TIDMCUSN

RNS Number : 0702B

Cornish Metals Inc.

29 September 2022

CORNISH METALS RELEASES UNAUDITED FINANCIAL STATEMENTS AND

MANAGEMENT'S DISCUSSION AND ANALYSIS FOR THE SIX MONTHSING 31 JULY

2022

Vancouver, September 28, 2022

Cornish Metals Inc. (TSX-V/AIM: CUSN) ("Cornish Metals" or the

"Company"), a mineral exploration and development company focused

on its projects in Cornwall, United Kingdom, is pleased to announce

that it has released its unaudited financial statements and

management, discussion and analysis ("MD&A") for the six months

ended July 31, 2022. The reports are available under the Company's

profile on SEDAR ( www.sedar.com ) and on the Company's website (

www.cornishmetals.com ).

Highlights for the six months ended July 31, 2022 and for the

period ending September 28, 2022

(All figures expressed in Canadian dollars unless otherwise

stated)

-- Completion of 10,159 meters of drilling at the United Downs

exploration project with assay results from the program confirming

management's belief in the potential to develop a Mineral Resource

in the United Downs project area;

-- Four main targets were drill-tested: UD Lode, United Mines,

Mount Wellington and Trenares Lode, with all four targets returning

results warranting further follow-up drilling (news release dated

August 23, 2022 );

-- Completion of financing for gross proceeds of GBP40.5 million

($65.1 million based on closest available exchange rate ),

including a strategic investment by Vision Blue Resources of

GBP25.0 million ($40.1 million), to advance the South Crofty tin

project to a potential construction decision (news releases dated

March 27, 2022 and May 23, 2022 ) ;

-- Issuance of a second tranche of common shares pursuant to the

restructuring of the deferred consideration relating to the

acquisition of the South Crofty tin project and associated mineral

rights in Cornwall (news release dated May 29, 2022 ) ;

-- Commencement of a drill program in July 2022 to collect

samples for metallurgical testwork as part of the Feasibility

Study, with the program likely to be between 8,000 and 12,000

meters of drilling (news release dated July 10, 2022 );

-- Key positions were filled to the South Crofty project

management team, including Project Manager for the construction and

commissioning of the water treatment plant, Feasibility Study

Manager and Project Engineer;

-- All substantial component parts of the water treatment plant

ordered with construction expected to commence before the end of

October 2022; and

-- Mr. Tony Trahar nominated by Vision Blue Resources as its

representative on the Board (news release dated June 5, 2022 ).

Richard Williams, CEO of Cornish Metals, stated, "Since the

completion of the GBP40.5m financing at the end of May, orders have

been placed for almost all component parts of the water treatment

plant. Notwithstanding supply constraints, we remain confident that

commissioning of the water treatment plant remains on track for the

first half of 2023, with dewatering activities commencing

thereafter.

"After completion of the first phase of the successful

exploration program at United Downs, we have now commenced a drill

program for the metallurgical testwork which is an integral part of

the South Crofty Feasibility Study. We have also had a successful

period recruiting key members of the project team (Project Manager,

Project Engineer and Feasibility Study Manager).

"Work has continued at pace in recent months and I look forward

to reporting on progress at South Crofty in due course . "

Review of activities

Results from exploration program at United Downs

The Company commenced its exploration program at United Downs in

April 2021. The drilling activities were contracted to Priority

Drilling Limited, under the supervision of the Company's geological

team.

Four targets were drill-tested: UD Lode, United Mines, Mount

Wellington and Trenares Lode. The key points to date arising from

this drill program are:

-- Multiple zones of copper - tin - silver - zinc mineralization have been intersected;

-- High-grade copper - tin mineralization was intersected down

dip beneath the historic United Mines; and

-- A transition from high-grade copper to high-grade tin at

depth as well as increasing tin grades with depth has been

encountered, similar to the mineralization transition seen at South

Crofty.

Details of the intercepts from the drill program can be found in

the press releases dated July 5, 2021, August 30, 2021, November 3,

2021, December 6, 2021, June 29, 2022 and August 23, 2022. In

total, 26 holes were drilled at United Downs amounting to 10,159

meters, of which all assay results have been reported in these

press releases. Drilling ceased at the end of May 2022, with the

metallurgical study drill program at South Crofty commencing soon

thereafter, as described below .

In summary, results from the United Downs exploration program

confirm management's belief in the potential to develop a Mineral

Resource in the United Downs project area, especially the down dip

section of the United Mine where high-grade copper, tin and silver

grades were encountered. The Company is considering the next steps

for advancing the United Downs project.

Outside of the United Downs project area, a third target, Carn

Brea has also been drill tested. Carn Brea is located approximately

two kilometers southeast of the South Crofty tin project. At Carn

Brea, eight holes have been drilled totaling 2,501 meters. Drilling

has now ceased and assays will follow when available.

Agreement of South Crofty mineral leases

On February 4, 2022, agreement was reached with Sir Ferrers

Vyvyan of Trelowarren in Cornwall to lease certain mineral rights

owned by the Vyvyan family. The mineral lease covers an area of 222

hectares and is valid for 25 years. The lease will enable the

Company to explore and mine within all the mineral right areas

owned by the Vyvyan family inside the South Crofty mine, and to

explore certain other mineral right areas adjacent to the South

Crofty mine.

The agreement with the Vyvyan family supplements the agreement

reached with Roskear Minerals LLP in March 2021 (the "Roskear

Agreement") to lease their mineral rights within the South Crofty

tin project. The Roskear Agreement enables the Company to explore

and develop the mineral resources that are contained in the Roskear

section of the South Crofty mine.

Strategic investment by Vision Blue Resources

On May 24, 2022, a financing of GBP40.5 million ($65.1 million

based on the closing exchange rate as at May 24, 2022) (the

"Offering") completed, which included a GBP25.0 million

(approximately $40.1 million based on the closing exchange rate as

at May 24, 2022) strategic investment by Vision Blue Resources

Limited ("VBR"). The balance of the Offering was completed through

a private placement with certain Canadian and UK investors and

eligible private investors.

A summary of the Offering is described below. Further details

can be found in the press releases dated March 27, 2022 and May 23,

2022.

The Offering was structured through a unit offering comprising

one common share at GBP0.18 ($0.30 for Canadian investors) and a

warrant to purchase one common share priced at GBP0.27 ($0.45 for

Canadian investors) for a period of 36 months from the closing date

of the Offering. A total of 225,000,000 units have been issued,

comprising around 44.0% of the issued share capital as at May 24,

2022, excluding the effect of the issuance of the Milestone Shares

as described below. VBR held approximately 27.2% of the enlarged

issued share capital upon closing of the Offering.

The planned use of the proceeds from the Offering is to complete

the dewatering program and Feasibility Study at South Crofty,

evaluate downstream beneficiation opportunities and commence

potential on-site early works in advance of a potential

construction decision. The proceeds raised under the Offering are

budgeted to fund a 30 month program from closing of the

Offering.

Pursuant to an Investment Agreement entered into between the

Company and VBR, upon closing of the Offering, VBR retains the

following rights, among others, subject to certain terms and

conditions:

-- For so long as its shareholding in the Company is in

aggregate not less than 10% of the Company's issued share

capital:

o Nomination of one person to the Company's board of directors

as a non-executive director as an additional director to the

current board of directors (the "Investor Director"), with Mr.

Trahar being appointed to this position on June 6, 2022, as

described below;

o Nomination of one person to the Company's technical committee

to be formed from closing of the Offering, which person may be a

person other than the Investor Director; and

o A participation right to maintain its percentage ownership

interest in the Company upon any offering of securities at the

subscription price and similar terms as are applicable to such

offering; and

-- For so long as its shareholding and its affiliates'

shareholdings in the Company are in aggregate not less than 5% of

the Company's issued share capital, the appointment of an observer

to the board of directors of the Company.

On closing of the Offering, VBR entered into a Relationship

Agreement with the Company and SP Angel Corporate Finance LLP (the

Company's nominated adviser on AIM) , relating to the carrying on

of the Company's business in an independent manner following the

closing of the Offering.

The Company has undertaken to VBR to use its reasonable

commercial efforts to complete a Feasibility Study in respect of

South Crofty on or before 31 December 2024.

The Offering was subject to the approval of the TSX-V and

shareholders, both of which were received by May 19. 2022.

Issuance of shares as deferred consideration payable for the

Cornwall mineral properties

On June 30, 2021, agreement was reached with Galena Special

Situations Limited (formerly Galena Special Situations Master Fund

Limited) and Tin Shield Production Inc. (together the "Sellers") to

restructure the outstanding deferred consideration payable to the

Sellers on the acquisition of the South Crofty tin project and

associated mineral rights (the "Side Letter"). The fixed and

variable payments that existed under the original share purchase

agreement were replaced with fixed payments linked to pre-agreed

project related milestones.

Pursuant to the Side Letter, 20,298,333 common shares were

issued to the Sellers on May 31, 2022 ("Milestone Shares"). This

payment was triggered by the Company raising funding for the

dewatering of the South Crofty mine within the planned use of

proceeds from the Offering, as described above.

The Milestone Shares represent consideration equivalent to an

amount of US$4,750,000 ($6,089,500 at a US dollar / Canadian dollar

exchange rate of 1.2820) at a deemed price of $0.30 per common

share. The deemed price was the same price under which Canadian

investors subscribed to the Offering pursuant to the terms of the

Side Letter. The value of the Milestone Shares in accordance with

IFRS is $9,844,692, being the market price of the Milestone Shares

at their date of issuance.

As a result of this payment, the remaining deferred

consideration payable to the Sellers is US$5,000,000 in common

shares, payable upon a decision to proceed with the development

and/or construction of a mine either at the South Crofty tin

project or at the United Downs property.

Disposal of Sleitat royalty to Electric Royalties

On May 27, 2022, the disposal of a 1% Net Smelter Royalty on the

Sleitat tin-silver project located in Alaska, USA to Electric

Royalties Limited was completed. The consideration was $100,000 and

1,000,000 common shares in Electric Royalties, which in aggregate

amounted to $355,000 at the date of completion.

Construction progress of water treatment plant at South

Crofty

Construction progress of the WTP at South Crofty has included

various enabling works and the placing of orders for a number of

long lead items, all of which have been delivered to site. The

preparation work for the laying of the concrete foundation slab for

the WTP has also been completed.

Detailed design work for the WTP is continuing with Galliford

Try Construction Limited ("GT"). The procurement process is also

underway, with GT specifying the major mechanical equipment and

identifying suitable sub-contractors for construction

activities.

Sand Separation Systems, an industry leader in the treatment of

mine water, have supported the running of a pilot plant to optimise

the water treatment process flowsheet.

Commencement of metallurgical study drill program at South

Crofty

A drill program as part of the South Crofty Feasibility Study

was started in July 2022. The drill program is anticipated to

require approximately 8,000 and 12,000 meters of drilling.

Three drill rigs have been contracted from Priority Drilling

Limited , under the supervision of the Company's geological team .

Two rigs are drilling from surface and one rig is drilling from

underground, collecting samples from the North Pool Zone (eastern

section of Mineral Resource), the #4 and #8 Lodes (central part of

the Mineral Resource), and Roskear / Dolcoath South (western part

of the Mineral Resource).

The program is designed to collect samples for various

metallurgical studies, including XRT ore sorting, flowsheet

optimisation and paste backfill studies, as well as collecting

assay data to complement the current Mineral Resource Estimate .

This testwork should allow the acceleration of the Feasibility

Study in advance of dewatering the mine and will provide key

information for the mineral processing flowsheet, especially the

amenability of the mineralized zones to ore sorting which, if

successful, will present an opportunity to deliver higher grade

feed and reduce the size of the processing plant.

Appointment of new director

On June 6, 2022, Mr. Tony Trahar was nominated by VBR to serve

as its representative on the Board. Mr. Trahar is currently a

special adviser to VBR.

Mr. Trahar has had a 40 year career in the mining, natural

resources and industrial sectors. From 2000 to 2007 he was Chief

Executive of Anglo American Plc, one of the world's largest mining

groups, and was also a director of Anglo Gold, Anglo Platinum and

De Beers.

From 1985 to 2000, Mr. Trahar was Chief Executive, and then

Chairman of Mondi Ltd (now listed in London as Mondi Plc), a

multinational forestry, pulp, paper and packaging group. Since

leaving Anglo American, Mr. Trahar has also held a number of senior

advisory roles for Barclays Natural Resource Investments (2007 to

2013) and Macquarie Bank (2014 to 2016).

Financial highlights for the six months ended July 31, 2022

Six months ended (unaudited)

(Expressed in Canadian dollars) July 31, July 31,

2022 2021

--------------- --------------

Total operating expenses 1,888,943 1,625,462

--------------- --------------

Loss for the period 3,250,557 1,097,062

--------------- --------------

Net cash (used in) operating

activities (1,836,464) (1,710,060)

--------------- --------------

Net cash (used in) investing

activities (2,552,626) (1,383,840)

--------------- --------------

Net cash provided by financing

activities 61,256,694 13,065,594

--------------- --------------

Cash at end of the period 61,629,169 10,138,512

--------------- --------------

-- Higher promotional and corporate expenses relating to

increased media/investor activities following last year's AIM

listing, preparatory work for the successful fundraise cornerstoned

by Vision Blue Resources and progression of the South Crofty tin

project;

-- Unrealized gain of $542,204 arising from increased valuation

of holding in Cornish Lithium following its most recent fundraising

completed in June 2022;

-- Costs of $687,603 and $226,884 capitalized in connection with

the exploration program at United Downs and Carn Brea, respectively

(excluding capitalized depreciation and other non-cash items);

-- Project related costs of $732,538 incurred since the closing

of the Offering relating to the advancement of the South Crofty tin

project, primarily for the metallurgical drill program, planning

activities and new or replacement equipment;

-- Gross proceeds raised from the Offering of GBP40.5 million

($65.1 million), following gross proceeds raised from the AIM

listing in comparative period of GBP8.2 million ($14.4 million);

and

-- Recognition of foreign currency translation loss of

$2,098,402 for those assets located in the UK when translated into

Canadian dollars for presentational purposes .

Outlook

The proceeds raised from the Offering completed in May 2022 are

being used to advance the South Crofty tin project to a potential

construction decision within 30 months from closing of the

Offering. The planned use of the proceeds from the Offering is to

complete the dewatering program and Feasibility Study at South

Crofty, evaluate downstream beneficiation opportunities and

commence potential on-site early works in advance of a potential

construction decision .

Within 30 months from the closing of the Offering, the Company's

plans are as follows:

-- Construct and commission the WTP in the first half of 2023

and thereafter complete the dewatering of the mine within 18

months;

-- Complete drill programs for metallurgical studies and to

produce an updated JORC compliant Mineral Resource estimate for a

Feasibility Study;

-- Complete a Feasibility Study using all reasonable commercial

efforts on or before 31 December 2024; and

-- Commence basic and detailed engineering studies, construction

of the processing plant, refurbishment of underground facilities

and other on-site early works.

Subject to the availability of financing, consideration will

also be given to continuing with the Company's exploration program

at United Downs and evaluating other near-surface, high potential,

exploration targets within transport distance of the planned

processing plant site at South Crofty .

ABOUT CORNISH METALS

Cornish Metals completed the acquisition of the South Crofty tin

and United Downs copper / tin projects, plus additional mineral

rights located in Cornwall, UK, in July 2016 (see Company news

release dated July 12, 2016 ). The additional mineral rights cover

an area of approximately 15,000 hectares and are distributed

throughout Cornwall. Some of these mineral rights cover old mines

that were historically worked for copper, tin, zinc, and

tungsten.

TECHNICAL INFORMATION

The technical information in this news release has been compiled

by Mr. Owen Mihalop. Mr. Mihalop has reviewed and takes

responsibility for the data and geological interpretation. Mr. Owen

Mihalop (MCSM, BSc (Hons), MSc, FGS, MIMMM, CEng) is Chief

Operating Officer for Cornish Metals Inc. and has sufficient

experience relevant to the style of mineralisation and type of

deposit under consideration and to the activity which he is

undertaking to qualify as a Competent Person as defined under the

JORC Code (2012) and as a Qualified Person under NI 43-101. Mr.

Mihalop consents to the inclusion in this announcement of the

matters based on his information in the form and context in which

it appears.

For additional information please contact:

In North America:

Irene Dorsman at (604) 200 6664 or by e-mail at

irene@cornishmetals.com

In the UK:

SP Angel Corporate

Finance LLP

(Nominated Adviser

& Joint Broker) Tel: +44 203 470 0470

Richard Morrison

Charlie Bouverat

Grant Barker

Hannam & Partners

(Joint Broker) Tel: +44 207 907 8500

Matthew Hasson

Andrew Chubb

Ernest Bell

BlytheRay

(Financial PR/IR-London) Tel: +44 207 138 3204

Tim Blythe tim.blythe@blytheray.com

Megan Ray megan.ray@blytheray.com

ON BEHALF OF THE BOARD OF DIRECTORS

"Richard D. Williams"

Richard D. Williams, P.Geo

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Caution regarding forward looking statements

This news release contains "forward-looking statements"

including, but not limited to, statements in connection with the

expected use of proceeds of the Offering, including in respect of

certain work programs, expected construction, including in respect

of the WTP, and the potential completion of a Feasibility Study on

the South Crofty mine and the timing thereof, the exploration

program at United Downs and other exploration opportunities

surrounding the South Crofty tin project, expected recruitment of

various personnel, and expectations respecting tin pricing and

other economic factors. Forward-looking statements, while based on

management's best estimates and assumptions at the time such

statements are made, are subject to risks and uncertainties that

may cause actual results to be materially different from those

expressed or implied by such forward-looking statements, including

but not limited to: risks related to receipt of regulatory

approvals, risks related to general economic and market conditions;

risks related to the COVID-19 global pandemic and any variants of

COVID-19 which may arise; risks related to the availability of

financing when required and on terms acceptable to the Company and

the potential consequences if the Company fails to obtain any such

financing, such as a potential disruption of the Company's

exploration program(s); the timing and content of upcoming work

programs; actual results of proposed exploration activities;

possible variations in Mineral Resources or grade; failure of

plant, equipment or processes to operate as anticipated; accidents,

labour disputes, title disputes, claims and limitations on

insurance coverage and other risks of the mining industry; changes

in national and local government regulation of mining operations,

tax rules and regulations.

Although Cornish Metals has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking statements, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements. Cornish Metals undertakes no obligation or

responsibility to update forward-looking statements, except as

required by law.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

CONSOLIDATED CONDENSED INTERIM STATEMENTS OF FINANCIAL

POSITION

(Unaudited)

(Expressed in Canadian dollars)

July 31, January 31,

2022 2022

------------------------------------------------- ------------------------ ------------------------

ASSETS

Current

Cash $ 61,629,169 $ 6,922,704

Marketable securities 2,371,710 1,574,506

Receivables 142,331 107,230

Prepaid expenses 313,755 231,933

64,456,965 8,836,373

Deposits 51,296 42,448

Property, plant and equipment 6,324,225 6,437,175

Exploration and evaluation assets 25,223,915 20,772,029

$ 96,056,401 $ 36,088,025

================================================= ======================== ========================

LIABILITIES

Current

Accounts payable and accrued liabilities $ 879,315 $ 613,178

Lease liability 2,523 4,204

Commitment to issue shares - 6,041,525

881,838 6,658,907

Lease liability - 667

NSR liability 8,789,295 8,717,330

9,671,133 15,376,904

SHAREHOLDERS' EQUITY

Capital stock 127,869,456 56,846,350

Capital contribution 2,007,665 2,007,665

Share-based payment reserve 630,265 630,265

Foreign currency translation reserve (2,272,525) (174,123)

Deficit (41,849,593) (38,599,036)

86,385,268 20,711,121

$ 96,056,401 $ 36,088,025

================================================= ======================== ========================

CONSOLIDATED CONDENSED INTERIM STATEMENTS OF LOSS AND

COMPREHENSIVE LOSS

(Unaudited)

(Expressed in Canadian dollars)

Six months ended

July 31, July 31,

2022 2021

------------------------------------------------ ------------------- ------------------

EXPENSES

Accretion $ - $ 15,764

Advertising and promotion 269,075 166,026

Depreciation 443 23,316

Finance cost - 3,895

Insurance 66,716 43,918

Office, miscellaneous and rent 55,516 39,712

Professional fees 359,845 704,810

Generative exploration costs 56,081 4,376

Regulatory and filing fees 98,718 91,704

Share-based compensation - 76,548

Salaries, directors' fees and benefits 982,549 455,393

Total operating expenses (1,888,943) (1,625,462)

Interest income 15,223 497

Foreign exchange loss (2,237,188) (203,001)

Gain on the disposal of royalty 318,147 -

Realized loss on marketable securities - (237)

Unrealized gain on marketable securities 542,204 733,120

Loss on the disposal of property, plant and

equipment - (1,979)

Loss for the period (3,250,557) (1,097,062)

Foreign currency translation (2,098,402) (29,841)

Total comprehensive loss for the period $ (5,348,959) $ (1,126,903)

================================================ =================== ==================

Basic and diluted loss per share $ (0.01) $ (0.01)

Weighted average number of common shares

outstanding: 378,614,227 259,248,342

================================================ =================== ==================

CONSOLIDATED CONDENSED INTERIM STATEMENTS OF CASH FLOWS

(Unaudited)

(Expressed in Canadian dollars)

Six months ended

July 31, July 31,

2022 2021

---------------------------------------------------------------- ----------------------- -----------------------

CASH FLOWS FROM OPERATING ACTIVITIES

Loss for the period $ (3,250,557) $ (1,097,062)

Items not involving cash:

Accretion - 15,764

Depreciation 443 23,316

Share-based compensation - 76,548

Finance cost - 3,895

Gain on the disposal of royalty (318,147) -

Realized loss on marketable securities - 237

Unrealized gain on marketable securities (542,204) (733,120)

Loss on the disposal of property, plant and equipment - 1,979

Foreign exchange loss 2,237,188 203,001

Changes in non-cash working capital items:

Increase in receivables (35,101) (92,177)

Increase in prepaid expenses (2,185) (76,990)

Increase (decrease) in accounts payable and accrued

liabilities 74,099 (35,451)

Net cash used in operating activities (1,836,464) (1,710,060)

CASH FLOWS FROM INVESTING ACTIVITIES

Acquisition of property, plant and equipment (388,283) (81,890)

Acquisition of exploration and evaluation assets (2,155,493) (1,287,953)

Proceeds from the sale of marketable securities,

net - 3,063

Increase in deposits (8,850) (17,060)

Net cash used in investing activities (2,552,626) (1,383,840)

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from AIM listing - 14,244,206

Proceeds from the Offering 65,135,746 -

Proceeds from option and warrant exercises 7,000 235,750

Share issue costs (3,947,087) (1,162,613)

Proceeds from the disposal of royalty 63,147 -

Conversion of Royalty Option costs - (226,290)

Lease payments (2,112) (25,459)

Net cash provided by financing activities 61,256,694 13,065,594

Impact of foreign exchange on cash (2,161,139) (186,783)

Change in cash during the period 54,706,465 9,784,911

Cash, beginning of the period 6,922,704 353,601

Cash, end of the period $ 61,629,169 $ 10,138,512

================================================================ ======================= =======================

CONSOLIDATED CONDENSED INTERIM STATEMENTS OF CHANGES IN

SHAREHOLDERS' EQUITY

(Unaudited)

(Expressed in Canadian dollars)

Share Foreign

subscriptions Share-based currency

Number of received Capital payment translation

shares Amount in advance contribution reserve reserve Deficit Total

---------------- ------------ -------------- -------------- ------------- ------------ ------------- ----------------------- --------------

Balance at

January $ ( 35,687,896

31, 2021 149,918,585 $ 40,737,065 $ 189,902 $ 2,007,665 $ 846,212 $ 239,028 ) $ 8,331,976

Share

issuance

pursuant

to

AIM

listing 117,226,572 14,434,108 (189,902) - - - - 14,244,206

Share issue

costs - (1,506,824) - - - - - (1,506,824)

Warrant

exercises 2,575,000 205,750 - - - - - 205,750

Option

exercises 200,000 30,000 - - - - - 30,000

Share-based

compensation - - - - 76,548 - - 76,548

Foreign

currency

translation - - - - - (29,841) - (29,841)

Loss for the

period - - - - - - (1,097,062) (1,097,062)

---------------- ------------ -------------- -------------- ------------- ------------ ------------- ----------------------- --------------

Balance at July

31, 2021 269,920,157 $ 53 ,900,099 $ - $ 2,007,665 $ 922,760 $ 209,187 $ (36,784,958) $ 20,254,753

---------------- ------------ -------------- -------------- ------------- ------------ ------------- ----------------------- --------------

Balance at

January $ ( 38,599,036

31, 2022 285,850,157 $ 56,846,350 $ - $ 2,007,665 $ 630,265 $ (174,123) ) $ 20,711,121

Share

issuance

pursuant to

the

Offering 225,000,000 65,135,746 - - - - - 65,135,746

Share issue

costs - (3,964,332) - - - - - (3,964,332)

Warrant

exercises 100,000 7,000 - - - - - 7,000

Shares

issued

pursuant

to property

option

agreement 20,298,333 9,844,692 - - - - - 9,844,692

Foreign

currency

translation - - - - - (2,098,402) - (2,098,402)

Loss for the ( 3,250,557

period - - - - - - (3,250,557) )

---------------- ------------ -------------- -------------- ------------- ------------ ------------- ----------------------- --------------

Balance at July

31, 2022 531,248,490 $127 ,869,456 $ - $ 2,007,665 $ 630,265 $(2,272,525) $ (41,849,593) $ 86,385,268

---------------- ------------ -------------- -------------- ------------- ------------ ------------- ----------------------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUGGBUPPGMR

(END) Dow Jones Newswires

September 29, 2022 02:00 ET (06:00 GMT)

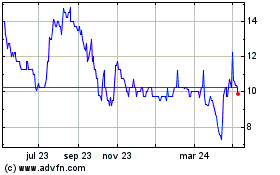

Cornish Metals (LSE:CUSN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

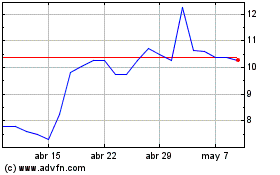

Cornish Metals (LSE:CUSN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024