TIDMECO

RNS Number : 8494H

Eco (Atlantic) Oil and Gas Ltd.

29 November 2022

29 November 2022

ECO (ATLANTIC) OIL & GAS LTD.

("Eco," "Eco Atlantic," "Company," or together with its

subsidiaries, the "Group")

Unaudited Results for the six months ended 30 September 2022

Corporate and Operational Update

Eco (Atlantic) Oil & Gas Ltd. (AIM: ECO, TSX -- V: EOG) ,

the oil and gas exploration company focused on the offshore

Atlantic Margins, is pleased to announce its results for the six

months ended 30 September 2022 and to provide a corporate and

operational update.

Highlights:

Financials (as at 30 September 2022)

-- The Company had cash and cash equivalents of US$24.6 million

and no debt (after paying US$11.3 million, being Eco's cash share

of the Block 2B well) as of September 30, 2022.

-- The Company had total assets of US$67.3 million, total

liabilities of US$5.7 million and total equity of US$61.6

million.

-- As of November 27, 2022, the Company is expected to have

approximately US$ 1 7.5 million cash and cash equivalents at the

end of November 2022, following receipt of the initial proceeds

from the sale of the Kozani project in the coming days referred to

below.

Corporate:

-- On November 28, 2022, the Company closed the sale of its 100%

interest in the Kozani Photovoltaic Development Project for total

cash proceeds of EUR2.3 million (US$2.4 million). US$2 million is

to be received by the Company by close of business on November 30,

2022, and the outstanding balance is expected to be received by

year end 2022.

-- After 12 years with the Company, Eco's Non-executive

Chairman, Moshe 'Peter' Peterburg has informed the Board of his

plans to retire, as such, he will not stand for re-election at the

upcoming Annual General Meeting on December 29, 2022, and will step

down from the Company with immediate effect. The Company has

commenced the process to find a replacement and, in the interim,

Peter Nicol, currently a Non-executive Director, will assume the

role of interim Non-executive Chairman. Further announcements will

be made as appropriate.

-- With regard to the closing of the acquisition of Azinam Group

Limited ("Azinam"), and in accordance with the previously announced

Share Purchase Agreement, the Company will shortly issue the

balance of 1,625,000 Common Shares ("Azinam Shares") to the

previous shareholders of Azinam representing the full and final

number of Common Shares to be issued in respect of this

transaction. These Common Shares are subject to a restrictive hold

period of four months and one day (beginning on the date of

issuance). The issuance of Common Shares is subject to approval

from the TSX Venture Exchange and a further announcement will be

made once such approval has been received and the Common Shares

issued.

Operations:

South Africa

Block 2B (post period end)

-- In early October 2022, the Island Innovator Semi-Submersible

Drilling Rig arrived on Block 2B, offshore South Africa, and

operations on the Gazania-1 Exploration Well commenced.

-- The well was spudded on October 10, 2022, and reached target

depth of 2,360m. However, evidence of commercial hydrocarbons was

not found, and the well has been plugged and abandoned.

-- The JV Partners submitted a Production Right Application to

the Petroleum Agency of South Africa ("PASA") on November 15, 2022,

for Block 2B, based on the existing oil discovery of AJ-1 and

potential future operations. Well logging has been completed and

the JV Partners now have time to conduct further analysis and

integrate the well data to allow them to determine the next steps

on the Block.

Block 3B/4B

-- The Company and its JV partners are progressing plans to

conduct a two-well campaign on Block 3B/4B offshore South

Africa.

-- As previously announced by the Operator of Block 3B/4B, a

collaborative farm-out process (up to 55% gross WI), has been

ongoing, and is now in a farm-out agreement negotiation stage. The

JV partners will update the market as appropriate and should a

farm-out agreement be concluded.

Namibia

-- Following recent significant hydrocarbon discoveries offshore

Namibia, Eco continues to assess options for progressing

exploration and commercial activity on its acreage.

-- Eco is witnessing considerable interest in its licences in

Namibia and is currently assessing options, including a potential

farm-out.

Guyana

-- As previously announced, Eco and its JV partners on the

Orinduik Block, offshore Guyana, are currently drawing up plans to

drill at least one well into light oil Cretaceous targets in the

next Petroleum Agreement exploration phase which begins in 2023.

Further updates will be made on this matter in due course.

Gil Holzman, President and Chief Executive Officer of Eco

Atlantic, commented:

"Our main focus during the period, and through to recent weeks,

was to execute a safe and environmentally friendly drilling

campaign on the Gazania-1 exploration well, offshore South Africa.

Although it was disappointing to not announce a commercial

discovery, we can be proud of how we conducted our operations,

which led to the well being drilled safely and on-time. We are now

working with our JV partners on the licence to analyse the well

data found and plan our next steps on the Block, which we believe

contains significant untapped potential.

On Block 3B/4B, offshore South Africa, we are making steady

progress towards conducting a two well drilling campaign on the

licence. The drilling preparations and program are expected to

commence in 2023 and, as previously announced, a potential farm-out

process is also underway on the licence. We look forward to

updating the market on both of these workstreams as

appropriate.

In Guyana, we remain highly optimistic about the potential

contained within the Orinduik Block, and we are working with our JV

partners to drill another well as quickly as possible. Guyana

remains one of the most exciting exploration hotspots, alongside

Orange Basin SA and Namibia, where we also hold a highly strategic

acreage position, and we are working hard to deliver value for all

our stakeholders across our asset portfolio in the near to medium

term.

Finally, on behalf of the Board I would like to thank Moshe

Peterburg for his tireless efforts during his tenure as Eco's

Chairman for the past 12 years and since inception of the Company.

He played a pivotal role in the development and success of the

Company to date and we wish him all the best for a happy retirement

and are pleased he will remain an important shareholder of

Eco."

The Company's unaudited financial results for the three months

ended 30 September 2022, together with Management's Discussion and

Analysis as at 30 September 2022, are available to download on the

Company's website at www.ecooilandgas.com and on Sedar at

www.sedar.com .

The following are the Company's Balance Sheet, Income

Statements, Cash Flow Statement and selected notes from the annual

Financial Statements. All amounts are in US Dollars, unless

otherwise stated.

Balance Sheet

September March 31,

30,

------------------------------------------------

2022 2022

------------------------------------------------ ------------------------- -------------------------

(Unaudited) (Audited)

------------------------- -------------------------

Assets

Current Assets

Cash and cash equivalents 24,590,082 3,438,834

Short-term investments 52,618 52,618

Government receivable 32,656 27,487

Amounts owing by license partners, 13,764 -

net

Accounts receivable and prepaid expenses 2,206,208 257,911

Assets held for sale 2,052,326 2,061,734

------------------------------------------------ ------------------------- -------------------------

Total Current Assets 28,947,654 5,838,584

------------------------------------------------ ------------------------- -------------------------

Non- Current Assets

Investment in associate 9,092,557 9,277,162

Petroleum and natural gas licenses 29,253,034 30,753,034

------------------------------------------------ ------------------------- -------------------------

Total Non-Current Assets 38,345,591 40,030,196

------------------------------------------------ ------------------------- -------------------------

Total Assets 67,293,245 45,868,780

------------------------------------------------ ------------------------- -------------------------

Liabilities

Current Liabilities

Accounts payable and accrued liabilities 3,361,588 1,931,823

Advances from and amounts owing to 67,406 -

license partners, net

Current liabilities related to assets

held for sale 882,959 473,254

Warrant liability 1,395,066 3,241,762

------------------------------------------------

Total Current Liabilities 5,707,019 5,646,839

Total Liabilities 5,707,019 5,646,839

------------------------------------------------ ------------------------- -------------------------

Equity

Share capital 113,930,574 63,141,609

Shares to be issued - 20,766,996

Restricted Share Units reserve 569,919 267,669

Warrants 14,778,272 7,806,000

Stock options 2,075,897 958,056

Foreign currency translation reserve (1,862,829) (1,309,727)

Accumulated deficit (67,905,607) (51,408,662)

------------------------------------------------ ------------------------- -------------------------

Total Equity 61,586,226 40,221,941

------------------------------------------------ ------------------------- -------------------------

Total Liabilities and Equity 67,293,245 45,868,780

------------------------------------------------ ------------------------- -------------------------

Income Statement

Three months ended Six months ended

September 30, September 30,

--------------------------------------------- -------------------------------------------------

2022 2021 2022 2021

------------------------ ------------------- ------------------------ -----------------------

Unaudited Unaudited

--------------------------------------------- -------------------------------------------------

Revenue

Interest income 36,325 3,911 56,452 8,435

------------------------ ------------------- ------------------------ -----------------------

36,325 3,911 56,452 8,435

Operating expenses :

Compensation

costs 210,605 206,327 479,914 410,087

Professional

fees 240,894 142,540 460,579 181,499

Operating costs 11,097,960 34,953 13,041,411 417,818

General and

administrative

costs 350,864 200,960 608,154 309,357

Share-based

compensation 750,667 5,888 1,751,886 11,710

Foreign exchange

loss 690,794 99,153 975,221 53,222

------------------------ -----------------------

Total operating

expenses 13,341,784 689,821 17,317,165 1,383,693

------------------------ ------------------- ------------------------ -----------------------

Operating loss (13,305,459) (685,910) (17,260,713) (1,375,258)

Fair value

change in

warrant

liability 415,712 637,189 1,846,696 637,189

Share of losses

of company

accounted for

at equity (92,302) - (184,605) -

------------------------ ------------------- ------------------------ -----------------------

Net loss for the period

from continuing

operations (12,982,049) (48,721) (15,598,622) (738,069)

Loss from discontinued

operations, after-tax (800,210) (351,915) (898,323) (488,191)

Net loss for the period (13,782,259) (400,636) (16,496,945) (1,226,260)

Foreign currency

translation

adjustment (441,472) (21,484) (553,102) (8,235)

Comprehensive loss for

the period (14,223,731) (422,120) (17,050,047) (1,234,495)

------------------------ ------------------- ------------------------ -----------------------

Net loss for the period

attributed to:

Equity holders

of the

parent (12,982,049) (421,643) (16,496,945) (1,226,260)

Non-controlling - 21,007 - -

interests

------------------------ ------------------- ------------------------ -----------------------

(12,982,049) (400,636) (16,496,945) (1,226,260)

======================== =================== ======================== =======================

Basic and diluted net

loss per share

attributable

to equity holders of

the parent (0.038) (0.002) (0.052) (0.006)

======================== =================== ======================== =======================

Weighted average number

of ordinary shares

used

in computing basic and

diluted net loss per

share 343,966,022 198,403,885 319,575,745 191,550,804

======================== =================== ======================== =======================

Cash Flow Statement

Six months ended

September 30,

------------------------------------------

2022 2021

(Unaudited) (Unaudited)

-------------------- --------------------

Cash flow from operating activities

Net loss from continuing operations (15,598,622) (738,069)

Net loss from discontinued operations (898,323) (488,191)

Items not affecting cash:

Share-based compensation 1,751,886 11,710

Depreciation and amortization - 38,124

Accrued interest - 6,770

Revaluation of warrant liability (1,846,696) (637,189)

Share of losses of companies accounted 184,605 -

for at equity

Changes in non--cash working capital:

Government receivable (5,169) 8,752

Accounts payable and accrued liabilities 1,601,059 102,372

Accounts receivable and prepaid expenses (948,297) (7,730)

Reallocation to discontinued operations (171,294) -

cashflows

Net change in non-cash working capital 419,113 -

items relating to discontinued operations

Advance from and amounts owing to license

partners 1,486,236 (247,066)

-------------------------------------------------- -------------------- --------------------

(14,025,502) (1,950,517)

-------------------------------------------------- -------------------- --------------------

Cash flow from investing activities

Investment in associate - (10,000,000)

Short-term investments - 1,500,022

-------------------------------------------------- --------------------

- (8,499,978)

-------------------------------------------------- -------------------- --------------------

Cash flow from financing activities

Proceeds from private placements, net 35,662,446 -

Issuance of shares - 4,793,789

Exercise of stock options 67,406 71,388

35,729,852 4,865,177

-------------------------------------------------- -------------------- --------------------

Increase (decrease) in cash and cash equivalents 21,704,350 (5,585,318)

Foreign exchange differences (553,102) (671)

Cash and cash equivalents, beginning of

period 3,438,834 11,807,309

-------------------------------------------------- -------------------- --------------------

Cash and cash equivalents, end of period 24,590,082 6,221,320

-------------------------------------------------- -------------------- --------------------

Notes to the Financial Statements

Basis of Preparation

The Condensed Interim Consolidated financial statements of the

Company have been prepared on a historical cost basis with the

exception of certain financial instruments that are measured at

fair value. Historical cost is generally based on the fair value of

the consideration given in exchange for assets.

**ENDS**

For more information, please visit www.ecooilandgas.com or

contact the following :

Eco Atlantic Oil and Gas c/o Celicourt +44 (0)

20 8434 2754

Gil Holzman, CEO

Colin Kinley, COO

Alice Carroll, Head of Corporate Sustainability +44(0)781 729 5070

Strand Hanson (Financial & Nominated Adviser) +44 (0) 20 7409 3494

James Harris

James Bellman

Berenberg (Broker) +44 (0) 20 3207 7800

Matthew Armitt

Detlir Elezi

Echelon Capital (Financial Adviser N.

America Markets)

Ryan Mooney +1 (403) 606 4852

Simon Akit +1 (416) 8497776

Celicourt (PR) +44 (0) 20 8434 2754

Mark Antelme

Jimmy Lea

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018 (as amended).

Notes to editors:

About Eco Atlantic:

Eco Atlantic is a TSX-V and AIM-quoted Atlantic Margin-focused

oil & gas exploration company with offshore license interests

in Guyana, Namibia, and South Africa. Eco aims to deliver material

value for its stakeholders through its role in the energy

transition to explore for low carbon intensity oil and gas in

stable emerging markets close to infrastructure.

Offshore Guyana in the proven Guyana-Suriname Basin, the Company

holds a 15% Working Interest in the 1,800 km(2) Orinduik Block

Operated by Tullow Oil. In Namibia, the Company holds Operatorship

and an 85% Working Interest in four offshore Petroleum Licences:

PELs: 97, 98, 99, and 100, representing a combined area of 28,593

km(2) in the Walvis Basin.

Offshore South Africa, Eco is Operator and holds a 50% working

interest in Block 2B and a 20% Working Interest (to be increased to

a 26.25% Working Interest, subject to Completion of the Acquisition

announced 27 June 2022) in Block 3B/4B operated by Africa Oil

Corp., totalling some 20,643 km (2) .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPGPPGUPPPGR

(END) Dow Jones Newswires

November 29, 2022 02:00 ET (07:00 GMT)

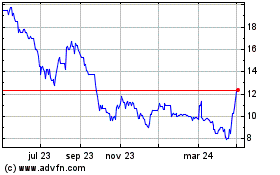

Eco (atlantic) Oil & Gas (LSE:ECO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

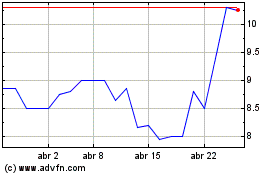

Eco (atlantic) Oil & Gas (LSE:ECO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024