TIDMCLIG

RNS Number : 6800M

City of London Investment Group PLC

18 September 2023

18th September 2023

CITY OF LONDON INVESTMENT GROUP PLC (LSE: CLIG)

("City of London", "the Group" or "the Company")

FINAL RESULTS FOR THE YEAR TO 30TH JUNE 2023

The Company announces that it has today made available on its

website, https://www.clig.com/, the following documents:

- Annual Report and Financial Statements for the year ended 30th

June 2023 (the 2023 Annual Report); and

- Notice of 2023 Annual General Meeting (the Notice of AGM).

The above documents will be uploaded to the National Storage

Mechanism for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism in due

course, in accordance with Listing Rule 9.6.1 R.

The 2023 Annual Report and the Notice of AGM, which will be held

on 23rd October 2023, will be posted to shareholders on 22nd

September 2023.

The Appendix to this announcement contains additional

information which has been extracted from the 2023 Annual Report

for the purposes of compliance with DTR 6.3.5 only and should be

read in conjunction with this announcement. Together, these

constitute the material required by DTR 6.3.5 to be communicated to

the media in unedited full text through a Regulatory Information

Service. This announcement should be read in conjunction with, and

is not a substitute for reading, the full 2023 Annual Report.

SUMMARY

- Funds under Management (FuM) of US$9.4 billion (GBP7.4

billion) at 30th June 2023. This compares with US$9.2

billion (GBP7.6 billion) at the beginning of this financial

year on 1st July 2022

- Net fee income was GBP54.6 million (2022: GBP58.2 million)

- Underlying profit before tax* was GBP22.7 million (2022:

GBP27.9 million). Profit before tax was GBP18.6 million

(2022: GBP23.2 million)

- Underlying basic earnings per share* were 36.5p (2022:

44.2p). Basic earnings per share were 30.2p (2022: 36.9p)

after an effective tax charge of 21% (2022: 22%) of profit

before taxation

- Recommended final dividend of 22p per share (2022: 22p)

payable on 27th October 2023 to shareholders on the register

on 29th September 2023, making a total for the year of

33p (2022: 46.5p, including a special dividend of 13.5p).

*This is an Alternative Performance Measure (APM). Please refer

to the Financial Review for more details on APMs.

For access to the full report, please follow the link below:

http://www.rns-pdf.londonstockexchange.com/rns/6800M_1-2023-9-16.pdf

This release includes forward-looking statements, which may

differ from actual results. Any forward-looking statements are

based on certain factors and assumptions, which may prove

incorrect, and are subject to risks, uncertainties and assumptions

relating to future events, the Group's operations, results of

operations, growth strategy and liquidity.

For further information, please visit www.citlon.co.uk or

contact:

Tom Griffith, CEO

City of London Investment Group PLC

Tel: 001-610-380-0435

Martin Green/

James Hornigold

Zeus Capital Limited

Financial Adviser & Broker

Tel: +44 (0)20 3829 5000

CHAIR'S STATEMENT

In 1989 it was claimed that on the basis of Tokyo land prices at

the time, the 284-acre Japanese Imperial Palace was worth more than

the entire state of California while frothy valuations drove the

Nikkei 225 index to nearly 39,000, a level to which it has not

returned in the 34 years since. That episode demonstrated that,

while markets generally behave in a rational way, occasionally they

do not. Fast forward to today and we find that the

"magnificent-seven" stocks*are valued at US$11 trillion or twice

the level of the entire Japanese stock market and more than 20% of

the entire US stock market. Whether or not this has taken this

handful of companies into unsustainable "bubble" territory is for

others to decide but in the six months to 30th June 2023, they

accounted for more than 70% of the rise in the S&P 500 index,

underlining the degree to which the recent strength in US equities

has been driven by a narrow and powerful "Artificial Intelligence

(AI)-bandwagon".

In contrast, international equity markets have been more muted,

particularly in the emerging market (EM) universe, with the MXEF EM

index rising by just 2.1% for the year to 30th June 2023. While the

relatively high exposure of EM economies to energy and raw

materials prices has been a factor, given that many have fallen

below pre-Ukraine war levels, it is the sluggish performance of

Chinese equities that has been the main contributor. Having been

slow to re-open the economy post-Covid, Chinese growth since has

been relatively weak despite central bank efforts to stimulate

activity. Important questions have also emerged on the country's

future growth trajectory as several of China's major trading

partners move to diversify supply chains in an era of growing trade

and geopolitical friction.

Although much of the initial economic dislocation brought on by

the Ukraine war has now dissipated, with supply chains gradually

being re-configured, global inflation has remained stubbornly high

with tight labour markets continuing to exert upward pressure on

wages. Despite some recent signs of a downward trend in prices, the

fact that central bank guidance remains relatively hawkish suggests

that equities could remain subdued in the coming months (bubbles

aside) as investors tap into more attractive fixed income returns.

Beyond the immediate horizon, however, the prospect of a more

accommodative monetary stance as electoral cycles beckon suggests

that, in the absence of geopolitical surprises, 2024 should offer

equity investors more opportunities for capital appreciation. Given

the relative cheapness of international equities (vs. their US

counterparts), the time for a long-awaited "catch-up" may not be

far off.

Assets and performance

In the year to 30th June 2023, CLIG's Funds under Management

(FuM) rose by 2% to US$9.4 billion and by 3% in the most recent

six-month period. Each of the two operating companies, CLIM and

KIM, saw modest net outflows over the year of US$228 million and

US$129 million respectively but these were more than offset by

positive investment performance across all strategies in absolute

terms. Relative investment performance in CLIM's EM and

Opportunistic Value (OV) strategies was ahead of the respective

benchmarks and slightly behind the benchmark in the International

(INTL) strategy. KIM continued to record excellent relative

performance in the core fixed income strategies, which represent

more than 60% of KIM's FuM, with SPACs once again providing

additional momentum.

Equity and fixed income markets have faced considerable

headwinds over the course of the last eighteen months with sharply

rising interest rates and conflict causing closed-end fund (CEF)

discounts to widen universally and prompting the need for a

relatively defensive investment posture. The fact that most

strategies have achieved positive relative performance is therefore

encouraging and, with discounts now at comparatively high levels,

the ability to capitalise on the inherent value in CEFs, in terms

of both investment performance and business development

opportunities, should improve as we approach 2024.

Results

Group statutory pre-tax profits fell by 20% to GBP18.6 million

in the year to 30th June 2023 (2022: GBP23.2 million) while

underlying pre-tax profits, which excludes amortisation and

gains/(losses) on investments fell by 19% to GBP22.7 million (2022:

GBP27.9 million). Fully diluted statutory earnings per share (EPS)

fell by 19% to 29.6p (2022: 36.4p) while underlying fully diluted

EPS also fell by 18% to 35.8p (43.7p). The Group's overall weighted

average net fee rate declined slightly over the year from 73bps to

72bps, reflecting a marginal reduction in the proportion of CLIM's

assets in the EM strategy to 61%, which is 38% of Group FuM (2022:

64% of CLIM FuM; 40% of Group FuM).

While year-end FuM rose by 2% year-on-year (YOY), as previously

noted, revenue metrics are driven by the average FuM across the

year as a whole and on this measure, FuM fell by c.12% in US dollar

terms YOY due to the more buoyant market conditions that preceded

the Ukraine war in February 2022. Partially offsetting this decline

in US dollar revenues was a c.9% fall in the average GBP/US$

exchange rate over the year to 30th June 2023 so that on

translation into sterling, net fee income was only 6% lower at

GBP54.6 million (2022: GBP58.2 million). Total overheads before

profit share, EIP, share option charge and investments

gains/(losses)* for the year to 30th June 2023 rose by 14% to

GBP22.5 million (2022: GBP19.7 million), reflecting higher business

development spending in comparison with the previous year, when

Covid-related travel constraints limited outlays on marketing

initiatives, together with ongoing investment in the Group's IT

infrastructure and inflation-related increases in payroll costs.

Although cost inflation remains a concern, it is anticipated that

the rate of growth in the Group's cost base will moderate in the

coming year.

Dividends and reporting currency

A clarification of the Group's dividend policy was included in

my interim statement to shareholders in February 2023 so I do not

propose to repeat the details in this statement. However, as

emphasised at the time, your Board believes that the use of a

dividend cover policy based on rolling five-year periods provides a

prudent template that serves to protect shareholders from the

market volatility that can affect profits of asset management

companies. The beneficial effects of this policy are illustrated

clearly in the year to 30th June 2023 when underlying fully diluted

EPS have fallen by 18%. On the basis of unchanged dividend payments

totalling 33p for the year as a whole, the cover ratio for the

single year is 1.09, whereas the rolling five-year cover ratio, at

1.24, will remain marginally ahead of the 1.2 target level.

Accordingly, your Board is recommending the payment of a final

dividend of 22p per share, to be paid on 27th October 2023 to those

shareholders on the register at 29th September 2023. This brings

total distributions for the year to 33p, the same level as the

previous year, excluding the 13.5p special dividend paid in March

2022.

Shareholders will be familiar with the fact that volatility in

the GBP/US$ exchange rate can distort the presentation of the

Group's financial performance considerably, as evidenced in the

past year with the rate fluctuating between an intraday low of

GBP1/US$1.03 in September 2022 and a June 2023 high of

GBP1/US$1.27. Variations on this scale have a magnified impact on

CLIG given that we report to shareholders in sterling while

virtually all revenues and the majority of costs arise in US

dollars. In order to present a more transparent statement of

comparative financial performance that effectively neutralises

currency fluctuations, the Board has decided to change the Group's

financial reporting currency to US dollars with effect from 1st

July 2023. However, as a UK-listed entity, dividends will continue

to be declared in sterling while shareholders will continue to be

given the option to receive distributions in US dollars as is the

case at present.

Board

Board composition in UK-listed companies forms an important

element in the regulatory oversight of corporate governance,

particularly in regard to independence and diversity, and the new

rules published by the Financial Conduct Authority (FCA) in April

2022, specifically in relation to diversity ratios, will need to be

addressed. Going forward, companies will need to demonstrate a

commitment to diversity both at Board level as well as the senior

management tier and while it is understood that a degree of leeway

will be necessary in terms of the time needed to achieve the

regulator's objectives, Boards will need to show an appropriate

direction of travel. Jane Stabile, as Chair of the Nomination

Committee, together with her Committee colleagues are engaged in

creating a succession road map designed to meet these new rules

over time and I urge shareholders to read her report on page 64 of

the full report.

Other than Barry Olliff stepping down from the Board in July

2022, no changes were made to the Board over the last financial

year. Two changes will occur in the current year, namely my

retirement in October 2023 and the recent retirement of George

Karpus. Subject to shareholder approval, Rian Dartnell will replace

me as Board Chair. These changes will also require changes to the

composition of the Board Committees, the details of which will be

notified to shareholders in due course.

As founder of Karpus Investment Management, George Karpus

decided to retire from the Board with effect from 31st July 2023,

having served as a CLIG director since the 2020 merger and, on

behalf of shareholders and my Board colleagues, I would like to pay

a special tribute to George's invaluable contribution in ensuring

the success of the merger and helping to steer the Group through

the critical post-merger process.

George's career spans a period of more than fifty years, during

which time he rose from an early induction into Wall Street through

a career in banking to build his own asset management business,

specialising in cash management and conservative balanced products

for high net worth clients. It was apparent from early discussions

between George and CLIG several years ago that he shared many of

the core values that had been developed by Barry Olliff since

CLIG's inception in the 1990s and this "cultural fit" has been a

central factor in the success of the merger on a number of

levels.

In tandem with George's achievements in building Karpus over a

35-year period, he has established his own not-for-profit

foundation to promote education and help for those in need to live

a productive life as well as supporting animal welfare causes.

While these philanthropic activities will assume increasing

importance for George in his retirement, he remains a significant

and valued shareholder of CLIG and on behalf of the Board, I would

like to thank him for his ongoing support and wish him well in his

retirement.

ESG

I reported to shareholders last year on the series of

initiatives that were being put in place to improve the Group's

track record on environmental policies and I am pleased to be able

to update shareholders on the further progress made this year in

realising those objectives. The mandated travel policy introduced

during the Covid pandemic, which prioritised the use of video

conferencing for both internal and external meetings, has become a

permanent feature across all Group offices. We have also engaged an

external consultant to enhance future reporting on environmental

risks and opportunities with the goal of net zero by 2050. This

year, we have produced a stand-alone report on the Task force for

Climate-related Financial Disclosures (TCFD) and climate risks,

explaining in more detail the Group's plans for progressive

improvements in our environmental record. Our disclosures for the

current financial year have been prepared with the assistance of

our external environmental consultant and start on page 39. By way

of example, the Rochester office has now been converted to being

primarily powered by the State-sponsored "Catch-the-Wind"

programme. Two of our four offices now have a reduced carbon

footprint, with Rochester NY and London having procured green

energy electricity contracts.

Efforts to enhance social awareness in the workplace continued

this year and all employees received two training sessions focusing

on diversity, equity and inclusion. Subjects addressed in these

sessions were "disrupting our unconscious bias" and "your words

matter about disabilities" and similar initiatives will remain an

important factor in the Group's commitment to encourage community

participation by employees. More recently, a new Pennsylvania

office has been commissioned to replace the Barn, which has been

our US home for the past 25+ years and, in decommissioning the

Barn, a third-party vendor was employed to redeploy the used office

furniture within their network of local charities.

Interaction between your Board and Group employees is an

important factor for all parties as it allows employees the

opportunity to understand better the strategic priorities under

discussion at Board level while giving Directors feedback directly

from the workplace, whether positive or negative. To that end,

Board meetings are now held in London, Rochester NY and

Pennsylvania each year to facilitate both formal and informal

discussion. In addition to these meetings, video conference

engagement sessions are held annually with all employees and the

independent Directors in an open forum that are designed to promote

two-way exchanges. In terms of working practices post-pandemic,

further refinements are being made to the hybrid WFH policy that

was introduced in 2022.

Farewell

I shall be stepping down from the CLIG Board in October after

serving as a Non-Executive Director for ten years and Chair for the

last five. While there have been major changes in the global,

political and economic landscape over that decade, it has also been

one of significant evolution at CLIG and I am proud to have been a

part of a development process which, I believe, will continue to

serve shareholders well in the coming years. Chief among these

changes was the 2020 merger with Karpus Investment Management,

which expanded significantly the Group's geographical and client

footprint in the US while enhancing profitability and helping to

reduce revenue volatility. In tandem with the merger, we have

navigated the management transition of both operating companies

from their original founders to a unified executive management

group in the midst of stresses imposed by the Covid-19

pandemic.

Subject to shareholder approval, Rian Dartnell will be appointed

as my successor in October and I am very confident that he and his

Board colleagues will continue to develop CLIG as a profitable

asset management business that delivers shareholder value while

serving the interests of both clients and employees in a prudent

fashion. Rian has been associated with CLIG over many years and

brings to the Board a wealth of investment management experience.

Together with his Board colleagues and an executive management team

led by Tom Griffith, the foundations are in place for the Group to

prosper and grow. I wish them well in their endeavours and would

like to thank our shareholders, clients, my Board colleagues and

all the CLIG employees for their support during my time with the

Group.

Before I depart, I would like to add a personal note on a

subject that has attracted widespread debate among public market

practitioners in the UK in the latter part of my time at CLIG and

this relates to corporate governance. Non-Executive Directors have

an important role to play in representing the interests of external

shareholders in public companies and the UK is leading the way in

formulating high standards of corporate governance (ESG) for small

and large companies alike. While CLIG is firmly committed to

meeting these standards, our UK listing has created a meaningful

burden in terms of human and financial resources, as evidenced by

the 150 pages that now comprise this annual report to shareholders.

The successful development of the UK's public markets needs to be

viewed in the context of competing providers of risk capital,

whether it is stock exchanges in other jurisdictions or private

equity sources. In this regard, I am concerned that both the

direction and pace of travel in UK governance policy may result in

the relative demise of London as a leading global market for

capital. To that end, I would urge regulators, investors and

related advisers to exercise due care in the future development of

governance policy to ensure that an appropriate balance is

maintained between a "one-size-fits-all" ESG regime and the

overriding need for stewards of public companies to enhance

shareholder value. Throughout my career, the UK has been a prime

mover in the development of globalised financial markets but the

challenge of retaining that position and the significant economic

benefits that go with it demand that the fabric of those markets

remains competitive.

Barry Aling

Chair

15th September 2023

CHIEF EXECUTIVE OFFICER'S STATEMENT

Glass half empty or glass half full?

In both the June 2022 Annual Report and the December 2022

Interim Report, we outlined headwinds that confronted the Group

over the preceding eighteen months. These included labour

shortages, supply chain disruptions, and the war in Ukraine which

led to steep declines in global stock and bond markets in 2022.

More recently, the impact of higher interest rates and a weakening

US commercial real estate market contributed to bank failures and

credit rating downgrades of a number of US regional banks.

Despite this economic backdrop, US stocks rose 19.6% for the

year ended 30th June 2023 as measured by the S&P 500, driven

mainly by the "magnificent-seven" technology stocks. While never

the same, there are parallels with the early 2000s, when US markets

had performed very well vs. Emerging Markets (EM) which had fallen

out of favour with US institutional clients. This is especially

true of many pension funds who are de-risking portfolios as their

funding positions improve.

Attempting to curb inflation, the US Federal Reserve has raised

rates eleven times since March 2022, and in July 2023 raised

interest rates to the highest level in 22 years, to a range of

5.25-5.5%. With the volatility and negative twelve-month returns of

3.6% and 9.7% on ten and thirty-year US Treasuries respectively,

many US consumers have chosen safety and flexibility earning 4%-5%

on money market accounts insured up to US$250,000 by the US Federal

Deposit Insurance Corporation (FDIC).

The rise in deposit rates has affected marketing efforts as

investors are wary of taking market risk, whether via equity or

bonds. This is an industry-wide issue affecting other asset

managers, regardless of whether they are publicly listed or

privately owned and the Group's share price has fared well relative

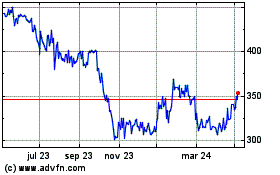

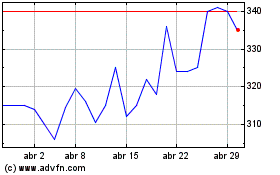

to listed peers (refer Figure 1 CLIG vs. peers and the FTSE Small

Cap Index FSMXX on page 8 of the full report). We are disappointed

that inflows have not matched outflows over the period but are

optimistic that green shoots are visible.

Do we see the glass as half empty or half full? Answering this

question is a fool's game. We view ourselves as entrepreneurial

realists seeking to capitalise on inefficiencies created during

periods of dislocation. Said another way, when times are difficult,

we seek to find the silver lining. To successfully harness these

opportunities requires conviction, patience and a great deal of

fortitude - qualities that are inherent in our Group culture:

--From the investment approach at KIM and CLIM to the overall

development of the business, our colleagues approach opportunities

with conviction.

--The Group's culture compels us to operate in team

environments, trusting in each other, and having the patience for

objectives to be realised.

--Our colleagues are experienced, and they have the internal

fortitude to remain calm and focused during market turmoil.

There are no short-cuts, and it takes persistence and hard work

from all of our colleagues to achieve success for our Clients,

Employees and Shareholders.

Silver linings

There are a number of opportunities identified across the

organisation that we expect should begin to benefit the Group over

the next financial year. These include:

CLIG opportunities

The integration of KIM is now complete. What remains is to

leverage the strengths of the Group in order to raise new FuM

across the Group. In this regard, we created a new position - Head

of Corporate Partnerships - to deepen our existing client

relationships, particularly as baby boomers transfer wealth to the

next generation, and build new partnerships with professional

organisations. This individual, who has over twenty years of

experience in the field, is also responsible for branding

opportunities, unique client experiences, and increasing the

profile for the Group.

As a result of technology improvements over the past few years,

our IT infrastructure network and phone systems have been modified

to reduce complexity and improve scalability and security while

lowering reliance on third party support and providing ongoing cost

savings.

The Group's revenue is almost entirely US dollar based whilst

its costs are incurred in US dollars, sterling and to a lesser

degree Singapore dollars. Presentation of the Group's financial

statements in sterling results in volatility in the income

statement because of sterling/US dollar exchange rate movements.

The functional currency of the Company and the presentational

currency of the Group has changed to US dollars with effect from

1st July 2023. The Board believes that this change will provide

investors and other stakeholders with greater transparency of the

Group's performance and reduced reported foreign exchange

volatility.

CLIM opportunities

Institutional client demand for alternative asset classes and

attractive discounts has provided new business opportunities in

closed-end funds (CEFs) offering listed alternatives exposure.

EM returns now lag US equities over two decades causing "EM

fatigue" resulting in fewer new institutional mandates generated in

the US. Historically wide discounts within CLIM's EM strategy, as

illustrated in Figure 2 on page 9 of the full report, provides

significant value to clients should the asset class perform well.

Similarly, CLIM's International (INTL) and Opportunistic Value (OV)

strategies have faced discount widening headwinds creating

significant value.

We capitalised on a weakening commercial office real estate

market in the US by moving CLIM's US office from a more rural

setting into the borough of West Chester, Pennsylvania. Our new

accommodations are located in a small-town environment with a

multitude of amenities within walking distance. The new location is

more desirable for our colleagues, and from a recruitment

perspective there is a university in town that should provide a

pipeline for talent.

KIM opportunities

The KIM CEF strategy provides the investment team with

flexibility to vary the percentage weighting of CEFs in client

portfolios. CEF exposure has increased significantly over the past

year, particularly in municipal bond CEFs that are at an extreme of

historical discount. Figure 3 on page 10 of the full report

reflects the overall widening of CEF discounts within various

investment strategies managed at KIM. The aforementioned municipal

debt funds are represented by the yellow-coloured line, which shows

the discounts widening over the two years since July 2021 when the

average CEF was trading at or around par.

We invested in the KIM business from a Human Resource

perspective during the year by realigning existing employees and

adding new employees, to build the platform for future growth. A

marketing support team was set up to coordinate relationships with

investment platforms and assist with onboarding clients from new

relationships. A dedicated manager of the Relationship Management

team was hired to build a more effective system of oversight and

reporting on activities. Two experienced Relationship Managers were

hired to develop new client opportunities, including those related

to generational wealth strategies.

FuM and flows

With risk-free rates increasing, exposure to riskier asset

classes are naturally being reduced by institutions. This is

especially the case with EM and INTL, which are much further up the

risk scale compared to US fixed income. In the 2022 Annual Report,

I highlighted the ten-year underperformance of EM Equity (measured

by MXEF) compared to both 1) the US Equity Market and 2) the World

ex-US Market. This underperformance continued in the 2022/2023

financial year. In this environment, asset allocators are

understandably wary to commit new capital to an asset class that

has underperformed US equities for over two full market cycles.

That said, the first half of calendar year 2023 saw a return to

normalised uplift in asset prices, with a strong 11.7% increase in

MSCI World Ex US Index (MXWOU) as a proxy for international

equities.

Figure 4: Asset class returns

Index Index Name Exposure 2H 2022 Return 1H 2023 Return 12 Month

Return

---------------------- --------------- --------------- ---------------

MXEF MSCI EM Index Emerging -2.8% 5.0% 2.1%

---------- ---------------------- --------------- --------------- --------------- ---------

MSCI World

MXWO Index Global 3.2% 15.4% 19.1%

---------- ---------------------- --------------- --------------- --------------- ---------

MSCI World

MXWOU Ex US Index International 5.7% 11.7% 18.0%

---------- ---------------------- --------------- --------------- --------------- ---------

Domestic

SPX S&P 500 Index US 2.3% 16.9% 19.6%

---------- ---------------------- --------------- --------------- --------------- ---------

Vanguard Balanced

VBINX Index ETF Balanced 0.2% 10.4% 10.6%

---------- ---------------------- --------------- --------------- --------------- ---------

Bloomberg Global-Agg

Total Return

LEGATRUU Index Global Bond -2.7% 1.4% -1.3%

---------- ---------------------- --------------- --------------- --------------- ---------

Bloomberg US

Aggregate Bond

LBUSTRUU Index US Bond -3.0% 2.1% -0.9%

---------- ---------------------- --------------- --------------- --------------- ---------

Bloomberg Muni

Bond Total Municipal

LMBITR Return Index Bond 0.5% 2.7% 3.2%

---------- ---------------------- --------------- --------------- --------------- ---------

During the year, there were net outflows at CLIM across the EM

and INTL strategies. The OV strategy saw net inflows, bolstered by

a new segregated account that funded in July 2022. In this

environment, the OV strategy allows CLIM's institutional clients to

take advantage of dislocations in specific markets and/or asset

classes via discounted CEFs.

At KIM, flows in the Institutional business were flat. On the

Retail side, ongoing outflows occurred via lost accounts to

attractive deposit rates that are FDIC-insured, individual

expenses, taxes and required minimum distributions from retirement

accounts.

The diversification offered by the KIM business has been proven

this year, as that business provides primarily exposure to US

domestic equity and fixed income markets. As mentioned earlier, the

strength of the US equity market has been significant relative to

EM.

Figure 5: CLIG - FuM by line of business (US$m)

CLIM 30 Jun 30 Jun 30 Jun 2021 30 Jun 2022 30 Jun 2023

2019 2020

US$m % US$m % US$m % % US$m % % US$m % %

of of of of of of of of

CLIM CLIM CLIM CLIG CLIM CLIG CLIM CLIG

total* total* total total total total total total

------ ------- ------ ------- ------- ------ ------ ------ ------ ------ ------ ------ ------

Emerging

Markets 4,221 78% 3,828 69% 5,393 72% 47% 3,703 64% 40% 3,580 61% 38%

------ ------- ------ ------- ------- ------ ------ ------ ------ ------ ------ ------ ------

International 729 14% 1,244 23% 1,880 25% 17% 1,812 32% 20% 1,983 34% 21%

------ ------- ------ ------- ------- ------ ------ ------ ------ ------ ------ ------ ------

Opportunistic

Value 233 4% 256 5% 231 3% 2% 193 3% 2% 244 4% 3%

------ ------- ------ ------- ------- ------ ------ ------ ------ ------ ------ ------ ------

Frontier 206 4% 175 3% 13 0% 0% 9 0% 0% 9 0% 0%

------ ------- ------ ------- ------- ------ ------ ------ ------ ------ ------ ------ ------

Other/REIT 7 0% 9 0% 13 0% 0% 74 1% 1% 88 1% 1%

------ ------- ------ ------- ------- ------ ------ ------ ------ ------ ------ ------ ------

CLIM

total 5,396 100% 5,512 100% 7,530 100% 66% 5,791 100% 63% 5,904 100% 63%

------ ------- ------ ------- ------- ------ ------ ------ ------ ------ ------ ------ ------

KIM 30 Jun 30 Jun 30 Jun 2021 30 Jun 2022 30 Jun 2023

2019 2020

--------------- --------------- ----------------------- ---------------------- ----------------------

US$m % US$m % US$m % % US$m % % US$m % %

of of of of of of of of

KIM KIM KIM CLIG KIM CLIG KIM CLIG

total* total* total total total total total total

------ ------- ------ ------- ------- ------ ------ ------ ------ ------ ------ ------ ------

Retail 2,291 67% 2,401 69% 2,804 72% 24% 2,419 70% 26% 2,441 69% 26%

Institutional 1,105 33% 1,087 31% 1,115 28% 10% 1,014 30% 11% 1,079 31% 11%

------ ------- ------ ------- ------- ------ ------ ------ ------ ------ ------ ------ ------

KIM total 3,396 100% 3,488 100% 3,919 100% 34% 3,433 100% 37% 3,520 100% 37%

------ ------- ------ ------- ------- ------ ------ ------ ------ ------ ------ ------ ------

CLIG

total 11,449 100% 9,224 100% 9,424 100%

--------------- ------ ------- ------ ------- ------- ------ ------ ------ ------ ------ ------ ------ ------

*Pre-merger

Figure 6: Net investment flows (US$000's)

CLIM FY 2020 FY 2021 FY 2022 FY 2023

---------- ---------- ----------

Emerging Markets (279,459) (275,493) (315,770) (205,924)

International 551,102 (14,145) 452,554 (50,824)

Opportunistic

Value 45,914 (102,663) 617 34,942

Frontier 16,178 (168,843) (4,748) -

Other/REIT 4,600 - 79,133 (5,709)

------------------- ---------- ---------- ---------- ----------

CLIM total 338,335 (561,144) 211,786 (227,515)

------------------- ---------- ---------- ---------- ----------

KIM FY 2020 FY 2021* FY 2022 FY 2023

------------------ ---------- ---------- ---------- ----------

Retail 26,323 (104,222) (106,444) (141,952)

Institutional (67,087) (130,911) (3,302) 12,530

------------------- ---------- ---------- ---------- ----------

KIM total (40,764) (235,133) (109,746) (129,422)

------------------- ---------- ---------- ---------- ----------

*Includes net investment flows for Retail - (24,407) and

Institutional - (20,264) pertaining to period before 1st October

2020 (pre-merger)

Group financial results

The Group's average net fee margin for the year was 72bps (2022:

73bps). The Group's net fee income over the period was GBP54.6

million as compared to GBP58.2 million in the prior year. The

decrease in net fee income was due to lower average FuM during the

year offset by a stronger US dollar against sterling, with an

average GBP/US$ rate of 1.21 in FY 2023 as compared with 1.33 in FY

2022, an increase of c.9% over last year's average rate.

The Group's business has always been relatively simple.

Pre-merger with KIM, c.49% of our expenses were in non-US dollar

currencies (sterling, Singapore dollars and Dubai dirhams) and

c.51% of our expenses were in US dollars. Post-merger with KIM,

this ratio has changed significantly and now c.65% of our expenses

are incurred in US dollars and almost all of our income is in US

dollars. This change in the composition of expenses from non-US

dollar currencies to US dollars has had the effect of magnifying

moves in the sterling/US dollar exchange rate.

As illustrated in Figure 7 below, the strengthening US dollar

had a major impact on the Group's expenses in sterling, but US

dollar employee costs and total operating expenses actually fell

over the year by 4.9% and 2.1% respectively. The move to US dollars

as the Group's reporting currency in the new financial year will

help provide shareholders with a clearer picture of our income and

expenses without the distorting impact of FX translation.

Compounding the issues mentioned above has been the fall in

average FuM from US$10.5 billion in FY 2022 to US$9.2 billion in FY

2023, leading to a c.15.4% reduction in net fee income in US dollar

terms.

Figure 7: Comparison of CLIG's operating profit GBP vs US$

Year Year Year Year

to 30th to 30th to 30th to 30th

June June Change June June Change

2023 2022 2023* 2022*

GBP GBP GBP % $ $ $ %

----------- ----------- ------------ ------- ----------- ----------- ------------- -------

Net fee

income 54,622,286 58,203,284 (3,580,998) -6.2% 65,480,095 77,439,355 (11,959,260) -15.4%

----------- ----------- ------------ ------- ----------- ----------- ------------- -------

Employee

costs 24,756,241 23,532,973 1,223,268 5.2% 29,761,921 31,306,147 (1,544,226) -4.9%

Other admin.

expenses 6,947,901 5,970,527 977,374 16.4% 8,382,266 7,928,529 453,737 5.7%

Depreciation

& amortisation 5,336,767 4,747,116 589,651 12.4% 6,434,400 6,284,244 150,156 2.4%

----------- ----------- ------------ ------- ----------- ----------- ------------- -------

Operating

expenses 37,040,909 34,250,616 2,790,293 8.1% 44,578,587 45,518,920 (940,333) -2.1%

----------- ----------- ------------ ------- ----------- ----------- ------------- -------

Operating

profit 17,581,377 23,952,668 (6,371,291) -26.6% 20,901,508 31,920,435 (11,018,927) -34.5%

----------- ----------- ------------ ------- ----------- ----------- ------------- -------

* Translated into US dollars at average GBP/US$ rates of

exchange of 1.33 in FY 2022 and 1.21 in FY 2023. Refer to Note 12

for further details .

CLIG profitability, cash and dividends

Operating profit before profit-share, EIP, share option charge

and investment gains/(losses)* of GBP32.6 million was lower by 15%

(2022: GBP38.4 million) primarily because of US dollar

strengthening and a combination of lower average FuM, higher

employee-related, travel and marketing and IT costs in FY 2023.

Profit before tax decreased to GBP18.6 million (2022: GBP23.2

million). Please refer to the Financial Review for additional

financial results.

The Board has recommended a final dividend of 22p per share

(2022: 22p), subject to approval by shareholders at the Company's

Annual General Meeting (AGM) to be held on 23rd October 2023. This

would bring the total dividend payment for the year to 33p (2022:

46.5p, including a special dividend of 13.5p). Rolling five-year

dividend cover based on underlying profits, excluding the special

dividend equates to 1.24 times (2022: 1.32 times) in line with our

target. Please refer to page 24 of the full report for the dividend

cover chart, which provides an overview of our dividend policy.

Inclusive of our regulatory and statutory capital requirements,

cash and cash equivalents were GBP22.5 million as at 30th June 2023

as compared to GBP22.7 million at 30th June 2022, in addition to

the seed and other own investments of GBP7.9 million (2022: GBP7.4

million). Our cash reserves will allow us to continue managing the

business conservatively through volatile markets while following

our dividend policy. The CLIG Board continues to review the

appropriate cash reserves needed to run the larger, but more

diversified, business and assesses variables such as the impact of

future revenue projections in case of a broad retreat in underlying

asset prices.

A review of CLIG's Share Price KPI can be found on page 25 of

the full report. Over the past five years, the average annualised

return to shareholders is 8.0%, within the 7.5%-12.5% target

range.

EIP

The Employee Incentive Plan (EIP) continues to be an integral

part of our remuneration package. Employees are able to set aside a

portion of their variable compensation, which to incentivise

employees is matched by the Company, in order to purchase shares

that vest over the following three years (five years for an

Executive Director). There is ongoing take-up by employees across

the Group, who continue to benefit from being a part of, and

owning, a public company.

Cybersecurity update

In April 2023, all CLIG employees were given a Security

Awareness Proficiency Assessment. This is similar to an assessment

taken by employees in 2021. The assessment covered multiple topics

that employees received training on, such as internet use, email

security, password management and incident reporting.

Our goal was to uncover what cybersecurity areas we should focus

our upcoming training sessions on for the rest of the calendar year

2023. We also received benchmarking against the average score of

financial industry employees.

As you can see in Figure 8 on page 13 of the full report, CLIG

employees outperformed the industry average in each category.

Relative to 2021, CLIG employees scored higher in six of the eight

categories. This is exactly what we were hoping to see as the

results show that our training approach has led to constant

improvement of our employees' information security awareness.

Environmental reporting update

In the 2022 annual report and accounts (ARA), we committed

to:

--Continue to develop our understanding of climate-related risk

at Board level and across the employee base;

--Identify and review the tools to enhance our understanding of

how climate-related risks impact our business;

--Continue to develop our path to a net zero transition; and

--Make a commitment to reach net zero by a particular date.

During the financial year, we engaged with ECO3 Partnership

Limited ("ECO3"), an environmental consulting firm based in

Edinburgh, to assist us with providing additional and improved

disclosures to shareholders, and to meet our commitments from the

2022 ARA.

On 3rd August 2023, we released a Supplemental TCFD/GHG Status

Report, produced in collaboration with ECO3. This supplemental

report includes information on Governance, Strategy, Risk

Management, and Metrics and Targets, and provides further insight

into how CLIG is responding to the risks and opportunities from

climate change.

Additional actions taken during the financial year include:

--CLIG's Audit & Risk Committee committing to net zero

emissions by 2050, at the latest;

--CLIG undergoing a review of obtaining energy for the local

offices via renewable sources.

Please see pages 39-47 of the full report for additional

information on these important initiatives, and the supplemental

report mentioned above can be found at

https://clig.com/wp-content/uploads/2023/09/2022-CLIG-TCFD-Supplemental-Report-August-2023.pdf

.

Corporate governance and stakeholders

As announced, Barry Aling will retire from the Board in October

of 2023. I will miss Barry's counsel and advice, and overall, his

"steady hand on the tiller". Barry was invaluable in guiding the

Board through the pandemic and the merger with KIM and I am certain

shareholders will join me in thanking him for his many and frequent

contributions to the Group over the years.

Pending shareholder approval at the AGM in October, Rian

Dartnell will succeed Barry as CLIG's new Chair. I look forward to

working with Rian in his new role, albeit after many years as a

CLIG Non-Executive Director, he needs no introduction to the Group

and is well-placed to lead the Board into the future. His immense

experience in the investment management industry as both a CEO and

CIO will be invaluable as we move forward.

On a day-to-day basis, the Group is led by the Group Executive

Committee (GEC), which consists of Carlos Yuste, Dan Lippincott,

Deepranjan Agrawal, Mark Dwyer, and me. The GEC regularly receives

presentations or updates from leaders or managers at CLIM and KIM.

Recent presentations have been provided by members of Investment

Management, Operations, Performance & Attribution, Relationship

Management, and Information Technology. These presentations keep

the GEC focused on, as Barry Olliff used to say, "the risk at the

coal face".

Retirement of George Karpus, KIM Founder and CLIG Director

As mentioned in the 26th May 2023 announcement, George Karpus,

Non-Executive Director and KIM Founder, has retired from the Board

of Directors effective 31st July 2023. George has had a storied

investing career and he built Karpus Investment Management into one

of the pre-eminent CEF houses. His foresight, tenacity and vision

created a lasting legacy in the CEF investment industry. The Board

and employees wish him the very best in his retirement.

CLIG outlook

Despite a challenging year, we believe the work done over the

past twelve months has laid the foundation for growth. With a

following wind, we are optimistic that the Group is well positioned

to go further together given the complementary strengths of CLIM

and KIM, attractive CEF discounts, and value in a number of asset

classes managed by the Group. I would like to thank my colleagues

for their contributions over the past year and look forward to

working with them to grow the business for our clients and

shareholders.

Tom Griffith

Chief Executive Officer

15th September 2023

INVESTMENT REVIEW - CLIM

In combination with the rich absolute value available in CEF

discounts and their persistent volatility, our portfolios are well

positioned as the headwinds of the last twelve months abate.

Risk assets gained over the twelve-month period ending 30th June

2023. Investor pessimism from mid-2022 dissipated and higher

multiples on resilient earnings pushed equity prices higher. Fixed

income lagged equity as long-term rates rose, taking their cue from

continued central bank tightening.

CLIM's core Emerging Market (EM) strategy outperformed by 0.1%

net of fees. NAV performance was favourable, particularly in H2

2022, led by Asian securities. Discounts widened meaningfully over

the period, as retail investors, typically the marginal CEF buyer,

reduced risk, preferring the safety of risk-free deposit rates

topping 5%. CLIM's International (INTL) CEF strategy underperformed

by 0.7% net of fees as net asset values underperformed and

discounts widened. Good top-down country allocation, specifically

an overweight to Japan, underweight to Canada and some modest US

exposure were positive. CLIM's smaller strategies had a mixed year.

Opportunistic Value (OV) outperformed by 2.1% net of fees,

benefitting from its flexible mandate to generate alpha across

multiple CEF sectors. The Frontier strategy underperformed due to

weak country allocation. Both REIT strategies significantly

outperformed their benchmark indices driven by good stock

selection.

Discounts have recently expanded in a highly correlated way

close to the widest in twenty years excluding the market volatility

of 2008/09. Despite these challenging conditions for our CEF

strategies a significant majority of CLIM's assets remain ahead of

benchmark and in line with peers over the five years ended June

2023 (see Figure 1 on page 14 of the full report).

Net flows at CLIM were negative over the year. There have been

several pressure points: firstly, many US-based pension fund

clients have benefitted from strong asset returns. As funding

positions improve so risk is dialled back. Secondly, government

bond yields moving closer to mid-single digit levels provide a

further incentive to de-risk. Thirdly, "EM fatigue" and

geopolitical uncertainty regarding China continues to influence

asset allocation decisions. EM returns now lag US equities over two

decades and the relative CAPE P/E ratios between the world market,

international equities (ex-US) and EM equities since 2006 are

highlighted in Figure 2 on page 15 of the full report. Predicting

market direction based on these metrics is difficult, however

history consistently shows better returns accrue to cheaper markets

in the long run.

CEF issuance was sharply lower in the twelve months ending June

2023. Approximately US$3 billion was issued globally as the IPO

market slowed considerably compared with the US$30 billion issued

in the previous twelve months. Stake building by value investors

has prompted an uptick in corporate actions as Boards attempt to

address their discounts and performance concerns. Hitherto, "hot"

CEF sectors including technology and public fixed income in the US,

listed alternatives and private equity in the UK have seen

significant discount widening, providing CLIM with new business

opportunities. The INTL, Global, OV and EM REIT strategies have

significant capacity and remain the focus for marketing.

CEF discounts are the overriding consideration in CLIM's

investment process, but our manager due diligence does include a

review of how ESG risk is managed by the underlying managers. We

undertake this work to encourage managers to improve their ESG

disclosures and also to keep our clients better informed about

their portfolios. We believe that improved transparency will result

in better management of ESG risks by CEF managers and ultimately in

better returns for our clients. The raw scores for MSCI ACWI

suggest that companies are improving their ESG performance. In

addition, based on Sustainalytics' analysis, CLIM's CEF portfolios

have slightly lower overall ESG risk than their benchmarks on

average, though this is not a targeted outcome. Our detailed annual

stewardship report is available here:

https://citlon.com/wp-content/uploads/2023/04/AnnualStewardshipReport3-23.pdf

Global equity markets have performed well considering the

headwinds: inflation and associated monetary tightening;

geopolitical strains from Taiwan to Ukraine and weaker Chinese

growth. Typically, strong equity performance would be reflected in

greater investor confidence and tighter discounts. In fact, the

opposite has occurred in the key CEF markets of UK, US and

Australia. We believe this is unlikely to persist. Figure 3 on page

15 of the full report shows that average discounts are

exceptionally wide and, importantly for our strategies, discount

volatility remains elevated. Finally, non-US equity markets which

comprise the bulk of CLIM's assets offer good value; again Figure 3

puts this into perspective. The upward move in risk-free rates

correlates with the de-rating in CEFs - this move is likely nearer

the end than the beginning. In combination with the rich absolute

value available in CEF discounts and their persistent volatility,

our portfolios are well positioned as the headwinds of the last

twelve months abate.

INVESTMENT REVIEW - KIM

Investors remain uncertain about the trajectory of inflation and

U.S. Federal Reserve policy. The U.S. Federal Reserve continues to

face a balancing act of reducing inflation toward their goal

without pushing rates so high they hamper economic growth.

Recap and outlook

-- Most central banks around the world have significantly

tightened monetary policy, highlighted by the US Federal Reserve

hiking rates from 0-0.25% to 5-5.25% while decreasing its balance

sheet by US$550 billion during the twelve months ended 30th June

2023.

-- In the US, several bank failures spooked investors, however

the US Federal Reserve took swift and decisive measures to provide

liquidity and restore confidence in the banking system.

-- US stock market has been very strong, up 19.6% as measured by

the S&P 500. However, breadth has been exceptionally narrow

with a small number of stocks contributing the bulk of the returns.

The equal weight S&P 500 index only returned 13.8% over the

past twelve months.

-- US Treasuries were volatile and negative over the past twelve

months, with the ten-year and thirty-year Treasuries returning

-3.6% and -9.7% respectively.

-- Looking ahead, major concerns include the lagged effects of

unprecedented monetary tightening, growth, inflation, and stretched

valuations in many stocks.

Performance

KIM's strategies experienced mixed performance over the past

twelve months as our fixed income, conservative balance, and

special purpose acquisition companies (pre-acquisition) (SPACs)

strategies outperformed, while equity and growth balanced lagged

indices.

Our discipline calls for us to increase our exposure to

closed-end funds (CEFs) when discounts widen. This is exactly what

we have done over the past twelve months as we have increased our

CEF exposure by over US$1.3 billion.

SPACs produced solid returns over the twelve months and continue

to offer compelling returns, however, we have reduced our exposure

in favour of Municipal CEFs as we believe they offer better

go-forward returns.

Despite solid short and long-term performance, flows were net

negative as high net worth clients withdrew funds for required

minimum distributions and institutional clients sought to

rebalance. While markets have been challenging, we feel that our

strategy has held up very well. With volatility comes opportunity

and we feel our strategy is positioned well to capitalise on market

inefficiencies.

BUSINESS DEVELOPMENT REVIEW

CLIG's FuM were US$9.4 billion (GBP7.4 billion) as at 30th June

2023. This compares with US$9.2 billion (GBP7.6 billion) as at 30th

June 2022.

Performance

Despite wider discounts for all CEF strategies, investment

performance was ahead of benchmark for the bulk of CLIM's assets

for the year ended 30th June 2023 due to strong NAV performance in

the Emerging Market (EM) strategy. The International (INTL)

strategy was slightly behind benchmark over the period while the

Opportunistic Value (OV) strategy outperformed. KIM's taxable fixed

income, conservative balanced and SPAC strategies outperformed

their market indices over the period, while equity strategies

lagged their benchmarks.

The Global EM Composite net investment returns for the rolling

one year ended 30th June 2023 were +2.5% vs. +1.7% for the MSCI EM

Index in US$.

The KIM Conservative Balanced Composite net investment returns

for the rolling one year ended 30th June 2023 were 6.65% vs. 5.03%

for the Morningstar US Fund Allocation - 30% to 50% Equity Category

in US$.

The KIM Taxable Fixed Income Composite net investment returns

for the rolling one year ended 30th June 2023 were 2.52% vs. 0.78%

for the Morningstar Average General Bond Fund Category in US$.

The International CEF Composite net investment returns for the

rolling one year ended 30th June 2023 were +11.7% vs. +12.7% for

the MSCI ACWI ex US in US$.

The Opportunistic Value Composite net investment returns for the

rolling one year ended 30th June 2023 were +9.3% vs. +7.5% for the

50/50 MSCI ACWI/Barclays Global Aggregate Bond benchmark in

US$.

The Frontier Markets Composite net investment returns for the

rolling one year ended 30th June 2023 were +7.5% vs. +12.4% for the

S&P Frontier EM 150 benchmark in US$.

Outlook

All investment strategies are open and have capacity at a time

when attractive discounts across the closed-end fund universe are

the focus of marketing efforts to consultants, institutional and

wealth management clients.

We are pleased to note that institutional clients have been

particularly interested in private assets, including listed private

equity, REITs and listed infrastructure and that our offering

continues to develop in this regard.

Investment platforms are a new area of business development for

wealth management strategies, including taxable fixed income which

has benefitted from strong performance over the period.

Opportunities to cross-sell strategies to qualified

institutional or wealth management clients are also being

explored.

FINANCIAL REVIEW

The Group income statement is presented in line with UK-adopted

International Accounting Standards on page 104 of the full report

but the financial information is reviewed by the management and the

Board in a slightly different way, as in the table provided below.

This makes it easier to understand the Group's operating results

and shows the profits which is used to calculate Group's

profit-share provision.

Consolidated income for financial years

ended 30th June

2023 2022

GBP'000 GBP'000

-------------------------------------------- --------- ---------

Gross fee income 57,326 61,294

Commissions (1,522) (1,599)

Custody fees (1,182) (1,492)

-------------------------------------------- --------- ---------

Net fee income 54,622 58,203

Interest 444 (121)

-------------------------------------------- --------- ---------

Total net income 55,066 58,082

-------------------------------------------- --------- ---------

Employee costs (14,809) (13,229)

Other administrative expenses (6,948) (5,781)

Depreciation and amortisation (696) (696)

-------------------------------------------- --------- ---------

Total overheads (22,453) (19,706)

-------------------------------------------- --------- ---------

Profit before bonus/EIP - operating profit 32,613 38,376

Profit-share (8,656) (9,162)

EIP (1,261) (1,298)

Share option charge (30) (34)

Investment gain/(loss) 573 (659)

-------------------------------------------- --------- ---------

Pre-tax profit before amortisation of

intangibles acquired on acquisition 23,239 27,223

Amortisation of intangibles (4,641) (4,051)

-------------------------------------------- --------- ---------

Pre-tax profit 18,598 23,172

Tax (3,859) (5,081)

-------------------------------------------- --------- ---------

Post-tax profit 14,739 18,091

-------------------------------------------- --------- ---------

FuM

FuM at 30th June 2023 were US$9.4 billion compared with US$9.2

billion at the end of the prior financial year. The small increase

was due to a combination of investment flows, market movements and

performance. Refer to Figure 5 FuM by line of business table within

the CEO statement for more detail. However, average FuM for the

year decreased by 12% from US$10.5 billion in FY 2022 to US$9.2

billion in FY 2023.

Revenue

The Group's gross revenue comprises of management fees charged

as a percentage of FuM. The Group's gross revenue decreased YoY by

7% to GBP57.3 million (2022: GBP61.3 million). The decrease in

revenue is primarily due to lower average FuM during the year

offset by a stronger US dollar against sterling, with an average

GBP/US$ rate of 1.21 in FY 2023 as compared with 1.33 in FY 2022,

an increase of c.9% over last year's average rate.

Commissions payable of GBP1.5 million (2022: GBP1.6 million)

relate to fees due to US registered investment advisers for the

introduction of wealth management clients. The marginal decrease is

due to slightly lower activity in FY 2023.

The Group's net fee income, after custody charges of GBP1.2

million (2022: GBP1.5 million), is GBP54.6 million (2022: GBP58.2

million), a reduction of c.6% as compared to last year. The Group's

average net fee margin for FY 2023 was 72bps as compared to 73bps

for FY 2022.

Net interest income is made up of interest earned on bank

deposits and short-term investments in treasury money market

instruments offset by interest paid on lease obligations. Refer to

page 114 of the full report for our lease accounting policy and

page 117 of the full report for details of net interest earned.

Costs

Total overheads before profit share, EIP, share option charge

and investments gains/(losses) for FY 2023 totalling GBP22.5

million (2022: GBP19.7 million) were 14% higher than FY 2022, out

of which c.6% was due to a stronger US dollar during the year. The

US dollar strengthened by an average of 9% during the year as

compared to sterling and c.65% of the Group's overheads are

incurred in US dollars.

The Group's cost/income ratio, arrived at by comparing total

overheads before profit share, EIP, share option charge and

investments gains/(losses) with net fee income, was 41% in FY 2023

(2022: 34%).

The largest component of overheads continues to be

employee-related at GBP14.8 million (2022: GBP13.2 million), an

increase of c.12% over last year, out of which c.6% is due to the

impact of a stronger average US dollar during the year and salary

and related pension cost increases with effect from 1st July 2022.

Additionally, employee-related costs increased during the year due

to the full year cost of replacing relationship managers and

assistants, primarily due to retirements, for the purpose of

transitioning client accounts and the full year impact of restoring

employee health care benefits at KIM.

Other administrative expenses increased by c.20% to GBP6.9

million (2022: GBP5.8 million), out of which c.6% was due to the

impact of a stronger average US dollar during the year and the

impact of additional spend on travel and marketing. FY 2023 was the

first full year post-pandemic after two years in which only limited

travel was possible due to Covid restrictions. Board travel to

attend meetings and employee engagement sessions as well as

employee travel for client meetings, entertainment and briefings

resumed during the year.

Other administrative expenses were also impacted by additional

IT spend during the year, mainly on infrastructure and network

consulting, which will provide additional protection from a

cybersecurity perspective, as well as provide opportunities for

future savings after implementation across all offices. Additional

expenditure increases are from development expenses on improving

existing systems, upgrading the core Microsoft applications to the

Office 365 SaaS solution, and cost increases by vendors.

Total net fee income less overheads resulted in a profit before

profit-share/EIP/share options charge and investment gain/(losses)

of GBP32.6 million (2022: GBP38.4 million).

The total variable profit-share for FY 2023 decreased by 5% to

GBP8.7 million as compared with GBP9.2 million in FY 2022 as a

result of lower operating profit for the year.

The Group's Employee Incentive Plan (EIP) charge for FY 2023

amounted to GBP1.3 million (FY 2022: GBP1.3 million).

Investment gains/(losses)

Gains of GBP0.6 million (2022: loss of GBP0.7 million) relate to

the realised and unrealised gains/(losses) on the Group's seed

investments and other investments in Special Purpose Acquisition

Companies (SPACs).

Amortisation of intangibles

Intangible assets relating to direct customer relationships,

distribution channels and KIM's trade name recognised on the merger

with KIM are being amortised over seven to fifteen years (refer to

note 1.6 of the financial statements) and have resulted in an

amortisation charge of GBP4.6 million for the year (2022: GBP4.1

million). Deferred tax liability on these intangibles as at 30th

June 2023 amounted to GBP7.2 million (2022: GBP8.7 million) based

on the relevant tax rate, which will unwind over the useful

economic life of the associated assets. Goodwill amounting to

GBP69.7 million was also initially recognised on the completion of

the merger. Foreign currency translation differences on the closing

balances of intangibles have been recognised in other comprehensive

income. Refer to note 7 of the financial statements for more

details.

Taxation

The pre-tax profit of GBP18.6 million (2022: GBP23.2 million),

after a corporation tax charge of GBP3.9 million in FY 2023 (2022:

GBP5.1 million), at an effective rate of 21% (2022: 22%), resulted

in a post-tax profit of GBP14.7 million (2022: GBP18.1 million),

which is all attributable to the equity shareholders of the

Company.

Group statement of financial position

The Group's financial position continues to be strong and

liquid, with cash resources of GBP22.5 million as at 30th June 2023

as compared with GBP22.7 million as at 30th June 2022. As at 30th

June 2023, c.52% of the Group's shareholders are based in North

America. Although the Group continues to declare dividends in

sterling, we have provided the option for shareholders to receive

dividends either in sterling or US dollars, at a pre-determined

exchange rate. Further, c.66% of Group's total expenses are

incurred in non-sterling currencies. In order to pay the

anticipated US dollar dividends and non-sterling expenses, c.58% of

the Group's cash resources are held in US dollars as at 30th June

2023.

The Group had invested US$5 million (GBP3.9 million) in seeding

its two REIT funds at the start of January 2019. By the end of June

2023, these investments were valued at GBP3.8 million (2022: GBP3.8

million), with the small unrealised gain (2022: loss) taken to the

income statement.

The Group had also invested US$2.5 million (GBP1.9 million) in

seeding the Global Equity CEF in December 2021 and US$2.5 million

(GBP1.9 million) in SPACs in March 2022. By the end of June 2023,

these investments were valued at GBP4.1 million (2022: GBP3.6

million), with the realised gain of GBP0.3 million and unrealised

gain of GBP0.2 million (2022: unrealised loss of GBP0.2 million)

taken to the income statement.

The International REIT and Global Equity CEF funds are assessed

to be under the Group's control and are thus consolidated using

accounts drawn up as of 30th June 2023. There were no third party

investors, collectively known as the non-controlling interest (NCI)

in these funds as at 30th June 2023 (2022: nil).

The Group's right-of-use assets (net of depreciation) amounted

to GBP2.0 million as at 30th June 2023 as compared with GBP2.4

million as at 30th June 2022. There were no additions to the

right-of-use assets during the year other than the impact of

currency translations.

The Employee Benefit Trust (EBT) purchased 622,746 shares (2022:

552,730 shares) at a cost of GBP2.6 million (2022: GBP2.7 million)

in preparation for the annual EIP awards due at the end of October

2023.

The EIP has had a consistently high level of participation each

year since inception (>60% of Group employees), with the first

tranche of awards vesting in October 2018. Only 26.2% (2022: 23.5%)

of the shares vesting during the year were sold in order to help

cover the employees' resulting tax liabilities, leading to a very

healthy 73.8% (2022: 76.5%) share retention within the Group.

In addition, Directors and employees exercised 23,350 (2022:

92,000) options over shares held by the EBT, raising GBP0.1 million

(2022: GBP0.3 million) which was used to pay down part of the loan

to the EBT.

Dividends paid during the year totalled GBP16.1 million (2022:

GBP21.5 million). The total dividend of 33p per share comprised:

the 22p per share final dividend for 2021/22 and the 11p per share

interim dividend for the current year (2022: 22p per share final

for 2020/21, 11p per share interim and a special dividend of 13.5p

per share). The Group's dividend policy is set out on page 24 of

the full report.

The Group is well capitalised and its regulated entities

complied at all times with their local regulatory capital

requirements. In the UK, the Group's principal operating

subsidiary, CLIM, is regulated by the FCA. As required under the

Capital Requirements Directive, the underlying risk management

controls and capital position are disclosed on CLIM's website

www.citlon.com.

Currency exposure

The Group's revenue is almost entirely US dollar based whilst

its costs are incurred in US dollars, sterling and to a lesser

degree Singapore dollars. The Group's currency exposure also

relates to its subsidiaries' non-sterling assets and liabilities,

which are again to a great extent in US dollars. For the UK

incorporated entities, the exchange rate differences arising on

their translation into sterling for reporting purposes each month

is recognised in the income statement. In order to minimise the

foreign exchange impact, the Group monitors its net currency

position and offsets it by forward sales of US dollars for

sterling. At 30th June 2023, these forward sales totalled US$24.8

million, with a weighted average exchange rate of US$1.26 to GBP1

(2022: US$24.5 million at a weighted average rate of US$1.29 to

GBP1).

The exchange rate differences arising from translating

functional currency to presentation currency for KIM are recognised

in the Group's other comprehensive income.

Functional and reporting currency change

The functional currency of the Company and the presentational

currency of the Group changed to US dollars with effect from 1st

July 2023. The Board believes that this change will provide

investors and other stakeholders with greater transparency of the

Group's performance and reduced foreign exchange volatility.

There will be no change in the Group's dividend policy, and

dividends will continue to be declared in sterling with an option

for shareholders based in the US to elect to receive dividends in

US$.

Following the change in the Group's presentational currency with

effect from 1st July 2023, the Group's interim results for the

six-month period ended 31st December 2023, and all subsequent

financial information, will be prepared using US dollars as the

presentational currency. Comparative information will also be

provided in US dollars as required by the relevant Accounting

Standards. Refer to note 12 for further information.

Viability statement

In accordance with the provisions of the UK Corporate Governance

Code, the Directors have assessed the viability of the Group over a

three-year period, taking into account the Group's current position

and prospects, Internal Capital Adequacy and Risk Assessment

(ICARA) and the potential impact of principal risks and how they

are managed as detailed in the risk management report on pages 30

to 31 of the full report.

Period of assessment

While the Directors have no reason to believe that the Group

will not be viable over a longer period, given the uncertainties

still associated with the global economic and political factors and

their potential impact on financial markets, any longer time

horizon assessments are subject to more uncertainty due to external

factors.

Taking into account the recommendations of the Financial

Reporting Council in their 2021 thematic review publication, the

Board has therefore determined that a three-year period to 30th

June 2026 constitutes an appropriate and prudent timeframe for its

viability assessment. This three-year view is also more aligned to

the Group's detailed stress testing.

Assessment of viability

As part of its viability statement, the Board has conducted a

robust assessment of the principal risks facing the Group,

including those that would threaten its business model, future

performance, solvency or liquidity. This assessment includes

continuous monitoring of both internal and external environments to

identify new and emerging risks, which in turn are analysed to

determine how they can best be mitigated and managed.

The primary risk is the potential for loss of FuM as a result of

poor investment performance, client redemptions, breach of mandate

guidelines or market volatility. The Directors review the principal

risks regularly and consider the options available to the Group to

mitigate these risks so as to ensure the ongoing viability of the

Group is sustained.

The ICARA is reviewed by the Board and incorporates stress

testing based on loss of revenue on the Group's financial position

over a three-year period. The Group has performed additional stress

tests using several different scenario levels, over a three-year

period which are significantly more severe than our acceptable risk

appetite, which include:

--a significant fall in FuM;

--a significant fall in net fee margin; and

--combined stress (significant falls both in FuM and net fee

margin).

Having reviewed the results of the stress tests, the Directors

have concluded that the Group would have sufficient resources in

the stressed scenarios and that the Group's ongoing viability would

be sustained. The stress scenario assumptions would be reassessed

if necessary over the longer term. An example of a mitigating

action in such scenarios would be a reduction in costs along with a

reduction in dividend.

Based on the results of this analysis, the Board confirms it has

a reasonable expectation that the Company and the Group will be

able to continue in operation and meet their liabilities as they

fall due over the next three years.

On that basis, the Directors also considered it appropriate to

prepare the financial statements on the going concern basis as set

out on page 94 of the full report.

Alternative Performance Measures

The Directors use the following Alternative Performance Measures

(APMs) to evaluate the performance of the Group as a whole:

Underlying profit before tax - Profit before tax, adjusted for

gain/(loss) on investments and amortisation of acquired

intangibles. This provides a measure of the profitability of the

Group for management's decision-making.

Underlying earnings per share - Underlying profit before tax,

adjusted for tax as per income statement and tax effect of

adjustments, divided by the weighted average number of shares in

issue as at the period end. Refer to note 6 in the financial

statements for reconciliation.

Alternative Performance Measures

Underlying profit and profit Jun 23 Jun 22

before tax

-------------------------------------