TIDMAFN

RNS Number : 9043R

ADVFN PLC

06 March 2023

6 March 2023

For immediate release

ADVFN PLC

("ADVFN" or the "Group")

Unaudited Interim Results for the Six Months Ended 31 December

2022

ADVFN today announces its unaudited interim results for the six

months ended 31 December 2022 (the "Period").

Chief Executive's Statement

On behalf of the board of Directors, I am delighted to report

that our recent fundraising has been a success. As announced in

January, we raised GBP4.52 million through the Open Offer and which

will provide us with the necessary resources to pursue our

strategic objectives and drive growth.

We are grateful to our investors for their confidence in our

ability to execute on our mission and deliver value to our

customers. With this infusion of capital, we can invest in our

business to drive growth and scale our operations to meet the

demand for our product offerings.

Looking ahead, we have a positive outlook for the future. Our

roadmap includes expanding our product portfolio, entering new

geographic markets, and strengthening our partnerships with our key

stakeholders. We are confident that these initiatives will drive

further growth and establish our position as a leader in our

industry.

Financial performance

The half-year financial report for the Period is in line with

the statements made in the Open Offer document and our trading

update. The changes in management, structure and employees

disrupted our normal workflow during the Period and made it a

challenge for the Company to meet its financial targets. However,

the Company remains optimistic and with the Open Offer completed

and the changes we are working on, we have confidence in our new

team. The Company acknowledges that changes take time and

appreciates the efforts being made by the team.

The key financial performance for the Period is summarised in

the table below:

Six Months ended 31 Six Months ended 31

December 2022 December 2021

GBP'000 GBP'000

-------------------- --------------------

Revenue 3,061 4,228

-------------------- --------------------

Profit / (loss) for

the period ) 616) 202

-------------------- --------------------

Operating profit /

(loss) (622) 229

-------------------- --------------------

Profit per share -

basic (see note 3) (2.36) p 0.77p

-------------------- --------------------

The Board is not recommending a dividend.

Outlook

As we move forward into 2023, I am excited to share with you our

plans to build new products and invest in our operations to drive

growth and deliver value to our users and shareholders.

With the proceeds from our recent fundraising efforts, we will

be able to accelerate our product development efforts and plan to

bring innovative new solutions to market. Our R&D team is

working tirelessly to identify emerging trends and technologies

that will enable us to stay ahead of the curve and deliver the next

generation of products and services.

We also plan to invest in our operations to improve our

efficiency and scalability. This will involve upgrading our

infrastructure, streamlining our processes, and investing in our

people to ensure that we have the talent and capabilities to

support our growth ambitions.

As we pursue these initiatives, we remain committed to

maintaining a disciplined approach to capital allocation and

managing our resources in a way that delivers the best returns for

our shareholders. We will closely monitor our progress and adjust

our strategy as necessary to ensure that we achieve good

results.

In summary, we are confident that our focus on product

innovation, operational excellence, and disciplined capital

allocation will enable us to achieve our growth objectives and

create long-term value for all our stakeholders.

We thank our shareholders for their continued support, and we

look forward to providing further updates on our progress in the

months ahead.

Amit Tauman

CEO

6 March 2023

For further information please contact:

ADVFN plc

Amit Tauman (CEO) +44 (0) 203 8794 460

Beaumont Cornish Limited

(Nominated Adviser)

Michael Cornish

Roland Cornish +44 (0) 207 628 3396

Peterhouse Capital Limited

(Broker)

Eran Zucker / Lucy Williams

/ Rose Greensmith +44 (0) 207 469 0930

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018. The person who arranged for the release of this announcement

on behalf of the Company was Amit Tauman, Director.

A copy of this announcement will be available on the Group's

website:

www.advfnplc.com

Condensed interim consolidated income statement

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2022 2021 2022

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Notes

Revenue 3,061 4,228 7,848

Cost of sales (196) (162) (374)

---------- ---------- ----------

Gross profit 2,865 4,066 7,474

Amortisation of intangible assets (91) (138) (256)

Administrative expenses (3,390) (3,699) (7,176)

Administrative expenses - non-recurring

items - (1,420)

Total administrative expense (3,481) (3,837) (8,852)

Operating (loss)/profit (616) 229 (1,378)

Finance expense (6) (27) (14)

(Loss)/profit before tax (622) 202 (1,392)

Taxation - 24

---------- ---------- ----------

(Loss)/profit for the period attributable

to shareholders of the parent (622) 202 (1,368)

========== ========== ==========

Earnings per share

Basic 3 (2.36p) 0.77p (5.22p)

Diluted (2.36p) 0.74p (5.22p)

Condensed interim consolidated statement of comprehensive

income

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2022 2021 2022

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

(Loss)/profit for the period (622) 202 (1,368)

Other comprehensive income:

Items that will be reclassified

subsequently to profit or loss:

Exchange differences on translation

of foreign operations 41 50 73

Total other comprehensive income 41 50 73

---------- ---------- ----------

Total comprehensive (loss)/income

for the year attributable to shareholders

of the parent (581) 252 (1,295)

========== ========== ==========

Condensed interim consolidated

balance sheet

31 Dec 31 Dec 30 June

2022 2021 2022

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Assets

Non-current assets

Property, plant and equipment (including

right of use assets) 51 180 98

Goodwill and intangible assets 2,054 2,513 2,112

Other receivables 26 25 26

2,131 2,718 2,236

Current assets

Trade and other receivables 368 725 460

Cash and cash equivalents 647 2,032 915

---------- ---------- --------

1,015 2,757 1,375

Total assets 3,146 5,475 3,611

========== ========== ========

Equity and liabilities

Equity

Issued capital 53 52 53

Share premium 305 223 305

Share based payments reserve 341 343 341

Foreign exchange translation reserve 324 260 283

Retained earnings (282) 2,497 340

---------- ---------- --------

741 3,375 1,322

Non-current liabilities

Borrowing - bank loans 34 47 41

Lease liabilities - 37 -

---------- ---------- --------

34 84 41

Current liabilities

Trade and other payables 2,314 1,902 2,148

Borrowing - bank loans 13 13 13

Lease liabilities 44 101 87

2,371 2,016 2,248

Total liabilities 2,405 2,100 2,289

---------- ---------- --------

Total equity and liabilities 3,146 5,475 3,611

========== ========== ========

Condensed interim consolidated statement of changes in

equity

Share Share Share Foreign Retained Total

capital premium based exchange earnings equity

payment translation

reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2021 52 223 343 210 2,295 3,123

Profit for the period after

tax - - - - 202 202

Other comprehensive income

Exchange differences on

translation of foreign operations - - - 50 - 50

--------- --------- --------- ------------- ---------- ---------

Total comprehensive income - - - 50 202 252

--------- --------- --------- ------------- ---------- ---------

At 31 December 2021 52 223 343 260 2,497 3,375

Transactions with equity

shareholders:

Shares issued 1 82 - - - 83

Transfer on exercise - - (2) - 2 -

--------- --------- --------- ------------- ---------- ---------

1 82 (2) - 2 83

-

Distribution to owners

Dividends - - - - (589) (589)

Loss for the period after

tax - - - - (1,570) (1,570))

Other comprehensive income

Exchange differences on

translation of foreign operations - - - 23 - 23

--------- --------- --------- ------------- ---------- ---------

Total comprehensive (loss)/income - - - 23 (2,159) (2,136)

At 30 June 2022 53 305 341 283 340 1,322

Loss for the period after

tax - - - - (622) (622)

Other comprehensive income

Exchange differences on

translation of foreign operations - - - 41 - 41

--------- --------- --------- ------------- ---------- ---------

Total comprehensive (loss)/income - - - 41 (622) (581)

--------- --------- --------- ------------- ---------- ---------

At 31 December 2022 53 305 341 324 (282) 741

========= ========= ========= ============= ========== =========

Condensed interim consolidated cash

flow statement

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2022 2021 2022

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Cash flows from operating activities

(Loss)/profit for the year (622) 202 (1,368)

Net finance expense in the income statement 6 27 14

Depreciation of property, plant and

equipment 53 110 181

Amortisation of intangible assets 91 138 256

Write off of intangible asset - - 296

Decrease / (Increase) in trade and other

receivables 92 (94) 170

Increase in trade and other payables 167 16 262

Net cash (used) / generated by operating

activities (213) 399 (189)

Cash flows from financing activities

Issue of share capital - - 83

Dividend payments - - (589)

Repayment of loans (7) (59) (13)

Repayments of lease liabilities (44) - (103)

Lease interest paid (3) (6) (10)

Other interest paid (3) (21) (4)

---------- ---------- ----------

Net cash (used)/generated by financing

activities (57) (86) (636)

Cash flows from investing activities

Payments for property, plant and equipment (6) (51) (39)

Purchase of intangibles - (160) (114)

Net cash used by investing activities (6) (211) (153)

Net (decrease)/increase in cash and

cash equivalents (276) 102 (978)

Gain / (loss) on foreign exchange 8 (9) (46)

---------- ---------- ----------

Net increase/(decrease) in cash and

cash equivalents (268) 93 (1,024)

Cash and cash equivalents at the start

of the period 915 1,939 1,939

---------- ---------- ----------

Cash and cash equivalents at the end

of the period 647 2,032 915

========== ========== ==========

1. Legal status and activities

The principal activity of ADVFN PLC ("the Company") and its

subsidiaries (together "the Group") is the development and

provision of financial information, primarily via the internet,

research services and the development and exploitation of ancillary

internet sites.

The principal trading subsidiaries are All IPO Plc,

InvestorsHub.com Inc, N A Data Inc, MJAC InvestorsHub International

Conferences Ltd and Cupid Bay Limited.

The Company is a public limited company which is quoted on the

AIM of the London Stock Exchange and is incorporated and domiciled

in the UK. The address of the registered office is Suite 28, Essex

Business Centre, The Gables, Fyfield Road, Ongar, Essex, CM5

0GA.

The registered number of the company is 0 2374988 .

2. Basis of preparation

These condensed interim financial statements have been prepared

in accordance with IAS 34, "Interim Financial Reporting".

The financial information does not include all the information

required for full annual financial statements. The same accounting

policies and methods of computation have been followed in the

interim financial statements as compared with the full audited

financial statements and should be read in conjunction with the

consolidated financial statements of the Group for the year ended

30 June 2022, which were prepared under applicable law and in

accordance with UK-adopted international accounting standards.

The unaudited consolidated interim financial information is for

the six-month period ended 31 December 2022.

The financial statements are presented in Sterling (GBP) rounded

to the nearest thousand except where specified.

The interim financial information has been prepared on the going

concern basis which assumes the Group will continue in existence

for the foreseeable future.

No material uncertainties that cast significant doubt about the

ability of the Group to continue as a going concern have been

identified by the directors. Accordingly, the directors believe it

is appropriate for the interim financial statement to be prepared

on the going concern basis.

The principle risks and uncertainties of the Company remain the

same as those reported in the consolidated financial statements of

the Group for the year ended 30 June 2022.

The interim financial information has not been audited nor has

it been reviewed under ISRE 2410 of the Auditing Practices Board.

The financial information presented does not constitute statutory

accounts as defined by section 434 of the Companies Act 2006. The

Group's statutory accounts for the year to 30 June 2022 have been

filed with the Registrar of Companies. The auditors, Saffery

Champness LLP reported on these accounts and their report was

unqualified and did not contain a statement under section 498(2) or

Section 498(3) of the Companies Act 2006.

3. Earnings per share

6 months 6 months 12 months

to to to

31 Dec 2022 31 Dec 2021 30 June

2022

GBP'000 GBP'000 GBP'000

(Loss) / profit for the year attributable

to equity shareholders (622) 202 (1,368)

Shares Shares Shares

Weighted average number of shares in

issue for the period 26,315,319 26,115,318 26,184,360

Dilutive effect of options - 1,144,585 -

------------ ------------ -----------

Weighted average shares for diluted

earnings per share 26,316,319 27,259,903 26,184,360

(Loss) / earnings per share (pence)

Basic (2.36p) 0.77p (5.22p)

Diluted (2.36p) 0.74p (5.22p)

Where a loss has been recorded for the year the diluted loss per

share does not differ from the basic loss per share. Where a profit

has been recorded but the average share price for the year remains

under the exercise price the existence of options is not normally

dilutive. However, whilst the average exercise price of all

outstanding options is above the average share price there are a

number of options which are not. Under these circumstances those

options where the exercise price is below the average share price

are treated as dilutive.

4. Dividends

The directors are not recommending payment of a dividend in the

current financial year.

5. Events after the balance sheet date

On 6 January 2023, the company raised GBP4.523m by way of an

open offer of shares to qualifying shareholders. A total of

20,676,322 shares were offered to existing shareholders at a price

of 33 pence per share. 13,708,300 shares were taken up.

6. Financial statements

Copies of these accounts are available from ADVFN Plc's

registered office at Suite 28, Ongar Business Centre, The Gables,

Fyfield Road, Ongar, Essex, CM5 0GA or from Companies House, Crown

Way, Maindy, Cardiff, CF14 3UZ, www.companieshouse.gov.uk and from

the ADVFN plc website: www.ADVFNPLC.com

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QXLFBXXLXBBX

(END) Dow Jones Newswires

March 06, 2023 02:00 ET (07:00 GMT)

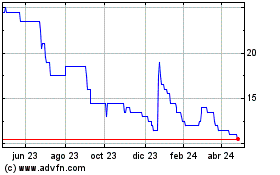

Advfn (LSE:AFN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

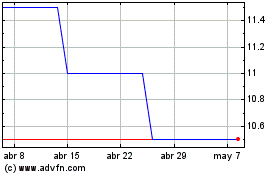

Advfn (LSE:AFN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024