TIDMART

RNS Number : 5985U

Artisanal Spirits Company PLC (The)

29 March 2023

29 March 2023

The Artisanal Spirits Company plc

('Artisanal Spirits', 'ASC' or 'the Group')

Preliminary Results for the year to 31 December 2022

Another strong year of delivery, with double digit revenue and

membership growth, margin expansion and positive progress on our

clear path to sustained and growing profitability.

The Artisanal Spirits Company (AIM: ART), curators of the

world's favourite, single-cask and limited-edition spirit brands

for a global movement of discerning consumers, and owner of The

Scotch Malt Whisky Society ("SMWS"), is pleased to announce its

preliminary results for the year ended 31 December 2022. The Group

has delivered another year of significant progress in which the

strategic plan has continued to be executed and the objectives

outlined at IPO to achieve long term sustainable growth continue to

be met.

Reported today are results which slightly exceed market

consensus expectations with 19% revenue growth, 12% membership

growth and adjusted EBITDA* improved by GBP1.0 million. Alongside

this, the Group delivered double digit growth in whisky stock and

value appreciation.

Consequently, the Board remains confident in delivering its

ambition of doubling revenue between 2020 and 2024 and building on

the progress made in 2022 towards delivering sustained

profitability.

Highlights

o Continued improvement across all key financial and non-financial

metrics, demonstrating profitable growth, supported by

a loyal, growing and highly engaged global membership,

underpinned by a substantial high-quality asset base

Financial highlights:

o Revenue increased 19% to GBP21.8 million (2021: GBP18.2

million) ahead of expectations+ with significant revenue

growth in China and UK venues and strong membership growth

in Europe, Australia, the US and Japan

o Gross margin of 63.6% up by 2.1ppt from 61.5% in FY21

o Gross profit increased 23% to GBP13.8 million (2021: GBP11.2

million)

o Continuing our path to profitability, adjusted EBITDA*

in positive territory with GBP0.4 million achieved (2021:

loss of GBP0.6 million)

o Loss before tax of GBP2.1 million (2021: GBP2.7 million

loss)

o Around GBP5.5 million of further investment in both cask

spirit and wood (cGBP3m), taking the total number of casks

to 16,500 (2021: 15,300) as well as completion of the

new state-of-the-art, multi-purpose Supply Chain Facility

at Masterton Bond (cGBP2.5m)

o Stock-in-cask at 30 December 2022 increased its notional

retail sales value by 15% to approximately GBP493 million

(31 December 2021: GBP430 million)

o ASC's current whisky stocks are sufficient to satisfy

demand through to 2028 and beyond

o Well-funded to continue to invest in growth for the medium

and long term with an increased facility to GBP21.5million

with RBS agreed in H2

* Adjusted EBITDA defined as earnings before interest tax,

depreciation, amortisation and non-underlying costs (see note

7)

+ The Board of The Artisanal Spirits Company considers that

current consensus revenue expectations for the year ending 31

December 2022 are GBP21.6 million (2021: GBP18.2 million) and

consensus adjusted EBITDA expectations for the year ending 31

December 2022 is GBP0.1 million (2021: negative GBP0.6

million).

Operational highlights:

o SMWS membership growth increased by 12% to over 37,400

(2021: 28,700). This included robust growth in European

members since the launch of the new EU route to market

towards the end of FY21

o Annual contribution per member rose by 11% and retention

maintained at an all-time high level of 77%

o Lifetime value per member rose to GBP1,457 (2021: GBP1,445)

o Our member venues recovered from the disruption of the

pandemic and recently recorded a record month in December

2022

Global membership

December 2022 December % change

2021

------------------ ---------- ----------

UK 1 8,029 1 6,445 10%

------------------ ---------- ----------

US 6 ,058 5 ,207 16%

------------------ ---------- ----------

China 1 ,659 1 ,732 (4%)

------------------ ---------- ----------

Europe* 4 ,327 3 ,349 29%

------------------ ---------- ----------

Australia 1 ,659 1 ,337 24%

------------------ ---------- ----------

Japan 1 ,809 1 ,496 21%

------------------ ---------- ----------

Rest of World 3 ,875 3 ,761 3%

------------------ ---------- ----------

Total members 3 7,416 3 3,327 12%

------------------ ---------- ----------

*Europe represents direct sales markets within continental

Europe, but excludes franchise markets in Denmark and

Switzerland which are shown within Rest of World

Current trading/Post period insights

o Revenue in Q1-23 broadly flat year on year vs the exceptional

growth experienced in Q1-22. Growth phasing in line with

management expectations to deliver full year consensus

forecasts for FY2023

o YTD growth in UK & EU, offset by Covid impacted performance

in China in the early part of the year, with signs of

recovery in China now emerging

o Continued strong performance in UK venues with the record

December 2022 performance followed by new records for

January and February in 2023

o Continued membership growth +10% year-on-year

o Successful change of leadership in January 2023, with

David Ridley stepping down as Managing Director and Andrew

Dane appointed as CEO

o Further consolidation of production, with around 70,000

bottles now produced and on target to achieve full operations

at new Masterton Bond Supply Chain facility early in Q2

Andrew Dane, CEO of The Artisanal Spirits Company,

commented:

"Our ambition is to create a global, premium business which is

highly profitable and cash generative by delivering the world's

best whisky experiences.

We have a pioneering model, a long-term global growth

opportunity on which we are primed to deliver. We are making

significant strategic progress with strong membership growth and

delivery of another strong year of profitable growth supported by

improvement across all financial and operational KPIs. Over the

last year we have continued to make investment for the future in

further spirit and wood, as well as our own supply chain facility,

and while the rate of cash spend on this has peaked, we will

continue to invest, with a focus for FY23 on IT and technology to

deliver and accelerate our growth even further.

Our markets benefit from underlying structural dynamics which

have increased our addressable market. We are seeking to exploit

this opportunity by growing our international footprint, including

in South Korea and Malaysia.

The new financial year has begun well. We remain on track to

meet our 2024 revenue target of GBP30m and deliver significant

progress on our path to sustained profitability."

Sellside analyst presentation

Andrew Dane, CEO and Billy McCarter, Interim Finance Director,

will host an in person presentation for sellside equity analysts,

followed by Q&A, at 09.30 hours BST today, 29 March 2023.

Analysts wishing to join should register their interest by

contacting: artisanalspirits@instinctif.com

Investor presentation

In addition, management will host a live online investor

presentation and Q&A at 14.00 hours BST tomorrow, 30 March

2023.

The Group is committed to ensuring that there are appropriate

communication channels for all elements of its shareholder base so

that its strategy, business model and performance are clearly

understood.

The presentation is open to all existing and potential

shareholders. To register to attend, please use the link below:

https://www.equitydevelopment.co.uk/news-and-events/artisanal-fyresults-presentation-30march2023

A recording of the presentation will also be made available via

the Group's website following the webinar.

For further information, please contact:

The Artisanal Spirits Company plc via Instinctif Partners

Andrew Dane, CEO

Billy Mccarter, Interim Finance Director

Singer Capital Markets (Nominated

Adviser and Broker)

Sandy Fraser

Phil Davies

George Tzimas

Asha Chotai 020 7496 3000

Instinctif Partners (Financial PR)

Justine Warren

Matthew Smallwood

Joe Quinlan 020 7457 2020

Notes to Editors:

The Artisanal Spirits Company (ASC) are curators of the world's

favourite, single-cask and limited-edition whisky.

Based in Edinburgh, ASC owns The Scotch Malt Whisky Society

(SMWS) which was established in 1983 and currently has a growing

worldwide membership of just over 37,400 paying members.

SMWS provides members with inspiring experiences, content and

exclusive access to a vast and unique range of outstanding single

cask Scotch malt whiskies and other craft spirits, with current

stocks sourced from over 100 distilleries in 20 countries and

expertly curated with diligence and care.

Since producing the Society's very first cask, we have created

around 10,000 different whisky releases, producing a constant flow

of unique and exciting one-of-a-kind whiskies.

With proven e-commerce reach and new brands like J.G. Thomson,

ASC is building a portfolio of limited-edition and small-batch

spirits brands for a global movement of discerning consumers -

delivering c.GBP20 million in annual revenues with over 80% of

revenue generated online and over 65% from outside the UK, with a

growing presence in the key global whisky markets including UK,

China, USA and Europe.

ASC has a pioneering business model, a substantial and growing

addressable market presenting a long-term global growth opportunity

and a strong and resilient business primed to deliver growth.

Chair's statement

I am delighted to report that 2022 has been another year of

significant progress in which we have continued to execute the

strategic plan and objectives outlined at IPO focused on our

disciplined investment programme and range of operational

initiatives to facilitate the Group's long-term, sustainable

growth.

The global whisky market continued to deliver compound growth in

2022, maintaining a trend which has now been established for many

years with the Ultra-Premium and limited-edition market, in which

we almost exclusively operate, being a stand-out performer.

Alongside this, our member venues in the UK have benefitted from

more normalised trading for the majority of the year, with a record

December most recently bringing unique and memorable experiences to

our members in the Group's four member venues in Edinburgh (Queen

Street and Leith), Glasgow and Farringdon in London, and enabling

marketing and member recruitment events in the UK to return in

earnest.

Our model is unique and brings many benefits. Membership, which

differs markedly from subscription, is synonymous with exclusivity,

embedded customer engagement, relationships and community. This,

combined with our powerful direct-to-consumer ("D2C") e-commerce

platform, creates a global stage from which to promote and market

our limited-edition portfolio of curated whiskies and precisely

focus our sales efforts.

Alongside membership, the heartbeat of our proposition, is our

focus on unique, high-quality whiskies that we purchase, curate and

release in limited-editions. In 2022 we further added to our world

beating stock of whisky, deploying funds from the IPO to ensure

that we have forward stock cover well into the next decade.

ASC continued to substantially develop and progress its

infrastructure in 2022. We further invested some of the proceeds

raised at IPO in our own state-of-the-art, supply chain facility at

Masterton Bond, near Glasgow, to bring elements of production, cask

storage, bottling, fulfilment and distribution capabilities

in-house. Opening on time and within budget in Q4 2022, we expect

to see the subsequent anticipated margin benefits of this facility

during the course of 2023 and beyond.

The combination of our loyal and engaged members and our unique

business model mean that we have managed to increase gross margin

by over 2 percentage points, despite the impact of inflationary

pressures seen across the wider economy in areas such as labour,

raw materials, glass and storage. ASC is fortunate to have a model

with high gross margins and a product where the price is relatively

elastic.

Our brand continues to grow in awareness and desirability. This

year has seen ASC achieve more accolades and global recognition for

our outstanding, limited-edition whiskies having now won almost 300

awards in the last few years. We also continually strive to provide

a unique and immersive experience for our SMWS members.

To have grown the business in the challenging conditions of last

year is nothing short of exceptional and is testament to the

quality of our product range and wider membership proposition. To

help deliver this growth, we produced in 2022 around 1,000

different limited-edition whiskies, improved our e-commerce

platform by continuing to make it even more engaging for our

members, grew our recently launched brand, JG Thomson, and hosted

hundreds of events worldwide for membership and recruitment.

In addition, SMWS continues to expand its global footprint into

new growth markets. We furthered our international reach with a new

franchise agreement in South Korea and a new partner, Alliance

Drinks, in Malaysia - adding to our existing presence in the

fast-growing Asian markets in our sweet spot of the Ultra-Premium

Scotch malt whisky sector.

ASC is conservatively financed and has more than sufficient

funds to continue to invest in and grow the Group for the medium to

long term. In order to continue to provide additional headroom, we

have extended our revolving credit facility with RBS, demonstrating

the strength of our asset base which is now worth almost half a

billion pounds at retail prices today. Our owned stock of spirit,

ageing in casks, provides us with all of the liquid required to

satisfy our demand beyond the end of FY28.

Our team has continued to develop; without their dedication and

hard work, we would not have delivered these excellent results. In

turn, the Group strives to deliver an outstanding working

environment for its employees, together with the flexibility and

respect which enables everyone to thrive. The Board wishes to

express its heartfelt thanks to the entire ASC team.

Over the last year the Board has also continued to pursue

exemplary standards of corporate governance and we strive to drive

the ASC values across the business, particularly the uncompromising

approach to keeping the interests of our loyal SMWS members firmly

at the forefront of everything we do.

Post the year end, David Ridley and the Board agreed that he

would step down as Managing Director of ASC following six years

with the Group in that role, during which time the business

delivered sustained revenue growth and, in 2021, successfully IPO'd

on the London Stock Exchange under his stewardship. The Board would

like to thank David for his leadership and significant

contribution. He leaves ASC in excellent shape and leaves with our

very best wishes for the future.

ASC has a strong and able successor to David in Andrew Dane who

was appointed as our new CEO in January 2023. Since joining as

Finance Director in 2020, Andrew has demonstrated strong strategic

and operational credentials in addition to his proven financial

skillset. He knows the business and ASC's wider market structure

and has been instrumental in developing and implementing the

Group's growth strategy in conjunction with the wider Executive

team. These qualities equip him well to provide continued

leadership as ASC progresses its strategy to unlock its significant

future growth opportunity. Billy McCarter, formerly Group Financial

Controller, has been appointed as Interim Finance Director and a

search process, comprising both internal and external candidates,

to identify a long-term CFO is well underway. Shareholders will be

updated on the outcome of this process in due course.

Looking to the future

We have a clear strategy focussed on taking advantage of our

global opportunity and achieving and delivering sustainable,

profitable growth. This is primarily driven by developing and

growing our membership base, enhancing the breadth and depth of our

whisky stocks, further domestic and international expansion,

continued enhancement of our e-commerce platform, increasing

margins and delivering value. Our long-term future is underpinned

by fundamental structural tailwinds: convenience, premiumisation,

collectability and rarity value, as well as digitalisation, none of

which show any sign of abating.

2023 will not be without its challenges. However, we are

optimistic that economic conditions will improve and confident that

our business will navigate whatever headwinds we may face. That

said, we benefit from a diversified and global membership who are

resilient and mostly affluent. We remain confident that they will

continue to enjoy the exclusive benefits and products that

membership of SMWS affords.

We submitted our response to the Scottish Government

consultation on restricting alcohol advertising and promotion. We

share the Scotch Whisky Association's concern and support the view

that the Scotch whisky industry already follows a robust marketing

code which regulates how brands are advertised globally.

Similarly, we agree with the Scotch Whisky Association that

"many concerns remain unanswered" in relation to the proposed

Deposit Return Scheme in Scotland. While we continue to prepare for

its scheduled launch in August of this year, we share the wider

industry concerns around the impact of this scheme.

We are increasingly well positioned to take advantage of our

global opportunity and to achieve our self-imposed goal of doubling

revenue from 2020 to 2024. We therefore anticipate further revenue

growth in 2023 as we pivot towards growing and sustainable

profitability. As we do this, we are committed to doing so

responsibly, working within the Scotch Whisky Association's

Sustainability Strategy, focused on striving for best practice. ASC

is on a journey in this regard, and we continuously seek to

improve.

We continue to see a significant opportunity in the American

Whiskey segment for ASC. The Board has agreed that some additional

time is required to evaluate the various options open to us to

ensure we optimise both the structure and our approach in this

exciting market. Our enthusiasm for the American Whiskey

opportunity remains and we look forward to updating shareholders on

our plans in due course.

We have invested in our business and have whisky stocks to

satisfy demand into the next decade hedging inflationary costs in

our supply chain. Our cash intensive investment phase has now

peaked as we enter into a new stage and move towards positive

unadjusted EBITDA for 2023 and positive profit before tax for 2024

and remain well positioned for further profitable growth

thereafter.

I am grateful to all shareholders for their continued support in

a difficult year for the markets. ASC is a long- term business and

whilst I believe we have played our part to date by consistently

delivering on the goals and aspirations set out at IPO, we will

continue to be totally focussed on endeavouring to do so again this

year and beyond as we grow this unique business.

Chief Executive's Review

Another strong year of delivery

In our first full year as a listed business, we have

successfully delivered on our promises. We have achieved both

strategic development, most notably the new supply chain facility

at Masterton Bond in Scotland, as well as an impressive financial

performance, once again ahead of market expectations, with 19%

revenue growth, growing margins and positive progress on our clear

path to profitability.

We have a pioneering model, a long-term global growth

opportunity and we are primed to deliver. We are making significant

strategic progress with strong membership growth and delivery of

another year of profitable growth supported by improvement across

all financial and operational KPIs. Over the last year we have

continued to make investment for the future in further spirit and

wood, as well as our own supply chain facility, and while the rate

of cash spend on this has peaked, we will continue to invest, with

a focus for FY23 on IT and technology to deliver and accelerate our

growth even further.

Delivering profitable growth

I have had the pleasure of helping to build our current strategy

and help set our clear ambition to double revenue between 2020 and

2024. It is now my privilege to have the opportunity to lead the

business towards achieving that ambition and to report on the

success to date on delivering that.

In 2022, we have made good progress, achieving revenue growth

ahead of market expectations and adjusted EBITDA improving by

GBP1.0 million.

We continue to deliver against our strategic framework and

successfully execute our strategy to build a unique portfolio of

curated, limited-edition spirit brands for a global movement of

discerning consumers, operating in a significant growing market

globally with underlying structural change taking place. We also

continue to meet, and in many cases exceed, the financial metrics

and KPIs put in place at the time of the IPO.

To achieve our ambition, we operate a pioneering model with a

loyal and growing membership who can exclusively purchase unique,

award-winning, limited-edition whiskies. We aim to innovate

relentlessly and deliver our members an outstanding experience

through our direct to member platform, generating rich data which

provides the Group with detailed customer insight to continually

improve and target ever more effectively.

Underlying structural dynamics growing the addressable

market

ASC is positioned to benefit from fundamental changes which are

driving significant growth within the spirits industry. Scotch

whisky remains a highly desirable category on the international

stage. We operate primarily in the global Ultra-Premium segment

which has seen substantial growth over the last decade and

continues to do so as repeatedly reported by the leading spirit

brands.

Trends such as premiumisation and experiential demand - with

consumers seeking authenticity, status and exclusivity, the drive

for increasing convenience and continued global digitalisation -

combine to play to ASC's strengths as a limited-edition producer

with our D2C model.

As these trends continue, this underpins the growth of the

Group's addressable market. The global Scotch whisky market for

Ultra-Premium price points (GBP35/bottle and above) was valued at

$7.6 billion in 2021 having grown by 32% since 2020. Of this, $5.8

billion is in markets where we already have a well-established

presence. In these markets, ASC has a market share of only 0.3%

currently.

Strong SMWS growth

Revenue continued to grow impressively underpinned by the growth

in global membership, combined with increasing spend per

member.

SMWS Membership

This year saw us grow global membership of SMWS once again, up

12% to 37,400 at the year end. A further benefit of our global

reach is that we have a diversified geography with markets

performing at different rates of maturity and growth. 2022

experienced particularly strong membership growth in Europe,

Australia, the US and Japan. This was driven by a material

acceleration of membership sign-ups supported by strong returns on

marketing campaigns, as well as effective targeting in those

territories to potential new members.

This was also supported by high levels of loyalty from our

existing members, delivering recurring revenues with retention

rates maintained at last year's historically high level of 77%.

SMWS Revenue

From a revenue perspective, there were standout performances for

a few areas in the year.

Firstly China, where revenue grew 28% despite the very strict

Covid lockdown restrictions which impacted the business - in the

context of membership recruitment in particular from April 2022

onwards. This result is testament to both the size of the

opportunity that exists in this geographic market, as well as the

outstanding quality of delivery and service provided by the ASC

team.

Secondly, a strong performance from the UK member venue rooms

helped drive the 27% revenue growth in the UK. The Group's four

outstanding member rooms - in Edinburgh (Queen Street and Leith),

Glasgow and London - rebounded following the easing of UK Covid

restrictions in the early part of 2022, finishing the year strongly

with record sales in December.

Thirdly, I was pleased to see the positive response from

European members following the establishment of a warehouse in

mainland Europe in December 2021 to mitigate the Brexit-related

logistical challenges which occurred during 2021. This helped to

deliver impressive membership growth of 29% (the fastest of any

market) and 18% revenue growth.

In the US, membership grew strongly in the period (up by 16%),

albeit market depletions were down slightly year on year as the

level of bottle sales per member unsurprisingly reduced from the

higher levels experienced during the Covid lockdown periods of

2020/21 to their pre-pandemic levels. The revenue effect of these

was offset by the timing of shipments and positive movements in FX

rates meaning that the total value of revenue grew by 6% in the

period.

SMWS International Expansion

Over the past year we have continued to enhance and extend our

international reach in some of the fastest growing markets in the

world to take advantage of growth opportunities in those

geographies. This follows our entry into Mexico and South Africa in

recent years.

In October 2022, the inaugural franchise agreement in Korea, the

world's 10th largest market for Ultra-Premium Scotch malt whisky,

was signed with F.J. Korea (a market leading distributor). We also

strengthened our presence in Malaysia with a new partner, Drinks

Alliance, which provides a new route to market and reinforces our

footprint in that region.

The Group will continue to seek opportunities to extend the

international reach of SMWS with further partnerships and franchise

agreements.

First year of trading for J.G. Thomson

We continued to grow our new suite of superior quality spirit

and complementary brands under the heritage moniker of J.G. Thomson

which is available both to SMWS members and through selected

independent retail channels.

The first full year of J.G. Thomson helped deliver over

GBP200,000 of additional revenue to the Group, with most of that

arising in H2 through initial exports to La Maison du Whisky in

France, as well as cross sales to SMWS members.

We continue to market and build the brand's presence through

innovative events such as Fringe by the Sea, an Arts Festival in

North Berwick, and at Hamlet by Ian McKellan in partnership with

influencers such as Bross Bagels.

The American Whiskey Opportunity

We continue to see a significant opportunity in the American

Whiskey segment for ASC. To that end, we remain focused on

exploring the various options open to us to enter and maximise our

opportunity in this exciting market. In order to take the right

approach to launch and sustainably grow our operations in this

market for the long term, the Board has agreed that some additional

time is required to evaluate the various options open to us.

Whilst this will require more time than originally anticipated

to ensure we optimise both the structure and our approach; one

positive impact of this extension is that short-term EBITDA drag

which a launch would be expected to incur would be avoided in FY23.

Our enthusiasm for the American Whiskey opportunity remains and we

look forward to updating the market on our plans in due course.

Investing for Growth

ASC is financially strong and fully funded to deliver its stated

ambitions. Its balance sheet is primarily supported by its whisky

stock, and we were delighted to agree the extension to the

inventory secured RCF facility with RBS in December 2022 which

provides additional flexibility with regards to our investment in

our strategic priorities.

Overall, we have now materially deployed the IPO proceeds as

planned, with key investments in the supply chain facility at

Masterton Bond, continued investment in expansion of our spirit and

wood stocks and marketing spend to grow membership, as well as

ongoing new brand development such as the launch of J.G. Thomson

and exploration of the American Whiskey opportunity and market

expansion in Asia in particular.

The Group has accumulated - and is further investing in - our

unique range of outstanding single cask Scotch malt whiskies. In

2022 around GBP3 million was invested in new whisky spirit and wood

stocks, increasing the total number of casks to 16,500 (15,300 at

the end of 2021) and investing in more ex-sherry casks which now

represent 25% of all production. The acquisition of new spirit and

the continued appreciation of in-cask whisky will stand us in good

stead to satisfy demand in future years, as well as providing a

substantial inflation hedge against future increases in the cost of

whisky. Our current whisky stocks are sufficient to satisfy our

projected demand beyond the end of 2028 and 75% of demand well into

the next decade. Stock in cask at the year-end had an estimated

retail value of approximately GBP493 million (31 December 2021:

GBP430 million), representing further value appreciation of a

further 15% over the period.

In Q4 2022 we began the initial production phase at our new

Masterton Bond multipurpose supply chain facility near Glasgow.

With bottling operations commenced, c20,000 bottles were produced

prior to the year end. Since then, production has continued to

increase with c.70,000 bottles produced as at the date of this

report. The facility will provide production, cask storage,

fulfilment and distribution of the Group's whisky and other spirit

products in due course. We are already beginning to benefit from

the improved operating margins (anticipated to be c.2% this year)

from this state-of-the-art facility.

The path to profitability

During the course of 2022 we have made significant investments

across our business, have a clear strategy to drive profitable

growth and anticipate growing EBITDA through 2023 and generating

profit before tax in 2024, a goal set at the time of IPO. Continued

growth in membership, prudent and selective investment in

interesting and rare whisky spirit and wood, conservative financing

and international expansion are the embedded disciplines for growth

and sustained future profitability.

Particularly pleasing has been the growth in gross margin which

has been faster than forecast, reflecting both underlying

improvements in the cost structure (despite wider economic

pressures) - supporting the strong inflation hedge provided by

ASC's substantial spirit stock - as well as improvements in pricing

driven by both product and market mix.

Overall, this has enabled us to deliver a GBP1.0 million

increased in adjusted EBITDA, equating to an equivalent incremental

EBITDA margin of almost 30%, lending further support to the

significant profit potential of the Group.

Our talent

The Group's key focus is people development and living ASC's

values and the team has come together well following the influx of

new staff pre and post IPO. We have a strong culture which develops

pride in what we do and respect for others in the business. While

we are delighted with the results of our employee survey during the

year (and in particular the employee engagement index score of 81),

we recognise there is always more to be done in this area and we

intend to continue to further develop and implement the talent and

organisational development plan originally launched in 2021.

Current trading and outlook

Whilst still early in the year, we remain on track to meet our

expectations for the full year. Revenue to date has seen growth

across many territories including UK and Europe albeit this was

offset by the impact of continued Covid in China in Q1 . Overall,

revenue is broadly flat, lapping a record Q1 in 2022, and we

anticipate further strong growth in sales in the second half.

Encouragingly, membership has continued to grow, including

increasing momentum in China most recently, and both January and

February 2023 have seen venues continue to trade at record

levels.

The Group will benefit from GBP220,000 (net of fees) in relation

to R&D tax credits received in January of this year for 2020

and 2021. We remain on target for the Group's new Masterton Bond

supply chain facility to be fully operational early in Q2.

We remain focussed on developing and progressing our business

through the continued growth of membership globally, building a

sustainable platform for the future and driving ASC towards

profitability which should be achieved in the near-term. We will

continue to benefit from the structural tailwinds of

digitalisation, premiumisation and convenience which underpin our

unique business model and the continued global growth of the

Ultra-Premium whisky segment.

Finance Director's Review

Continued Growth Driving Aim of Near-term Profit Delivery

Another year of exceeding performance expectation and investing

in the future growth of the business

Strong 2022 performance as the basis for future years

delivery

It is a pleasure and honour for me to step into the Finance

Director role on an interim basis, following Andrew's move into the

CEO role as David Ridley leaves the business. We wish him all the

best in his next endeavour. Overall, 2022 was another strong year

of performance for the Group with the headlines showing we have

exceeded market expectations on revenue and ensuring as a result

that we deliver the associated EBITDA profit expectation. Another

period of delivery gives us confidence we are on track to continue

to meet our future profit objectives in the near to medium

term.

To further support the strategy long-term, we have made

significant further investment during the year in cask spirit and

we also reached a major investment milestone in completing the

fit-out and operational commencement of our new self-contained

Supply Chain Facility, Masterton Bond. The completion, on time and

within budget, allows us to achieve not only margin improvement in

the near-term with regards to operational costs, but also allows us

to take control of operations from third parties.

Continued improvement in Group financial performance

As a Group, we have delivered revenue, gross profit, adjusted

EBITDA and membership growth in the year, this momentum serving to

ensure we deliver on the expectations of our growth journey over

the next few years.

Revenue growth of 19%, at GBP21.8million which was above

expectation, has resulted in a step-change delivery at an adjusted

EBITDA level, our gross margin improvement of 210 basis points a

key factor as we manage costs and drive profitable sales. This

gives us significant confidence that alongside our strategic plans,

we can achieve profit in the near-term as expected. Our adjusted

EBITDA achievement excludes pre-operational non-underlying costs

within our Income Statement in 2022, Masterton Bond and American

Whiskey costs, which together represented a GBP0.6 million

investment in the year.

Membership has grown 12% over the year and we remain committed

to ensuring our membership proposition is strong and always looks

to seek improvement and meet member expectations. A maintained

retention rate is pleasing in year, and a key focus of our

strategic priorities are geared toward improvement of this -

ensuring members feel engaged in what we offer, part of a 'whisky

club' that has community and togetherness at its heart.

Membership has performed strongly across all regions, with

significant growth in Europe and the US, 29% and 16% respectively,

supported by 10% in the UK and 5% across Asia. In the US, we have

seen the growth come from a 900bps improvement in retention and

within the UK the growth is mainly driven by new members. Europe is

benefitting from the improved supply following Brexit, and as a

result membership has increased across new and renewing

members.

Growing Global Revenue

United Kingdom

As the home of the Scotch Malt Whisky Society, the UK remains

our longest standing and largest global market, with around half of

total membership and around a third of global revenue. In the UK we

have a truly omni-channel approach, with four outstanding member

rooms complimenting the online presence at www.smws.com . Growth

within the UK was a very strong 27%, predominantly driven by our

venues as we recovered from the restrictions of Covid. Online sales

continued with another strong year-on-year improvement of 5%, with

delivery across the region of GBP7.4 million (2020: GBP5.8

million). As a result, the UK business has reinforced its position

as the biggest individual market within the Group having

contributed 34% of revenue in the year. Membership also grew double

digit at 10%.

Asia

The Asian markets continue to be a key area of growth for the

business, with China now our second largest overall market after

the UK. This is despite the fact that SMWS China only celebrated

its five-year anniversary of launch in November 2022. This is a

testament to both the size of the opportunity that exists there, as

well as the outstanding quality of delivery and service provided by

the team.

China revenue grew by 28% in the year, representing the fastest

growth of any market. However this growth was delivered in the face

of some very challenging conditions in the country with the rate of

growth slowing in H2 as a result of the continued "Zero Covid"

policy which was pursued until the tail end of 2022. This impacted

both logistics in Q2-22 when some of the strict lockdown periods in

Shanghai began, and also the whisky festivals which would normally

be a key source of recruitment, but which were cancelled in 2022.

This meant that after a record period of membership growth in 2021,

and a strong start to 2022, membership at 31 December 2022 was

similar to 31 December 2021 at around 1,700 members.

The wider Asian market growth was supported by performance in

Japan with double digit revenue growth supported by over 20%

membership growth in the year, delivered through both growing

recruitment and improvements in retention to an outstanding level

of 85%, reflecting the extreme focus by the local team on member

satisfaction.

More broadly, we were pleased to announce in October that SMWS

had signed a new franchise agreement with F.J. Korea ("FJK") in

South Korea, Asia's fourth largest economy and the world's tenth

largest market for Ultra-Premium Scotch whisky. Alongside that we

entered a new partnership agreement in Malaysia, providing a new

route to market (the 12(th) largest market within the global

Ultra-Premium Scotch malt whisky sector) and further strengthening

the Group's geographic footprint in South-East Asia.

North America

The North American market is led by the United States which

represented around 20% of total global sales for the year.

Membership levels in the US grew strongly in the period, up by 16%

in the period and breaking through the 6,000 member milestone.

However, in market depletions were down slightly year on year as

the levels of bottle sales per member fell from the higher levels

during the Covid lockdown periods of 2020/21 to their pre-pandemic

levels. The revenue effect of these was offset by the timing of

shipments and positive movements in FX rates meaning that the total

value of revenue grew by 6% in the period. More generally,

performance in the Canadian franchise was positive, with sales up

29% and with a very modest contribution from the relatively new

Mexican franchise which began operating fully in 2022.

Europe

2022 performance built on the progress made at the tail end of

2021- with the establishment of a warehouse in mainland Europe,

enabling the Group to mitigate Brexit-related logistical challenges

and reduce shipping and delivery times to EU members. This new

set-up operated throughout 2022 with the dramatic reduction in

delivery times and increase in level of online and in person

support for membership recruitment and engagement helping to

deliver 29% membership growth in the year (the fastest rate of any

market) and helping to deliver 18% revenue growth, with the growing

number of members also increasing their average spend and

contribution in the period.

Australia

Strong performance in the Australian market was led by 24%

membership growth in the period, supported by some very strong

campaign activations which have now been replicated both in

Australia and other markets. This helped to deliver double digit

revenue growth in the period, as well as giving a strong basis for

further growth in future periods.

Cost base maturation ensuring gross profit delivery and growth

delivers EBITDA

As we have invested in our cost base over recent years to

deliver growth, we have built a strong and experienced team within

the business who have ultimately helped us achieve our growth to

date, and although we will always look to invest in skilled

employees who bring attributes and new ways of thinking, that

investment level is starting to mature. Payroll costs in the year

(including share options) were GBP6.0 million (2021: GBP4.5

million). Significant further investment has been made in a new

Technology Team and continues to be made on the digital

transformation of the business which will be instrumental in

helping us achieve the next stage of our strategic

opportunities.

As we enter 2023, our payroll base is maturing, opportunities

being specific and tactical as opposed to the last few years of

growth and expertise requirement. We will continue to ensure we

invest wisely in Advertising and Promotional spend ("A&P").

This helps to ensure we manage costs within a high inflation

environment, supporting revenue and EBITDA delivery ambitions.

A&P spend saw a 9% year on year increase representing good

management and return against the backdrop of our 19% revenue

increase and GBP1.0 million additional adjusted EBITDA delivery.

Other major costs within the year include Share Options costs of

GBP0.2 million (2021: GBP0.3 million), IT and Systems Costs of

GBP0.7 million (2021: GBP0.6 million) as we continue to invest and

improve in our IT infrastructure to deliver strategic priorities

and drive efficiencies, including the new Masterton Bond Supply

Chain facility, which itself had GBP0.3 million of pre-operational

cost expensed within the year. Earnings per share at the end of the

year (2.9p) is an improved closing of 2021: (5.9p) our growth and

EBITDA conversion delivering on our journey to EBITDA and

shareholder return over the medium-term.

Initial spend on the American Whisky opportunity of GBP0.3

million spend in year (2021: zero) has given the business a good

initial grounding on which to build as we consider our next

move.

Share Incentive Schemes

We have followed up the award of share options in 2021 with

further options within the scheme. In 2022, 139,000 new share

options were issued, consisting of time vesting options for central

office and venue staff, with senior management options all

performance related, based on Revenue, EBITDA and Share Price.

Further awards under the framework of the existing scheme, with new

targets for the forthcoming years, are expected this year.

Balance sheet strength driven by continued cask investment and

asset backed funding

Our balance sheet remains strong, with net assets of GBP22.0

million supported by further investment in year in spirit and wood

of around GBP3 million, as well as around GBP2.5 million on our

self-contained multi-purpose supply chain facility at Masterton

Bond.

This further investment utilised our RCF facility as planned, as

a result net debt at the end of 2022 at GBP14.7million, considered

well manageable within the remit of our strong asset backed balance

sheet, cask spirit stock holding at GBP23million.

These investments during the year give us a strong foundation to

allow us to meet our future strategic priorities, delivering

greater EBITDA and cash conversion as we hold stock coverage for

sales through to 2028, and look to drive efficiencies across the

supply chain leading to better cost of our the finished product

through to the end consumer.

Improved inventory secured RCF with Royal Bank of Scotland

(RBS)

In Q4 the Group extended its agreement with RBS to increase its

existing revolving credit facility to GBP21.5 million (previously

GBP18.5 million) and also lengthened the term of the commitment

until December 2025, broadly extending the term by two years and on

better terms saving the Group c. GBP40,000 per year. The RBS

facility provides additional flexibility to expand and grow all

aspects of the business including membership, whisky stocks and

international reach. As at the end of 2022, the Group had GBP5

million of unutilised headroom on this facility.

Cash flow driving investment

2022 has been another year of significant investment, delivering

business growth beyond expectations and plans, with around GBP5.5

million invested in spirit and other strategic opportunities,

primarily the Masterton Bond supply chain facility completion,

resulting in our ability to not only ensure coverage of stock until

2028 but also achieve our offering at a more productive and

efficient, self-controlled bottling facility, driving gross margin

benefits to the business for future return against investment.

As a result, during 2022 we have drawn down as planned around

GBP10 million against our RCF agreement, as the source for the

investment required. Our stock position has grown, as we control

risks against changes in supply chain with Masterton Bond and a

short stock position evidenced in earlier years. Looking forward,

the level of cash investment, in particular in spirit and wood, has

peaked and the business is expected to begin to generate cash

inflows as profitability continues to grow.

Change of External Auditors

Following a number of years with our previous auditors, and our

continued maturity, we appointed new external auditors in May 2022,

Mazars LLP.

Looking ahead to 2023

We remain positive about our ability to meet our strategic goals

in the short, medium and long-term following our achievements this

year.

Our investment in spirit and supply chain safeguards our ability

to deliver to our growth plans and, at the heart of all of this,

deliver further improvements on our EBITDA and cash conversion,

which we have seen in 2022 with regards to the revenue growth.

Our strategy is working, and we will maintain our confidence in

that strategy, ensuring we continue to understand and invest in our

membership proposition, achieving new and improved routes to

market. This will include 2023 opportunities in Korea and Taiwan,

as well as growth in key markets, particularly the US and China.

The addressable market is significant ($5.8 billion) and growing,

with over 50% of this addressable market in China, US, Taiwan and

the UK. We are well placed to take advantage of this sizable and

expanding market and have the strategy to deliver that growth and

look forward to continuing to deliver that profitable growth

ambition.

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2022

2022 2021

Notes GBP'000 GBP'000

=================================================== ===== ======== ========

Revenue 6 21,781 18,237

Cost of sales (7,936) (7,026)

--------------------------------------------------- ----- -------- --------

Gross profit 13,845 11,211

Selling and distribution expenses (5,503) (4,046)

Administrative expenses (9,875) (9,694)

Finance costs (576) (348)

Other income 9 37 160

--------------------------------------------------- ----- -------- --------

Loss on ordinary activities before taxation 7 (2,072) (2,717)

Taxation 11 359 (631)

--------------------------------------------------- ----- -------- --------

Loss for the year (1,713) (3,348)

Other comprehensive income:

Items that may be reclassified to profit

or loss:

Movements in cash flow hedge reserve 31 (113)

Movements in translation reserve (59) -

Tax relating to other comprehensive loss - 23

--------------------------------------------------- ----- -------- --------

(28) (90)

--------------------------------------------------- ----- -------- --------

Total comprehensive loss for the year (1,741) (3,438)

=================================================== ===== ======== ========

Loss for the year attributable to:

* Owners of parent company (2,010) (3,653)

* Non-controlling interest 297 305

--------------------------------------------------- ----- -------- --------

(1,713) (3,348)

=================================================== ===== ======== ========

Total comprehensive loss for the year attributable

to:

* Owners of parent company (2,038) (3,743)

* Non-controlling interest 297 305

--------------------------------------------------- ----- -------- --------

(1,741) (3,438)

--------------------------------------------------- ----- -------- --------

Basic EPS (pence) 12 (2.9p) (5.9p)

--------------------------------------------------- ----- -------- --------

Diluted EPS (pence) 12 (2.9p) (5.9p)

=================================================== ===== ======== ========

Consolidated Statement of Financial Position

As at 31 December 2022

2022 2021

Notes GBP'000 GBP'000

====================================== ===== ======== ========

Non-current assets

Investment property 405 391

Property, plant and equipment 13 10,362 8,377

Intangible assets 2,249 2,420

-------------------------------------- ----- -------- --------

13,016 11,188

Current assets

Inventories 14 28,303 23,719

Trade and other receivables 3,714 2,968

Cash and cash equivalents 2,331 2,012

-------------------------------------- ----- -------- --------

34,348 28,699

-------------------------------------- ----- -------- --------

Total assets 47,364 39,887

-------------------------------------- ----- -------- --------

Current liabilities

Trade and other payables 3,703 3,949

Current tax liabilities 405 277

Financial liabilities 15 357 392

Lease liability 360 259

Forward currency contracts - 31

-------------------------------------- ----- -------- --------

4,825 4,908

-------------------------------------- ----- -------- --------

Net current assets 29,523 23,791

Non-current liabilities

Financial liabilities 15 16,984 6,796

Lease liability 2,959 3,332

Deferred tax liabilities - 563

Provisions 580 407

-------------------------------------- ----- -------- --------

Total non-current liabilities 20,523 11,098

-------------------------------------- ----- -------- --------

Total liabilities 25,348 16,006

-------------------------------------- ----- -------- --------

Net assets 22,016 23,881

====================================== ===== ======== ========

Equity

Called up share capital 174 174

Share premium account 14,997 14,938

Translation reserve (76) (17)

Retained earnings 6,685 8,505

Cash flow hedge reserve 8 (23)

-------------------------------------- ----- -------- --------

Equity attributable to parent company 21,788 23,577

====================================== ===== ======== ========

Non-controlling interest 228 304

Net assets 22,016 23,881

====================================== ===== ======== ========

Consolidated Statement of Cash Flows

For the year ended 31 December 2022

2022 2021

Notes GBP'000 GBP'000

============================================== ===== ======== ========

Loss for the year after tax (1,713) (3,348)

Adjustments for:

Taxation charged (359) 631

Finance costs 494 348

Interest receivable (4) (5)

Movements in provisions 10 3

Share-based payments 190 216

Investment property fair value movement (14) -

Lease interest 82 -

Depreciation of tangible assets 1,000 671

Amortisation of intangible assets 259 271

Movements in working capital:

(Increase) in stocks (4,496) (2,068)

(Decrease)/increase in debtors (746) (929)

(Decrease)/increase in creditors 240 252

---------------------------------------------- ----- -------- --------

Cash absorbed by operations (5,057) (3,958)

Income taxes paid (75) (360)

Interest paid (494) (347)

---------------------------------------------- ----- -------- --------

Net cash outflow used in operating activities (5,626) (4,665)

---------------------------------------------- ----- -------- --------

Cash flow from investing activities

Purchase of intangible assets (88) (92)

Purchase of property, plant and equipment 13 (2,911) (1,101)

Purchase of JV China share (359) -

Interest receivable 4 5

---------------------------------------------- ----- -------- --------

Net cash used in investing activities (3,354) (1,188)

---------------------------------------------- ----- -------- --------

Cash flows from financing activities

Share issue 59 14,878

Asset backed lending repaid - (14,823)

Inventory secured RCF facility 15 10,300 6,200

Dividends paid (373) (385)

Loan received - 93

Repayment of loan (148) (145)

Repayment of leases (354) (139)

---------------------------------------------- ----- -------- --------

Net cash from financing activities 9,484 5,679

---------------------------------------------- ----- -------- --------

Net increase in cash and cash equivalents 504 (174)

Cash and cash equivalents at beginning of

year 2,012 2,176

Other reserve movements - 10

---------------------------------------------- ----- -------- --------

Non controlling interest movement (185) -

---------------------------------------------- ----- -------- --------

Cash and cash equivalents at end of year 2,331 2,012

============================================== ===== ======== ========

Relating to:

Bank balances and short term deposits 2,331 2,012

============================================== ===== ======== ========

Consolidated Statement of Changes In Equity

For the year ended 31 December 2022

Cash

Called Share flow Total

up share premium Retained hedge Translation Other controlling Non-controlling Total

GBP'000 capital account earnings reserve reserve reserves interest interest equity

================ ======== ======== ======== ======== =========== ======== =========== =============== =======

Balance at 31

December

2020 135 99 12,544 67 (15) - 12,830 163 12,993

---------------- -------- -------- -------- -------- ----------- -------- ----------- --------------- -------

Issue of share

capital 39 15,579 - - - - 15,618 - 15,618

Share issue

direct

costs - (740) - - - - (740) - (740)

Loss for the

period - - (3,653) - - - (3,653) 305 (3,348)

Adjustment to

non-controlling

interest - - (252) - - - (252) 252 -

Share-based

compensation - - 216 - - - 216 - 216

Dividend paid - - - - - - - (280) (280)

Investment in

subsidiary - - (350) - - - (350) (136) (486)

Other

comprehensive

gain/(loss) - - - (90) (2) - (92) - (92)

---------------- -------- -------- -------- -------- ----------- -------- ----------- --------------- -------

Balance at 31

December

2021 174 14,938 8,505 (23) (17) - 23,577 304 23,881

================ ======== ======== ======== ======== =========== ======== =========== =============== =======

Issue of share

capital - 59 - - - - 59 - 59

Loss for the

period - - (2,010) - - - (2,010) 297 (1,713)

Share-based

compensation - - 190 - - - 190 - 190

Dividend paid - - - - - - - (373) (373)

Other

comprehensive

gain/(loss) - - _ 31 (59) - (28) - (28)

---------------- -------- -------- -------- -------- ----------- -------- ----------- --------------- -------

Balance at 31

December

2022 174 14,997 6,685 8 (76) - 21,788 228 22,016

================ ======== ======== ======== ======== =========== ======== =========== =============== =======

Notes to the Financial Statements

1) Basis of preparation:

The condensed interim financial information presents the

consolidated financial results of The Artisanal Spirits Company plc

and its subsidiaries (together the "Group") for the twelve months

ended 31 December 2022 and the comparative figures for the twelve

months ended 31 December 2021.

The Group's consolidated financial statements have been prepared

on a going concern basis under the historical cost convention; in

accordance with UK adopted International Accounting Standards.

This statement does not include all the information required for

the annual financial statements and should be read in conjunction

with the Annual Report & Accounts.

The financial information set out above does not constitute the

company's statutory accounts for 2022 or 2021. The statutory

accounts for 2021 have been delivered to the Register of Companies,

and those for 2022 will be delivered in due course. The independent

auditor has reported on these accounts, their reports were (i)

unqualified, (ii) did not draw attention to any matter by way of

emphasis without qualifying their report and (iii) did not contain

a statement under section 498 (2) or (3) of the Companies Act

2006.

This announcement was approved on behalf of the Board on 29

March 2023.

2) Accounting Policies:

The accounting policies applied in preparing the condensed

consolidated financial information are the same as those applied in

the preparation of the Annual Report and Accounts for the year

ended 31 December 2022, and those applied in the preparation of the

Group's Historical Financial Information included within the

Company's Admission Document.

3) Going concern:

The Directors are, at the time of approving the financial

statements, satisfied that the Group and Company have adequate

resources to continue in operational existence for a period of at

least 12 months. Thus, they continue to adopt the going concern

basis of accounting in preparing the financial statements.

The Group meets its day-to-day working capital requirements from

a revolving credit facility of GBP21.5m together with cash

balances. The revolving credit facility was renewed in December

2022 and is not due for renewal until January 2025. The revolving

credit facility has quarterly leverage and covenants relating to

minimum stock holding level as a percent of the facility drawn

down, the 'springing test', which requires 135% of eligible

inventory holding against the RCF balance, reviewed monthly.

Secondary covenants of EBITDA and Net Assets (excluding

Intangibles) exist if the springing test isn't met. The Group did

not make use of government backed borrowing facilities such as the

Coronavirus large business interruption loan scheme.

The Group remained compliant with its banking covenants

throughout the year to 31 December 2022.

In the context of the above, the directors have prepared cash

flow forecasts for the period to 31 April 2024 which indicate that,

taking account of reasonably plausible downside scenarios, the

Group will have sufficient funds to meet its liabilities as they

fall due for that period.

The Directors have assessed the potential on-going impacts of

the Covid-19 pandemic and have modelled scenarios as follows:

1. A base cash flow forecast. The 2023 figures in this forecast

are based on the Group's 2022 budget, which is based on board

approved forecasts and reflecting current performance, expected

revenue growth and membership retention. The 2024 figures in the

base cash flow forecast are taken from the Group's 3-5 year long

range planning. Cost inflation has been considered and additional

costs have been included to account for increased wage

inflation.

2. A severe, but plausible downside scenario. The directors have

also prepared a sensitised forecast which considers the impact of

certain severe but plausible downside events, when compared to the

base case. This scenario assumes a return of a covid-19 outbreak

modelling the impact of a full national lock-downs of one month

duration as a result of government-imposed restrictions together

with an associated reduction in global online sales.

In this scenario, capital expenditure has been reduced to

run-rate expenditure. This scenario demonstrates that the Group

would remain within its facility limits and in compliance with the

relevant covenants.

The Directors are mindful of the potential impacts to

macro-economic conditions and further risk of disruption to supply

chains that the conflict in Ukraine presents, but after assessing

the risks do not believe there to be a material risk to going

concern. Based on the above, the directors are confident that the

Group and Company will have sufficient funds to continue to meet

their liabilities as they fall due for at least 12 months from the

date of approval of the financial statements, and therefore the

directors believe it remains appropriate to prepare the financial

statements on a going concern basis.

4) Principal risks and uncertainties

The principal risks and uncertainties affecting the Group are

separately disclosed in the Annual Report & Accounts.

5) Dividends

No dividend was declared or paid during the period (prior period

GBPnil).

6) Revenue

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker;

Revenue by geography and by type.

* Europe represents direct sales markets within continental

Europe but excludes franchise markets in Denmark and Switzerland

which are shown within Rest of World.

7) Loss on ordinary activities before taxation

* Adjusted EBITDA classed as earnings before interest, tax,

depreciation, amortisation and exceptional costs (see note 10).

8) KPIs

1 Contribution is a non-IFRS measure, and is defined by

Management as Gross Profit less Commission paid in on sales

(primarily in relation to the US).

2 Expected Years is a non-IFRS measure, and is defined by

Manager as one divided by one minus retention 1/(1-r%).

3 Lifetime Value (LTV) is a non-IFRS measure, and is defined as

Annual Contribution per member, multiplied by expected years.

4 Europe represents direct sales markets within continental

Europe, but excludes franchise markets in Denmark and Switzerland

which are shown within Rest of World.

5 Revenue excludes JG Thomson and cask sales of GBP0.6m as they

aren't sales related to membership proposition.

9) Other operating income

10) Exceptional items

The 2022 non underlying costs relate to pre-operational expenses

in setting up the Masterton Bond site to be operational by the end

of 2022, and the initial costs of the American Whiskey concept and

brand assessment and development as well as establishment of

relevant legal entities. These costs are fully expensed in the year

with no revenue achievement and are therefore separately shown to

make clear the underlying profitable performance of the

business.

11) Taxation

12) Earnings per Shares (EPS)

13) Property, plant and equipment

GBP88k (2021: GBP96k) of the depreciation charge for casks has

been capitalised as a cost of stock. The remaining balance has been

expensed to the Statement of Comprehensive Income.

Leases are in relation to venues Queen Street in Edinburgh and

Bath Street in Glasgow as well as our new Masterton Bond supply

chain facility.

14) Inventories

15) Financial liabilities

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EALDNASPDEEA

(END) Dow Jones Newswires

March 29, 2023 02:00 ET (06:00 GMT)

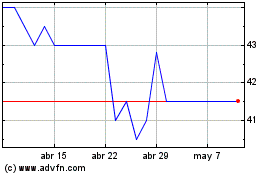

The Artisanal Spirits (LSE:ART)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

The Artisanal Spirits (LSE:ART)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024