Echo Energy PLC Commercial and Financial Update (6604O)

02 Febrero 2023 - 1:00AM

UK Regulatory

TIDMECHO

RNS Number : 6604O

Echo Energy PLC

02 February 2023

2 February 2023

Echo Energy plc

("Echo" or the "Company")

Commercial and Financial Update

Echo Energy, the Latin American focused energy company, is

pleased to provide the following commercial update regarding the

Company's gas sales from the producing Santa Cruz Sur assets,

onshore Argentina, and a financial update.

New Gas Sales Contracts

The Company confirms that, following a successful commercial

process for industrial clients, it has secured two new gas sales

contracts (the "Contracts") for the upcoming 2023-2024 period with

materially improved terms compared with the contracts announced on

3 May 2022.

The Contracts have an initial term of 12 months, with gas sales

under the Contracts beginning in May 2023. The Contracts provide

gross 6.8 MMscf/d of committed production (4.8 MMscf/d net to Echo)

at an increased average price of US$4.48 per Mmbtu for the

2023-2024 period (compared with US$4.33 per Mmbtu for the previous

period). In addition, an upfront gross cash payment of US$1 million

(US$0.7 million, net to Echo) will immediately be paid and applied

towards the working capital of the Santa Cruz joint venture.

The Company is able to elect to sell additional volumes of up to

0.7 MMscf/d (net to Echo) under the Contracts. This optionality, at

the election of the Santa Cruz Sur partners, allows for the

potential sale of additional volumes under the Contract at contract

pricing, whilst also providing the Santa Cruz partners with a

degree of flexibility with which to capitalise on spot market or

other pricing when attractive. The Contracts additionally enable

the potential for the parties to mutually extend arrangements for a

further two years, subject to future negotiation and market

pricing.

The improved pricing terms and the upfront cash payment (without

financing costs), combined with volume flexibility, represent a

significant step for the Company in its strategy to maximise the

commercial value of its production as it continues with the ongoing

programme of increasing production.

Reduction in Joint Venture Creditor Balances

The Company reported total creditors of approximately US$19.5

million in its unaudited Interim Results announced on 30 September

2022. Of this total, approximately US$11.5 million related to the

Company's joint venture in Argentina (net to Echo), which has since

been estimated to have reduced to approximately US$9.3 million

(unaudited) as at 31 December 2022 using the official ARS$ to US$

exchange rate of 177. This estimated creditor amount when

calculated using the current ARS$ to US$ international market

exchange rate (blue chip swap) of 368, is US$4.5 million

(unaudited). This reduction is due to a combination of creditor

negotiations, positive business developments, favourable exchange

rate movements and the repayment of creditors from production cash

flows.

The Company continues to focus on successfully reducing its

creditor balances in a controlled manner, whilst also pursuing the

strategic objective of investing in order to further increase

production and asset value at Santa Cruz Sur.

The Company's unaudited cash balance as at 2 January 2023 was

US$1.1 million.

Martin Hull, Chief Executive of Echo, commented: "We are very

pleased to see our financial and commercial positions continuing to

improve and provide firmer foundations for our growth strategy, as

we look to increase production and revenues across our asset base.

These enhanced gas sales contracts will contribute to that process

while the decrease in our joint venture creditors contributes to a

stronger financial footing for Echo as we grow the business."

For further information, please contact:

Echo Energy via Vigo Consulting

Martin Hull, Chief Executive Officer

Vigo Consulting (IR & PR Advisor)

Patrick d'Ancona

Finlay Thomson +44 (0) 20 7390 0230

Cenkos Securities (Nominated Adviser)

Ben Jeynes

Katy Birkin +44 (0) 20 7397 8900

Zeus Capital Limited (Corporate Broker)

Simon Johnson (Corporate Broking)

John Llewellyn-Lloyd (Corporate Finance) +44 (0) 20 3829 5000

Note

The assignment of Echo's 70% non-operated participation in the

Santa Cruz Sur licences is subject to the authorisation of the

Executive Branch of Santa Cruz's Province, which is part of the

overall process of title transfer that is proceeding as

anticipated.

MMscf/d means million standard cubic feet of gas per day and

Mmbtu means million British thermal units.

Certain of the information contained within this announcement is

deemed by the Company to constitute inside information as

stipulated under the Market Abuse Regulation (EU 596/2014) pursuant

to the Market Abuse (Amendment) (EU Exit) Regulations 2018. Upon

the publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDBGDDRBGDGXB

(END) Dow Jones Newswires

February 02, 2023 02:00 ET (07:00 GMT)

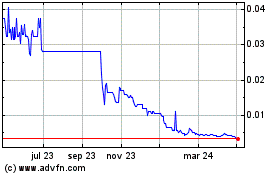

Echo Energy (LSE:ECHO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

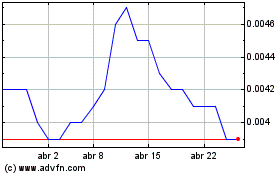

Echo Energy (LSE:ECHO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024