Eurocell plc Year End Trading Update (8923N)

26 Enero 2023 - 1:00AM

UK Regulatory

TIDMECEL

RNS Number : 8923N

Eurocell plc

26 January 2023

26 January 2023

EUROCELL PLC

("Eurocell" or the "Group")

Year End Trading Update

Eurocell plc, the market leading, vertically integrated UK

manufacturer, recycler and distributor of innovative window, door

and roofline PVC products, provides the following update for the

for the year ended 31 December 2022.

Trading Performance

Group sales for the year ended 31 December 2022 were GBP384

million, up 12% compared to 2021. Divisional growth rates were as

follows:

Sales growth vs 2021 6 months 6 months 12 months

to 30 June to 31 Dec to 31 Dec

2022 2022 2022

Total Group 13% 11% 12%

Profiles Division 17% 13% 15%

Building Plastics Division 11% 9% 10%

------------ ----------- -----------

Following a strong first six months of the year, new build,

large contract and RMI project work continued to be robust

throughout the second half of 2022. This was offset by the impact

of the previously reported cyber incident and a slowdown in smaller

discretionary RMI work experienced by our branch network and trade

fabricators in H2, albeit against an exceptionally strong

comparative period. After a period of very strong demand, we

believe the market is now returning to pre-pandemic norms.

Price was the driver of sales growth in 2022. Whilst we continue

to offset input cost inflation with selling price increases and

surcharges, we experienced margin pressure in the second half,

reflecting a lag on implementing some selling price increases.

However, the cost of key raw materials does now appear to be

stabilising, and in some cases beginning to fall.

Cyber Insurance Claim

As reported at the Half Year, we experienced a cyber incident

towards the end of July, which resulted in some temporary

disruption. The incident was efficiently resolved, with the

business remaining operational throughout and trading normally from

mid-August. We have now partially resolved our cyber insurance

claim and expect to recognise compensation in excess of GBP1

million as an underlying item in our 2022 financial statements,

primarily for business interruption. Work is ongoing with the

insurer to resolve the remaining aspects of the claim.

Disposal of Security Hardware

To further streamline our business, in December 2022 we sold the

trade and assets of Security Hardware, a supplier of window locks,

hardware and spares to the RMI market with annual third-party sales

of c.GBP3 million, to UAP Limited, a UK-based door hardware

supplier. Going forward, UAP will supply hardware to all our

branches.

As a result of the sale, we expect to report an overall loss

from discontinued operations in the 2022 financial statements of

c.GBP2 million. This incorporates a trading loss for the period of

c.GBP1 million (inclusive of costs incurred to prepare the business

for sale), as well as the sale proceeds and associated asset

impairments.

2022 Financial Results

Reflecting the factors described above, we expect underlying

profit before tax from continuing operations for the year ended 31

December 2022 to be in line with market expectations, with the

trading loss at Security Hardware of c.GBP1 million separately

classified within discontinued operations.

Outlook and Cost Saving Programme

We are mindful of the uncertain macro-economic background and

its impact on our markets. The Construction Product Association's

latest forecast, published in November 2022, predicts declines in

both the RMI and new build markets of 9% for 2023, before

recovering in 2024, and we have experienced some recent weakness in

those sectors.

In anticipation of weaker markets in 2023, we completed a

restructuring programme in Q4 2022, which along with other cost

saving measures, will reduce operating costs by approximately GBP5

million per annum from the start of 2023. A charge of c.GBP2

million will be included as a non-underlying item in our 2022

financial statements in respect of the programme. We also intend to

temporarily pause our branch opening programme until the economic

outlook is clearer.

However, we continue to take market share and have increased the

run rate on new fabricator account acquisitions, with our pipeline

of other potential new fabricator customers remaining healthy.

Market share gains are further supported by the impact of maturing

branches and a widening product range, all underpinned by very high

product availability and increasingly efficient operations.

Our debt is low, our balance sheet is strong and we remain

confident of continuing to outperform our markets.

Notice of Results

We expect to publish our results for the year ending 31 December

2022 on 16 March 2023, at which time we will provide further

guidance on the year ahead.

Enquiries:

Eurocell plc

Mark Kelly, Chief Executive

Officer +44 (0) 1773 842 105

Michael Scott, Chief Financial

Officer +44 (0) 1773 842 140

Teneo

Ben Foster +44 (0) 777 624 0806

Camilla Cunningham +44 (0) 746 498 2426

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKELFLXFLBBBX

(END) Dow Jones Newswires

January 26, 2023 02:00 ET (07:00 GMT)

Eurocell (LSE:ECEL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

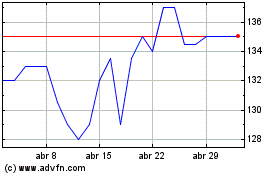

Eurocell (LSE:ECEL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024