TIDMECK

RNS Number : 8060E

Eckoh PLC

01 November 2022

1 November 2022

Eckoh plc

("Eckoh", the "Group", or the "Company")

Half year trading update

- Trading in line with market expectations

- Strong double-digit revenue, profit, and order growth

- New security solutions proposition will broaden target market

and increase client value

Eckoh plc (AIM:ECK), the global provider of Customer Engagement

Security Solutions , announces a trading update for the six months

ended 3 0 September 2022. All commentary relates to this period,

unless otherwise stated.

Trading update

The Group performed strongly in the first half of the year, in

line with the Board's expectations. A highlight was the growth in

revenue, which improved by 33% to GBP19.6m. The progress in revenue

growth was also reflected in significantly higher levels of

operating profit, which grew by more than 50%, including some

benefit from positive currency movement.

Following the acquisition of Syntec and the expected increase in

activity coming from a global market, we will now be reporting on

UK, US and Rest of World revenues. All these markets grew, but

particularly good progress was made in the US market, which

increased from $7.9m to $10.6m, up 34%, and accounted for a 44%

share of total revenue, up from 39%.

As reported in the order update on 6 October, following a

challenging period last year, total order levels recovered

strongly, increasing by more than 50% to GBP17.6m. This supports

the expectations of future growth and underpins the increasing

levels of ARR (1) which had grown by 52% to GBP27.8m at the end of

the period.

Overall, the first half performance reflects the continued

progress of Eckoh's strategy to pursue major opportunities for

large blue-chip organisations, cross-sell from a broader product

suite and continue the trend towards cloud adoption and more

international mandates. Eckoh is increasingly focusing on

attractive sectors which are suited to its model, technology, and

product suite.

Product and market update

As showcased at last month's Capital Markets Day, Eckoh is

developing a suite of new security solutions that will help

organisations deal with the challenges that are arising from a

rapidly changing customer engagement environment. Research shows

that the industry shift to remote working over the pandemic is

becoming a permanent feature, with 77% of US contact centres still

having more than half their agents working remotely (2) . This

creates a security challenge for organisations that Eckoh can help

solve, and alongside the core voice security products CallGuard and

CardEasy, the new product offering already includes Secure Chat and

Digital Payments.

With further complementary products set to launch in the coming

months the ability for Eckoh to attract new clients, grow client

value and aid retention will be further enhanced, and there have

been early successes in cross selling multiple products into target

accounts.

Outlook and financial position

There was strong cash generation during the period and Eckoh's

balance sheet remains robust with net cash of GBP4.4m at half year

end up from GBP2.8m at year end.

Despite the ongoing macro-economic uncertainty, the Board expect

revenue and profit for FY23 to be significantly higher than FY22.

The Group is trading in line with consensus market expectations (3)

, supported by long-term structural growth drivers, increasing

Cloud adoption and Eckoh's strengthening product offering.

Notice of interim results date

The Group will report its results for the six months ended 30

September 2022 on 23 November 2022.

This announcement contains inside information for the purposes

of Article 7 of Regulation 596/2014.

1. ARR is the annual recurring revenue of all contracts billing

at the end of the period. Included within Group ARR is all revenue

that is contractually committed and an element of UK revenue that

has proven to be repeatable, but not contractually committed.

2. Contact Babel: US Contact Centers 2022-2026 - The State of

the Industry & Technology. Published February 2022.

3. Eckoh believes that consensus market expectations for the

year ending 31 March 2023 is revenue of GBP40.25 million and

adjusted operating profit of GBP7.45 million.

- Ends -

For further information please contact:

Eckoh plc Tel: 01442 458 300

Nik Philpot, Chief Executive Officer

Chrissie Herbert, Chief Financial Officer

www.eckoh.com

FTI Consulting LLP Tel: 020 3727 1017

Ed Bridges / Jamie Ricketts / Tom Blundell

eckoh@fticonsulting.com

Singer Capital Markets (Nomad & Joint Tel: 020 7496 3000

Broker)

Shaun Dobson / Tom Salvesen / Alex Bond

/ Kailey Aliyar

www.singercm.com

Canaccord Genuity Limited (Joint Broker) Tel: 020 7523 8000

Simon Bridges / Emma Gabriel

www.canaccordgenuity.com

About Eckoh plc

Eckoh is a global provider of Customer Engagement Security

Solutions, supporting an international client base from its offices

in the UK and US.

Our Customer Engagement Security Solutions enable enquiries and

transactions to be performed on whatever device the customer

chooses, allowing organisations to increase efficiency, lower

operational costs and provide a true omnichannel experience.

We help our clients to take payments and transact securely with

their customers through all customer engagement channels. The

solutions, which are protected by multiple patents, remove

sensitive personal and payment data from contact centres and IT

environments and are delivered globally through our multiple cloud

platforms or can be deployed on the client's site. They offer

merchants a simple and effective way to reduce the risk of fraud,

secure sensitive data and become compliant with the Payment Card

Industry Data Security Standards ("PCI DSS") and wider data

security regulations. Eckoh has been a PCI DSS Level One Accredited

Service Provider since 2010, securing over GBP5 billion in payments

annually.

Our large portfolio of clients come from a broad range of

vertical markets and includes government departments, telecoms

providers, retailers, utility providers and financial services

organisations.

For more information go to www.eckoh.com or email

MediaResponseUK@eckoh.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFDEFWFEESEDS

(END) Dow Jones Newswires

November 01, 2022 03:00 ET (07:00 GMT)

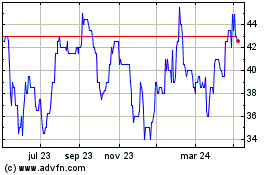

Eckoh (LSE:ECK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

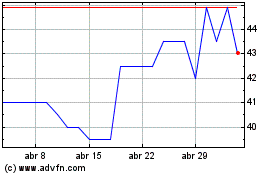

Eckoh (LSE:ECK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024