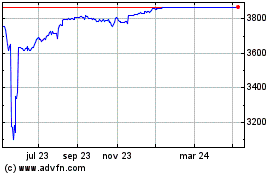

TIDMDPH

RNS Number : 1880Y

Dechra Pharmaceuticals PLC

05 September 2022

Monday, 5 September 2022

Dechra Pharmaceuticals PLC

(Dechra, Company or the Group)

Preliminary Results Announcement

Global veterinary pharmaceutical business, Dechra, issues

audited preliminary results for the year ended 30 June 2022

"We have continued to progress on all aspects of our strategy;

the product development pipeline was strengthened, material

acquisitions were completed post year-end and a new subsidiary

was established in South Korea as we continue our geographical

expansion."

Ian Page, Chief Executive Officer

Highlights

Strategic progress:

* Strong organic growth in all key markets and across

all therapeutic segments

* Pipeline strengthened through own innovation and

acquisition

* International portfolio strengthened through numerous

product approvals

* Successfully completed two material company

acquisitions post year-end: Piedmont and Med-Pharmex

* Executed numerous bolt-on product acquisitions to

complement existing equine and CAP portfolios.

Financial performance:

* Revenue growth of 13.8% to GBP681.8 million

* Underlying operating profit increased by 9.4% to

GBP174.3 million

* Reported operating profit increased by 16.2% to

GBP95.5 million

* Strong cash generation of GBP163.3 million

representing cash conversion of 93.7%

* Underlying diluted EPS increase of 14.0% to 120.84

pence

* Full year dividend increased by 10.8% to 44.89 pence.

All of the above measures are at constant exchange rate

(CER).

Financial Summary

2022 2021

GBPm GBPm Growth at AER Growth at CER

------------------------------------- ------ ------ ------------- -------------

Revenue 681.8 608.0 12.1% 13.8%

------------------------------------- ------ ------ ------------- -------------

Underlying

Underlying operating

profit 174.3 162.2 7.5% 9.4%

Underlying EBIT % 25.6% 26.7% (110 bps) (110 bps)

Underlying EBITDA 190.6 177.7 7.3% 9.2%

Underlying diluted

EPS (p) 120.84 108.14 11.7% 14.0%

------------------------------------- ------ ------ ------------- -------------

Reported

Operating profit 95.5 84.0 13.7% 16.2%

Diluted EPS (p) 53.40p 51.03p 4.6% 7.5%

Cash generated from

operations before interest/taxation 163.3 141.2 15.7%

Dividend per Share 44.89p 40.50p 10.8%

------------------------------------- ------ ------ ------------- -------------

Underlying results exclude items associated with amortisation

and impairment of acquired intangibles and notional intangibles in

respect of Medical Ethics, acquisition and integration costs

including release of acquisition tax provisions, transformational

cloud computing arrangements, loss on extinguishment of debt,

foreign exchange and discount unwind relating to contingent

consideration, the tax impact of these items and the deferred tax

impact of changes in tax rates. Further details are provided in

notes 5 and 21.

AER is defined as Actual Exchange Rate.

Results Briefing today:

A presentation of the Annual Results will be held today at 10.00

am (UK time) via https://stream.brrmedia.co.uk/broadcast/62dac1dc878cf86b3409dea5

This will also be available on the Dechra website later today.

Dial in ref: Dechra - Preliminary Announcement of Results

United Kingdom: Participant Local: +44 (0)330 165 4017

Confirmation Code: 3730022

For assistance please contact Fiona Tooley on +44 (0) 7785 703 523.

Enquiries:

Dechra Pharmaceuticals Office: +44 (0) 1606 814 730

PLC

Ian Page, Chief Executive

Officer

Paul Sandland, Chief Financial

Officer

Jonny Armstrong, Head of

Investor Relations

e-mail: corporate.enquiries@dechra.com

TooleyStreet Communications

Ltd

Fiona Tooley, Director Office: +44 (0) 121 309 0099

e-mail: fiona@tooleystreet.com Mobile: +44 (0) 7785 703 523

Notes:

Foreign Exchange Rates:

FY2022 Average: EUR 1.1807: GBP 1.0; FY2021 Average: EUR 1.1287: GBP 1.0;

USD 1.3316: GBP 1.0 USD 1.3466: GBP 1.0

FY2022 Closing: EUR 1.1652: GBP 1.0; FY2021 Closing: EUR 1.1654: GBP 1.0;

USD 1.2103: GBP 1.0 USD 1.3850: GBP 1.0

About Dechra

Dechra is a global specialist veterinary pharmaceuticals and related

products business. Its expertise is in the development, manufacture, marketing

and sales of high quality products for veterinarians worldwide. For more

information, please visit: www.dechra.com

Stock Code: Full Listing (Pharmaceuticals): DPH

LEI: 213800J4UVB5OWG8VX82

Trademarks

Trademarks appear throughout this document in italics. Dechra and the

Dechra 'D' logo are registered trademarks of Dechra Pharmaceuticals PLC.

StrixNB(R) and DispersinB(R) are trademarks licensed from Kane Biotech

Inc.

Forward Looking Statement

This document contains certain forward-looking statements. The forward-looking

statements reflect the knowledge and information available to the Company

during the preparation and up to the publication of this document. By

their very nature, these statements depend upon circumstances and relate

to events that may occur in the future thereby involve a degree of uncertainty.

Therefore, nothing in this document should be construed as a profit forecast

by the Company.

Market Abuse Regulation (MAR)

The information contained within this announcement may contain inside

information stipulated under the Market Abuse (Amendment) (EU Exit) Regulations

2018. Upon the publication of this announcement via the Regulatory Information

Service, this inside information is now considered to be in the public

domain.

Dechra Pharmaceuticals PLC

Preliminary Results for the year ended 30 June 2022

Chief Executive Officer's Statement

Introduction

I am pleased to report that the Group has delivered strong

growth throughout our financial year as we continue to outperform

the major international markets in which we operate. After a very

strong start to the year, revenue in the second half started to

return to more normalised historical levels of growth as the

benefit of increased spending on pets seen during the COVID-19

restrictions slowed down. This growth was delivered across all

product categories, all major therapeutic areas and in all the

international markets in which we trade. We have continued to

progress on all aspects of our strategy; the product development

pipeline was strengthened, material acquisitions were completed

post year-end and a new subsidiary was established in South Korea

as we continue our geographical expansion. Excellent progress has

been made on systems and quality in our supply chain, which

remained robust throughout the year. Information technology

implementations strengthened the infrastructure of the Group and

provided better management information. ESG is integrated into the

way we work and our people remain highly engaged, motivated and

dedicated in achieving our strategic goals.

Operational Review

EU Pharmaceuticals Segment

In the period our total European (EU) Pharmaceuticals Segment

revenue increased by 8.2% at CER (4.7% at AER). This includes a 12

month contribution from the acquisition of Tri-Solfen(R) ANZ

acquired in February 2021 and an additional month's contribution

from Osurnia(R) acquired on 27 July 2020. Existing net revenues

increased by 6.4% at CER (3.0% at AER). This Segment includes our

International business, which is detailed below. It also includes

non-core business, such as the Agricultural Chemical business,

which was originally acquired as part of the Genera acquisition in

2015 and was divested in January 2022; annual sales from this

business were approximately GBP6.0 million.

The EU growth was delivered across all product segments and all

countries with Iberia, Poland, Italy and Austria all achieving

double digit growth. The main driver of growth was CAP; however, it

is pleasing that FAP remains in growth in a challenging market and

that Equine and Nutrition continue to perform well.

Education continues to be the main tool to engage our veterinary

customers. Throughout the year we provided technical support for

6,000 clinical cases in the UK alone and have provided over 85,000

hours of continuing professional development (CPD) training across

Europe to veterinarians through our Lunch and Learn programmes and

educational seminars. Digital communication has also been an area

of focus with 13,500 veterinarians and veterinary nurses in Europe

and 17,600 globally, utilising our online Dechra Academy, which now

has 596 educational modules in our key therapeutic areas.

International Pharmaceuticals

It is five years since we established a team to focus purely on

international expansion. During this time, we have established

Dechra Australia as the second largest company in CAP

pharmaceuticals, have significantly strengthened our New Zealand

operation through two small acquisitions and have established a

strong foothold in South America through our Brazilian subsidiary.

Our ANZ and Brazilian businesses delivered good growth in the

year.

We have extended our international footprint by establishing a

new subsidiary in South Korea. We terminated the agreement with our

previous distributor following their change of ownership. We have

appointed a senior management team, whom we have known for many

years, to manage this new entity which will commence trading in the

second quarter of the new financial year. Having our own operation

will give us greater transparency on the opportunities in this fast

growing market and will also allow us to better assess our future

options for expansion in this region.

NA Pharmaceuticals Segment

Our total North America (NA) Pharmaceuticals Segment revenues

increased by 23.8% at CER (25.3% at AER). This revenue includes a

contribution from various products we acquired in the year, the

majority of which were launched in the second half, and one month

of additional Osurnia sales on a like-for-like basis over the

previous year. Existing net revenues increased strongly by 21.3% at

CER (22.7% at AER). This exceptional performance was delivered

despite increased competition to three of our branded generics. We

did manage to retain market share, albeit at a lower price point,

due to our strong relationship with our customers and through a

Dechra Rewards Scheme, managed by Vetcove, that now has 9,000

veterinary practice members. We continue to review and assess our

relationship with the veterinary distributors (wholesalers) who

proactively promote their own generic products that compete with

ours.

In the USA we increased the marketing team with four specialists

in digital and product management to support the launch of the

newly developed and acquired products. We continue to increase the

scale of our sales team with the appointment of 18 new

representatives in the year, a number of which joined us as part of

the Laverdia(R) acquisition.

The majority of growth is delivered from the US; however, we

also delivered strong performances in Mexico and Canada. In Mexico,

we transitioned completely out of our old manufacturing site and

relocated to new sales offices. In Canada, we initiated a FAP

business unit with the launch of two products and added three

internal sales representatives to our sales team.

As with DVP EU, education and technical support are important

tools in our relationship with our customers. In the year, our

veterinary technical services team dealt with 8,500 technical

queries, which involved over 15,000 telephone calls; we also held

413 certified educational presentations to 15,794 attending

veterinarians. Furthermore, we continued to invest in our

University engagement programme to educate veterinary graduates on

our key therapeutic areas.

Product Category Performance

CAP

Companion Animal Products (CAP), which represent 74.6% of Group

turnover, grew by 16.0% at CER in the year. Our key therapeutic

sectors, endocrinology, dermatology, anaesthesia and analgesia were

the main drivers of this growth. At the end of the year, we

launched Zenalpha(R) in the USA, a new novel canine sedative,

approved by the FDA, which contributed revenue of $1.3 million.

FAP

The strong performance in Food producing Animal Products (FAP)

during recent years, which represents 11.6% of Group turnover,

slowed to 6.0% at CER. This remains a solid performance as the

European market, a key area for our FAP sales, has been challenging

due to avian influenza, African swine fever and inflationary

costs.

Equine

Equine, which represents 7.2% of Group turnover, grew by 12.1%.

This growth was driven by locomotion, a therapeutic sector, which

includes Osphos, Equipalazone(R) and HY-50(R) and by internal

medicine, including Equibactin(R) and Prednidale Horse. In the

second half of the year we also launched three acquired products in

the USA, which are detailed later in this report.

Nutrition

Nutrition, which represents 5.1% of Group turnover, continues to

perform well and grew by 15.1%. The majority of our Specific

branded diet sales are in the EU where we have continued to

increase market penetration, especially with our newly launched

products, such as the organic range.

Product Development and Regulatory Affairs (PDRA)

Pipeline Progress

We have delivered another year of consistent progress on the

pipeline. We have generated positive dose range finding data in

both the dog and cat for the diabetes drugs being developed in

partnership with Akston Biosciences. Using its recently

commissioned GMP biologics production facility, Akston Biosciences

is currently on track to deliver active ingredient for our planned

pivotal efficacy studies. Lifecycle innovation of our key brands,

such as Vetoryl(R) and Osurnia, are ongoing and showing good

progress. New opportunities are constantly being identified and new

candidates have been added to the pipeline. With the addition of

the Piedmont projects (outlined later in this report), our pipeline

is stronger than ever and positioned to deliver material products

to support future growth.

Product Approvals

Numerous marketing authorisations have been achieved throughout

the year. Although only Zenalpha(R) is material in its own right,

they all add depth and breadth to the current product range and

strengthen our international portfolio. Major approvals in Dechra

territories are:

-- in Europe, Metomotyl 10mg chewable tablet for dogs

(Metoclopramide hydrochloride), Bupredine(R) Multidose 0.3mg/ml

solution for injection for dogs, cats and horses (Buprenorphine),

Canergy 100mg coated tablets for dogs (Propentofylline), Cefabam

1000mg, 250mg and 50mg tablets for dogs (Cephalexin monohydrate),

Clindacutin 10mg ointment for dogs (Clindamycin hydrochloride),

Lodisure(R) 1mg tablets for cats (Amlodipine besilate),

Octacillin(R) 800mg/g powder for use in water for pigs (Amoxicillin

trihydrate), Sedadex 0.1mg/ml solution for injection for dogs and

cats (Dexmedetomidine hydrochloride), Vomend(R) vet 10mg chewable

tablets for dogs (Metoclopramide hydrochloride);

-- in Great Britain and Northern Ireland, Tri-Solfen(R) Solution

for Pigs (Adrenaline tartrate, Lidocaine hydrochloride, Bupivacaine

hydrochloride, Cetrimide) was approved. An exemption from the need

for a maximum residue limit (MRL) for an equine product at an

advanced stage of development was also approved;

-- a novel canine sedative injection Zenalpha (Medetomidine

hydrochloride, Vatinoxan hydrochloride), a generic antibiotic

Amoxicillin Trihydrate and Clavulanate Potassium Drops and generic

Carprofen Caplets have been approved in the USA;

-- two sedative products, Dexmedesed 0.5mg/ml (Dexmedetomidine

hydrochloride) and Dormazolam(R) (Midazolam) as well as the

antimicrobial Rexxolide(R) (Tulathromycin) were registered in

Canada;

-- in Mexico, five new products were registered;

-- in Australia, four new products and in New Zealand three new products were registered;

-- in Brazil, three new products were registered including two vaccines; and

-- additionally, in other international territories, we have

received 52 approvals in countries including Egypt, Iran, Korea,

Pakistan, Peru, Puerto Rico, Serbia, Sri Lanka, Switzerland,

Thailand, West Africa (UEMOA), Ukraine, United Arab Emirates,

Uruguay and Vietnam.

Acquisitions

We have successfully completed several product acquisitions and

two material company acquisitions.

In July 2022, post the year end, we acquired Piedmont Animal

Health, Inc for $210 million (GBP175 million), a product

development company with a long, successful track record of

developing major international products for multi-national animal

health companies. Piedmont has eight novel products in various

stages of development, all in the CAP market for cats and dogs and

all within Dechra's key therapeutic areas of competence. The

business significantly strengthens Dechra's pipeline of novel

products with two near term opportunities, both expected to be top

ten products for Dechra. The development team of 19 people who have

joined Dechra, located in Greensboro, North Carolina, have added

additional strength and expertise to the Company's existing product

development capabilities.

Also, post the year end in August 2022 we completed the

acquisition of Med-Pharmex Holdings, Inc for $260.0 million

(GBP221.5 million). Med-Pharmex, with sales of $43.0 million and

adjusted EBITDA of $15.3 million, is an established platform

business located in Pomona, California with manufacturing, product

development and regulatory capabilities. It has several products

already approved and established in the US market. As they have no

sales and marketing capabilities, these products are currently sold

through third party partners. We are planning to sell many of these

products under a Dechra brand through our existing sales and

marketing channels, providing material margin synergies and

operational leverage. In the longer term, synergies will also be

realised from integration and improved utilisation of the

manufacturing facilities. The facility has the capability to

produce Cephalosporins, a type of antibiotic that is required to be

manufactured in a dedicated suite. They currently have one product

registered and one product in the development pipeline that fall

into this category, which is expected to be first entrant generic

in product markets of material scale in the USA.

We executed numerous bolt on product acquisitions, which

complement our equine and CAP portfolios.

The equine products acquired are all for the US market and

are:

-- Rompun(R) (xylazine injection) and Butorphanol Tartrate

Injection from Elanco(TM) Animal Health, which complement our

anaesthesia and analgesia portfolio;

-- Sucromate(TM) Equine (deslorelin acetate) sterile suspension

from Thorn Bioscience LLC, which expands our US Equine portfolio

into reproduction; and

-- ProVet APC(TM) (Autologous Platelet Concentrate) and ProVet

BMC(TM) (Bone Marrow Concentrate) systems from Hassinger

Biomedical. These two patented medical devices harness growth

factors from the horse's whole blood, which when injected back into

the horse positively enhance healing results in soft tissue

injuries. The ProVet APC(TM) system is a revolutionary device and

is arguably the fastest and most transportable platelet

concentrator available to the veterinary industry.

The CAP products acquired are:

-- LAVERDIA(R) -CA1, a novel oral SINE (selective inhibitor of

nuclear export) drug and the first oral tablet for canine lymphoma

acquired from Anivive Lifesciences Inc. It is currently sold under

a conditional approval by the FDA Center for Veterinary Medicine in

the USA with full dossier submissions planned for the USA, UK, EU,

Brazil, Australia, Japan and Canada;

-- Isoflurane(R) , USP and Sevoflurane(R) , USP from Halocarbon,

both inhalant anaesthetics, which expand our US veterinary surgical

suite;

-- Atopivet(R) range of products for cats and dogs in

collaboration with Bioiberica, which offer unique alternatives to

multi-modal dermatology therapy; and

-- Malaseb(R) , a leading dermatological medicated shampoo which

we already market across Europe, was acquired from Dermcare for the

US market, an excellent addition to our leading topical dermatology

range.

Enablers

Manufacturing and Supply Chain

The investment made in Manufacturing and Supply Chain over the

last two years has resulted in higher levels of stock availability

with backorders at the end of the year being at a three year low.

The huge improvements in our quality systems are clearly

demonstrated by successful regulatory inspections at our sites in

Zagreb, Croatia, Skipton, UK and Fort Worth, USA. Investment has

continued across

our Manufacturing sites:

-- two new automated lines were installed at Zagreb;

-- a new autoclave system for sterilisation of finished goods

has been installed in Bladel, Netherlands;

-- a high speed tablet press was commissioned at our Fort Worth site in the USA;

-- a new water for injection facility has been commissioned in Brazil; and

-- work has commenced on a new building in Skipton, which will

expand the site and improve work flows.

We have extended our European logistics centre in Uldum, Denmark

creating over 6,000 new pallet spaces with a subterranean store for

temperature controlled drugs that materially reduces the

electricity required to maintain low temperatures. We have also

increased our warehousing capacity in Australia.

This ongoing investment in our Manufacturing and Supply Chain

will allow us to continue our strategy to bring more production

in-house; nine products were transferred into Zagreb, Melbourne

(USA), Bladel and Fort Worth within the year.

Technology

Information technology remains a key area of focus for the

business. We are working on numerous projects which strengthen the

infrastructure, improve internal information, provide educational

support and improve employee and customer engagement. We are making

excellent progress on two major projects outlined in the Half Year

Report, these being the new quality document management system to

support Manufacturing, Product Development, Regulatory Affairs and

Technical Services, and in addition we have also established a

project team to upgrade the Manufacturing ERP system to one

consolidated cloud-based Oracle platform. Salesforce, a customer

relationship management system, is now being utilised across the

majority of countries in which we operate and we have also fully

rolled out a new global payroll system across the Group. We have

restructured and recruited new hires to increase our digital

communication capabilities as we continue to expand our on-line

training capabilities to our employees and to our customers through

the Dechra Academy, a platform which we are constantly upgrading in

both its technical capabilities and increased content.

People

On 1 January 2022, Alison Platt was appointed Chair of the Board

following the retirement of Tony Rice. On 1 June 2022, John Shipsey

was appointed as Non-Executive Director with the view to being the

successor to Julian Heslop as Audit Committee Chair. The Board and

I would like to express our thanks and gratitude for the huge

contribution both Tony and Julian have made to the Board over their

tenure as Non-Executive Directors.

We have commenced the recruitment process to find a successor to

Ishbel Macpherson as Remuneration Chair as Ishbel is in her tenth

year as a Non-Executive Director on the Dechra Board.

Following the retirement of Dr Susan Longhofer as Chief

Scientific Officer, we are pleased to announce the appointment of

Patrick Meeus as her replacement. Patrick, who has joined the

Senior Executive Team, is a veterinary surgeon and brings a wealth

of experience gained in multi-national pharmaceutical companies in

animal health.

Isabelle Gaillet has been appointed as EU Commercial Director.

Isabelle, who previously worked for the Company from 2015 to 2019

as French Country Manager will join the European Senior Management

Team. She will support the EU Country Managers and lead our

commercial strategy for the EU alongside Tony Griffin, European

Pharmaceuticals Managing Director.

We have launched a Future Facing Leaders programme with 24

employees from across our global subsidiaries joining the scheme,

which is designed to develop our management talent and will support

the future growth of Dechra. Furthermore, we have launched

leadership development programmes for our International, North

America and Manufacturing management teams.

We have rolled out a Group wide applicant tracking system and

also an automated talent review process that allows us to monitor

our talent pipeline, succession plans, employee mobility and

individuals' progress.

ESG

To enable our business to adapt to climate change, we have

focused on mitigating our impact through the decarbonisation of the

business. We remain committed to the Science Based Target

initiatives, working towards a Net-Zero ambition by 2050. We have

also released our inaugural separate Sustainability Report and

provided enhanced Task Force on Climate-related Financial

Disclosures, which are included in the 2022 Annual Report.

Dividend

The Board is proposing a final dividend of 32.89 pence per share

(2021: 29.39 pence per share). Added to the interim dividend of

12.00 pence per share (2021: 11.11 pence per share), this brings

the total dividend for the financial year ended 30 June 2022 to

44.89 per share (2021: 40.50 pence per share), representing 10.8%

growth over the previous year.

Subject to shareholder approval at the Annual General Meeting to

be held on 20 October 2022, the final dividend will be paid on 18

November 2022 to shareholders on the Register at 28 October 2022.

The shares will become ex-dividend on 27 October 2022.

Outlook

As the market returns to normal levels of trading post the

impact of COVID-19 and as current macroeconomic uncertainties are

expected to continue, the veterinary pharmaceutical market,

particularly in the CAP sector, is resilient and in growth.

The acquisition, post year end, of Med-Pharmex strategically

strengthens our position in the US market. The acquisition of

Piedmont adds several novel exciting products to our development

pipeline and we continue to identify new opportunities as we

successfully execute our strategy.

We remain confident in our ability to outperform the markets in

which we operate and in the prospects for the current financial

year.

Ian Page

Chief Executive Officer

5 September 2022

Financial Review

Overview of Reported Financial Results

To assist with understanding our reported financial performance,

the consolidated results below are split between existing and

acquired businesses; acquisition includes the incremental effect of

those businesses acquired in the current and prior year, reported

on a 'like-for-like' basis. Additionally, the following table shows

the growth at both reported actual exchange rates (AER), and

constant exchange rates (CER) to identify the impact of foreign

exchange movements. The acquisition operating profit of GBP1.8

million includes underlying operating profit of GBP6.7 million and

non-underlying charges of GBP4.9 million relating to amortisation

of acquired intangibles.

Including non-underlying items, the Group's consolidated

operating profit increased by 16.2% at CER (13.7% at AER) whilst

consolidated profit before tax increased by 7.8% at CER (4.9% at

AER), impacted by an increase in net finance costs. Diluted EPS

growth was 7.5% at CER (4.6% at AER) reflecting the marginal

reduction in the effective tax rate.

Growth Growth

at AER at CER

------------------ --------- ------------ ------------- -----

2022 2022 2022

Existing Acquisition Consolidated 2021 Consolidated Consolidated

As Reported GBPm GBPm GBPm GBPm % %

------------------ --------- ------------ ------------- ----- ------------- ------------

Revenue 669.4 12.4 681.8 608.0 12.1% 13.8%

Gross profit 377.0 7.8 384.8 345.9 11.2% 12.9%

Gross profit % 56.3% 62.9% 56.4% 56.9% (50bps) (40bps)

Operating profit 93.7 1.8 95.5 84.0 13.7% 16.2%

EBIT % 14.0% 14.5% 14.0% 13.8% 20bps 30bps

Profit before tax 75.8 1.8 77.6 74.0 4.9% 7.8%

Diluted EPS (p) 53.40 51.03 4.6% 7.5%

------------------ --------- ------------ ------------- ----- ------------- ------------

Overview of Underlying Financial Results

The Group presents a number of non-GAAP Alternative Performance

Measures (APMs). This allows investors to understand better the

underlying performance of the Group by excluding certain

non-underlying items as set out in notes 3, 4, 5, 6 and 21. As

underlying results include the benefits of acquisitions but exclude

significant costs such as amortisation of acquired intangibles,

they should not be regarded as a complete picture of the Group's

financial performance, which is presented in its total Reported

results. The exclusion of non-underlying items may result in

underlying earnings being materially higher or lower than total

Reported earnings. In particular, when significant amortisation of

acquired intangibles is excluded, underlying earnings will be

higher than total Reported earnings. A reconciliation of underlying

results to Reported results in the year to 30 June 2022 is provided

in the table below. In the commentary which follows, all references

will be to CER movement unless otherwise stated.

Non-underlying Items

------------------------------------

Amortisation Acquisition,

and related impairments Tax rate

2022 costs of and cloud changes

Underlying acquired computing and finance 2022 Reported

Results intangibles costs expenses Results

GBPm GBPm GBPm GBPm GBPm

------------------------------------ ----------- ------------ ------------ ------------ -------------

Revenue 681.8 - - - 681.8

Gross profit 385.3 - (0.5) - 384.8

Selling, general and administrative

expenses (178.6) (69.1) (5.5) - (253.2)

R&D expenses (32.4) (3.7) - - (36.1)

Operating profit 174.3 (72.8) (6.0) - 95.5

Net finance costs (3.1) - - (13.5) (16.6)

Share of associate profit (1.2) (0.1) - - (1.3)

Profit before tax 170.0 (72.9) (6.0) (13.5) 77.6

Taxation (38.3) 17.3 1.2 0.4 (19.4)

Profit after tax 131.7 (55.6) (4.8) (13.1) 58.2

Diluted EPS (p) 120.84 53.40

------------------------------------ ----------- ------------ ------------ ------------ -------------

In the year, Dechra delivered consolidated revenue of GBP681.8

million, representing an increase of 13.8% on the prior year. This

included GBP669.4 million from its existing business, an increase

of 11.8%, and a GBP12.4 million contribution from acquired product

rights.

Consolidated underlying operating profit of GBP174.3 million

represents a 9.4% increase on the prior year. This included

GBP167.6 million from Dechra's existing business, an increase of

5.2% on a like-for-like basis, and a GBP6.7 million contribution

from acquired product rights.

Underlying EBIT margin decreased by 110 bps to 25.6%,

principally due to the increase in Selling, General and

Administrative expenses (SG&A) spend as a percentage of revenue

with our cost base normalising following lower levels of spend

during the COVID-19 pandemic.

Underlying diluted EPS grew by 14.0% to 120.84 pence reflecting

the profit growth from the existing and acquired businesses and

benefiting from lower net finance costs driven by realised foreign

exchange gains.

A more detailed explanation of our non-underlying items is

included later in this Financial Review.

Growth at CER

------------------------ --------- ------------ ------------- ------

2022 2022 2022

Existing Acquisition Consolidated 2021 Existing Consolidated

Underlying GBPm GBPm GBPm GBPm % %

------------------------ --------- ------------ ------------- ------ -------- ------------

Revenue 669.4 12.4 681.8 608.0 11.8% 13.8%

Underlying gross profit 377.5 7.8 385.3 345.9 10.8% 13.1%

Underlying gross profit

% 56.4% 62.9% 56.5% 56.9% (50bps) (40bps)

Underlying operating

profit 167.6 6.7 174.3 162.2 5.2% 9.4%

Underlying EBIT % 25.0% 54.0% 25.6% 26.7% (170bps) (110bps)

Underlying EBITDA 183.9 6.7 190.6 177.7 5.3% 9.2%

Underlying diluted EPS

(p) 120.84 108.14 14.0%

Dividend per share (p) 44.89 40.50 10.8%

------------------------ --------- ------------ ------------- ------ -------- ------------

Reported Segmental Performance

Reported segmental performance is presented in note 2. The

effect of acquisitions in the year was material; the reported

segmental performance is analysed between existing and acquired

businesses, and at AER and CER in the table below. The acquisition

elements capture the additional base business coming into the Group

up to the first anniversary of their acquisition, including the

growth Dechra generated in them during the year, and the synergies

that have already been realised by the Group since acquisition.

This analysis becomes less definitive the further in time from the

completion of the acquisition, as the acquired business is

progressively integrated with the existing business.

Growth at AER Growth at CER

------------------ ------------- ------------ ------------- ------

2022 2022

2022 Existing Acquisition Consolidated 2021 Existing Consolidated Existing Consolidated

Reported GBPm GBPm GBPm GBPm % % % %

------------------ ------------- ------------ ------------- ------ -------- ------------ -------- ------------

Revenue by segment

EU Pharmaceuticals 400.0 6.7 406.7 388.5 3.0% 4.7% 6.4% 8.2%

NA Pharmaceuticals 269.4 5.7 275.1 219.5 22.7% 25.3% 21.3% 23.8%

Total 669.4 12.4 681.8 608.0 10.1% 12.1% 11.8% 13.8%

Underlying

operating

profit/(loss)

by segment

EU Pharmaceuticals 127.7 3.8 131.5 127.8 (0.1%) 2.9% 3.8% 6.9%

NA Pharmaceuticals 84.8 2.9 87.7 75.9 11.7% 15.5% 9.7% 13.6%

Pharmaceuticals

Research and

Development (32.4) - (32.4) (32.4) 0.0% 0.0% (1.5%) (1.5%)

Underlying segment

operating profit 180.1 6.7 186.8 171.3 5.1% 9.0% 6.9% 10.9%

Corporate and

unallocated costs (12.5) - (12.5) (9.1) (37.4%) (37.4%) (37.4%) (37.4%)

Underlying

operating

profit 167.6 6.7 174.3 162.2 3.3% 7.5% 5.2% 9.4%

Non-underlying

operating items (73.9) (4.9) (78.8) (78.2)

Reported operating

profit 93.7 1.8 95.5 84.0 11.5% 13.7% 13.9% 16.2%

------------------ ------------- ------------ ------------- ------ -------- ------------ -------- ------------

Underlying Segmental Performance

European Pharmaceuticals

Revenue in European (EU) Pharmaceuticals grew by 8.2% to

GBP406.7 million. The existing business grew by 6.4% with this

growth driven by a robust performance across all established

European markets and also in the key International businesses in

ANZ and Brazil. The acquisitions of Tri-Solfen(R) (for the ANZ

market) and Osurnia (July sales) contributed a combined GBP6.7

million to revenue for the period where there is no

comparative.

Operating profit from existing business increased by 3.8%, with

operating margin decreasing to 31.9% and consolidated operating

margin decreasing to 32.3% as our cost base normalised following

COVID-19.

Growth at CER

------------------- --------- ------------ ------------- -----

2022 2022 2022

Existing Acquisition Consolidated 2021 Existing Consolidated

Underlying GBPm GBPm GBPm GBPm % %

------------------- --------- ------------ ------------- ----- -------- ------------

Revenue 400.0 6.7 406.7 388.5 6.4% 8.2%

Operating profit 127.7 3.8 131.5 127.8 3.8% 6.9%

Operating profit % 31.9% 56.7% 32.3% 32.9% (100bps) (60bps)

------------------- --------- ------------ ------------- ----- -------- ------------

North American Pharmaceuticals

Revenue from North American (NA) Pharmaceuticals grew by 23.8%

to GBP275.1 million. The existing business grew by 21.3% reflecting

strong demand for our CAP products in the US, Canada and Mexico.

Osurnia (July sales), along with the product acquisitions made in

the latter part of 2021 and early in 2022, contributed a combined

GBP5.7 million to revenue for the period where there is no

comparative.

Operating profit from existing business grew 9.7% with operating

margin decreasing to 31.5% and consolidated operating margin

decreasing to 31.9% as our cost base normalised following

COVID-19.

Growth at CER

------------------- --------- ------------ ------------- -----

2022 2022 2022

Existing Acquisition Consolidated 2021 Existing Consolidated

Underlying GBPm GBPm GBPm GBPm % %

------------------- --------- ------------ ------------- ----- -------- ------------

Revenue 269.4 5.7 275.1 219.5 21.3% 23.8%

Operating profit 84.8 2.9 87.7 75.9 9.7% 13.6%

Operating profit % 31.5% 50.9% 31.9% 34.6% (310bps) (270bps)

------------------- --------- ------------ ------------- ----- -------- ------------

Pharmaceuticals Research and Development

Pharmaceuticals Research and Development (R&D) expenses of

GBP32.4 million represented 4.8% of existing revenue with some

project spend being delayed due to the impact of COVID-19 and

specifically our ability to recruit and perform clinical study

work. This spend included GBP3.3 million in relation to Akston.

Growth at CER

------------- --------- ---------------- ----------------- ------

2022

Existing 2022 Acquisition 2022 Consolidated 2021 Existing Consolidated

GBPm GBPm GBPm GBPm % %

------------- --------- ---------------- ----------------- ------ -------- ------------

R&D expenses (32.4) - (32.4) (32.4) (1.5%) (1.5%)

% of revenue 4.8% - 4.8% 5.3%

------------- --------- ---------------- ----------------- ------ -------- ------------

Revenue by Product Category

CAP revenue continues to be the largest proportion of Dechra's

business at 74.6%, up from 72.8% in the prior year. CAP grew 16.0%

in the year with further market penetration across all therapeutic

areas. Equine revenue grew by 12.1% in the year driven by the US

product rights acquisitions. FAP revenue growth was 6.0% benefiting

from the launch of Tri-Solfen(R) in ANZ following the acquisition

of rights in July 2021, but offset by the divestment of the

non-core Agricultural Chemicals business in January 2022 (revenue

growth on an existing basis was 5.6%). Nutrition revenue increased

by 15.1% on the prior year reflecting the continuing success of our

strategy with key customers in our key markets.

Other revenue reduced by 12.6% to GBP10.1 million, now

representing only 1.5% of the business as we continue our planned

exit from third party contract manufacturing in line with our

manufacturing strategy, to improve the production efficiency of

Dechra's own products.

% %

2022 2021 Change Change

GBPm GBPm at AER at CER

------------------------ ----- ----- ------- -------

CAP 508.4 442.6 14.9% 16.0%

Equine 49.5 44.8 10.5% 12.1%

FAP 78.8 77.0 2.3% 6.0%

------------------------ ----- ----- ------- -------

Subtotal Pharmaceutical 636.7 564.4 12.8% 14.3%

Nutrition 35.0 31.7 10.4% 15.1%

Other 10.1 11.9 (15.1%) (12.6%)

------------------------ ----- ----- ------- -------

Total 681.8 608.0 12.1% 13.8%

------------------------ ----- ----- ------- -------

Underlying Gross Profit

Underlying gross profit margin for the existing business

decreased by 50 bps to 56.4% on an Existing basis and decreased by

40 bps to 56.5% on a consolidated basis reflecting the strong CAP

performance offset by the increased generic competition,

particularly in our NA Business.

Underlying Selling, General and Administrative Expenses

(SG&A)

SG&A costs grew from GBP151.3 million in the prior year to

GBP178.6 million in the current year, an increase of 19.8%. This

growth principally represents the full year impact of the

investment in our people costs following the review of compensation

across the Group in January 2021 and the normalisation of our cost

base (including sales & marketing and travel &

entertainment costs) following COVID-19 lockdowns in the prior

year.

Non-underlying Items

Non-underlying items incurred in the year are fully described in

note 5. In summary, they relate to the following:

-- Amortisation of acquired intangibles of GBP72.8 million has

decreased from GBP75.2 million in 2021 principally due to new

charges relating to the product acquisitions more than offset by

the reducing charge from the AST Farma and Le Vet acquisition;

-- Cloud computing arrangement costs of GBP2.8 million relating

to the initial costs of the programme to implement the

Manufacturing and Supply function's new ERP and Electronic Quality

Management systems;

-- Impairment costs of GBP2.9 million predominately relating to

the sale of the Agricultural Chemicals business (GBP1.0 million)

and an impairment of a small number of In-Process R&D assets

recognised on the acquisition of AST Farma and Le Vet (GBP1.7

million);

-- Finance charge of GBP13.5 million (2021: credit of GBP2.8

million) represents the charge arising on the unwind of the

discount relating to the contingent consideration liability of

GBP3.4 million and associated foreign exchange loss of GBP10.1

million driven by the depreciation of Sterling against the US and

Australian Dollars;

-- Taxation credit of GBP18.9 million (2021: GBP14.0 million)

represents the tax impact of the above items (GBP21.1 million),

offset by the revaluation of deferred tax balance sheet items

(GBP2.2 million charge) following changes in corporate tax rates,

including a further revision to the Netherlands rate (which is

increasing to 25.8%);

-- Expenses relating to acquisition and subsequent integration

activities were GBP0.3 million (2021: GBP1.4 million) with costs

relating

to the product rights acquisitions in the current year being

immaterial so treated as underlying; and

-- Costs relating to rationalisation of the manufacturing

organisation were nil (2021: GBP1.6 million), as this programme was

completed in the prior year.

Taxation

The reported effective tax rate (ETR) for the year is 25.0%

(2021: 25.0%) and includes the one-off impact of the substantively

enacted increase in corporate tax rates in the Netherlands (from

25.0% to 25.8%) on deferred tax balances. On an underlying basis

the ETR is 22.5% (2021: 21.7%); the main differences to the UK

corporation tax rate applicable of 19.0% (2021: 19.0%) relate to

differences in overseas tax rates and non-deductible expenses

offset by patent box allowances and other incentives.

The underlying ETR is expected to remain at a similar level in

the year to 30 June 2023. We continue to monitor relevant tax

legislation internationally as it may affect our future ETR.

Reported Profit

Reported profit before tax increased by 4.9% at AER reflecting

the reported operating profit growth of 13.7% at AER and the

increase in net finance costs which include a foreign exchange loss

of GBP10.1 million on the remeasurement of the contingent

consideration liabilities driven by the depreciation of Sterling

against the US and Australian Dollars.

Earnings per Share and Dividend

Underlying diluted EPS for the year was 120.84 pence, a 14.0%

growth on the prior year reflecting the underlying EBIT growth of

9.4% and the benefit from a lower net finance expense principally

due to foreign exchange gains realised. The weighted average number

of shares for diluted earnings per share for the year was 109.0

million (2021: 108.8 million).

The reported diluted EPS for the year was 53.40 pence (2021:

51.03 pence). This represents an increase of 4.6% (at AER) in

reported EPS which is lower than the reported EBIT growth of 13.7%

(at AER) reflecting the increase in net finance expense due to the

foreign exchange losses recognised on contingent liabilities.

The Board is proposing a final dividend of 32.89 pence per share

(2021: 29.39 pence); added to the interim dividend of 12.00 pence,

the total dividend per share for the year ended 30 June 2022 is

44.89 pence. This represents 10.8% growth over the prior year.

Dividend cover based on underlying diluted EPS is 2.7 times (2021:

2.7 times). The Board continues to operate a progressive dividend

policy, recognising investment opportunities as they arise.

Currency Exposure

The average rate for GBP/EUR increased by 4.6%, and the GBP/$

rate decreased by 1.1% during the financial year. The effect in the

Consolidated Income Statement and Statement of Financial Position

is analysed in the above paragraphs of this review between

performance at AER and CER. CER analysis compares the performance

of the business on a like-for-like basis applying constant exchange

rates.

Average rates

--------

2022 2021 % Change

-------- ------- ------ --------

GBP/EUR 1.1807 1.1287 4.6%

GBP/$ 1.3316 1.3466 (1.1%)

-------- ------- ------ --------

Currency Sensitivity

Euro EUR: a 1% variation in the GBP/EUR exchange rate affects

underlying diluted EPS by approximately +/- 0.5%.

US Dollar $: a 1% variation in the GBP/$ exchange rate affects

underlying diluted EPS by approximately +/- 0.5%.

Current exchange rates are GBP/EUR 1.1623 and GBP/$ 1.1623 as at

1 September 2022. If these rates had applied throughout the year,

the underlying diluted EPS would have been approximately 8.3%

higher.

Statement of Financial Position

The Statement of Financial Position is summarised in the table

below.

-- Non-current assets (excluding deferred tax) increased from

GBP819.9 million to GBP846.6 million and include the intangible

assets recognised on the product acquisitions, partly offset by

amortisation of acquired intangibles.

-- Working capital increased from GBP142.7 million to GBP175.7

million (GBP33.0 million at AER, GBP27.8 million cash flow impact)

mainly due to the growth of the Group with an investment in

inventory made to maintain service levels during this continuing

period of heightened growth and uncertainty.

-- Net debt increased in the year by GBP8.0 million from

GBP200.2 million to GBP208.2 million; this includes cash generation

from operations at GBP166.1 million, an outflow of GBP54.4 million

relating to product acquisitions made during the year, net capital

expenditure of

GBP20.3 million, net interest/tax outflows of GBP39.8 million

and GBP44.8 million in dividends. Exchange rate variations

negatively impacted the net debt position by GBP7.2 million.

-- Current and deferred tax assets and liabilities reduced from

GBP45.8 million to GBP34.7 million principally due to the

realisation of deferred tax liabilities relating to the

amortisation of acquired intangibles.

2022 2021

GBPm GBPm

--------------------- ------- -------

Non-current assets 846.6 819.9

Working capital 175.7 142.7

Net debt (208.2) (200.2)

Current and deferred

tax (34.7) (45.8)

Other liabilities (112.6) (83.7)

--------------------- ------- -------

Total net assets 666.8 632.9

--------------------- ------- -------

Cash Flow, Financing and Liquidity

The Group enjoyed good cash generation during the year, with a

strong Underlying EBITDA margin of 28.0% (2021: 29.2%). However, as

mentioned above, working capital has increased by GBP27.8 million,

mainly due to the growth of the Group with an investment in

inventory made to maintain service levels during this continuing

period of heightened growth and uncertainty. This resulted in net

cash generated from operations after non-underlying items of

GBP163.3 million, representing cash conversion of 93.7% of

underlying operating profit.

2022 2021

GBPm GBPm

------------------------- ------ ------

Underlying operating

profit 174.3 162.2

Depreciation and

amortisation 16.3 15.5

Underlying EBITDA 190.6 177.7

Underlying EBITDA

% 28.0% 29.2%

Working capital movement (27.8) (36.0)

Other 3.3 2.5

Cash generated from

operations before

interest, taxation

and non-underlying

items 166.1 144.2

Non-underlying items (2.8) (3.0)

Cash generated from

operations before

interest and taxation 163.3 141.2

Cash conversion

(%) 93.7% 87.1%

------------------------- ------ ------

Net Debt Bridge

Notable cash items are listed below in the net debt

reconciliation table:

-- Net capital expenditure on tangible assets increased to

GBP20.3 million (2021: GBP19.8 million), representing 1.8 times

depreciation.

-- Acquisitions of intangible assets of GBP57.3 million includes

the product acquisitions (see below) and capitalised development

expenditure (GBP1.2 million).

-- The net debt/underlying EBITDA leverage ratio per the

borrowing facilities' leverage covenant, which includes the

proforma adjustment to full year EBITDA for the acquisitions, was

1.0 times (2021: 1.1 times) versus a covenant of 3 times.

GBPm

---------------------------------- -------

Net Debt 30 June 2021 (200.2)

Net cash generated from

operations before non-underlying

items 166.1

Non-underlying items (2.8)

Net capital expenditure (20.3)

Acquisition of intangible

assets (57.3)

Acquisition of subsidiary (0.8)

New lease liabilities (3.8)

Interest and tax (39.8)

Dividend paid (44.8)

Other movements 2.3

Other non-cash movements 0.4

Foreign exchange on net

debt (7.2)

---------------------------------- -------

Net Debt 30 June 2022 (208.2)

---------------------------------- -------

Borrowing Facilities

As reported in preceding Annual Reports, the Group completed a

refinancing and entered into a multi-currency facilities agreement

in July 2017 (the Facility Agreement), with a group of banks

comprising Bank of Ireland (UK) plc, BNP Paribas, Fifth Third Bank,

HSBC Bank plc, Lloyds Bank plc (replaced by Credit Industriel et

Commercial, London branch (CIC) in August 2019), Raiffeisen Bank

International AG and Santander UK plc (the Banks). The Facility

Agreement has a revolving credit facility (the RCF) of GBP340.0

million, which is committed until July 2024.

In January 2020 the Group undertook a Private Placement raising

EUR50.0 million and USD100.0 million (under seven and ten year new

senior secured notes respectively), the proceeds of which were used

to repay existing debt. The placement achieved the Group's aims of

diversifying the sources of debt financing and extending the debt

maturity profile.

On 14 July 2022, the Group undertook a further Private Placement

raising EUR50.0 million and EUR100.0 million (under seven and ten

year new senior secured notes respectively), the proceeds of which

were used to repay existing debt.

Capital Management

On 21 July 2022, the Group successfully completed a share

placing of 5,364,683 new ordinary shares, representing 4.95% of the

existing issued share capital of the Company, at a price of 3430

pence per placing share, raising gross proceeds of GBP184.0 million

which were largely deployed to fund the Piedmont Animal Health, Inc

acquisition upon its completion on 20 July 2022.

Covenants

There are two covenants governing the RCF and the Private

Placements:

-- Leverage: Net Debt to underlying EBITDA not greater than

3.0:1 for the RCF and 3.5:1 for the Private Placements (30 June

2022: 1.0:1); and

-- Interest Cover: underlying EBITDA to Net Finance Charges not

less than 4.0:1 (30 June 2022: 24.6:1).

The above ratios are calculated excluding the impact of IFRS 16

and having adjusted for the pro-forma impact of acquisitions in

accordance with the terms of the RCF and Private Placements

arrangements.

On 22 December 2021, the Group entered into an Amendment and

Restatement Agreement in relation to the GBP340.0 million Revolving

Credit Facility (RCF) maturing 25 July 2024. With effect from 1

January 2022, any new Borrowings drawn on the RCF will now use Risk

Free Reference (RFR) rates instead of LIBOR rates. The relevant RFR

rates for the principal Borrowings of the Group will be SONIA (for

Borrowings in GBP), SOFR (for Borrowings in USD) and EURIBOR (for

Borrowings in EUR). The interest rate charged on any new Borrowings

drawn under the RCF will be the relevant RFR rate plus the Margin

plus a Credit Adjustment Spread (CAS). The CAS charged on the RCF

will be a minimum of 0.0326% and a maximum of 0.42826%, dependent

upon the term and currency of the new Borrowings. The CAS will not

be charged on any new Borrowings that are drawn in EUR currency.

The margin over LIBOR (or equivalent) remains in the range from

1.3% for leverage below 1.0 times, up to 2.2% for leverage above

2.5 times.

The weighted average coupon of the Private Placements fixed rate

notes equates to 3.2%.

Underlying Return on Capital Employed (ROCE)

Underlying ROCE increased to 19.5% in the year (2021: 18.8%)

reflecting the increased contribution from the Group's existing

businesses.

Acquisitions

The Group has made several acquisitions in recent years. The

incremental performance during the first year of ownership of the

acquisitions made during the 2021 and 2022 financial years is

separately summarised compared to the existing business in the

sections above.

During the year the Group completed the following product rights

acquisitions:

-- In July 2021, the rights to Isoflurane(R) and Sevoflurane(R)

were acquired from Halocarbon Life Sciences LLC for USD12.0 million

(GBP8.7 million).

-- In September 2021, the rights to ProVet APC(TM) and ProVet

BMC systems were acquired from Hassinger Biomedical and DSM Medical

for USD4.0 million (GBP3.0 million). A payment of GBP0.1 million

was also made for inventory.

-- In October 2021, the rights to Rompun(R) (xylazine injection)

and Butorphanol Tartrate injection were acquired from Elanco(TM)

Animal Health for USD4.0 million (GBP3.0 million). A payment of

GBP0.2 million was also made for inventory.

-- In October 2021, the rights to Sucromate(TM) Equine sterile

suspension were acquired from Thorn Bioscience LLC for USD9.0

million (GBP6.5 million). A minor payment was also made for

inventory.

-- In January 2022, the global product rights to Verdinexor, a

novel treatment for all forms and stages of canine lymphoma in

dogs, including a first right of refusal for other species along

with the trademark (Laverdia) were acquired from Anivive

Lifesciences Inc. Following the initial payment of USD19.0 million

(GBP14.0 million) there are subsequent milestone payments totalling

USD45.5 million (GBP33.5 million) due on the achievement of various

approval and sales milestones for the product in the USA, UK, EU,

Brazil, Australia, Japan and Canada. Royalties are also payable as

part of this transaction and have been accrued as part of the

contingent consideration liabilities.

Accounting Standards

The accounting policies adopted are outlined in note 1 to the

financial statements in the 2022 Annual Report.

In April 2021, the IFRS Interpretations Committee published its

final agenda decision on Configuration and Customisation costs in a

Cloud Computing Arrangement. The agenda decision considers how a

customer accounts for configuration or customisation costs in

a cloud computing arrangement. The agenda decision does not have

a material impact on the Group in respect of the current period or

prior periods (note 5). There are no other accounting policy

changes which have materially impacted the 2022 financial year.

Going Concern

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. Accordingly, they continue to adopt the going

concern basis of accounting in preparing these annual financial

statements.

In reaching this conclusion, the Directors have given due regard

to the following:

-- The Group's business activities, together with factors likely

to impact the future growth and operating performance;

-- The financial position of the Group, its cash flows,

available debt facilities and compliance with the financial

covenants associated with the Group's borrowings, which are

described in the financial statements;

-- The cash generated from operations, available cash resources

and committed bank and other facilities and their maturities, which

taken together, provide confidence that the Group will be able to

meet its obligations as they fall due; and

-- Post balance sheet events (see note 20).

As at 30 June 2022, the Group had net debt of GBP208.2 million

(2021: GBP200.2 million), and had available cash balances and

unutilised committed borrowing facilities of GBP271.2 million.

Further information on available resources and committed bank

facilities is provided in notes 18 and 21 to the financial

statements of the 2022 Annual Report.

Subsequent Events

On 20 July 2022, the Group acquired 100% of the share capital of

Piedmont Animal Health, Inc. (Piedmont) for US$210.0 million

(GBP175.0 million) in cash. Piedmont is an established product

development business with a strong track record of developing

products for multi-national animal health companies.

On 26 August 2022, the Group acquired 100% of the share capital

of the Med-Pharmex Holdings, Inc. group of companies (Med-Pharmex)

for US$260.0 million (GBP221.5 million) in cash. Med-Pharmex is an

established platform business with manufacturing, product

development and regulatory capabilities, and has several products

already approved and being sold in the US market.

Summary

Our business continued to benefit from strong market conditions

which remained heightened from pre COVID-19 levels accelerating

growth in our existing business. This excellent revenue

performance, particularly in North America, has been facilitated by

a robust global supply chain and supplemented by healthy

incremental contributions from our product acquisitions in the

year.

R&D expenditure was lower than expected during the period,

but we continued to invest heavily in our people and have seen the

rest of our cost base return to more normalised levels following

COVID-19.

The Group's balance sheet and cash flows are strong, enabling us

to continue to consider further relevant acquisition and investment

opportunities as they arise.

Paul Sandland

Chief Financial Officer

5 September 2022

Key Performance Indicators

Existing Revenue Growth

Existing revenue includes the impact Performance 11.8% Increase

of previous acquisitions where there 2022 GBP669.4m

is a comparator period, and therefore 2021 GBP608.0m

growth rates are stated on a like-for-like 2020 GBP515.2m

basis. 2019 GBP481.8m

2018 GBP407.1m

--------------------------

Commentary

Dechra's existing business grew by

6.4% in EU Pharmaceuticals (excluding

third party manufacturing), and by

21.3% in NA Pharmaceuticals.

--------------------------

Relevance to Strategy

A key driver of our strategy is to

deliver sustainable sales growth through

delivering our pipeline maximising

our existing portfolio and expanding

geographically.

1 2 3

------------------------------------------- --------------------------

Underlying Diluted Earnings Per Share

Growth

Underlying profit after tax divided Performance 14.0% Increase

by the diluted average number of shares, 2022 120.84p

calculated on the same basis as note 2021 108.14p

11 to the Accounts. 2020 92.19p

2019 90.01p

2018 76.45p

--------------------------

Commentary

This reflects profit growth from the

existing and acquired products and

benefiting from lower net finance

costs driven by foreign exchange gains

realised.

--------------------------

Relevance to Strategy

Underlying diluted EPS is a key indicator

of our performance and the return

we generate for our stakeholders.

It is one of the performance conditions

of the LTIP.

1 2 3 4

Long Term Incentive Plan (LTIP) performance

condition

-------------------------------------------- --------------------------

Underlying Return on Capital Employed

Underlying operating profit expressed Performance 70bps Increase

as a percentage of the average of 2022 19.5%

the opening and closing operating 2021 18.8%

assets (excluding cash/debt and net 2020 15.4%

tax liabilities). 2019 15.6%

2018 15.4%

--------------------------

Commentary

There was an increase in ROCE during

the year reflecting the increased

contribution from the Group's existing

business. The Group's target is 15%.

--------------------------

Relevance to Strategy

As we look to grow the business, it

is important that we use our capital

efficiently to generate returns superior

to our costs of capital in the medium

to long term. It underpins the performance

conditions of the LTIP.

1 2 3 4 5

Long Term Incentive Plan (LTIP) performance

condition

-------------------------------------------- --------------------------

Cash Conversion

Cash generated from operations before Performance 660bps Increase

tax and interest payments as a percentage 2022 93.7%

of underlying operating profit. 2021 87.1%

2020 99.4%

2019 85.0%

2018 81.9%

---------------------------

Commentary

Cash conversion increased during the

year as a result of the increase in

working capital representing a smaller

proportion of the underlying operating

profit compared to the prior year.

---------------------------

Relevance to Strategy

Our stated aim is to be a cash generative

business. Cash generation supports

investment in the pipeline, acquisitions

and people.

1 2 3 4

------------------------------------------ ---------------------------

New Product Revenue

Revenue from new products as a percentage Performance 960bps decrease

of total Group revenue. A new product 2022 10.8%

is defined as any molecule launched 2021 20.4%

in the last five years. 2020 16.7%

2019 16.7%

2018 11.9%

---------------------------

Commentary

New product revenue reflects market

penetration of product launches in

the year and new product right acquisitions

made in the second half offset by

products no longer defined as new.

The new product right acquisitions

will deliver a greater uplift next

year.

---------------------------

Relevance to Strategy

This measure shows the delivery of

revenue in each year from new products

launched in the prior five years,

on a rolling basis. It shows the performance

of our R&D and sales and marketing

organisations when launching newly

developed or in-licensed or acquired

products.

1 2 3

--------------------------------------------- ---------------------------

Lost Time Accident Frequency Rate

(LTAFR)

All accidents resulting in the absence Performance 88.9% Increase

or inability of employees to conduct 2022 0.17

a full range of their normal working 2021 0.09

activities for a period of more than 2020 0.17

three workings days after the day 2019 0.21

when the incident occurred, normalised 2018 0.00

per 100,000 hours worked.

--------------------------

Commentary

The lost time accident frequency increased

this year to 0.17. All of the incidents

occurred in our manufacturing sites.

None of these incidents resulted in

a work-related fatality or disability.

--------------------------

Relevance to Strategy

The safety of our employees is core

to everything we do. We are committed

to a strong culture of safety in all

our workplaces.

6 7 8

------------------------------------------- --------------------------

Employee Turnover

Number of leavers during the period Performance 250 bps Increase

as a percentage of the average total 2022 16.0%

number of employees in the period. 2021 13.5%

2020 12.4%

2019 13.6%

2018 15.9%

--------------------------------------

Commentary

We saw an increase in employee turnover

in the period due to a reorganisation

at Londrina, Brazil and resignations

across the business.

--------- ---------------------------

Relevance to Strategy

Attracting and retaining the best

employees is critical to the successful

execution of our strategy.

6 8

------------------------------------------ --------- ---------------------------

Key to Strategic Growth Drivers Key to Strategic Enablers:

: 5 Technology

1 Pipeline Delivery 6 People

2 Portfolio Focus 7 Manufacturing and Supply Chain

3 Geographical Expansion 8 ESG

4 Acquisition

How the Business Manages Risk

Effective risk management and control is key to the delivery of

our business strategy and objectives.

Our risk management and control processes are designed to

identify, assess, mitigate and monitor significant risks, and

provide reasonable, but not absolute, assurance that the Group will

be successful in delivering its objectives.

Risk Management Process

Our strategy informs the setting of objectives across the

business and is widely communicated. Strategic risks and

opportunities are identified as an integral part of our strategy

setting process, whilst operational, financial, compliance and

emerging risks are identified as an integral part of our functional

planning and budget setting processes.

The Board oversees the risk management and internal control

framework and the Audit Committee reviews the effectiveness of the

risk management process and the internal control framework.

Our Senior Executive Team (SET) owns the risk management process

and is responsible for managing specific Group risks. The SET

members are also responsible for embedding sound risk management in

strategy, planning, budgeting, performance management, and

operational processes within their respective Operating Segments

and business units.

The Board and the SET together set the tone and decide the level

of risk and control to be taken in achieving the Group's

objectives.

SET members present their risks, controls and mitigation plans

to the Board for review on a rolling programme throughout the year,

whilst the Board undertakes a full review of the risk management

process biannually. The SET is responsible for conducting

self-assessments of their risks and the effectiveness of their

control processes. Where control weaknesses are identified,

remedial action plans are developed, and these are included in the

risk reports presented to the Board.

Internal Audit coordinates the ongoing risk reporting process

and provide independent assurance on the internal control

framework.

Emerging Risks

Emerging risks are new risks that are unlikely to impact the

business in the next year but have the potential to evolve over a

longer term and could have a significant impact on our ability to

achieve our objectives. They may develop into key risks or may not

arise at all.

As part of our risk management process, both the Board and SET

are tasked with identifying and assessing our emerging risks. These

are then monitored on an ongoing basis and reviewed alongside

existing risks.

Ukraine

Russia's invasion of Ukraine has had some impact on our

business, with increased energy costs and additional supply chain

uncertainty. Our sales to Russia, which were not material, have

also ceased. We will continue to monitor the situation in Ukraine

and the associated impacts this may have on our principal risks,

with regard to our markets, supply chain and people.

Dechra Culture

The Dechra Values are the foundation of our entire business

culture including our approach to risk management and control. The

Board expects these Values to drive the behaviours and actions of

all employees. We encourage an open communication style where it is

normal practice to escalate issues promptly so that appropriate

action can be taken quickly to minimise any impact on the

business.

Internal Control Framework

Our internal control framework is designed to ensure:

-- proper financial records are maintained;

-- the Group's assets are safeguarded;

-- compliance with laws and regulations; and

-- effective and efficient operation of business processes.

The key elements of the control framework are described

below:

Management Structure

Our management structure has clearly defined reporting lines,

accountabilities and authority levels. The Group is organised into

business units. Each business unit is led by a SET member and has

its own management team.

Policies and Procedures

Our key financial, legal and compliance policies that apply

across the Group are:

-- Code of Business Conduct and How to Raise a Concern;

-- Delegation of Authorities;

-- Dechra Finance Manual, including Tax and Treasury policies;

-- Anti-Bribery and Anti-Corruption;

-- Data Protection;

-- Health and Safety;

-- Sanctions; and

-- Charitable Donations.

Strategy and Business Planning

We have a five-year strategic plan which is developed by the SET

and endorsed by the Board annually. Business objectives and

performance measures are defined annually, together with budgets

and forecasts. Monthly business performance reviews are conducted

at both Group and business unit levels.

Operational Controls

Our key operational control processes are as follows:

-- Product Pipeline Reviews: We review our pipeline regularly to

identify new product ideas and assess the fit with our product

portfolio, prioritise development projects, review whether products

in development are progressing according to schedule, and assess

the expected commercial return on new products.

-- Lifecycle Management: We manage and monitor lifecycle

management activities for our key products to meet evolving

customer needs.

-- Pricing Policies: We manage and monitor our national and

European pricing policies to deliver equitable pricing for each

customer group.

-- Product Supply: We continue to develop our demand forecasting

and supply planning processes, with monthly reviews of demand and

production forecasts, inventory controls, and remediation plans for

products that are out of supply.

-- Quality Assurance: Each of our manufacturing sites has an

established Quality Management System. These systems are designed

to ensure that our products are manufactured to a high standard and

in compliance with the relevant regulatory requirements.

-- Pharmacovigilance: Our regulatory team operates a robust

system with a view to ensuring that any adverse reactions and

product complaints related to the use of our products are reported

and dealt with promptly.

-- Financial Controls: Our controls are designed to prevent and

detect financial misstatement or fraud and operate at three

levels:

- Entity Level Controls performed by senior managers at Group and business unit level;

- Month end and year end procedures performed as part of our

regular financial reporting and management processes; and

- Transactional Level Controls operated on a day-to-day basis.

The key controls in place to manage our principal risks are

described in the table below. Internal Audit provides independent

and objective assurance and advice on the design and operation of

the Group's internal control framework. The internal audit plan

seeks to provide balanced coverage of the Group's material

financial, operational and compliance control processes.

Improvements in 2022

We have continued to strengthen and improve our governance and

control processes and the following changes have been

implemented:

-- New governance and oversight processes to provide

transparency of performance, decisions and actions across the

manufacturing and supply network.

-- We have continued to make improvements to our manufacturing,

quality and supply processes, with additional investments in people

and production facilities.

-- Recruitment of a new Head of Good Distribution Practices and

Head of Good Practices to further strengthen the Quality team.

-- Launched an independent hotline to enable employees to submit

confidential reports using our How to Report a Concern

Procedure.

-- Roll out of an enhanced Financial Control Framework in

response to the BEIS white paper on Restoring Trust in Audit and

Corporate Governance. This will put the business in a strong

position to comply with the potential requirements of the BEIS

proposals.

-- Our Environmental, Social and Governance (ESG) strategy has

been further enhanced. We continue to execute our 'Making a

Difference' plan as well as working towards our commitment of

setting verifiable targets across the entire value chain through

the Science Based Targets initiative.

Plans for 2023

We will continue to refine and strengthen our internal control