institutional 171.7 9.1 (12.5) (3.4) 0.8 2.5 171.6

Wholesale 80.0 12.9 (14.0) (1.1) 1.6 - 80.5

Insurance 205.2 9.1 (12.9) (3.8) 3.1 - 204.5

----------------------- -------- -------- ----------- --------- ---------- ----------- -------

Investments 456.9 31.1 (39.4) (8.3) 5.5 2.5 456.6

Adviser 67.0 4.6 (2.6) 2.0 3.3 - 72.3

interactive investor - - - - - - -

Personal Wealth 13.3 1.0 (0.5) 0.5 0.6 - 14.4

----------------------- -------- -------- ----------- --------- ---------- ----------- -------

Personal(1) 13.3 1.0 (0.5) 0.5 0.6 - 14.4

Parmenion 8.1 0.7 (0.4) 0.3 0.3 (8.7) -

Eliminations(1) (10.7) (1.4) 1.3 (0.1) (0.7) - (11.5)

----------------------- -------- -------- ----------- --------- ---------- ----------- -------

Total AUMA 534.6 36.0 (41.6) (5.6) 9.0 (6.2) 531.8

----------------------- -------- -------- ----------- --------- ---------- ----------- -------

1. Eliminations remove the double count reflected in

Investments, Adviser and Personal. The Personal vector includes

assets that are reflected in both the discretionary investment

management and financial planning businesses. This double count is

also removed within Eliminations.

2. Market and other movements include the transfer of retained

LBG AUM of cGBP7.5bn from Insurance into Institutional

(quantitatives), to better reflect how the relationship is being

managed.

3. Corporate actions in H1 2022 relate to the acquisition of

interactive investor on 27 May 2022. The eliminations are to remove

the double count for the assets that are reflected in both

interactive investor and Investments.

4. Corporate actions relate to the acquisition of a majority

interest in Tritax on 1 April 2021 supplementing Institutional AUM

by cGBP6bn at the acquisition date. This is partially offset by the

disposal of our domestic real estate business in the Nordics region

on 31 May 2021 which reduced AUM by cGBP3bn. The sale of Parmenion

completed on 30 June 2021.

5.3.2 Quarterly net flows

3 months to 3 months to 3 months to 3 months to 3 months to

30 Jun 22 31 Mar 22 31 Dec 21 30 Sep 21 30 Jun 21

15 months ended 30 June 2022 GBPbn GBPbn GBPbn GBPbn GBPbn

----------------------------- ----------- ----------- ----------- ----------- -----------

Institutional (7.8) (1.3) 2.5 (2.0) (0.7)

Wholesale - (1.9) (0.8) (0.3) (0.5)

Insurance (4.6) (21.7) (0.4) (1.3) (1.5)

----------------------------- ----------- ----------- ----------- ----------- -----------

Investments (12.4) (24.9) 1.3 (3.6) (2.7)

Adviser 0.5 0.9 1.1 0.8 0.9

interactive investor 0.2 - - - -

Personal Wealth - 0.1 - 0.1 0.3

----------------------------- ----------- ----------- ----------- ----------- -----------

Personal 0.2 0.1 - 0.1 0.3

Parmenion - - - - 0.2

Eliminations (0.1) (0.2) (0.2) (0.1) -

----------------------------- ----------- ----------- ----------- ----------- -----------

Total net flows (11.8) (24.1) 2.2 (2.8) (1.3)

----------------------------- ----------- ----------- ----------- ----------- -----------

5.4 Institutional and Wholesale AUM

Detailed asset class split

Opening Closing

AUM at Market AUM at

1 Jan Gross and other Corporate 30 Jun

2022 inflows Redemptions Net flows movements actions 2022

6 months ended 30 June

2022 GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Developed markets equities 17.0 1.1 (1.6) (0.5) (4.8) - 11.7

Emerging markets equities 16.4 1.1 (1.5) (0.4) (2.4) - 13.6

Asia Pacific equities 25.3 1.4 (2.6) (1.2) (2.9) - 21.2

Global equities 10.3 0.7 (0.8) (0.1) (2.1) - 8.1

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total equities 69.0 4.3 (6.5) (2.2) (12.2) - 54.6

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Developed markets credit 28.3 1.6 (2.8) (1.2) (2.9) - 24.2

Developed markets rates 2.9 0.2 (0.3) (0.1) (0.6) - 2.2

Emerging markets fixed

income 12.2 1.6 (1.4) 0.2 (1.0) - 11.4

Private credit 2.4 0.2 (0.1) 0.1 0.4 - 2.9

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total fixed income 45.8 3.6 (4.6) (1.0) (4.1) - 40.7

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Absolute return 10.0 0.2 (0.7) (0.5) (2.0) - 7.5

Diversified growth/income 0.5 0.1 (0.1) - (0.1) - 0.4

MyFolio 17.7 0.9 (1.0) (0.1) (1.8) - 15.8

Other multi-asset 7.8 0.5 (0.4) 0.1 (1.5) - 6.4

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total multi-asset 36.0 1.7 (2.2) (0.5) (5.4) - 30.1

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total private equity 12.3 0.2 (0.5) (0.3) 0.7 - 12.7

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

UK real estate 19.9 0.2 (0.5) (0.3) 0.8 - 20.4

European real estate 10.3 0.2 - 0.2 2.8 - 13.3

Global real estate 1.8 0.1 (0.1) - (0.1) - 1.7

Real estate multi-manager 1.2 0.1 (0.1) - - - 1.2

Infrastructure equity 6.2 0.3 (0.5) (0.2) 0.1 - 6.1

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total real assets 39.4 0.9 (1.2) (0.3) 3.6 - 42.7

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total alternatives 20.8 1.3 (0.7) 0.6 1.2 - 22.6

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total quantitative(1) 5.5 1.5 (1.1) 0.4 6.4 - 12.3

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total liquidity 24.3 3.1 (10.8) (7.7) - - 16.6

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total(1) 253.1 16.6 (27.6) (11.0) (9.8) - 232.3

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

1. Market and other movements include the transfer of retained

LBG AUM of cGBP7.5bn from Insurance into Institutional

(quantitatives), to better reflect how the relationship is being

managed.

Opening Closing

AUM at Market AUM at

1 Jan Gross and other Corporate 30 Jun

2021 inflows Redemptions Net flows movements actions 2021

6 months ended 30 June

2021 GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Developed markets equities 14.7 1.7 (2.0) (0.3) 1.5 - 15.9

Emerging markets equities 19.0 1.1 (2.0) (0.9) 1.0 - 19.1

Asia Pacific equities 26.6 2.7 (3.0) (0.3) 0.2 - 26.5

Global equities 8.9 0.8 (0.8) - 0.6 - 9.5

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total equities 69.2 6.3 (7.8) (1.5) 3.3 - 71.0

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Developed markets credit 32.2 2.9 (4.4) (1.5) (1.5) - 29.2

Developed markets rates 2.8 0.3 (0.2) 0.1 (1.8) - 1.1

Emerging markets fixed

income 12.2 2.3 (2.2) 0.1 1.3 - 13.6

Private credit 1.0 0.7 - 0.7 0.6 - 2.3

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total fixed income 48.2 6.2 (6.8) (0.6) (1.4) - 46.2

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Absolute return 11.5 0.4 (1.1) (0.7) (0.6) - 10.2

Diversified growth/income 0.6 - (0.1) (0.1) - - 0.5

MyFolio 15.6 1.1 (1.4) (0.3) 2.0 - 17.3

Other multi-asset 10.0 0.6 (0.7) (0.1) (3.0) - 6.9

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total multi-asset 37.7 2.1 (3.3) (1.2) (1.6) - 34.9

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total private equity 10.9 1.3 (0.5) 0.8 0.3 - 12.0

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

UK real estate 9.2 0.7 (0.5) 0.2 3.2 5.8 18.4

European real estate 12.1 0.6 (0.2) 0.4 0.7 (3.3) 9.9

Global real estate 1.8 0.2 (0.2) - - - 1.8

Real estate multi-manager 1.6 0.1 (0.1) - (0.6) - 1.0

Infrastructure equity 5.3 0.6 (0.3) 0.3 - - 5.6

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total real assets 30.0 2.2 (1.3) 0.9 3.3 2.5 36.7

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total alternatives 19.5 1.4 (0.6) 0.8 - - 20.3

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total quantitative 6.4 0.5 (0.5) - (0.4) - 6.0

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total liquidity 29.8 2.0 (5.7) (3.7) (1.1) - 25.0

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

Total 251.7 22.0 (26.5) (4.5) 2.4 2.5 252.1

--------------------------- ------- -------- ----------- --------- ---------- --------- -------

5.5 Analysis of Insurance

Opening Closing

AUM at Market AUM at

1 Jan Net and other Corporate 30 Jun

2022 Gross inflows Redemptions flows movements actions 2022

6 months ended 30

June 2022 GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

------------------ ------- ------------- ----------- ------ ---------- --------- -------

Phoenix 175.5 8.5 (9.5) (1.0) (21.7) - 152.8

Lloyds(1) 33.6 0.3 (25.5) (25.2) (8.4) - -

Other 1.4 - (0.1) (0.1) (0.1) - 1.2

------------------ ------- ------------- ----------- ------ ---------- --------- -------

Total(1) 210.5 8.8 (35.1) (26.3) (30.2) - 154.0

------------------ ------- ------------- ----------- ------ ---------- --------- -------

Opening Closing

AUM at Market AUM at

1 Jan Net and other Corporate 30 Jun

2021 Gross inflows Redemptions flows movements actions 2021

6 months ended 30

June 2021 GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

------------------ ------- ------------- ----------- ------ ---------- --------- -------

Phoenix 171.5 6.0 (9.9) (3.9) 1.1 - 168.7

Lloyds 31.8 3.1 (2.9) 0.2 2.2 - 34.2

Other 1.9 - (0.1) (0.1) (0.2) - 1.6

------------------ ------- ------------- ----------- ------ ---------- --------- -------

Total 205.2 9.1 (12.9) (3.8) 3.1 - 204.5

------------------ ------- ------------- ----------- ------ ---------- --------- -------

1. Following completion of the LBG tranche withdrawals, the

remaining LBG AUM of cGBP7.5bn which has been retained was

reallocated to quantitatives in Institutional and is included in

market and other movements in the table above.

5.6 Analysis of total AUM

5.6.1 AUM by geography

30 Jun 2022 31 Dec 2021

------------------------------------------ ---------------------------------------------

Institutional Personal Institutional

and Wholesale Insurance (2) Total and Wholesale Insurance Personal(2) Total

GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

-------------------- -------------- --------- -------- ----- -------------- --------- ----------- -----

UK 109.3 154.0 8.2 271.5 120.3 210.5 8.9 339.7

Europe, Middle East

and Africa (EMEA) 56.4 - - 56.4 62.5 - - 62.5

Asia Pacific (APAC) 17.3 - - 17.3 19.2 - - 19.2

Americas 49.3 - - 49.3 51.1 - - 51.1

-------------------- -------------- --------- -------- ----- -------------- --------- ----------- -----

Total AUM 232.3 154.0 8.2 394.5 253.1 210.5 8.9 472.5

-------------------- -------------- --------- -------- ----- -------------- --------- ----------- -----

2. Excludes assets under advice of GBP5.1bn at 30 June 2022 (FY

2021: GBP5.5bn) and interactive investor assets under

administration of GBP52.3bn (FY 2021: GBPnil).

5.7 Surplus regulatory capital

The GBP0.6bn indicative capital surplus below includes a

deduction to allow for the proposed interim dividend which will be

paid in September 2022.

H1 2022 FY 2021

IFPR Group regulatory capital position GBPbn GBPbn

----------------------------------------------------- ------- -------

Common Equity Tier 1 capital resources 1.2 2.4

Additional Tier 1 capital resources 0.2 0.2

----------------------------------------------------- ------- -------

Total Tier 1 capital resources 1.4 2.6

Tier 2 capital resources 0.6 0.6

----------------------------------------------------- ------- -------

Total regulatory capital resources 2.0 3.2

Subordinated debt restrictions (0.3) (0.3)

----------------------------------------------------- ------- -------

Total regulatory capital resources available to meet

total regulatory capital requirements 1.7 2.9

Total regulatory capital requirements (1.1) (1.1)

----------------------------------------------------- ------- -------

Surplus regulatory capital 0.6 1.8

----------------------------------------------------- ------- -------

6. Glossary

Adjusted net financing costs and investment return

Adjusted net financing costs and investment return is a

component of adjusted profit and relates to the return from the net

assets of the shareholder business, net of costs of financing. This

includes the net assets in defined benefit staff pension plans and

net assets relating to the financing of subordinated

liabilities.

Adjusted operating expenses

Adjusted operating expenses is a component of adjusted operating

profit and relates to the day-to-day expenses of managing our

business.

Adjusted operating profit

A d justed operating profit before tax is the Group's key APM.

Adjusted operating profit includes the results of the Group's three

growth vectors: Investments, Adviser and Personal, along with

Corporate/strategic.

It excludes the Group's adjusted net financing costs and

investment return, and discontinued operations.

Adjusted operating profit also excludes the impact of the

following items:

-- Restructuring costs and corporate transaction expenses.

Restructuring includes the impact of major regulatory change.

-- Amortisation and impairment of intangible assets acquired in

business combinations and through the purchase of customer

contracts.

-- Profit or loss arising on the disposal of a subsidiary, joint

venture or equity accounted associate.

-- Change in fair value of/dividends from significant listed

investments.

-- Share of profit or loss from associates and joint

ventures.

-- Impairment loss/reversal of impairment loss recognised on

investments in associates and joint ventures accounted for using

the equity method.

-- Fair value movements in contingent consideration.

-- Items which are one-off and, due to their size or nature, are

not indicative of the long-term operating performance of the

Group.

Adjusted profit before tax

In addition to the results included in adjusted operating profit

above, adjusted profit before tax includes adjusted net financing

costs and investment return.

Assets under management and administration (AUMA)

AUMA is a measure of the total assets we manage, administer or

advise on behalf of our clients. It includes assets under

management (AUM), assets under administration (AUA) and assets

under advice (AUAdv). AUMA does not include assets for associates

and joint ventures.

AUM is a measure of the total assets that we manage on behalf of

individual and institutional clients. AUM also includes assets

managed for corporate purposes.

AUA is a measure of the total assets we administer for clients

through our Platforms.

AUAdv is a measure of the total assets we advise our clients on,

for which there is an ongoing charge.

Board

The Board of Directors of the Company.

Carbon intensity

Weighted-Average Carbon Intensity (WACI) is calculated by

summing the product of each company's weight in the portfolio or

loan book with that company's carbon-to-revenue intensity.

Carbon-to-revenue intensity is calculated by dividing the sum of

all apportioned emissions, with the sum of all apportioned revenues

across an investment portfolio or loan book. This metric gives an

indication of how efficient companies in a portfolio or loan book

are at generating revenues per tonne of carbon emitted.

Carbon neutral

Being carbon neutral means that carbon released through our

operational emissions is balanced by an equivalent amount being

removed through carbon offsetting. For the purposes of offsetting,

we include Scope 1, 2 and 3 emissions within our operational

emissions.

Carbon offsetting

Carbon offsetting is an internationally recognised way to take

responsibility for carbon emissions. The aim of carbon offsetting

is that for every one tonne of offsets purchased there will be one

less tonne of carbon dioxide in the atmosphere than there would

otherwise have been. To offset emissions we purchase the equivalent

volume of carbon credits (independently verified emissions

reductions) to compensate for our operational carbon emissions. We

work with Climate Impact Partners to offset our operational

greenhouse gas emissions and voluntarily offset via two verified

projects. We have historically supported a Gold Standard wind

turbine project in India and a Verified Carbon Standard (VCS)

Climate, Carbon, and Community rainforest protection project in

Gola. For our 2021 emissions, we supported the development of wind

energy in Nicaragua, with a Gold Standard Project, and a VCS

project in Malawi focused on forest conservation and provision of

clean cook stoves. We chose offsets that we knew were verifiable

and correctly accounted for and have a low risk of

non-additionality, reversal, and creating negative unintended

consequences for people and the environment . Our intention is to

review our approach in H2 2022 as the voluntary carbon market

continues to evolve.

Chief Operating Decision Maker

The executive leadership team.

Company

abrdn plc. Standard Life Aberdeen plc was renamed abrdn plc on 2

July 2021.

Cost/income ratio

This is an efficiency measure that is calculated as adjusted

operating expenses divided by fee based revenue.

CRD IV

CRD IV is the European regulatory capital regime (comprising the

Capital Requirements Directive and Capital Requirements Regulation)

that applied to investment firms up to and including 31 December

2021. The new IFPR regime came into force on 1 January 2022.

Director

A director of the Company.

Earnings per share (EPS)

EPS is a commonly used financial metric which can be used to

measure the profitability and strength of a company over time. EPS

is calculated by dividing profit by the number of ordinary shares.

Basic EPS uses the weighted average number of ordinary shares

outstanding during the year. Diluted EPS adjusts the weighted

average number of ordinary shares outstanding to assume conversion

of all dilutive potential ordinary shares, such as share options

awarded to employees.

Effective tax rate

Tax expense/(credit) attributable to equity holders' profit

divided by profit before tax attributable to equity holders'

profits expressed as a percentage.

Executive leadership team (ELT)

Our ELT leads the business across our growth vectors and

supporting functions globally and is responsible for executing and

monitoring progress on the delivery of our business plans. The ELT

also ensures we meet our obligations to our clients, people,

shareholders, regulators and partners.

Fair value through profit or loss (FVTPL)

FVTPL is an IFRS measurement basis permitted for assets and

liabilities which meet certain criteria. Gains or losses on assets

or liabilities measured at FVTPL are recognised directly in the

income statement.

FCA

Financial Conduct Authority of the United Kingdom.

Fee based revenue

Fee based revenue is a component of adjusted operating profit

and includes revenue we generate from asset management charges

(AMCs), platform charges, treasury income and other transactional

charges. AMCs are earned on products such as mutual funds, and are

calculated as a percentage fee based on the assets held. Investment

risk on these products rests principally with the client, with our

major indirect exposure to rising or falling markets coming from

higher or lower AMCs. Treasury income is the interest earned on

cash balances less the interest paid to customers. Fee based

revenue is shown net of fees, costs of sale, commissions and

similar charges. Costs of sale include revenue from fund platforms

which is passed to the product provider.

Fee revenue yield (bps)

The average revenue yield on fee based business is a measure

that illustrates the average margin being earned on the assets that

we manage, administer or advise our clients on excluding

interactive investor. It is calculated as annualised fee based

revenue (excluding performance fees, interactive investor and

revenue for which there are no attributable assets) divided by

monthly average fee based assets. interactive investor is excluded

from the calculation of Personal and total fee revenue yield as

fees charged for this business are primarily from subscriptions and

trading transactions.

Greenhouse gases

Greenhouse gases are those gaseous constituents of the

atmosphere, both natural and anthropogenic, that absorb and emit

radiation at specific wavelengths within the spectrum of thermal

infrared radiation emitted by the earth's surface, the atmosphere

itself, and by clouds. This property causes the greenhouse effect.

Water vapour (H2O), carbon dioxide (CO2), nitrous oxide (N2O),

methane (CH4) and ozone (O3) are the primary greenhouse gases in

the earth's atmosphere. Moreover, there are a number of entirely

human-made greenhouse gases in the atmosphere, such as halocarbons

and other chlorine- and bromine-containing substances, dealt with

under the Montreal Protocol. Beside CO2, N2O and CH4, the Kyoto

Protocol deals with the greenhouse gases sulphur hexafluoride

(SF6), hydrofluorocarbons (HFCs) and perfluorocarbons (PFCs).

Group or abrdn

Relates to the Company and its subsidiaries.

Growth vectors

We provide services across three growth vectors:

- I nvestments : Asset management investment solutions for

institutional, wholesale and insurance clients.

- Adviser : Our Wrap and Elevate adviser platforms.

- Personal : Comprises of Personal Wealth which includes our financial planning business and our direct-to-consumer services, and interactive investor following the completion of the acquisition in May 2022.

Internal Capital Adequacy and Risk Assessment (ICARA)

The ICARA is the means by which the Group assesses the levels of

capital and liquidity that adequately support all of the relevant

current and future risks in its business.

International Financial Reporting Standards (IFRS)

International Financial Reporting Standards are accounting

standards issued by the International Accounting Standards Board

(IASB).

Investment Firms Prudential Regime (IFPR)

The Investment Firms Prudential Regime is the FCA's new

prudential regime for MiFID investment firms. The regime came into

force on 1 January 2022.

Investment performance

Investment performance has been aggregated using a money

weighted average of our assets under management which are

outperforming their respective benchmark. Calculations for

investment performance are made gross of fees with the exception of

those for which the stated comparator is net of fees. Benchmarks

differ by fund and are defined in the relevant investment

management agreement or prospectus, as appropriate. The investment

performance calculation covers all funds that aim to outperform a

benchmark, with certain assets excluded where this measure of

performance is not appropriate or expected, such as private markets

and execution only mandates, as well as replication tracker funds

which aim to perform in line with a given index.

LBG tranche withdrawals

On 24 July 2019, the Group announced that it had agreed a final

settlement in relation to the arbitration proceedings between the

parties concerning LBG's attempt to terminate investment management

arrangements under which assets were managed by members of the

Group for LBG entities. In its decision of March 2019, the arbitral

tribunal found that LBG was not entitled to terminate these

investment management contracts. The Group had continued to manage

approximately GBP104bn (as at

30 June 2019) of assets under management (AUM) for LBG entities

during the period of the dispute. Approximately two thirds of the

total AUM (the transferring AUM) will be transferred to third party

managers appointed by LBG through a series of planned tranches from

24 July 2019. During this period, the Group will continue to be

remunerated for its services in relation to the transferring AUM.

The final tranche withdrawal was completed in H1 2022.

Net flows

Net flows represent gross inflows less gross outflows or

redemptions. Gross inflows are new funds from clients. Redemptions

is the money withdrawn by clients during the period.

Net zero

Net zero is the target of completely negating the amount of

greenhouse gases produced by human activity, to be achieved by

reducing emissions to the lowest possible amount and offsetting

(see carbon offsetting) only the remainder as a last resort.

Net Zero Direct Investing

Net Zero Directed Investing means moving towards the goal of net

zero in the real world - not just in specific investment

portfolios. At abrdn we seek to achieve this goal through a

holistic set of actions, including rigorous research into net-zero

trajectories, developing net-zero-directed investment solutions and

active ownership to influence corporates and policy makers.

Operational emissions

Operational emissions are the greenhouse gas emissions related

to the operations of our business. They are categorised into three

groups or 'scopes'. Scope 1 covers direct emissions from owned or

controlled sources. Scope 2 covers indirect emissions from the

generation of purchased electricity, steam, heating and cooling

consumed by the reporting company. Scope 3 includes all other

indirect emissions that occur in a company's value chain. At abrdn

we report Scope 1, Scope 2, and Scope 3 emissions, which includes

our working from home emissions.

Paris alignment

'Paris alignment' refers to the alignment of public and private

financial flows with the objectives of the Paris Agreement on

climate change. Article 2.1c of the Paris Agreement defines this

alignment as making finance flows consistent with a pathway towards

low greenhouse gas emissions and climate-resilient development.

Alignment in this way will help to scale up the financial flows

needed to strengthen the global response to the threat of climate

change.

Phoenix or Phoenix Group

Phoenix Group Holdings plc or Phoenix Group Holdings plc and its

subsidiaries.

Significant listed investments

Relates to our investments in HDFC Asset Management, HDFC Life

and Phoenix. Fair value movements and dividend income relating to

these investments are treated as adjusting items for the purpose of

determining the Group's adjusted profit.

Subordinated liabilities

Subordinated liabilities are debts of a company which, in the

event of liquidation, rank below its other debts but above share

capital. The 5.25% Fixed Rate Reset Perpetual Subordinated

Contingent Convertible Notes issued by the Company in December 2021

are classified as other equity as no contractual obligation to

deliver cash exists.

7. Shareholder information

Registered office

1 George Street

Edinburgh

EH2 2LL

Scotland

Company registration number: SC286832

For shareholder services call: 0371 384 2464*

* Calls are monitored/recorded to meet regulatory obligations

and for training and quality purposes. Call charges will vary.

Secretary: Kenneth A Gilmour

Registrar: Equiniti

Auditors: KPMG LLP

Solicitors: Slaughter and May

Brokers: JP Morgan Cazenove, Goldman Sachs

Shareholder services

We offer a wide range of shareholder services. For more

information, please:

-- Contact our registrar, Equiniti, who manage this service for

us. Their details can be found on the inside back cover.

-- Visit our share portal at www.abrdnshares.com

Sign up for Ecommunications

Signing up means:

-- You'll receive an email when documents like the Annual report

and accounts, Half year results and AGM guide are available on our

website.

-- Voting instructions for the Annual General Meeting will be sent to you electronically.

Set up a share portal account

Having a share portal account means you can:

-- Manage your account at a time that suits you.

-- Download your documents when you need them.

To find out how to sign up, visit www.abrdnshares.com

Preventing unsolicited mail

By law, the Company has to make certain details from its share

register publicly available. As a result it is possible that some

registered shareholders could receive unsolicited mail, emails or

phone calls. You could also be targeted by fraudulent 'investment

specialists', clone firms or scammers posing as government bodies

e.g. HMRC, FCA. Frauds are becoming much more sophisticated and may

use real company branding, the names of real employees or email

addresses that appear to come from the company. If you get a social

or email message and you're unsure if it is from us, you can send

it to emailscams@abrdn.com and we'll let you know .

You can also check the FCA warning list and warning from

overseas regulators, however, please note that this is not an

exhaustive list and do not assume that a firm is legitimate just

because it does not appear on the list as fraudsters frequently

change their name and it may not have been reported yet.

www.fca.org.uk/consumers/unauthorised-firms-individuals

www.iosco.org/investor_protection/?subsection=investor_alerts_portal

You can find more information about share scams at the Financial

Conduct Authority website www.fca.org.uk/consumers/scams

If you are a certificated shareholder, your name and address may

appear on a public register. Using a nominee company to hold your

shares can help protect your privacy. You can transfer your shares

into the Company-sponsored nominee - the abrdn Share Account - by

contacting Equiniti, or you could get in touch with your broker to

find out about their nominee services.

If you want to limit the amount of unsolicited mail you receive

generally, please visit www.mpsonline.org.uk

Financial calendar

Half year results 2022 9 August

Ex-dividend date for 2022 18 August

interim dividend

Record date for 2022 interim 19 August

dividend

Last date for DRIP elections 7 September

for 2022 interim dividend

Dividend payment date for 27 September

2022 interim dividend

---------------------------- ------------

Analysis of registered shareholdings at 30 June 2022

% of % of

Range Number total Number total

of shares of holders holders of shares shares

-------------- ----------- -------- ------------- -------

1-1,000 59,344 65.69 23,754,048 1.09

1,001-5,000 26,379 29.20 54,294,871 2.49

5,001-10,000 2,642 2.92 17,651,293 0.81

10,001-100,000 1,481 1.64 36,159,333 1.66

(#) 100,001+ 499 0.55 2,048,866,415 93.95

-------------- ----------- -------- ------------- -------

Total 90,345 100.00 2,180,725,960 100.00

-------------- ----------- -------- ------------- -------

# These figures include the Company-sponsored nominee - the

abrdn Share Account - which had 927,858 participants holding

643,129,574 shares.

8. Forward-looking statements

This document may contain certain 'forward-looking statements'

with respect to the financial condition, performance, results,

strategies, targets, objectives, plans, goals and expectations of

the Company and its affiliates. These forward-looking statements

can be identified by the fact that they do not relate only to

historical or current facts.

Forward-looking statements are prospective in nature and are not

based on historical or current facts, but rather on current

expectations, assumptions and projections of management of the

abrdn Group about future events, and are therefore subject to known

and unknown risks and uncertainties which could cause actual

results to differ materially from the future results expressed or

implied by the forward-looking statements.

For example but without limitation, statements containing words

such as 'may', 'will', 'should', 'could', 'continues', 'aims',

'estimates', 'projects', 'believes', 'intends', 'expects', 'hopes',

'plans', 'pursues', 'ensure', 'seeks', 'targets' and 'anticipates',

and words of similar meaning (including the negative of these

terms), may be forward-looking. These statements are based on

assumptions and assessments made by the Company in light of its

experience and its perception of historical trends, current

conditions, future developments and other factors it believes

appropriate.

By their nature, all forward-looking statements involve risk and

uncertainty because they are based on information available at the

time they are made, including current expectations and assumptions,

and relate to future events and/or depend on circumstances which

may be or are beyond the Group's control, including among other

things: UK domestic and global political, economic and business

conditions, (such as the UK's exit from the EU and the ongoing

conflict between Russia and Ukraine); market related risks such as

fluctuations in interest rates and exchange rates, and the

performance of financial markets generally; the impact of inflation

and deflation; the impact of competition; the timing, impact and

other uncertainties associated with future acquisitions, disposals

or combinations undertaken by the Company or its affiliates and/or

within relevant industries; experience in particular with regard to

mortality and morbidity trends, lapse rates and policy renewal

rates; the value of and earnings from the Group's strategic

investments and ongoing commercial relationships; default by

counterparties; information technology or data security breaches

(including the Group being subject to cyberattacks); operational

information technology risks, including the Group's operations

being highly dependent on its information technology systems (both

internal and outsourced); natural or man-made catastrophic events;

the impact of pandemics, such as the COVID-19 (coronavirus)

outbreak; climate change and a transition to a low-carbon economy

(including the risk that the Group may not achieve its targets);

exposure to third party risks including as a result of outsourcing;

the failure to attract or retain necessary key personnel; the

policies and actions of regulatory authorities and the impact of

changes in capital, solvency or accounting standards, and tax and

other legislation and regulations (including changes to the

regulatory capital requirements that the Group is subject to in the

jurisdictions in which the Company and its affiliates operate. As a

result, the Group's actual future financial condition, performance

and results may differ materially from the plans, goals, objectives

and expectations set forth in the forward-looking statements.

The Company, nor any of its associates, directors, officers or

advisers, provides any representation, assurance or guarantee that

the occurrence of the events expressed or implied in any

forward-looking statements in this document will actually occur.

Persons receiving this document should not place reliance on

forward-looking statements. All forward-looking statements

contained in this document are expressly qualified in their

entirety by the cautionary statements contained or referred to in

this section. Each forward-looking statement speaks only as at the

date of the particular statement. Neither the Company nor its

affiliates assume any obligation to update or correct any of the

forward-looking statements contained in this document or any other

forward-looking statements it or they may make (whether as a result

of new information, future events or otherwise), except as required

by law. Past performance is not an indicator of future results and

the results of the Company and its affiliates in this document may

not be indicative of, and are not an estimate, forecast or

projection of, the Company's or its affiliates' future results.

Contact us

Got a shareholder question? Contact our shareholder services

team.

UK and overseas (excluding Germany and Austria)

phone +44 (0)371 384 2464*

email questions@abrdnshares.com

visit www.abrdnshares.com

mail abrdn Shareholder Services Aspect House

Spencer Road Lancing, West Sussex

BN99 6DA, United Kingdom

Germany and Austria

phone +44 (0)371 384 2493*

email fragen@abrdnshares.com

visit www.abrdnshares.com

mail abrdn Shareholder Services Aspect House

Spencer Road Lancing, West Sussex

BN99 6DA, United Kingdom

* Calls are monitored/recorded to meet regulatory obligations

and for training and quality purposes. Call charges will vary.

Please remember that the value of shares can go down as well as

up and you may not get back the full amount invested or any income

from it. All figures and share price information have been

calculated as at 30 June 2022 (unless otherwise indicated).

This document has been published by abrdn plc for information

only. It is based on our understanding as at August 2022 and does

not provide financial or legal advice.

abrdn plc is registered in Scotland (SC286832) at 1 George

Street, Edinburgh EH2 2LL.

www.abrdn.com (c) 2022 abrdn, images reproduced under licence.

All rights reserved.

UKIR22 0822

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EANPPELXAEFA

(END) Dow Jones Newswires

August 09, 2022 02:00 ET (06:00 GMT)

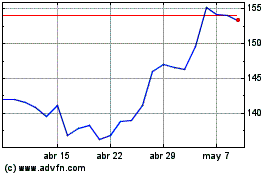

Abrdn (LSE:ABDN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Abrdn (LSE:ABDN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024