TIDMCMH

RNS Number : 2109R

Chamberlin PLC

28 February 2023

28 February 20 23

AIM: CMH

CHAMBERLIN PLC

("Chamberlin" or "the Company" or "the Group")

Interim Results

for the six months ended 30 November 2022

Chamberlin plc (AIM: CMH) is pleased to announce its interim

results for the six months ended 30 November 2022 ("H1 2023").

Key Points

-- Revenue of GBP10.5m (H1 2022: GBP8.0m), an increase of 32%

-- Underlying loss before tax GBP0.3m (H1 2022: GBP0.1m)

-- Continued strong growth at Petrel with significantly improved operating performance

Post Period

-- Potential sale and leaseback for Walsall freehold site, subject to contract

Chairman, Keith Butler-Wheelhouse, commented:

"All operating businesses within the Group are now operationally

profitable, with new opportunities for growth continuing to emerge,

the most significant being the newly reinvigorated Petrel".

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the UK version of the EU Market Abuse Regulation (2014/596) which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended and supplemented from time to time.

Enquiries

Chamberlin plc T: 01922 707100

Kevin Price, Chief Executive Officer

Alan Tomlinson, Finance Director

Cenkos Securities plc (Nominated Adviser T: 020 7397 8900

and Broker)

Katy Birkin

Stephen Keys

George Lawson

Peterhouse Capital Limited (Joint Broker) T: 020 7469 0930

Lucy Williams

Duncan Vasey

Chairman's Statement

Revenues in the first six months increased by 32% to GBP10.5m

compared to GBP8.0m in the prior period, reflecting strong growth

across all operations. Revenues in the second half of the year are

expected to continue on a similar path, supported by strong order

books at RDC and Petrel and the commencement of new contracts

recently won by CHC, as previously announced.

Operational performance of the Group in H1 2023 was impacted by

inflationary cost pressures, primarily at CHC, with the underlying

loss before tax increasing slightly to GBP0.3m (H1 2022: GBP0.1m),

although these cost pressures have now been addressed through price

increases and further cost savings. Despite these cost pressures,

both Petrel and RDC delivered strong operating performances, with

operating profit increasing by 78% and 11% respectively, compared

with the prior period.

Petrel's new management team, led by divisional Managing

Director Mark Pemberton, has overseen a substantial increase in

operating performance. The team are now seeking to build on this

strong base and have developed a strategy for Petrel that will

involve entry into new export markets and sectors such as

pharmaceutical and oil and gas. Petrel will continue to modernise

and innovate to ensure it remains at the forefront of hazard

lighting technology and meets evolving customer requirements.

In January 2023, Chamberlin completed a placing and subscription

raising GBP650,000 to support the Group's working capital

requirements as it enters a period of profitable growth. At that

time, the Board stated that it was continuing to evaluate further

opportunities to strengthen the balance sheet, including in

relation to the Group's property assets. The Group is in

discussions regarding a proposed sale and leaseback transaction at

its Walsall freehold property which would include a proportion of

any realised funds to be utilised to further reduce the Company's

pension fund deficit. Whilst the freehold is currently under offer

at GBP2.2m, Shareholders should note that this is subject to

contract and there can be no certainty that this transaction will

be completed. Further announcements will be made, as

appropriate.

Outlook

The Group continues to go from strength to strength and is

performing in line with market expectations.

The Board believes that Chamberlin is now entering a period of

continuous growth with all businesses profitable in January 2023

for the first time in many years and supporting the Board's

expectations that Group profits in FY 2023 will be second half

weighted.

Keith Butler-Wheelhouse

Chairman

Consolidated Income Statement

for the six months ended 30 November 2022

Unaudited Unaudited

six months ended six months ended Year ended

Note 30 November 2022 30 November 2021 31 May 2022

# # #

Underlying Non-underlying Total Underlying Non-underlying Total Underlying Non-underlying Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 2 10,544 - 10,544 8,013 - 8,013 16,836 - 16,836

Cost of sales (9,104) - (9,104) (6,636) - (6,636) (15,038) - (15,038)

Gross profit 1,440 - 1,440 1,377 - 1,377 1,798 - 1,798

Other operating

expenses 7 (1,583) (140) (1,723) (1,409) 50 (1,359) (2,501) 505 (1,996)

----------- --------------- ------------ ----------- --------------- --------- ----------- --------------- -------------

Operating

(loss)/profit (143) (140) (283) (32) 50 18 (703) 505 (198)

Interest receivable 47 - 47 - - - 26 - 26

Finance costs 3 (231) - (231) (104) - (104) (337) - (337)

----------- --------------- ------------ ----------- --------------- --------- ----------- --------------- -------------

(Loss)/profit

before tax (327) (140) (467) (136) 50 (86) (1,014) 505 (509)

Tax credit/(expense) 4 186 - 186 188 - 188 581 - 581

----------- --------------- ------------ ----------- --------------- --------- ----------- --------------- -------------

Profit/(loss)

for the period

attributable

to equity holders

of the Parent

Company (141) (140) (281) 52 50 102 (433) 505 72

---- ----------- --------------- ------------ ----------- --------------- --------- ----------- --------------- -------------

Earnings/(loss)

per share:

Basic 5 (0.1)p (0.2)p (0.3)p 0.1p - 0.1p (0.5)p 0.6p 0.1p

Diluted (0.1)p (0.2)p (0.3)p 0.1p - 0.1p (0.5)p 0.6p 0.1p

(#) Non-underlying items include restructuring costs, hedge

ineffectiveness, impairment of assets, dilapidation costs and

share-based payment costs together with the associated tax

impact.

Consolidated Statement of Comprehensive Income

for the six months ended 30 November 2022

Unaudited

six months Unaudited

ended six months ended Year ended

30 November 30 November 31 May

2022 2021 2022

GBP000 GBP000 GBP000

(Loss)/profit for the

period (281) 102 72

-------------- ------------------- -------------

Other comprehensive

income

Gain on revaluation

of property, plant

& equipment - - 1,003

Movements in fair value

of cash flow hedges

taken to other comprehensive

income 3 (69) (158)

Deferred tax on movements

in cash flow hedges (1) 17 40

-------------- ------------------- -------------

Net other comprehensive

income/(expense) that

may be recycled to

profit and loss 2 (52) 885

-------------- ------------------- -------------

Re-measurement (losses)/gains

on pension scheme assets

and liabilities (880) (42) 332

Deferred tax on re-measurement

(losses)/ gains on

pension assets and

liabilities 167 8 (63)

Net other comprehensive

(expense)/ income that

will not be reclassified

to profit and loss (713) (34) 269

-------------- ------------------- -------------

Other comprehensive

(expense)/income for

the period net of tax (711) (86) 1,154

Total comprehensive

(expense)/income for

the period attributable

to equity holders of

the Parent Company (992) 16 1,226

============== =================== =============

Consolidated Balance Sheet

at 30 November 2022

Unaudited Unaudited

30 November 30 November 31 May

2022 2021 2022

GBP000 GBP000 GBP000

Non-current assets

Property, plant and

equipment 3,525 2,515 3,506

Intangible assets 263 244 283

Deferred tax assets 1,621 1,402 1,434

Defined benefit pension

scheme surplus - - 64

-------------- -------------- ---------

5,409 4,161 5,287

-------------- -------------- ---------

Current assets

Inventories 3,449 2,264 3,143

Trade and other receivables 4,955 3,160 4,303

Cash at bank 124 6 -

8,528 5,430 7,446

-------------- -------------- ---------

Total assets 13,937 9,591 12,733

============== ============== =========

Current liabilities

Financial liabilities 3,873 2,573 2,877

Trade and other payables 7,281 6,429 6,475

11,154 9,002 9,352

-------------- -------------- ---------

Non-current liabilities

Financial liabilities 1,814 1,007 2,097

Deferred tax liabilities 60 107 70

Provisions 806 890 806

Defined benefit pension

scheme deficit 634 1,077 -

3,314 3,081 2,973

Total liabilities 14,468 12,083 12,325

-------------- -------------- ---------

Capital and reserves

Share capital 2,088 2,051 2,087

Share premium 6,332 4,720 6,308

Capital redemption

reserve 109 109 109

Revaluation reserve 1,003 - 1,003

Hedging reserve 102 166 100

Retained earnings (10,165) (9,538) (9,199)

-------------- -------------- ---------

Total equity (531) (2,492) 408

-------------- -------------- ---------

Total equity and liabilities 13,937 9,591 12,733

============== ============== =========

Consolidated Cash Flow Statement

for the six months ended 30 November 2022

Unaudited Unaudited

six months six months

ended ended Year ended

30 November 30 November 31 May

2022 2021 2022

GBP000 GBP000 GBP000

Operating activities

Loss for the period before

tax (467) (86) (509)

Adjustments for:

Interest receivable (47) - (26)

Net finance costs 231 104 337

Impairment charge on property,

plant and equipment, inventory

and receivables - (84) (498)

Dilapidations provision - - (84)

Depreciation of property,

plant and equipment 186 176 324

Amortisation of intangible

assets 20 23 24

Profit on disposal of

property plant and equipment - - (66)

Foreign exchange rate

movements (6) (1) (1)

Share-based payments 34 34 67

Defined benefit pension

contributions paid (180) (165) (935)

(Increase) in inventories (307) (566) (945)

(Increase)/decrease in

receivables (796) 779 (168)

Increase/(decrease) in

payables 830 (1,688) (1,557)

Corporation tax received 306 - -

-------------- -------------- ------------

Net cash outflow from

operating activities (196) (1,474) (4,037)

-------------- -------------- ------------

Investing activities

Purchase of property,

plant and equipment (205) (197) (520)

Purchase of software - (4) (20)

Development costs - - (24)

Disposal of property,

plant and equipment - - 1,189

Net cash outflow from

investing activities (205) (201) 625

-------------- -------------- ------------

Financing activities

Interest received 47 - 26

Interest paid (233) (94) (324)

Net invoice finance drawdown 1,048 1,011 1,585

New share capital issued - - 1,624

Finance lease payments (337) (274) (537)

Net cash inflow from

financing activities 525 643 2,374

-------------- -------------- ------------

Net increase/(decrease)

in cash and cash equivalents 124 (1,032) (1,038)

Cash and cash equivalents

at the start of the period

Impact of foreign exchange - 1,038 1,038

rate movements - - -

Cash and cash equivalents

at the end of the period 124 6 -

============== ============== ============

Cash and cash equivalents

compromise:

Cash at bank 124 6 -

============== ============== ============

Consolidated Statement of Changes in Equity

for the six months ended 30 November 2022

Capital

Share Share redemption Hedging Revaluation Retained Total

capital premium reserve reserve reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 June 2021 2,051 4,720 109 218 - (9,664) (2,566)

Profit for the

period - - - - - 102 102

Other

comprehensive

income/(expense)

for the period

net of tax - - - (52) - (34) (86)

------------ ------------ ------------- ---------- -------------- ----------- -------------

Total

comprehensive

income/(expense) - - - (52) - 68 16

Share-based

payments - - - - - 34 34

Deferred tax on

share-based

payments - - - - - 24 24

Total of

transactions

with

shareholders - - - - - 58 58

At 30 November

2021 2,051 4,720 109 166 - (9,538) (2,492)

Loss for the

period - - - - (30) (30)

Other

comprehensive

income for the

period net of

tax - - - (66) 1,003 303 1,240

------------ ------------ ------------- ---------- -------------- ----------- -------------

Total

comprehensive

income/(expense) - - - (66) 1,003 273 1,210

New share capital

issued 36 1,588 - - - - 1,624

Share-based

payments - - - - - 33 33

Deferred tax on

share-based

payments - - - - - 33 33

------------ ------------ ------------- ---------- -------------- ----------- -------------

Total of

transactions

with

shareholders 36 1,588 - - - 66 1,690

At 1 June 2022 2,087 6,308 109 100 1,003 (9,199) 408

Loss for the

period - - - - - (281) (281)

Other

comprehensive

expense for the

period net of

tax - - - 2 - (713) (711)

Total

comprehensive

(expense)/income - - - 2 - (994) (992)

New share capital

issued 1 24 - - - - 25

Share-based

payments - - - - 34 34

Deferred tax on

share-based

payments - - - - (6) (6)

Total of

transactions

with

shareholders 1 24 - - - 28 53

At 30 November

2022 2,088 6,332 109 102 1,003 (10,165) (531)

============ ============ ============= ========== ============== =========== =============

Notes to the Interim Financial statements

1 General information and accounting policies

The unaudited interim condensed consolidated financial

statements do not comprise the Group's statutory accounts as

defined by section 434 of the Companies Act 2006. Statutory

accounts for the year ended 31 May 2022 were approved by the Board

of Directors on 4 November 2022 and filed at Companies House. The

auditor's report on those accounts was unqualified but contained an

emphasis of matter paragraph relating to a material uncertainty

regarding going concern.

Basis of preparation

The Group's financial statements have been prepared in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006.

The condensed set of financial statements included in this

half-yearly financial report has been prepared in accordance with

AIM Rules issued by the London Stock Exchange.

Accounting policies

The principal accounting policies applied in preparing the

interim Financial Statements comply with IFRS as adopted by the

European Union and are consistent with the policies set out in the

Annual Report and Accounts for the year ended 31 May 2022.

No new standards or interpretations issued since 31 May 2022

have had a material impact on the financial statements of the

Group.

Going concern

The Director's assessment of going concern is based on the

Group's detailed forecast for the three years ending 31 May 2023,

31 May 2024 and 31 May 2025, which reflect the Director's view of

the most likely trading conditions. In November 2022, the Group

secured an increase to its invoice finance facilities from GBP3.5m

to GBP4.5m and the forecasts indicate that these bank facilities

are expected to remain adequate.

The forecasts include revenue growth and margin improvement

assumptions across all of the Group's businesses. At Chamberlin and

Hill Castings, these assumptions include an improvement in

automotive volumes as this sector recovers from the backlog of

passenger vehicle orders arising from the shortage of vital

electronic and other components in the last 18 months, modest

growth from fitness equipment and cookware products and

diversification into new markets. At RDC, the forecasts assume that

revenue and margin growth will be achieved from the investment

being made in the expansion of its capacity and the ability to

manufacture and sell a wider range of products using new materials.

At Petrel, revenue and margin growth assumptions are based on the

introduction of new products, including the use of new technology,

and services, including warranty, inspection and maintenance.

The Directors have applied reasonably foreseeable downside

sensitivities to the forecast, including sales growth and margin

improvement at Chamberlin and Hill Castings is 40% and 20% lower

than expectations respectively, sales growth and margin improvement

at RDC are both 20% lower than expectations and sales growth and

margin at Petrel are 20% and 10% lower than expectations

respectively. Furthermore, the Group is reliant on an invoice

finance facility to fund its working capital needs. The renewal of

the facility at the next annual review in March 2023 cannot be

guaranteed, although there are no indications at the date of the

approval of the financial statements that a renewal with the

existing provider would not be granted or that alternative

providers could not be found. In addition, the Directors have

assumed that deferred settlement terms will be agreed with HMRC in

relation to PAYE arrears of GBP1.5m for one subsidiary in the Group

that have arisen in the period since the announcement by

BorgWarner, having already agreed deferred settlement terms with

HMRC for two subsidiaries.

As a consequence, after making enquiries, the Directors have an

expectation that, in the circumstances of the reasonably

foreseeable downside scenarios described above, the Group and

Company have adequate resources to continue in operational

existence for the foreseeable future.

However, the rate at which revenue growth and margin improvement

can be achieved during a potentially future recessionary period and

uncertain global trading conditions is difficult to predict.

Furthermore, the ability to renew or source alternative invoice

finance facilities or to agree deferred settlement terms with HMRC

results in material uncertainty, which may cast significant doubt

over the ability of the Group and the Company to realise its assets

and discharge its liabilities in the normal course of business and

hence continue as a going concern.

The Directors continue to adopt the going concern basis, whilst

recognising there is material uncertainty relating to the above

matters.

2 Segmental analysis

For management purposes, the Group is organised into two

operating divisions: Foundries and Engineering. The operating

segments reporting format reflects the Group's management and

internal reporting structures for the Chief Operating Decision

Maker.

Revenue Operating (loss)/ profit

Unaudited Unaudited Unaudited Unaudited

six months six months Year six months six months

ended ended ended ended ended Year ended

30 November 30 November 31 May 30 November 30 November 31 May

2022 2021 2022 2022 2021 2022

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Foundries 8,600 6,469 13,604 (9) 120 (463)

Engineering 1,944 1,544 3,232 343 193 535

-------------- -------------- ---------- -------------- -------------- --------------

Segmental results 10,544 8,013 16,836 334 313 72

-------------- -------------- ----------

Shared costs (477) (345) (775)

Non-underlying

items (Note

7) (140) 50 505

Net finance

costs (184) (104) (311)

Loss before

tax (467) (86) (509)

============== ============== ==============

The Foundries segment is a supplier of iron castings, in raw or

machined form, to a variety of industrial customers who incorporate

the castings into their own products or carry out further machining

or assembly operations on the castings before selling them on. The

Engineering segment provides manufactured hazardous area lighting

products to distributors and end-users.

Financing and income tax are managed on a Group basis and are

not allocated to operating segments.

3 Finance costs

Unaudited Unaudited

six months six months

ended ended Year ended

30 November 30 November 31 May

2022 2021 2022

GBP000 GBP000 GBP000

Interest on bank financing facilities (132) (23) (94)

Interest expense on lease liabilities

and other interest payable (101) (71) (230)

Net interest on defined benefit pension

liability 2 (10) (13)

-------------- -------------- ------------

(231) (104) (337)

============== ============== ============

4 Income tax expense

An estimated effective rate of tax for the six months to 30

November 2022 of 39.8% (30 November 2021: 218.6%) has been used in

these interim statements. This rate differs to the standard

corporation tax rate of 19% due primarily due to the recognition of

a deferred tax asset on certain trading losses, accelerated capital

allowances and short-term timing differences. The corporation tax

rate remained at 19% for the year ended 31 May 2022.

5 Earnings/(loss) per share

The calculation of earnings/(loss) per share is based on the

profit/(loss) attributable to shareholders and the weighted average

number of ordinary shares in issue. In calculating the diluted loss

per share, adjustment has been made for the dilutive effect of

outstanding share options where applicable. Underlying

earnings/(loss) per share, which excludes non-underlying items and

the related tax thereon as disclosed in Note 7, as analysed below,

has been disclosed as the Directors believe this allows a better

assessment of the underlying trading performance of the Group.

Unaudited Unaudited Year ended

six months six months 31 May

ended ended 2022

30 November 30 November

2022 2021

GBP000 GBP000 GBP000

(Loss)/profit after tax for

basic earnings per share (281) 102 72

Non-underlying operating items 140 (50) (505)

Taxation effect of the above - - -

-------------- -------------- ------------

(Loss)/profit for underlying

earnings per share (141) 52 (433)

-------------- -------------- ------------

Unaudited Unaudited Year ended

six months six months 31 May

ended ended 2022

30 November 30 November

2022 2021

000 000 000

Weighted average number of

ordinary shares 105,625 69,625 79,488

Adjustment to reflect dilutive

shares under option 3,581 3,581 3,581

---------------- ---------------- --------------

Diluted weighted average number

of ordinary shares 109,206 73,206 83,069

---------------- ---------------- --------------

There is no adjustment for the shares under option in the

diluted loss per share calculation for the six months ended 30

November 2022 as they are required to be excluded from the weighted

average number of shares as they are anti-dilutive.

6 Pensions

The Group operates a defined benefit pension scheme and a

defined contribution pension scheme on behalf of its employees. For

the defined contribution scheme, contributions paid in the period

are charged to the income statement. For the defined benefit

scheme, actuarial calculations are performed in accordance with IAS

19 in order to arrive at the amounts to be charged in the income

statement and recognised in the statement of comprehensive income.

The defined benefit scheme is closed to new entrants and future

accrual.

Under IAS 19, the Group recognises all movements in the

actuarial funding position of the scheme in each period. This is

likely to lead to volatility in shareholders' equity from period to

period.

The IAS 19 figures are based on a number of actuarial

assumptions as set out below, which the actuaries have confirmed

they consider appropriate. The projected unit credit actuarial cost

method has been used in the actuarial calculations.

30 November 30 November 31 May

2022 2021 2022

Salary increases n/a n/a n/a

Pension increases (post 1997) 3.1% 3.2% 3.4%

Discount rate 4.5% 1.6% 3.4%

Inflation assumption - RPI 3.1% 3.3% 3.5%

Inflation assumption - CPI 2.4% 2.6% 2.8%

The demographic assumptions used for 30 November 2022 were the

same as those used at 31 May 2022, and were based on the last full

actuarial valuation performed as at 31 March 2019. The

contributions expected to be paid during the year to 31 May 2023

are GBP362,000. The triennial valuation as at 31 March 2022 is

currently in progress.

The defined benefit scheme funding has changed under IAS 19 as

follows:

Unaudited Unaudited

30 November 30 November 31 May

Funding status 2022 2021 2022

GBP000 GBP000 GBP000

Scheme assets at end of period 11,924 16,156 14,024

Benefit obligations at end

of period (12,558) (17,233) (13,960)

------------------------ -------------------------- ----------

(Deficit)/surplus in scheme (634) (1,077) 64

Related deferred tax asset/(liability) 159 269 (16)

------------------------ -------------------------- ----------

Net pension (liability)/asset (475) (808) 48

======================== ========================== ==========

The change in the net pension liability since 31 May 2022 is

mainly due to negative investment returns arising from a fall in

the market value of scheme assets partially offset by a reduction

in the value of liabilities as a consequence of an increase in bond

yields increasing the discount rate.

7 Non-underlying items

Unaudited Unaudited Year ended

six months six months 31 May

ended ended 2022

30 November 30 November

2022 2021

GBP000 GBP000 GBP000

Group reorganisation 106 - -

Additional liability from customer

claim relating to disposal of

Exidor Limited - - 10

Impairment reversal relating

to inventory and receivables - (84) (498)

Dilapidations provision release - - (84)

Share-based payment charge 34 34 67

-------------- -------------- ------------

Non-underlying operating costs/(income) 140 (50) (505)

Taxation

- tax effect of non-underlying - - -

costs

140 (50) (505)

============== ============== ==============

In the six months ended 30 November 2022, the Group undertook a

restructure of the senior management team at Petrel leading to

redundancy and other associated costs of GBP106,000.

8 Net debt

Unaudited Unaudited

30 November 30 November 31 May

2022 2021 2022

GBP000 GBP000 GBP000

Financial liabilities

Net cash (124) (6) -

Lease liabilities 580 1,065 634

Invoice finance liability 3,293 1,508 2,243

-------------- -------------- ----------

Net debt due in less than one

year 3,749 2,567 2,877

-------------- -------------- ----------

Lease liabilities due in more

than one year 1,814 1,007 2,097

Net debt 5,563 3,574 4,974

============== ============== ==========

9 Interim report

This interim results statement is available on the Group's

website, www.chamberlin.co.uk.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR TRMPTMTJTBIJ

(END) Dow Jones Newswires

February 28, 2023 02:00 ET (07:00 GMT)

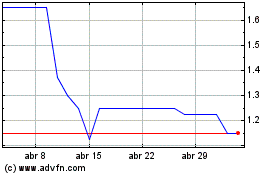

Chamberlin (LSE:CMH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Chamberlin (LSE:CMH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024