TIDMCMH

RNS Number : 9921H

Chamberlin PLC

30 November 2022

30 November 2022

Chamberlin plc

("Chamberlin", the "Company" or the "Group")

AGM Statement and Trading Update

Chamberlin plc (AIM: CMH.L), the specialist castings and

engineering group, announces that at the Company's Annual General

Meeting this morning, Kevin Price, Chief Executive, will make the

following statement regarding trading in the first half of the

financial year ("H1 2023").

"I am pleased to report that trading across all of Chamberlin's

businesses is in line with expectations in the first half of the

financial year, as we continue to implement our strategy and build

on the improved operational and financial performance achieved in

the previous financial year. Despite orders and operational

performance at Russell Ductile Castings and Petrel remaining

buoyant, the Group's profitability in H1 2023 has been held back by

a slower recovery at Chamberlin & Hill Castings ("CHC"). We

have continued to take the necessary corrective actions in H1 2023

at CHC to improve its performance through cost savings and margin

enhancement initiatives, with this business now entering H2 2023 at

a broadly break-even position on a monthly basis. These actions,

together with the profit contributions expected from the contract

wins discussed below, give the Board confidence that CHC will

deliver a strong, profitable performance in H2 2023 and enable the

Group to meet market expectations for the year ending 31 May

2023.

Chamberlin & Hill Castings ("CHC")

Despite the uneven demand in automotive volumes in H1 2023 that

has held back its performance, CHC has been successful in its

strategy of diversification away from the automotive sector having

secured a number of new orders in the last two months with a

potential aggregate annualised revenue value of approximately

GBP1.2m, in the construction, cast iron radiator and commercial

vehicle markets. Production is expected to commence on all of these

programmes by the end of the first quarter of the 2023 calendar

year. A significant proportion of these new orders are the result

of the concerted efforts of customers to source from local UK

supply chains and CHC has the excess capacity and technical

expertise to be able to benefit further from this trend.

In addition, CHC, through its Emba cookware brand, has entered

into an agreement with a well-established cookware company to

develop, market and sell, a jointly branded cookware range, through

their substantial existing network of distributors and retailers.

The product range is currently in development and is expected to be

available for retail sale towards the end of March 2023. This

arrangement is a promising and exciting development for the Group's

Emba brand, providing access to a much wider customer base than

could have been established with the Group's in-house resources and

supporting the potential for Emba to become a more meaningful

contributor to CHC's diversification strategy.

CHC's machining facility has also won a number of recent new

orders that will see production ramp up over the next three months

as these programmes gather momentum. These orders are expected to

have an aggregate annualised revenue value of around GBP1.0m and

will enable five out of the six machining cells to be fully

occupied on a single shift basis for the first time in nearly two

years by the end of March 2023.

These new contracts, in addition to a currently break-even

trading position, provide CHC with the opportunity to deliver a

strong end to the current financial year and ensure that it is well

placed to make further progress in FY 2024.

Russell Ductile Castings ("RDC")

RDC has continued to perform well in H1 2023 and the Board is

pleased to report that order intake and financial performance have

continued to demonstrate resilience and consistency. RDC's order

book has remained stable at around GBP4m throughout H1 2023 and

remains on track to deliver to the Board's expectations for this

financial year. Notably in the first half, RDC was successful in

securing a significant contract in the renewable energy sector,

which is a target market for RDC's future growth strategy.

The positive outlook for RDC is now also supported by the

completion of the capacity expansion project in November 2022 that

has increased RDC's ability to produce large castings over three

tons by around 30%, providing the means to reduce customer

lead-times and take advantage of its buoyant enquiry pipeline from

new and existing customers. This investment demonstrates the

Board's belief that RDC can continue to capitalise on its market

leading position in the UK for the manufacture of specialist and

highly technical large cast iron products.

Petrel

Petrel has made a positive contribution to the Group's results

in H1 2023, at a run rate consistent with the previous financial

year and delivering operating profit averaging around 17% of

revenue. Order intake has remained elevated, enabling the order

book to be maintained at a consistently healthy level. This

includes a substantial order in the defence sector to supply

lighting to a branch of His Majesty's Armed Forces.

Petrel has a significant opportunity to release its untapped

potential and to increase its market share, having already earned a

solid reputation with its existing product range and in-house

capability to develop its products further and enter new markets.

With this in mind, the Board has installed a new management team at

Petrel in the first half, with the industry knowledge, vision and

experience to exploit Petrel's true potential. As a result of this

change, there will be an exceptional restructuring charge of

approximately GBP0.1m in the income statement in the first half

(unaudited). The Board continues to strongly believe that the Group

being in control of its own destiny, through the ability to design,

manufacture and market its own products is an important part of the

Group's future strategy and Petrel's unique ability to be flexible

and react quickly to customer needs means that it is well placed to

be a material contributor to Group performance going forward.

Outlook

The green shoots of recovery that were evident from the Group's

financial performance in the previous financial year, have

continued into H1 2023. Although profitability will be second-half

weighted due to the further efforts required to improve the

performance of CHC in H1 2023, these actions have had the desired

effect and give the Board the confidence that the Group will meet

full year market expectations for the year ending 31 May 2023

should current market conditions remain unchanged. The Board,

however, remains mindful of the demand on working capital that the

expected growth in revenue in the second half from new orders at

CHC and the capacity expansion at RDC will create, and continues to

evaluate opportunities to strengthen the balance sheet, including

in relation to the Group's property assets, in order to deliver on

the Group's growth objectives."

Certain of the information contained within this announcement is

deemed by the Company to constitute inside information as

stipulated under the UK version of the EU Market Abuse Regulation

(2014/596) which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018, as amended and supplemented from time to

time.

Enquiries:

Chamberlin plc T: 01922 707100

Kevin Price, Chief Executive

Alan Tomlinson, Finance Director

Cenkos Securities plc (Nominated Adviser T: 020 7397 8900

and Broker)

Katy Birkin

Stephen Keys

George Lawson

Peterhouse Capital Limited (Joint Broker) T: 020 7469 0930

Lucy Williams

Duncan Vasey

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDZMZMNLNGZZM

(END) Dow Jones Newswires

November 30, 2022 02:00 ET (07:00 GMT)

Chamberlin (LSE:CMH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

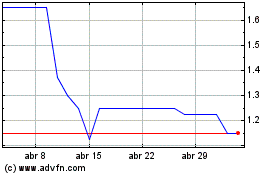

Chamberlin (LSE:CMH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024