TIDMCMH

RNS Number : 4021F

Chamberlin PLC

04 November 2022

4 November 2022

CHAMBERLIN plc

("Chamberlin", the "Company" or the "Group")

FINAL RESULTS

for the year ended 31 May 2022

Chamberlin plc (AIM: CMH.L), the specialist castings and

engineering group, is pleased to announce its final results for the

year ended 31 May 2022:

Key Points

Financial

-- FY 2022 Group operational performance significantly improved

compared to the prior period, delivering a 79% increase in adjusted

EBITDA and a full year profit after tax for the first time in five

years

-- Revenue of GBP16.8m (14 months to 31 May 2021: GBP26.4m) was

26% lower than prior year on a pro rata basis reflecting the loss

of BorgWarner Turbo Systems Worldwide ("BorgWarner") contracts in

2021 and headwinds in the automotive sector. Encouragingly,

revenues at Russell Ductile Castings ("RDC") and Petrel increased

by 20% and 21% respectively on a pro rata basis

-- Significant reduction in underlying operating loss to GBP0.7m

(14 months to 31 May 2021: GBP2.9m loss) driven by improvements

across all divisions, but most significantly, by record profits at

RDC and Petrel

-- Underlying loss before taxation reduced to GBP1.0m (14 months

to 31 May 2021: GBP3.2m)

-- Statutory loss before tax of GBP0.5m (14 months to 31 May

2021: GBP10.4m) significantly reduced from 2021 which included

GBP7.2m of non-underlying costs and impairments

-- Profit after tax of GBP0.1m (14 months to 31 May 2021:

GBP9.6m loss) demonstrates the significant progress made in

2022

-- Underlying diluted loss per share of (0.5)p (14 months to 31

May 2021: (13.7)p loss per share)

-- Total diluted earnings per share of 0.1p (14 months to 31 May

2021: (55.1)p loss per share)

1. Underlying figures are stated before non-underlying costs

(restructuring costs, impairment, onerous leases and share based

payment costs) together with the associated tax impact.

2. Adjusted EBITDA defined as operating profit before interest,

taxation, depreciation, amortisation and non-underlying items

Operational

-- Foundry revenues fell by 32% on a pro rata basis to GBP13.6m

(14 months to 31 May 2021: GBP23.3m) reflecting the loss of

BorgWarner revenue at Chamberlin & Hill Castings ("CHC")

partially offset by a 20% increase at RDC

-- Foundry operating loss reduced to GBP0.5m (14 months to 31

May 2021: GBP1.9m) driven by lower losses at CHC from cost

reductions and a record level of profitability at RDC

-- Engineering revenues of GBP3.2m increased by 21% on a pro

rata basis (14 months to 31 May 2021: GBP3.1m) as the business made

substantial progress in recovering from COVID-19 impacts in 2021.

Operating performance continued to go from strength to strength,

with the business delivering a record operating profit of GBP0.5m

(14 months to 31 May 2021: GBP0.2m) by improving margins and

tightly controlling costs

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the UK version of the EU Market Abuse Regulation (2014/596) which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended and supplemented from time to time.

Chamberlin plc T: 01922 707100

Kevin Price, Chief Executive

Alan Tomlinson, Finance Director

Cenkos Securities plc T: 020 7397 8900

(Nominated Adviser and Joint Broker)

Katy Birkin

Stephen Keys

George Lawson

Peterhouse Capital Limited T: 020 7469 0930

(Joint Broker)

Lucy Williams

Duncan Vasey

Chairman's Statement

The difficulties that Chamberlin faced in the previous financial

period have been well documented but I am pleased to report that

these difficulties are now largely behind us. This financial year

has seen the Group execute its restructuring plan to significantly

reduce its cost base following the loss of the BorgWarner work in

2021 and effectively manage a rapidly changing economic landscape

that has seen unprecedented cost and supply chain pressures.

The Group strengthened the balance sheet through a GBP1.6m

fundraise in February 2022 and completed a sale and leaseback of

the property owned by RDC in May 2022. These actions have

contributed to the Group returning to a positive net asset position

of GBP0.4m at the end of the financial year compared to a GBP2.6m

net liability position in 2021.

In addition, the Group launched two new e-commerce brands in

Iron Foundry Weights ("IFW") and Emba cookware and developed and

pursued a new, ambitious strategic direction to enhance shareholder

value over the medium to long term.

The journey to a full recovery in the operational performance

and financial standing of the Group has begun extremely well and

the financial results for 2022 are evidence of the progress made.

All of the operating divisions have made substantial improvements

to their performance compared to the prior financial period,

although progress at CHC has been slower than anticipated. These

operational improvements have enabled the Group to deliver a profit

after tax of GBP0.1m, a significant turnaround from the GBP9.6m

loss made in 2021.This is the first time in over five years that

Chamberlin has reported a profit after tax to shareholders and is

the first step towards our future growth ambitions.

The Board and Staff

The Board have worked tirelessly through these challenging times

to return the Group to a stable financial position and I have been

pleased with the seamless transition made by Kevin Price, Alan

Tomlinson and Trevor Brown to their new roles on the Board.

The success of Chamberlin in the future will not only be

determined by the leadership and strategic vision provided by the

Board but as importantly, will be shaped by the outstanding

professionalism, dedication and expertise provided by our loyal

workforce. Our employees have a passion for innovation and a keen

focus on delivering excellence to all our customers, which enhance

Chamberlin's reputation and contribute to making the Group a leader

in many of its markets. I would like to place on record the Board's

thanks to all our employees for their considerable efforts during

the past year.

Outlook

The Group is well positioned to continue its recovery and

expects to return to a more sustainable level of profitability,

having taken the appropriate steps to reduce its cost base and

improve performance at CHC, and to develop and invest in new growth

strategies for each business.

The overall economic outlook for global markets remains

uncertain, but the Board is pleased to report that all three

operating divisions have made a positive start to the new financial

year. At the present time, demand across all of the Group's

businesses remains buoyant driven in particular at CHC and RDC by

an increasing trend towards UK on-shore supply. This has

contributed to higher than expected levels of orders for Q1 FY 2023

and strong ongoing order books.

The Board continues to focus on opportunities to provide the

Group with adequate resources to meet the requirements of the

Group's growth strategy and insulate the Group from potential

adverse macro-economic risks.

Keith Butler-Wheelhouse

Chairman

Chief Executive's Review

I am delighted to report that Chamberlin has returned to

profitability for the first time in over five years. This

performance is even more pleasing given the challenges faced by the

Group over the last 12 months. During this period, the Board and

the senior management team have worked together to:

-- Substantially reduce the cost base at Chamberlin and Hill

Castings in the wake of the loss of the BorgWarner contracts at the

end of the last financial period

-- Mitigate the unprecedented level of raw material price

increases to maintain margins at the required level

-- Raise GBP1.6m from shareholders to strengthen the balance

sheet and to implement the new growth strategy and investment

plans

-- Generate GBP1.25m from the sale and leaseback of the property owned by RDC, providing

further funds for investment in its capacity expansion plans and

to reduce the pension deficit by GBP0.6m

-- Launch new products at Chamberlin and Hill Castings through

its IFW fitness and Emba cookware brands

-- Navigate an uneven level of demand from our automotive customers

-- Refinance historic debts relating to machine shop plant and equipment

The Group has been able to successfully navigate its way through

these issues to deliver a significant improvement in financial

performance and to place the Group on a solid financial base from

which our strategic plans for growth can be delivered.

Group revenue of GBP16.8m for the year ended 31 May 2022 (14

months to 31 May 2021: GBP26.4m) was 26% lower than the prior

period on a pro rata basis, largely reflecting the loss of revenue

at Chamberlin and Hill Castings from the cancellation of contracts

by BorgWarner in 2021. However, revenue at RDC and Petrel continued

the strong upward trajectory from 2021, leading to increases of 20%

and 21% respectively on a pro rata basis. The 20% increase in

revenue at RDC was in addition to an 18% pro rata increase in 2021

and continues to be driven by reduced competition in the UK foundry

industry and the trend to re-shoring to the UK from overseas.

Petrel's revenue growth in 2022 has been primarily driven by a

recovery in export markets following a reduction in the immediate

aftermath of Brexit, with export revenues now representing 31% of

Petrel's total revenue (2021: 10%).

The underlying operating loss reduced by 76% to GBP0.7m (2021:

GBP2.9m), with the underlying loss before interest, tax,

depreciation and amortisation reducing to GBP0.4m (2021: GBP2.1m

loss). This improvement in financial operating performance compared

to 2021 came from all three sites, although the pace of the

improvement in results at Chamberlin and Hill Castings was slower

than anticipated due to the uneven recovery in automotive volumes.

RDC improved its operating profit significantly through increased

revenues and gross margin improvement whilst Petrel's performance

benefitted from higher revenues and gross margin together with the

full year benefit of overhead cost reductions implemented in

2021.

After net interest costs of GBP0.3m (2021: GBP0.3m), the Group

made an underlying loss before tax of GBP1.0m (2021: GBP3.2m loss).

With non-underlying items amounting to a GBP0.5m credit in 2022

compared to the GBP7.2m charge taken in 2021, the statutory loss

before tax of GBP0.5m was 95% lower than the GBP10.4m loss incurred

in 2021. The tax credit in 2022 amounted to GBP0.6m (2021: GBP0.8m)

and reflected research and development tax credits receivable from

the prior period of GBP0.3m and deferred tax of GBP0.3m recognised

on trading losses in respect of RDC in the light of their continued

improved financial performance. On an after tax basis, the Group

delivered a modest but pleasing GBP0.1m profit (2021: GBP9.6m

loss), a significant turnaround compared to the prior period and

giving the Group a basis for delivering future sustainable

profitable growth.

In conjunction with returning the Group to profitability, there

has been substantial progress made in the key objective of

strengthening the balance sheet after the significant loss incurred

in 2021. With this in mind, the Group successfully raised GBP1.6m

net of expenses from shareholders in February 2022 to provide funds

for investment in new growth strategies and provide working capital

during the implementation. In addition, as part of the Group's

initiative to improve financial stability, a sale and leaseback

transaction was completed in May 2022 on the property owned by RDC

generating gross proceeds of GBP1.25m. The proceeds were used to

reduce the pension scheme deficit by GBP0.6m and to provide the

funds for further investment in the business. These actions have

contributed to the improvement in the Group's financial position,

with the balance sheet returning to a positive net asset position

of GBP0.4m compared to a GBP2.6m net liabilities position in 2021.

Although net debt increased at 31 May 2022 to GBP5.0m (31 May 2021:

GBP1.8m), this was largely due to the payment of redundancy costs

provided for in 2021 of GBP1.3m, the unwind of working capital

associated with the loss of the BorgWarner contracts in 2021 and an

increase in lease liabilities of GBP1.0m arising from the sale and

leaseback of the property at RDC.

During this financial year, the Group embarked upon its strategy

to deliver sustainable profitable growth over the medium to long

term by diversifying away from reliance on the automotive sector,

investing in plant and machinery to increase capacity and investing

in new products in markets with strong growth characteristics and

opportunities. The progress made in each of our three businesses in

the context of the above strategy is discussed below:

Chamberlin & Hill Castings Ltd - Casting Facility and

Machining Facility ("CHC")

The Board has continued to implement the strategy to reduce sole

reliance on the automotive industry, diversify the Group's customer

base and pursue more attractive markets.

In relation to the Group's automotive products, well publicised

global economic conditions such as inflation, escalating raw

material costs, supply chain shortages and a slowdown in the

automotive industry remain challenges to trading conditions. As a

result, management continue to reduce costs, improve efficiencies,

and optimise pricing at CHC in order to improve margins and restore

sustainable profitability to the Group. Unfortunately, these

actions are taking longer to implement than anticipated and the

division continues to operate at a loss and is not yet cash

generative, albeit the losses are reducing on a monthly basis.

However, longer term demand for the Group's automotive products is

expected to improve in the second half of FY 2023 and the Group has

been successful in winning new contracts in the niche supercar

market and the commercial vehicle sector.

The Group, as the sole UK based foundry manufacturer and

distributor of UK made cast iron cookware, launched its Emba range

at the end of November 2021, which continues to be very well

received by consumers. The Group has utilised targeted marketing to

businesses, subsequently entering into a number of small

distribution deals, with traditional and digital retailers, for the

Emba products, as well as focusing on more penetrative marketing

strategies for sales direct to consumers including advertising

through social media platforms, such as Instagram.

The Board was very encouraged by the rapid increase in sales,

new leads and social media followers in the final quarter of FY

2022. With the in-house capability to design, manufacture and

distribute new products into a global marketplace, the Board firmly

believe that further development and investment in Emba cookware

will position the brand to be a material contributor to growth over

the coming months and years.

The IFW brand was launched in May 2021 selling direct to the

consumer, where the Group can offer high-quality, UK made products

that have a significantly reduced carbon footprint compared to

products imported from overseas. Demand in the fitness equipment

market has reduced considerably in the final quarter of the

financial year and the Board are continuing to assess the most cost

effective options for securing market share. However, Chamberlin is

well positioned to take advantage of market opportunities as they

arise through our unique ability to design, manufacture and machine

fitness products on a high-volume or bespoke basis.

Driven by the exciting progress of the consumer products brands

and the feedback from consumers, Chamberlin has designed a number

of new premium products to support the existing Emba and IFW

offerings and plans to launch these products in 2023. Chamberlin

has recently installed a new shotblast system at CHC to support the

growth plans and ensure that it provides premium quality,

competitively priced products.

Russell Ductile Castings Ltd ("RDC")

The Company's Scunthorpe foundry continues to operate at near

full capacity in response to both a growing customer demand and

pipeline of opportunities, with the current order book at

sufficient levels to ensure already that around 70% of the

full-year FY 2023 management sales expectations are met. The

substantial opportunities for RDC arise from a combination of

reduced competition in the UK as competitor foundry numbers

continue to dwindle and the growing trend of re-shoring production

back to the UK from overseas foundries. With planning permission

now secured, the investment programme to expand both the production

capacity by up to 40% and the types of product that can be

manufactured at RDC's facilities to exploit new growth

opportunities, including in the offshore and green energy

generation markets, is expected to be completed towards the end of

November 2022.

Petrel Ltd

Petrel, Chamberlin's specialist lighting business, delivered a

record operating profit during FY 2022 and continues to exceed the

Board's expectations significantly. Petrel continues to benefit

from a strong order book, reflecting recovery from the lows brought

about by both COVID-19 and Brexit. Petrel is developing a pipeline

of new and innovative products that can be brought to market

swiftly and potentially move Petrel into a market leading position.

Management is also investigating the provision of additional

services (such as warranty, inspection and maintenance) to its

customers that have a significant installed base of Petrel

products. In addition, management continue to review and update

Petrel's existing product range through in-house design and

manufacture of new products as new technology evolves.

Outlook

The Board's strategy has already begun both to shape the future

direction of the business and to be reflected in the financial

performance of the Group, having generated a modest profit after

tax in 2022. We have made good progress on implementing the

strategy in a relatively short period of time and have improved the

financial stability of the Group to provide the platform to

accelerate our plans. There remains work to do in order to achieve

our growth ambitions and the Board are mindful of the resources

that will be required. Consequently, the Board continues to

evaluate the use of its property assets with the objective of

strengthening the balance sheet and ensuring that the Group has

adequate resources to deliver on its growth strategy. Overall, the

Board remain confident that the Group is heading in the right

direction, with a strategic plan that will deliver shareholder

value in the future.

Kevin Price

Chief Executive

Finance Review

Overview

Revenue for the year ended 31 May 2022 of GBP16.8m (14 months

ended 31 May 2021: GBP26.4m) represents a 26% reduction on a pro

rata basis compared to the prior period, largely due to the effect

of the cancellation of all contracts by BorgWarner in 2021.

Gross profit margin increased to 10.7% from 8.3% in 2021

reflecting the recovery in performance of the Foundry division,

which reduced its operating loss to GBP0.5m from a GBP1.9m loss in

the previous period, and a substantial increase in operating margin

at Petrel in the Engineering division.

Underlying operating loss before tax reduced to GBP0.7m (14

months ended 31 May 2021: GBP2.9m) due to the improved operating

results noted above together with a pro rata 22% reduction in Head

Office costs.

Financing costs were maintained at GBP0.3m (14 months ended 31

May 2021: GBP0.3m) with a reduction in the interest charge

associated with the pension scheme offset by increased interest on

higher average net debt.

As a result of the above, the underlying loss before tax

amounted to GBP1.0m (14 months ended 31 May 2021: GBP3.2m

loss).

The statutory loss before tax reduced dramatically to GBP0.5m

(14 months ended 31 May 2021: GBP10.4m) largely reflecting GBP7.2m

of non-underlying items in 2021 that were not repeated in the

current year.

Tax

The tax credit in the year of GBP0.6m (14 months ended 31 May

2021: GBP0.8m) includes the recognition of a deferred tax asset on

trading losses in RDC reflecting the confidence the Group has in

the future profitability of this business.

Diluted earnings per share

Diluted earnings per share of 0.1p (14 months ended 31 May 2021:

55.1p loss per share) reflects the return to profitability of the

Group for the first time in over five years and a significant

turnaround compared to the prior period.

Cash generation and financing

Operating cash outflow of GBP4.0m (14 months ended 31 May 2021:

inflow of GBP0.3m) includes GBP1.3m of cash payments relating to

restructuring the business in 2021, GBP0.9m paid to the Group's

defined benefit pension scheme and increased working capital.

Cash spent on property, plant and equipment and capitalised

software and development costs in the year ended 31 May 2022 was

GBP0.5m (14 months ended 31 May 2021: GBP0.2m).

New equity of GBP1.6m was raised in February 2022 following a

fundraise and was net of transaction costs of GBP0.2m.

Lease payments of GBP0.5m (14 months ended 31 May 2021: GBP0.9m)

primarily relate to assets at the Group's machining facility and

were lower than the prior period due to a payment holiday agreed

with HSBC. These asset leases were subsequently refinanced with

HSBC in April 2022 over a 42 month term ending in September

2025.

Net debt

Net debt at 31 May 2022 increased by GBP3.2m to GBP5.0m (31 May

2021: GBP1.8m) reflecting the operating cash outflow described

above and an increase in lease liabilities of GBP1.0m relating to

the sale and leaseback of the property owned by RDC partially

offset by the GBP1.6m fundraise in February 2022. The Group debt

facility has two elements: a GBP3.5m invoice discounting facility

limited to 90% of outstanding invoice value (of which GBP2.3m was

drawn at the year end) and lease liabilities of GBP2.7m.

Foreign exchange

It is the Group's policy to minimise risk arising from exchange

rate movements affecting sales and purchases by economically

hedging or netting currency exposures at the time of commitment, or

when there is a high probability of future commitment, using

forward exchange contracts. A proportion of forecast exposures are

hedged depending on the level of confidence and hedging is topped

up following regular reviews. On this basis up to 90% of the

Group's annual exposures are likely to be hedged at any point in

time and the Group's net transactional exposure to different

currencies varies from time to time.

During the year ended 31 May 2022, the average exchange rate

used to translate into GBP Sterling was EUR1.18 (14 months ended 31

May 2021: EUR1.13).

Pension

The Group has one defined benefit pension scheme. It is closed

to future accrual, with the Group operating a defined contribution

pension scheme for its current employees. The defined benefit

pension scheme moved from a liability position of GBP1.2m at 31 May

2021 to a GBP0.1m surplus at 31 May 2022, as reduced liabilities

arising from an increase in bond yields and Company contributions

of GBP0.9m more than offset a reduction in the market value of

scheme assets.

The 31 March 2019 triennial valuation established that employer

contributions are GBP0.30m for 2021, GBP0.33m for 2022 and GBP0.36m

for 2023. The next triennial valuation as at 31 March 2022 is

currently in progress.

Administration costs of the defined benefit pension scheme were

GBP0.2m in the year ended 31 May 2022 (14 months ended 31 May 2021:

GBP0.2m) and are shown in other operating expenses. The Group cash

contribution during the year ended 31 May 2022 was GBP0.9m (14

months ended 31 May 2021: GBP0.4m), which included an additional

GBP0.6m payment following completion of the sale and leaseback of a

property over which the pension scheme had a charge.

Audit Opinion

The auditors have reported on the accounts for the year ended 31

May 2022 and have given a modified audit opinion drawing attention

to a material uncertainty regarding going concern. After making

enquiries, the Directors have an expectation that, in the

circumstances of reasonably foreseeable downside scenarios, the

Group and Company have adequate resources to continue in

operational existence for the foreseeable future.

However, the rate at which revenue growth and margin improvement

can be achieved during a potentially future recessionary period and

uncertain global trading conditions is difficult to predict.

Furthermore, the ability to renew or source alternative invoice

finance facilities or to agree deferred settlement terms with HMRC

results in material uncertainty, which may cast significant doubt

over the ability of the Group and the Company to realise its assets

and discharge its liabilities in the normal course of business and

hence continue as a going concern.

The Directors continue to adopt the going concern basis, whilst

recognising there is material uncertainty relating to the above

matters.

Alan Tomlinson

Group Finance Director

Consolidated Income Statement

for the year ended 31 May 2022

Year ended 31 May 2022 14 months ended 31 May 2021

---------------------------------------- -----------------------------------------------

(+) Non- (+) Non-

Note Underlying underlying Total Underlying underlying Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 3 16,836 - 16,836 26,444 - 26,444

Cost of sales (15,038) - (15,038) (24,262) - (24,262)

Gross profit 1,798 - 1,798 2,182 - 2,182

Other operating

expenses 6 (2,501) 505 (1,996) (5,083) (7,193) (12,276)

------------ ------------- ----------- ------------ -------------- -----------------

Operating

loss (703) 505 (198) (2,901) (7,193) (10,094)

Bank interest

receivable 26 - 26 13 - 13

Finance costs 4 (337) - (337) (310) - (310)

------------ ------------- ----------- ------------ -------------- -----------------

Loss before

tax (1,014) 505 (509) (3,198) (7,193) (10,391)

Tax credit 581 - 581 817 - 817

------------ ------------- ----------- ------------ -------------- -----------------

Profit/(loss)

for the period

attributable

to equity holders

of the parent

company (433) 505 72 (2,381) (7,193) (9,574)

============ ============= =========== ============ ============== =================

Underlying loss

per share:

Basic 5 (0.5)p - - (13.7)p - -

Diluted 5 (0.5)p - - (13.7)p - -

Total

earnings/(loss)

per share:

Basic 5 - - 0.1p - - (55.1)p

Diluted 5 - - 0.1p - - (55.1)p

*Non-underlying items include restructuring costs, impairment

of assets, dilapidation costs and share-based payment

costs together with the associated tax impact.

Consolidated Statement of Comprehensive Income

for the year ended 31 May 2022

Year ended 14 months

31 May ended 31

2022 May 2021

Note GBP000 GBP000

Profit/(loss) for the period 72 (9,574)

Other comprehensive income

Gain on revaluation of property, plant 1,003 -

& equipment

Movements in fair value of cash flow

hedges taken to other comprehensive

income (158) 650

Deferred tax on movement in cash flow

hedges 40 (133)

------------ -----------

Net other comprehensive income that

may be recycled to profit and loss 885 517

------------ -----------

Remeasurement gain on pension scheme

assets and liabilities 8 332 463

Deferred tax on remeasurement gain

on pension scheme (63) 7

Net other comprehensive income that

will not be recycled to profit and

loss 269 470

Other comprehensive income for the

period net of tax 1,154 987

Total comprehensive income/(expense)

for the period attributable to equity

holders of the parent company 1,226 (8,587)

============ ===========

Consolidated Balance Sheet

at 31 May 2022

Note 2022 2021

GBP000 GBP000

Non-current assets

Property, plant and equipment 3,506 2,431

Intangible assets 283 263

Deferred tax assets 1,434 1,206

Defined benefit pension scheme

surplus 8 64 -

5,287 3,900

Current assets

Inventories 3,143 1,698

Trade and other receivables 4,303 3,932

Cash at Bank - 1,038

7,446 6,668

Total assets 12,733 10,568

========= =========

Current liabilities

Financial liabilities 7 2,877 1,715

Trade and other payables 6,475 8,031

9,352 9,746

Non-current liabilities

Financial liabilities 7 2,097 1,158

Deferred tax 70 150

Provisions 806 890

Defined benefit pension scheme

deficit 8 - 1,190

--------- ---------

2,973 3,388

Total liabilities 12,325 13,134

--------- ---------

Capital and reserves

Share capital 2,087 2,051

Share premium 6,308 4,720

Capital redemption reserve 109 109

Hedging reserve 100 218

Revaluation reserve 1,003 -

Retained earnings (9,199) (9,664)

--------- ---------

Total equity 408 (2,566)

Total equity and liabilities 12,733 10,568

========= =========

Consolidated Cash Flow Statement

for the year ended 31 May 2022

14 months

Year ended ended

31 May 31 May

2022 2021

GBP000 GBP000

Operating activities

Loss for the period before tax (509) (10,391)

Adjustments to reconcile loss for

the period to net cash outflow

from operating activities:

Interest receivable (26) (13)

Finance costs 337 310

Impairment (reversal)/charge on

property, plant and equipment,

inventory and receivables (498) 4,632

Dilapidations provision (84) 690

Depreciation of property, plant

and equipment 324 1,135

Amortisation of intangible assets 24 86

(Profit)/loss on disposal of property,

plant and equipment (66) 135

Foreign exchange rate movement (1) 37

Share-based payments 67 41

Defined benefit pension contributions

paid (935) (355)

(Increase)/decrease in inventories (945) 175

(Increase)/decrease in receivables (168) 2,036

(Decrease)/increase in payables (1,557) 1,009

Corporation tax received - 129

-------------- -----------

Net cash outflow from operating

activities (4,037) (344)

-------------- -----------

Investing activities

Purchase of property, plant and

equipment (520) (183)

Purchase of software (20) (3)

Development costs (24) (5)

Disposal of property, plant and

equipment 1,189 -

Net cash inflow/(outflow) from

investing activities 625 (191)

-------------- -----------

Financing activities

Interest received 26 13

Interest paid (324) (261)

Net invoice finance inflow/(outflow) 1,585 (1,202)

New share capital issued 1,624 3,312

Proceeds from convertible loan - 200

Principal element of lease payments (537) (946)

Net cash inflow from financing

activities 2,374 1,116

-------------- -----------

Net (decrease)/increase in cash

and cash equivalents (1,038) 581

Cash and cash equivalents at the

start of the period 1,038 457

Impact of foreign exchange rate - -

movements

Cash and cash equivalents at the

end of the period - 1,038

============== ===========

Cash and cash equivalents comprise:

Cash at bank - 1,038

-------------- -----------

- 1,038

============== ===========

Consolidated statement of changes in equity

Attributable

to equity

Share Capital Revaluation holders

Share premium redemption Hedging reserve Retained of the

capital account reserve reserve earnings parent

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance

at 1

April

2020 1,990 1,269 109 (299) - (524) 2,545

Loss

for the

year - - - - - (9,574) (9,574)

Other

comprehensive

income

for the

period

net of

tax - - - 517 - 470 987

---------- ------------- ------------- ---------- ------------- ----------- --------------

Total

comprehensive

income/(expense) - - - 517 - (9,104) (8,587)

New share

capital

issued 61 3,451 - - - - 3,512

Share-based

payment - - - - - 41 41

Deferred

tax on

share-based

payment - - - - - (77) (77)

---------- ------------- ------------- ---------- ------------- ----------- --------------

Total

of transactions

with

shareholders 61 3,451 - - - (36) 3,476

Balance

at 1

June

2021 2,051 4,720 109 218 - (9,664) (2,566)

Profit

for the

year - - - - - 72 72

Other

comprehensive

income

for the

year

net of

tax - - - (118) 1,003 269 1,154

---------- ------------- ------------- ---------- ------------- ----------- --------------

Total

comprehensive

income/(expense) - - - (118) 1,003 341 1,226

New share

capital

issued 36 1,588 - - - - 1,624

Share-based

payments - - - - - 67 67

Deferred

tax on

share-based

payment - - - - - 57 57

---------- ------------- ------------- ---------- ------------- ----------- --------------

Total

of transactions

with

shareholders 36 1,588 - - - 124 1,748

Balance

at 31

May 2022 2,087 6,308 109 100 1,003 (9,199) 408

========== ============= ============= ========== ============= =========== ==============

NOTES TO THE FINAL RESULTS ANNOUNCEMENT

1. AUTHORISATION OF FINANCIAL STATEMENTS AND STATEMENT OF

COMPLIANCE WITH UK ADOPTED INTERNATIONAL ACCOUNTING STANDARDS

The Group and Company financial statements of Chamberlin Plc

(the 'Company') for the year ended 31 May 2022 were authorised for

issue by the Board of Directors on 4 November 2022, and the balance

sheets were signed on the Board's behalf by Kevin Price and Alan

Tomlinson. The Company is a public limited company incorporated and

domiciled in England and Wales. The Company's ordinary shares are

admitted to trading on AIM, a market of the same name operated by

the London Stock Exchange.

The Group's financial statements have been prepared in

accordance with UK adopted International Accounting Standards in

conformity with the requirements of the Companies Act 2006. The

Company's financial statements have been prepared in accordance

with Financial Reporting Standard 101 'The Reduced Disclosure

Framework'.

The financial information set out in this announcement does not

constitute the statutory accounts of the Group for the year ended

31 May 2022 or for the 14 months ended 31 May 2021 but is derived

from the 2022 Annual Report and Accounts. The Annual Report and

Accounts for the 14 months ended 31 May 2021 have been delivered to

the Registrar of Companies and the Group Annual Report and Accounts

for the year ended 31 May 2022 will be delivered to the Registrar

of Companies by 30 November 2022. The auditors, Crowe UK LLP, have

reported on the accounts for the year ended 31 May 2022 and have

given a modified audit opinion drawing attention to a material

uncertainty regarding going concern.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation

The consolidated financial statements are presented in sterling

and all values are rounded to the nearest thousand pounds (GBP000)

except when otherwise indicated.

Basis of consolidation

The consolidated financial statements comprise the financial

statements of Chamberlin plc and its subsidiaries as at 31 May. The

financial statements of subsidiaries are prepared for the same

reporting year as the parent Company, using consistent accounting

policies. All inter-Company balances and transactions, including

unrealised profits arising from intra-group transactions, have been

eliminated in full. Subsidiaries are consolidated from the date on

which control is transferred to the Group and cease to be

consolidated from the date on which control is transferred out of

the Group.

Accounting policies

The preliminary announcement has been prepared on the same basis

as the financial statements for the year ended 31 May 2022. There

were no new accounting standards adopted in the year that have a

material impact on the financial statements.

Going concern

The Director's assessment of going concern is based on the

Group's detailed forecast for the three years ending 31 May 2023,

31 May 2024 and 31 May 2025, which reflect the Director's view of

the most likely trading conditions. Since the balance sheet date,

HSBC have confirmed their agreement to an increase in the Group's

invoice finance facilities and the forecasts indicate that these

bank facilities are expected to remain adequate.

The forecasts include revenue growth and margin improvement

assumptions across all of the Group's businesses. At Chamberlin and

Hill Castings, these assumptions include an improvement in

automotive volumes as this sector recovers from the backlog of

passenger vehicle orders arising from the shortage of vital

electronic and other components in the last 18 months, modest

growth from fitness equipment and cookware products and

diversification into new markets. At RDC, the forecasts assume that

revenue and margin growth will be achieved from the investment

being made in the expansion of its capacity and the ability to

manufacture and sell a wider range of products using new materials.

At Petrel, revenue and margin growth assumptions are based on the

introduction of new products, including the use of new technology,

and services, including warranty, inspection and maintenance.

The Directors have applied reasonably foreseeable downside

sensitivities to the forecast, including sales growth and margin

improvement at Chamberlin and Hill Castings is 40% and 20% lower

than expectations respectively, sales growth and margin improvement

at RDC are both 20% lower than expectations and sales growth and

margin at Petrel are 20% and 10% lower than expectations

respectively. Furthermore, the Group is reliant on an invoice

finance facility to fund its working capital needs. The renewal of

the facility at the next annual review in March 2023 cannot be

guaranteed, although there are no indications at the date of the

approval of the financial statements that a renewal with the

existing provider would not be granted or that alternative

providers could not be found. In addition, the Directors have

assumed that deferred settlement terms will be agreed with HMRC in

relation to PAYE arrears of GBP1.5m for one subsidiary in the Group

that have arisen in the period since the announcement by

BorgWarner, having already agreed deferred settlement terms with

HMRC for two subsidiaries.

As a consequence, after making enquiries, the Directors have an

expectation that, in the circumstances of the reasonably

foreseeable downside scenarios described above, the Group and

Company have adequate resources to continue in operational

existence for the foreseeable future.

However, the rate at which revenue growth and margin improvement

can be achieved during a potentially future recessionary period and

uncertain global trading conditions is difficult to predict.

Furthermore, the ability to renew or source alternative invoice

finance facilities or to agree deferred settlement terms with HMRC

results in material uncertainty, which may cast significant doubt

over the ability of the Group and the Company to realise its assets

and discharge its liabilities in the normal course of business and

hence continue as a going concern.

The Directors continue to adopt the going concern basis, whilst

recognising there is material uncertainty relating to the above

matters.

3. SEGMENTAL ANALYSIS

For management purposes, the Group is organised into two

operating divisions according to the nature of the products and

services. Operating segments within those divisions are combined on

the basis of their similar long-term characteristics and similar

nature of their products, services and end users as follows:

The Foundries segment is a supplier of iron castings, in raw or

machined form, to a variety of industrial customers who incorporate

the castings into their own products or carry out further machining

or assembly operations on the castings before selling them on to

their customers.

The Engineering segment supplies manufactured products to

distributors and end-users operating in hazardous area and

industrial lighting markets.

Management monitors the operating results of its divisions

separately for the purposes of making decisions about resource

allocation and performance assessment. The Chief Operating Decision

Maker is the Chief Executive.

(i) By operating segment

Segmental operating

Segmental revenue (loss)/profit

Year 14 months Year 14 months

ended ended ended ended 31

31 May 31 May 31 May May 2021

2022 2021 2022

GBP000 GBP000 GBP000 GBP000

Foundries 13,604 23,321 (463) (1,931)

Engineering 3,232 3,123 535 191

----------- ----------- ---------- -----------

Segment results 16,836 26,444 72 (1,740)

=========== =========== ========== ===========

Reconciliation of reported segmental

operating profit/(loss)

Segment operating profit/(loss) 72 (1,740)

Shared costs (775) (1,161)

Non-underlying items 505 (7,193)

Net finance costs (311) (297)

Loss before tax (509) (10,391)

Segmental assets Year 14 months

ended ended

31 May

31 May 2021

2022

GBP000 GBP000

Foundries 9,811 7,211

Engineering 1,425 1,113

---------- -----------

11,236 8,324

---------- -----------

Segmental liabilities

Foundries (5,771) (7,674)

Engineering (1,511) (1,247)

---------- -----------

(7,282) (8,921)

---------- -----------

Segmental net assets/(liabilities) 3,954 (597)

Unallocated net liabilities (3,546) (1,969)

Total net assets/(liabilities) 408 (2,566)

=========== ===========

Unallocated net liabilities include the pension asset of

GBP64,000 (2021: GBP1,190,000), net debt of (GBP4,974,000) (2021:

GBP1,835,000) and a net deferred tax asset of GBP1,364,000 (2021:

GBP1,056,000).

Capital expenditure,

depreciation, amortisation

and impairment

Capital additions Foundries Engineering Total

------------------- ------------------- -----------------------

Year 14 months Year 14 months Year 14 months

ended ended ended ended ended ended

31 31 May 31 31 May 31 May 31 May

May 2021 May 2021 2022 2021

2022 2022

------- ---------- ------- ---------- ---------- -----------

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------- ---------- ------- ---------- ---------- -----------

Property, plant and equipment 1,327 177 - 20 1,327 197

------- ---------- ------- ---------- ---------- -----------

Software 20 3 - - 20 3

------- ---------- ------- ---------- ---------- -----------

Development costs - - 24 5 24 5

------- ---------- ------- ---------- ---------- -----------

Depreciation, amortisation Foundries Engineering Total

and impairment

------------------- ------------------- -----------------------

Year 14 months Year 14 months Year 14 months

ended ended ended ended ended ended

31 31 May 31 31 May 31 May 31 May

May 2021 May 2021 2022 2021

2022 2022

------- ---------- ------- ---------- ---------- -----------

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------- ---------- ------- ---------- ---------- -----------

Property, plant and equipment (317) (1,113) (7) (22) (324) (1,135)

------- ---------- ------- ---------- ---------- -----------

Software 4 (47) (1) (6) 3 (53)

------- ---------- ------- ---------- ---------- -----------

Development costs - - (27) (33) (27) (33)

------- ---------- ------- ---------- ---------- -----------

In addition to the above, property, plant and equipment in the

Foundries division in 2021 were impaired by GBP3,809,000.

(ii) By geographical segment

Year 14 months

ended ended 31

31 May May 2021

2022

Revenue by location of customer: GBP000 GBP000

United Kingdom 13,344 13,944

Italy 1,171 1,351

Germany 1,382 2,595

Rest of Europe 211 7,425

Other countries 738 1,129

--------- ---------

16,836 26,444

========= =========

4. FINANCE COSTS

14 months

Year ended

ended 31 May

31 May 2021

2022

GBP000 GBP000

Bank overdraft and invoice finance interest payable (94) (103)

Interest expense on lease liabilities and other

interest payable (230) (158)

Finance cost of pensions (13) (49)

---------- -----------

(337) (310)

========== ===========

5. EARNINGS /( LOSS) PER SHARE

The calculation of earnings/(loss) per share is based on the

earnings/(loss) attributable to shareholders and the weighted

average number of ordinary shares in issue. In calculating the

diluted earnings/(loss) per share, adjustment has been made for the

dilutive effect of outstanding share options where applicable.

Underlying earnings/(loss) per share, which excludes non-underlying

items, as disclosed in Note 6, has also been disclosed.

14 months

Year ended

ended 31 May

31 May 2021

2022

GBP000 GBP000

Earnings/(loss) for basic earnings

per share 72 (9,574)

Non-underlying items (505) 7,193

Taxation effect of the above - -

Loss for underlying earnings

per share (433) (2,381)

========== ===========

Underlying loss per share (pence):

Basic (0.5) (13.7)

Diluted (0.5) (13.7)

Total earnings/(loss) per share

(pence):

Basic 0.1 (55.1)

Diluted 0.1 (55.1)

2022 2021

Number Number

'000 '000

Weighted average number of ordinary

shares 79,488 17,387

Adjustment to reflect shares

under options 3,581 3,798

---------- -----------

Weighted average number of ordinary

shares - fully diluted 83,069 21,185

========== ===========

There is no adjustment in the diluted loss per share calculation

for the 3,798,000 shares under option in 2021 as they are required

to be excluded from the weighted average number of shares for

diluted loss per share as they are anti-dilutive. The weighted

average number of shares used in the fully diluted calculation is

83,069,000 (2021:17,387,000).

6. NON-UNDERLYING ITEMS

14 months

Year ended

ended 31 May

31 May 2021

2022

GBP000 GBP000

Group reorganisation - 1,310

Adviser costs relating to corporate restructuring - 520

Impairment of property, plant and equipment - 3,809

Impairment of inventory and receivables (498) 823

Additional liability from customer claim 10 -

relating to disposal of Exidor Limited

Dilapidations provision (84) 690

Share-based payment charge 67 41

---------- -----------

Non-underlying operating items (505) 7,193

Taxation

- tax effect of non-underlying items - -

---------- -----------

(505) 7,193

---------- -----------

During the year, an agreement was reached on the settlement of a

customer claim relating to Exidor Limited, a subsidiary that was

sold in December 2018. Additional costs of GBP10,000 over and above

the original provision made at the time of the disposal were agreed

to settle the claim.

In 2022, GBP84,000 was released from the dilapidations provision

following negotiations with the landlord. The charge of GBP690,000

in 2021 relates to the estimated costs for land and building leases

that are nearing their end date.

In 2021, following the cancellation of all contracts by the

Group's major customer, BorgWarner, announced on 16 December 2020,

the Group embarked upon a significant restructuring programme to

realign the cost base of the Foundry division to the reduced level

of continuing revenue. Group reorganisation costs of GBP1,310,000,

which include redundancy and associated costs, relate to this

restructuring programme.

Following the cancellation of the Group's contracts by

BorgWarner, the Group undertook a review of the carrying value of

the assets in the Foundry division in 2021. This gave rise to an

asset impairment charge of GBP4,632,000, of which GBP3,809,000

related to property, plant & equipment, GBP716,000 related to

obsolete inventory and GBP107,000 related to irrecoverable

receivables. In 2022, GBP498,000 of the impairment charge relating

to inventory was reversed, as a number of new contract wins

indicates that the inventory will now be utilised.

The share-based payment charge in 2022 of GBP67,000 (2021:

GBP41,000) relates to the fair value cost of share option schemes

for the year.

7. NET DEBT

31 May 31 May

2022 2021

GBP000 GBP000

Net cash - (1,038)

Invoice finance facility 2,243 665

Lease liabilities 634 1,050

Net debt due in less than one year 2,877 677

Non-current liabilities

Lease liabilities 2,097 1,158

Total net debt 4,974 1,835

-------- ---------

Lease liabilities are secured against the specific item to which

they relate. These leases are repayable by monthly instalments for

a period of up to 10 years to May 2032. Interest is payable at

fixed amounts that range between 3.1% and 9.4%.

Invoice finance balances are secured against the trade

receivables of the Group and are repayable on demand. Interest is

payable at 2.75% over base rate. The maximum facility as at 31 May

2022 was GBP3,500,000 (2021: GBP3,500,000). Management have

assessed the treatment of the financing arrangements and have

determined it is appropriate to recognise trade receivables and

invoice finance liabilities separately.

8. PENSIONS ARRANGEMENTS

During the year, the Group operated funded defined benefit and

defined contribution pension schemes for the majority of its

employees in the UK, these being established under trusts with the

assets held separately from those of the Group. The pension

operating cost for the Group defined benefit scheme for 2022 was

GBP151,000 (2021: GBP236,000), with the reduction being due to

costs associated with the triennial valuation in 2021 not repeated,

together with GBP13,000 of financing cost (2021: GBP49,000).

The other scheme within the Group is a defined contribution

scheme and the pension cost represents contributions payable. The

total cost of the defined contribution scheme was GBP200,000 (2021:

GBP377,000). The notes below relate to the defined benefit

scheme.

The actuarial liabilities have been calculated using the

Projected Unit method. The major assumptions used by the actuary

were (in nominal terms):-

31 May 31 May 31 March

2022 2021 2020

Salary increases n/a n/a n/a

Pension increases (post 1997) 3.4% 3.1% 2.6%

Discount rate 3.4% 1.85% 2.3%

Inflation assumption - RPI 3.5% 3.2% 2.6%

Inflation assumption - CPI 2.8% 2.5% 1.7%

Demographic assumptions are all based on the S3PA (2019: S2PA)

mortality tables with a 1.25% annual increase. The post retirement

mortality assumptions allow for expected increases in longevity.

The current disclosures relate to assumptions based on longevity in

years following retirement as of the balance sheet date, with

future pensioners relating to an employee retiring in 2032.

2022 2021

Years Years

Current pensioner at 65 - male 20.6 20.5

* female 23.0 22.9

Future pensioner at 65 - male 21.4 21.3

* female 24.1 24.0

The scheme was closed to future accrual with effect from 30

November 2007, after which the Company's regular contribution rate

reduced to zero (previously the rate had been 9.1% of members'

pensionable salaries).

The latest triennial valuation was completed as at 31 March 2019

and concluded that Company contributions would increase to

GBP300,000 for the year ended 31 March 2021, GBP330,000 for the

year ended 31 March 2022 and GBP360,000 for the year ended 31 March

2023, with the deficit reduction period reducing to 2032. The

Company has given security over the Group's land and buildings to

the pension scheme. During the year, the charge over one of the

Group's properties was released following the payment of an

additional contribution to the pension scheme of GBP600,000, paid

out of the proceeds of a sale and leaseback transaction. The

triennial review with effect from 31 March 2022, which will

establish future deficit payments, is currently in progress.

The scheme assets are stated at the market values at the

respective balance sheet dates. The assets and liabilities of the

scheme were:

2022 2021

GBP000 GBP000

Equities/ diversified growth

fund 1,937 5,273

Bonds - -

Liability Driven Investments 2,370 2,993

Buy and Maintain Credit 1,853 2,211

Multi-Sector Credit 4,273 4,962

Insured pensioner assets 13 21

Cash 3,578 141

---------- ----------

Market value of assets 14,024 15,601

Actuarial value of liabilities (13,960) (16,791)

---------- ----------

Scheme surplus/(deficit) 64 (1,190)

Related deferred tax asset (16) 297

---------- ----------

Net pension surplus/(deficit) 48 (893)

Net benefit expense recognised 2022 2021

in profit and loss GBP000 GBP000

Net interest cost (13) (49)

(13) (49)

---------- ----------

Re-measurement losses/ (gains) in other 2022 2021

comprehensive income GBP000 GBP000

Actuarial losses/(gains) arising from

changes in financial assumptions (2,466) 1,510

Actuarial gains arising from changes

in demographic assumptions 60 (429)

Experience adjustments 98 171

(Return)/loss on assets (excluding interest

income) 1,976 (1,715)

--------- ---------

Total re-measurement gain shown in other

comprehensive income (332) (463)

--------- ---------

2022 2021

GBP000 GBP000

Actual return/(loss) on plan assets (1,686) 2,092

--------- ---------

Movement in deficit during the 2022 2021

period GBP000 GBP000

Deficit in scheme at beginning

of period (1,190) (1,959)

Employer contributions 935 355

Net interest expense (13) (49)

Actuarial gain 332 463

--------- ---------

Surplus/(deficit) in scheme at

end of period 64 (1,190)

--------- ---------

Movement in scheme assets 2022 2021

GBP000 GBP000

Fair value at beginning of period 15,601 14,538

Interest income on scheme assets 290 377

Return on assets (excluding interest

income) (1,976) 1,715

Employer contributions 935 355

Benefits paid (826) (1,384)

--------- ---------

Fair value at end of period 14,024 15,601

--------- ---------

Movement in scheme liabilities 2022 2021

GBP000 GBP000

Benefit obligation at start of period 16,791 16,497

Interest cost 303 426

Actuarial (gains)/ losses arising from

changes in financial assumptions (2,466) 1,510

Actuarial gains arising from changes in

demographic assumptions 60 (429)

Experience adjustments 98 171

Benefits paid (826) (1,384)

Benefit obligation at end of period 13,960 16,791

--------- ---------

The weighted average duration of the pension scheme liabilities

are 12 years (2021: 13 years).

A quantitative sensitivity analysis for significant assumptions

as at 31 May 2022 is as shown below:

2022 2021

Present value of scheme liabilities when changing GBP000 GBP000

the following assumptions:

Discount rate increased by 1% p.a. 12,543 14,859

RPI and CPI increased by 1% p.a. 14,584 17,705

Mortality- members assumed to be their actual

age as opposed to one year older 14,627 17,653

The sensitivity analysis above has been determined based on a

method that extrapolates the impact on defined benefit obligations

as a result of reasonable changes in key assumptions occurring at

the end of the year.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR MZMGMZDLGZZM

(END) Dow Jones Newswires

November 04, 2022 08:23 ET (12:23 GMT)

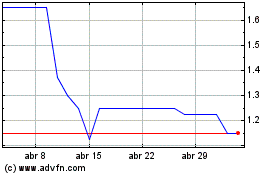

Chamberlin (LSE:CMH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Chamberlin (LSE:CMH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024