TIDMECHO

RNS Number : 2489B

Echo Energy PLC

30 September 2022

30 September 2022

Echo Energy plc

("Echo" or "the Company")

Interim Results

Echo Energy, the Latin American focused upstream energy company,

announces its unaudited interim results for the six months ended 30

June 2022.

H1 2022 Highlights:

-- Revenue increase of 6% to US$6.2 million in H1 2022 (H1 2021: US$5.9 million)

-- Secured new gas contracts for 2022-2023 significantly above the 2021 annual pricing

-- Total net aggregate H1 2022 production of 261,290 boe,

including 48,600 bbls of oil and condensate and 1,280 MMscf of

gas

-- Continued to prioritise production opportunities with swift

payback, a key component of the Group's overarching growth

strategy

Post Period-End Highlights

-- Agreement by the Santa Cruz Sur partners to a production and

infrastructure enhancement plan to materially increase Santa Cruz

Sur production by c.40% above average H1 2022 production levels

-- Post period fundraising and conditional debt restructuring

Echo Energy plc Via Vigo Communications Ltd

Martin Hull, Chief Executive

Officer

Cenkos Securities plc (Nominated Tel: 44 (0)20 7397 8900

Adviser)

Ben Jeynes

Katy Birkin

Vigo Consulting Ltd (IR/PR Tel: 44 (0)20 7390 0230

Advisor)

Patrick d'Ancona

Chris McMahon

Arden Partners plc (Corporate Tel: 44 (0)20 7614 5900

Broker)

Simon Johnson (Corporate Broking)

John Llewellyn-Lloyd (Corporate

Finance)

Certain of the information communicated within this announcement

is deemed to constitute inside information for the purposes of

Article 7 of EU Regulation 596/2014 (as amended), which forms part

of domestic UK law pursuant to the European Union (Withdrawal) Act

2018 . Upon the publication of this announcement, this inside

information is now considered to be in the public domain.

Chairman and Chief Executive Officer's Statement

In the six months ended 30 June 2022, despite a number of legacy

challenges resulting from the pandemic, the Company has taken clear

steps forward, underpinned by considerable operational and

commercial progress. Echo has continued to bolster its financial

foundations, facilitating the development of cashflow enhancing

rapid return production opportunities, which remains a a key

component of the Group's long-term growth strategy.

The successful negotiation of the new premium priced gas sales

agreements, coming into effect in May 2022, are expected to

underpin significantly increased gas revenues from the Santa Cruz

Sur asset base. T he additional cashflows which will be delivered

from the Santa Cruz Sur Enhancement Plan announced post period-end

will enable the Company to broaden the scope of choices available

to bring additional reserves and resources into production from the

many opportunities the portfolio presents.

Amid the current favourable macro environment and with the

potential debt restructuring on the horizon, Echo remains

well-placed to evolve its existing portfolio. Whilst the Santa Cruz

Sur assets remain a strategic priority, Echo is also pursuing

additional business development opportunities across the full

energy spectrum in Latin America, aimed at enhancing the Company's

reputation as a leading sector player in the wider region.

Progress on Production

Echo is highly focused on delivering near term production

increases following the prudent financial stabilisation of the

business across 2020 and 2021, and the normalisation of operating

and trading conditions, albeit against a strong commodity price

backdrop, across the energy sector as the impact of the Covid-19

pandemic continues to ease.

In April 2022, the compressor at the Santa Cruz Sur assets was

successfully upgraded, and important maintenance was performed

whilst the Oceano field was temporarily shut-in. This was a

significant and planned operational milestone and the programme has

delivered on its target of substantially increasing production from

the Santa Cruz Sur assets since the compressor was brought back

online, with the full impact expected to be seen in future

production figures. Post period additional work at a number of

fields has been undertaken to improve power generation capacity as

part of the production enhancement plan, and these efforts

continue.

Production over H1 2022 has continued to remain strong and

reached an aggregate of 261,290 boe net to Echo during the period,

including 48,600 bbls of oil and condensate and 1,280 MMscf of gas.

Concurrently, net liquids production in Q2 2022 averaged 272 bopd,

an increase over Q1 levels (Q1 2022: 265 bopd) despite the 35-day

maintenance and upgrade programme on the Oceano field during the

quarter.

Net gas production averaged 6.8 MMscf/d during Q2 2022 (Q1 2022:

7.4 MMscf/d), with Q2 2022 production again impacted as a result of

the Oceano field production being brought temporarily offline.

Successful Execution of Sales Contracts at Premium Prices

In May 2022, Echo extended its customer footprint, securing two

new gas sales contracts ("the Contracts") at significant premiums

to 2021 contracted rates. The Contracts reflect the strong

competition amongst customers to secure gas supplies from the

Company for the coming year.

Alongside providing the Group with further sales options and

flexibility as Echo focuses on increasing competition and prices

for specific products, the Contracts demonstrate the continued

implementation of the Company's strategy to leverage the strong

upswing in global commodity prices whilst seeking to underpin gas

sales from Santa Cruz Sur under secure long-term supply agreements

where appropriate.

The Contracts have a term of 12 months, with gas sales under the

Contracts beginning in May 2022, and provide for a 65% increase in

pricing over average annual contract pricing previously achieved by

the Company in March 2021 and a 116% increase on the current summer

pricing until end April 2022 under those same March 2021 contracts.

Only 2 months of the higher gas revenues under the new contracts is

reflected in the interim accounts for the 6 months to 30 June,

however, they now create a much more positive outlook for revenue

growth in the next 12 month period.

Financial

The Group posted a Gross Loss of US $1.0 million for the six

month period ended June 2020 compared to a profit of US $0.4

million for the comparable period in 2021. Growing production costs

are attributable to general inflationary increases and additional

expenditure required to get operations back to a more normal

environment following the pandemic.

Total revenue for the period was US $6.2 million (H1 2020: US $

5.9 million), and comprised of US $2.5 million of Oil sales and US

$3.7 million of Gas sales.

Financial income of US $2.2 million and was almost entirely the

net foreign exchange gains. Finance expense of US $1.8 million for

H1 2022 (H1 2020: US $ 3.3 million) and comprised primarily of US

$1.3 million unwinding of discount on long term loans..

Total comprehensive loss for the Group for the 6 month period

ending 30 June 2022 was US $2.0 million (H1 2020: US $ 1.5

million)

The Company's cash balance as at 30 June 2022 was US $1.3

million, compared to $0.7 million balance as at 31 December

2021.

Post Period-End Highlights

Post period-end, the Group has continued to build on the

positive momentum generated in H1 2022 following the agreement of

new gas sales contracts, focusing on proving up the Santa Cruz Sur

assets which provide Echo with material production and revenues

from a strong reserves base as well as the potential for exciting

higher impact projects.

In July 2022, the Santa Cruz Sur joint venture partners agreed

to a detailed plan to materially increase production at Santa Cruz

Sur by approximately 40% from the levels previously achieved over

H1 2022, as well as to improve the quality of sales liquids from

the Santa Cruz Sur assets (the "Enhancement Plan"). If achieved,

the Enhancement Plan would increase total daily production from

Santa Cruz Sur to around 2,000 boepd, net to Echo's 70% interest in

Santa Cruz Sur.

This Enhancement Plan is the agreed next step for production

growth from Santa Cruz Sur and is focused on low-risk

infrastructure upgrades to sustain the increased production from

existing well stock.

Echo successfully installed all three additional power

generation units on schedule in the respective fields over August

2022, a key pillar of the Enhancement Plan, with the unit installed

in the larger Cerro Molino Oeste field commissioned and available

to support existing and future production levels. The Group is

planning on delivering upgrades to the workover rig owned by the

Santa Cruz joint venture, including an overhaul of the hydraulic

system and the blowout preventer stack.

Conditional Debt Restructuring and Fundraising

On 12 August 2022, the Company announced the conditional

conversion of an aggregate of EUR15.0 million of existing debt

principal, together with accrued interest thereon, into new

Ordinary Shares - the significant majority of which is proposed to

be converted into new Ordinary Shares at a price of 0.45p. In doing

so, the Company also confirmed that it would be proposing a

conditional reduction of the coupon on the remaining EUR10.0

million of Euro Note debt (the "Notes") from 8% to 2% with

suspension of further cash interest payments for two years and an

extension on maturity on the remaining Notes to 2032.

The Company subsequently announced publication of its proposals

to restructure the Notes on 5 September 2022. The debt

restructuring remains conditional on both the approval of the

holders of the Note and on the approval of the Company's

shareholders. The changes are aimed at comprehensively

restructuring and strengthening the Company's balance sheet and

accelerating growth.

On 14 August 2022, the Company was also pleased to confirm that

it had successfully raised GBP600,000 (before expenses) pursuant to

a placing of new ordinary shares. The net proceeds of this placing

provided the Group with additional resources to fund working

capital, including expenses related to the proposed debt

restructuring, and enable operating cashflows in Argentina to be

focused on activities in country in the near term, including the

plan to increase production by c. 40% over approximately the next

six months.

Outlook

H1 2022 was a productive period for the Group, as we

consolidated our asset base in Latin America with significant long

term commercial agreements and continued solid output from key

licences.

Against the backdrop of strong global commodity prices, the

Company has delivered on its key aspirations for the period,

accelerating its strategy to deliver organic growth from the Santa

Cruz Sur assets, which present material low - risk production

upside and has the potential to providing potential additional

benefits to all stakeholders.

Looking ahead, management is confident of the Group's growth

prospects as we continue to unlock the potential of Santa Cruz Sur,

identify further commercial opportunities, and strive to deliver

the important conditional debt restructuring announced in August

this year.

James Parsons Martin Hull

Chairman Chie f Executive Office

Consolidated Statement of Comprehensive Income

Period ended 30 June 2022

Unaudited Unaudited Audited

1 January 2022 1 January 2021 Year to

30 June 2022 30 June 2021 31 December

2021

Notes US $ US $ US $

--------------------------------- ------- ----------------- ---------------- -------------

Continuing operations

Revenue 3 6,230,288 5,891,413 11,124,487

Cost of sales 4 (7,256,796) (5,497,993) (15,147,779)

--------------------------------- ------- ----------------- ---------------- -------------

Gross (loss)/profit (1,026,508) 393,420 (4,023,292)

Exploration expenses (143,545) (45,807) (205,651)

Administrative expenses (1,125,073) (1,492,010) (2,965,548)

Operating loss (2,295,126) (1,537,817) (7,194,491)

Financial income 5 2,161,898 3,140,024 4,355,334

Financial expense 6 (1,834,643) (3,287,229) (8,993,432)

Derivative financial gain/

(loss) 7 - 17,575 62,477

--------------------------------- ------- ----------------- ---------------- -------------

Loss before tax (1,967,871) (1,274,027) (11,770,112)

Taxation 8

--------------------------------- ------- ----------------- ---------------- -------------

Loss from continuing operations (1,967,871) (1,274,027) (11,770,112)

Loss for the period (1,274,027) (11,770,112)

Other comprehensive income:

Exchange difference on

translating foreign operations 26,834 (177,930) 211,820

--------------------------------- ------- ----------------- ---------------- -------------

Total comprehensive loss ( 11,558,292

for the period (1,941,036) (1,451,957) )

--------------------------------- ------- ----------------- ---------------- -------------

Loss attributable to: Owners ( 11,558,292

of the parent (1,941,036) (1,451,957) )

--------------------------------- ------- ----------------- ---------------- -------------

Total comprehensive loss

attributable to: Owners ( 11,558,292

of the parent (1,941,036) (1,451,957) )

--------------------------------- ------- ----------------- ---------------- -------------

Loss per share (cents) 9

Basic (0.14) (0.10) (0.93)

--------------------------------- ------- ----------------- ---------------- -------------

Diluted (0.14) (0.10) (0.93)

--------------------------------- ------- ----------------- ---------------- -------------

Loss per share (cents)

for continuing operations

Basic (0.14) (0.10) (0.93)

--------------------------------- ------- ----------------- ---------------- -------------

Diluted (0.14) (0.10) (0.93)

--------------------------------- ------- ----------------- ---------------- -------------

The notes form an integral part of these financial

statements.

Consolidated Statement of Financial Position

Period ended 30 June 2022

Unaudited Unaudited Audited

1 January 1 January Year to

2022 2021

30 June 30 June 2021 31 December

2022 2021

Notes US $ US $ US $

------------------------------------- ------- -------------- -------------- --------------

Non-current assets

Property, plant and equipment 10 2,668,770 2,516,805 2,674,405

Other intangibles 11 6,662,805 7,773,210 7,131,907

9,331,575 10,290,015 9,806,312

Current Assets

Inventories 1,415,225 438,014 1,365,225

Other receivables 3,566,742 5,846,670 2,108,438

Cash and cash equivalents 12 1,314,969 945,488 742,339

------------------------------------- ------- -------------- -------------- --------------

6,296,936 7,230,172 4,216,002

Current Liabilities

Trade and other payables (19,511,235) (10,075,368) (16,023,500)

Derivatives and other liabilities - (44,885) -

(19,511,235) (10,120,253) (16,023,500)

Net current assets (13,214,299) (2,890,081) (11,807,498)

------------------------------------- ------- -------------- -------------- --------------

Total assets less current

liabilities (3,882,724) 7,399,934 (2,001,186)

Non-current liabilities

Loans due in over one year 15 (28,031,316) (28,162,903) (28,768,380)

Provisions (3,039,911) (2,959,976) (3,039,911)

(31,071,227) (31,122,879) (31,808,291)

Total Liabilities (50,582,462) (41,243,132) (47,831,791)

------------------------------------- ------- -------------- -------------- --------------

Net Assets (34,953,951) (23,722,945) (33,809,477)

------------------------------------- ------- -------------- -------------- --------------

Equity attributable to

equity holders of the parent

Share capital 13 7,686,151 7,135,082 7,209,086

Share premium 14 64,884,556 64,748,942 64,977,243

Warrant reserve 12,589,970 12,188,032 12,177,786

Share option reserve 1,522,499 1,570,827 1,522,499

Foreign currency translation

reserve (3,504,752) (3,141,836) (3,531,587)

Retained earnings (118,132,375) (106,223,992) (116,164,504)

------------------------------------- ------- -------------- -------------- --------------

Total Equity (34,953,951) (23,722,945) (33,809,477)

------------------------------------- ------- -------------- -------------- --------------

The notes form an integral part of these financial

statements.

Consolidated Statement of Changes in Equity

Period ended 30 June 2022

Foreign

Share currency

Retained Share Share Warrant option translation

earnings capital premium reserve reserve reserve Total equity

US $ US $ US $ US $ US $ US $ US $

-------------------- -------------- ---------- ----------- ----------- ---------- ------------- ---------------

1 January 2022 (116,164,504) 7,209,086 64,977,243 12,177,786 1,522,499 (3,531,587) (33,809,477)

Loss for the period (1,967,871) - - - - - (1,967,871)

Exchange Reserve - - - - - 26,835 26,835

-------------------- -------------- ---------- ----------- ----------- ---------- ------------- ---------------

Total comprehensive

loss for the

period (1,967,871) - - - - 26,835 (1,941,036)

Warrants issued - 433,696 400,735 - - - 834,431

Warrants exercised - - - - - - -

Share issue - - (412,184) 412,184 - - -

Transaction costs - 43,369 (81,238) - - - (37,869)

30 June 2022 (118,132,375) 7,686,152 64,884,556 12,589,970 1,522,499 (3,504,752) (34,953,951)

-------------------- -------------- ---------- ----------- ----------- ---------- ------------- ---------------

1 January 2021 (104,772,035) 6,288,019 64,961,905 11,373,966 1,417,285 (3,319,767) (24,050,627)

Loss for the period (1,274,027) - - - - - (1,274,027)

Exchange Reserve (177,930) - - - - 177,930 -

-------------------- -------------- ---------- ----------- ----------- ---------- ------------- ---------------

Total comprehensive

loss for the

period (1,451,957) - - - - 177,930 (1,274,027)

Warrants issued - (814,066) 814,066 - - -

Warrants exercised - 274,803 86,122 - - - 360,925

Share issue - 572,260 595,153 - - - 1,167,413

Transaction Costs (80,171) - - - (80,171)

Share options - - - - - - -

lapsed

Share-based

payments - - - - 153,542 - 153,542

-------------------- -------------- ---------- ----------- ----------- ---------- ------------- ---------------

30 June 2021 (106,223,992) 7,135,082 64,748,943 12,188,032 1,570,827 (3,141,837) (23,722,925)

-------------------- -------------- ---------- ----------- ----------- ---------- ------------- ---------------

1 January 2021 (104,772,035) 6,288,019 64,961,905 11,373,966 1,417,285 (3,319,767) (24,050,627)

Loss for the year (11,558,292) (11,558,292)

Exchange Reserve (211,820) (211,820)

Total comprehensive

loss for the year (11,558,292) 0 0 0 0 (211,820) (11,770,112)

New shares issued - 646,265 813,207 - - - 1,459,472

Warrants - 274,803 105,484 (19,362) - - 360,925

Warrants exercised - - (823,182) 823,182 - - -

Share issue costs - - (80,171) - - - (80,171)

Share options

lapsed 165,824 - - - (165,824) - -

Share-based

payments - - - - 271,038 - 271,038

-------------------- -------------- ---------- ----------- ----------- ---------- ------------- ---------------

31 December 2021 (116,164,504) 7,209,086 64,977,243 12,177,786 1,522,499 (3,531,587) (33,809,477)

-------------------- -------------- ---------- ----------- ----------- ---------- ------------- ---------------

The notes form an integral part of these financial

statements.

Consolidated Statement of Cash Flows

Period ended 30 June 2022

Unaudited Unaudited

1 January 1 January Year to

2022 2021

30 June 30 June 31 December

2022 2021 2021

US $ US $ US $

------------------------------------------ ------------ --------------- --------------

Cash flows from operating activities

Loss from continuing operations (1,967,871) (1,274,027) (11,770,112)

(1,967,871) (1,274,027) (11,770,112)

Adjustments for:

Depreciation and depletion of

property, plant and equipment 8,449 35,887 127,656

Depreciation and depletion of

intangible assets 503,706 738,412 1,498,431

(Gain)/Loss on disposal of property,

plant and equipment - - 1,858

Share-based payments - 153,542 271,038

Financial income (2,161,898) (3,140,024) (4,355,334)

Financial expense 1,834,643 3,287,229 8,993,432

Exchange difference (171,072) (1,656,272) (5,612,490)

Derivative financial gain - (17,575) (62,477)

------------------------------------------ ------------ --------------- --------------

13,828 (598,801) 862,114

Decrease/(Increase) in inventory (50,000) 103,215 (823,995)

Decrease/(Increase) in other receivables 657,790 1,700,723 5,120,825

(Decrease)/increase in trade and

other payables 1,371,642 (1,020,415) 5,072,974

------------------------------------------ ------------ --------------- --------------

1,979,432 783,523 9,369,804

Net cash used in operating activities 25,389 (1,089,305) (1,538,194)

Cash flows from investing activities

Purchase of intangible assets (34,604) - (118,716)

Purchase of property, plant and

equipment (2,813) - (251,226)

------------------------------------------ ------------ --------------- --------------

Net cash used in investing activities (37,417) (369,942)

Cash flows from financing activities

Interest received 26 166,820 249,351

Bank Fees and other finance cost (42,276) (63,136) (169,991)

Issue of share capital 834,430 958,513 1,459,472

Share issue costs (37,867) (80,171) (80,171)

Warrant exercise - 360,925 360,925

------------------------------------------ ------------ --------------- --------------

Net cash from financing activities 754,313 1,342,951 1,819,586

------------------------------------------ ------------ --------------- --------------

Net (decrease)/increase in cash

and cash equivalents 742,286 253,646 (88,550)

Cash and cash equivalents at

the beginning of the period 742,339 682,159 682,159

------------------------------------------ ------------ --------------- --------------

Foreign Excahnge gains(losses)

on cash and cash equivalents (169,655) 9,683 148,730

------------------------------------------ ------------ --------------- --------------

Cash and cash equivalents at

the end of the period 1,314,969 945,488 742,339

------------------------------------------ ------------ --------------- --------------

The notes form an integral part of these financial

statements.

Notes to the Financial Statements

Period ended 30 June 2022

1. Accounting Policies

General Information

These financial statements are for Echo Energy plc ("the

Company") and subsidiary undertakings ("the Group"). The Company is

registered, and domiciled, in England and Wales and incorporated

under the Companies Act 2006.

Basis of Preparation

The condensed and consolidated interim financial statements for

the period from 1 January 2022 to 30 June 2022 have been prepared

in accordance with International Accounting Standards ("IAS") 34

Interim Financial Reporting, and on the going concern basis. They

are in accordance with the accounting policies set out in the

statutory accounts for the year ended 31 December 2021 and are

expected to be applied for the year ended 31 December 2022.

The comparatives shown are for the period 1 January 2021 to 30

June 2021, and 31 December 2021 and do not constitute statutory

accounts, as defined in section 435 of the Companies Act 2006, but

are based on the statutory financial statements for the year ended

31 December 2021.

A copy of the Company's statutory accounts for the year ended 31

December 2021 has been delivered to the Registrar of Companies; the

accounts are available to download from the Company website at

www.echoenergyplc.com .

Going Concern

The financial information has been prepared assuming the Group

will continue as a going concern. Under the going concern

assumption, an entity is ordinarily viewed as continuing in

business for the foreseeable future with neither the intention nor

the necessity of liquidation, ceasing trading or seeking protection

from creditors pursuant to laws or regulations.

Despite the consolidated statement of financial position showing

a negative net asset position at 30 June 2022, the outlook for the

Group has materially changed.

2022 continues to be a year of financial stabilisation, progress

and improvement, particularly driven by a marked increase in energy

commodity prices, following the worst impacts of the COVID 19

pandemic in 2020. The successful restructuring of all the Company's

loans during 2021 and post period in 2022 means that minimal cash

servicing of these loans is required during 2022 materially

improving the cashflow outlook and enabling greater investment on

increasing production levels further improving revenues. Post

period the improvement has continued. The Company has executed new

gas sales agreements for the majority of its gas production.

Average Gas prices in July 2022 are US$4.53 (mmbtu) and Liquids

(m3) sell at US$51 in July 2022.

Agreements with customers allowing for a prepayment receipt of

$1.6m in April 2022, in combination with a revenue increase in cash

receipts from June 2022 has alleviated the immediate creditor

concern in Argentina, whilst the additional share offering has

raised further funds in the UK.

However, financial challenges remain ahead for the Company as it

emerges and recovers from the impact of the covid pandemic and

whilst the Company forecast the SCS assets to be cashflow positive

at prevailing oil and gas price levels in the long term, there is

still a short term requirement for additional funding through debt

financing, joint venture equity or share issues. These conditions

indicate the existence of a material uncertainty which may cast

significant doubt about the Company's ability to continue as a

going concern. The directors have formed a judgement based on

Echo's proven success in raising capital and a review of the

strategic options available to the group, that the going concern

basis should be adopted in preparing the financial statements.

The directors have formed a judgement based on Echo's proven

success in raising capital and a review of the strategic options

available to the Group, that the going concern basis should be

adopted in preparing the Condensed Interim Consolidated Financial

Statements.

Estimates

The preparation of the interim financial information requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing this condensed interim financial information, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those applied to consolidated financial statements

for the year ended 31 December 2021. The key sources of uncertainty

in estimates that have a significant risk of causing material

adjustment to the carrying amounts of assets and liabilities,

within the next financial year, are the Group's going concern

assessment.

Revenue Recognition

Revenue comprises the invoice value of goods and services

supplied by the Group, net of value added taxes and trade

discounts. Revenue is recognised in the case of oil and gas sales

when goods are delivered and title has passed to the customer. This

generally occurs when the product is physically transferred into a

pipeline or vessel. Echo recognised revenue in accordance with IFRS

15. We have a contractual arrangement with our joint venture

partner who markets gas and crude oil on our behalf. Gas is

transferred via a metred pipeline into the regional gas

transportation system, which is part of the national transportation

system, control of the gas is transferred at the point at which the

gas enters this network, this is the point at which gas revenue is

recognised. Gas prices vary from month to month based on seasonal

demand from customer segments and production in the market as a

whole. Our partner agrees pricing with their portfolio of gas

clients based on agreed pricing mechanisms in multiple contracts.

Some pricing is regulated by government such as domestic supply.

Echo receive a monthly average of gas prices attained. Oil

shipments are priced in advance of a cargo and revenue is

recognised at the point at which cargoes are loaded onto a shipping

vessel at terminal.

2. Business Segments

The Group has adopted IFRS 8 Operating Segments. Per IFRS 8,

operating segments are regularly reviewed and used by the board of

directors being the chief operating decision maker for strategic

decision-making and resources allocation, in order to allocate

resources to the segment and assess its performance.

The Group's reportable operating segments are as follows:

a. Corporate and Administrative

b. Santa Cruz Sur c . Bolivia

Performance is based on assessing progress made on projects and

the management of resources used. Segment assets and liabilities

are presented inclusive of inter-segment balances. Reportable

segments are based around licence activity, although the reportable

segments are reflected in legal entities, certain corporate costs

collate data across legal entities and the segmental analysis

reflects this.

Information regarding each of the operations of each reportable

segment within continuing operations is included in the following

table.

All revenue, which represents turnover, arises within Argentina

and relates to external parties:

Corporate Santa Bolivia Total

& Administrative Cruz Sur

US $ US $ US $ US $

Period to 30 June 2022

Revenues 86 6,230,201 - 6,230,288

Cost of sales (7,256,796) - (7,256,796)

Exploration expense (143,545) - - (143,545)

Administration expense (737,067) (372,609) (15,396) (1,125,073)

Financial income 2,161,872 26 - 2,161,898

Financial expense (1,363,845) (470,525) (272) (1,834,643)

------------------------ ------------------ ------------- ---------- -------------

Depreciation (4,445) (4,004) - (8,449)

Income tax

------------------------ ------------------ ------------- ---------- -------------

Loss before tax (82,500) (1,869,704) (15,668) (1,967,871)

Non-current assets 1,902,102 7,980,917 (551,445) 9,331,575

Assets 2,072,637 14,040,306 (484,432) 15,628,511

Liabilities (28,685,308) (21,874,676) (22,477) (50,582,462)

Parent Corporate Santa

Company Santa Tapi Bolivia Consolidation Total & Cruz Sur Tapi Bolivia Total

US $ Cruz Sur Aike US $ US $ US $ Administrative US $ Aike US US $

US $ US $ US $ US $ $

Period to 30 June 2021

Revenues - 5,891,413 - - 5,891,413

Cost of sales - (5,497,993) - (5,497,993)

Exploration expense (45,807) - - (45,807)

Administration expense (1,332,349) (113,839) (48,928) (115,043) (1,610,158)

Impairment of intangible - - - - -

assets

Impairment of property, - - - - -

plant and equipment

Financial income 2,898,300 77,101 164,616 - 3,140,024

Financial expense (1,823,398) (898,236) (467,375) (61) (3,186,081)

------------------------------------------------------------------------ ---------------- ------------ ------------ ---------- -------------

Depreciation 17,592 - - - 17,592

Income tax - - - - -

------------------------------------------------------------------------ ---------------- ------------ ------------ ---------- -------------

Loss before tax (285,662) (541,554) (351,687) (115,104) (1,262,545)

Non-current assets 28,792,797 4,740,757 3,362,308 (453,174) 36,442,688

Assets 28,940,599 9,214,984 5,947,869 (413,628) 43,689,824

Liabilities (28,816,764) (7,943,328) (4,421,895) (81,125) (41,263,112)

Consolidation adjustments in respect of assets relate to the

impairment of intercompany assets .

Depreciation is included in administration expenses

The geographical split of non-current assets arises as

follows:

United

Kingdom South America Total

US $ US $ US $

------------------------------- --------- ---------------- ----------

30 June 2022

Property, plant and equipment 1 2,668,769 2,668,770

Other intangible assets 480,189 6,182,616 6,662,805

------------------------------- --------- ---------------- ----------

30 June 2021

Property, plant and equipment 2,457 2,514,348 2,516,805

Other intangible assets 326,869 7,446,341 7,773,210

------------------------------- --------- ---------------- ----------

3. R evenue

Unaudited Unaudited Audited

1 January 1 January Year to

2022 - 2021 - 31 December

30 June 2022 30 June 2021 2020

US $ US $ US $

Oil revenue 2,514,419 2,024,421 4,060,802

Gas revenue 3,715,668 3,833,857 7,036,861

Other Income 201 33,135 26,824

Total Revenue 6,230,288 5,891,413 11,124,487

--------------- -------------- -------------- -------------

4. Cost of Sales

Unaudited Unaudited Audited

1 January 1 January Year to

2022 - 2021 - 31 December

30 June 30 June 2021 2021

2022 US $ US $

US $

Production costs 5,870,851 3,794,486 12,024,454

Selling and distribution

costs 928,235 863,065 1,684,320

Movement in stock of crude

oil (50,000) 72,239 (181,274)

Depletion 507,710 768,203 1,620,279

Total Costs 7,256,796 5,497,993 15,147,779

---------------------------- ----------- -------------- -------------

5. Finance Income

Period to Period to Year to

30 June 30 June 2021 31 December

2022 US$ 2021

US $ US $

---------------------------- ---------- -------------- -------------

Interest income 340 241,716 249,351

Net foreign exchange gains 2,161,558 2,898,308 4,105,983

Total 2,161,898 3,140,024 4,355,334

---------------------------- ---------- -------------- -------------

6. Financial Expense

Period to Period to Year to

30 June 30 June 2021 31 December

2022 US$ 2021

US $ US $

------------------------------------ ---------- -------------- -------------

Interest payable 227 11,912 11,912

Net foreign exchange losses 432,660 1,242,035 5,122,810

Unwinding of discount on

long term loan 1,272,735 1,691,248 3,394,647

Amortisation of loan fees 86,745 119,526 234,101

Unwinding of abandonment

provision - 19,980 59,955

Bank fees and overseas transaction

taxes 42,276 202,528 170,007

------------------------------------ ---------- -------------- -------------

Total 1,834,643 3,287,229 8,993,432

------------------------------------ ---------- -------------- -------------

7. Derivative Financial Gain/Loss

Period Period Year to

to to 31 December

30 June 30 June 2021

2022 2021 US $

US $ US $

----------------- ---------- --------- -------------

Fair value gain - 17,575 62,477

----------------- ---------- --------- -------------

Total - 17,575 62,477

----------------- ---------- --------- -------------

Represents fair value gain on valuation of derivatives

instruments at period end.

8. Taxation

The Group has tax losses available to be carried forward in

certain subsidiaries and the parent company. Due to uncertainty

around timing of the Group's projects, management have not

considered it appropriate to anticipate an asset value for them. No

tax charge has arisen during the six month period to 30 June 2022,

or in the six months period to June 2021, or the year to 31

December 2021.

9. Loss Per Share

The calculation of basic and diluted loss per share at 30 June

2021 was based on the loss attributable to ordinary shareholders.

The weighted average number of ordinary shares outstanding during

the period ending 30 June 2021 and the effect of the potentially

dilutive ordinary shares to be issued are shown below.

Period to Period to Year to

30 June 30 June 31 December

2022 2021 2021

----------------------------------- -------------- -------------- --------------

Net loss for the year (US $) (1,967,871) (1,274,027) (11,770,112)

----------------------------------- -------------- -------------- --------------

Basic weighted average ordinary

shares in issue during the

year 1,440,666,214 1,236,231,219 1,270,891,563

----------------------------------- -------------- -------------- --------------

Diluted weighted average ordinary

shares in issue during the

year 1,440,666,214 1,236,231,219 1,270,891,563

----------------------------------- -------------- -------------- --------------

Loss per share (cents)

Basic (0.14) (0.10) (0.93)

----------------------------------- -------------- -------------- --------------

Diluted (0.14) (0.10) (0.93)

----------------------------------- -------------- -------------- --------------

In accordance with IAS 33 and as the entity is loss making,

including potentially dilutive share options in the calculation

would be anti-dilutive. Deferred shares have been excluded from the

calculation of loss per share due to their nature.

10. Property, Plant and Equipment

PPE - O&G

Properties Fixtures

US $ & Fittings Total

US $ US $

------------------ ------------ ------------- ------------

30 JUNE 2022

Cost

1 January 2022 2,873,147 95,397 2,968,544

Additions - 2,813 2,813

Disposals - - -

------------------ ------------ ------------- ------------

30 June 2022 2,873,147 98,210 2,971,357

------------------ ------------ ------------- ------------

Depreciation

1 January 2022 202,718 91,421 294,139

Charge for the

period 4,004 4,445 8,449

Disposals - - -

------------------ ------------ ------------- ------------

30 June 2022 206,722 95,866 302,588

------------------ ------------ ------------- ------------

Carrying amount

30 June 2022 2,666,425 2,344 2,668,769

------------------ ------------ ------------- ------------

30 JUNE 2021

Cost

1 January 2021 2,621,921 97,254 2,719,175

Additions - - -

Disposals - - -

------------------ ------------ ------------- ------------

30 June 2021 2,621,921 97,254 2,719,175

------------------ ------------ ------------- ------------

Depreciation

1 January 2021 79,941 86,542 166,483

Charge for the

period 29,790 6,097 35,887

Disposals - - -

------------------ ------------ ------------- ------------

30 June 2021 109,731 92,639 202,370

------------------ ------------ ------------- ------------

Carrying amount

30 June 2021 2,512,190 4,615 2,516,805

------------------ ------------ ------------- ------------

31 DECEMBER

2021

Cost

1 January 2021 2,621,921 97,254 2,719,176

Additions 251,226 - 251,226

Disposals (1,858) (1,858)

------------------ ------------ ------------- ------------

31 December 2021 2,873,147 95,397 2,968,544

------------------ ------------ ------------- ------------

Depreciation

1 January 2021 79,941 86,542 166,483

Charge for the

year 122,777 4,879 127,656

Disposals - - -

------------------ ------------ ------------- ------------

31 December 2021 202,718 91,421 294,139

------------------ ------------ ------------- ----------

Carrying amount

31 December 2021 2,541,980 3,976 2,674,405

------------------ ------------ ------------- ----------

31 December 2020 975,826 10,713 2,552,693

------------------ ------------ ------------- ----------

11. Intangible Assets

Argentina

Exploration

& Evaluation Total

US $ US $

------------------------------ -------------- -----------

30 June 2022

Cost

1 January 2022 10,875,022 10,875,022

Additions 34,604 34,604

Disposals - -

30 June 2022 10,909,626 10,909,626

------------------------------ -------------- -----------

Impairment

1 January 2022 3,743,115 3,743,115

Depletion 443,706 443,706

Depreciation decommissioning

assets 60,000 60,000

Impairment charge for - -

the period

30 June 2022 4,246,821 4,246,821

------------------------------ -------------- -----------

Carrying amount

30 June 2022 6,662,805 6,662,805

------------------------------ -------------- -----------

30 June 2021 7,773,210 7,773,210

------------------------------ -------------- -----------

30 JUNE 2021

Cost

1 January 2021 10,756,306 10,756,306

Additions - -

Disposals - -

------------------------------ -------------- -----------

30 June 2021 10,756,306 10,756,306

------------------------------ -------------- -----------

Impairment

1 January 2021 2,244,684 2,244,684

Depletion 415,912 415,912

Depreciation decommissioning

assets 322,500 322,500

Impairment charge for - -

the period

------------------------------ -------------- -----------

30 June 2021 2,983,096 2,983,096

------------------------------ -------------- -----------

Carrying amount

30 June 2021 7,773,210 7,773,210

------------------------------ -------------- -----------

30 June 2020 8,511,622 8,511,622

------------------------------ -------------- -----------

31 DECEMBER 2021

Cost

1 January 2021 10,756,306 10,756,306

Additions 118,716 118,716

Disposals - -

31 December 2021 10,875,022 10,875,022

------------------------------ -------------- -----------

Impairment

1 January 2021 2,244,684 2,244,684

Disposals - -

Depletion 1,375,931 1,375,931

Impairment charge for

the year 122,500 122,500

31 December 2021 3,743,115 3,743,115

------------------------------ -------------- -----------

Carrying amount

31 December 2021 7,131,907 7,131,907

------------------------------ -------------- -----------

31 December 2020 8,511,622 8,511,622

------------------------------ -------------- -----------

12 . Cash and Cash Equivalents

Period Period to

to 30 June 30 June 31 December

2022 2021 2021

US $ US $ US $

------------------------------------- ------------ ---------- --------------

Cash held by joint venture partners 54,604 190,974 500,719

Cash and cash equivalents 1,260,365 754,514 241,620

------------------------------------- ------------ ---------- --------------

Total 1,314,969 945,488 742,339

------------------------------------- ------------ ---------- --------------

Echo has advanced cash to its joint venture partner. The equity

share of the balance held is recognised

13. Share Capital

Period Period to

to 30 June 30 June 31 December

2022 2021 2021

US $ US $ US $

--------------------------------------- ------------ ---------- --------------

Issued, Called Up and Fully Paid

1,452,491,345 0.32c (June 2021:

1,298,813,085 0.32c) ordinary shares

1 January 2022 7,209,086 6,288,019 6,288,019

Equity shares issued 477,065 847,063 921,067

--------------------------------------- ------------ ---------- --------------

30 June / 31 December 7,686,151 7,135,082 7,209,086

--------------------------------------- ------------ ---------- --------------

The holders of 0.32c (0.25p) ordinary shares are entitled to

receive dividends from time to time and are entitled to one vote

per share at meetings of the Company.

During the six month period to 30 June 2022, 143,478,260 share

were issued.

14. Share Premium Account

Period to Period to

30 June 2022 30 June 31 December

2021 2021

US$ US $ US $

------------------------------------ -------------- ----------- --------------

1 January 64,977,243 64,961,905 64,961,905

Premium arising on issue of equity

shares/warrants 400,735 595,153 813,207

Warrants Issued (412,184) (727,944) (717,698)

Transaction costs (81,238) (80,171) (80,171)

-------------- ----------- --------------

30 June 64,884,556 64,748,942 64,977,243

------------------------------------ -------------- ----------- --------------

15. Loans (due over 1 year)

Period Period

to 30 June to 30 June 31 December

2022 2021 2021

------------------------ ---------------- ----------------- -------------- -------------- --------------

Five-year secured

bonds (20,909,700) (20,907,802) (21,385,663)

Additional net

funding (5,871,466) (5,940,825) (6,059,126)

Other loans (1,250,150) (1,452,341) (1,323,591)

------------------------ ---------------- ----------------- -------------- -------------- --------------

Total (28,031,316) (28,300,968) (28,768,380)

------------------------ ---------------- ----------------- -------------- -------------- --------------

Amortised Repayment

Balance as finance charges of principle Exchange

at less cash adjustments 30 June

31 December interest US$ US $ 2022

2021 paid US$

US $ US $

------------------------ ---------------- ----------------- -------------- -------------- --------------

EUR 20 million five-year

secured bonds 21,895,166 1,276,611 - (1,861,485) 21,310,292

EUR5 million Lombard

Odier debt 6,187,142 314,160 - (523,425) 5,977,876

Other loans 1,323,591 69,495 - (142,936) 1,250,150

Loan fees (509,503) 63,642 - 45,269 (400,594)

Incremental loan

fees (128,016) 23,103 - (1,497) (106,410)

------------------------ ---------------- ----------------- -------------- -------------- --------------

Total 28,768,380 1,747,011 - (2,484,075) 28,031,316

------------------------ ---------------- ----------------- -------------- -------------- --------------

16. Subsequent Events

Operational Update

In July 2022, the Santa Cruz Sur joint venture partners agreed

to a detailed plan to materially increase production at Santa Cruz

Sur by approximately 40% from the levels previously achieved over

H1 2022, as well as to improve the quality of sales liquids from

the Santa Cruz Sur assets (the "Enhancement Plan"). If achieved,

the Enhancement Plan would increase total daily production from

Santa Cruz Sur to around 2,000 boepd, net to Echo's 70% interest in

Santa Cruz Sur.

This Enhancement Plan is the agreed next step for production

growth from Santa Cruz Sur and is focused on low-risk

infrastructure upgrades to sustain the increased production from

existing well stock.

Echo successfully installed all three additional power

generation units on schedule in the respective fields over August

2022, a key pillar of the Enhancement Plan, with the unit installed

in the larger Cerro Molino Oeste field commissioned and available

to support existing and future production levels. The Group is

planning on delivering upgrades to the workover rig owned by the

Santa Cruz joint venture, including an overhaul of the hydraulic

system and the blowout preventer stack.

Conditional Debt Restructuring and Fundraising

On 12 August 2022, the Company announced the conditional

conversion of an aggregate of EUR15.0 million of existing debt

principal, together with accrued interest thereon, into new

Ordinary Shares - the significant majority of which is proposed to

be converted into new Ordinary Shares at a price of 0.45p. In doing

so, the Company also confirmed that it would be proposing a

conditional reduction of the coupon on the remaining EUR10.0

million of Euro Note debt (the "Notes") from 8% to 2% with

suspension of further cash interest payments for two years and an

extension on maturity on the remaining Notes to 2032.

The Company subsequently announced publication of its proposals

to restructure the Notes on 5 September 2022. The debt

restructuring remains conditional on both the approval of the

holders of the Note and on the approval of the Company's

shareholders. The changes are aimed at comprehensively

restructuring and strengthening the Company's balance sheet and

accelerating growth.

On 14 August 2022, the Company was also pleased to confirm that

it had successfully raised GBP600,000 (before expenses) pursuant to

a placing of new ordinary shares. The net proceeds of this placing

provided the Group with additional resources to fund working

capital, including expenses related to the proposed debt

restructuring, and enable operating cashflows in Argentina to be

focused on activities in country in the near term, including the

plan to increase production by c. 40% over approximately the next

six months.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UKSBRUSUKUAR

(END) Dow Jones Newswires

September 30, 2022 02:00 ET (06:00 GMT)

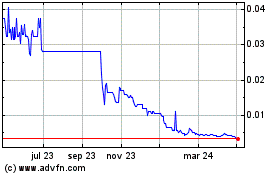

Echo Energy (LSE:ECHO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

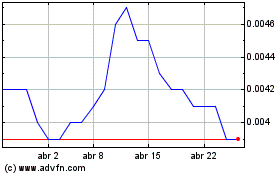

Echo Energy (LSE:ECHO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024