TIDMEAH

RNS Number : 2733H

Eco Animal Health Group PLC

23 November 2022

ECO Animal Health Group plc

("ECO" or the "Group") (AIM: EAH)

Results for the six months ended 30 September 2022

"In line with full year expectations"

HIGHLIGHTS

Financials

-- Group Sales at GBP34.9 million (H1 2021: GBP38.5 million)

- China and Japan sales declined to GBP8.5 million (H1 2021:

GBP15.7 million)

- Excluding China and Japan, revenues in aggregate increased by

16% to GBP26.4 million (H1 2021: GBP22.8 million)

-- Gross margins at 45% remained consistent with the prior year period

-- Adjusted EBITDA at GBP1.7 million (H1 2021 restated*: GBP3.4 million)

-- Profit before taxation of GBP3.0 million including a GBP2.6

million foreign exchange gain (H1 2021 restated profit*: GBP0.5

million, including GBP0.3 million gain)

-- Earnings per share of 1.96p (H1 2021: restated loss per share*: (0.92)p)

-- Cash generated by operations of GBP3.0 m (H1 2021 restated*: GBP6.1 m)

* Prior period figures have been restated to reflect adjustments

arising from the March 2022 audit

Operations

-- Sales in Latin America increased by 25% to GBP7.9 million (H1 2021: GBP6.3 million)

-- Sales in South and Southeast Asia increased by 23% to GBP7.4

million (H1 2021: GBP6.0 million)

-- China revenue represented 24% of total Group revenues (H1

2021: 41%) which declined significantly as a result of reduced

sales from the Group's largest customers in the region and

continued impact of COVID restrictions

-- New R&D collaborations with Imperial College for saRNA

technology and Moredun Research Institute for the development of a

poultry red mite vaccine

-- Two Mycoplasma vaccines for poultry expected to be submitted

for regulatory approval in late 2023 and early 2024

Dr Andrew Jones, Non-Executive Chairman of ECO Animal Health

Group plc, commented:

"We are delighted with the continuing growth in all markets

outside of China and the increasing market penetration experienced

by Aivlosin(R) in its multiple formulations. The China swine

industry has been slow during the first half of this year; the

socio-economic reasons for this are well publicised and understood.

Nevertheless, we are pleased to retain our strong market position

and we expect a return to healthy markets in China during the

course of this next year.

We are excited by the progress in our new product developments

and it is particularly pleasing that some ground breaking

technologies are being explored in new collaborations announced in

the last few months. We are on track for submission of our new

Mycoplasma poultry vaccines at the end of 2023 and we expect

marketing approval to be received shortly afterwards. The rest of

the portfolio is demonstrating good progression.

Our recent annual strategy review endorsed the vision,

objectives and direction for the Group and we look forward with

cautious optimism to reporting the full year numbers in line with

market expectations."

Contacts:

ECO Animal Health Group plc

David Hallas (CEO)

Christopher Wilks (CFO) 020 8447 8899

IFC Advisory

Graham Herring

Zach Cohen 020 3934 6630

Singer Capital Markets (Nominated Adviser

& Joint Broker)

Mark Taylor

George Tzimas 020 7496 3000

Investec (Joint Broker)

Gary Clarence

Daniel Adams

Carlo Spingardi 020 7597 5970

Equity Development

Hannah Crowe

Matt Evans 020 7065 2692

The information contained within this announcement is deemed by the

Group to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014 ("MAR"). Upon the publication of

this announcement via a Regulatory Information Service ("RIS"), this

inside information is now considered to be in the public domain.

About ECO Animal Health

ECO Animal Health Group plc researches, develops and commercialises

products for livestock. Our business strategy is to generate shareholder

value by achieving the maximum sales potential from the existing product

portfolio whilst investing in research and development ("R&D") for new

products, particularly vaccines, and seeking to in-license new products.

Chairman's statement

I am pleased to present the results for the Group for the six

months ended 30 September 2022 ("H1 2022"). During the first half

of our financial year, we experienced positive sales momentum in

all our major markets outside of China. Furthermore, our very

promising new product development pipeline is progressing well

towards product registration.

Financial Performance

Group revenue was 9% lower in H1 2022 at GBP34.9 million (H1

2021: GBP38.5 million), as a result of a decline in revenues from

China. China and Japan revenue of GBP8.5 million represented 24% of

Group revenue (H1 2021: 41%). Excluding China and Japan, revenue

from other markets grew by 16%, in aggregate, to GBP26.4 million

(H1 2021: GBP22.8 million).

The gross margin in H1 2022 was 45% (H1 2021: 45%). Despite the

significant reduction in higher margin China revenues, gross

margins were maintained as a result of favourable exchange rates

and cost control within the Group.

Administrative expenses at GBP11.9 million were 9% higher than

the comparative period last year (H1 2021: GBP10.9 million). This

arose from further investment in sales and marketing, a return to

travel after the easing of COVID restrictions and a

reclassification of technical support costs previously included as

an R&D expense (in the H1 2021 results) but now shown as

administrative expenses.

Research and development ("R&D") expenses shown in the

income statement together with the amounts capitalised were in

aggregate a cash investment of GBP4.2 million (H1 2021: GBP4.0

million); for comparative purposes this represented 12.0% of

revenue generated in the period (H1 2021: 10.4%).

Earnings before interest, tax, depreciation, amortisation and

impairment, share based payments and foreign exchange movements

("Adjusted EBITDA") were GBP1.7 million (H1 2021 restated: GBP3.4

million). This reduction was due to the fall in revenues in

China.

Cash generated from operations was GBP3.0 million (H1 2021

restated: GBP6.1 million). Improved receivables and management of

payables partly offset the reduced profitability in the period.

This cash generation after allowing for tax payments of GBP1.0

million, resulted in cash balances at the period end of GBP12.9

million (31 March 2022: GBP14.3 million), of which GBP4.0 million

(31 March 2022: GBP6.1 million) was held in the Group's 51% owned

subsidiary in China. The Group repatriates cash from China by

dividend declaration, accordingly only 51% is received by the Group

and is subject to withholding taxes. Additionally, the Group has a

wholly owned subsidiary in China, the cash in this company is

repatriated annually by dividend. On a day-to-day basis, the Board

considers the cash held in the Group's joint venture subsidiary in

China to be unavailable to the Group outside of China; accordingly,

cash management and funds available for investment in R&D is

based upon the cash balances outside of the China JV, which at 30

September 2022 was GBP8.9 million (31 March 2022: GBP8.2

million).

Subsequent to the period end, two dividends totalling GBP5.7

million were received from China.

The Group's committed banking facilities remain at GBP15.0

million, being a GBP5.0 million overdraft facility and a GBP10

million revolving credit facility. These facilities expire on 30

June 2026 and were undrawn as at 30 September 2022.

Basic EPS in the six months ended 30 September 2022 was 1.96p

(H1 2021 restated: loss per share 0.92p). EPS benefited from the

exchange rate gain reported in the period of GBP2.6 million (H1

2021: GBP0.3 million) and the prior period loss per share was

adversely affected by the impairment of intangible assets recorded

in the six months ended 30 September 2021. The dilutive effect of

unexercised share options has reduced earnings per share to 1.95p

in the six months ended 30 September 2022 (H1 2021 restated: no

change).

Business Performance

The geographical analysis of the Group's revenue in the six

months ended 30 September 2022 compared to the prior period in 2021

and the full year ended 31 March 2022 was as follows:

6 months ended 30

Revenue Summary September Year ended

H1 2022

vs H1 31 March

2022 2021 2021 2022

(GBP'm) (GBP'm) % Change (GBP'm)

China and Japan 8.5 15.7 (46%) 28.4

North America (USA and

Canada) 6.5 6.0 8% 16.4

South and Southeast Asia 7.4 6.0 23% 11.8

Latin America 7.9 6.3 25% 15.8

Europe 2.9 2.9 - 6.4

Rest of World and UK 1.7 1.6 6% 3.4

Total Group 34.9 38.5 (9%) 82.2

---------------------------- --------- --------- --------- -----------

Group revenue reduced by 9% to GBP34.9 million (H1 2021: GBP38.5

million). The overall reduction in Group revenue in the six months

ended 30 September 2022 was caused by a 46% reduction in revenue

from China and Japan; excluding China and Japan revenues in

aggregate increased by 16% to GBP26.4 million (H1 2021: GBP22.8

million). Travel restrictions during H1 2022 were largely lifted in

most of the Group's markets, with the exception of China, enabling

sales and marketing efforts to return to the in-person support that

has historically characterised the Group's approach to its

customers and market place.

As previously indicated, trading in China was subdued during the

first quarter of the current financial year and therefore the

Board's outlook for the Chinese market in 2022 was cautious. Many

of the Group's larger customers needed to repair their respective

balance sheets which had been damaged by extended periods of

trading at a loss and reduced their purchases of Aivlosin(R) in the

period. However, the Group enjoyed good trading with its mid-tier

customers in China who, in the main, were less expansive during the

re-stocking phase in 2020/2021. We also noted in our Annual Report

and Accounts for the year ended 31 March 2022 that the pork to

grain price ratio had for the first time in over a year risen above

5 in August; the China National Reform and Development Commission

reported that the ratio on 16 November 2022 was 8.78. This provides

the Board with some optimism for improved trading conditions in

China.

Revenue in North America, in particular the USA, has been

broadly consistent; farm hog prices in the USA and Canada have been

generally stable throughout 2022 and this has resulted in

continuing strong market conditions. Aivlosin(R) continues to gain

market share.

The growth seen in Southeast Asia during the last three or four

years has continued during 2022. The poor poultry market in India

in recent years has recovered with revenue increasing to GBP2.2

million (H1 2021: GBP0.4 million). Thailand remained the largest

single market for the Group's products in this region with revenue

increasing to GBP3.5 million (H1 2021: GBP4.0 million), supported

with good sales into Pakistan, Malaysia and Vietnam of GBP1.6

million (H1 2021: GBP1.6 million).

Revenue in Latin America grew 25% to GBP7.9 million (H1 2021:

GBP6.3 million), with Brazil representing the largest market at

GBP4.2 million (H1 2021: GBP3.0 million). Brazil's exports of pork

to China continued strongly during the period providing strong

demand for Aivlosin(R). Mexico revenue in H1 2022 was GBP0.5

million higher than the equivalent period last year and the

remaining counties in Latin America were broadly consistent year on

year.

Revenue derived from Europe was consistent at GBP2.9 million.

Within the continent, Spain remained the largest single market with

revenues of GBP1.0 million in the six months ended 30 September

2022 (H1 2021: GBP1.1 million) .

Research and development

Work on the Group's promising pipeline of new products has

continued at pace during the first half of this financial year with

GBP4.2 million (H1 2021: GBP4.0 million) spent during the period.

This is in line with plan and the first two Mycoplasma vaccines for

poultry are expected to be submitted for regulatory approval in

late 2023 and early 2024, with marketing authorisation expected to

be gained shortly thereafter.

In June 2022 we announced a very exciting collaboration with

Imperial College to assess the veterinary application of

self-amplifying RNA technology. This technology represents the next

generation of RNA delivered medicines and is particularly

interesting for veterinary medication because it implies fewer

doses, lower dose rates, a broader range of applications and cost

savings for the producer compared with conventional mRNA

approaches. Work is underway on key proof of concept studies.

In July 2022 the Group signed a partnership agreement with the

Moredun Research Institute to research and develop an effective

first in class vaccine solution for the sustainable control of

poultry red mite ("PRM"). Red mite infestation in poultry is one of

the emerging and important causes of production losses in laying

hens and has a major impact on animal welfare. Poultry red mites

also serve as vectors for several disease-causing bacteria and

viruses in poultry. Their ubiquitous presence threatens the poultry

industry globally, as there are no effective non-chemical solutions

available for the prevention of PRM infestation in poultry. If this

programme is successful, ECO may take the option of developing,

registering and commercialising the vaccine under a worldwide

exclusive license from the Moredun Research Institute.

Management plans to hold another Capital Markets Day during the

first quarter of 2023 during which an update will be provided on

the new product development portfolio.

Strategy

During the Autumn, the leadership team and the Board undertook a

refresh of the Group's strategy. This involved an analysis of the

vision for the Group, and assessment of the key internal and

external elements available to the Group to achieve this vision, as

well as an appraisal of the risks and threats to the success of the

strategy. The exercise endorsed the Group's direction: to maximise

the commercial opportunity in the Group's existing products, to

bring forward the exciting array of new vaccine and biologicals

products programmes, continuing to focus on swine and poultry. The

Group is open to and will pursue further collaboration including

technical partnering, licensing and M&A activity.

Dividend

The Board recognises the value of dividends to shareholders and

balancing the need for prudent management of cash resources as well

as funding the exciting pipeline of new products. It has however

decided that the best use of the Group's cash is in the new product

development initiatives and accordingly no dividend is recommended

at the current time.

Auditors

The Company announced on 14 November 2022 that BDO resigned as

auditors to the Group and we are delighted to have appointed

Haysmacintyre LLP to be the Group's auditors. Transitionary

arrangements are underway, and we look forward to their first audit

for the year ending 31 March 2023.

Change of advisers

The Group also announces that from 23 November 2022, Singer

Capital Markets and Investec, will be retained and will act as the

Group's nominated adviser and joint broker, and joint broker,

respectively.

Outlook

The China pork price has improved from less than CNY13/kg in

March 2022 to in excess of CNY27/kg by the end of October 2022.

This increase in pork price prompted the Ministry of Agriculture to

release frozen pork onto the market ahead of the National Day on 1

October - the first time it has done so during 2022. The Group has

experienced improving trading conditions in China with October's

revenue greater than any other month recorded during this financial

year. Whilst this is a promising start to the second half, we

remain cautious on China's revenue recovery until January 2023 and

the period of strong pork demand associated with Chinese New Year

and national holidays. The containment policy in relation to COVID

also provides short term reason to be cautious regarding pork

demand.

We expect continuing growth in our markets outside of China.

Seasonally occurring disease is anticipated to drive demand in the

second half of the financial year. This seasonal effect, together

with expected stronger trading in China in our fourth quarter is

expected to result in the customary second half weighting to our

revenue. In the event Sterling weakness continues, this would

provide further upside in revenue opportunity. Cost control in

relation to manufacturing costs has served us well during 2022 and

we are cautiously optimistic in relation to the 2023 contractual

price negotiations.

The Board is excited about the continuing results from our new

product development programme and we look forward to providing an

update at a Capital Markets Day in the first quarter next year.

We look forward with cautious optimism to reporting the full

year numbers in line with market expectations.

Dr Andrew Jones

Non-Executive Chairman

23 November 2022

CONSOLIDATED INCOME STATEMENT

Six months Six months Year ended

to 30.09.22 to 30.09.21 31.03.22

Notes (unaudited) (unaudited) (audited)

GBP000's GBP000's GBP000's

Restated*

Revenue 4 34,859 38,474 82,195

Cost of sales (19,063) (21,335) (47,059)

------------ ------------ -----------

Gross Profit 15,796 17,139 35,136

Other income 242 16 65

Administrative expenses (11,884) (10,852) (22,421)

Research and development expenses (2,923) (3,309) (8,762)

Foreign exchange gains 2,573 274 989

Amortisation of intangible assets (546) (586) (1,140)

Share based payments (175) (83) (342)

Impairment of intangible assets 8 - (2,085) (2,085)

Profit from operating activities: 3,083 514 1,440

Net finance cost (95) (89) (94)

Share of profit of associate 51 47 43

Profit before income tax 3,039 472 1,389

Income tax charge 7 (929) (828) (2,094)

------------ ------------ -----------

Profit/(loss) for the period 2,110 (356) (705)

============ ============ ===========

Attributable to:

Owners of the parent company 1,325 (621) (686)

Non-controlling interest 785 265 (19)

------------ ------------ -----------

2,110 (356) (705)

============ ============ ===========

Basic earnings per share (pence) 6 1.96 (0.92) (1.01)

Diluted earnings per share (pence) 6 1.95 (0.92) (1.01)

Earnings before interest, taxation,

depreciation,

amortisation and share based payments

(EBITDA) 4,243 1,593 6,395

Exclude foreign exchange differences

and impairment (2,573) 1,811 (989)

------------ ------------ -----------

Adjusted EBITDA 1,670 3,404 5,406

============ ============ ===========

*Details of the restatement, which is unaudited, are presented

in note 3.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months Six months Year ended

to 30.09.22 to 30.09.21 31.03.22

(unaudited) (unaudited) (audited)

GBP000's GBP000's GBP000's

Restated*

Profit/(loss) for the period 2,110 (356) (705)

Other Comprehensive income/(loss) (net

of related tax effects):

Items that will or may be reclassified

to profit/(loss):

Foreign currency translation differences 276 136 2,195

Items that will not be reclassified:

Deferred tax on property revaluations - 2 1

Defined benefit plan - actuarial losses - - 24

Other comprehensive income/(loss) for

the period 276 138 2,220

Total comprehensive income for the period 2,386 (218) 1,515

Attributable to:

Owners of the parent Company 1,506 (560) 435

Non-controlling interest 880 342 1,080

*Details of the restatement, which is unaudited, are presented

in note 3.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Revaluation Other Foreign Retained Total Minority Total

Capital Premium Reserves Reserves Exchange Earnings Interest Equity

Account Account Reserve

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

FOR THE YEARED

31 MARCH 2022

Balance as at

31 March

2021

(restated) 3,379 63,258 656 106 1,092 13,410 81,901 13,414 95,315

Loss for the

year - - - - - (686) (686) (19) (705)

Other

comprehensive

income:

Foreign

currency

differences - - - - 1,096 - 1,096 1,099 2,195

Deferred tax

on property

revaluations - - 1 - - - 1 - 1

Actuarial

gains on

pension

scheme assets - - - - - 24 24 - 24

Total

comprehensive

income/(loss)

for

the year - - 1 - 1,096 (662) 435 1,080 1,515

--------- --------- ------------ --------- --------- ---------- --------- --------- ---------

Transactions

with

owners

recorded

directly

in equity:

Issue of

shares in

the year 2 61 - - - - 63 - 63

Share-based

payments - - - - - 342 342 - 342

Dividends - - - - - (677) (677) (2,210) (2,887)

Transactions

with

owners 2 61 - - - (335) (272) (2,210) (2,482)

--------- --------- ------------ --------- --------- ---------- --------- --------- ---------

Balance as at

31

March 2022 3,381 63,319 657 106 2,188 12,413 82,064 12,284 94,348

========= ========= ============ ========= ========= ========== ========= ========= =========

FOR THE SIX

MONTHSED 30

SEPTEMBER

2022

Profit for the

period - - - - - 1,325 1,325 785 2,110

Other

comprehensive

income:

Foreign

currency

differences - - - - 181 - 181 95 276

Total

comprehensive

income for

the period - - - - 181 1,325 1,506 880 2,386

Transactions

with

owners

recorded

directly

in equity:

Issue of - - - - - - - - -

shares in

the period

Share-based

payments - - - - - 175 175 - 175

Dividends - - - - - - - (1,810) (1,810)

Total

transactions

with owners - - - - - 175 175 (1,810) (1,635)

--------- --------- ------------ --------- --------- ---------- --------- --------- ---------

Balance as at

30

September

2022 3,381 63,319 657 106 2,369 13,913 83,745 11,354 95,099

========= ========= ============ ========= ========= ========== ========= ========= =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Foreign

Capital Premium Revaluation Other Exchange Retained Minority Total

Account Account Reserves Reserves Reserve Earnings Total Interest Equity

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

FOR THE YEARED

31 MARCH 2021

Balance as at

31 March

2020

(restated) 3,377 62,882 572 106 800 5,982 73,719 5,766 79,485

Profit for the

year

(restated) - - - - - 7,337 7,337 8,491 15,828

Other

comprehensive

income:

Foreign

currency

differences

(restated) - - - - 292 - 292 (281) 11

Deferred tax

on property

revaluations - - 84 - - - 84 - 84

Actuarial

losses on

pension

scheme assets - - - - - (32) (32) - (32)

Total

comprehensive

income for

the year - - 84 - 292 7,305 7,681 8,210 15,891

--------- --------- ------------ --------- --------- ---------- --------- --------- ---------

Transactions

with

owners

recorded

directly

in equity:

Issue of

shares in

the year 2 376 - - - - 378 - 378

Share-based

payments - - - - - 123 123 - 123

Deferred tax

on share-based

payments - - - - - - - - -

Dividends - - - - - - - (562) (562)

Transactions

with

owners 2 376 - - - 123 501 (562) (61)

--------- --------- ------------ --------- --------- ---------- --------- --------- ---------

Balance as at

31

March 2021

(restated) 3,379 63,258 656 106 1,092 13,410 81,901 13,414 95,315

========= ========= ============ ========= ========= ========== ========= ========= =========

FOR THE SIX

MONTHSED 30

SEPTEMBER

2021

(Loss)/profit

for

the period -

*restated - - - - - (621) (621) 265 (356)

Other

comprehensive

income:

Foreign

currency

differences

(restated) - - - - 59 - 59 77 136

Deferred tax

on property

revaluations - - 1 - - - 1 - 1

Total

comprehensive

income for

the period - - 1 - 59 (621) (561) 342 (219)

--------- --------- ------------ --------- --------- ---------- --------- --------- ---------

Transactions

with

owners

recorded

directly

in equity:

Issue of

shares in

the period 2 61 - - - - 63 - 63

Share-based

payments - - - - - 83 83 - 83

Total

transactions

with owners 2 61 - - - 83 146 - 146

--------- --------- ------------ --------- --------- ---------- --------- --------- ---------

Balance as at

30

September

2021 -

restated* 3,381 63,319 657 106 1,151 12,872 81,486 13,756 95,242

========= ========= ============ ========= ========= ========== ========= ========= =========

*Details of the restatement, which is unaudited, are presented

in note 3.

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

As at As at As at

30.09.22 30.09.21 31.03.22

(unaudited) (unaudited) (audited)

Notes GBP000's GBP000's GBP000's

Restated*

Non-current assets

Intangible assets 8 35,058 34,126 34,304

Property, plant and equipment 4,835 2,220 3,465

Investment property 227 305 227

Right-of-use assets 1,635 1,275 1,773

Investments 264 229 212

Deferred tax assets 523 352 523

Total non-current assets 42,542 38,507 40,504

Current assets

Inventories 32,853 26,492 30,142

Trade and other receivables 24,832 27,252 25,969

Income tax recoverable 1,598 3,358 1,596

Other taxes and social security 801 748 1,075

Cash and cash equivalents 12,883 22,892 14,314

Total current assets 72,967 80,742 73,096

Total assets 115,509 119,249 113,600

Current liabilities

Trade and other payables (13,242) (18,466) (12,954)

Provisions (4,512) (2,333) (3,875)

Income tax (351) (1,683) (224)

Other taxes and social security (481) (47) (239)

Amounts due under leases (97) (874) (397)

Dividends (50) (50) (50)

------------ -------------- ----------

Total current liabilities (18,733) (23,453) (17,739)

------------ -------------- ----------

Net current assets 54,234 57,289 55,357

------------ -------------- ----------

Total assets less current liabilities 96,776 95,796 95,861

Non-current liabilities

Amounts due under leases (1,677) (554) (1,513)

------------ -------------- ----------

Total assets less total liabilities 95,099 95,242 94,348

------------ -------------- ----------

Equity

Capital and reserves

Issued share capital 3,381 3,381 3,381

Share premium account 63,319 63,319 63,319

Revaluation reserve 657 657 657

Other reserves 106 106 106

Foreign exchange reserve 2,369 1,151 2,188

Retained earnings 13,913 12,872 12,413

Shareholders' funds 83,745 81,486 82,064

Non-controlling interests 11,354 13,756 12,284

Total equity 95,099 95,242 94,348

============ ============== ==========

*Details of the restatement, which is unaudited, are presented

in note 3.

CONSOLIDATED STATEMENT OF CASH

FLOWS

Six months Year ended

to 30.09.22 to 30.09.21 31.03.22

(unaudited) (unaudited) (audited)

GBP000's GBP000's GBP000's

Restated*

Cash flows from operating activities

Profit/(loss) before income tax 3,039 472 1,389

Adjustment for: - - -

Finance income (42) (83) (190)

Finance cost 137 172 284

Foreign exchange (gain)/loss (2,573) (654) (989)

Depreciation 162 215 455

Amortisation of right-of-use assets 196 198 398

Revaluation of investment property - - 78

Amortisation of intangible assets 546 586 1,140

Impairment of intangible assets - 2,085 2,085

Share of associate's results (51) (47) (43)

Share based payment charge 175 83 342

Operating cash flows before movements

in working capital 1,589 3,027 4,949

Change in inventories (1,671) (5,660) (8,585)

Change in receivables 4,153 5,217 7,630

Change in payables (1,593) 3,091 (2,868)

Change in provisions 502 376 1,392

Cash generated from operations 2,980 6,051 2,518

Finance costs (71) (68) (106)

Income tax (1,039) (2,288) (2,960)

Net cash from/(used in) operating

activities 1,870 3,695 (548)

------------ ------------ -----------

Cash flows from investing activities

Acquisition of property, plant and

equipment (1,255) (223) (1,624)

Disposal of property, plant and

equipment - 1 3

Purchase of intangibles (1,300) (689) (1,263)

Finance income 40 83 190

Net cash (used in)/from investing

activities (2,515) (828) (2,694)

------------ ------------ -----------

Cash flows from financing activities

Proceeds from issue of share capital - 62 63

Interest paid on lease liabilities (67) (67) (111)

Principal paid on lease liabilities (202) (195) (371)

Dividends paid (1,810) - (2,886)

Net cash (used in)/from financing

activities (2,079) (200) (3,305)

Net increase/(decrease) in cash

and cash equivalents (2,724) 2,667 (6,547)

Foreign exchange movements 1,293 702 1,338

Balance at the beginning of the

period 14,314 19,523 19,523

Balance at the end of the period 12,883 22,892 14,314

============ ============ ===========

*Details of the restatement, which is unaudited, are presented

in note 3.

NOTES TO THE PRELIMINARY RESULTS FOR THE SIX MONTHS TO 30

SEPTEMBER 2022

1. Basis of preparation

The financial information for the period to 30 September 2022

does not constitute statutory accounts as defined by Section 435 of

the Companies Act 2006. It has been prepared in accordance with the

accounting policies set out in, and is consistent with, the audited

financial statements for year ended 31 March 2022.

The Group applies revised IAS 1 "Presentation of Financial

Statements (2007)". As a result, the Group presents all non-owner

changes in equity in consolidated statements of comprehensive

income and all owner changes in equity in consolidated statements

of changes in equity.

This Interim Statement has not been audited or reviewed by the

Group's auditors.

2. Statement of compliance

This Interim Statement is prepared in accordance with IAS 34

"Interim Financial Reporting". Accordingly, whilst the Interim

Statement has been prepared in accordance with IFRS, and the

primary statements follow the format of the annual financial

statements, only selected notes are included - those that provide

an explanation of events and transactions that are significant to

an understanding of the changes in financial position and

performance of the Group since the last annual reporting date. IAS

34 states a presumption that anyone who reads the Group's Interim

Statement will also have access to its most recent annual report.

Accordingly, annual disclosures are not repeated in this Interim

Statement.

3. Changes to significant accounting policies and other restatements

The principal accounting policies which are adopted by the Group

in the preparation of its financial statements are set out in in

the consolidated financial statements of the Group for the year

ended 31 March 2022. These policies have been consistently applied

to all prior years. Where necessary, and as detailed in the

consolidated financial statements of the Group for the year ended

31 March 2022, any corrections to the application of the Group's

accounting policies to comply with International Financial

Reporting Standards have been made as restatements of prior period

financial statements for the correction of errors in accordance

with IAS8 . The Group's accounting policies have been consistently

applied in accordance with IFRS continued into the six months ended

30 September 2022.

For the March 2022 Annual Report and Accounts, the Group became

aware of tax liabilities in a foreign jurisdiction associated with

the importation of goods and which would have fallen due in

previous periods. The Group had not previously recognised a

liability, nor had it recognised a cost, in the financial records

for the years ended 31 March 2021, 31 March 2020 or periods prior.

The Group estimated the total liabilities, the related foreign

corporation tax impact, and their effect on the prior periods'

consolidated financial statements. As the Group has only recently

become aware of the liability, it has yet to confirm the exact

amounts payable and it is not clear when a settlement of these

obligations will occur, however precedent suggests that this may be

up to seven years. The tax is related to the importation of goods

and therefore charged to cost of sales. The associated corporation

tax impact is shown in the Group's corporation tax charge and

deferred tax asset.

Full details are given in the Annual Report and Accounts for the

year ended 31 March 2022, but the financial effect on the interim

consolidated financial statements is summarised below.

Impact on the Balance Sheet and Income Statement

Balance sheet As reported Adjustment Adjustment As restated

as at to reserves through as at

30.09.21 Income Statement 30.09.21

Net assets: GBP000's GBP000's GBP000's GBP000's

Deferred tax assets 134 287 (69) 352

Provisions - (1,921) (412) (2,333)

Reserves:

Foreign exchange reserve 726 425 - 1,151

Retained earnings 15,412 (2,059) (481) 12,872

NOTES TO THE PRELIMINARY RESULTS FOR THE SIX MONTHS TO 30

SEPTEMBER 2022 (Continued)

3. Changes to significant accounting policies and other restatements (continued)

Income Statement As reported Adjustment As restated

for 6 months for 6 months

ended 30.09.21 ended 30.09.21

GBP000's GBP000's GBP000's

Cost of sales (20,959) (376) (21,335)

Net finance cost (53) (36) (89)

Income tax (759) (69) (828)

4. Revenue is derived from the Group's animal pharmaceutical businesses.

5. Principal risks and uncertainties

The principal risks and uncertainties relating to the Group were

set out on pages 20-22 of the Group's Annual Report and Accounts

for the year ended 31 March 2022. The key exposures are to foreign

currency exchange rates, potential delays in obtaining marketing

authorisations, single sources of supply for some raw materials,

disease impact on growth, and trade debtor recovery and have

remained unchanged since the year end.

6. Earnings per share

Six months Six months Year ended

to 30.09.22 to 30.09.21 31.03.22

(unaudited) (unaudited) (audited)

Restated

Weighted average number of shares in issue

(000's) 67,722 67,712 67,717

Fully diluted weighted average number of

shares in issue (000's) 68,071 67,712 67,717

Profit/(loss) attributable to equity holders

of the company (GBP000's) 1,325 (621) (686)

Basic earnings/(loss) per share (pence) 1.96 (0.92) (1.01)

Diluted earnings/(loss) per share (pence) 1.95 (0.92) (1.01)

Diluted earnings per share takes into account the dilutive

effect of share options. As the Group's result for the six months

ended 30 September 2021 and the year ended 31 March 2022 were

losses, there was no dilutive effect on the earnings per share in

those periods.

7. Taxation

The effective rate of the tax charge in the six months to 30

September 2022 is 31%, which is lower than the effective rate in

the six months to 30 September 2021 of 175%. This reflects

non-deductible tax expenses during the prior period, of which the

impairment of intangibles was the most significant.

NOTES TO THE PRELIMINARY RESULTS FOR THE SIX MONTHS TO 30

SEPTEMBER 2022 (Continued)

8. Intangible non-current assets

Group Goodwill Distribution Drug registrations, Total

rights patents

and licence

costs

GBP000's GBP000's GBP000's GBP000's

Cost

At 1 April 2021 17,930 407 23,963 42,300

Additions - - 689 689

Impairment - - (2,092) (2,092)

--------- ------------- -------------------- ---------

At 30 September 2021 17,930 407 22,560 40,897

Additions - - 732 732

--------- ------------- -------------------- ---------

At 31 March 2022 17,930 407 23,292 41,629

Additions - - 1,300 1,300

At 30 September 2022 17,930 407 24,592 42,929

========= ============= ==================== =========

Amortisation

At 1 April 2021 - 139 6,053 6,192

Charge for the period - 9 577 586

Written back on impairment - - (7) (7)

--------- ------------- -------------------- ---------

At 30 September 2021 - 148 6,623 6,771

Charge for the period - 10 544 554

--------- ------------- -------------------- ---------

At 31 March 2022 - 158 7,167 7,325

Charge for the period - 10 536 546

At 30 September 2022 - 168 7,703 7,871

========= ============= ==================== =========

Net Book Value

At 30 September 2022 17,930 239 16,889 35,058

========= ============= ==================== =========

At 31 March 2022 17,930 249 16,125 34,304

========= ============= ==================== =========

At 30 September 2021 17,930 259 15,937 34,126

========= ============= ==================== =========

At 1 April 2021 17,930 268 17,910 36,108

========= ============= ==================== =========

The Group continuously reviews the status of its research and

development activity, paying close attention to the likelihood of

technical success and the commercial viability of development

projects. In the period to September 2021 there were indications

that certain development projects for which costs have previously

been capitalised were unlikely to achieve technical success or

commercial viability. The capitalised costs in respect of these

projects were impaired through the income statement during the

period to 30 September 2021.

NOTES TO THE PRELIMINARY RESULTS FOR THE SIX MONTHS TO 30

SEPTEMBER 2022 (Continued)

This financial information was approved by the board on 23

November 2022.

This interim statement is available on the Group's website.

DIRECTORS AND OFFICERS Andrew Jones (Non-Executive Chairman)

David Hallas (Chief Executive)

Chris Wilks (Chief Financial Officer)

Tracey James (Non-Executive Director)

Frank Armstrong (Non-Executive Director)

REGISTERED OFFICE 78 Coombe Road, New Malden, Surrey, KT3 4QS

Tel: 020 8447 8899

COMPANY NUMBER 01818170

INFORMATION AT www.ecoanimalhealthgroupplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BTBPTMTMTBLT

(END) Dow Jones Newswires

November 23, 2022 02:00 ET (07:00 GMT)

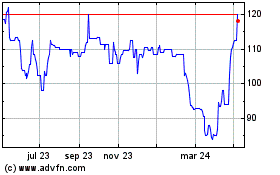

Eco Animal Health (LSE:EAH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

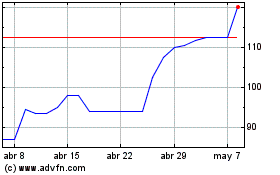

Eco Animal Health (LSE:EAH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024