TIDMCBA

RNS Number : 3295C

Ceiba Investments Limited

22 February 2022

CEIBA INVESTMENTS LIMITED

("CEIBA" or the "Company")

(TICKER CBA, ISIN: GG00BFMDJH11)

Legal Entity Identifier: 213800XGY151JV5B1E88

TRADING UPDATE

CEIBA, the largest listed international company solely dedicated

to investing in Cuba, with interests in Cuba's commercial and

tourism real estate sectors, is pleased to provide an update on

trading, operations and investment in 2021, in particular with

respect to the operations of Inmobiliaria Monte Barreto S.A.

("Monte Barreto") and Miramar S.A. ("Miramar") and the hotel

development of TosCuba S.A.

Inmobiliaria Monte Barreto S.A. - 49% interest CEIBA Investments

Limited

Occupancy levels at the Miramar Trade Centre of Monte Barreto

have been over 95% throughout the full 2021 financial year and

demand for international-standard office accommodation in Havana

continues to exceed supply, with Monte Barreto remaining the

dominant option in this market segment.

However, as previously stated in the Company's half year

financial statements, commercial real estate activities such as the

ones carried out by Monte Barreto have been excluded from some of

Cuba's general rules relating to "liquid" payments (the ability to

transfer funds abroad on an autonomous basis, without foreign

exchange controls), and consequently the local payments of many

tenants of the joint venture are not deemed to be "liquid".

As a result, to date the joint venture continues to operate

under limited financial autonomy. It is operating under a mixed

regime having reduced liquidity requirements, in which certain

liquid resources of the joint venture are generated by the joint

venture itself from operations, and the rest are to be allocated

centrally by both the Cuban partner and the Cuban government. In

2021, Monte Barreto did not receive significant centrally allocated

liquidity rights as a result of the tenuous liquidity situation of

the country. In addition, hard currency transfers from Cuban banks

are experiencing delays.

The short term goals that the manager is presently pursuing with

Monte Barreto, its Cuban shareholder, and the relevant Cuban

authorities is to resolve the payment of dividends declared by

Monte Barreto for the period up to 30 June 2021, and to determine

in what way, and through which authorized legal exceptions, Monte

Barreto will be able to obtain full financial autonomy as from that

date going forward.

Without such goals being achieved it is likely that the discount

rates that are applied to future cash flows in order to establish

the fair value of the Miramar Trade Centre will continue to

increase. More importantly, the absence of a structure that enables

the Company to make solid projections of its cash flow and to count

on the cash dividend income generated by Monte Barreto would likely

adversely affect the ability of the Company to carry out its

present investment programs.

Miramar S.A. - 32.5% interest CEIBA Investments Limited

On 15 November 2021, Cuba re-opened its borders for

international tourism and expected to welcome a large number of

travel-hungry (and Covid-19 tired) Canadians, Europeans and

Russians. A week later the World Health Organization warned of the

new Omicron variant.

The world-wide fear of this new variant prompted a rise in new

travel restrictions that resulted in heavy cancellations from

Canada, the United Kingdom and most European countries. As a result

it would appear that Cuba's path to recovery is expected to take

longer than previously expected.

Under the negative circumstances described above, Miramar, the

Cuban joint venture company that owns four operational hotels in

Havana and Varadero, performed reasonably well during 2021 and is

expected to present a modestly positive 2021 operational year-end

result. The Meliá Habana hotel operated throughout the year as one

of Havana's principal quarantine hotels, while the Sol Palmeras

operated on a skeletal basis. The Meliá Las Americas and Meliá

Varadero hotels re-opened during November and December

respectively. The income generated by the Meliá Habana, in

combination with the positive effects of Cuba's monetary reforms,

formed the drivers behind the positive result. Under the financial

autonomy rules, Miramar generates sufficient liquidity (i.e.

international tourism income) to make all of its dividend

payments.

TosCuba S.A. - 40% interest CEIBA Investments Limited

The construction of the Meliá Trinidad Peninsula hotel has

continued to progress throughout the pandemic, albeit at a slower

pace. Major efforts were put into setting up and carrying out

tender procedures for the procurement of operating supplies &

equipment and dealing with transport and logistics. The procurement

of furniture, fittings & equipment is still pending. Soft

opening of the hotel is expected to take place during the first

quarter of 2023.

2021 Year End and 2022 Outlook

The above-mentioned drop in tourism income from the hotels of

Miramar and the expected lower valuations of both the hotel assets

and the Miramar Trade Centre will have a negative impact on the

Company's 2021 audited year end results that will be published at

the end of April 2022.

However, if during the present year the Company is able to find

a structural solution to create financial autonomy for Monte

Barreto and international tourism continues to recover, and even

more so if during 2022 the Biden administration takes steps to ease

the Cuban embargo, at least as regards family remittances and U.S.

travel, Cuba and CEIBA's liquidity position would greatly improve

which in turn could lead to a much brighter outlook for the Company

by the end of the year.

END OF ANNOUNCEMENT

For further information, please contact:

Aberdeen Standard Fund Managers Limited Tel: +44 (0)20 7463

6000

Sebastiaan Berger, Evan Bruce-Gardyne

Singer Capital Markets Tel: +44 (0)20 7496 3000

James Maxwell, , Michael Nothnagel (Corporate Finance)

James Waterlow (Sales)

JTC Fund Solutions (Guernsey) Limited Tel: +44 (0)1481

702400

www.ceibainvestments.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFSEFFILFIF

(END) Dow Jones Newswires

February 22, 2022 02:00 ET (07:00 GMT)

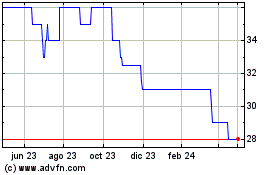

Ceiba Investments (LSE:CBA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

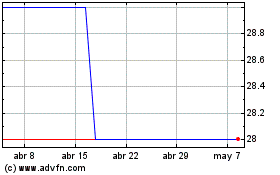

Ceiba Investments (LSE:CBA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024