TIDMCTY

RNS Number : 8313Z

City of London Investment Trust PLC

19 September 2022

Legal Entity Identifier: 213800F3NOTF47H6AO55

THE CITY OF LONDON INVESTMENT TRUST PLC

Annual financial results for the year ended 30 June 2022

This announcement contains regulated information

CHAIRMAN'S COMMENT

" City of London's NAV total return of 7.5% was 5.9 percentage

points ahead of the FTSE All-Share Index. The dividend was

increased for the 56(th) consecutive year and covered by earnings

per share, leaving GBP6.0 million to be added to our revenue

account. "

INVESTMENT OBJECTIVE

The Company's objective is to provide long-term growth in income

and capital, principally by investment in equities listed on the

London Stock Exchange. The Board fully recognises the importance of

dividend income to shareholders.

PERFORMANCE AT 30 JUNE

2022 2021

--------------------------------------------- ------- -------

Total Return Performance:

Net asset value ("NAV") per ordinary share

(1) 7.5% 20.0%

Share price(2) 7.7% 21.3%

FTSE All-Share Index (Benchmark) 1.6% 21.5%

AIC UK Equity Income sector(3) -1.5% 26.4%

IA UK Equity Income OEIC sector -0.5% 25.4%

2022 2021

--------------------------------------------- ------- -------

NAV per ordinary share 390.9p 387.6p

NAV per ordinary share (debt at fair value) 393.5p 384.1p

Share price 400.5p 390.0p

Premium 2.5% 0.6%

Premium (debt at fair value) 1.8% 1.5%

Gearing at year end 7.1% 6.9%

Revenue earnings per share 20.7p 17.1p

Dividends per share 19.6p 19.1p

Ongoing charge for the year(4) 0.37% 0.38%

Revenue reserve per share 9.5p 8.4p

1 Net asset value per ordinary share total return with debt at

fair value (including dividends reinvested)

2 Share price total return using mid-market closing price

3 AIC UK Equity Income sector size weighted average NAV total

return (shareholders' funds)

4 Calculated using the methodology prescribed by the Association

of Investment Companies ("AIC")

Sources: Morningstar Direct, Janus Henderson, Refinitiv

Datastream

CHAIRMAN'S STATEMENT

I am pleased to report a net asset value ("NAV") total return of

7.5%, which compares with a total return of 1.6% for the FTSE

All-Share Index. The dividend was increased for the 56(th)

consecutive year and covered by earnings per share, leaving GBP6.0

million to be added to our revenue reserve.

The Markets

The key economic concern over the 12 months was the significant

rise in inflation, partly caused by higher oil and gas prices

triggered in response to the war in Ukraine. UK CPI inflation

reached 9.4% in June, the highest level for 30 years. The Bank of

England increased the base rate, in four moves, from 0.1% to

1.25%.

The FTSE 100 Index (comprising the largest UK listed companies)

produced a total return of 5.8% during the year. The best

performing sector was oil and gas, benefiting from the rise in

energy prices. Banks also performed well, with rising interest

rates providing a helpful tailwind for their net interest margins.

Pharmaceutical companies, which are typically defensive in a

downturn, outperformed. In contrast, the indices for UK

medium-sized and small companies, which have much less exposure to

banks, oil and pharmaceutical companies, underperformed. The FTSE

250 Mid Cap Index produced a negative total return of 14.6% and the

FTSE SmallCap Index a negative total return of 12.6%.

Performance

Earnings and Dividends

City of London's revenue earnings per share increased by 21.2%

to 20.72p, reflecting dividend growth from across the portfolio,

with particular highlights from our stakes in the mining companies,

Rio Tinto, Anglo American and BHP. Special dividends accounted as

income increased by GBP3.9 million to GBP6.3 million. A further

GBP5.4 million of special dividends were deemed to be capital by

nature (largely resulting from business disposals) and were

therefore accounted as capital rather than revenue.

City of London increased its dividend for the 56th consecutive

year by 2.6% to 19.6p. Although the increase was lower than

inflation over the 12 months, City of London has increased its

dividend by 41.2% over the last 10 years compared with a cumulative

increase in UK CPI inflation of 26.5%. The Board understands the

importance of growing the dividend in real terms through the

economic cycle.

Expenses remained under tight control, with our ongoing charge

of 0.37% very competitive compared with other actively managed

funds. Our revenue reserve increased by GBP6.0 million to GBP43.6

million. In addition, the capital reserve arising from capital

gains on investments sold, which could also help fund dividend

payments, rose by GBP30.0 million to GBP326.6 million.

NAV Total Return

City of London's NAV total return of 7.5% was 5.9 percentage

points ahead of the FTSE All-Share Index. Gearing contributed 1.5

percentage points to the outperformance due to the decline in fair

value of our secured debt. The GBP30 million 2.67% maturing 2046

and the GBP50 million 2.94% maturing 2049 secured notes, which the

Company has issued over the last five years, will provide low-cost

debt financing over the next quarter of a century for investment in

equities.

Stock selection contributed 4.7 percentage points, helped by the

portfolio's tilt towards large companies and dividend yield and

away from highly valued, growth stocks and medium-sized and small

companies. The biggest stock contributor was BAE Systems, the

defence equipment manufacturer, followed by Imperial Brands, the

tobacco company. Brewin Dolphin, the private client wealth

management group, which received a takeover bid from Royal Bank of

Canada, was the sixth biggest stock contributor. The underweight

position in Shell was the biggest stock detractor, somewhat offset

by the holding in TotalEnergies, the French international oil

company, which was the eighth biggest stock contributor. The second

biggest stock detractor was being underweight in AstraZeneca,

although partly balanced by the holding in US pharmaceutical

company, Merck, which was the ninth biggest contributor.

City of London's NAV total return was ahead of the FTSE

All-Share Index over 1, 3, 5 and 10 years. City of London was also

ahead of the averages of the AIC UK Equity Income Investment Trust

and IA UK Equity Income OEIC sectors over 1, 3, 5 and 10 years.

Share Issues

During the year City of London's ordinary shares have again been

in strong demand and continued to trade at a premium. 14 million

ordinary shares were issued at a premium to NAV for proceeds of

GBP57.1 million. Issuing shares at a premium enhances NAV and

spreads costs across a larger asset base. Over the past ten years,

City of London has issued 220.8 million shares, at a premium to

NAV, increasing our share capital by 192.4%.

Environmental, Social and Governance

The Fund Manager takes environmental, social and governance

("ESG") related risks and opportunities into careful consideration

when selecting stocks for the portfolio. An analysis by

Sustainalytics, a Morningstar-owned company widely used for ESG

analytics, shows that City of London's portfolio continues to rate

slightly better for ESG risks compared with the FTSE All-Share

Index. The Fund Manager reports on ESG matters at each Board

meeting, including how it has voted on resolutions at investee

company shareholder meetings. Please see the Annual Report for more

detail of the analysis by Sustainalytics and a description of how

ESG considerations feature in the Fund Manager's investment

process.

Annual General Meeting

The 2022 Annual General Meeting ("AGM") will be held at the

offices of Janus Henderson, 201 Bishopsgate, London EC2M 3AE on

Thursday, 27 October 2022 at 2.30pm. The meeting will include a

presentation by our Fund Manager, Job Curtis, and Deputy Fund

Manager, David Smith. Any shareholder who is unable to travel is

encouraged to join virtually by Zoom, the conference software

provider. There will, as usual, be live voting for those physically

present at the AGM but we cannot offer live voting via Zoom because

of technical restrictions. We therefore request all shareholders,

and particularly those who cannot attend physically, to submit

their votes by proxy to ensure their vote counts at the AGM.

Communication with Shareholders

The Board believes that many shareholders will welcome its

proposal to reduce the Company's increasing postage and printing

costs by sending Annual and Half Year reports and other

communications to them electronically. This proposal will also have

a positive environmental impact. The Board fully appreciates that

some shareholders will wish to continue to receive communications

in printed form and there will be an option for them to request

this. Further details of this proposal, which is expected to save

significant costs annually for the Company, can be found in the AGM

Notice and the letter enclosed with the Annual Report.

Outlook

The macro economic outlook has darkened since the year end, with

inflation expectations increasing to levels last seen in the 1980s.

The Bank of England which, this time last year, predicted that

elevated inflation would be "transitory", is now forecasting that

it could reach 13.3%. It has reacted by increasing its base rate to

1.75%, whilst simultaneously warning of an impending recession.

These forecasts are inevitably damaging for consumer and business

confidence, with a growing risk that inflationary expectations

become embedded as pay settlements "catch up."

The outlook for the UK is particularly unclear as the new Prime

Minister steers a course towards increased public borrowing and tax

cuts. This uncertainty, which appears already to be unsettling

confidence about sterling in the currency markets, is compounded by

the prospect of higher interest rates across all major economies as

central banks respond to inflation and start to reverse their

programmes of quantitative easing. Most worrying, however, are the

rising geopolitical risks stemming from Russia's invasion of

Ukraine and the tensions with China over Taiwan, with consequences

which are already apparent for the sourcing of energy supplies and

important manufacturing components.

It remains the case, despite these concerns, that UK equities

still offer a better dividend yield than can be obtained from bank

deposits or ten-year gilts. Many of our shareholdings are in high

quality businesses, with significant foreign revenues, which are

well placed to withstand economic turbulence. Furthermore,

UK-listed companies continue to attract takeover bids in

recognition of their relative value compared with peers traded in

other stock markets (the latest in our portfolio being for Brewin

Dolphin). During the recent corporate results season, a number of

our investee companies have demonstrated their ability to cope with

inflationary pressures with positive dividend declarations. These

considerations, together with the advantages of our investment

trust status, underpin the Board's confidence of building on City

of London's unique 56-year record of annual dividend increases and

of continuing to provide reliable returns.

Sir Laurie Magnus CBE

Chairman

16 September 2022

FUND MANAGER'S REPORT

Investment Background

The UK stock market made solid gains during the first half of

the period under review as companies continued to benefit from the

reopening of the economy after the restrictions caused by the

pandemic. In addition, monetary policy was stimulatory with the UK

base rate at 0.1%. The rise in inflation that took place was higher

than the Bank of England expected and longer lasting. The base rate

was raised to 0.25% in December 2021 and there were four further

increases to reach 1.25% by the end of June 2022. In the US,

inflation was also higher than anticipated and the Federal Reserve

increased interest rates. The move from the previous era of

quantitative easing (ultra-low interest rates and bond purchases by

central banks) to quantitative tightening (rising interest rates

and no bond purchases/bond sales by central banks) led to more

subdued stock markets in the first six months of 2022. The rise in

interest rates and bond yields was a factor behind the derating of

some shares that had started 2022 on a high valuation, based on

future profits. The highest inflation for several decades led to

uncertainty on the impact on the consumer and corporate profit

margins. Finally, the invasion by Russia of Ukraine significantly

increased geopolitical risks.

A key factor causing inflation was the oil price, which rose by

53% over the 12 months. The oil price had slumped in the first part

of the pandemic given the collapse in economic activity. As demand

subsequently recovered, the oil market tightened, partly because of

the lack of spare oil production capacity as a result of under

investment in recent years given scepticism about long-term returns

due to decarbonisation. In addition, the war in Ukraine was an

adverse shock to oil and gas supply.

Although the UK base rate of 1.25% in June 2022 was its highest

for over 10 years, it was still significantly below the dividend

yield of the UK equity market, as it had been throughout the 12

months. The 10-year Gilt yield, which also remained below the

equity market dividend yield, rose from 0.8% to 2.2% over the 12

months in response to the rise in inflation and the UK base rate.

Overall, the additional yield available in UK equities was

supportive of gearing. City of London's gearing started the period

at 6.9%, rose to 8.3% at 31 December 2021 and finished the 12

months at 7.1% at 30 June 2022.

Over the 12 months, sterling weakened against the US dollar by

12% but was steady against the euro. The strength of the US dollar

reflected the more aggressive stance towards fighting inflation and

raising interest rates by the US's Federal Reserve compared with

the Bank of England and the European Central Bank. In addition, the

US dollar has a "safe haven" status and attracted funds given the

uncertainty caused by the war in Ukraine.

Performance Review

Estimated performance attribution (relative to FTSE All-Share

Index total return)

2022 2021

% %

======================== ====== ======

Stock selection +4.69 -3.80

Gearing +1.53 +2.49

Expenses -0.37 -0.38

Share issues/buy backs +0.04 +0.27

------------------------ ------ ------

Total +5.89 -1.42

------------------------ ------ ------

Source: Janus Henderson

City of London outperformed the FTSE All-Share Index by 5.89

percentage points in the year to 30 June 2022. Stock selection

contributed by 4.69 percentage points and gearing by 1.53

percentage points. The fall in the fair value of City of London's

secured notes caused the positive contribution of gearing.

The biggest stock contributor was BAE Systems, which is the UK's

biggest defence contractor but has its largest operations in the

US. The war in Ukraine led to a rerating of BAE's shares. Tobacco

shares, which were lowly valued and had resilient profits,

performed well and Imperial Brands and British American Tobacco

were among the top six contributors. The takeover bid for Brewin

Dolphin by Royal Bank of Canada led to it being the fifth biggest

contributor. Not holding Scottish Mortgage or Ashtead were also

among the top six contributors.

The biggest detractor was the underweight position in Shell,

although this was somewhat offset by the holding in TotalEnergies,

which was the eighth largest contributor. The underweight position

in AstraZeneca was the second biggest detractor (partly offset by

the position in Merck which was the ninth largest contributor). The

biggest detracting stock where City of London was overweight was

St. James's Place, which had performed very well the previous

12-month period.

It was a relatively good year for large companies, with the FTSE

100 Index of the largest companies returning 5.8% compared with

negative 14.6% for the FTSE 250 Index of medium-sized companies and

negative 12.6% for the FTSE SmallCap Index. The FTSE 100 Index was

helped by the outperformance of oil company shares, banks and

utilities.

Higher yielding shares also had a good year, as the chart in the

Annual Report shows. It compares the performance of the FTSE 350

Higher Yield Index (the higher dividend yielding half of the

largest 350 shares listed in the UK) with the FTSE 350 Lower Yield

Index (the lower dividend yielding half of the largest 350 shares

listed in the UK). Oil and tobacco shares were significant

contributors to the outperformance of the FTSE 350 Higher Yield

Index.

Distribution of the portfolio as at 30 June 2022

% of the portfolio

-------------------------------------------- -------------------

Large UK-listed companies (constituents of

the FTSE 100 Index) 71%

Medium-sized and small UK-listed companies 12%

Overseas-listed companies 17%

Source: Janus Henderson, 30 June 2022

During the year, the proportion of the portfolio invested in

companies with their prime listing overseas rose from 15% to 17%.

The proportion invested in large UK-listed companies fell by one

percentage point, as did the proportion invested in medium-sized

and small UK-listed companies. This increase in the overseas listed

share reflected the move by BHP away from being partly listed in

London to a full listing in Australia and also the move by Ferguson

to a US listing. The overseas listed stocks provide the portfolio

with additional diversification and in some cases exposure to types

of business not listed on the London Stock Exchange, such as

Microsoft.

Portfolio Changes

Takeover activity led to two holdings leaving the portfolio.

First, the bidding war from two private equity groups for Wm

Morrison, the supermarket group, which had started in the previous

financial year, completed at a significant premium to the share

price which had prevailed before. Secondly, Daily Mail &

General was taken private by Lord Rothermere and his family.

In addition, Brewin Dolphin, the private wealth manager, agreed

to be taken over by Royal Bank of Canada. Half City of London's

holding was sold at a very small discount to the offer price, with

the deal expected to complete by the end of the third quarter of

2022. A new holding was initiated in Rathbones, another leading UK

wealth manager, at a considerable discount to the valuation at

which Brewin Dolphin was taken over. Private client wealth

management is enjoying secular growth as people choose to take more

control of their pension assets.

A significant reduction was made to the holding in BHP, which

became fully listed in Australia. BHP has been a very successful

holding in terms of both share price appreciation and dividends

paid. The most important commodity that BHP mines is iron ore,

which is very dependent on demand from China. After the strong

performance of the iron price in recent years, there were grounds

for some caution and therefore a reduction was made in BHP.

A small reduction was also made in Anglo American, while Rio

Tinto was left unchanged, leaving the mining sector as 5.2% of the

total portfolio at 30 June 2022.

A new holding in Woodside Energy came into the portfolio as a

result of the merger of BHP's oil and gas interests with those of

Woodside, which is also listed in Australia. Woodside's assets are

predominantly in Australia and the Gulf of Mexico. Some 50% of its

total oil and gas production is Liquified Natural Gas ("LNG"),

which is seen as a "transition" energy source because it emits less

carbon than coal or oil but is more efficient than renewables.

Demand for LNG has been growing steadily in recent years and is

expected to strengthen further as Europe weans itself off Russian

gas. Given the favourable backdrop for oil companies, an increase

was made to the stake in TotalEnergies, the international oil

company headquartered in France, which has a good dividend track

record.

Two other new overseas listed companies were bought. Sanofi is

the France-headquartered, international pharmaceutical company with

key franchises in immunology, oncology and rare diseases. Its

growth is expected to be driven by the success of Dupixent, its

medicine for dermatitis (eczema).

Holcim is a Switzerland-listed, international building materials

company. It is the global leader in cement as well as having

significant operations in ready-mix concrete, aggregates and

roofing products. It should benefit from growing demand for the

building materials and the products it makes in both developed and

developing markets. The other two building materials companies in

the portfolio, Ibstock (the brick maker) and Marshalls (paving

stones and roofing products), are both focused on the UK

market.

In addition to Rathbones, mentioned above, two other new

medium-sized (outside the FTSE 100 Index), UK-listed companies were

bought. Hays is a specialist recruitment agency for permanent and

temporary staff split into three main divisions: UK and Ireland,

Australia and New Zealand, and Germany. Hays has been trading well,

supported by rising wages, increased fees for temps and higher

demand across its network. Wincanton is a leading supply solutions

company with a long history, operating from some 200 warehouses

across the UK. Its digital and e-fulfilment division is growing

rapidly.

A new holding was also bought in 3i, the investment company

focused on private equity. Slightly over half of 3i's net assets

are accounted for by its investment in Action, a successful and

fast-growing discount retailer in Continental Europe. In addition,

3i has investments in private companies benefiting from certain

growth trends: demographics, value for money, low carbon and

digitisation.

Against a background of rising interest rates, vulnerable

sectors were reviewed. An underweight position was maintained in

consumer discretionary sectors, such as retail and travel and

leisure. In real estate investment trusts ("REITs"), Hammerson, the

owner of shopping centres, was sold given the continuing over

capacity in that part of the property market. Holdings were

retained in Land Securities and British Land, which are mainly

invested in offices, and Segro, which owns industrial property and

warehouses. In housebuilding, Berkeley, the specialist in London

flats, was sold but Persimmon and Taylor Wimpey, the nationwide

builders of family homes, were retained.

Finally, a complete sale was made of Go-Ahead, the transport

group, which had over-accounted for profits under a government

contract in its rail division. It received a fine and a temporary

suspension of its London Stock Exchange listing.

Portfolio Outlook

Consumer staples companies, which make and sell everyday

products, constitute 20.5% of the portfolio. They tend to have a

degree of pricing power to cope with inflationary cost pressures.

Three of the ten largest stocks in the portfolio are consumer

staples companies. British American Tobacco (largest holding) and

Imperial Brands (ninth largest) have strong cash flow to support

their dividends. British American Tobacco has also made significant

progress in the transition to less harmful products and is the

leader in vaping, with Vuse, in the United States. Diageo (third

largest holding) is the world's largest spirits company (outside

China) as well as owning Guinness. Leading spirits brands it owns

include Johnnie Walker (Scotch whisky), Tanqueray (gin) and

Smirnoff (vodka). It has also grown to become the leader by value

of total sales in tequila, which is the fastest growing spirits

category in the United States, with brands such as Don Julio and

Casamigos. Tesco (11th largest holding) and Unilever (12th largest)

are also consumer staples companies. Tesco has market leadership

and competitive pricing in UK food retailing. Unilever has

significant sales from its beauty and personal care, food and

homecare divisions in both developed and emerging markets.

The oil sector is represented in the top ten by Shell (second

largest holding) and BP (tenth largest). Both companies benefit

from the elevated price of oil, which is likely to persist given

the imbalance between demand and supply in the global market. Long

term, a key determinant of their performance will be how well they

execute on ambitious plans to achieve "Net Zero", which means

completely negating the amount of greenhouse gases they produce.

They aim to achieve this by reducing fossil fuel exposure,

investing in renewable energy (wind and solar) and developing

carbon capture technology. National Grid (13th largest holding) and

SSE (17th largest) are both well placed to benefit from

electrification of the economy and growth in renewable energy.

It is likely that governments will increase defence spending

given the rising threat from hostile countries. The products made

by BAE Systems (fourth largest holding) are of crucial important in

this context. RELX (fifth largest), which provides essential

information and analytics for businesses, professionals and

scientists, is expected to continue its outstanding record of

steady growth.

The pharmaceutical sector constitutes 8.9% of the portfolio. The

two largest holdings are UK listed, AstraZeneca (sixth largest

holding) and GlaxoSmithKline (eighth largest). In addition, four

overseas-listed pharmaceutical companies are held: Merck, Novartis,

Johnson & Johnson and Sanofi. These companies have a strong

record of bringing to the market medicines and vaccines that

improve health, prolong and save lives. Given its importance and

the large-scale funding from governments, healthcare spending is

fairly resilient in a period of slowing economic growth.

HSBC is the seventh largest holding and there are also smaller

positions in Lloyds Banking and Barclays in the portfolio. Banks

should benefit from the rise in interest rates as they are able to

improve rates for deposit accounts and the margin between deposits

and loans. Banks are vulnerable to loan losses and impairments if

the rise in interest rates leads to a recession. Life assurers

Phoenix (16th largest holding) and Legal & General (19th

largest) offer anomalously high dividend yields, as does M&G

(15th largest), which is a mixture of fund manager and life

assurer.

Revenue exposure

% of the portfolio

---------------------------------- -------------------

United Kingdom 33

North America 24

Europe ex UK 15

Emerging Markets (Other) 12

Emerging Markets (Asia) 10

Developed Markets (Asia/Pacific) 3

Japan 3

Source: FactSet, 30 June 2022

The portfolio is well diversified with a bias towards large,

international companies and shares with above average dividend

yield. Some 67% of investee companies' revenues comes from

overseas. The aim is to be invested in those companies that can

support their dividends through profits and cash generation and

invest enough for growth. While dividends from mining companies

have probably peaked, given lower prices for their key commodities,

dividend recovery from other parts of the market, such as banks and

energy, should continue to drive the aggregate level of market

dividends in the UK higher. Overall, there are currently serious

macroeconomic and political challenges but the quality of the

companies in the portfolio gives confidence for the future.

Job Curtis

Fund Manager

David Smith

Deputy Fund Manager

16 September 2022

FORTY LARGEST INVESTMENTS as at 30 June 2022

The 40 largest investments, representing 77.96% of the portfolio, are

listed below

Market

value Portfolio

Position Company Sector GBP'000 %

--------- ----------------------- -------------------------------------- -------- ----------

British American

1 Tobacco Tobacco 91,507 4.76

2 Shell Oil, Gas and Coal 71,723 3.73

3 Diageo Beverages 68,463 3.56

4 BAE Systems Aerospace and Defence 64,340 3.35

5 RELX Media 56,679 2.95

6 AstraZeneca Pharmaceuticals and Biotechnology 56,160 2.92

7 HSBC Banks 53,014 2.76

8 GlaxoSmithKline Pharmaceuticals and Biotechnology 50,579 2.63

9 Imperial Brands Tobacco 48,641 2.53

10 BP Oil, Gas and Coal 48,343 2.51

--------- ----------------------- -------------------------------------- -------- ----------

Top 10 609,449 31.70

------------------------------------ -------------------------------------------------- ----------

Personal Care, Drug and Grocery

11 Tesco Stores 45,972 2.39

Personal Care, Drug and Grocery

12 Unilever Stores 45,954 2.39

13 National Grid Gas, Water and Multi-utilities 44,794 2.33

14 Rio Tinto Industrial Metals and Mining 44,740 2.33

Investment Banking and Brokerage

15 M&G Services 44,174 2.30

16 Phoenix Life Insurance 42,308 2.20

17 SSE Electricity 39,107 2.03

18 Anglo American Industrial Metals and Mining 31,866 1.66

19 Legal & General Life Insurance 31,374 1.63

Personal Care, Drug and Grocery

20 Reckitt Benckiser Stores 30,790 1.60

--------- ----------------------- -------------------------------------- -------- ----------

Top 20 1,010,528 52.56

------------------------------------ -------------------------------------------------- ----------

Investment Banking and Brokerage

21 St. James's Place Services 30,636 1.59

22 TotalEnergies Oil, Gas and Coal 29,479 1.53

Investment Banking and Brokerage

23 Schroders Services 28,990 1.51

24 Nestlé Food Producers 28,750 1.49

25 Direct Line Insurance Non-life Insurance 28,694 1.49

Telecommunications Service

26 Vodafone Providers 27,861 1.45

27 Severn Trent Gas, Water and Multi-utilities 27,859 1.45

28 Lloyds Banking Banks 27,501 1.43

29 Persimmon Household Goods and Home Construction 26,641 1.39

Investment Banking and Brokerage

30 IG Services 25,548 1.33

--------- ----------------------- -------------------------------------- -------- ----------

Top 30 1,292,487 67.22

------------------------------------ -------------------------------------------------- ----------

Telecommunications Service

31 Verizon Communications Providers 23,824 1.24

32 BHP Industrial Metals and Mining 22,970 1.19

33 Barclays Banks 22,968 1.19

Investment Banking and Brokerage

34 3i Services 22,915 1.19

35 Merck Pharmaceuticals and Biotechnology 21,064 1.09

36 Land Securities Real Estate Investment Trusts 19,920 1.04

37 Munich Re Non-life Insurance 19,248 1.00

38 Novartis Pharmaceuticals and Biotechnology 18,287 0.96

39 Microsoft Software and Computer Services 17,978 0.93

40 Segro Real Estate Investment Trusts 17,579 0.91

--------- ----------------------- -------------------------------------- -------- ----------

Top 40 1,499,240 77.96

------------------------------------ -------------------------------------------------- ----------

Convertibles and all classes of equity in any one company are treated

as one investment.

PRINCIPAL RISKS

The Board, with the assistance of the Manager, has carried out a

robust assessment of the principal risks and uncertainties facing

the Company, including those that would threaten its business

model, future performance, solvency or liquidity and

reputation.

The Board regularly considers the principal risks facing the

Company and has drawn up a register of these risks. The Board has

also put in place a schedule of investment limits and restrictions,

appropriate to the Company's investment objective and policy, in

order to mitigate these risks as far as practicable. The principal

risks which have been identified and the steps taken by the Board

to mitigate these are set out in the table below. The principal

financial risks are detailed in note 16 to the financial statements

in the Annual Report. Details of how the Board monitors the

services provided by Janus Henderson and its other suppliers, and

the key elements designed to provide effective internal control,

are explained further in the internal controls section of the

Corporate Governance Report in the Annual Report.

Geopolitical risks had been identified as an emerging risk in

the 2021 Annual Report. Given the events in Ukraine and the

resulting potential global impact, including increased market

volatility and cyber security risks, this was moved from emerging

to principal risks during the year.

Principal risks Trend Mitigating measure

Geopolitical The Fund Manager keeps the global

Heightened political tensions political and economic picture under

in and among a number of countries review as part of the investment

around the world have potential process.

impacts, including increasing

market volatility, risks to

cyber security and on the supply

of commodities, including oil

and gas, and manufacturing components.

------ ---------------------------------------------

Global pandemic The Fund Manager maintains close

The impact that the coronavirus oversight of the Company's portfolio,

pandemic or some future manjor and in particular the dividend strategies

health crisis could have on of investee companies. Regular stress

the Company's investments and testing of the revenue account under

its direct and indirect effects, different scenarios for dividends

including the effect on the is carried out.

global economy.

The Board also maintains close oversight

of the third-party service providers

which assist in the administration

of the Company.

------ ---------------------------------------------

Portfolio and market price The Board reviews the portfolio at

Although the Company invests the seven Board meetings held each

almost entirely in securities year and receives regular reports

that are listed on recognised from the Company's brokers. A detailed

markets, share prices may move liquidity report is considered on

rapidly. The companies in which a regular basis.

investments are made may operate

unsuccessfully, or fail entirely. The Fund Manager closely monitors

A fall in the market value of the portfolio between meetings and

the Company's portfolio would mitigates this risk through diversification

have an adverse effect on equity of investments. The Fund Manager

shareholders' funds. periodically presents the Company's

investment strategy in respect of

The wider consequences of Brexit current market conditions. Performance

on employment and regulation relative to the FTSE All-Share Index,

together with resultant, adverse other UK equity income trusts and

trade negotiations may impact IA UK Equity Income OEICs is also

the Company's investments. monitored.

The majority of the Company's investments

are multi-national companies with

operations in local markets.

------ ---------------------------------------------

Dividend income The Board reviews income forecasts

A reduction in dividend income at each meeting. The Company has

could adversely affect the Company's revenue reserves of GBP43.6 million

dividend record. (before payment of the fourth interim

dividend) and distributable capital

reserves of GBP326.6 million.

------ ---------------------------------------------

Investment activity, gearing At each meeting, the Board reviews

and performance investment performance, the level

An inappropriate investment of gearing, the level of premium/discount,

strategy (for example, in terms income forecasts and a schedule of

of asset allocation or the level expenses. It also has an annual meeting

of gearing) may result in underperformance focused on strategy at which these

against the Company's benchmark. matters are considered in more depth.

------ ---------------------------------------------

Tax and regulatory The Manager provides its services,

Changes in the tax and regulatory inter alia, through suitably qualified

environment could adversely professionals and the Board receives

affect the Company's financial internal control reports produced

performance, including the return by the Manager on a quarterly basis,

on equity. which confirm legal and regulatory

compliance. The Fund Manager also

A breach of Section 1158/9 of considers tax and regulatory change

the Corporation Tax Act 2010 in his monitoring of the Company's

as amended could lead to a loss underlying investments.

of investment trust status,

resulting in capital gains realised

within the portfolio being subject

to corporation tax. A breach

of the Listing Rules could result

in suspension of the Company's

shares, while a breach of the

Companies Act 2006 could lead

to criminal proceedings, or

financial or reputational damage.

The Company must also ensure

compliance with the Listing

Rules of the New Zealand Stock

Exchange.

------ ---------------------------------------------

Operational The Board monitors the services provided

Disruption to, or failure of, by the Manager and its other suppliers

the Manager's or its Administrator's and receives reports on the key elements

(BNP Paribas Securities Services) in place to provide effective internal

accounting, dealing or payment control.

systems or the Depositary's

records could prevent the accurate Cyber security is closely monitored

reporting and monitoring of and the Audit Committee receives

the Company's financial position. regular presentations from Janus

Cyber crime could lead to loss Henderson's Chief Information Security

of confidential data. The Company Officer.

is also exposed to the operational

risk that one or more of its The Board considers the loss of the

suppliers may not provide the Fund Manager as a risk but this is

required level of service. mitigated by the experience of the

team at Janus Henderson as detailed

in the Annual Report.

------ ---------------------------------------------

Emerging risks

In addition to the principal risks facing the Company, the Board

also regularly considers emerging risks, which are defined as

potential trends, sudden events or changing risks which are

characterised by a high degree of uncertainty in terms of the

probability of them happening and the possible effects on the

Company. Should an emerging risk become sufficiently clear, it may

be moved to a significant risk.

BORROWINGS

The Company has a borrowing facility of GBP120.0 million (2021:

GBP120.0 million) with HSBC Bank plc, of which GBP16.3 million was

drawn at the year end (2021: GBP10.0 million).

The Company has GBP114.2 million (2021: GBP114.1 million) (par

value) of secured notes in issue (fair value of the loan notes:

GBP101.1 million (2021: GBP128.5 million)).

The level of gearing at 30 June 2022 was 7.1% of net asset value

(2021: 6.9%).

VIABILITY STATEMENT

The AIC Code of Corporate Governance includes a requirement for

the Board to assess the future prospects for the Company, and to

report on the assessment within the Annual Report.

The Board considers that certain characteristics of the

Company's business model and strategy are relevant to this

assessment:

-- The Board seeks to deliver long-term performance by the Company.

-- The Company's investment objective, strategy and policy, which are

subject to regular Board monitoring, mean that the Company is invested

mainly in readily realisable, UK-listed securities and that the level

of borrowings is restricted.

-- The Company is a closed end investment company and therefore does

not suffer from the liquidity issues arising from unexpected redemptions.

-- The Company has an ongoing charge of 0.37%, which is lower than other

comparable investment trusts.

Also relevant were a number of aspects of the Company's

operational agreements:

-- The Company retains title to all assets held by the Custodian under

the terms of formal agreements with the Custodian and Depositary.

-- Long-term borrowing is in place, being 4.53% secured notes 2029,

2.94% secured notes 2049 and 2.67% secured notes 2046 which are subject

to formal agreements, including financial covenants with which the

Company complied in full during the year. The value of long-term

borrowing is relatively small in comparison to the value of net assets,

being 6.4 %.

-- Revenue and expenditure forecasts are reviewed by the Directors at

each Board meeting. This includes stress testing of the forecast

under different scenarios.

-- Cash is held with approved banks.

In addition, the Directors carried out a robust assessment of

the principal risks and uncertainties which could threaten the

Company's business model, including future performance, liquidity

and solvency and considered emerging risks that could have a future

impact on the Company.

The principal risks identified as relevant to the viability

assessment were those relating to investment portfolio performance

and its effect on the net asset value, share price and dividends,

and threats to security over the Company's assets. The Board took

into account the liquidity of the Company's portfolio, the

existence of the long-term fixed rate borrowings, the effects of

any significant future falls in investment values and income

receipts on the ability to repay and renegotiate borrowings, grow

dividend payments and retain investors and the potential need for

share buybacks to maintain a narrow share price discount.

The Directors assess viability over five-year rolling periods,

taking account of foreseeable severe but plausible scenarios. In

coming to this conclusion, the Directors have considered the

aftermath of the Covid-19 pandemic and heightened macroeconomic

uncertainty following Russia's invasion of Ukraine, in particular

the impact on income and the Company's ability to meet its

investment objective. The Directors do not believe that they will

have a long-term impact on the viability of the Company and its

ability to continue in operation, notwithstanding the short-term

uncertainty these events have caused in the markets and specific

short-term issues such as energy, supply chain disruption,

inflation and labour shortages.

The Directors believe that a rolling five-year period best

balances the Company's long-term objective, its financial

flexibility and scope with the difficulty in forecasting economic

conditions affecting the Company and its shareholders.

Based on their assessment, and in the context of the Company's

business model, strategy and operational arrangements set out

above, the Directors have a reasonable expectation that the Company

will be able to continue in operation and meet its liabilities as

they fall due over the five-year period to June 2027.

RELATED PARTY TRANSACTIONS

The Company's transactions with related parties in the year were

with the Directors and the Manager. There were no material

transactions between the Company and its Directors during the year

and the only amounts paid to them were in respect of expenses and

remuneration for which there were no outstanding amounts payable at

the year end. Directors' shareholdings are disclosed in the Annual

Report.

In relation to the provision of services by the Manager, other

than fees payable by the Company in the ordinary course of business

and the provision of marketing services, there were no material

transactions with the Manager affecting the financial position of

the Company during the year under review. More details on

transactions with the Manager, including amounts outstanding at the

year end, are given in the Annual Report.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

Each of the Directors, who are listed below, confirms that, to

the best of his or her knowledge:

-- the Company's financial statements, which have been prepared in accordance

with UK Accounting Standards on a going concern basis, give a true

and fair view of the assets, liabilities, financial position and

return of the Company; and

-- the Strategic Report and financial statements include a fair review

of the development and performance of the business and the position

of the Company, together with a description of the principal risks

and uncertainties that it faces.

On behalf of the Board

Sir Laurie Magnus CBE

Chairman

16 September 2022

INCOME STATEMENT

Year ended 30 June 2022 Year ended 30 June 2021

Revenue Capital Total Revenue Capital Total

return return return return return return

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----- ---------------------- --------------- ---------------- --------------- -------- -------- ---------------

Gains on investments

held at fair value

through profit or

loss - 13,394 13,394 - 200,267 200,267

Income from

investments

held at fair value

through profit or

2 loss 98,028 - 98,028 77,626 - 77,626

Other interest

receivable

3 and similar income 190 - 190 263 - 263

--------------- ---------------- --------------- -------- -------- ---------------

Gross revenue and

capital gains 98,218 13,394 111,612 77,889 200,267 278,156

Management fee (1,746) (4,073) (5,819) (1,493) (3,484) (4,977)

Other administrative

expenses (774) - (774) (726) (7) (733)

--------------- ---------------- --------------- -------- -------- ---------------

Net return before

finance costs and

taxation 95,698 9,321 105,019 75,670 196,776 272,446

Finance costs (1,474) (3,075) (4,549) (1,696) (3,589) (5,285)

--------------- ---------------- --------------- -------- -------- ---------------

Net return before

taxation 94,224 6,246 100,470 73,974 193,187 267,161

Taxation (1,236) - (1,236) (1,165) - (1,165)

--------------- ---------------- --------------- -------- -------- ---------------

Net return after

taxation 92,988 6,246 99,234 72,809 193,187 265,996

--------------- ---------------- --------------- -------- -------- ---------------

Return per ordinary

share basic and

5 diluted 20.72p 1.39p 22.11p 17.09p 45.36p 62.45p

--------------- ---------------- --------------- -------- -------- ---------------

The total columns of this statement represent the Company's

Income Statement. The revenue return and capital return columns are

supplementary to this and are prepared under guidance published by

the Association of Investment Companies. All revenue and capital

items in the above statement derive from continuing operations. The

Company has no recognised gains or losses other than those

recognised in the Income Statement.

STATEMENT OF CHANGES IN EQUITY

Called Share Capital Other

up share premium redemption capital Revenue

Year ended capital account reserve reserves reserve Total

Notes 30 June 2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2021 111,406 855,597 2,707 720,048 37,567 1,727,325

Net return

after taxation - - - 6,246 92,988 99,234

Issue of 14,015,000

new ordinary

8 shares 3,504 53,546 - - - 57,050

7 Dividends paid - - - - (86,952) (86,952)

---------- --------- ------------ ---------- --------- ----------

At 30 June

2022 114,910 909,143 2,707 726,294 43,603 1,796,657

---------- --------- ------------ ---------- --------- ----------

Called Share Capital Other

up share premium redemption capital Revenue

Year ended capital account reserve reserves reserve Total

Notes 30 June 2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2020 104,101 752,967 2,707 526,861 45,623 1,432,259

Net return

after taxation - - - 193,187 72,809 265,996

Buyback of

1,175,000 ordinary

shares for

treasury - - - (3,736) - (3,736)

Issue of 1,175,000

ordinary shares

from treasury - 124 - 3,736 - 3,860

Issue of 29,220,000

new ordinary

8 shares 7,305 102,506 - - - 109,811

7 Dividends paid - - - - (80,865) (80,865)

---------- --------- ------------ ---------- --------- ----------

At 30 June

2021 111,406 855,597 2,707 720,048 37,567 1,727,325

---------- --------- ------------ ---------- --------- ----------

STATEMENT OF FINANCIAL POSITION

30 June

2022 30 June 2021

Notes GBP'000 GBP'000

-------- --------------------------------------- ---------- ---------------

Fixed assets

Investments held at fair value through

profit or loss

Listed at market value in the United

Kingdom 1,642,199 1,618,973

Listed at market value overseas 281,071 227,701

Investment in subsidiary undertakings 347 347

---------- ---------------

1,923,617 1,847,021

---------- ---------------

Current assets

Debtors 11,451 10,157

11,451 10,157

Creditors: amounts falling due within

one year (22,835) (14,323)

---------- ---------------

Net current liabilities (11,384) (4,166)

---------- ---------------

Total assets less current liabilities 1,912,233 1,842,855

Creditors: amounts falling due after

more than one year (115,576) (115,530)

---------- ---------------

Net assets 1,796,657 1,727,325

---------- ---------------

Capital and reserves

8 Called up share capital 114,910 111,406

Share premium account 909,143 855,597

Capital redemption reserve 2,707 2,707

Other capital reserves 726,294 720,048

Revenue reserve 43,603 37,567

---------- ---------------

6 Total shareholders' funds 1,796,657 1,727,325

---------- ---------------

Net asset value per ordinary share

6 - basic and diluted 390.88p 387.62p

---------- ---------------

NOTES TO THE FINANCIAL STATEMENTS

Accounting policies

1.

Basis of accounting

The Company is a registered investment company as defined in Section

833 of the Companies Act 2006 and is incorporated in the UK. It operates

in the UK and is registered at the address below.

The financial statements have been prepared in accordance with the

Companies Act 2006, FRS 102, the Financial Reporting Standard applicable

in the UK and Republic of Ireland, and with the Statement of Recommended

Practice: Financial Statements of Investment Trust Companies and Venture

Capital Trusts ("the SORP") issued in April 2021 by the Association

of Investment Companies.

The principal accounting policies applied in the presentation of these

financial statements are set out in the Annual Report. These policies

have been consistently applied to all the years presented.

As an investment fund the Company has the option, which it has taken,

not to present a cash flow statement. A cash flow statement is not

required when an investment fund meets all the following conditions:

substantially all of the entity's investments are highly liquid, substantially

all of the entity's investments are carried at market value, and the

entity provides a Statement of Changes in Equity. The Directors have

assessed that the Company meets all of these conditions.

The financial statements have been prepared under the historical cost

basis except for the measurement at fair value of investments. In

applying FRS 102, financial instruments have been accounted for in

accordance with Sections 11 and 12 of the standard. All of the Company's

operations are of a continuing nature.

The financial statements of the Company's three subsidiaries have

not been consolidated on the basis of immateriality and dormancy.

Consequently, the financial statements present information about the

Company as an individual entity. The Directors consider that the values

of the subsidiary undertakings are not less than the amounts at which

they are included in the financial statements.

The preparation of the Company's financial statements on occasion

requires the Directors to make judgements, estimates and assumptions

that affect the reported amounts in the primary financial statements

and the accompanying disclosures. These assumptions and estimates

could result in outcomes that require a material adjustment to the

carrying amount of assets or liabilities affected in the current and

future periods, depending on circumstance.

The decision to allocate special dividends as income or capital is

a judgement but not deemed to be material. The allocation of expenses

to income or capital is a judgement as well, but also is not deemed

to be material. The Directors do not believe that any accounting judgements

or estimates have been applied to this set of financial statements

that have a significant risk of causing a material adjustment to the

carrying amount of assets and liabilities within the next financial

year.

Going concern

The assets of the Company consist of securities that are readily realisable

and, accordingly, the Directors believe that the Company has adequate

resources to continue in operational existence for at least twelve

months from the date of approval of the financial statements. The

Directors have also considered the aftermath of the Covid-19 pandemic

and the risks arising from the wider ramifications of the conflict

between Russia and Ukraine, including cash flow forecasting, a review

of covenant compliance including the headroom above the most restrictive

covenants and an assessment of the liquidity of the portfolio. They

have concluded that the Company is able to meet its financial obligations,

including the repayment of the bank overdraft, as they fall due for

a period of at least twelve months from the date of approval of the

financial statements. Having assessed these factors, the principal

risks and other matters discussed in connection with the viability

statement, the Board has determined that it is appropriate for the

financial statements to be prepared on a going concern basis.

Income from investments held at fair value through profit or loss

2.

2022 2021

GBP'000 GBP'000

-------------------------- -------------------------

UK dividends:

Listed - ordinary dividends 79,682 64,806

Listed - special dividends 5,702 2,413

-------------------------- -------------------------

85,384 67,219

-------------------------- -------------------------

Other dividends:

Dividend income - overseas investments 10,041 8,856

Dividend income - overseas special dividends 586 -

Dividend income - UK REIT 2,017 1,497

Scrip dividends - 54

-------------------------- -------------------------

12,644 10,407

-------------------------- -------------------------

Total 98,028 77,626

-------------------------- -------------------------

3. Other interest receivable and similar income

2022 2021

GBP'000 GBP'000

-------------------------- -------------------------

Stock lending revenue 190 263

-------------------------- -------------------------

190 263

-------------------------- -------------------------

At 30 June 2022, the total value of securities on loan by the Company

for stock lending purposes was GBP177,048,000 (2021: GBP211,020,000).

The maximum aggregate value of securities on loan at any one time

during the year ended 30 June 2022 was GBP288,549,000 (2021: GBP285,200,000).

The Company's agent holds collateral at 30 June 2022, with a value

of GBP192,321,000 (2021: GBP223,341,000) in respect of securities

on loan, the value of which is reviewed on a daily basis and comprises

CREST Delivery By Value ("DBVs") and Government Bonds with a market

value of 109% (2021: 106%) of the market value of any securities on

loan.

Management fee

4.

2022 2021

Revenue Capital Total Revenue Capital Total

return return return return return return

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- ---------- ---------- ---------------- -------- ------------

Management fee 1,746 4,073 5,819 1,493 3,484 4,977

-------- ---------- ---------- ---------------- -------- ------------

A summary of the terms of the Management Agreement is given in the

Annual Report. Details of apportionment between revenue and capital

can be found in the Annual Report.

Return per ordinary share - basic and diluted

5.

The return per ordinary share is based on the net return attributable

to the ordinary shares of GBP99,234,000 (2021: return of GBP265,996,000)

and on 448,747,183 ordinary shares (2021: 425,921,991), being the

weighted average number of ordinary shares in issue during the year.

The return per ordinary share is analysed between revenue and capital

as below:

2022 2021

GBP'000 GBP'000

------------------------------- --------------------------------------------

Net revenue return 92,988 72,809

Net capital return 6,246 193,187

------------------------------- --------------------------------------------

Net total return 99,234 265,996

------------------------------- --------------------------------------------

Weighted average number of

ordinary shares in issue during

the year 448,747,183 425,921,991

------------------------------- --------------------------------------------

2022 2021

Pence Pence

------------------------------- --------------------------------------------

Revenue return per ordinary

share 20.72 17.09

Capital return per ordinary

share 1.39 45.36

------------------------------- --------------------------------------------

Total return per ordinary

share 22.11 62.45

------------------------------- --------------------------------------------

The Company does not have any dilutive securities, therefore the basic

and diluted returns per share are the same.

6. Net asset value per ordinary share - basic and diluted

The net asset value per ordinary share is based on the net assets

attributable to the ordinary shares of GBP1,796,657,000 (2021: GBP1,727,325,000)

and on 459,639,868 (2021: 445,624,868) shares in issue on 30 June

2022.

An alternative net asset value per ordinary share can be calculated

by deducting from the total assets less current liabilities of the

Company the preference and preferred ordinary stocks and secured notes

at their market (or fair) values rather than at their par (or book)

values. The net asset value per ordinary share at 30 June 2022 calculated

on this basis was 393.45p (2021: 384.12p). See the Annual Report for

further details of the Alternative Performance measure and how it

is calculated.

The movements during the year of the assets attributable to the ordinary

shares were as follows:

GBP'000

-------------------------

Total net assets attributable to the ordinary shares at

1 July 2021 1,727,325

Total net return after taxation 99,234

Dividends paid on ordinary shares in the year (86,952)

Issue of shares 57,050

-------------------------

Total net assets attributable to the ordinary shares

at 30 June 2022 1,796,657

-------------------------

The Company does not have any dilutive securities.

7. Dividends paid on ordinary shares

2022 2021

Record date Payment date GBP'000 GBP'000

----------------- --------------- --------- -----------

Fourth interim dividend (4.75p)

for the year ended 30 June

2020 31 July 2020 28 August 2020 - 19,779

First interim dividend (4.75p)

for the year ended 30 June 30 October 30 November

2021 2020 2020 - 19,723

Second interim dividend (4.75p)

for the year ended 30 June 29 January 26 February

2021 2021 2021 - 20,205

Third interim dividend (4.80p)

for the year ended 30 June

2021 30 April 2021 28 May 2021 - 21,218

Fourth interim dividend (4.80p)

for the year ended 30 June 06 August

2021 2021 31 August 2021 21,434 -

First interim dividend (4.80p)

for the year ended 30 June 29 October 30 November

2022 2021 2021 21,434 -

Second interim dividend (4.80p)

for the year ended 30 June 28 January 28 February

2022 2022 2022 21,434 -

Third interim dividend (5.00p)

for the year ended 30 June

2022 28 April 2022 31 May 2022 22,684 -

Unclaimed dividends over 12

years old (34) (60)

--------- -----------

86,952 80,865

--------- -----------

In accordance with FRS 102, interim dividends payable to equity shareholders

are recognised in the Statement of Changes in Equity when they have

been paid to shareholders. All dividends have been paid out of revenue

reserves or current year revenue profits and at no point during the

year did the revenue reserve move to a negative position.

The total dividends payable in respect of the financial year which

form the basis of the test under Section 1158 of the Corporation Tax

Act 2010 are set out below.

2022 2021

GBP'000 GBP'000

--------------- ----------------------

Revenue available for distribution by

way of dividend for the year 92,988 72,809

First interim dividend of 4.80p (2021:

4.75p) (21,434) (19,723)

Second interim dividend of 4.80p (2021:

4.75p) (21,434) (20,205)

Third interim dividend of 5.00p (2021:

4.80p) (22,684) (21,218)

Fourth interim dividend of 5.00p (2021:

4.80p) paid on 31 August 2022(1) (23,139) (21,434)

--------------- ----------------------

Transfer to/(from) revenue reserve (2) 4,297 (9,771)

--------------- ----------------------

1 Based on 462,789,868 ordinary shares in issue at 4 August 2022 (the

ex-dividend date) (2021: 446,549,868)

2 The surplus of GBP4,297,000 (2021: deficit of GBP9,771,000) has

been taken to/(from) the revenue reserve

Since the year end, the Board has announced a first interim dividend

of 5.00 p per ordinary share, in respect of the year ending 30 June

2023. This will be paid on 30 November 2022 to holders registered

at the close of business on 28 October 2022. The Company's shares

will go ex-dividend on 27 October 2022.

8. Called up share capital

Nominal value

of total shares

in issue

Shares in issue GBP'000

---------------------- ----------------------

Allotted and issued ordinary shares

of 25p each:

At 1 July 2021 445,624,868 111,406

Issue of new ordinary shares 14,015,000 3,504

---------------------- ----------------------

At 30 June 2022 459,639,868 114,910

---------------------- ----------------------

Nominal value

of total shares

in issue

Shares in issue GBP'000

---------------------- ----------------------

Allotted and issued ordinary shares

of 25p each:

At 1 July 2020 416,404,868 104,101

Buyback of ordinary shares for treasury (1,175,000) -

Issue of ordinary shares from treasury 1,175,000 -

Issue of new ordinary shares 29,220,000 7,305

At 30 June 2021 445,624,868 111,406

---------------------- ----------------------

The Company issued 14,015,000 (2021: 29,220,000) ordinary shares with

total proceeds of GBP57,050,000 (2021: GBP109,811,000) after deduction

of issue costs of GBP291,000 (2021: GBP170,000). The average price of

the ordinary shares that were issued was 408.6p (2021: 375.8p). During

the year there were no shares re-purchased by the Company (2021: 1,175,000

shares were bought back at a total cost of GBP3,736,000 all of which

were placed into treasury. These shares were then re-issued for total

proceeds of GBP3,860,000 after deduction of issue costs of GBP6,000).

9. 2022 financial information

The figures and financial information for the year ended 30 June 2022

are extracted from the Company's annual financial statements for that

period and do not constitute statutory accounts. The Company's annual

financial statements for the year to 30 June 2022 have been audited but

have not yet been delivered to the Registrar of Companies. The Independent

Auditors' Report on the 2022 annual financial statements was unqualified,

did not include a reference to any matter to which the auditors drew

attention without qualifying the report, and did not contain any statements

under Sections 498(2) or 498(3) of the Companies Act 2006.

10. 2021 financial information

The figures and financial information for the year ended 30 June 2021

are compiled from an extract of the published financial statements for

that year and do not constitute statutory accounts. Those financial statements

have been delivered to the Registrar of Companies and included the report

of the auditors which was unqualified, did not include a reference to

any matter to which the auditors drew attention without qualifying the

report, and did not contain any statements under Sections 498(2) or 498(3)

of the Companies Act 2006.

11. Annual Report

The Annual Report will be posted to shareholders in late September 2022

and will be available on the Company's website www.cityinvestmenttrust.com

. Copies will be available thereafter in hard copy format from the Company's

registered office, 201 Bishopsgate, London, EC2M 3AE.

12. Annual General Meeting

The Annual General Meeting will be held on Thursday, 27 October 2022

at 2.30pm. The Notice of Meeting will be sent to shareholders with the

Annual Report.

13. General Information

Company Status

The City of London Investment Trust plc is a UK domiciled investment

trust company.

ISIN number / SEDOL: ordinary shares: GB0001990497 / 0199049

London Stock Exchange (TIDM) Code: CTY

New Zealand Stock Exchange Code: TCL

Global Intermediary Identification Number (GIIN): S55HF7.99999.SL.826

Legal Entity Identifier (LEI): 213800F3NOTF47H6AO55

Company Registration Number

UK : 00034871

New Zealand : 1215729

Registered Office

201 Bishopsgate, London EC2M 3AE

Directors and Secretary

The Directors of the Company are Sir Laurie Magnus (Chairman), Samantha

Wren (Audit Committee Chair), Clare Wardle (Senior Independent Director),

Ominder Dhillon and Robert (Ted) Holmes.

The Corporate Secretary is Janus Henderson Secretarial Services UK Limited,

represented by Sally Porter, ACG.

For further information please contact:

Job Curtis

Fund Manager

The City of London Investment Trust plc

Telephone: 020 7818 4367

Dan Howe

Head of Investment Trusts

Janus Henderson Investors

Telephone: 020 7818 4458

Harriet Hall

Investment Trust PR Manager

Janus Henderson Investors

Telephone: 020 7818 2919

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) are incorporated into, or forms part of,

this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR LFMFTMTIBBBT

(END) Dow Jones Newswires

September 19, 2022 02:00 ET (06:00 GMT)

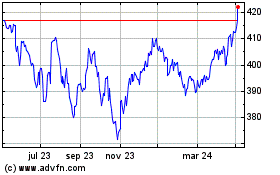

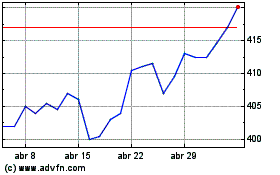

City Of London Investment (LSE:CTY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

City Of London Investment (LSE:CTY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024