TIDMECO

RNS Number : 1511G

Eco (Atlantic) Oil and Gas Ltd.

28 March 2022

28 March 2022

ECO (ATLANTIC) OIL & GAS LTD.

("Eco," "Eco Atlantic," "Company," or together with its

subsidiaries, the "Group")

TSXV Approval for the Closing of the Azinam Acquisition

Further to the Company's announcement of 11 March 2022, Eco

(Atlantic) Oil & Gas Ltd. (AIM: ECO, TSX -- V: EOG), the oil

and gas exploration company focused on the offshore Atlantic

Margins, is pleased to confirm that it and Azinam Holdings Limited

("Azinam Holdings") have now received final approval from the TSX

Venture Exchange (the "Exchange") (the "Approval") for Eco's

acquisition (through a wholly-owned subsidiary) of Azinam Group

Limited ("Azinam") (the "Acquisition"), and accordingly Eco is now

the sole owner of Azinam and will now issue 22,296,300 new Common

Shares in Eco ("Common Shares") to Azinam Holdings representing

9.9% of the Enlarged Share Capital detailed below (the "First

Tranche"), with the issuance of the remaining 17,874,174 Common

Shares (the "Second Tranche"), subject only to Exchange clearance

of the Personal Information Forms ("PIFs") of Azinam Holdings'

Directors, which is expected to be received this week. A further

announcement confirming the issue of the Second Tranche will be

released once the Exchange confirmation has been received.

As disclosed in the Company's announcement of February 8, 2022,

the Acquisition will result in the issuance to Azinam Holdings of,

in aggregate, 40,170,474 Common Shares (the "New Issue"), providing

Azinam Holdings with 16.5% of Eco's share capital as enlarged by

such issue ("Enlarged Share Capital"), providing for a cashless

acquisition to become the sole owner of Azinam's entire African

portfolio. In addition, the Company expects to receive customary

formal acknowledgment from the government of South Africa in

respect of this change of control shortly.

At no time will Azinam Holdings be entitled to subscribe for and

purchase such amount of Common Shares which, when aggregated with

its already existing ownership of Common Shares, would result in

Azinam Holdings being the registered or beneficial holder of more

than 19.9% of the then issued and outstanding Common Shares,

without the prior written consent of the Exchange and Eco and in

accordance with the policies of the Exchange. Eco has agreed that,

for as long as Azinam Holdings holds at least a 12.5% interest in

Eco's share capital, Azinam Holdings shall be entitled to nominate

one director for election to Eco's board of directors.

Admission of the Consideration Shares

Application has been made for admission of the First Tranche ,

which will rank pari passu with existing Common Shares, to trading

on AIM ("Admission"). It is expected that Admission will become

effective and tradin g will commence at 8.00 a.m. on 31 March

2022.

Following Admission of the First Tranche, the enlarged issued

share capital of the Company will be 224,989,935 Common Shares. The

above figure may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

share capital of the Company.

Gil Holzman Co-Founder and CEO of Eco Atlantic commented:

"We are happy to now officially own Azinam Group Ltd. and its

subsidiaries. We now look forward to operating a number of highly

prospective licences in three exploration hotspots: Guyana, Namibia

and South Africa. We continue to make strong progress towards the

upcoming drilling of the Gazania-1 well on Block 2B, offshore South

Africa, and following the signing of the rig contract earlier in

the month we anticipate drilling to commence in late Q3 2022. We

look forward to receiving the final formal acknowledgement from the

South African government for the change of control entities and to

making further updates on our strategic acreage in due course."

**ENDS**

For more information, please visit www.ecooilandgas.com or

contact the following :

Eco Atlantic Oil and Gas c/o Celicourt +44 (0) 20

8434 2754

Gil Holzman, CEO

Colin Kinley, COO

Alice Carroll, Head of Marketing and +44(0)781 729 5070 | +1 (416)

IR 318 8272

Strand Hanson Limited (Financial & Nominated

Adviser) +44 (0) 20 7409 3494

James Harris

James Bellman

Berenberg (Broker) +44 (0) 20 3207 7800

Emily Morris

Detlir Elezi

Celicourt (PR) +44 (0) 20 8434 2754

Mark Antelme

Jimmy Lea

Hannam & Partners (Research Advisor)

Neil Passmore +44 (0) 20 7905 8500

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018 (as amended).

Notes to editors:

About Eco Atlantic:

Eco Atlantic is a TSX-V and AIM quoted Atlantic margin focused

Oil & Gas Exploration Company with offshore license interests

in Guyana, Namibia, and South Africa. Eco aims to deliver material

value for its stakeholders through its role in the energy

transition to explore for low carbon consuming oil and gas in

stable emerging markets near to infrastructure.

Offshore Guyana in the proven Suriname-Guyana Basin, the Company

holds a 15% Working Interest in the 1,800 km(2) Orinduik Block

Operated by Tullow Oil, and also indirectly through a soon to be

7.3% shareholding in JHI Associates Inc. a private company which

holds a 17.5% working interest in the 4,800km(2) Canje Block

Operated by ExxonMobil. In Namibia, the Company holds Operatorship

and 85% Working Interests in four offshore Petroleum Licences:

PEL's: 97, 98, 99 and 100 totalling 28,593 km(2) in the Walvis

Basin.

Offshore South Africa, Eco will, subject to completion of its

acquisition of Azinam Group Limited, become designated Operator and

hold a 50% working interest in Block 2B, and a 20% Working Interest

of Blocks 3B/4B, totalling some 20,643 km (2) .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FURQDLFLLXLXBBX

(END) Dow Jones Newswires

March 28, 2022 02:00 ET (06:00 GMT)

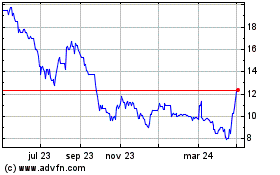

Eco (atlantic) Oil & Gas (LSE:ECO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

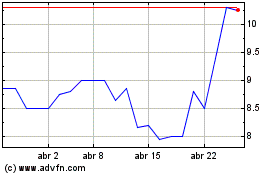

Eco (atlantic) Oil & Gas (LSE:ECO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024