TIDMANTO

RNS Number : 6312V

Antofagasta PLC

11 August 2022

NEWS RELEASE, 11 AUGUST 2022

HALF YEARLY FINANCIAL REPORT

FOR THE SIX MONTHSED 30 JUNE 2022

Antofagasta plc CEO Iván Arriagada said : "Although we have

experienced significant challenges over the half year - a volatile

copper price as a result of macro developments, the continued

drought in Chile, and an incident with our concentrate pipeline at

Los Pelambres - the actions we have taken, coupled with the quality

of our assets and balance sheet, have meant that we were able to

weather the storm. Sales volumes during the period were lower as

were copper prices and this is reflected in the 30% decline in

revenue. As we previously announced, with the fall in production

and higher input prices, cash costs were higher. And although we

have experienced general inflation, the impact was offset by the

weak Chilean peso.

"As we continue to decarbonise our business, we successfully

moved all our mining operations away from using fossil fuels for

energy generation and as of April this year, they are now all using

100% renewable energy.

"We expect the remainder of the year to look very different from

the first half - as production improves quarter-on-quarter, we ship

and sell the concentrate that was impacted by the concentrate

pipeline incident, and the desalination plant at Los Pelambres

starts, significantly alleviating the issue of water availability.

We remain on track to produce our revised guidance of 640-660,000

tonnes of copper for the full year.

"While the short-term outlook remains uncertain for copper,

inflation, global economics and geopolitics, we remain committed to

maintaining our operating discipline and cost control, and a strong

balance sheet.

"Copper's critical role in the development of low-carbon

technologies is essential for the energy transition and the

long-term fundamentals for copper remain favourable. I am confident

that Antofagasta's strategy of developing mining for a better

future is the right one and will deliver long-term value for all

our stakeholders.

"In line with our normal 35% pay-out ratio for interims, the

Board has declared an interim dividend of 9.2 cents per share."

HIGHLIGHTS

Financial performance

-- Revenue for the first half of 2022 was $2,528 million , 29.6%

lower than the same period in 2021 mainly because of lower copper

and by-product sales volumes and lower realised copper prices

-- EBITDA(1) was $1,238 million , 47.5% lower than in the same

period last year on lower revenue and operating costs that

increased by 6.9% mainly due to higher input prices

-- EBITDA margin(2) was 49.0% , compared with 65.6% in H1 2021

and 64.7% for the full year 2021

-- The Cost and Competitiveness Programme generated savings and

productivity improvements of $35 million in the first half of 2022,

equivalent to 6c/lb of unit cash costs

-- Profit before tax was $680 million, a $1,104 million decrease on the same period in 2021

-- Continuing strong balance sheet with a net debt to EBITDA

ratio at the end of the period of 0.13 times. The cash, cash

equivalents and liquid investments balance at 30 June 2022 was

$2,878 million, a decrease from $3,713 million at the end of 2021 ,

largely reflecting the $1,172 million payment of the 2021 final

dividend

-- Cash flow from operations reduced to $1,683 million compared

with $2,461 million in the first half of 2021

-- Capital expenditure of $831 million was 44% of full year guidance

-- Earnings per share of 26.4 cents, 41.1 cents lower than the same period in 2021

-- Interim dividend of 9.2 cents per share, equivalent to a

pay-out ratio of 35% of underlying net earnings in line with the

Company's capital allocation framework

Production and cost performance (as previously announced on 20

July 2022)

-- Group copper production in the first six months of the year

was 268,600 tonnes , 25.7% lower than in the same period last year

mainly due to the expected temporary reduction in throughput at Los

Pelambres as a result of the drought and the concentrate pipeline

incident and expected lower grades at Centinela Concentrates.

Throughput at Los Pelambres was 36.2% lower than in H1 2021, and

the grades at Centinela Concentrates were 25.4% lower

-- Cash costs before by-product credits for the first half of

the year were $2.37/lb , 37.0% higher than in the same period last

year mainly due to the temporary decrease in production and higher

input prices, particularly for diesel and sulphuric acid. General

inflation was largely offset by the weaker Chilean peso

-- Net cash costs were $1.82/lb for the first half of the year ,

compared with $1.14/lb in the first half of 2021, reflecting the

increase in cash costs before by-product credits and slightly lower

by-product credits due to lower by-product production, partially

offset by higher realised prices

2022 Guidance (as previously announced)

-- Full year copper production for the Group is expected to be

640-660,000 tonnes. This includes the impact of the concentrate

pipeline incident, and the impact of the water shortage at Los

Pelambres due to the drought

-- The drought has continued at Los Pelambres during the period

although there has been heavier precipitation since then. The

revised guidance range incorporates a negative outlook for water

availability for the rest of the year, which we consider to be low

probability. Strict water management protocols remain in place to

optimise water usage and mitigate the impact of low water

availability

-- With increases in diesel and other input prices, net cash

cost guidance is $1.65/lb, assuming market consensus estimates of

by-product prices and the Chilean Peso exchange rate for the rest

of the year

-- As announced in April, expected Group capital expenditure for

the year is unchanged at $1.9 billion

-- The Group is on track to achieve its Cost and Competitiveness

Programme savings target of at least $50 million for the full

year

Growth projects

-- As previously announced, at the end of H1 the Los Pelambres

Expansion project was 82% complete

-- Completion of the desalination plant is expected in Q4 2022

and of the concentrator plant expansion in early 2023

-- On completion of the desalination plant, the Group's exposure to water scarcity risk will be substantially reduced. An application to further expand the plant is underway

-- As previously announced, the Zaldívar Chloride Leach project

was completed in January 2022 on budget

-- Since the period end, mining with the Group's first fleet of

autonomous trucks has started at Esperanza Sur and the ore is being

processed at the Centinela concentrator

-- Following the completion of a detailed review of the

Centinela Second Concentrator project, the capital cost estimate

has been revised to $3.7 billion (up from $2.7 billion in the 2015

prefeasibility study). This estimate includes a new water system

and the increase reflects design changes, inflation, heightened

environmental and other regulatory requirements, and the results of

advanced engineering and a more detailed execution plan. The

decision on whether to proceed with the project is scheduled for

early 2023

-- The expansion at Centinela will increase production by an

average of 170,000 tonnes per annum of copper equivalent and move

Centinela into the first cost quartile, and takes advantage of the

Group's large resource base in the Centinela district

Sustainability

-- As previously announced, from April this year all mining

operations have been operating solely using renewable energy,

significantly reducing the Company's Scope 2 emissions

-- The Group's Sustainability Report was published in April and

its first Tax Report was published in July

-- In August, Antucoya obtained the Copper Mark, for compliance

with this independently verified responsible production standard,

joining Centinela and Zaldívar who received it in 2021

Other

-- As previously announced, there was a discharge from the

concentrate pipeline at Los Pelambres during the period and the

pipeline resumed operations on 26 June. There was no material

environmental impact and the pipeline was approved for reopening by

the relevant local regulator. A review is underway to ensure

enhanced safety conditions are incorporated into pipeline

operations ahead of the replacement of the pipeline which is

currently being permitted and is expected to be completed in 2025.

Engagement with members of the local communities concerned about

the safety of the pipeline by the Company together with the local

authorities were also concluded successfully

-- The Constitutional Convention completed the draft of the new

constitution on 4 July. A national referendum to accept or reject

the new constitution will be held on 4 September

-- The government presented a tax reform bill to Congress on 7

July and a new proposal for the mining royalty on 11 July. This

proposal is being evaluated by the mining industry. The initial

view is that it is more onerous than the proposal made by the

Senate Mining and Energy Committee in January, but less onerous

than the original proposal made by the lower house in May 2021. The

new draft will now be reviewed by the Senate before being passed to

the lower house for its consideration

UNAUDITED RESULTS SIX MONTHSED 30

JUNE 2022 2021 %

-------- --------

Revenue $m 2,528.2 3,591.0 (29.6)

EBITDA(1) $m 1,237.7 2,357.1 (47.5)

EBITDA margin(1, 2) % 49.0 65.6 (25.3)

Profit before tax (including exceptional

items) $m 679.6 1,783.5 (61.9)

Earnings per share (continuing and discontinued

operations including exceptional items) cents 26.4 67.5 (60.9)

Dividend per share cents 9.2 23.6 (61.0)

Cash flow from operations (continuing

and discontinued) $m 1,682.5 2,460.5 (31.6)

Capital expenditure(3) $m 831.0 781.9 6.3

Net debt/(cash) at period end $m 491.4 (701.3) N/A

Realised copper price $/lb 4.13 4.42 (6.6)

-------

Copper sales(4) kt 240.4 325.1 (26.1)

Gold sales koz 73.6 103.7 (29.0)

Molybdenum sales kt 3.9 5.7 (31.6)

Cash costs before by-product credits(1) $/lb 2.37 1.73 37.0

Net cash costs(1) $/lb 1.82 1.14 59.6

------------------------------------------------- ------- -------- -------- -------

Note : The financial results are for continuing operations and

are prepared in accordance with IFRS unless otherwise noted

below.

(1) Non-IFRS measures. Refer to the alternative performance

measures section on page 60 in the half-year financial report

below.

(2) Calculated as EBITDA/Revenue. If Associates and JVs' revenue

is included EBITDA Margin was 44.6% in HY 2022 and 61.8% in HY

2021.

(3) On a cash basis.

(4) Does not include 22,700 tonnes of sales by Zaldívar in HY

2022 and 21,100 tonnes in HY 2021, as it is equity accounted.

A recording and copy of the 2022 Half Year Results presentation

is available for download from the Company's website

www.antofagasta.co.uk .

There will be a Q&A video conference call at 2:00pm BST

today hosted by Iván Arriagada - Chief Executive Officer, Mauricio

Ortiz - Chief Financial Officer and René Aguilar, Vice President -

Corporate Affairs and Sustainability. Participants can join the

conference call here .

Investors Media - London

- London

Andrew Lindsay alindsay@antofagasta.co.uk Carole Cable antofagasta@brunswickgroup.com

Telephone +44 20 7808 0988 Telephone +44 20 7404 5959

Rosario Orchard rorchard@antofagasta.co.uk

Telephone +44 20 7808 0988 Media - Santiago

Pablo Orozco porozco@aminerals.cl

Carolina Pica cpica@aminerals.cl

Telephone +56 2 2798 7000

Register on our website to receive our email alerts

http://www.antofagasta.co.uk/investors/email-alerts/

Twitter LinkedIn

FINANCIAL AND OPERATING REVIEW

FINANCIAL HIGHLIGHTS

Group revenue was $2,528.2 million, 29.6% lower than in the same

period last year mainly as a result of copper sales volumes falling

by 26.1%, the realised copper price decreasing by 6.6%, and as

by-product revenues decreased by 25.3%, mainly due to lower

molybdenum and gold volumes, partially offset by higher realised

by-product prices.

EBITDA during the first six months was $1,237.7 million, 47.5%

lower than in the same period in 2021, reflecting lower revenue and

higher cost of sales which increased by 6.9%.

Profit before tax including exceptional items was $679.6

million, 61.9% lower than in the same period in 2021 reflecting the

lower EBITDA.

Earnings per share from continuing operations including

exceptional items for the year were 26.4 cents, a decrease of 60.9%

compared with 2021.

Cash flow from operations was $1,682.5 million, a 31.6% decrease

compared with the same period last year, reflecting the Group's

lower EBITDA.

The Board has declared an interim ordinary dividend of 9.2 cents

per share, equal to a 35% pay-out ratio in both periods and in line

with our dividend policy.

SUSTAINABILITY

Safety and health

Antofagasta prioritises the safety and wellbeing of its

people.

Given that our safety management system prioritises eliminating

fatalities, the Group's focus is on high potential incidents

(HPIs), and we are using this measure as our key lead indicator of

safety performance. During the first half of 2022, the Group

recorded 23 HPIs, 21% less than the same period in the previous

year, with improvements seen in both our Mining and Transport

divisions.

The Group's Lost Time Injury Frequency Rate (LTIFR) was 0.92 per

million hours worked, 23% less than in 2021. All incidents with

lost time are now being investigated to identify and learn from the

organisational causes.

Communities

We seek to engage in long-term sustainable relationships with

the communities near to our operations through our Somos Choapa (We

are Choapa) and Diálogos para el Desarrollo (Dialogues for

Development) engagement mechanisms in the Choapa Province and the

Antofagasta Region, respectively.

Following the concentrate pipeline incident at Los Pelambres,

engagement with several rural communities ensued with the

participation of local and regional authorities. Agreements reached

include initiatives focused on participatory monitoring through

enhanced information sharing about parts of the company's

infrastructure, and financing social projects related to drinking

water, sanitation, health, education and public spaces. In line

with the Group's community relations model, most of these projects

will be in partnership with the public sector.

Over recent years, Los Pelambres has strengthened its water

strategy to contribute to the mitigation of communities' challenges

arising from water scarcity. Projects have been developed to

provide assistance during emergencies and improve the quantity and

quality of water available to local communities. Los Pelambres has

also implemented projects to improve the efficient use of water for

irrigation, financing the lining of more than 200 kilometres of

irrigation canals over the last 10 years and the construction of

some 200,000 m(3) of water storage. Additionally, innovation and

technology have been used to automate sluice gates on the Illapel

River to improve the efficiency and use of water.

In recent months Zaldívar has advanced its relationship with the

community of Peine, an indigenous Atacameño village located in the

Salar de Atacama, approximately 100km from the operation and close

to its water well field. The community has established an elected

committee to work with the company and the local and regional

authorities in supporting the community's development.

Climate Change and emission targets

At Antofagasta, we see climate change as one of the greatest

challenges facing the world today and are committed to being part

of the solution. As a copper producer, we have a clear role to play

in supplying a metal that is a critical input for many low-carbon

technologies such as electromobility and the generation of

renewable energy.

After meeting our 2018-2022 GHG emissions reduction target two

years early in 2020, the Company announced two new targets.

The first is to reduce the Company's Scope 1 and Scope 2 GHG

emissions by 30%, or 730,000 tonnes of CO(2) e by 2025, relative to

2020. And the second is for the Group to achieve carbon neutrality

by 2050, in line with Chile's own national target, or earlier if

suitable technologies are developed.

These targets are supported by the conversion of our operations

to electricity generated solely from renewable sources, which was

achieved in April 2022. At the same time, we are working to reduce

and, ultimately, eliminate the use of diesel at our mining

operations by using alternative power sources and a portfolio of

energy efficiency initiatives.

More details of our Climate Change Strategy can be found in our

2021 Climate Change Report.

Water

One clear impact of climate change is the 13-year drought in

central Chile, which is where Los Pelambres is located. In 2018, we

took the decision to build a desalination plant for Los Pelambres

and the first stage of this project, with an output of 400 litres

per second, is due to start operation in Q4 2022 and to double its

capacity as soon as the necessary permitting is obtained.

Our Centinela and Antucoya operations in the north of Chile

already almost only use sea water and Zaldívar will use continental

water until 2025 or 2031 (see below). As a result, we expect raw or

desalinated seawater and reused or recycled water to account for

90% of the operational water use of all our mining operations by

2025.

In 2018, Zaldívar submitted an Environmental Impact Assessment

(EIA), which included an application to extend its water permit

from 2025 to 2031 and the mining lease (which expires at the end of

2023). This has involved government agencies reviewing the

application and a consultation process with the indigenous

community in Peine, led by the environmental authority.

If the relevant permits are not extended, this is likely to be

considered as an indicator of a potential impairment, requiring a

full impairment assessment to be carried out.

Zaldívar's mine life is to 2036. Field work and studies are

underway on further extending the life of the mine by exploiting

the primary sulphide ore body that lies below the current ore

reserves. Water planning beyond the extension to 2031 is being

evaluated as part of these studies as is the use of the Group's

Cuprochlor-T technology.

To safeguard the availability of water resources for our

operations, communities and the environment, we published our first

Water Policy earlier this year, which commits us to increasing our

water efficiency, implementing robust and transparent water

governance practices, and collaborating with other stakeholders on

environmentally responsible and sustainable water management.

Suppliers

The Group is requiring improved sustainability practices from

its suppliers with the purpose of working with them to ensure

alignment with leading standards on environmental, social and

governance (ESG) matters.

This strategy includes applying an internal carbon price to

tenders as well as other ESG criteria. The use of an internal

carbon price is being rolled out and during the half year was used

with larger suppliers for specific goods and services contracts,

such as explosives and mine haulage trucks. The new measures

complement the energy efficiency and safety criteria already used

in bid evaluations.

At the same time, as part of supply chain management,

Antofagasta is holding workshops to help micro, small and

medium-sized suppliers near our operations to comply with these

conditions so as to take advantage of their inherent advantage of

having short transport distances and enhance trustworthy supplier

relationships built on shared value creation.

PRODUCTION AND CASH COSTS

Group copper production in the first half of 2022 was 268,600

tonnes, 25.7% lower than in the same period last year, mainly due

to the expected temporary reduction in throughput at Los Pelambres

as a result of the drought, the concentrate pipeline incident and

expected lower grades at Centinela Concentrates.

Group gold production for the first six months decreased by

38.8% to 73,800 ounces.

Molybdenum production was 4,000 tonnes, 31.0% lower than in the

same period last year.

Group cash costs before by-product credits in the first half of

2022 were $2.37/lb, 64c/lb higher than last year, a result of the

temporary decrease in production and higher input prices,

particularly for diesel and sulphuric acid. General inflation was

largely offset by the weaker Chilean peso.

Net cash costs for the first half of 2022 were $1.82/lb, 68c/lb

higher than in the same period last year reflecting the higher cash

costs before by-product credits, and slightly lower by-product

credits due to lower by-product production, partially offset by

higher realised by-product prices.

COST AND COMPETITIVENESS PROGRAMME

During the first half of the year, the Cost and Competitiveness

Programme achieved savings of $35 million, equivalent to $6c/lb as

the Group has managed to reduce cash expenditure in some areas by

optimising and negotiating third party services and increasing

productivity. The Group is on track to achieve its savings target

of at least $50 million for the full year.

EXPLORATION AND EVALUATION COSTS

Exploration and evaluation costs for the first half of the year

were $51.4 million, similar to the same period last year.

TAXATION

The effective tax rate for the period was 36.5%, which compares

with 37.1% during the same period in 2021 and 36.5% (before

exceptional items) for the full year 2021.

CAPITAL EXPITURE AND DEPRECIATION & AMORTISATION

Group capital expenditure on a cash basis was $831.0 million

during the period of which $301.4 million was mine development,

$188.0 million was sustaining (mining) and $323.8 million was

development, of which $218.5 million was on the Los Pelambres

Expansion project. The balance was at the Transport division and at

the corporate centre. Group capital expenditure for the full year

is expected to be $1.9 billion.

Depreciation and amortisation for the first half of 2022 was

$489.0 million, an increase of $6.5 million compared with the same

period in 2021.

NET DEBT

Net debt at the end of the period was $491.4 million, reflecting

the $1,172.2 million payment of the final dividend. The Net Debt to

EBITDA ratio at the end of the period was 0.13 times. Cash flow

from operations reduced to $1,682.5 million compared with $2,460.5

million in the first half of 2021.

CORPORATE BOND

The Group successfully issued its second bond, a $500 million

5.625% note due 2032. This financing further diversifies funding

sources and extends the maturity profile of the Group.

DIVIDS

The Board has declared an interim dividend of 9.2 cents per

share, equivalent to $90.7 million and a pay-out ratio of 35%,

consistent with the Company's policy and previous interim

dividends. Any distribution of excess cash for the year, as defined

under the policy, will be made as part of the final dividend.

LABOUR AGREEMENTS

A labour negotiation with the supervisors' union at Antucoya was

successfully concluded during the period before the November 2022

deadline.

There are three other labour agreements that will expire during

the year, with the workers at Antucoya (September) and the

supervisors at Los Pelambres (October) and Zaldívar (August).

PROPOSED MINING ROYALTY

The government presented a tax reform bill to Congress on 7 July

and a new proposal for the mining royalty on 11 July. This proposal

is being evaluated by the mining industry. The initial view is that

it is more onerous than the proposal made by the Senate Mining and

Energy Committee in January, but less onerous than the original

proposal made by the lower house in May 2021. The new draft will

now be reviewed by the Senate before being passed to the lower

house for its consideration.

CONSTITUTIONAL CONVENTION

The Constitutional Convention completed the draft of the new

constitution on 4 July. A national referendum to accept or reject

the new constitution will be held on 4 September.

MINERAL RESOURCES

As announced on 14 June, the Company has released maiden mineral

resource figures for the Encierro deposit in Chile of 522Mt of

Inferred Resources at 0.79% copper equivalent. The deposit is

jointly held with Barrick Gold, with Antofagasta the majority

shareholder and operator.

Note: Inferred Resources are compliant with the Australasian

Joint Ore Reserves Committee Code for Reporting of Exploration

Results, Minerals Resources and Reserves 2012 edition (JORC Code).

A cut-off grade of 0.5% copper has been applied. The geological

model and resource estimation have been reviewed and validated by

registered Competent Person (Chile) Mr. Osvaldo Galvez.

CUPROCHLOR -T(R)

During the first quarter of 2022 we finalised a large-scale

pilot programme to validate our in-house patented primary sulphides

leaching technology (Cuprochlor-T(R)). We conducted

industrial-scale trials at Centinela using a 40,000-tonne heap of

Centinela's primary sulphides. The results were consistent with

previous test work, giving recoveries of 70% after approximately

200 days.

This new technology will potentially unlock value from

previously uneconomic mineral resources and bring forward the

profitable processing of ore otherwise scheduled to be mined in

many years' time or that was previously considered to be

uneconomic.

We are currently progressing studies for the primary sulphide

orebody that lies below the Zaldívar reserves to evaluate if

Cuprochlor-T leaching is a viable processing route.

An alternative is for idle leach pad and SX-EW capacity to be

used to process material using the Cuprochlor-T technology and one

area of flexibility is that the existing EW plant can process

blended solutions from both oxide and chloride leach. This allows

the technology to be gradually deployed during the life of each

mine as appropriate for the specific situation and the use of this

option is being investigated by Centinela and Antucoya as part of

their annual mine planning processes.

REKO DIQ PROJECT'S ARBITRATION

In March 2022 the Company reached an agreement in principle with

Barrick Gold and the Governments of Pakistan and Balochistan on a

framework that provides for the reconstitution of the Reko Diq

project, and a pathway for the Company to exit the project. If

definitive agreements are executed and the conditions to closing

are satisfied, a consortium comprising various Pakistani

state-owned enterprises will acquire an interest in the project for

consideration of approximately $900 million to jointly develop the

project with Barrick, and Antofagasta would exit. If all the

conditions are satisfied during 2022, we would expect to receive

the proceeds in 2023.

AUDIT TER

The Group intends to undertake a competitive tender process

during the second half of 2022 in respect of the appointment of the

Group's external auditor with effect from 2024 onwards. The Group

previously conducted a tender process during 2014, which resulted

in PwC replacing the previous auditor and being appointed with

effect from 2015 onwards. The tender process in respect of the 2024

audit is one year in advance of the regulatory requirement to

undertake a tender at least every ten years.

FUTURE GROWTH

The Group has a pipeline of embedded growth projects across our

significant mineral resource base which we are currently advancing

through a disciplined process of project evaluation.

The Zaldívar Chloride Leach project was completed in January on

budget and pre-stripping of the Esperanza Sur pit project was

completed in July. The Los Pelambres Expansion project was 82%

complete as at the end of H1 with the completion of the

desalination plant expected in Q4 2022 and of the concentrator

plant expansion in early 2023.

A detailed review of the Centinela Second Concentrator Plant

schedule and costs has recently been updated. The capital cost

estimate has been revised to $ 3 .7 billion (up from $2.7 billion

in the 2015 prefeasibility study). This increase reflects design

improvements, inflation, and the results of advanced engineering

and a detailed execution plan. The decision on whether to proceed

with the project is scheduled for early 2023.

OUTLOOK

As previously announced, considering the impact of the

concentrate pipeline incident and the risk of continued low water

shortages at Los Pelambres, Group copper production guidance for

the full year has been revised from 660-690,000 tonnes to

640-660,000 tonnes. The increased rate of production in H2 is based

on the precipitation levels to date, the stockpiled concentrates at

Los Pelambres and the expected increase in grade at Centinela

Concentrates.

Following increases in diesel and other input prices, net cash

cost guidance is increased to $1.65/lb, assuming market consensus

estimates at the period end of by-product prices, the Chilean Peso

exchange rate and inflation for the rest of the year.

The significant decline in the copper price since the beginning

of June has reinforced our commitment to control costs,

particularly during this period of higher input prices and general

inflation.

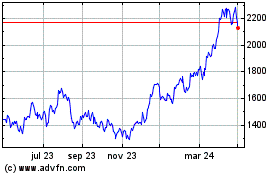

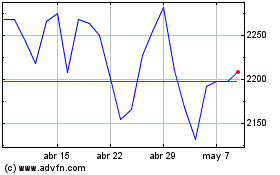

Although the copper price traded strongly at the beginning of

the year averaging $4.49/lb in the first five months, it weakened

rapidly in June, ending the half year at $3.74/lb as concerns about

the speed of the economic recovery in China and the likelihood of a

recession in the United States and Europe increased. These concerns

were further heightened by the ongoing conflict in Ukraine and its

impact on the availability of energy supplies, trade and stability,

particularly in Europe. Given the current global environment of

rising inflation and rising interest rates, commodity price

volatility is expected to continue over the rest of the year,

however the longer term fundamentals for copper remain strong.

REVIEW OF OPERATIONS AND PROJECTS

MINING DIVISION

LOS PELAMBRES

Financial performance

EBITDA at Los Pelambres was $510.6 million in the first half of

2022, a 62.1% decrease compared with $1,346.9 million in the first

six months of 2021. This decrease was mainly due to a lower copper

sales tonnage (41.8%) and the lower realised copper price, which

was partially offset by lower operating costs during the

period.

Production

In the first six months of 2022, copper production decreased by

41.9% to 98,400 tonnes compared with the same period last year,

mainly driven by the expected reduced throughput, which was down

36.2% compared with the same period last year due to water

restrictions arising from the drought. This decrease also includes

the impact of the concentrate pipeline incident, with unfiltered

copper produced during the incident but not shipped expected to be

recorded as production during the balance of 2022.

Molybdenum production for the first six months of the year

decreased to 2,700 tonnes from 5,100 in H1 2021, due to lower

throughput and molybdenum grades.

Costs

Cash costs before by-product credits for the first six months of

2022 were $2.02/lb, 33.8% higher than in the same period last year.

This was due to the decrease in production, higher input prices,

mainly diesel and explosives, and general inflation, partially

offset by the weaker Chilean peso.

For the first six months of 2022, by-product credits were

$0.70/lb, in line with the same period last year.

Net cash costs for the year to date increased by 59.0% to

$1.32/lb. This reflected the higher cash costs before by-product

credits.

Capital expenditure

Capital expenditure in the first six months of 2022 was $404.0

million in total of which $115.5 million was sustaining capital

expenditure, $67.0 million mine development and $221.5 million was

on the Los Pelambres Expansion project.

CENTINELA

Financial performance

EBITDA for the first six months of 2022 was $526.9 million, a

decrease of 36.6% compared with the first half of 2021. This

decrease was due to lower copper and gold sales volumes, higher

operating costs and the lower copper realised price compared with

the same period last year.

Production

Total copper production in H1 2022 was 111,300 tonnes, 15.7%

lower than in H1 2021 due to expected lower ore grades at Centinela

Concentrates, slightly offset by higher grades at Centinela

Cathodes.

Production of copper in concentrates was 66,200 tonnes for the

half year, 26.8% lower than in the same period last year, mainly

due to the expected lower copper grade of 0.44% compared with 0.59%

in H1 2021. This was partially offset by increased throughput, with

the concentrator averaging above design capacity over the half

year.

Copper cathode production for the first six months was 45,100

tonnes, 8.2% higher than in the same period last year primarily due

to expected higher grades and recoveries.

Gold production in H1 was 58,400 ounces, 36.9% lower than H1

last year as grades, which are correlated to copper grades, and

recoveries decreased.

Molybdenum production in H1 2022 increased to 1,300 tonnes from

700 tonnes in H1 2021, due to higher grades.

Costs

Cash costs before by-product credits for the first six months of

2022 were $2.68/lb, 48.9% higher than the same period in 2021

primarily due to lower production and higher input costs,

particularly for diesel, sulphuric acid and explosives. General

inflation was largely offset by the weaker Chilean peso.

For the first six months of 2022, by-product credits were

$0.70/lb, 2c/lb lower than in the same period last year.

Net cash costs during the first six months of the year were

$1.98/lb, 90c/lb higher than in H1 2021 reflecting the increase in

cash costs before by-product credits and the slightly lower

by-product credits.

Capital expenditure

Capital expenditure in the first six months of 2022 was $387.2

million of which $51.5 million was sustaining capex, $233.5 million

was mine development and $102.2 million was development capex , of

which $44.7 million was on the Centinela Second Concentrator

project.

ANTUCOYA

Financial performance

For the first half of the year, EBITDA was $153.4 million, a

decrease of 3.5% compared with $159.0 million in the same period

last year, due to lower copper sales volumes and higher operating

costs, largely offset by the higher copper realised price.

Production

Production in the first six months of 2022 was 36,400 tonnes,

7.8% lower than the same period last year due to expected lower

grades, partially offset by higher throughput.

Costs

During the first six months, cash costs were 22.5% higher than

in H1 2021 at $2.50/lb due to lower production and increased input

costs, particularly for sulphuric acid, diesel and explosives.

General inflation was largely offset by the weaker Chilean

peso.

Capital expenditure

Capital expenditure in the first six months of the year was

$21.9 million, almost all of which was sustaining capital

expenditure.

ZALDÍVAR

Financial performance

Attributable EBITDA at Zaldívar was $104.8 million in the first

half of 2022, compared with $76.4 million in the same period last

year largely because of higher sales volumes, lower operating costs

and the higher realised copper price.

Production

Copper production at Zaldívar for the year to date was 22,500

tonnes, 9.2% higher compared with the same period last year due to

higher copper grades and recoveries. Following completion of the

Chloride Leach project during the period, recoveries are projected

to increase as the project ramps up.

Costs

Cash costs during the first six months of 2022 were $2.14/lb

compared with $2.46/lb in the same period in 2021, mainly due to

higher production partially offset by higher input prices.

Capital expenditure

In the first six months of 2022, attributable capital

expenditure was $25.1 million of which $17.4 million was sustaining

capital expenditure and $7.7 million was development capital

expenditure.

TRANSPORT DIVISION

Financial performance

EBITDA at the Transport division was $37.4 million in the first

half of 2022, a 3.9% improvement on the same period last year, as a

result of higher revenue.

Transport volumes

For the first six months of the year, transport volumes

increased by 11.8% as new rail transport contracts ramped up during

the period.

Capital expenditure

Capital expenditure for the first half of the year was $13.7

million.

GROWTH PROJECTS AND OPPORTUNITIES

Los Pelambres Expansion

This expansion project is divided into two phases. Phase 1 is

expected to be completed in early 2023 and Phase 2 by the end of

2025.

Phase 1

This phase is designed to optimise throughput within the limits

of the existing operating, environmental and water extraction

permits.

As mining progresses at Los Pelambres , ore hardness will

increase. The expansion is designed to compensate for this,

increasing plant throughput from the current capacity of 175,000

tonnes of ore per day to an average of 190,000 tonnes of ore per

day. The expansion is divided into two sub-projects, the

construction of a desalination plant and water pipeline from the

coast to the El Mauro tailings storage facility, and the expansion

of the concentrator plant , which includes the installation of an

additional SAG mill and ball mill, and six additional flotation

cells.

Annual copper production will be increased by an average of

60,000 tonnes per year over 15 years, starting at approximately

40,000 tonnes per year for the first four to five years and rising

to 70,000 tonnes for the rest of the period as the hardness of the

ore increases and the benefit of the higher milling capacity is

fully realised.

In 2020 the decision was made to change the scope of the project

and double the planned capacity of the desalination plant that is

part of Phase 1 of the project, from 400 l/s to 800 l/s. However,

the amount of work that can be done on the expansion of the

desalination plant during Phase 1 is limited by what is allowed

under the permits that have already been issued. These additional

costs are included as part of the total Phase 1 capital cost.

As at the end of H1 the Los Pelambres Expansion project was

81.7% complete. The desalination plant is expected to be completed

in Q4 2022 and the concentrator plant expansion in early 2023.

The desalination plant and the water pipeline are 87.5% complete

and preparation for pre-commissioning is underway. The concentrator

expansion site is 75.9% complete and the principal equipment (SAG

and ball mills, and flotation cells) have been installed.

A detailed review of the project schedule and costs was

completed in Q1 2022 resulting in the capital cost estimate for

Phase 1 being increased to $2.2 billion (from $1.7 billion). Of

this increase, approximately $220 million was related to the impact

of COVID-19 on costs and the construction schedule, $170 million to

general inflation, including increased input prices, wages, labour

incentives and logistics costs, with the balance reflecting other

adjustments to implementation plans and an updated contingency

provision.

Phase 2 - Further expansion

Following the decision to increase the size of the desalination

plant, Phase 2 of the expansion now requires two separate

Environmental Impact Assessment (EIA) applications, one for the

expansion of the desalination plant and one for the extension of

the mine life of Los Pelambres through the permitting of an

increase in the size of the El Mauro tailings storage facility. The

latter EIA will also provide for the option to further increase the

throughput capacity of the concentrator plant.

Desalination plant expansion

This project is to protect Los Pelambres from the future impact

of climate change and the deteriorating availability of water in

the region. The project cost will be reported as part of the

Group's sustaining capital expenditure.

The project includes the expansion of the desalination plant and

the construction of a new water pipeline from the El Mauro tailings

storage facility to the concentrator plant. In 2021 Los Pelambres

submitted the EIA required for this project, which includes the

desalination plant expansion and two other sustaining capital

infrastructure projects, the replacement of the concentrate

pipeline and the construction of certain planned enclosures at the

El Mauro tailings storage facility. The EIA is expected to be

approved in time for the project to be completed in 2025 at which

time over 95% of Los Pelambres's water needs will be from either

desalinated or recycled water.

Mine life extension

The current mine life of Los Pelambres is 13 years and is

limited by the capacity of the El Mauro tailings storage facility.

The scope of the second EIA will include increasing the capacity of

the tailings storage facility and the mine waste dumps. This will

extend the mine's life by a minimum of 15 years, accessing a larger

portion of Los Pelambres's six billion tonnes of mineral resources.

The EIA will also provide for the option to increase throughput to

205,000 tonnes of ore per day, increasing copper production by

35,000 tonnes per year.

The feasibility study is underway and includes repowering the

conveyor that runs from the primary crusher in the pit to the

concentrator plant which will support the additional

throughput.

The capital expenditure to extend the mine life was estimated in

a pre-feasibility study in 2014 at approximately $500 million, with

most of the expenditure on mining equipment and increasing the

capacity of the concentrator and the El Mauro tailings facility.

Community consultation is ongoing and the EIA application is being

prepared.

Esperanza Sur pit

Esperanza Sur pit is 4 km south of the Esperanza pit and is

close to Centinela's concentrator plant. The deposit contains 1.4

billion tonnes of reserves with a grade of 0.4% copper, 0.13g/t of

gold and 0.012% of molybdenum.

Pre- stripping by a contractor has been completed and Centinela

has taken over the operation of the pit using a fleet of 11

autonomous trucks. These are the first autonomous trucks to be used

by the Group. Ore from the pit is now being processed at the

Centinela concentrator.

The opening of the Esperanza Sur pit improves Centinela's

flexibility to supply its concentrator and, over the initial years,

the higher-grade material from the pit will increase production by

some 10-15,000 tonnes of copper per year, compared with how much

would be produced if material was solely supplied from the

Esperanza pit. This greater flexibility will allow Centinela to

smooth and optimise its year-on-year production profile, which has

in the past been variable.

Zaldívar Chloride Leach

The project is expected to increase copper recoveries by

approximately 10 percentage points with further upside in

recoveries possible, depending on the type of ore being processed.

This will increase copper production at Zaldívar by approximately

10-15,000 tonnes per annum over the remaining life of the mine.

The project was completed on-budget in early 2022 at a total

capital cost of $190 million. The project required an upgrade of

the Solvent Extraction (SX) plant, new reagents facilities and the

construction of additional washing ponds for controlling the

chlorine levels. Ramp-up to achieve the full improvement in

recoveries is currently underway.

As the Group equity accounts for its interest in Zaldívar,

capital expenditure at the operation is not included in Group total

capital expenditure amounts.

Centinela Second Concentrator

The project has two phases, the first being the construction of

a new concentrator and its associated infrastructure, and the

second its possible expansion. The EIA for both phases was approved

in 2016.

Detailed engineering and costings have recently been updated for

Phase 1 of the project and key contracts finalised. The capacity of

the new concentrator will be 95,000 tonnes of ore per day producing

on average approximately 170,000 tonnes of copper equivalent a year

over the first 10 years of operation. This will move Centinela into

the first cost quartile of producers.

The Phase 1 capital cost is estimated at $ 3.7 billion,

including the cost of the new water supply system. The increase on

the previously quoted 2015 pre-feasibility estimate of $2.7 billion

reflects inflation, design improvements, heightened environmental

and other regulatory requirements, and the results of advanced

engineering and a more detailed execution plan. The estimate

includes a concentrator plant, capitalised stripping, mining

equipment, a new tailings storage facility, a water pipeline and

other infrastructure, pre commercial production operating costs

plus owner's and other costs.

The decision by the Board on whether to proceed with the project

is scheduled for early 2023. Work on Phase 2 would only start once

construction of Phase 1 is completed and it is operating

successfully.

The second concentrator, and its potential further expansion to

150,000 tonnes of ore per day, will source ore initially from the

recently opened Esperanza Sur pit and later from the Encuentro pit.

The sulphide ore in the Encuentro pit lies under the Encuentro

Oxides reserves, which are expected to be depleted by 2026. These

expansions will be further steps towards Centinela maximising the

potential of its large mineral resource base.

In late 2020 a tender process was started to invite third

parties to provide water for Centinela's current and future

operations, by acquiring the existing water supply system, and

building the new water pipeline. This process is expected to be

completed in Q4 2022. The outsourcing of the water supply will only

proceed if it improves the net present value of the project.

Twin Metals Minnesota (TMM)

Twin Metals Minnesota (Twin Metals) is a wholly owned copper,

nickel and platinum group metals (PGM) underground mining project,

which holds copper, nickel/cobalt and PGM deposits in north-eastern

Minnesota, US.

The project envisages mining and processing 18,000 tonnes of ore

per day for 25 years and producing three separate concentrates -

copper, nickel/cobalt and PGM. Twin Metals has been progressing its

Mine Plan of Operations (MPO) and Scoping Environmental Assessment

Worksheet Data Submittal, submitted in December 2019 to the US

Bureau of Land Management (BLM) and Minnesota Department of Natural

Resources (DNR), respectively. However, over the past year, while

the Twin Metals project was advancing its environmental review,

several actions were taken by the federal government that have

changed the potential outcomes for the project.

In 2021, the US Forest Service (USFS) and BLM initiated an up to

two-year study regarding the potential withdrawal of lands within

the Superior National Forest (SNF), which could ultimately lead to

an effective ban on mining for twenty years. This action alone

would not have prevented Twin Metals from proceeding with the

project.

BLM also rejected advancing Twin Metals' preference right lease

applications (PRLAs) and prospecting permit applications (PPAs),

using the potential withdrawal as a rationale. Twin Metals is

challenging this rejection, and has made minor changes to the

project's configuration to address it.

In early 2022, BLM took an additional action through a legal

opinion issued by the Office of the Solicitor (M-Opinion). This

action arbitrarily cancelled Twin Metals' federal leases 1352 and

1353, citing concerns with the reinstatement and renewal process.

Twin Metals considers the lease cancellation to be contrary to the

terms of the leases and in violation of its rights.

In early 2022, BLM also stopped its evaluation of Twin Metals'

MPO, and an administrative court dismissed Twin Metals' appeal of

that decision.

Unless reversed, these actions prevent Twin Metals from

continuing the project as configured in the MPO. Considering the

time and uncertainty related to any legal action to challenge the

government decisions, an impairment was recognised as at 31

December 2021 in respect of the intangible assets and property,

plant and equipment relating to the Twin Metals project. Twin

Metals is currently evaluating its options to protect its mineral

rights and to respond to these legal challenges.

FINANCIAL REVIEW FOR THE SIX MONTHSED 30 JUNE 2022

Results (unaudited)

Six months Six months

ended ended

30.06.2022 30.06.2021

------------------------------------------ ------------ ------------

Total Total

------------------------------------------ ------------ ------------

$m $m

Revenue 2,528.2 3,591,0

------------------------------------------ ------------ ------------

EBITDA (including share of EBITDA from

associates and joint ventures) 1,237.7 2,357.1

------------------------------------------ ------------ ------------

Total operating costs (1,886.9) (1,790.4)

------------ ------------

Operating profit from subsidiaries 641.3 1,800.6

Net share of results from associates

and joint ventures 49.1 19.4

Total profit from operations, associates

and joint ventures 690.4 1,820.0

Net finance expense (10.8) (36.5)

------------

Profit before tax 679.6 1,783.5

Income tax expense (247.9) (661.9)

------------ ------------

Profit for the year 431.7 1,121.6

Attributable to:

------------ ------------

Non-controlling interests 171.4 456.3

Profit attributable to the owners of

the parent 260.3 665.3

------------ ------------

Basic earnings per share cents cents

Basic earnings per share from continuing

operations 26.4 67.5

------------ ------------

The $405.0 million decrease in the profit for the financial

period attributable to the owners of the parent from $665.3 million

in the first six months of 2021 to $260.3 million in the current

period reflected the following factors:

$m

Profit for the financial period attributable to the

owners of the parent in H1 2021 665.3

Decrease in revenue (1,062.8)

Increase in total operating costs (96.5)

Increase in net share of profit from associates and

joint ventures 29.7

Decrease in net finance expenses 25.7

Decrease in income tax expense 414.0

Decrease in non-controlling interests 284.9

(405.0)

Profit for the financial period attributable to the

owners of the parent in H1 2022 260.3

----------

Revenue

The $1,062.8 million decrease in revenue from $3,591.0 million

in the first six months of 2021 to $2,528.2 million in the current

period reflected the following factors:

$m

Revenue in the first six months of 2021 3,591.0

Decrease in copper sales volumes (824.4)

Decrease in realised copper price (152.8)

Decrease in treatment and refining charges 12.6

Decrease in gold revenue (44.4)

Decrease in molybdenum revenue (42.8)

Decrease in silver revenue (16.7)

Increase in transport division revenue 5.7

----------

(1,062.8)

----------

Revenue in the first six months of 2022 2,528.2

----------

Revenue from the Mining division

Revenue in the first half of 2022 from the Mining division

decreased by $1,068.5 million, or 30.5%, to $2,436.2 million,

compared with $3,504.7 million in the first six months of 2021. The

decrease reflected a $964.6 million decrease in copper sales and

$103.9 million decrease in by-product revenue.

Revenue from copper sales

Revenue from copper concentrate and copper cathode sales

decreased by $964.6 million, or 31.2%, to $2,129.7 million,

compared with $3,094.3 million in the first six months of 2021. The

decrease reflected the impact of $824.4 million from lower sales

volumes and $152.8 million from lower realised prices, offset

slightly by a $12.6 million benefit from lower treatment and

refining charges.

(i) Copper volumes

Copper sales volumes reflected within revenue decreased by 26.1%

from 325,100 tonnes in 2021 to 240,400 tonnes in 2022, decreasing

revenue by $824.4 million. This decrease was due to lower copper

sales volumes at Los Pelambres (69,200 tonnes decrease) as a result

of its decreased production volumes due to the expected impact of

the drought and the temporary closure of the concentrate pipeline

in June, and lower sales volumes at Centinela (12,400 tonnes

decrease) due to decreased production volumes reflecting expected

lower ore grades.

(ii) Realised copper price

The average realised price decreased by 6.6% to $4.13/lb in the

first six months of 2022 (first half of 2021 - $4.42/lb), resulting

in a $152.8 million decrease in revenue. The LME average market

price increased by 7.3% in H1 2022 to $4.43/lb (first half of 2021

- $4.13/lb). In the first half of 2022 there was a $206.8 million

negative impact from provisional pricing adjustments, mainly

reflecting the decrease in the period-end mark-to-mark copper price

to $3.75/lb at 30 June 2022, compared with $4.42/lb at 31 December

2021. Conversely there had been a $282.1 million positive impact

from provisional pricing adjustments in the first six months of

2021, which mainly reflected the increase in the period-end copper

price to $4.26/lb at 30 June 2021, compared with $3.52/lb at 31

December 2020. In addition, during the first six months of 2022

there was nil impact in respect of realised losses from commodity

hedging instruments, as all commodity hedges had matured by 31

December 2021, whereas in the first six months of 2021 there had

been an $73.5 million negative impact.

Realised copper prices are determined by comparing revenue

(before treatment and refining charges for concentrate sales) with

sales volumes in the period. Realised copper prices differ from

market prices mainly because, in line with industry practice,

concentrate and cathode sales agreements generally provide for

provisional pricing at the time of shipment with final pricing

based on the average market price in future periods (normally

around one month after delivery to the customer in the case of

cathode sales and four months after delivery to the customer in the

case of concentrate sales).

Further details of provisional pricing adjustments are given in

Note 6 to the condensed consolidated interim financial

statements.

(iii) Treatment and refining charges

Treatment and refining charges (TC/RCs) for copper concentrate

decreased by $12.6 million to $57.0 million in 2022, compared with

$69.6 million in 2021, reflecting the decrease in the concentrate

sales volumes at Los Pelambres and Centinela.

With sales of concentrates at Los Pelambres and Centinela, which

are sold to smelters and roasting plants for further processing

into fully refined metal, the price of the concentrate invoiced to

the customer reflects the market value of the fully refined metal

less a "treatment and refining charge" deduction, to reflect the

lower value of this partially processed material compared with the

fully refined metal. For accounting purposes, the revenue amount is

the net of the market value of fully refined metal less the

treatment and refining charges. However, under the standard

industry definition of unit cash costs, treatment and refining

charges are regarded as an expense and part of cash costs.

Accordingly, the decrease in these charges has had a positive

impact on revenue in the year.

Revenue from molybdenum, gold and other by-product sales

Revenue from by-product sales at Los Pelambres and Centinela

relate mainly to molybdenum and gold and, to a lesser extent,

silver. Revenue from by-products decreased by $103.9 million or

25.3% to $306.5 million in the first half of 2022, compared with

$410.4 million in the first six months of 2021. This decrease was

mainly due to lower molybdenum and gold sales volumes.

Revenue from gold sales (net of treatment and refining charges)

was $139.4 million (first half of 2021 - $183.8 million), a

decrease of $44.4 million which reflected a decrease in volumes

slightly offset by a 6.9% higher realised price. Gold sales volumes

decreased by 29.1% from 103,700 ounces in the first half of 2021 to

73,600 ounces in the first six months of 2022, mainly due to lower

gold grades and recoveries at Centinela and the expected lower

throughput and gold grades at Los Pelambres. The realised gold

price was $1,899.3/oz in the first half of 2022 compared with

$1,776.3/oz in the first six months of 2021, reflecting the average

market price for 2022 of $1,873.4/oz (2021 - $1,807.5/oz) and a

positive provisional pricing adjustment of $3.7 million.

Revenue from molybdenum sales (net of roasting charges) was

$141.9 million (first half of 2021 - $184.7 million), a decrease of

$42.8 million. The decrease was due to lower sales volumes of 3,900

tonnes (first half of 2021 - 5,700 tonnes) partially offset by a

11.8% higher realised price of $18.0/lb (first half of 2021 -

$16.1/lb).

Revenue from silver sales decreased by $16.7 million to $25.2

million (first six months of 2021 - $41.9 million). The decrease

was due to lower sales volumes of 1.1 million ounces (first half of

2021 - 1.6 million ounces) and a 12.6% lower realised silver price

of $23.5/oz (first six months of 2021 - $26.9/oz).

Revenue from the Transport division

Revenue from the Transport division (FCAB) increased by $5.7

million or 6.6% to $92.0 million (first six months of 2021 - $86.3

million), as a result of increased volumes transported, offset

slightly by the impact of the weakening of the Chilean peso on

sales denominated in the local currency.

Total operating costs

The $96.5 million increase in total operating costs from

$1,790.4 million in the first half of 2021 to $1,886.9 million in

the first six months of 2022 reflected the following factors:

$m

Total operating costs in the first half

of 2021 1,790.4

Increase in mine-site operating costs 82.0

Decrease in closure provision and other

mining expenses (4.1)

Decrease in exploration and evaluation costs (0.9)

Increase in corporate costs 8.5

Increase in Transport division operating

costs 5.1

Increase in depreciation, amortisation and

loss on disposals 5.9

96.5

Total operating costs in the first six

months of 2022 1,886.9

--------

Operating costs (excluding depreciation, amortisation and loss

on disposals) at the Mining division

Operating costs (excluding depreciation, amortisation and loss

on disposals) at the Mining division increased by $85.5 million to

$1,340.3 million in the first half of 2022, an increase of 6.8%. Of

this increase, $82.0 million was attributable to higher mine-site

operating costs. This increase in mine-site costs reflected higher

key input prices and general inflation, partly offset by the weaker

Chilean peso, decreased sales volumes in the period and the cost

savings from the Group's Cost and Competitiveness Programme. On a

unit cost basis, weighted average cash costs excluding treatment

and refining charges and by-product revenue increased from $1.61/lb

in the first six months of 2021 to $2.25/lb in the first half of

2022. As detailed in the alternative performance measures section

on page 60 of the half-year financial report, for accounting

purposes by-product credits and treatment and refining charges both

form part of revenue, and don't therefore impact operating

expenses.

The Cost and Competitiveness Programme was implemented to reduce

the Group's cost base and improve its competitiveness within the

industry. During 2022 the programme achieved benefits of $34.7

million in the mining division, of which $33.7 million reflected

cost savings and $1.0 million reflected the value of productivity

improvements. Of the $33.7 million of cost savings, $19.4 million

related to Los Pelambres, Centinela and Antucoya, and therefore

impacted the Group's operating costs, and $14.3 million related to

Zaldívar (on a 100% basis) and therefore impacted the share of

results from associates and joint ventures.

Closure provisions and other mining expenses decreased by $4.1

million. Exploration and evaluation costs decreased by $0.9 million

to $51.4 million (2021 - $52.3 million), reflecting decreased

expenditure in respect of the Twin Metals project and the

desalination plant expansion pre-feasibility study at Los

Pelambres, offset by increased exploration expenditure, principally

in Chile. Corporate costs increased by $8.5 million.

Operating costs (excluding depreciation, amortisation and loss

on disposals) at the Transport division

Operating costs (excluding depreciation, amortisation and loss

on disposals) at the Transport division increased by $5.1 million

to $57.6 million (first half of 2021 - $52.5 million), mainly due

to higher diesel prices.

Depreciation, amortisation and disposals

The depreciation and amortisation charge increased by $5.9

million in the first half of 2022 to $489.0 million (first half of

2021 - $483.1 million). This increase is mainly due to higher

amortisation of IFRIC 20 stripping costs at Centinela, largely

offset by the impact of depreciation deferred in inventory at

Centinela and Los Pelambres. The loss on disposal of property,

plant & equipment was nil (2021 - $0.6 million).

Operating profit from subsidiaries

As a result of the above factors, operating profit from

subsidiaries decreased by $1,159.3 million or 64.4% in 2022 to

$641.3 million (first half of 2021 - $1,800.6 million).

Share of results from associates and joint ventures

The Group's share of results from associates and joint ventures

increased by $29.7 million to a profit of $49.1 million in the

first six months of 2022, compared with $19.4 million in the first

half of 2021. Of this increase, $24.1 million was due to the higher

profit from Zaldívar, reflecting increased copper sales volumes and

reduced cash costs.

EBITDA

EBITDA (earnings before interest, tax, depreciation and

amortisation) decreased by $1,119.4 million or 47.5% to $1,237.7

million (first half of 2021 - $2,357.1 million). EBITDA includes

the Group's proportional share of EBITDA from associates and joint

ventures.

EBITDA from the Mining division decreased by $1,120.8 million or

48.3% from $2,321.1 million in the first six months of 2021 to

$1,200.3 million this half year. This reflected the lower revenue

and higher mine-site costs, slightly offset by higher EBITDA from

associates and joint ventures.

EBITDA at the Transport division increased by $1.4 million to

$37.4 million in 2022 ($36.0 million - first half of 2021),

reflecting the higher revenue and slightly increased EBITDA from

associates and joint ventures, offset by the higher operating costs

(linked to the price of diesel and inflation).

Commodity price and exchange rate sensitivities

The following sensitivities show the estimated approximate

impact on EBITDA for the first six months of 2022 of a 10% movement

in the average copper, molybdenum and gold prices and a 10%

movement in the average US dollar / Chilean peso exchange rate.

The impact of the movement in the average commodity prices

reflects the estimated impact on the relevant revenues during the

first six months of 2022, and the impact of the movement in the

average exchange rate reflects the estimated impact on Chilean peso

denominated operating costs during the period. These estimates do

not reflect any impact in respect of provisional pricing or hedging

instruments, any potential inter-relationship between commodity

price and exchange rate movements, or any impact from the

retranslation or changes in valuations of assets or liabilities

held on the balance sheet at the period-end.

Average market Impact of a

commodity price 10% movement

/ average exchange in the commodity

rate during price / exchange

the six months rate on EBITDA

ended 30.06.22 for the six

months ended

30.06.22

$m

Copper price $4.43/lb 257

Molybdenum price $18.7/lb 16

Gold price $1,873/oz 14

US dollar / Chilean peso exchange

rate 826 71

Net finance expense

Net finance expense decreased by $25.7 million to $10.8 million,

compared with $36.5 million in 2021.

Six months Six months

ended ended

30.06.22 30.06.21

$m $m

Investment income 4.3 2.9

Interest expense (34.8) (33.5)

Other finance items 19.7 (5.9)

----------- -----------

Net finance expense (10.8) (36.5)

----------- -----------

Investment income increased from $2.9 million in 2021 to $4.3

million in 2022, mainly due to an increase in average interest

rates partially offset by lower average cash and liquid investment

balances.

Interest expense increased marginally from $33.5 million in 2021

to $34.8 million in 2022, reflecting an increase in the average

relevant borrowing balances and an increase in the average interest

rates.

Other finance items were a net gain of $19.7 million, compared

with a net loss of $5.9 million in 2021, a variance of $25.6

million. This was mainly due to the foreign exchange impact of the

retranslation of Chilean peso denominated assets and liabilities,

which resulted in a $26.4 million gain in 2022 compared with a $2.4

million loss in 2021. In addition, there was an expense of $6.8

million in respect of the unwinding of the discounting of

provisions (first half of 2021 - expense of $3.4 million).

Profit before tax

As a result of the factors set out above, profit before tax

decreased by 61.9% to $679.6 million in the first half of 2022

(first half of 2021 - $1,783.5 million).

Income tax expense

The tax charge in the first half of 2022 decreased by $414.0

million to $247.9 million (first half of 2021 - $661.9 million) and

the effective tax rate was 36.5% (first half of 2021 - 37.1%).

Six months Six months

ended ended

30.06.2022 30.06.2021

ítems ítems

$m % $m %

Profit before tax 679.6 1,783.5

Tax at the Chilean corporate

tax rate of 27% (183.5) 27.0 (481.6) 27.0

Mining Tax (royalty) (41.0) 6.0 (128.5) 7.2

Deduction of mining royalty

as an allowable expense

in determination of first

category tax 11.7 (1.7) 36.0 (2.0)

Withholding tax (32.0) 4.7 (111.3) 6.2

Items not deductible from

first category tax (13.7) 2.0 (7.2) 0.4

Adjustment in respect of

prior years (2.5) 0.4 0.8 -

Tax effect of share of

profit of associates and

joint ventures 13.0 (1.9) 5.2 (0.3)

Impact of unrecognised

tax losses on current tax 0.1 0.0 24.7 (1.4)

Tax expense and effective

tax rate for the period (247.9) 36.5 (661.9) 37.1

-------- ------ -------- ---------

The effective tax rate of 36.5% varied from the statutory rate

principally due to the mining tax (royalty) (net impact of $29.3

million / 4.3% including the deduction of the mining tax (royalty)

as an allowable expense in the determination of first category

tax), the withholding tax relating to the remittance of profits

from Chile (impact of $32.0 million / 4.7%), items not deductible

for Chilean corporate tax purposes, principally the funding of

expenses outside of Chile (impact of $13.7 million / 2.0%) and

adjustments in respect of prior years (impact of $2.5 million /

0.4%), partly offset by the impact of the recognition of the

Group's share of profit from associates and joint ventures, which

are included in the Group's profit before tax net of their

respective tax charges (impact of $13.0 million / 1.9%).

Non-controlling interests

Profit for the first half of the year attributable to

non-controlling interests was $171.4 million, compared with $456.3

million in the first half of 2021, a decrease of $284.9 million.

This reflected the decrease in earnings analysed above.

Earnings per share

Six months Six months

ended ended

30.06.22 30.06.21

$ cents $ cents

Basic earnings per share 26.4 67.5

----------- -----------

Earnings per share calculations are based on 985,856,695

ordinary shares.

As a result of the factors set out above, profit attributable to

equity shareholders of the Company was $260.3 million, compared

with $665.3 million in the first half of 2021, and total earnings

per share were 26.4 cents for the first half of 2022 (first half of

2021 - 67.5 cents per share).

Dividends

Dividends per share declared in relation to the period are as

follows:

Six months Six months

ended ended

30.06.22 30.06.21

$ cents $ cents

Ordinary dividends:

Interim 9.2 23.6

Total dividends to ordinary shareholders 9.2 23.6

----------- -----------

The Board determines the appropriate dividend each year based on

consideration of the Group's cash balance, the level of free cash

flow and underlying earnings generated during the year and

significant known or expected funding commitments. It is expected

that the total annual dividend for each year would represent a

payout ratio based on underlying net earnings for that year of at

least 35%.

The Board has declared an interim dividend for the first half of

2022 of 9.2 cents per ordinary share, which amounts to $90.7

million. The interim dividend will be paid on 30 September 2022 to

ordinary shareholders that are on the register at the close of

business on 2 September 2022.

Capital expenditure

Capital expenditure increased by $49.1 million from $781.9

million in the first half of 2021 to $831.0 million in the current

period. The capital expenditure in the first six months of 2022

included $301.4 million of IFRIC 20 stripping costs and $218.5

million in respect of the Los Pelambres Expansion project.

NB: capital expenditure figures quoted in this report are on a

cash flow basis, unless stated otherwise.

Derivative financial instruments

The Group periodically uses derivative financial instruments to

reduce its exposure to commodity price, foreign exchange and

interest rate movements. The Group does not use such derivative

instruments for speculative trading purposes. At 30 June 2022 there

were no derivative financial instruments in place (30 June 2021 -

negative fair value of $51.1 million).

Cash flows

The key features of the cash flow statement are summarised in

the following table.

Six months Six months

ended 30.06.22 ended

30.06.21

$m $m

Cash flows from continuing operations 1,682.5 2,460.5

Income tax paid (620,6) (348.1)

Net interest paid (26.2) (26.5)

Capital contributions and loans to associates - (5.5)

Purchases of property, plant and equipment (831.0) (781.9)

Dividends paid to equity holders of the

Company (1,172.2) (478.1)

Dividends paid to non-controlling interests (80.0) (40.0)

Dividends from associates and joint ventures 50.0 65.0

Other items (0.1) 1.7

----------------- -------------

Changes in net debt relating to cash

flows (997.6) 847.1

Other non-cash movements (23.0) (59.3)

Effects of changes in foreign exchange

rates (11.3) (4.5)

----------------- -------------

Movement in net debt in the period (1,031.9) 783.3

Net cash/(debt) at the beginning of the

year 540.5 (82.0)

----------------- -------------

Net (debt) / cash at the end of the

period (491.4) 701.3

----------------- -------------

Cash flows from continuing operations were $1,682.5 million in

the first half of 2022 compared with $2,460.5 million in the first

half of 2021. This reflected EBITDA from subsidiaries for the

period of $1,130.3 million (first half of 2021 - $2,283.7 million)

adjusted for the positive impact of a net working capital decrease

of $569.7 million (first half of 2021 - positive impact of $187.6

million from a net working capital decrease), partly offset by the

negative impact of a decrease in provisions of $17.5 million (first

half of 2021 - negative impact of a decrease in provisions of $10.8

million).

The working capital decrease in the first six months of 2022 was

mainly due to a decrease in receivables, reflecting lower sales

volumes towards the end of the current period compared with the end

of 2021, as well as the impact of a negative mark-to-market

adjustment of $173.8 million at 30 June 2022 compared with a

positive mark-to-market adjustment of $12.3 million at 31 December

2021.

The net cash outflow in respect of tax in the first half of 2022

was $620.6 million (first half of 2021 - $348.1 million). This

amount differs from the current tax charge in the consolidated

income statement of $276.1 million (first half of 2021 - $543.4

million) mainly because cash tax payments for corporate tax and the

mining tax include payments on account for the current year (based

on prior periods' profit levels) of $272.3 million (first half of