TIDMECK

RNS Number : 6801L

Eckoh PLC

17 May 2022

17 May 2022

Eckoh plc

("Eckoh", the "Group", or the "Company")

Full year trading update

- Revenue in line with market expectations, profit ahead

- Strong ARR growth in US Secure Payments; resilient performance

in the UK

- Expectation of material growth in FY23

Eckoh plc (AIM:ECK), the global provider of customer engagement

security solutions, is pleased to announce a trading update for the

year ended 31 March 2022.

The Board confirms that revenue for the year was in line with

consensus market expectations*. Operating profit grew strongly,

some 5% ahead of consensus market expectations. This is an

excellent outcome given the ongoing challenges presented by the

pandemic and the now planned completed exit from US and UK Support,

which had contributed GBP2m to the previous year's profit

figure.

Our strong performance reflects ongoing progress in our US

Secure Payments operation, which now accounts for nearly 90% of

total US revenues. There was more than 20% organic growth in US

ARR. Including Syntec, US ARR ended the period at $12.7m, nearly

60% higher than last year.

The UK business returned to growth, and transactional volumes

have largely returned to pre-pandemic levels with just a few

exceptions. Since period end our largest contract renewal scheduled

for this financial year, a contract through Capita for a large

public service organisation, was successfully renewed for GBP2.1m

over the term.

Our recently announced implementation of a new Microsoft Azure

cloud platform with a Fortune 100 US retailer is now live, making

Eckoh the only provider in our industry to offer alternative cloud

providers. This supports our stated strategy to continue investing

in broadening our cloud proposition geographically, and with

multiple suppliers and product offerings.

Syntec's contribution to revenue and profits in the final

quarter of the year was consistent with our expectations at the

time of the transaction, and the integration of the businesses is

proceeding on plan. Unification of the technology and product

offering is making excellent progress and we expect to deliver a

unified and enhanced go-to-market proposition in the second

half.

Outlook and financial position

The balance sheet remains strong with net cash of GBP2.8m (FY21:

GBP11.7m), well ahead of expectations. The change reflects the

acquisition of Syntec in December 2021, which was part funded by

cash.

The Board expects revenue and profit for FY23 to be

significantly higher than FY22. FY23 guidance for material growth

reflects the successful integration of Syntec to derive synergistic

benefits, an anticipated return to normal UK trading activity,

ongoing momentum in US Secure Payments supported by long-term

structural growth drivers, Cloud adoption, coupled with the

benefits of new products and operational gearing. These

expectations are subject to ongoing uncertainty in the

macro-economic climate.

This announcement contains inside information for the purposes

of Article 7 of Regulation 596/2014.

* Eckoh believes that consensus market expectations for the year

ending 31 March 2022 is revenue of GBP32.15 million, Adjusted

Operating profit of GBP4.90 million and Net cash of GBP1.1m.

- Ends -

For further information please contact:

Eckoh plc Tel: 01442 458 300

Nik Philpot, Chief Executive Officer

Chrissie Herbert, Chief Financial Officer

www.eckoh.com

FTI Consulting LLP Tel: 020 3727 1017

Ed Bridges / Jamie Ricketts / Tom Blundell

eckoh@fticonsulting.com

Singer Capital Markets (Nomad & Joint Tel: 020 7496 3000

Broker)

Shaun Dobson / Tom Salvesen / Alex Bond

/ Kailey Aliyar

www.singercm.com

Canaccord Genuity Limited (Joint Broker) Tel: 020 7523 8000

Simon Bridges / Andrew Potts

www.canaccordgenuity.com

About Eckoh plc

Eckoh is a global provider of customer engagement security

solutions , supporting an international client base from its

offices in the UK and US.

Our secure payments products help our clients take payments

securely from their customers through multiple channels. The

products, which include the patented CallGuard, can be hosted in

the Cloud or deployed on the client's site and remove sensitive

personal and payment data from contact centres and IT environments.

They offer merchants a simple and effective way to reduce the risk

of fraud, secure sensitive data and become compliant with the

Payment Card Industry Data Security Standards ("PCI DSS") and wider

data security regulations. Eckoh has been a PCI DSS Level One

Accredited Service Provider since 2010, securing over GBP5bn in

payments annually.

Eckoh's customer engagement solutions enable enquiries and

transactions to be performed on whatever device the customer

chooses, allowing organisations to increase efficiency, lower

operational costs and provide a true Omnichannel experience. We

also assist organisations in transforming the way that they engage

with their customers by providing support and transition services

as they implement our innovative customer contact solutions.

Our large portfolio of clients come from a broad range of

vertical markets and includes government departments, telecoms

providers, retailers, utility providers and financial services

organisations.

For more information go to www.eckoh.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSFUFMMEESEEI

(END) Dow Jones Newswires

May 17, 2022 10:03 ET (14:03 GMT)

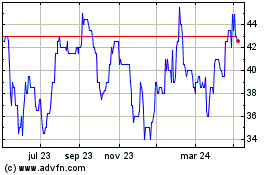

Eckoh (LSE:ECK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

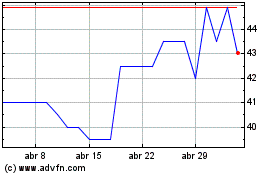

Eckoh (LSE:ECK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024