TIDMART

RNS Number : 6120N

Artisanal Spirits Company PLC (The)

24 January 2023

24 January 2023

The information contained within this announcement is deemed to

constitute inside information for the purposes of the UK Market

Abuse Regulation.

The Artisanal Spirits Company plc

("The Artisanal Spirits Company", "ASC" or the "Group")

Full Year Trading Update & Board Changes

The Artisanal Spirits Company (AIM: ART) , curators of the

world's favourite, single-cask and limited-edition whisky, and

owner of The Scotch Malt Whisky Society ("SMWS") , today provides

an unaudited trading update for the financial year ended 31

December 2022 ("FY 2022") and announces a change of leadership with

David Ridley stepping down as Managing Director and Andrew Dane

appointed as CEO following another year of strong growth.

Financial & Operational Highlights:

-- Revenue for the year ended 31 December is expected to show

growth of approximately 20% over the previous year (FY 2021:

GBP18.2 million), with this strong year on year performance being

slightly ahead of the consensus revenue forecast of GBP21.6

million

-- Global membership grew by approximately 12% with c.37,000

members at the year-end, up from 33,000 at the end of 2021.

Retention remained broadly consistent with the prior year level of

77%, demonstrating the loyal nature of the membership base

-- Continued recovery in UK member venues and events: sales now

seeing the benefits of more normalised trading conditions with a

record December

-- Masterton Bond, the Group's multi-purpose supply chain

facility, became operational on time and to budget in Q4 2022

o The facility has had an encouraging start and has commenced

bottling operations with c.20,000 bottles produced, hundreds of

casks delivered and first pallets dispatched from site prior to the

year end

o It is anticipated that, once fully operational, this facility

will improve operating margins by c.2%, with the initial benefits

now starting to be realised and the full effect expected early in

the current financial year

-- RBS revolving credit facility extended by two years and

increased to GBP21.5 million on more favourable terms, providing

additional flexibility to expand and grow all aspects of the

business, ranging from membership, continued investment in the

Group's brand, whisky stocks and international reach. This enhanced

bank facility provides significant headroom to further grow the

business

-- Continued international expansion during the year with an

inaugural franchise agreement in South Korea and a new partnership

with Drinks Alliance in Malaysia

-- An update on the American Whiskey Society proposition will be

given with the Group's full year results in March 2023

-- Confident of continued progress in FY 2023, entering the year

from a position of strength, and continuing to deliver against the

Group's stated strategy, consistent with market expectations

Board Changes:

o David Ridley and the Board have agreed that David steps down

as Managing Director of ASC following six years with the Group in

that role, during which time the business has delivered sustained

revenue growth and, in 2021, successfully IPO'd on the London Stock

Exchange under his stewardship

o The Board is pleased to announce that Andrew Dane, currently

Finance Director, has been appointed as CEO with immediate effect.

Andrew is charged with driving the next phase of growth in line

with ASC's stated strategy which continues to serve the Group well.

Billy McCarter, formerly Group Financial Controller, has been

appointed as Interim Finance Director and the Board has initiated a

search process, comprising both internal and external candidates,

to identify a long-term CFO. Shareholders will be updated on the

outcome of this process in due course

o David will remain available to support the Group until July

2023 in order to assist with an orderly transition, as required

Mark Hunter, Chairman, commented:

"2022 was another strong year of considerable strategic progress

together with further consistent delivery of both financial and

operational goals. We continue to leverage and evolve our

pioneering business model to maximise our long-term global growth

opportunity. Sales have increased by c.20% once again and

membership by c.12% and we remain on track to meet our target of

doubling revenue to GBP30m between 2020 and 2024, whilst continuing

to improve our operating margins.

"We have invested simultaneously in additional whisky stocks

which continue to appreciate, and in advancing our infrastructure

and global reach through the development of our Masterton Bond

multi-purpose supply chain facility and, most recently, new

distribution capability in South Korea and Malaysia. Looking

forward, the investments we have made in 2022 will enhance the

business this year and beyond. With whisky stocks to satisfy demand

into the next decade already acquired and investment-driven cash

burn having already peaked as we pivot towards sustained

profitability, we are well positioned to continue expanding our

business, benefit from the growing appreciation globally of small

batch whisky and the key underlying trends of convenience,

premiumisation and digitalisation which are set to continue to

drive consumer behaviour.

"I would like to take this opportunity on behalf of the Board to

thank David for his leadership and significant contribution at the

helm of ASC over the last six years. He has presided over

impressive levels of consistent growth during his tenure and he

leaves ASC in excellent shape. David leaves with our very best

wishes and we wish him well for the future.

"ASC is fortunate to have a strong and able successor in Andrew

Dane and the Board has confidence in his readiness and capability

as CEO. Since joining in 2020, Andrew has demonstrated strong

operational and commercial credentials in addition to his proven

financial skillset. He knows the business and ASC's wider market

structure well and has been instrumental in developing and

implementing the Group's growth strategy in conjunction with the

wider Executive team. These qualities equip him well to provide

continued leadership as ASC progresses its stated strategy to

unlock its significant future growth opportunity."

David Ridley, commented:

"I have thoroughly enjoyed my time with ASC and am proud of the

Group's success to date. There is demonstrable momentum in the

business and following another year of strong growth, I feel the

time is now right for me to seek a fresh challenge and hand over

the reins for the next phase of ASC's development. I wish Andrew

and the wider team every success for the future."

Shares Magazine Investor Event

As part of its ongoing shareholder engagement programme,

Artisanal Spirits Company will be presenting 'live' at the Shares

Magazine investor event at The Radisson Hotel, Edinburgh on 9

February 2023 at 17.45 GMT. Existing shareholders and potential

investors can register to attend and join the evening event at:

https://www.sharesmagazine.co.uk/events/event/shares-investor-evening-edinburgh-live-event-090223

For further information, please contact:

The Artisanal Spirits Company plc via Instinctif Partners

Mark Hunter, Chairman

Andrew Dane, CEO

Singer Capital Markets (Nominated Adviser & Sole

Broker)

Sandy Fraser

Phil Davies

George Tzimas

Asha Chotai 020 7496 3000

Instinctif Partners (Financial PR)

Justine Warren

Matthew Smallwood 020 7457 2020

About The Artisanal Spirits Company

Notes to Editors: The Artisanal Spirits Company (ASC) are

curators of the world's favourite, single-cask and limited-edition

whisky.

Based in Edinburgh, ASC owns The Scotch Malt Whisky Society

(SMWS) which was established in 1983 and currently has a growing

worldwide membership of over 37,000 paying members.

SMWS provides members with inspiring experiences, content and

exclusive access to a vast and unique range of outstanding single

cask Scotch malt whiskies and other craft spirits, sourced from

over 100 distilleries in 20 countries and expertly curated with

diligence and care.

Since producing the Society's very first cask, we have created

around 10,000 different whisky releases, producing a constant flow

of unique and exciting one-of-a-kind whiskies.

With proven e-commerce reach and new brands like J.G. Thomson,

ASC is building a portfolio of small-batch spirits brands for a

global movement of discerning consumers - delivering over GBP20

million in annual revenues with over 80% of revenue generated

online and over 65% from outside the UK, with a growing presence in

the key global whisky markets including UK, China, USA and

Europe.

ASC has a pioneering business model, a substantial and growing

addressable market presenting a long-term global growth opportunity

and a strong and resilient business, primed to deliver growth.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBJMLTMTJTBFJ

(END) Dow Jones Newswires

January 24, 2023 02:00 ET (07:00 GMT)

The Artisanal Spirits (LSE:ART)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

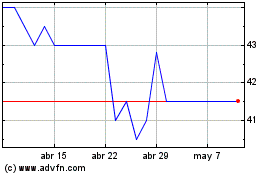

The Artisanal Spirits (LSE:ART)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024