TIDMCOG

RNS Number : 8974Z

Cambridge Cognition Holdings PLC

20 September 2022

20 September 2022

Cambridge Cognition Holdings Plc

("Cambridge Cognition", the "Company" or the "Group")

Interim Results for the six months ended 30 June 2022

Cambridge Cognition Holdings plc (AIM: COG), which develops and

markets digital solutions to assess brain health, announces its

unaudited interim results for the six months ended 30 June

2022.

The Company followed its strong performance in 2021 with a 31%

growth in revenues to GBP5.9million in the first half of 2022 (H1

2021: GBP4.5 million). Order intake was in line with the Board's

expectations at GBP7.2 million, up 44% on a like-for-like basis on

H1 2021 (H1 2021:GBP8.6 million, including GBP3.6 million of

one-off orders) and the Company has a growing, qualified pipeline

of opportunities for the second half of 2022.

The contracted order book was GBP18.6 million at 30 June 2022

increasing from GBP17.1m at 31 December 2021. The order book

provides the Company with visibility over future revenues and

provides a solid foundation from which the Company can continue to

invest in product and commercial development to further expand the

business.

Trading conditions continue to be positive, and the Company has

high levels of engagement with existing and potential new clients.

With continued investment in commercial activities and product

development, the Company expects to achieve further year-on-year

revenue growth. The cash position continued to grow to GBP8.6

million at 30 June 2022 and provides the business with the platform

to make considered investments as opportunities arise.

Financial highlights

-- Growth in revenue of 31% to GBP5.9 million (H1 2021: GBP4.5 million)

-- Profit after tax in line with expectations at GBP0.02 million (H1 2021: GBP0.1 million)

-- Continued growth in cash balances to GBP8.6 million at 30

June 2022 (31 December 2021: GBP6.8 million)

-- Increase in like-for-like sales orders of 44% to GBP7.2

million (H1 2021: GBP8.6 million including GBP3.6 million of

one-off orders)

-- Increase in contracted order book of GBP1.5 million to

GBP18.6 million (31 December 2021: GBP17.1 million)

Operational highlights

-- Strengthened senior leadership team with the appointment of a

Chief Financial Officer and a Chief Scientist

-- Entered a new therapeutic area for the Company, PTSD

-- Launched an Alzheimer's validation study for the Company's

voice-based cognitive assessment solution

Commenting on the results Matthew Stork, Chief Executive Officer

of Cambridge Cognition, said: "I am delighted with our continued

progress over the last six months. Our contracted order book is at

its highest level and, along with a healthy sales order pipeline

and strong cash generation, puts us in a great position to continue

to invest in strategies to grow the business further."

Enquiries:

Cambridge Cognition Holdings plc Tel: 01223 810 700

Matthew Stork, Chief Executive Officer press@camcog.com

Stephen Symonds, Chief Financial Officer

Panmure Gordon (Nomad and Joint Broker) Tel: 020 7886 2500

Freddy Crossley / Emma Earl / Mark (Corporate Finance)

Rodgers

Rupert Dearden (Corporate Broking)

Dowgate Capital Limited (Joint Broker) Tel: 020 3903 7715

David Poutney / James Serjeant

IFC Advisory Ltd (Financial PR and Tel: 020 3934 6630

IR)

Tim Metcalfe / Graham Herring / Zach cog@investor-focus.co.uk

Cohen

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

CHIEF EXECUTIVE OFFICER'S REVIEW

Overview

The Company delivered a strong financial and operational

performance in the first half of 2022, with our contracted order

book growing to its highest level at GBP18.6m at the end of June

2022.

Orders received totalled GBP7.2 million ( H1 2021: GBP8.6

million including GBP3.6 million of one-off orders ). These orders

included a new major pharmaceutical client for a schizophrenia

contract worth GBP0.7m over two years, a GBP2.1 million contract

award to provide cognitive assessments for a neurodegenerative

disease trial and a GBP1.0 million contract award to provide

digital cognitive assessments for a pivotal phase III autoimmune

disease trial.

Around 79% of the Company's clinical trial orders came from

existing customers (H1 2021: 66%), with the balance from new

customers, reflecting excellent customer service and the benefits

of the Company's focus on commercialisation. These sales orders

cover a range of endpoints and clinical trial phases, evidencing

the Company's ability to deliver against a spectrum of client

requirements. Approximately 29% of our sales orders were for more

than one product (H1 2021: 17%), demonstrating the strength of the

Company's growing product offering to fulfil customer needs.

As well as achieving a record sales orders total in the first

half, I am pleased to report more milestones for Cambridge

Cognition in the period, some of which closed subsequent to the end

of June. These include:

-- Strengthened senior leadership team with the appointment of a

permanent Chief Financial Officer, Chief Scientist dedicated to

R&D and a Head of HR to manage a growing workforce

-- Entered a new, high-growth therapeutic area for the Company -

PTSD - earning contracts with a top 10 pharma company and the US

Department of Defense

-- Launched an Alzheimer's validation study for NeuroVocalix(R)

in collaboration with the University of Oxford and Novo Nordisk

Cambridge Cognition is focused on successful operational

delivery, while continuing to innovate, as is critical for a

growing technology business to meet future customer requirements.

During the period, the business continued to invest through R&D

initiatives and increased headcount to deliver against increased

sales orders and order backlog, and to improve back-office support

to enhance the ability to deliver future growth.

Financial results

Sales orders of GBP7.2 million ( H1 2021: GBP8.6 million

including GBP3.6 million of one-off orders ) contributed to further

growth in the Company's contracted order book, which has increased

to GBP18.6m at 30 June 2022. The contracted order book represents

confirmed orders that will be recognised as revenue in future

periods.

Revenue, recognised as our software and associated services are

used, grew to GBP5.9 million (H1 2021: GBP4.5 million), a 31%

increase and continues the consistent upward profile of our revenue

over recent periods. The contracted order book provides us with

great visibility over our future revenues.

The key components of revenue are shown in the table below:

Revenue H1 2022 H1 2021 Change Increase

GBPm GBPm GBPm %

Software 2.3 1.4 0.9 63

-------- -------- ------- ---------

Services 3.1 2.9 0.2 7

-------- -------- ------- ---------

Total Software &

Services 5.4 4.3 1.1 25

-------- -------- ------- ---------

Hardware 0.5 0.2 0.3 122

-------- -------- ------- ---------

Total Revenues 5.9 4.5 1.4 31

-------- -------- ------- ---------

Software is recognised over the course of the contract once the

product is in use and Services recognised from the start and

throughout the contract. Software revenue increased by 63% to

GBP2.3 million due to the increased number and value of contracts

being delivered. Services revenue grew by 7% to GBP3.1 million,

more modestly than previously as studies continue to be delivered

and after an increase in the number of contracts being started

early in 2021.

Hardware revenue continues to be a small part of our revenue,

though it still doubled to GBP0.5 million. The trend in customers

asking us to supply and validate hardware for their studies is

becoming more prevalent. We consider each project individually on

the basis of profitability and product development opportunities,

and expect there may be some dilutive impact on our gross margin

longer term if the trend continues.

Gross profit rose by GBP1.1 million to GBP4.7 million (H1 2021:

GBP3.5 million), with the gross profit margin of 80% flat year on

year (H1 2021: 80%).

Excluding the impact of foreign currency exchange movement,

administrative expenses increased by GBP1.2 million to GBP4.6

million (H1 2021: GBP3.4 million) reflecting our continued

investment in commercial activities and product development.

Profit before tax, profit for the period and adjusted EBITDA

were all positive in the first half of 2022, although reflected the

increase in administrative expenses as we expanded our headcount.

Basic and diluted earnings per share are at 0.1p, respectively (H1

2021: 0.3p profit on a basic and diluted basis).

Net cash inflow from operations of GBP1.7 million (H1 2021:

GBP1.2 million), drove an overall improvement in cash to GBP8.6

million at 30 June 2022; driven primarily by invoices on order for

clinical trials. The high value of sales orders in H1 2022 has

driven strong cash conversion and resulted in an increase in cash,

up GBP1.8 million since 31 December 2021 to GBP8.6 million. This

results in the recognition of deferred revenue on the balance sheet

until revenue is recognised in line with our accounting

policies.

Operational Review

The Company's increasing contracted order book is underpinned by

continued strong commercial performance and significant progress

against our strategic activities, as set out in the 2021 annual

report:

1. Healthy pipeline and contracted order book. With the return

of in-person conferences and a dedicated prospecting programme, we

have more than tripled the number of sales-leads. Successful

commercialisation activities resulted in a 44% increase in

like-for-like sales (H1 2021: GBP8.6 million including GBP3.6

million of one-off orders) and a GBP1.5 million increase in the

contracted order book since year end.

2. Developing products that secure new business. We secured

contracted development work that aligned well with our product

development plans. This synergy enables us to continue developing

products while meeting client demands and positions us well to

continually meet the evolving demands of the industry. We continue

to assess new opportunities that enhance our product offering and

produce cross selling opportunities.

3. Expanding our specialist team. We are committed to having an

engaged, capable and well-resourced team and have grown our

headcount during H1 2022. This strengthened team enables us to

deliver our growing number of contracts with the same exceptional

service our customers value.

4. Multi-regional data centres. We have successfully migrated

our servers to the market leaders in cloud infrastructure - Amazon

Web Services (AWS) - so we benefit from the ability for

multi-regional data storage, which helps us meet the stringent data

privacy requirements in the sector. Furthermore, AWS offer many

micro-services that we can leverage for faster software

development.

5. Enabling efficient growth by software development in a lower

cost country. Having established a subsidiary in a lower cost

country, this has expanded our talent pool and we now have an

office with more than 10 software developers that will enable the

continued development and improvement of our full product set at a

lower cost.

Cambridge Cognition provides digital technology solutions for

clinicians and scientists and so coverage, whether explanation or

validation, in scientific publications, conferences and

exhibitions, in person or virtual, are vitally important to

success. During the period, further high-profile publications from

DiMe, 4YouandMe and Novartis were added to the Company's

bibliography of peer-reviewed papers of trials using our outcomes

assessments, taking the Company's total to over 2,600, while

Cambridge Cognition scientists represented the company at 17

conferences and exhibitions.

The business continued to provide excellent customer service

through strong operational delivery over the first half of 2022,

while at the same time managing a step-up in clinical trial volume

through contracts won over 2021 and H1 2022. Compared to December

2021, the business was running nearly 10% more clinical trials at

30 June 2022; a move made possible by configurable, cloud-based

systems.

Board Changes

As previously announced, we were pleased that Stephen Symonds,

who joined the company as Chief Financial Officer in April 2022,

was appointed to the board in August. Stephen has extensive

experience in the sector and is a valuable addition to the

board.

Outlook

The Company has made a great start to 2022, and has a positive

outlook that is not only sustainable but well positioned for

further year-on-year growth. The outlook is built on the strength

of an attractive contracted order book and a qualified pipeline of

opportunities, increasing investment in commercial activities and

continued product development, a rising cash balance and supportive

shareholder base.

There are possible challenges ahead with inflation increasing

across global economies. The Company has limited expenditure on gas

and electricity, though is subject to other inflationary pressures.

Inflation may also impact on pharmaceutical companies and dampen

demand, though we have not seen that at this time and our order

book provides the Company with visibility over revenues in the

short to medium term .

Cambridge Cognition will continue to grow in this rapidly

expanding market by leveraging our validated portfolio of digital

assessments, investing in R&D to keep pace with the evolving

demands of the industry, investing in opportunities that enhance

our product offering and safeguarding our reputation for

exceptional customer service.

Matthew Stork

Chief Executive Officer

20 September 2022

1. https://www.grandviewresearch.com/industry-analysis/virtual-clinical-trials-market

2. GlobalData. Virtual trials run by pharma x therapeutic area Jan 2021 - Aug 2022

3. GlobalData. 2021. Virtual Trials Research Report

CONDENSED CONSOLIDATED COMPREHENSIVE INCOME STATEMENT

For the six months ended 30 June 2022

6 months 6 months Year to

to 30 June to 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------ ------------ -------------

Revenue 5 5,879 4,500 10,094

Cost of sales (1,192) (885) (2,015)

------------ ------------ -------------

Gross profit 4,687 3,615 8,079

Administrative expenses (4,673) (3,529) (7,829)

Other income 2 - 14

Finance costs - (2) (11)

------------ ------------ -------------

Profit before tax 16 84 253

Tax - - 197

------------ ------------ -------------

Profit for the period 16 84 450

============ ============ =============

Profit for the period 16 84 450

Other comprehensive income - items

that may be reclassified subsequently

to profit or loss:

Exchange differences on translation

of foreign operations (509) 51 14

------ ---- ----

Total comprehensive (expense)/income

for the period (493) 135 464

====== ==== ====

Earnings per share (pence) 6

Basic 0.1 0.3 1.4

Diluted 0.1 0.3 1.4

All amounts are attributable to equity holders in the parent

The above results relate to continuing operations

CONDENSED Consolidated statement of financial position

At 30 June 2022

At 31

At 30 At 30 December

June 2022 June 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------- ----------- ----------

Assets

Non-current assets

Intangible assets 370 376 373

Property, plant and equipment 77 105 52

Investments 49 49 49

Total non-current assets 496 530 474

Current assets

Inventories 255 138 126

Trade and other receivables 5,611 5,025 5,130

Cash and cash equivalents 8,561 4,168 6,810

----------- ----------- ----------

Total current assets 14,427 9,331 12,066

----------- ----------- ----------

Total assets 14,923 9,861 12,540

=========== =========== ==========

Liabilities

Current liabilities

Trade and other payables 14,736 9,600 11,908

Total liabilities 14,736 9,600 11,908

----------- ----------- ----------

Equity

Share capital 312 312 312

Share premium account 11,151 11,151 11,151

Other reserves 5,616 6,162 6,125

Own shares (78) (78) (78)

Retained earnings (16,814) (17,286) (16,878)

----------- ----------- ----------

Total equity 187 261 632

----------- ----------- ----------

Total liabilities and equity 14,923 9,861 12,540

=========== =========== ==========

CONDENSED Consolidated statement of changes in equity

Share Share Other Own Retained

capital premium reserve shares earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- --------- --------- --------- -------- ---------- --------

Balance at 1 January

2021 312 11,151 6,111 (78) (17,439) 57

Profit for the

period - - - - 84 84

Other comprehensive

income - - 51 - - 51

--------- --------- --------- -------- ---------- --------

Total comprehensive

income for the

period - - 51 - 84 135

--------- --------- --------- -------- ---------- --------

Credit to equity

for share-based

payments - - - - 69 69

--------- --------- --------- -------- ---------- --------

Transactions with

owners - - - - 69 69

--------- --------- --------- -------- ---------- --------

Balance at 30

June 2021 312 11,151 6,162 (78) (17,286) 261

Balance at 1 July

2021 312 11,151 6,162 (78) (17,286) 261

Profit for the

period - - - - 366 366

Other comprehensive

expense - - (37) - - (37)

--------- --------- --------- -------- ---------- --------

Total comprehensive

income for the

period - - (37) - 366 329

--------- --------- --------- -------- ---------- --------

Credit to equity

for share-based

payments - - - - 42 42

--------- --------- --------- -------- ---------- --------

Transactions with

owners - - - - 42 42

--------- --------- --------- -------- ---------- --------

Balance at 31

December 2021 312 11,151 6,125 (78) (16,878) 632

---------------------- --------- --------- --------- -------- ---------- --------

Balance at 1 January

2022 312 11,151 6,125 (78) (16,878) 632

Profit for the

period - - - - 16 16

Other comprehensive

expense - - (509) - - (509)

--------- --------- --------- -------- ---------- --------

Total comprehensive

expense for the

period - - (509) - 16 (493)

--------- --------- --------- -------- ---------- --------

Credit to equity

for share-based

payments - - - - 48 48

--------- --------- --------- -------- ---------- --------

Transactions with

owners - - - - 48 48

--------- --------- --------- -------- ---------- --------

Balance at 30

June 2022 312 11,151 5,616 (78) (16,814) 187

--------- --------- --------- -------- ---------- --------

CONDENSED Consolidated statement of cash flows

For the 6 months ended 30 June 2022

6 months 6 months Year to

to 30 June to 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------ ------------ -------------

Net cash flows from operating

activities 7 1,679 1,236 3,945

Investing activities

Interest received 2 - -

Purchase of intangible assets - - -

Purchase of property, plant and

equipment (43) (38) (56)

Purchase of investment - (49) (49)

------------ ------------ -------------

Net cash flow used in investing

activities (41) (87) (105)

Financing activities

Interest payments - - (11)

Lease payments - (36) (86)

------------ ------------ -------------

Net cash flows from financing

activities - (36) (97)

Net increase in cash and cash

equivalents 1,638 1,113 3,743

Cash and cash equivalents at start

of period 6,810 3,047 3,047

Exchange differences on cash and

cash equivalents 113 8 20

------------ ------------ -------------

Cash and cash equivalents at end

of period 8,561 4,168 6,810

============ ============ =============

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. General information

Cambridge Cognition Holdings plc ('the Company') and its

subsidiaries (together, 'the Group') develops and markets digital

solutions to assess brain healt h for sale worldwide, principally

in the UK, the US and Europe.

The Company is a public limited company listed on the

Alternative Investment Market ('AIM') of the London Stock Exchange

(symbol COG) and is incorporated and domiciled in the UK. The

address of its registered office is Tunbridge Court, Tunbridge

Lane, Bottisham, Cambridge, CB25 9TU.

The condensed consolidated interim financial statements were

approved by the Board of Directors for issue on 20 September 2022.

The condensed consolidated interim financial statements do not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006.

Statutory accounts of the Group for the year ended 31 December

2021 were approved by the Board of Directors on 13 May 2022 and

delivered to the Registrar of Companies. The report of the auditors

on those accounts was unqualified, did not contain an emphasis of

matter paragraph and did not contain any statement under section

498 of the Companies Act 2006.

The condensed consolidated interim financial statements together

with the comparative information for the six months ended 30 June

2022 have not been audited.

2. Basis of preparation

Going concern basis

The Group's forecasts and projections, taking account of

reasonably possible changes in trading performance, support the

conclusion that there is a reasonable expectation that the Group

has adequate resources to continue in operational existence for the

foreseeable future, a period of not less than twelve months from

the date of this report. Whilst having proper regard to the

continuing uncertainties brought by the pandemic, the Directors

believe that the Group will remain a going concern for the

foreseeable future. The Group therefore continues to adopt the

going concern basis in preparing its condensed consolidated interim

financial statements.

3. Accounting policies

The accounting policies adopted in the preparation of the

condensed consolidated interim financial statements are consistent

with those followed in the preparation of the Group's consolidated

financial statements for the year ended 31 December 2021.

4. Critical accounting judgements and key sources of estimation

uncertainty

In the application of the Group's accounting policies the

directors are required to make judgements, estimates and

assumptions about the carrying amounts of assets and liabilities

that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other

factors that are considered to be relevant. Actual results may

differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis.

The following are the critical judgements that the directors

have made in the process of applying the Group's accounting

policies.

Revenue recognition

Judgements may be required in recognising revenue and cost.

These judgements include

-- The extent to which, and the way in which, contracts are

separated into their component parts and the values attributed to

those parts;

-- Whether software licences are granted to allow the customer

the benefit of use of our intellectual property over a period of

time (including benefitting from future maintenance and

improvements) or whether that right is given as the intellectual

property exists at the point of time the licence is granted. In the

case of the former, software is recognised over the period of use,

for the latter revenue is recognised when the licence commences and

the customer is able to use the software;

-- The adoption of the portfolio approach for lower value sales

and the recognition criteria applied;

-- Where performance obligations are satisfied over time, the

length of time remaining for performance, and whether this needs

revising over time; and

-- The length of time for performance also dictates the initial

deferral and subsequent recognition of commissions in cost of

sales.

Goodwill

The Group reviews the carrying value of its goodwill balances by

carrying out impairment tests at least on an annual basis. These

tests require estimates to be made of the value in use of its CGUs

which are dependent on estimates of future cash flows and long-term

growth rates of the CGUs.

Capitalisation of development costs

The point at which development costs meet the criteria for

capitalisation is critically dependent on management judgment of

the probability of future economic benefits.

Recovery of deferred tax assets

Deferred tax assets have not been recognised for deductible

temporary differences, share options and tax losses as management

considers that there is not sufficient certainty that future

taxable profits will be available to utilise those temporary

differences and tax losses.

5. Segmental information

The analysis of revenue by product type is as follows:

6 months 6 months Year to

to 30 June to 30 June 31 December

2022 2021 2020

GBP'000 GBP'000 GBP'000

Software 2,240 1,374 3,609

Services 3,096 2,882 5,638

Hardware 543 244 847

5,879 4,500 10,094

------------ ------------ -------------

6. Earnings per share

The calculation of earnings per share is based on the following

profit and numbers of shares:

6 months 6 months Year to

to 30 June to 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Earnings

Earnings for the purposes of basic and

diluted earnings per share being net profit

attributable to owners of the Company 16 84 450

'000 '000 '000

Number of shares

Weighted average number of ordinary shares

for the purposes of basic EPS 31,097 31,097 31,170

Effect of dilutive share options 2,154 2,177 349

------------ ------------ -------------

Weighted average number of ordinary shares

for the purposes of diluted EPS 33,251 33,274 31,519

------------ ------------ -------------

6. Earnings per share (continued)

Pence Pence Pence

Earnings per share

Basic 0.1 0.3 1.4

Diluted 0.1 0.3 1.4

The basic weighted average number of shares excludes shares held

by an Employee Benefit Trust. Fully diluted earnings per share is

calculated after showing the effect of outstanding options in

issue.

The number of shares in issue at 30 June 2022 was 31,170,903 (31

December 2021: 31,170,903).

7. Reconciliation of operating result to operating cash

flows

6 months 6 months

to 30 June to 30 June Year to 31

2022 2021 December 2021

GBP'000 GBP'000 GBP'000

Profit/(loss) before tax 16 84 253

Adjustments for:

Depreciation of property plant

and equipment 18 70 142

Amortisation of software licences 3 3 6

Share-based payments charge 47 69 111

Finance costs - 2 11

Interest received (2) - -

Operating cash flows before

working capital movements 82 228 523

Change in inventories (126) (86) (75)

Change in trade and other

receivables (246) (2,416) (2,285)

Change in trade and other

payables 1,969 3,512 5,782

------------ ------------ ---------------

Cash generated by operations 1,679 1,238 3,945

Taxation paid - (2) -

------------ ------------ ---------------

Net cash flows from operations 1,679 1,236 3,945

------------ ------------ ---------------

8. Copies of interim financial statements

Copies of the interim financial statements are available from

the Company at its registered office at Tunbridge Court, Tunbridge

Lane, Bottisham, Cambridge, CB25 9TU. The interim financial

information document will also be available on the Company's

website www.cambridgecognition.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FIFFTAEIALIF

(END) Dow Jones Newswires

September 20, 2022 02:00 ET (06:00 GMT)

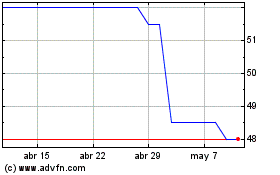

Cambridge Cognition (LSE:COG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cambridge Cognition (LSE:COG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024