MARKET MOVEMENTS:

--Brent crude oil edged down 0.6% to $75.62 a barrel

--European benchmark gas fell 3.9% to EUR134 a megawatt hour

--Gold futures edged down 0.4% to $1,803 a troy ounce

--Three-month copper edged down 0.4% to $8,453 a metric ton

--Wheat futures rose 2% to $7.49 a bushel

TOP STORY:

EU Delays Labeling Lithium Toxic as Concerns From EV Industry

Mount

The prospect that the European Union will classify lithium as

toxic is adding to worries in the electric-vehicle battery industry

that policymakers aren't doing enough to attract investment and the

EU will lose out to the U.S., an attractive destination for such

companies partly thanks to the Inflation Reduction Act.

Last week, the European Commission was set to give a final

ruling on whether lithium, a crucial battery input, should be

classified as a toxic substance. The commission's scientific arm

recommended that it do so.

The decision by the EU's executive arm has now been pushed back

into the new year, the second delay in as many months. Europe's

nascent battery companies are warning that investors may be drawn

away from the continent to the U.S., where the IRA has created

strong incentives to establish supply chains in the country.

OTHER STORIES:

BHP Invests in, Collaborates With Friedland's Pulsed-Power

Company, Affiliate

BHP Group Ltd., the world's biggest miner by market value, has

invested in and entered collaboration agreements with mining tycoon

Robert Friedland's I-Pulse Inc. and a venture that company has with

Bill Gates-backed Breakthrough Energy Ventures, called I-ROX.

The agreements will give BHP access to I-Pulse's pulsed-power

technology for the crushing and grinding of mineral ores and allow

it to collaborate on developing applications for the technology,

I-Pulse and I-ROX said in a statement on Monday. The value of the

equity investments in I-Pulse and I-ROX wasn't disclosed, but BHP

will join I-Pulse and BEV Europe as shareholders of I-ROX, the

entities said.

MARKET TALKS:

Palm Oil Ends Lower, Dragged by Decline in Soybean Oil

1014 GMT - Malaysian palm oil prices ended lower, dragged by a

selloff in soybean oil on the Chicago Board of Trade on Friday and

losses in palm-oil futures on the Dalian Commodity Exchange on

Monday, Singapore-based Palm Oil Analytics co-founder Sathia Varqa

says. Soybean oil, a close substitute for palm oil, declined after

the USDA's latest report lowered forecasts for soybean oil use in

biofuel and for export in 2022-2023, Varqa adds. The benchmark

Bursa Malaysia Derivatives contract for February delivery was

MYR254 lower at MYR3,741 a ton. (clarence.leong@wsj.com)

---

Copper Edges Lower as Market Weighs China Reopening Risks

0926 GMT - Copper prices edge lower but remain close to a

six-month high as expectations of China's reopening have lifted

prices. Three-month copper on the LME is down 0.4% at $8,454.50 a

metric ton. Having hit a low of $7,104 a ton during the summer, the

metal has rebounded and is up 13% for the quarter so far as demand

expectations have been lifted by China's reopening plans. Still,

analysts caution that the process could be bumpy as China

encounters spikes in Covid-19 cases along the way. China's metal

demand might actually underwhelm JPMorgan says in a note.

"Reopening is going to likely be a process of starts and stops,"

the bank says. (william.horner@wsj.com)

---

Oil Slips on Global Demand Concerns

0843 GMT - Oil prices fall as weak economies in the West and

concerns about China's reopening weigh on demand hopes. Brent

crude, the international oil benchmark, is down 0.6% at $75.64 a

barrel while WTI is down 0.6% at $70.61 a barrel. While China's

reopening was hoped to boost demand for crude, concerns have built

that it could send Covid-19 cases sharply higher, which could be

negative for oil demand. "An expected bumpy China reopening coupled

with the scenario of a mild recession in Europe and the U.S. could

lead to a harsher economic climate for oil markets," says Stephen

Innes, managing partner at SPI Asset Management.

(william.horner@wsj.com)

---

Palm Oil Prices Fall, Mirroring Weakness in CBOT Soybean Oil

0246 GMT - Palm oil prices fall, in line with weakness in the

CBOT soybean oil market and palm olein on the Dalian Commodities

Exchange in Asian trading hours, says David Ng, a trader at Kuala

Lumpur-based proprietary trading firm Iceberg X. He thinks weaker

soybean oil demand, weighed by the cautious economic outlook, is

causing downward pressure on soybean oil prices, hence dragging

palm oil prices lower as two oils often trade in tandem as they are

used in similar products. He pegs crude palm-oil futures support at

MYR3,700 and resistance at MYR4,100. The benchmark Bursa Malaysia

Derivatives contract for February delivery is MYR179 lower at

MYR3,816 a ton.(yingxian.wong@wsj.com)

---

Chinese Iron Ore Gains; Upbeat Sentiment Likely to Continue on

Easing of Covid Curbs

0237 GMT - Iron ore prices are higher in China morning trade,

extending recent sharp gains, as investors welcomed China's

wide-ranging relaxations of its pandemic curbs. Yongan Futures

analysts point out that buying interest is likely to remain

supported by upbeat sentiment for a mid-term rebound in demand, as

China's economic activities recover amid the country's reopening

and a stabilizing property sector. However, the analysts caution

that investors should monitor near-term port transactions in the

physical market as a sign of how fast steel-making demand is

picking up on the ground after the policy changes. The most-traded

January contract is up 0.5% at CNY835.5 a ton.

(yifan.wang@wsj.com)

---

Copper Prices Retreat; Buying Interest May Support Prices

0227 GMT - Copper prices are lower in early Asian trade,

retreating from a rally last week as China effectively relaxed most

of its Covid-Zero restrictions. The move has triggered investor

hopes over a demand rebound in China, one of the world's largest

copper consuming countries, ANZ Research analysts note. A

stabilizing property sector and stronger policy support for the

market would offer an extra boost to the metal's demand outlook,

they say. They reckon buying interest is likely to remain high and

support prices in the near term. The three-month LME contract is

down 1.5% at $8,414.50 a ton. (yifan.wang@wsj.com)

---

Proposed Pricing Rule Worries Australian Gas Industry

0119 GMT - A so-called reasonable pricing provision proposed for

Australia's domestic gas market could bring forward any shortfall

in local gas supplies by strengthening demand and deterring

investment, Commonwealth Bank of Australia analyst Vivek Dhar says

in a note. He highlights the planned provision as the biggest

surprise in the government's announcement of gas- and coal-price

caps Friday. "One of the key objectives of the 'reasonable pricing

provision' is to ensure that local gas prices 'reflect costs of

production' and allow 'for a reasonable return on capital'," but

"how this is managed, while having the objective of maintaining

'incentives for investment in new sources of supply', is a key

market concern," Dhar says. (rhiannon.hoyle@wsj.com;

@RhiannonHoyle)

---

Crude Oil Rises After Russia Threatens to Slash Production

0117 GMT - Crude oil prices are higher in early Asian trade.

Despite the release of higher-than-expected U.S. PPI data, prices

may continue to remain supported, in no small part due to Putin

threatening to slash Russian oil production in retaliation to the

G-7's proposed price caps, says Stephen Innes, managing partner at

SPI Asset Management, in a research report. However, several other

factors could keep the price of crude from gaining too sharply,

such as the prospect of slowing global economic growth, he adds.

The front-month contract for WTI futures rises 0.7% to $71.74/bbl,

while the front-month Brent crude contract is up 0.8% at

$76.71/bbl. (yiwei.wong@wsj.com)

Write to Barcelona Editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

December 12, 2022 07:08 ET (12:08 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

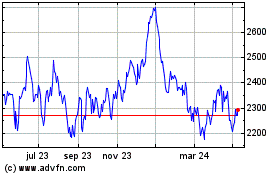

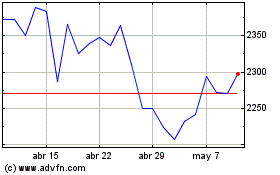

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024