eEnergy Group PLC Trading Update (7550N)

25 Enero 2023 - 1:00AM

UK Regulatory

TIDMEAAS

RNS Number : 7550N

eEnergy Group PLC

25 January 2023

25 January 2023

eEnergy Group plc

("eEnergy" or "the Group")

Trading Update

eEnergy (AIM: EAAS), the net zero energy services provider, is

pleased to provide an update on trading for the six months ended 31

December 2022 ("Period").

Group Trading and Highlights

The Board is pleased with progress made on trading during

H1.

-- Strong H1 revenue growth, up 58% to GBP15.1 million

(H1 2022: GBP9.6 million)

-- Improving operating margin with Adjusted EBITDA(1)

up 87% to GBP1.5 million (H1 2022: GBP0.8 million)

-- Cash as at 31 December 2022 was GBP1.1m (30 June 2022:

GBP1.4m) excluding GBP0.4m of restricted cash balances

(30 June 2022: GBP0.2m)

Business Segments

Energy Services revenues were GBP8.5 million in the Period, a

79% increase compared to the six months ended 31 December 2021 ("H1

2022") reflecting momentum in the sales pipeline and despite higher

margin solar revenues being delayed into H2. Energy Management

revenues were GBP6.5 million, a 35% increase compared to H1 2022,

with revenues reflecting consumption in line with expectations and

strong renewal levels.

Cash Position

Cash as at 31 December 2022 was GBP1.1 million (30 June 2022:

GBP1.4million), excluding GBP0.4m of restricted cash balances (30

June 2022: GBP0.2m), reflecting scheduled payments of trade

creditors and legacy balance sheet items following drawdown of the

new subordinated debt facility.

Full Year Outlook

The Group has a growing pipeline of opportunities for the

remainder of the financial year and has contracted forward revenues

("Forward Order Book"), as at 31 December 2022, of GBP26.4 million

over 4 years (up 45% from 31 December 2021). Of the Forward Order

Book, GBP8.8 million is expected to be recognised as revenue in H2

FY23 and GBP6.8 million recognised in FY24.

Amortisation charges will reflect full year effect of certain

items, with increased finance costs relating to a generally higher

interest rate environment and the new subordinated debt

facility.

Given the strength of the pipeline and historic H2 weighting,

whilst recognising the importance of the next two key trading

months ahead, the Board is cautiously optimistic for the trading

outlook for FY2023

eEnergy expects to report its interim results during the week

commencing 27 March 2023.

Note: (1) Adjusted EBITDA excluding Exceptional Items.

Exceptional Items are those items which, in the opinion of the

Directors, should be excluded in order to provide a consistent and

comparable view of the underlying performance of the Group's

ongoing business, including the costs incurred in delivering the

'Buy & Build' strategy associated with acquisitions and

strategic investments, costs of restructuring and transforming

acquired businesses and share-based payments.

For further information, please visit www.eenergy.com or

contact:

eEnergy Group plc Tel: +44 20 7078

9564

Harvey Sinclair, Chief Executive Officer info@eenergy.com

Crispin Goldsmith, Chief Financial Officer www. eenergy .com

Singer Capital Markets (Nominated Adviser Tel: +44 20 7496

and Joint Broker) 3000

Justin McKeegan, Asha Chotai, James Maxwell

(Corporate Finance)

Tom Salvesen (Corporate Broking)

Canaccord Genuity Limited (Joint Broker) Tel: +44 20 7523

8000

Max Hartley, Tom Diehl (Corporate Broking)

Kit Stephenson (Sales)

Tavistock Tel: +44 207 920

3150

Jos Simson, Heather Armstrong, Katie Hopkins eEnergy@tavistock.co.uk

About eEnergy Group plc

eEnergy (AIM: EAAS) is a Net Zero energy services provider,

empowering organisations to achieve Net Zero by tackling energy

waste and transitioning to clean energy, without the need for

upfront investment. It is making Net Zero possible and profitable

for all organisations in four ways:

-- Transition to the lowest cost clean energy through our digital

procurement platform and Energy Management services.

-- Tackle energy waste with granular data and insight on energy use

and dynamic Energy Management.

-- Reduce energy use with the right energy efficiency solutions without

upfront cost.

-- Reach Net Zero with onsite renewable generation and electric vehicle

(EV) charging.

eEnergy is a Top 5 B2B energy company and has been awarded The

Green Economy Mark by London Stock Exchange.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUSSUROKUAUUR

(END) Dow Jones Newswires

January 25, 2023 02:00 ET (07:00 GMT)

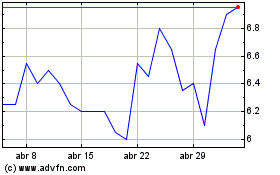

Eenergy (LSE:EAAS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

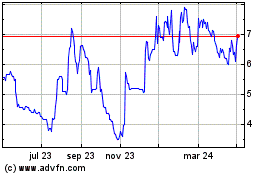

Eenergy (LSE:EAAS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024