TIDMECO

RNS Number : 3829H

Eco (Atlantic) Oil and Gas Ltd.

05 April 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014.

THIS ANNOUNCEMENT IS FOR INFORMATIONAL PURPOSES ONLY, AND DOES

NOT CONSTITUTE OR FORM PART OF ANY OFFER OR INVITATION TO SELL OR

ISSUE, OR ANY SOLICITATION OF AN OFFER TO PURCHASE OR SUBSCRIBE

FOR, ANY SECURITIES OF ECO ( ATLANTIC ) OIL & GAS LTD.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION , IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM , OR TO ANY PERSON

LOCATED OR RESIDENT IN, the United States, Australia, Canada, the

Republic of South Africa, Japan OR ANY OTHER JURISDICTION WHERE IT

IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS

ANNOUNCEMENT.

THIS ANNOUNCEMENT AMOUNTS TO A FINANCIAL PROMOTION FOR THE

PURPOSES OF SECTION 21 OF THE FINANCIAL SERVICES AND MARKETS ACT

2000 ("FSMA") AND HAS BEEN APPROVED BY PRIMARYBID LIMITED WHICH IS

AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY (FRN

779021)

5 April 2022

ECO (ATLANTIC) OIL & GAS LTD.

(" Eco Atlantic ", "Eco", the " Company" , or, together with its

subsidiaries, the "Group")

PrimaryBid Retail Offer

Eco ( Atlantic ) Oil & Gas Ltd. (AIM : ECO , TSX-V:EOG) ,

the TSX-V and AIM quoted Atlantic Margin focused oil & gas

exploration company with offshore license interests in Guyana,

Namibia, and South Africa is pleased to announce a conditional

offer for subscription via PrimaryBid (the "Retail Offer") of new

Common shares of nil-par value each in the Company ("Retail Offer

Shares") at an issue price of 30 pence per Retail Offer Shares (the

"Issue Price ").

As announced earlier today, the Company is also conducting a

placing of new Common Shares at the Issue Price by way of an

accelerated bookbuild process (the "Placing") to raise up to

approximately US$21m. In addition, the Company has announced that

Africa Oil Corp intends to subscribe for up to US$4m of new Common

Shares at the Issue Price by way of a subscription (the

"Subscription", together with the Placing and Retail Offer, the

"Equity Fundraise ").

The Equity Fundraise is conditional on the new Common Shares to

be issued pursuant to the Equity Fundraise being admitted to

trading on AIM (" Admission "). Admission is expected to be take

place at 8.00 a.m. on 11 April 2022 . The Retail Offer will not be

completed without the Placing and Subscription also being

completed.

The Company will use the net proceeds of the Equity Fundraise

primarily to fund Eco's share of the drilling of the Gazania-1 well

on Block 2B offshore South Africa, estimated to be approximately

US$23 million, to cover Geological and Geophysical expenses across

the Group's portfolio and license fees in Namibia and on Block

3B/4B in South Africa as well as for general working capital

purposes.

Retail Offer

The Company values its retail investor base and is therefore

pleased to provide private and other investors the opportunity to

participate in the Retail Offer by applying exclusively through the

PrimaryBid mobile app available on the Apple App Store and Google

Play. PrimaryBid does not charge investors any commission for this

service.

The Retail Offer, via the PrimaryBid mobile app, will be open to

individual and institutional investors following the release of

this announcement. The Retail Offer will close on the completion of

the Bookbuild process. The Retail Offer may close early if it is

oversubscribed.

The Company reserves the right to scale back any order at its

discretion. The Company and PrimaryBid reserve the right to reject

any application for subscription under the Retail Offer without

giving any reason for such rejection.

No commission is charged to investors on applications to

participate in the Retail Offer made through PrimaryBid. It is

vital to note that once an application for new Common Shares has

been made and accepted via PrimaryBid, an application cannot be

withdrawn.

For further information on PrimaryBid or the procedure for

applications under the Retail Offer, visit www.PrimaryBid.com or

email PrimaryBid at enquiries@primarybid.com.

The new Common Shares will be issued free of all liens, charges

and encumbrances and will, when issued and fully paid, rank pari

passu in all respects with the Company's existing Ordinary

Shares.

Unless otherwise defined herein, capitalised terms used in this

announcement shall have the same meanings as defined in the

announcement of the Equity Fundraise made by the Company on 5 April

2022.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

General Information

Application will be made to the London Stock Exchange for

admission of the Equity Fundraise Shares to trading on AIM.

Application will be made to the TSX-V for the Equity Fundraise

Shares to be admitted to trading on the TSX-V, with listing subject

to the approval of the TSX-V and the Company satisfying all of the

requirements of the TSX-V. It is expected that AIM Admission will

take place on or before 8.00 a.m. (London time) on 11 April 2022

and that dealings in the Equity Fundraise Shares on AIM will

commence at the same time.

The Retail Offer Shares will be subject to statutory resale

(hold) restrictions to trading on TSX for a period of four months

and one day under the applicable Canadian securities laws and any

resale of the Retail Offer Shares must be made in accordance with

such resale restrictions or in reliance on an available exemption

therefrom. The Retail Offer Shares are not subject to statutory

resale (hold) restrictions in relation to their trading on AIM.

Each retail investor subscribing to the Retail Offer is solely

responsible (and the Company is not in any way responsible) for

compliance with applicable securities laws in the resale of any

Retail Offer Shares.

For more information, please visit www.ecooilandgas.com or

contact the following :

Eco Atlantic Oil and Gas c/o Celicourt +44 (0) 20

Gil Holzman, CEO 8434 2754

Colin Kinley, COO

Alice Carroll, Head of Marketing and

IR +44(0)781 729 5070 | +1

(416) 318 8272

PrimaryBid Limited enquiries@primarybid.com

Charles Spencer

James Deal

S trand Hanson Limited, Nominated and

Financial Adviser

James Harris

James Bellman +44 (0) 20 7409 3494

Celicourt (PR)

Mark Antelme

Jimmy Lea +44 (0) 20 8434 2754

Details of the Retail Offer

The Company highly values its retail investor base which has

supported the Company alongside institutional investors over

several years. Given the longstanding support of retail

shareholders, the Company believes that it is appropriate to

provide retail and other interested investors the opportunity to

participate in the Retail Offer. The Company is therefore making

the Retail Offer available exclusively through the PrimaryBid

mobile app.

The Retail Offer is offered under the exemptions against the

need for a prospectus allowed under the Prospectus Rules. As such,

there is no need for publication of a prospectus pursuant to the

Prospectus Rules, or for approval of the same by the Financial

Conduct Authority in its capacity as the UK Listing Authority. The

Retail Offer is not being made into the United States, Australia,

Canada, the Republic of South Africa, Japan or any other

jurisdiction where it would be unlawful to do so.

There is a minimum subscription of GBP250 per investor under the

terms of the Offer which is open to existing shareholders and other

investors subscribing via the PrimaryBid mobile app.

For further details please refer to the PrimaryBid website at

www.PrimaryBid.com . The terms and conditions on which the Retail

Offer is made, including the procedure for application and payment

for new Common Shares, is available to all persons who register

with PrimaryBid.

Investors should make their own investigations into the merits

of an investment in the Company. Nothing in this announcement

amounts to a recommendation to invest in the Company or amounts to

investment, taxation or legal advice.

It should be noted that a subscription for new Common Shares and

investment in the Company carries a number of risks. Investors

should consider the risk factors set out on www.PrimaryBid.com

before making a decision to subscribe for new Common Shares.

Investors should take independent advice from a person experienced

in advising on investment in securities such as the new Common

Shares if they are in any doubt.

IMPORTANT NOTICES

THIS ANNOUNCEMENT (THIS "ANNOUNCEMENT") IS FOR INFORMATION

PURPOSES ONLY AND DOES NOT CONSTITUTE OR FORM ANY PART OF AN OFFER

TO SELL OR ISSUE, OR A SOLICITATION OF AN OFFER TO BUY, SUBSCRIBE

FOR OR OTHERWISE ACQUIRE ANY SECURITIES IN THE UNITED STATES

(INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED

STATES AND THE DISTRICT OF COLUMBIA (COLLECTIVELY, THE "UNITED

STATES")), AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA, JAPAN

OR ANY OTHER JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION WOULD

BE UNLAWFUL OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE SUCH

OFFER OR SOLICITATION. NO PUBLIC OFFERING OF COMMON SHARES IS BEING

MADE IN ANY SUCH JURISDICTION. ANY FAILURE TO COMPLY WITH THESE

RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE SECURITIES LAWS OF

SUCH JURISDICTIONS.

This Announcement is not for public release, publication or

distribution, in whole or in part, directly or indirectly, in or

into the United States, Australia, Canada, the Republic of South

Africa, Japan or any other jurisdiction in which such release,

publication or distribution would be unlawful.

The securities referred to herein have not been and will not be

registered under the US Securities Act of 1933, as amended (the "US

Securities Act"), or under the securities laws of, or with any

securities regulatory authority of, any state or other jurisdiction

of the United States, and may not be offered or sold in the United

States (including its territories and possessions, any state of the

United States and the District of Columbia), except pursuant to an

applicable exemption from the registration requirements of the US

Securities Act and in compliance with any applicable securities

laws of any state or other jurisdiction of the United States. No

public offering of Common Shares is being made in the United

States.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEUVUNRURUSRAR

(END) Dow Jones Newswires

April 05, 2022 12:24 ET (16:24 GMT)

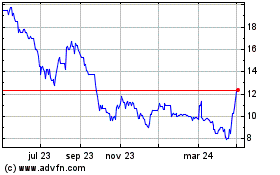

Eco (atlantic) Oil & Gas (LSE:ECO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

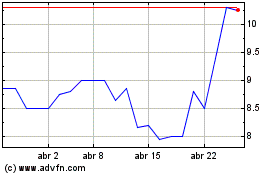

Eco (atlantic) Oil & Gas (LSE:ECO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024