TIDMECHO

RNS Number : 5199Y

Echo Energy PLC

14 January 2022

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN (THE

"ANNOUNCEMENT") IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN,

INTO OR FROM THE UNITED STATES, CANADA, AUSTRALIA, JAPAN, SOUTH

AFRICA OR ANY OTHER JURISDICTION WHERE TO DO SO MIGHT CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH

JURISDICTION.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR CONTAIN ANY INVITATION,

SOLICITATION, RECOMMATION, OFFER OR ADVICE TO ANY PERSON TO

SUBSCRIBE FOR, OTHERWISE ACQUIRE ANY SECURITIES OF THE COMPANY.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

THE MARKET ABUSE REGULATION (EU) NO. 596/2014. UPON THE PUBLICATION

OF THIS ANNOUNCEMENT VIA REGULATORY INFORMATION SERVICE, THIS

INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN

.

14 January 2022

Echo Energy plc

("Echo" or the "Company")

Argentinian Production Update,

Chilean Solar Acquisition,

Issue of Equity

Echo Energy, the Latin American focused upstream energy company,

is pleased to provide a Q4 2021 production update regarding its

Santa Cruz Sur assets, onshore Argentina.

In addition, further to Echo's long stated intention to leverage

its commercial and technical capabilities across the wider energy

spectrum, including solar, the Company is pleased to announce its

entry into the Chilean solar energy market with the entry of an

option agreement to purchase a 70% interest in a 3MW solar project

in Chile (the "Option") and the forming of a partnership with

Chilean company, Land & Sea SpA ("LAS"), a highly experienced

developer of solar projects in Chile, to fund, construct and

operate the project.

Q4 2021 Argentinian Production Update

During Q4 2021 daily operations in the field at Santa Cruz Sur

continued with the delivery of produced gas and liquids to key

industrial customers and total 2021 cumulative production from

Santa Cruz Sur net to Echo's 70% interest reached an aggregate of

567,370 boe (including 2,920 MMscf of gas).

During Q4 2021, net liquids production averaged 240 bopd whilst

net gas production averaged 7.0 MMscf/d. These production levels

have been achieved despite a province-wide strike that temporarily

reduced production levels over a six-day period in mid-December.

Production for the first eight days of 2022 has been strong, with

liquids production net to Echo averaging 262 bopd and net gas

production averaging 8.3 MMscf/d.

As previously announced, the successful implementation of the

Company's strategy with the commercial focus on high-quality blends

at Santa Cruz Sur, has continued to lead to an increased frequency

of liquids sales throughout Q4 2021. Total liquids sales net to

Echo over Q4 2021 reached 25,881 bbls which is an increase of 71%

over the previous quarter (Q3 2021: 15,050 bbls).

Entry into Chilean Solar Market - Highlights

-- Option in relation to the 3 MW Vincente Méndez solar project

(the "Project") and Joint Venture with LAS, a highly experienced

developer of solar projects in Chile

-- On exercise of the Option, Echo will loan 100% of capex to

construct the Project in return for a 70% indirect equity interest

in the Zorro Solar SpA holding the rights to the Project (the

"Project SPV") with the remaining 30% interest in the Project SPA

held by LAS

-- Entry into the Project requires no upfront acquisition

payment and instead provides Echo with access to attractive 'ground

floor terms'

-- LAS will manage the Project locally, without a management

fee, whilst Echo will maintain its 70% controlling interest in the

Project SPV

-- Following construction and on the sale of the Project, the

construction loan provided will be repaid to Echo at 4% interest,

with remaining sale proceeds split 70% Echo and 30% LAS, after

reimbursement of US$100,000 of historical LAS costs

-- If the option is exercised by Echo, gross construction capex

for the Project is currently estimated at US$2.6 million and Echo

will control the timing of expenditure

Under the Option agreement, the Company has the right to acquire

a 70% interest in the Project, subject to certain conditions

including the provision by the Company of the funding described

below, with the intention to form a Joint Venture to construct and

operate the Project. The Option is exercisable by the Company, in

its sole discretion, at any time during the period up to 4 weeks

from the date on which sufficient documentation has been provided

to the Company required to enable a Final Investment Decision

("FID"). Echo's current intention is to exercise the Option

providing final documentation, including supplier and service

contracts, is provided confirming the attractiveness of potential

Project returns and the availability of non-recourse or project

finance funds sufficient to meet Echo's potential capex

obligations. Further announcements will be made by the Company in

this regard as appropriate.

By diversifying its asset portfolio via the entry of the Option,

Echo will be well placed to capitalise on a new business segment

that has the potential to provide low risk, stable cash flows, and

attractive risk weighted returns that can support future

investments in the base business in Santa Cruz Sur, whilst

capitalising on complementary skills sets and geographic focus.

Furthermore, Chile is a country with world class renewable energy

resources; an established renewable energy industry and fiscal

regime; excellent infrastructure; and ambitious energy transition

targets.

Following careful analysis of multiple renewable energy

projects, the Echo Board believe the Option to acquire an interest

in the Project provides an important and exciting opportunity in

the continued growth of the Company.

The Vincente Méndez Solar Project

The Vincente Méndez solar project is located 4 km from Chillan,

a city of around two hundred thousand people, in central Chile,

less than 0.2 km from the grid connection point and near to

trunkline electricity and transport infrastructure to the capital

Santiago. In this area, where solar radiation levels are similar to

Mediterranean Europe, 3 MW capacity is expected to produce around

5,800 MWh/year, which is approximately double the average output of

a UK solar plant of the same size.

Importantly, the Project will be part of the Chilean PMGD Scheme

(Pequeños Medios de Generación Distribuida) which provides access

to a favourable and stabilised long-term price regime and a fast-

tracked approval process. These aspects make the project low risk

to the Company in the construction phase and attractive to

potential future purchasers / investors once operational.

Following any FID and successful commercial negotiation of

construction contracts, total gross capex for the Project is

currently anticipated to be approximately US$2.6 million. Subject

to FID, construction is expected to begin in Q2 2022 and to

complete in Q3 2023.

Whilst Echo will maintain a controlling equity interest in the

Project SPV, on the ground, the Project will be led by LAS, who

have demonstrated their expertise by managing solar projects

through construction to operation, most recently, a similar 3 MW

solar plant with another international partner. The Company's

partnership with LAS also provides access to LAS' pipeline of

similar solar projects already in the planning stage, which can be

used by the Company to scale up the renewables business. The

Company expects to be able to secure project finance to fund this

project in due course.

Terms of the Option agreement

The transaction has been structured to ensure that the project

is low risk to the Company, whilst providing exposure to the

potential upside associated with the interest, with no capital risk

prior to FID. LAS are responsible for any remaining costs prior to

the exercise of the Option and FID and the timing of FID is

controlled by the Company.

Following a FID, when the Project cost has been accurately

defined with contracts, the Company will fund 100% of the Project

capex in the form of a loan to the Project SPV. In the event of any

future sale of the Project post-construction, the proceeds would be

utilised to cover the 4% per annum interest on the loan, the loan

principal and a US$100k historical cost reimbursement to LAS. The

remaining net proceeds would then be distributed according to the

partner's working interests.

If following construction, the attractiveness of pricing in the

wholesale power markets is such that the JV believes it would be

preferable to retain the project and sell electricity into the

grid, the cash flows generated from electricity sales will be used

to satisfy the historical cost repayment obligations in the same

way. As at 31 December 2021 the Project SPV had estimated net

assets of approximately US$100,000.

Key Project milestones

Currently the Project is approaching Ready-To-Build ("RTB")

status, with LAS securing permits with relevant authorities and

finalising the Engineering, Procurement & Construction ("EPC")

contract and the provision of solar panels. Following successful

FID, it is expected that the Project would begin construction

around Q2 2022. The completion of construction and commencement of

commercial operations, when electricity is supplied to the grid, is

currently anticipated around Q3 2023.

Echo Energy post transaction

This transaction is the next step towards becoming a full

spectrum energy company leveraging the Company's Latin America

strategic focus and strong relationships. The Company's base

business in the Santa Cruz Sur assets in Argentina remains robust

and a vital component of the ongoing business. In combination this

transaction provides the Company with the ability, on exercise of

the option, to better diversify the Company's portfolio, across

commodity type and country risk, yet is still positioned to take

advantage of strengthening oil and gas prices and production

enhancement opportunities. Going forward the Company is well

positioned to grow its renewables business and provide stable cash

flows to further support investment activities in Santa Cruz

Sur.

The Company continues to evaluate other opportunities in the

renewable energy space in Latin America with its local partners,

alongside its existing investment programme including the ongoing

well workover programme in its Santa Cruz Sur portfolio. This

innovative, low risk structure transaction is indicative of how the

Company will aim to bring further assets into the Company at a low

upfront cost to shareholders.

Issue of equity and warrants

The Company announces that it has raised gross proceeds of

GBP660,000 through the issue of 143,478,260 new ordinary shares in

the Company (the "Subscription Shares") at 0.46 pence per share

(the "Subscription Price") to new investors pursuant to a direct

subscription with the Company (the "Subscription"), conditional on

admission of the Subscription Shares to trading on AIM.

In connection with the Subscription, the Company has issued

65,217,391 warrants to subscribe for new Ordinary Shares

exercisable at 0.65 pence per new Ordinary Share at any time until

the second anniversary of issue (the "First Subscription Warrants")

subject to admission of the Subscription Shares to trading on

AIM.

In addition, the Company has also conditionally agreed to issue

a further 78,260,869 warrants to subscribe for new Ordinary Shares

exercisable at 0.65 pence per new Ordinary Share at any time until

the second anniversary of issue (the "Second Subscription

Warrants") subject to the receipt of the necessary share issuance

authorities at the Company's 2022 annual general meeting.

The Subscription Shares will, when issued, rank pari passu in

all respects with the Company's existing ordinary shares of 0.25

pence each ("Ordinary Shares") and application will be made for the

Subscription Shares to be admitted to trading on AIM ("Admission").

Admission is expected to take place on or around 8.00 a.m. on 24

January 2022.

The net proceeds of the Subscription of approximately GBP600,000

will add to the Company's working capital resources and be applied

towards the formation of the solar project Joint Venture to

construct and operate the Project. As at 30 December 2021 the

Company's unaudited cash balance, excluding Echo's 70% entitlement

to cash balances held by the Santa Cruz Sur joint venture in

Argentina, was approximately US$520,000.

Following Admission, the Company's issued share capital will

comprise 1,452,491,345 Ordinary Shares. Each Ordinary Share has one

voting right and no shares are held in treasury and this figure may

be used by shareholders in the Company as the denominator for the

calculation by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

share capital of the Company under the Financial Conduct

Authority's Disclosure Guidance and Transparency Rules.

Martin Hull, Chief Executive Officer of Echo Energy,

commented:

"I am very pleased to be able to announce our first steps into

the solar energy space via the entry of the partnership with LAS

and this option agreement. The resultant JV represents what we hope

will be the start of a long and fruitful relationship with LAS.

This agreement is another example of Echo leveraging its in-house

transactional capabilities to bring exciting and potentially highly

value accretive assets into the business while at the same time

minimising upfront cost to its shareholders.

Our Santa Cruz Sur assets provide Echo with a very robust base

business, highlighted by the strong production numbers at the start

of this year, and a strong foundation on which to add a new

business segment. Chile is a sweet spot for renewable energy in

Latin America, and our entry to the region diversifies our

geographic footprint whilst providing near term catalysts as we

progress the new project.

Our focus remains on balancing risk and reward in the most

efficient way possible for our shareholders - as we broaden the

range of our energy investment opportunities, we will be able to

identify the best paths to value creation across both hydrocarbons

and renewables, whilst also positioning the business for the energy

transition."

For further information, please contact:

Echo Energy via Vigo Communications

Martin Hull, Chief Executive Officer

Vigo Consulting (IR & PR Advisor)

Patrick d'Ancona

Chris McMahon +44 (0) 20 7390 0230

Cenkos Securities (Nominated Adviser)

Ben Jeynes

Katy Birkin +44 (0) 20 7397 8900

Shore Capital (Corporate Broker)

Anita Ghanekar +44 (0) 20 7408 4090

Note

The assignment of Echo's 70% non-operated participation in the

Santa Cruz Sur licences is subject to the authorisation of the

Executive Branch of Santa Cruz's Province, which is part of the

overall process of title transfer that is proceeding as

anticipated. bopd means barrels of oil per day; bbl means barrel;

MMscf means million standard cubic feet of gas per day; and MMscf/d

means million standard cubic feet of gas per day

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCLZLFFLFLXBBZ

(END) Dow Jones Newswires

January 14, 2022 07:36 ET (12:36 GMT)

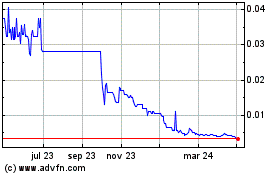

Echo Energy (LSE:ECHO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

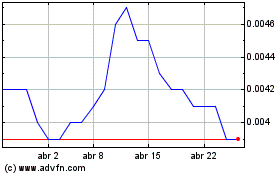

Echo Energy (LSE:ECHO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024