Banco Bilbao Vizcaya Argentaria SA Buy Back Program - Terms and Conditions 2 Segment (6140Q)

29 Junio 2022 - 2:13AM

UK Regulatory

TIDMBVA

RNS Number : 6140Q

Banco Bilbao Vizcaya Argentaria SA

29 June 2022

Banco Bilbao Vizcaya Argentaria, S.A. ("BBVA" or the "Company"),

in compliance with the Spanish Securities Market legislation,

hereby proceeds to notify the following:

INSIDE INFORMATION

Further to the notice of Inside Information of 28 June 2022,

with CNMV registration number 1511 (the "Second Segment Execution

II") ([1]) , BBVA hereby notifies the execution of the Second

Segment which completes the Program Scheme pursuant to Regulation

(EU) No. 596/2014 of the European Parliament and of the Council, of

16 April 2014, on market abuse ("MAR") and Commission Delegated

Regulation (EU) No. 2016/1052, of 8 March 2016, (the "Delegated

Regulation" and, together with MAR, the "Regulations") under the

terms and conditions detailed below:

Purpose: To reduce BBVA's share capital by means

of the redemption of the acquired shares.

Maximum cash amount: The maximum cash amount will be 1,000 million

Euros.

Maximum number of The maximum number of BBVA shares to be

shares: acquired will be 149,996,808.

Start of the execution: Execution will start on 1 July 2022.

End of the execution: The Second Segment will end no later than

29 September 2022 and, in any event, when

the maximum cash amount is reached or the

maximum number of shares is acquired.

However, the Company reserves the right

to temporarily suspend or to early terminate

the execution of the Second Segment in the

event of any circumstance that so advises

or requires.

Trading venue: The acquisitions will be made on the Spanish

Electronic Trading Interconnection System

- Continuous Market (the "Continuous Market").

Manager: The execution will be carried out externally

through CITIGROUP GLOBAL MARKETS EUROPE

AG (the "Manager"), who will make its decisions

concerning the timing of the purchases of

the BBVA shares independently of the Company.

Conditions of the The Second Segment will be executed pursuant

Second Segment: to the following conditions:

(i) by purchasing in each trading session

on the Continuous Market (other than a Discontinued

Day) 4 ,250,000 shares (the "Daily Target

Number of Shares"), except in cases of force

majeure or if the Manager is unable to purchase

such number of shares due to limitations

derived from the provisions of article 3.2

of the Delegated Regulation.

For these purposes, a Discontinued Day is

understood to be any trading session of

the Continuous Market in which there is

a significant disruption in the market or

in the quotation of the BBVA shares (including

if their trading price falls below their

nominal value during a substantial part

of the session) or if the trading volume

for the BBVA share is less than 2.5 times

the Daily Target Number of Shares.

(ii) The own shares will be purchased respecting

in all cases the conditions and the price

and volume limits set forth in the Regulations.

In particular, it is hereby stated that

the Daily Target Number of Shares is less

than 25% of the average daily volume of

the BBVA shares in the Spanish Electronic

Trading Interconnection System - Continuous

Market in the month preceding this communication

(thus complying with the provisions of article

3.3.a) of the Delegated Regulation).

The share purchase transactions carried out, as well as the

completion or, as the case may be, the interruption of the

execution of the Second Segment, will be duly reported to the

Spanish National Securities Market Commission in accordance with

the Regulations.

Madrid, 29 June 2022

([1]) The terms Second Segment and Program Scheme will have the

same meaning as provided in the Second Segment Execution II.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSFLMRTMTBTMMT

(END) Dow Jones Newswires

June 29, 2022 03:13 ET (07:13 GMT)

Banco Bilbao Vizcaya Arg... (LSE:BVA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

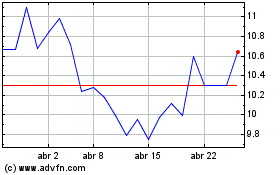

Banco Bilbao Vizcaya Arg... (LSE:BVA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024