Echo Energy PLC Extension to publication of 2021 Accounts (2588Q)

27 Junio 2022 - 1:00AM

UK Regulatory

TIDMECHO

RNS Number : 2588Q

Echo Energy PLC

27 June 2022

27 June 2022

Echo Energy plc

(" Echo " or the " Company ")

Operational and Commercial update

Extension to publication of 2021 Audited Report and Accounts

Echo Energy plc, the Latin American focused upstream energy

company, announces that AIM Regulation has granted the Company an

additional period of up to two months to publish its annual audited

accounts for the year ended 31 December 2021. The Company must

therefore publish its annual audited accounts for the year ended 31

December 2021 (the "2021 Annual Report") by 31 August 2022 but will

endeavour to do so as soon as possible.

This additional period is in view of the adverse impact of

COVID-19 having resulted in delays in the ability of the local

Argentinian Santa Cruz Sur joint venture entity in which Echo holds

a 70% interest (the "SCS JV") to provide information to its

Argentinian auditor. As a result, the Argentinian auditor has been

delayed in the finalisation of the SCS JV audit, which the Company

now expects to be concluded during July 2022. The Company remains

in constant dialogue with both the Argentinian auditor and Echo's

UK auditor to seek to conclude and publish the 2021 Annual Report

as soon as is possible.

The Company is also pleased to provide a production and

commercial update regarding its Santa Cruz Sur assets, onshore

Argentina, where production during the period from 1 January 2022

to 18 June 2022 reached an aggregate of 243,230 boe net to Echo

during the period, including 44,905 bbls of oil and condensate and

1,190 MMscf of gas.

Net liquids production in Q2 to 18 June 2022 averaged a 267

bopd, a slight increase on Q1 levels despite a 35-day maintenance

and upgrade programme on the Oceano field during Q2, when oil and

gas production from the field was temporarily brought offline.

Net gas production averaged 6.7 MMscf/d in Q2 to 18 June 2022, a

reduction compared to the Q1 2022 figure of 7.4 MMscf/d as a result

of the Oceano field production being brought temporarily offline

for maintenance and upgrades to the compressor and associated

infrastructure.

Production from Oceano remains strong and with production

increases remaining sustainable. In the 40 days post-maintenance

commissioning, production from Oceano average 2.15 MMscf/d,

representing an increase of 46% in daily gas production at Oceano

when compared to the 40-day period immediately prior to maintenance

operations.

Gas sold since the start of May 2022 has been sold under the new

2022-2023 contracts announced by the Company on 3 May 2022, with

flexibility to capitalise on periods of attractive spot pricing. In

May, gas revenue net to Echo (inclusive of VAT) is expected to be

c.US$1.0m, an increase of more than 160% over gas sales in

April.

Total liquid sales net to Echo in 2022 to 23 June were 45,847

bbls. In Q2 2022 an additional new customer signed an agreement to

purchase liquids from the Company, providing further sales options

and competitive leverage in the domestic market. In May total net

liquids revenue was c.US$0.4m.

It is anticipated that these increased revenues over the course

of the annual gas contracts are capable of being applied towards

the acceleration of the Company's operational programme to increase

production whilst also being applied to the outstanding Santa Cruz

Sur Joint Venture historical creditor balances. As of 30 April

2022, this SCS JV current liabilities were estimated (unaudited) at

US$13.9m gross (US$9.7m net to Echo's 70% interest). This is

slightly up compared with the (unaudited) balances at 31 Dec 2021

of US$13.8m (US$9.6m net to Echo's 70% interest). The Santa Cruz

Sur Joint Venture balances are prior to Argentinian VAT credits due

to the Company.

The Company's cash balances as at 30 April 2022 stood at

c.US$1.6 million (including US$1.0 million of Echo's 70% interest

of SCS JV cash balances in Argentina). Echo's consolidated cash

position as at 31 December 2021 was US$0.9m, up 28% from US$0.6m as

at 31 December 2020.

Whilst remaining subject to audit, the Company confirms that it

expects to report revenues for the year ended 31 December 2021 of

US$11.1m (2020: US$11.1m) and net long-term debt of US$29.0m as at

31 December 2021 (2020: $30.0m). As announced by the Company on 14

January 2022, total 2021 cumulative production from Santa Cruz Sur

net to Echo's 70% interest in the Santa Cruz Sur assets was 567,370

boe (including 2,920 MMscf of gas).

For further information please contact:

Echo Energy plc Via Vigo Communications Ltd

Martin Hull, Chief Executive

Officer

Cenkos Securities plc (Nominated Tel: 44 (0)20 7397 8900

Adviser)

Ben Jeynes

Katy Birkin

Vigo Consulting Ltd (IR/PR Tel: 44 (0)20 7390 0230

Advisor)

Patrick d'Ancona

Chris McMahon

Shore Capital (Corporate Broker) Tel: 44 (0)20 7408 4090

Anita Ghanekar

Boe means barrels of oil equivalent; MMscf means million

standard cubic feet; MMscf/d means million standard cubic feet per

day; bopd means barrels of oil per day; and boe means barrels of

oil equivalent.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGUGDLGXDDGDR

(END) Dow Jones Newswires

June 27, 2022 02:00 ET (06:00 GMT)

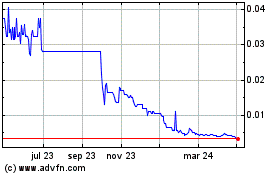

Echo Energy (LSE:ECHO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

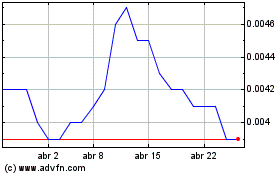

Echo Energy (LSE:ECHO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024