TIDMCNIC

RNS Number : 7769S

CentralNic Group PLC

18 July 2022

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU ) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ( "MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

18 July 2022

CentralNic Group plc

("CentralNic" or the "Company", or the "Group")

H1 2022 Trading Update and Notice of Results

Sixty-two per cent organic growth and upgraded FY22 outlook

CentralNic Group plc (AIM: CNIC), the global internet platform

company that derives recurring revenues selling online presence and

marketing services, is pleased to announce that the positive

trading momentum previously announced has continued and the

Company's organic growth has further accelerated during the second

quarter of 2022.

Highlights

-- H1 2022 reported revenue of USD 335m, up 92% from USD 174.7m

-- H1 2022 Adjusted EBITDA of USD 38m, up 85% from USD 20.5m

-- Organic revenue growth up to 62%

-- 30 June 2022 gross cash of $94m, up 68% from USD $56m as at 31 December 2021

-- 30 June 2022 net debt down to $65m, down 20% from USD $81m as at 31 December 2021

-- Inclusion in AIM 100 and AIM UK 50

Trading Update

The Company expects to report revenue of c.USD 335 million and

Adjusted EBITDA(1) of c.USD 38 million for the six months ending 30

June 2022, up by 92% and 85% respectively. Year-on-year pro forma

organic growth(2) for the trailing twelve months ending 30 June

2022 is c.62%. This outperformance has largely resulted from the

growth of our Online Marketing Segment, driven by increased demand

for our privacy-safe online customer acquisition services.

The Company maintained a strong balance sheet during the period,

with gross cash increasing by 68% to USD 94m(3) as at 30 June 2022

from USD 56m as at 31 December 2021, whilst Net Debt(4) decreased

by 20% to c.USD 65m as at 30 June 2022 from c.USD 81m as at 31

December 2021. Adjusted operating cash conversion continued to be

in excess of 100%.

Outlook

While the Directors remain vigilant concerning the current

global macro-economic environment, the Board has confidence that

the Group will meet at least the upper end of current market

expectations for the FY22 financial year(5) .

FTSE index inclusion

CentralNic is also pleased to announce that FTSE Russell has

recently included CentralNic Group PLC in its AIM 100 and AIM UK 50

indices for the first time. The inclusion of CentralNic within

these indices was effective from 20 June 2022.

Ben Crawford, CEO of CentralNic, said : "CentralNic has enjoyed

a strong first half of the year with year-on-year organic growth

now reaching a record 62%, a further improvement over the 53%

reported for the twelve-month period ending 31 March 2022.

CentralNic continues to deliver sustainable growth thanks to our

privacy safe solutions and the enormous scale of the market

opportunities we are addressing."

Notice of Results

The Company will publish its unaudited interim report for the

six months ending 30 June 2022 on Tuesday, 30 August 2022.

There will be a webinar / conference call for equity analysts at

9:30am BST on the day of results, hosted by CEO Ben Crawford and

CFO Michael Riedl. Anybody wishing to register should contact

Isabelle Smurfit at centralnic@secnewgate.co.uk where further

details will be provided.

Further, there will be an Investor Meet Company webinar at 1pm

BST on that date. Investors can sign up to Investor Meet Company

for free and add to meet CENTRALNIC GROUP PLC via:

https://www.investormeetcompany.com/centralnic-group-plc/register-investor

. Investors who already follow CENTRALNIC GROUP PLC on the Investor

Meet Company platform will automatically be invited.

(1) Parent, subsidiary and associate earnings before interest,

tax, depreciation, amortisation, non-cash charges and non-core

operating expenses. Non-core operating expenses include items

related primarily to acquisition, integration and other related

costs, which are not incurred as part of the underlying trading

performance of the Group, and which are therefore adjusted for, in

line with Group policy.

(2) Organic growth is calculated based on trailing twelve-month

pro-forma revenue adjusted for acquired revenue, constant currency

FX impact and non-recurring and non-cash items (c.USD 608m and

c.USD 374m for the trailing twelve months ending 30 June 2022 and

31 June 2021 respectively)

(3) Includes a net influx of c.USD 16m pertaining to the VGL

acquisition (equity and bond offering of c.USD 81m less

consideration paid net of cash acquired of c.USD 65m) whereas the

isolated net increase on Net Debt is c. USD 6m

(4) Includes gross cash, interest-bearing debt, prepaid finance

costs and Mark-To-Market (MTM) for the bond hedges of c.USD 16.6m

as of 30 June 2022 (USD 6.4m as of 31 December 2021) - MTM has

historically been reported outside of Net Debt

(5) Analyst expectations of revenue and adjusted EBITDA for the

financial year ending 31 Dec 2022 as of Sunday, 17 July 2022 range

from USD 570m to USD 603m and USD 66m to USD 70m respectively

-Ends-

For further information:

CentralNic Group Plc

Ben Crawford, Chief Executive Officer

Don Baladasan, Group Managing Director

Michael Riedl, Chief Financial Officer +44 (0) 203 388 0600

Zeus (NOMAD and Joint Broker)

Nick Cowles / Jamie Peel / James Edis

(Investment Banking) +44 (0) 161 831 1512

Dominic King (Corporate Broking) +44 (0) 203 829 5000

Berenberg (Joint Broker)

Mark Whitmore / Richard Andrews / Alix

Mecklenburg-Solodkoff +44 (0) 20 3207 7800

SEC Newgate (for Media) +44 (0) 203 757 6880

Bob Huxford / Isabelle Smurfit/ Max Richardson centralnic@secnewgate.co.uk

About CentralNic Group plc

CentralNic (AIM: CNIC) is a London-based AIM-listed company

which drives the growth of the global digital economy by developing

and managing online marketplaces allowing businesses globally to

buy subscriptions to domain names for websites and email, monetise

their websites, and acquire customers online. Its core growth

strategy is identifying and acquiring cash-generative businesses in

its industry with annuity revenue streams and exposure to growth

markets and migrating them onto the CentralNic software and

operating platforms.

For more information please visit: www.centralnicgroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFIFSEDAITLIF

(END) Dow Jones Newswires

July 18, 2022 02:00 ET (06:00 GMT)

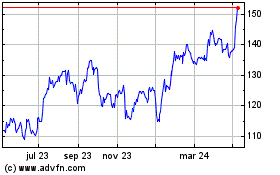

Team Internet (LSE:TIG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

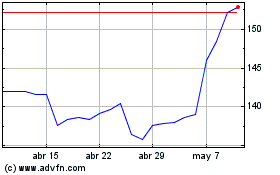

Team Internet (LSE:TIG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024