TIDMCNN

RNS Number : 7974G

Caledonian Trust PLC

31 March 2022

31 March 2022

Caledonian Trust plc

("Caledonian Trust", the "Company" or the "Group")

Unaudited interim results for the six months ended 31 December

2021

Caledonian Trust plc, the Edinburgh-based property investment

holding and development company, announces its unaudited interim

results for the six months ended 31 December 2021.

Enquiries:

Caledonian Trust plc

Douglas Lowe, Chairman and Chief Executive Officer Tel: 0131 220 0416

Mike Baynham, Finance Director Tel: 0131 220 0416

Allenby Capital Limited

(Nominated Adviser and Broker)

Nick Athanas Tel: 0203 328 5656

Alex Brearley

CHAIRMAN'S STATEMENT

Introduction

The Group made a pre-tax loss of GBP196,000 in the six months to

31 December 2021 compared with a pre-tax loss of GBP327,000 for the

same period last year. The loss per share for the six months to 31

December 2021 was 1.66p and the NAV per share as at 31 December

2021 was 206.7p compared with a loss per share of 2.77p and a NAV

per share of 201.7p last year. The Group's emphasis will continue

to be to secure, improve and realise the value in our property

portfolios.

Review of Activities

I provided a comprehensive review of activities in my December

statement accompanying our audited results for the year ended 30

June 2021.

The Group's property investment business continues, but the fit

out of the largest unit in our high yielding retail / industrial

property at Scotland Street, Glasgow, recently let to Deliveroo for

their first dark kitchen in Scotland, has been delayed pending the

installation of a new sub-station by Scottish Power Energy

Networks, which should proceed shortly. We continue to hold our

high yielding retail properties and North Castle Street offices,

four Edinburgh garages, a licensed restaurant in Alloa and our

residential site at Belford Road / Bell's Brae, Edinburgh.

St Margaret's House continues to be fully let at a nominal rent,

presently just over GBP1.50/ft(2) of occupied space, to a charity,

Edinburgh Palette, who have reconfigured and sub-let all the space

to over 200 artists, artisans and galleries. St Margaret's House

continues to maintain its high, long-term occupancy level which has

been largely unaffected by the impact of Covid-19.

We have appointed Montagu Evans to market St Margaret's House

and we plan to launch the marketing campaign next month. Already we

have extensive interest from a broad spectrum of parties in advance

of the formal market launch, including unsolicited offers.

At Brunstane the construction of the five new houses over

8,650ft(2) , in the Steading Courtyard, is progressing well with

the first house, which we will utilise as a show house, nearing

completion. We intend to commence marketing of all five houses as

soon as this house is complete and available for viewing.

Completion of the remaining four houses is expected in the

summer.

After a rather torturous planning application process we

obtained planning consent for 11 new houses over 20,500ft(2) in the

adjoining stackyard, "Upper Brunstane", at the end of January. We

are now preparing the requisite application to modify the consent

we hold for the conversion of an existing dilapidated stone

building, the farmhouse, to create two new houses over 3,100ft(2)

to fit in better with the adjoining developments.

At Wallyford we will go out to tender next month for the

construction of six detached houses and four semi-detached houses

over 13,500ft(2) and expect to commence construction this summer,

with a phased construction period over 15 months. The site lies

within 400m of the East Coast mainline station, is near the A1/A720

City Bypass junction and is contiguous with a completed development

of houses. Taylor Wimpey have completed the construction of over

500 houses nearby but on the other side of the mainline railway. On

the southern edge of Wallyford a very large development of around

2,000 houses has commenced at St Clements Wells on ground rising to

the south, affording extensive views over the Forth estuary to

Fife, and, on the eastern edge, Persimmon have completed a

development of 131 houses. On an adjacent site Taylor Wimpey have

completed 80 houses and have commenced work on their next site of

141 houses with four bedroom detached houses being marketed at

GBP273-GBP295/ft(2) . On the western side of St Clements Wells,

Barratts have sold all of the 245 three and four-bedroom houses in

Phase 1 and are currently building 106 three and four bedroom

houses in Phase 2 of the St Clements Wells site and 141 three and

four bedroom houses on the first phase of the adjoining site, St

Clements View. The Master Plan for the St Clements Wells

development includes a primary school and a separate nursery and

community facility, both of which opened in 2020, and a new

secondary school on an adjacent site which is under construction.

Planning consent in principle has been granted for another 600-800

new houses on the adjacent Dolphingstone site to the South-East.

Wallyford, no longer a mining village, is rapidly becoming another

leafy commuting Edinburgh suburb on the fertile East Lothian

coastal strip.

Economic Prospects

The UK's economic prospects now depend on the course of and the

effect of the two wars convulsing much of the western world: the

Russian military invasion of Ukraine, and the western economic

attack on Russia. Before these two separate shocks the UK economy

had recovered to the pre-Covid level, having grown 10.1% in the

twelve months ended 31 January 2022 and the National Institute of

Economic and Social Research (NIESR) forecasts growth of 1.3% in

Q1, 4.8% in 2022 and then in 2023 a return to the pre-Covid growth

rate of "well below" 2%. On such a forecast output would be around

4% lower in 2025 than was forecast in 2020 pre-Covid, resulting in

GBP5,500 of activity per person having been lost (compared to

forecast) over about two years! After this "one-off" loss of output

the future pattern of growth was expected to return to the

pre-Covid level. In contrast the growth pattern prior to the 2007

Great Recession and the ensuing financial crisis did not recover

and subsequent growth was at a lower level than before the Great

Recession. The growth forecasts were made, notwithstanding NIESR's

expected rise of inflation to 7% in the second quarter of 2022,

resulting in four interest rate rises, but with inflation falling

below 5% by 2023 and to the 2% target in 2024.

The possible economic consequences of the Russian invasion vary

widely. Fortunately, neither of these wars will cause a dramatic

change to the world economy or to the UK economy. Surprisingly,

regional wars, such as have occurred in Afghanistan, Syria, Iraq,

Vietnam and Korea have not impacted seriously on remote or

noncombative economies, while the effect of localised wars such as

in Kuwait and Libya has been even more contained.

The economic damage to adjacent economies and to the world

economy depends on the progress of the Ukraine war whose progress

had several scenarios. Initially, the most likely scenario, with

the least damaging economic implications, was that there would be a

successful multi-pronged Panzer type blitzkrieg. Armoured columns

would advance rapidly over the plains - in Army parlance "good tank

country" - typical of much of Ukraine, one of the world's major

wheat producers, immediately after strikes had disabled Ukraine's

command and control centres and destroyed its aircraft and air

defence systems. Infrastructure, including roads and, particularly,

bridges would have been left intact to facilitate the weakly

opposed advance of the Russian armoured battle groups which would

quickly reach and occupy key cities, especially Kyiv. Following

such an occupation President Zelensky, if not detained, would flee

to Western Ukraine, or abroad and establish a government in exile.

A pro-Russian puppet regime would be set up in Kyiv. Then, Russia

would declare "liberation", withdraw its assault troops, leaving

garrisons but establishing extensive "security systems". Ukraine,

like Belarus, would become a client state of Russia, and while

there would be dire economic consequences for Ukraine, they would

be minimal elsewhere once any necessary supply adjustments have

been made.

Now a more likely scenario is of a "long war", the "blitzkrieg"

having failed as air supremacy is not obtained; Russian supply

lines are too outstretched; roads are obstructed by wreckage and

bridges blown; deep unsupported armoured penetration leaves flanks

exposed; and the quality of the Russian equipment, troops and

leadership is poor. In contrast, Ukraine's opposition is robust and

morale is reportedly high, and its troops are battle hardened from

the eastern conflict, have local support and are well supplied with

food, fuel and, at present, armaments, including, crucially, the

UK's NLAW and Javelin anti-armour missiles, Bayraktar TB2 drones

and Stinger anti-aircraft missiles. Unfortunately, however, while

Ukrainian resilience has exposed severe Russian qualitative

defects, such defects can be circumvented, as Stalin said,

"Quantity has a quality of its own". Russian "quantity" is

sufficient to suffer the losses required to bring the battle to its

key objectives, the cities, Kyiv in particular. If this occurs, and

consequently the resistance is concentrated in built-up and other

areas offering close cover and shelter from armoured vehicles, then

the outcome could be a long stalemate. Such a stalemate would be

broken only if, as seems likely, based on Russian strategy in Syria

and Chechnya, Russia employs military tactics to raze the cities or

thermobaric or even chemical weapons to annihilate the population.

If the cities were so destroyed the conflict would almost certainly

revert to widespread insurgency which, if supported internally and

externally, would permanently hold down much of the Russian army.

While little of the Ukraine terrain is favourable for an Afghan

type insurgency, the type and

quality of the available defensive weapons is more favourable as

are the re-supply routes on broad and varied boundaries. The

economic damage to Ukraine of a long war would be wider and persist

longer but there would be minimal additional damage to most

external economies.

Other scenarios, widening the scope of the conflict, would

result in greater economic damage, the extent varying widely. The

least serious economic damage would arise from an occupation of

other, but non-NATO, countries such as Moldova or Georgia, and the

most serious would be an attack on a NATO country such as

Lithuania, possibly to secure the Suwalki corridor to the Russian

enclave on the Baltic Sea and the port of Kaliningrad. Such attacks

could be construed as responses to the supply of arms to Ukraine or

in response to a "false flag" incident. Additionally, a

miscalculation and an escalation might follow a border incident,

leading to a wider war. Similarly, any involvement of NATO,

including a no-fly zone, could escalate into a wider war, but the

NATO countries appear steadfast in their resolve not to enter the

hostilities. The chaos, destruction and severe economic damage of a

wider war will, we all hope, be avoided.

A long war against insurgents, such as might present Russia in

Ukraine, has long established unfavourable precedents, including,

interestingly, the attempted Roman conquest of Scotland. Tacitus,

writing of his father-in-law's "set-piece" victory over the

Caledonii in AD83 near the Moray Firth, quotes the defeated

chieftain, Calgacus, "to ravage, to slaughter, to usurp under false

titles, they call empire; and where they make a desert, they call

it peace". A peace never endured as the distance, the culture and

the climate ensured that the Romans never overcame the subsequent

insurgency to command Scotland and thus Scotland never became part

of the Roman empire.

Much later analogies include Vietnam, and, in more similar

circumstances, the insurgency in Algeria between 1954 and 1962

which ground down the much superior French army and so sapped the

political will in France that the French withdrew. Similarly, an

occupation of Ukraine, apart from predominantly Russian areas,

would be faced with an effective, well-motivated and widely

supported armed insurgency. The starkest reminder of the likely

outcome of such an insurgency war is starkly evident in the

experiences in Afghanistan of the recent allied forces, the Russian

army before them and the British colonial forces all of whom, bowed

and bloodied, eventually left.

The likely consequences of losing such an insurgency war will

reinforce Putin's fear of the inauspicious precedent of the

downfall of a previous Russian autocrat, the final Russian Tsar,

Nicholas II. His defeat in the Japanese war in 1905 provided a

tripwire for the Bolshevik Revolution in which he lost not only his

crown but his life. The Tsar's tripwire may have been on a long

fuse, as was President Mugabe's of Zimbabwe and President Maduro's

of Venezuela, but detonation can be immediate as it was with

Presidents Mubarak of Egypt and Zine el-Abidine of Tunisia in 2011.

A long insurgency war would be a significant risk for a personality

cult leader like Putin, already weakened by the absolute failure of

the Blitzkrieg in Ukraine and the conduct of the war, including its

very heavy casualties. Professor Friedman of Kings College suggests

Putin may already have "tripped" the wire: "It is now as likely

that there will be regime change in Moscow as in Kyiv", but there

may be a long fuse. The most damaging option would be for Putin to

conclude like Lady Macbeth: "I am in blood / Stepped in so far,

that, should I wade no more, / Returning were as tedious as go

o'er".

Alternatively, as a long war morphing into a continuing bloody

insurgency would result in a "hurting stalemate". Putin, until now

a consummate strategist, may judge that the lesser of two evils

would be to build a "bridge out": a political settlement, and seek

an agreement disliked by both sides, but better than the

alternative. Such an agreement would encompass: no NATO

participation; ceding Crimea; ceding parts of the Donbas;

withdrawal of Russian troops; Ukrainian independence; and rights to

join the EU, or at least continue economic ties with Western

Europe!

I consider a diplomatic solution as the most likely outcome of

the military war, but, if the military war continues to be

restricted geographically, it is likely there would be minimal

effects on the non-combatants and the world economies. However, an

important, and more enduring, effect on the UK economy would be the

second ongoing war, the economic war against Russia.

The military war has caused an antithetical view of the value of

the relationship with Russia. Previously, while certain moral and

political differences were deplored, it was considered that in the

long-term co-operation, consideration and concession would align

such differences to mutual advantage: Putin was fêted; the

oligarchs were welcomed; and new trade deals on which our economies

now depend were agreed. Subsequently, many aspects of Russian

intentions and behaviour, precisely the same, while previously

interpreted as one "image", became instantly interpreted as a

contrary "image". A key example of such an illusion is the

ambiguous image presented equally as of an old lady or of a young

woman, a situation described as "perceptual rivalry" in which,

while the whole image is exposed to vision, key aspects only of the

image reaching the brain are accepted and used by the brain to

interpret a whole: in evolutionary terms, a wonderfully adaptive

rapid response mechanism - a few stripes are instantly interpreted

as a predatory tiger! However, the same image when different key

aspects are accepted by the brain is interpreted as a different

whole: the young woman is replaced by an old woman. The Russian

"image" has undergone such a comparable switch from benign

companion to malign witch: a realisation encapsulated in the

vernacular: "we was conned", or, as more tactfully put by the FT,

our vision has changed from "A dictatorship of spin to one of

fear".

The benign companion "came out" in 1989, the debut marked by the

fall of the Berlin Wall. The demolition of this totem of

isolationism resulted from the policies introduced by Mikhail

Gorbachev in response to the increasingly growing and obvious

difference in performance of the Western and Soviet economies,

highlighted by

the 1986 Chernobyl nuclear disaster. Gorbachev's policies of Glasnost "openness" and Perestroika "restructuring" were designed to galvanise the economy and transform society, changes marked by the introduction of the elected Congress of People's Deputies. The resulting economic reforms, wholly at variance with Russian culture and its existing institutions, led to a severe economic contraction, huge government deficits and rampant inflation, particularly in respect of food, which formed a high percentage of expenditure for a large proportion of the population. The consequent unrest in impoverished and other sections of society was reinforced by opposition from the Russian communist bureaucracy whose power had been sapped by newly elected Congress, fatally wounding the controlling Communist Party and undermining its power throughout all the Soviet Republics. Ukraine brought these discordant actions to a head by calling an independence referendum in 1991 in which the turnout was 84% and the vote in favour was over 90%, a majority varying from 54% in Crimea to 80% in Donetsk and other eastern regions and over 95% in Kyiv and western districts. The then US ambassador in Moscow, Robert Strauss, advised Washington - "the most revolutionary event of 1991 for Russia may not be the collapse of Communism, but the loss of something Russians of all political stripes think of as part of their own body politic, and near to the heart at that: Ukraine."

Starting with Glasnost, Western policy towards Russia became

more and more accommodative, even as Russian policy under Putin

reversed Gorbachev's policies, particularly latterly with Germany

where Angela Merkel, brought up in East Germany, was fluent in

Russian. Taubman, Gorbachev's biographer says:-

"Russian President Vladimir Putin has been a vocal critic. When

Putin says that the collapse of the Soviet Union was the greatest

geo-political catastrophe of the 20(th) century, he is indicting

Gorbachev as the man he blames for that collapse," Taubman says,

"Everything that Gorbachev did, Putin is in effect reversing".

Of the western powers, Germany continued to view Russia

particularly favourably, a policy of which the UK Ambassador, Sir

Paul Lever, said:-

"The German attitude is that trade is the key to harmonious

relations and should not be threatened, no matter how vilely China

or Russia behaves towards its own people. It is a genuine

principle, but also, of course, self-serving."

Such a view is succinctly put in the German catchphrase "Wandel

durch Handel" - change through trade.

The war in Ukraine has focused attention on the perception of

Russia's image where the benign has been replaced by the malign.

Symptomatic of such a reversal is the standing of Russian oligarchs

who, until now, were honoured, fêted and, at times, revered

throughout UK society, but who are now outcast. The sanctions

imposed on these individuals are among, although a small part of,

the vast range of economic sanctions agreed by the Western

economies, with worldwide support, at short notice. The oligarchs'

sanctions have the benefit of being "high profile", politically

advantageous and relatively costless, but their efficacy is

doubtful. The cost to the oligarchs may be high, but for the

majority will represent only a tolerable portion of their wealth.

More importantly, what political influence do they carry?

Certainly, they do not control the political parties, the security

services or the armed forces - indeed they have fled the more

austere "Mother Russia" for the "hedonist" West. Possessions for

Putin rank lower than politics, power and posterity. Such

sanctions may prove no more than expensive irritations.

But will such economic warfare "work" or are these, like the

sanctions on oligarchs, more a kneejerk reaction. The key questions

are: what effect will they have on the Russian economy; what

influence will that have on Russian policy; what will the cost be

to the Western economies, the UK's economy in particular; and are

they worth it? That there has been an immediate effect on the

Russian economy is evident by the rise in interest rates to 20%,

the 25% devaluation of the rouble and the immediate shortage of

goods. However, the extensive withdrawal of Western companies has

aspects of "tokenism" as often replacements, of at least some sort,

seem to become available: surely the meat sources for "McDonalds"

are still available! The effect of the inhibition on international

banking access and the extensive denial of certain financial

services is uncertain, as traders often create substitutive

arrangements and facilities may open with China or others. Oil and

commodity sanctions seem most damaging but, patently, the cost to

the sanctioners would be very high (German gas!) but, as most

commodities are traded worldwide, piped gas largely excluded, often

only the customer would change. However, the sanctions will have an

important economic effect and, consequent to the sanctions

announced by 9 March 2022, Capital Economics forecast an 8% fall in

Russian GDP followed by economic stagnation.

The influence of sanctions on Russian policy, whatever their

extent, is uncertain. First, sanctions generally have been poor

weapons with results, if and when achieved, taking a long time.

Second, in the specific conditions in Russia sanctions might be

counterproductive as the centrally controlled media might credibly

portray the West as being responsible for any resulting suffering,

particularly, as for many, there continues to be an unswerving

loyalty to the incumbent "Tsar". In addition, there is a culture in

times of crisis of "suffering" for "Mother Russia", a reaction

which might imitate a London "blitz" type spirit. There will be

opposition, there will be local objections and some general unrest,

but it seems likely that only a long and / or deep period of

economic stress would have significant political influence.

In the UK's case the answers seem clearer. The economic war will

be expensive for the UK economy and the expense, while varying with

the length of that war, is likely to leave a long deleterious

trail. The costs of the economic war are difficult to disentangle

from the costs of the invasive war, but analysts, quoted in the

Financial Times, recognise them, if only in general terms:-

"The longer the war lasts and the greater the sanctions on

Russia are, the greater the hit to UK activity".

While the cost of sanctions is presently obscure, it is

self-evident that some sanctions have a great impact at little cost

while others have little impact but at great cost: the former

should be maximised and the latter minimised.

The wars will increase the inflation inherent in the recovery of

the economy and which, as measured by the financial markets, is

expected to average more than 5% over the next five years and,

whereas the Bank in February expected inflation to peak at 7% in

April, Goldman Sachs now expects 9.5% in October 2022 and over 7%

until Spring 2023. Overall, the cost of the invasive war is

estimated to be moderate with the UK 2022 growth forecast reduced

by 0.8% points to 4.0%. The effects of the war on other economies

varies with geographical and trade separation and, thus, while US

growth is only forecast to be 0.1% lower, the EU's growth,

including Germany, most closely tied to Russia, is forecast to be

1.0% lower! I regard these forecasts likely to be tempered by

optimism bias, as at the commencement of the World War I - "the war

will be over by Christmas"!

Before the war, the Bank of England had forecast the largest

squeeze on living standards in 30 years to occur in 2022, primarily

as a result of inflation, particularly of fuel costs, both directly

and indirectly throughout the economy, a squeeze which will be

greatly exacerbated by the further increase expected on both fuel

and food prices caused by the military and economic wars. Such

increases will reduce discretionary consumer spending, a key

element of forecast GDP growth, such that the British Chamber of

Commerce reduced its forecast of consumer spending growth in 2022

from 6.9% to 4.4%.

Business investment will be reduced due to higher interest rates

and the current high risk of unfavourable market conditions, and

these inhibitions will similarly affect consumer capital

expenditure, particularly for houses. These external influences

weigh particularly heavily on the UK as it lacks the "normal" level

of compensatory internal offset of increased growth engendered by

higher productivity. There is no single identifiable cause for the

UK's slow growth in productivity but the rigidity of the UK's

economic structures, the unnecessary regulation, the extensive

range of organisations profiting from distributive coalitions,

oligopolies, including some professions, and the continuing policy

errors of politicians, and Government agencies all contribute

adversely to it. In such adversity, Scotland should enjoy an

unexpected economic benefit from the resurgence of the oil and gas

industry - a sensible reversal as the source of the energy consumed

is unrelated to "green" aspirations.

I conclude that within a very wide spectrum of possible outcomes

the "wars" and their likely outcomes will reduce UK economic growth

by less than two percentage points: a good forecast in difficult

circumstances, but one subject to an unusually high degree of

error.

Property Prospects

I reviewed property prospects comprehensively in my statement to

30 June 2021 based on forecasts made in the autumn. By December

2021 the forecast returns for 2021 had improved very considerably

over the forecasts made only three months earlier. The Investment

Property Forum (IPF) All Property return for 2021, previously

forecast at 6.9%, is now estimated at 11.0%, due primarily to an

outstanding estimate of a 24.5% return for Industrials compared to

the earlier forecast of 16.4% - itself an outstanding return - and

of 15.8% for Retail Warehouses as opposed to "only" 8.4% with

improved estimates in all other sectors, including Standard Retail

and Shopping Centres where the "negative" returns were reduced.

Since then, the rapid economic recovery has continued and GDP had

recovered to the pre-pandemic 2020 level in late 2021 and has grown

a further 1.1% in the months to February 2022.

The continued improvement is reflected in improved IPF forecast

returns for 2022 compared to previous estimates. The All Property

return for 2022 is now forecast at 8.6% compared to 7.4% earlier,

primarily due to an upward revisal of Industrial returns to 12.3%,

a significant forecast return for 2022, but small compared to the

estimated 2021 returns of over 20%, together with small upward

revisals to Office returns, but with little overall change of

forecast in the Retail sector where Retail Warehouse returns were

forecast to improve, but Standard Retail and Shopping Centre

returns were forecast to fall slightly.

Forecasts for 2023 and subsequent years are very little changed

and show All Property returns averaging 6.0%, but for Industrials

and Retail Warehouses are higher at 7.0% and lower for Standard

Retail and Shopping Centres at 4.5%. The limited net return on

these retail sectors reflects a persistent small decline in capital

value.

The IPF forecasts are based on the mean of 20 forecasts whose

individual forecasts are widely dispersed. Colliers provides

comprehensive forecasts which, interestingly, as there is no

averaging, are very similar to the IPF means. Colliers also provide

wide ranging reports, some of exceptional interest. For example,

they report that in 2021 the All Property return was 16.5%, a six

year high, due primarily to an Industrial return of 36.4% and a

Retail Warehouse return of 21.9%. The exceptional returns from

Industrials result from the demand for storage and distribution

centres for "online" shopping, accounting for 29.1% of all

retailing in 2021, up from 19.2% in 2019 before the Covid

pandemic.

The mirror image of a rise in online sales has been a fall in

offline sales indirectly responsible for the significant fall in

retail values. The retail sales fall was exacerbated by "lockdown",

tourist restrictions and Work from Home ("WFH"), all of which

restrictions are now easing, although WFH seems likely to continue

but at a much lower frequency. Almost all the above restrictions to

Retail sales will be lifted shortly.

Colliers suggest that online sales outlets may increasingly

switch to offline collections, including presumably, some retail

locations, due to increased costs. They cite higher labour costs,

HGV driver shortage and rising fuel costs as likely to increase

delivery charges and make online prices less competitive, giving an

incentive to switch online deliveries to retail type locations. I

observed in December that some online sales may be loss leaders as

return rates on many fashion items (75% is reported anecdotally)

are so high that return, repackaging and wastage costs may make

some sales uneconomic. Online sales and retail premises will

benefit from any resulting changes.

The rate of decline in the number of retail traders has greatly

reduced and the uptake of retail premises, especially for goods and

services that cannot be delivered or delivered easily online, has

greatly increased. In 2021 retail openings rose 10.5% to 43,167

while closures rose 1.4% to 51,069, a net loss of 7,902 units

compared to 11,319 in 2020.

The type of shops opening and closing are not representative of

the previously existing stock as a change is taking place in the

type and ownership of shops. In 2021 10,059 net multiples closed

and 2,157 net independents opened. The main sectors expanding (net)

are in personal services: Barbers 545; Fast Food 508; Beauty 266;

Nail 149; and "convenience": cafes, tearooms, bars, ice cream

parlours, pizzerias and restaurants. The main sectors closing (net)

are primarily now increasingly trading "online": Banks 734, Bookies

403, Estate Agents 293, Travel Agents 374 and Recruitment Agents

289; and secondarily comparison shops such as fashion; charity

clothes - women; and, separately, public houses and inns.

The trend to fewer closures seems likely to continue - how many

banks and similar premises remain to be closed?; - while the demand

for convenience openings should grow with income, demographic

change and habit, such habits extending both down and up the age

groups; and the return to more office working and to more extensive

leisure activity. Two other factors reinforce the likely retail

premises recovery: rent reductions of around 20% have occurred

reducing retailers' costs and rates and other concessions seem

possible, if not even likely, and there is a growing ambition,

shared by private owners and local authorities, to revitalise, to

redecorate and to repurpose the high street. Local Data Company

forecast a "burgeoning recovery" with significant growth in

Leisure, Food and Beverage; stabilised rents on traditional leases;

and increased involvement in the community by retailers and

increased support for such retailers by the community, so

modernising and revitalising the high street and increasing demand.

Thus, the retail market will turn but such a turn, unlike the

yacht's rapid gybe of the industrial market, will be the tanker's

slow turn.

The anomalously high rise in house prices that I reported in

December 2021 has continued. In the year to February 2022 rises

were reported by the Halifax as 10.8%; Nationwide 12.6%; Acadata

(E&W) 6.9%; and Acadata (Scotland) 7.6%. In the most recent

three months this 12-month high rate has continued and the Halifax

index increased by an annualised three-month rate of 7.2% and the

Nationwide by an unexplained and very high 14.4%. The Halifax and

Nationwide prices as "standardised" are seasonally adjusted - in

this case upwards, because actual prices normally fall in the

winter - and their indices are not comparable with the Acadata

indices which are not seasonally adjusted. The Acadata E&W

three-month price rise annualised (and not seasonally adjusted up!)

was an astonishing 18.4% but in Scotland a more reasonable

6.0%.

In its February 2022 report the Halifax comments: "house prices

rise at fastest annual pace since 2007 to reach record high...".

"The biggest one-year cash rise in over 39 years of the index

history". The index rose 10.8% with the highest rises of 13% in

outlying areas: Wales, SW England and Northern Ireland and with the

lowest rise of 5.0% in London. The Halifax states "these areas

benefit from more rural scenic living". In Scotland prices rose 9%,

the lowest rise apart from London. The Nationwide also reports

record price rises: "the largest ever annual increase in cash terms

since the start of our monthly index in 1991" due to "robust demand

and limited stock of homes on the market".

The Acadata (E&W) survey highlights a real movement from

"rural living" back to "Greater London and the South East [in the]

top four areas of growth". This is emphasised by the price rise in

Runnymede (Magna Carta!) on the Thames with an annual rise of 50.4%

in detached houses (but -14.1% in flats!) and 35.2% overall. The

Acadata Scotland survey says the average price "sets a new record

level for the eighth time in the last 12 months". The survey

highlights the "race for space" due to the "effects of the pandemic

and lifestyle changes" and comments that "the Lothians [were] the

top three in terms of price growth..." [giving] homes with plenty

of space outside Edinburgh City Centre, but within commuting

distance of the capital" .... Perhaps a "Scottymede" on the Forth?

at a fraction of the price!

Comprehensive forecasts for house prices are given by Savills,

but, as the latest forecasts were published in November 2021, they

do not reflect the current circumstances prospectively so changed

since then and say "we await to see how the market and the broader

economy react to the Omicron variant".

Industry comments on price changes are guarded: Lloyds Bank

consider growth will be "flatter" at 1%, due to interest rate rises

and "further financial strains in households", and Rightmove

consider the "asking price... will rise next year by 5% which will

mean an increase of about GBP17,000". RICS "predicts that house

prices could end up 3-5% higher in 2022 as higher borrowing costs

will dampen demand..." offset by "inventory back close to historic

lows". Separately, the Office for Budget Responsibility (OBR)

"expect demand to ease over the next year due to a fall in real

incomes and a rise in interest rates, causing house prices to slow

to around 1% by late 2023".

Comments on future average house price rises often consider the

effects of the ending of the Covid pandemic on the distribution of

house price changes as a result of a change back - i.e. from "rural

living to city dwelling", a trend Acadata reports is already

occurring in England's SE market.

The main immediate determinant of house prices will be the

changes underway in the economy. Such changes arise first from the

unprecedented return of demand as the economy, recovering from the

restrictions imposed to obviate the health catastrophe, encounters

supply shortages primarily caused by the short-term inelasticity of

supply. The recent inflation is due to short-term supply shortages

rather than excess demand. Unfortunately, such price rises, large

in themselves, will be eclipsed by the even more significant rises

already being caused by the war in Ukraine - see for instance the

over 100% rise in wheat prices - and these price rises which will

extend the longer the conflicts continue.

While the economy at present is growing strongly, growth will

depend on the impact of the projected inflationary rises. As the

inflation is not caused primarily by excess demand or 1970s type

labour cost rises, raising interest rates other than to preserve

the image and culture of inflation control to avoid a cultural

acceptance of inflation is disadvantageous: monetary policy should

be maintained "loose" as is allowed in the Bank's mandate under

such exceptional conditions. Similarly, fiscal policy should also

be kept loose to offset some of the price effect on demand. The

economic failure of fiscal policy following the 2007 Great

Recession should not be repeated: that mistaken austerity programme

proved a disaster.

Thus, I forecast that both monetary and fiscal policy will be

accommodative to at least some extent and that interest rates will

not rise above 3%. However, even such a level, low by historical

standards will have a significant influence on demand for houses in

two respects. Mortgage costs will reduce demand which will be

further artificially restricted by The Mortgage Market Review rules

governing the borrowing capacity.

I conclude that the current house price boom will not continue.

I forecast that over the short-term prices will fall in real terms

but in money terms will, on average at least, be stable until the

current crisis passes. However, in the long term the major

determinant of prices will be supply, primarily land supply. The

land supply is determined by centrally set rules and regulations

based on social and political objectives, interpreted locally,

which invariably restricts the supply of land, raising its price.

These supply restrictions are deeply entrenched and closely guarded

with considerable political influence and thus, without

equivocation, I repeat my forecast: "the key determinant of the

long-term housing market will be a shortage of supply, resulting in

higher prices".

Conclusion

Two years ago I concluded:

"I believe that the measures to reduce the spread of Covid-19

will inflict an unprecedented shock to the economy, possibly

resulting in an unprecedented 20% short term economic

contraction.

Evidence from countries subject to similar measures shows that

the measures now being adopted, primarily "lock down" (as in

medieval Italy), bring a rapid stabilisation in the numbers of new

infections within 4 - 6 weeks. Thereafter stricter quarantine

measures, extensive testing - equipment will become available for

this - higher NHS capacity, potentially the effect of higher

daytime temperatures and UV levels, better personal hygiene and the

use of existing or the discovery of new drugs and vaccines should

allow the rates of infection and mortality rate to fall. All the

time the proportion of the population immune to the disease will

rise, reducing the propagation rate of the disease for any given

circumstances. Like "true" influenza, it will become a continuing

endemic disease, but one no longer influencing the economy.

The release of or a qualified use of "lockdown" will provide an

immediate upsurge in the UK economy, but it is unlikely to recover

immediately more than 80% of the "lost" ground. It is the estimate

of rate of recovery of the balance of GDP that is subject to a very

wide margin of error. The delay to the return to the present level

of GDP will be determined by the damage to the supply side of the

economy by the current pre-emptive slow down. Recessions normally

impair the demand side of the economy - squeezing inflation, making

credit expensive and sometimes unobtainable even for the

creditworthy. The current and proposed government measures seem

likely to support demand. My current forecast for a full recovery

in GDP is within two years". The 2020 forecast has proved

apposite.

Last year I forecast the long-term cost to the economy to be

equivalent to about two years of normal 1.5% growth, say 3%, and

that this gap would not be made-up or closed by increased output

above the normal 1.5% p.a. It would be a permanent "scar" due to

damage to the supply side of the economy, in contrast to "normal"

recessions induced by measures that bear primarily on the demand

side of the economy. The current NIESR estimate is for a long-term

loss of about 4% to the economy as the economy, prior to the

Ukraine war, was expected, having completed its recovery in 2022,

to return to the pre-Covid rate of growth of "well below 2.0%".

This is an economic analysis: I hold as implicit moral

repugnance, indignation and outrage. I note with horror the

similarity of Putin's to Adolf Hitler's rise and progressive

autocratic control, a process noted by Robert Kagan "as often has

been the case in other countries where fascist leaders arise, their

would-be opponents are paralysed in confusion and amazement at this

charismatic authoritarian leader".

The war in Ukraine has pre-empted all previous economic

forecasts, the chief variables being the length of the wars and the

extent of the adverse effect of the economic war, currently greatly

underestimated, and the measures taken to counter these adverse

variables. Suitable UK accommodative monetary and fiscal measures

could ameliorate their effects considerably.

The Ukraine war is the latest in a series of deleterious

influences on the UK economy, or paraphrasing Alan Bennett's The

History Boys, "Economics is just one damned thing after another".

Certainly, this is the latest in a series starting with the 2007

Great Recession, the 2014 Independence Referendum, the 2016 Brexit

decision and the 2020 Covid pandemic. More importantly, cumulative

incurred losses have not been recovered subsequently by increased

productivity, which has not reverted to the level obtained prior to

2007 of about 2.25%. Since 2015/16 productivity has increased 4.9%

over six years or 0.8%pa.

Productivity has been about 1.5 percentage points below the

2007/8 level which, had it been maintained at that level, would

have resulted in output now being around 25% higher than current

estimates. In its analysis the NIESR concludes:-

"The UK has one of the poorest productivity performances among

the OECD's 38 advanced economies and this has been made worse by

Covid-19. If policymakers return to the same economic structures

post-pandemic that failed to resolve the productivity problem

pre-pandemic, then the UK is set for another decade of a

low-growth, low-productivity and low-wage economy".

Of this Mark Wolf says "The biggest problem for the UK remains

its dismal underlying productivity growth". This is dramatically

illustrated by the NIESR's recent analysis of Public Sector

productivity - where it says: "inputs rising by 19% since 2019 and

output by only about half that", or a reduction of 8%.

Covid-19 and the lockdown measures have adversely affected the

Group, directly and indirectly. Our property investment business

has only suffered mildly as the smaller businesses tenanting our

properties have proved resilient and have not been so affected by

the inroads made by online ordering. The principal adverse effect

on the Group has been the grave uncertainty that teaching formats

and travel has had, until very recently, on University entrance

rolls and rental collection from student accommodation. Such

uncertainty had caused the widespread postponement of securing

further student accommodation and has resulted in delays to the

sale of St. Margaret's House. However, recent market information is

that university UCAS clearing applications are at record numbers

and that demand for purpose-built accommodation for students

continues to increase.

Market conditions improved in late 2021 and an extensive

pre-sale preparation programme for St. Margaret's House was nearly

complete in December, but given new Covid restrictions and the

effect of the imminent holiday season the proposed marketing was

delayed then until February 2022 when, acting on Agents advice on

the type of enquiries being informally received, we determined to

improve and simplify the pre-sale conditions in order to obviate or

at least reduce the likelihood of a "false finish" as had occurred

previously.

The very successful prices achieved at Brunstane and the

strength of the housing market, especially for large family homes

which, as a result of the pandemic, has spread out to wider

commuting areas and is enabling us to extend our development

programme.

The first house in the Steading phase of the Brunstane

development is expected to be available for viewing in April and

marketing of the five houses will commence then with prices

expected to be over GBP370/ft(2) . Planning consent for the next 11

houses in Upper Brunstane has recently been gained and we are

endeavouring to bring this development forward to follow the

Steading development.

The 10-house site at Wallyford has been redesigned and a site

start is expected in the summer. Further work has been commenced on

the 20 flat site at Belford Road, Edinburgh where discussions

continue on a planning variation which would improve its design and

amenity and meet enhanced modern market requirements. Work is also

taking place on other sites to allow a sequential development

programme.

For some years I have concluded:

"In our existing portfolio, most development properties are

valued at cost, usually based on existing use, and when these sites

are developed or sold, I expect their considerable upside will be

realised. Some investment properties also have considerable

development value, as we expect to realise at St Margaret's." I am

confident that these expectations are now being realised.

I D LOWE

Chairman

31 March 2022

Caledonian Trust PLC

Registered Number 01040126

Consolidated income statement for the six months ended 31

December 2021

__________________________________________________________________________________

Note 6 months 6 months Year

ended ended ended

31 Dec 31 Dec 30 Jun

2021 2020 2021

GBP000 GBP000 GBP000

Revenue

Revenue from development property

sales - 947 4,186

Gross rental income from investment

properties 167 193 368

---------------- ---------------- --------------------

Total Revenue 167 1,140 4,554

Cost of development property

sales - (787) (3,930)

Impairment adjustment on development - (165) -

property

Property charges (47) (56) (128)

---------------- ---------------- --------------------

Cost of Sales (47) (1,008) (4,058)

---------------- ---------------- --------------------

Gross Profit 120 132 496

Administrative expenses (254) (233) (440)

Other income - 6 2

---------------- ---------------- --------------------

Net operating (loss)/profit

before investment property

disposals and valuation movements

(134) (95) 58

---------------- ---------------- --------------------

Valuation gains on investment

properties 5 - - 690

Valuation losses on investment

properties

Loss on sale on sale of investment - (165) -

property 5 - - (151)

---------------- ---------------- --------------------

Net (losses)/gains on investment

properties - (165) 539

---------------- ---------------- --------------------

Operating (loss)/profit (134) (260) 597

---------------- ---------------- --------------------

Financial expenses (62) (67) (137)

---------------- ---------------- --------------------

Net financing costs (62) (67) (137)

---------------- ---------------- --------------------

(Loss)/profit before taxation (196) (327) 460

Income tax 6 - - -

(Loss)/profit and total comprehensive

income

for the financial period attributable

to equity

holders of the parent Company (196) (327) 460

(Loss)/profit per share

Basic and diluted (loss)/profit

per share (pence) 7 (1.66p) (2.77p) 3.90p

Caledonian Trust PLC

Registered Number 01040126

Consolidated statement of changes in equity as at 31 December

2021

__________________________________________________________________________________

Share Capital Share Retained Total

Capital redemption premium earnings

reserve account

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 July 2021 2,357 175 2,745 19,278 24,555

Loss and total

comprehensive expenditure

for the period - - - (196) (196)

At 31 December 2021 2,357 175 2,745 19,082 24,359

At 1 July 2020 2,357 175 2,745 18,818 24,095

Loss and total

comprehensive expenditure

for the period - - - (327) (327)

At 31 December 2020 2,357 175 2,745 18,491 23,768

At 1 July 2020 2,357 175 2,745 18,818 24,095

Profit and total

comprehensive income

for the period - - - 460 460

At 30 June 2021 2,357 175 2,745 19,278 24,555

Caledonian Trust PLC

Registered Number 01040126

Consolidated balance sheet as at 31 December 2021

__________________________________________________________________________________

31 Dec 31 Dec 30 Jun

2021 2020 2021

Note GBP000 GBP000 GBP000

Non-current assets

Investment property 8 17,110 17,555 17,110

Plant and equipment 11 10 3

Investments 1 1 1

Total non-current assets 17,122 17,566 17,114

Current assets

Trading properties 9,896 12,146 9,313

Trade and other receivables 121 150 135

Cash and cash equivalents 2,322 62 3,020

Total current assets 12,339 12,358 12,468

Total assets 29,461 29,924 29,582

Current liabilities

Trade and other payables (722) (1,206) (647)

Interest bearing loans and

borrowings (360) (830) (360)

Total current liabilities (1,082) (2,036) (1,007)

Non-current liabilities

Interest bearing loans and

borrowing (4,020) (4,120) (4,020)

Total liabilities (5,102) (6,156) (5,027)

Net assets 24,359 23,768 24,555

Equity

Issued share capital 10 2,357 2,357 2,357

Capital redemption reserve 175 175 175

Share premium account 2,745 2,745 2,745

Retained earnings 19,082 18,491 19,278

----------------- ----------------- --------------

Total equity attributable

to equity

holders of the parent Company 24,359 23,768 24,555

NET ASSET VALUE PER SHARE 206.7p 201.7p 208.4p

Caledonian Trust PLC

Registered Number 01040126

Consolidated cash flow statement for the six months ended 31

December 2021

__________________________________________________________________________________

6 months 6 months Year

ended ended ended

31 Dec 31 Dec 30 Jun

2021 2020 2021

GBP000 GBP000 GBP000

Cash flows from operating

activities

(Loss)/profit for the period (196) (327) 460

Adjustments for:

Net loss on sale of investment

property - - 151

Net loss/(gain) on revaluation

of investment properties - 165 (690)

Impairment adjustment on development - 165 -

property

Depreciation and Loss on sale

of fixed assets - - 2

Net finance expense 62 67 137

Operating cash flows before

movements (134) 70 60

in working capital

(Increase)/decrease in trading

properties (583) 695 3,693

Decrease/(increase) in trade

and other receivables 14 (28) (13)

Increase/(decrease) in trade

and other payables 73 (74) (370)

Cash (absorbed by)/generated

from operations (630) 663 3,370

Interest paid (60) - (333)

Net cash (outflow)/inflow

from operating activities (690) 663 3,037

Investment activities

Proceeds from sale of investment

properties - - 1,149

Proceeds from sale of fixed

assets - - 5

Acquisition of plant and equipment (8) - -

Cash flows (absorbed by) investing

activities (8) - 1,154

(Decrease) in borrowings - (673) (1,243)

Cash flows (absorbed by) financing

activities - (673) (1,243)

Net (decrease)/increase in

cash and cash equivalents (698) (10) 2,948

Cash and cash equivalents

at beginning of period 3,020 72 72

Cash and cash equivalents

at end of period 2,322 62 3,020

================= =================== ==============

Caledonian Trust PLC

Registered Number 01040126

Notes to the interim statement

1 This interim statement for the six-month period to 31 December

2021 is unaudited and was approved by the directors on 31 March

2022. Caledonian Trust PLC (the "Company") is a company

incorporated in England and domiciled in the United Kingdom. The

information set out does not constitute statutory accounts within

the meaning of Section 434 of the Companies Act 2006.

2 Going concern basis

The Group and parent Company finance their day to day working

capital requirements through related party loans and bank and other

funding for specific development projects. The directors have

assessed the impact of the Covid-19 pandemic on its cash flow

forecasts and expect that current rental streams and property sales

in the normal course of business will provide sufficient cash

inflows to allow the Group to continue to trade.

The related party lender, Leafrealm Limited, a company

controlled by Douglas Lowe, Caledonian Trust's Chairman, Chief

Executive and major shareholder, has indicated its willingness to

continue to provide financial support and not to demand repayment

of its principal loan during 2022. Accordingly, the directors

continue to adopt the going concern basis in preparing this interim

statement.

3 Basis of preparation

The consolidated interim financial statements of the Company for

the six months ended 31 December 2021 are in respect of the Company

and its subsidiaries, together referred to as the "Group". The

financial information set out in this announcement for the year

ended 30 June 2021 does not constitute the Group's statutory

accounts for that period within the meaning of Section 434 of the

Companies Act 2006. Statutory accounts for the year ended 30 June

2021 are available on the Company's website at

www.caledoniantrust.com and have been delivered to the Registrar of

Companies. The accounts for the year ended 30 June 2021 have been

prepared in accordance with International Financial Reporting

Standards ("IFRS") in conformity with the requirements of the

Companies Act 2006. The auditors have reported on those financial

statements; their reports were (i) unqualified, (ii) did not

include references to any matters to which the auditors drew

attention by way of emphasis without qualifying their reports, and

(iii) did not contain statements under Section 498 (2) or (3) of

the Companies Act 2006.

The financial information set out in this announcement has been

prepared in accordance with International Accounting Standard IAS34

"Interim Financial Reporting". The financial information is

presented in sterling and rounded to the nearest thousand.

The interim financial statements have been prepared based on

IFRS that are expected to exist at the date on which the Group

prepares its financial statements for the year ending 30 June 2022.

To the extent that IFRS at 30 June 2022 do not reflect the

assumptions made in preparing the interim statements, those

financial statements may be subject to change.

In the process of applying the Group's accounting policies,

management necessarily makes judgements and estimates that have a

significant effect on the amounts recognised in the interim

statement. Changes in the assumptions underlying the estimates

could result in a significant impact to the financial information.

The most critical of these accounting judgement and estimation

areas are included in the Group's 2021 consolidated financial

statements and the main areas of judgement and estimation are

similar to those disclosed in the financial statements for the year

ended 30 June 2021.

4 Accounting policies

The accounting policies used in preparing these financial

statements are the same as those set out and used in preparing the

Group's audited financial statements for the year ended 30 June

2021 .

5 Valuation (losses)/gains on investment properties

31 Dec 31 Dec 30 Jun

2021 2020 2021

GBP000 GBP000 GBP000

Valuation gains in investment

properties - - 690

Valuation losses on investment

properties after transaction - (165) -

costs

Net valuation (losses)/gains

on investment properties - (165) 690

6 Income tax

Taxation for the six months ended 31 December 2021 is based on

the effective rate of taxation which is estimated to apply to the

year ending 30 June 2022. Due to the tax losses incurred there is

no tax charge for the period.

In the case of deferred tax in relation to investment property

revaluation surpluses, the base cost used is historical book cost

and includes allowances or deductions which may be available to

reduce the actual tax liability which would crystallise in the

event of a disposal of the asset. At 31 December 2021 there is a

deferred tax asset which is not recognised in these accounts.

7 Profit or loss per share

Basic profit or loss per share is calculated by dividing the

profit or loss attributable to ordinary

shareholders by the weighted average number of ordinary shares

outstanding during the period as follows:

6 months 6 months Year

ended ended ended

31 Dec 31 Dec 30 Jun

2021 2020 2021

GBP000 GBP000 GBP000

(Loss)/profit for financial

period (196) (327) 460

No. No. No.

Weighted average no. of

shares:

For basic and diluted profit

or

loss per share 11,783,577 11,783,577 11,783,577

Basic (loss)/profit per

share (1.66p) (2.77p) 3.90p

Diluted (loss)/profit per

share (1.66p) (2.77p) 3.90p

8 Investment Properties

31 Dec 31 Dec 30 Jun

2021 2020 2021

GBP000 GBP000 GBP000

Valuation

Opening valuation 17,110 17,720 17,720

Disposed in period - - (1,300)

Revaluation in period - (165) 690

Closing valuation 17,110 17,555 17,110

The fair value of investment property at 31 December 2021 was

determined by the directors taking cognisance of the independent

valuation by Montagu Evans, Chartered Surveyors as at 30 June 2019

having made adjustments for changes in leases and market

conditions.

The valuations take into account the impact of Covid-19 which

has not had a significant effect on the value of the Group's

investment properties due to the nature of the properties and

demand being maintained for small commercial properties.

9 Financial instruments

Fair values

Fair values versus carrying amounts

The fair values of financial assets and liabilities, together

with the carrying amounts shown in the balance sheet, are as

follows:

31 Dec 2021 31 Dec 2020 30 Jun 2021

Fair Carrying Fair Carrying Fair Carrying

value amount value amount value amount

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Trade and other

receivables 86 86 81 81 108 108

Cash and cash

equivalents 2,322 2,322 62 62 3,020 3,020

2,408 2,408 143 143 3,128 3,128

-------- --------- ------- --------- ------- ---------

Loans from related

parties 4,380 4,380 4,595 4,595 4,380 4,380

Bank loan - - 355 355 - -

Trade and other

payables 722 722 1,201 1,201 639 639

5,102 5,102 6,151 6,151 5,019 5,019

======== ========= ======= ========= ======= =========

Estimation of fair values

The following methods and assumptions were used to estimate the

fair values shown above:

Trade and other receivables/payables - the fair value of

receivables and payables with a remaining life of less than one

year is deemed to be the same as the book value.

Cash and cash equivalents - the fair value is deemed to be the

same as the carrying amount due to the short maturity of these

instruments.

Other loans - the fair value is calculated by discounting the

expected future cashflows at prevailing interest rates.

10 Issued share capital

31 Dec 2021 31 Dec 2020 30 Jun 2021

No. No. No.

000 GBP000 000 GBP000 000 GBP000

Issued and

Fully paid

Ordinary shares

of 20p each 11,784 2,357 11,784 2,357 11,784 2,357

11 Seasonality

Investment property sales by the Group are not seasonal and

sales of completed houses on development sites are driven more by

completion of construction projects than by season.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BBGDXDUXDGDB

(END) Dow Jones Newswires

March 31, 2022 08:56 ET (12:56 GMT)

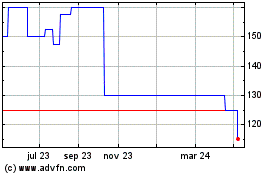

Caledonian (LSE:CNN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

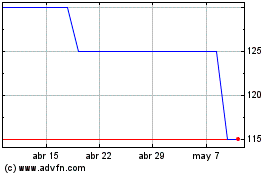

Caledonian (LSE:CNN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024