TIDMEDL

RNS Number : 1577B

Edenville Energy PLC

29 September 2022

29 September 2022

EDENVILLE ENERGY PLC

("Edenville", "Company" or the "Group")

Interim Results for the six months to 30 June 2022

Edenville Energy Plc (AIM: EDL) announces its unaudited interim

results for the six months ended 30 June 2022.

CEO's report

Operational overview

The six month period to 30 June 2022 was one of transition for

the Company and prior to the significant management and operational

changes that took place post period end, as further detailed

below.

On 3 February 2022 the Company's subsidiary Edenville

International (Tanzania) Limited ("EITL") entered into a contract

with Nextgen Coalmine Limited ("Nextgen") for the operation of the

Company's Rukwa Coal Project ("Rukwa" or the "Project") in

Tanzania. The agreement with Nextgen was subsequently terminated on

31 May 2022 following a lack of progress by Nextgen, allowing the

Company to resume full control of the Project site and seek

alternative arrangements for the operation of Rukwa in light of the

macro changes that made the economics of the Project significantly

more attractive.

Following a period of consultation with several key

shareholders, a number of significant changes took place post

period end. CEO Alistair Muir, Non-executive Chairman Jeff

Malaihollo and Non-executive director Franco Caselli all resigned

from the board and were replaced by Noel Lyons as CEO, Paul Ryan as

Executive Director and Andre Hope as a Non-executive Director. Nick

von Schirnding assumed the role of Non-Executive Chairman. In

addition, there were several personnel changes within the Tanzania

based team, leading to a more coordinated and dedicated team fully

focused on stabilising output and striving to grow the monthly

output.

Following their appointment, the newly appointed executive team

signed an initial 12-month agreement (the "Agreement") with Brahma

Energies Limited ("Brahma") on 16 August 2022, commencing

immediately, to secure production and sales of a minimum of 4,000

tonnes of washed coal per month at the Company's Rukwa Project,

with the potential to increase to a minimum 6,000 tonnes

thereafter. Brahma are a local mine operator and commercial and

logistics specialist having up to 70 transport vehicles on the

roads of Tanzania. Their team is experienced in all aspects of

operations, mine management and coal commercial sales. One of the

significant attractions of Brahma to Edenville was an offtake which

will enable Edenville to sell any of its washed coal produced to

parties introduced by Brahma, as required.

Since the signing of the Agreement, Brahma have assumed full

day-to-day operational management and control of the Rukwa mine,

including covering all operational costs, with ultimate oversight

continuing to be provided by Edenville. Given local demand, sales

are currently expected to take place to customers in Tanzania and

adjoining neighboring countries.

The revenue share arrangements under the Agreement give

Edenville US$10 per tonne of washed coal sold at a minimum price of

US$35 per tonne, plus 60% of any sales revenue above US$35 per

tonne of washed coal. The global thermal coal price has reached new

highs since entering into the Agreement and the Company is

witnessing a knock-on positive effect on the domestic thermal coal

price in Tanzania. The previously reported 'at gate' sales price

range of US$35-50 per tonne for washed coal from Rukwa therefore

appears robust. Once consistent production is established and Rukwa

becomes a reliable source of coal for its clients, the Company

anticipates its position in offtake negotiations is likely to be

strengthened further.

Following extensive servicing and repairs on the main machinery

and wash plant at the Rukwa site, and the purchase of two

additional trucks, final works are expected to be completed

shortly, with production recommencing sufficient to achieve up to

4000 tonnes by the end of October 2022. The targeted production and

sales increase to 6,000 tonnes per month of washed coal is expected

to take place after the rainy season ends in March/April 2023.

Edenville will continue to manage the Rukwa project and fund its

corporate operational costs from its existing cash resources.

Edenville, at its sole discretion, can also deploy additional

capital to expedite production ramp up; any such capital deployed

is to be repaid to Edenville before any profit share is paid.

Edenville and Brahma continue to work closely to ensure maximum

efficiency and whilst Brahma have only been on site for a limited

time, we are encouraged by their performance. We look forward to

reporting on production levels and offtake contracts in due

course.

Financial results

For the six month period ended 30 June 2022 the Company had

revenue of GBP56,146 (H1 2021: GBP27,752).

The Group made a total comprehensive loss for the period of

GBP196,429 (H1 2021 loss of GBP513,497), which included a gain of

GBP624,211 arising from the translation of the Tanzanian subsidiary

accounts from US Dollars to Sterling.

The net assets at 30 June 2022 amounted to GBP6,926,616 (30 June

2021 GBP7,842,563). In addition, post period end, the Company

reached agreement for certain costs, amounting to GBP180,000, to be

recouped following an earlier aborted acquisition process, which

will strengthen the Group's working capital position pending

revenue from coal sales in the coming months.

Noel Lyons

Chief Executive Officer

29 September 2022

For further information please contact:

Edenville Energy Plc Via IFC Advisory

Nick Von Schirnding - Chairman

Noel Lyons - CEO

+44 (0) 20 7409

Strand Hanson Limited 3494

(Financial and Nominated Adviser)

James Harris

Rory Murphy

+44 (0) 20 7100

Tavira Securities Limited 5100

(Broker)

Oliver Stansfield

Jonathan Evans

+44 (0) 20 3934

IFC Advisory Limited 6630

(Financial PR and IR)

Tim Metcalfe

Florence Chandler

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months Six months Year

ended ended ended

30 June 30 June 31 Dec

22 21 21

Unaudited Unaudited Audited

As restated

Note GBP GBP GBP

Revenue 56,146 27,752 105,228

Cost of sales (452,484) (280,320) (684,848)

Gross loss (396,338) (252,568) (579,620)

Administrative expenses (423,627) (332,209) (875,564)

Share based payments - - -

Group operating loss (819,965) (584,777) (1,455,184)

Finance income - 12 701

Finance costs (675) (2589) (5,842)

Loss on operations before taxation (820,640) (587,354) (1,460,325)

Taxation - - (526)

Loss for the period after taxation (820,640) (587,354) (1,460,851)

Other comprehensive income/(loss):

Gain on translation of overseas

subsidiary 624,211 73,857 87,013

Total comprehensive loss for

the period (196,429) (513,497) (1,373,838

Attributable to:

Equity holders of the Company (195,155) (512,683) (1,371,573)

Non-controlling interest (1,274) (814) (2,265)

(196,429) (513,497) (1,373,838)

Loss per share

- basic and diluted (pence) 2 (3.79) (4.43) (8.04)

The income for the period arises from the Group's continuing

operations.

CONSOLIDATED statement of financial position

as at 30 June 2022

As at As at As at

30 June 30 June 31 Dec

22 21 21

Unaudited Unaudited Audited

Note GBP GBP GBP

Non-current assets

Property, plant and equipment 4 5,906,709 5,466,165 5,451,921

Intangible assets 5 349,607 307,080 315,002

6,256,316 5,773,245 5,766,923

Current assets

Inventories 180,124 248,864 142,721

Trade and other receivables 353,457 429,672 415,479

Cash and cash equivalents 477,438 1,873,072 1,229,801

1,011,019 2,551,608 1,788,001

Current liabilities

Trade and other payables (308,174) (419,825) (389,264)

Borrowings (5,206) (16,094) (18,258)

(313,380) (435,919) (407,522)

Current assets less current

liabilities 697,639 2,115,689 1,380,479

Total assets less current liabilities 6,953,955 7,888,934 7,147,402

Non - current liabilities

Borrowings - (23,517) -

Environmental rehabilitation

liability (27,339) (22,854) (24,632)

6,926,616 7,842,563 7,122,770

Capital and reserves

Called-up share capital 6 4,176,601 4,176,601 4,176,601

Share premium account 22,254,317 22,373,442 22,254,317

Share based payment reserve 346,774 341,522 453,614

Foreign currency translation

reserve 1,205,354 420,273 581,143

Retained earnings (21,038,103) (19,453,531) (20,325,577)

Issued capital and reserves

attributable to owners of the

parent company 6,944,943 7,858,307 7,140,098

Non-controlling interest (18,327) (15,744) (17,328)

Total equity 6,926,616 7,842,563 7,122,770

CONSOLIDATED statement of changes in equity

--------------------------------------------------Equity

Interests---------------------------------------

Share Share Retained Share Foreign Total Non-controlling Total

Capital Premium Earnings Option Currency interest

Account Reserve Translation

Reserve

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2022 4,176,601 22,254,317 (20,325,577) 453,614 581,143 7,140,098 (17,328) 7,122,770

Comprehensive

Income

for the year

Foreign

currency

translation - - - - 624,211 624,211 - 624,211

Loss for the

year - - (819,366) - - (819,366) (1,274) (820,640)

---------- ----------- ------------- ---------- ------------ ---------- ---------------- ----------

Total

comprehensive

income for

the year - - (819,366) - 624,211 (195,155) (1,274) (196,274)

Transactions

with

owners

Lapsed share

options - - 106,840 (106,840) - - - -

---------- ----------- ------------- ---------- ------------ ---------- ---------------- ----------

Total

transactions

with owners - - 106,840 (106,840) - - - -

Non-

controlling

interest

share of

goodwill - - - - - - 275 275

At 30 June

2022 4,176,601 22,254,317 (21,038,103) 346,774 1,205,354 6,944,943 (18,327) 6,926,616

========== =========== ============= ========== ============ ========== ================ ==========

--------------------------------------------------Equity

Interests---------------------------------------

Share Share Retained Share Foreign Total Non-controlling Total

Capital Premium Earnings Option Currency interest

Account Reserve Translation

Reserve

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2021 4,041,601 19,390,849 (18,866,991) 301,174 494,130 5,360,763 (14,902) 5,345,861

Comprehensive

Income

for the year

Foreign

currency

translation - - - - (73,857) (73,857) (28) (73,885)

Loss for the

year - - (586,540) - - (586,540) (814) (587,354)

---------- ----------- ------------- -------- ------------ ---------- ---------------- ----------

Total

comprehensive

income for

the year - - (586,540) - (73,857) (660,397) (842) (661,239)

Transactions

with

owners

Issued share

capital 135,000 3,240,000 - - - 3,375,000 - 3,375,000

Share issue

costs - (217,059) - - - (217,059) - (217,059)

Share based

payment - (40,348) - 40,348 - - - -

Total

transactions

with owners 135,000 2,982,593 - 40,348 - 3,157,941 - 3,157,941

At 30 June

2021 4,176,601 22,373,442 (19,453,531) 341,522 420,273 7,858,307 (15,744) 7,842,563

========== =========== ============= ======== ============ ========== ================ ==========

--------------------------------------------------Equity

Interests---------------------------------------

Share Share Retained Share Foreign Total Non-controlling Total

Capital Premium Earnings Option Currency interest

Account Reserve Translation

Reserve

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January 2021 4,041,601 19,390,849 (18,866,991) 301,174 494,130 5,360,763 (14,902) 5,345,861

Comprehensive

Income

for the year

Foreign currency

translation - - - - 87,013 87,013 - 87,013

Loss for the year - - (1,458,586) - - (1,458,586) (2,265) (1,460,851)

---------- ----------- ------------- -------- ------------ ------------ ---------------- ------------

Total

comprehensive

income for the

year - - (1,458,586) - 87,013 (1,371,573) (2,265) (1,373,838)

Transactions with

owners

Issue of share

capital 135,000 3,240,000 - - - 3,375,000 - 3,375,000

Share issue costs - (224,092) - - - (224,092) - (224,092)

Share

options/warrants

charge - (152,440) 152,440 -

---------- ----------- ------------- -------- ------------ ------------ ---------------- ------------

Total

transactions

with owners 135,000 2,863,468 - 152,440 - 3,150,908 - 3,150,908

Non- controlling

interest share

of

goodwill - - - - - - (161) (161)

At 31 December

2021 4,176,601 22,254,317 (20,325,577) 453,614 581,143 7,140,098 (17,328) 7,122,770

========== =========== ============= ======== ============ ============ ================ ============

consolidated CASH FLOW STATEMENT

Six months Six months Year

ended ended ended

30 June 30 June 31 Dec

22 21 21

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows from operating activities

Operating loss (819,965) (584,777) (1,455,184)

Depreciation 144,039 113,420 264,677

Movement in inventories (20,310) - 17,799

Movement in trade and other receivables 185,761 (169,082) (116,768)

Movement in trade and other payables (112,135) (222,450) (286,968)

Loss on foreign exchange (115,391) (4,597) (2,687)

----------- ------------------------ ------------

Net cash used in operating activities (738,001) (867,486) (1,579,131)

----------- ------------------------ ------------

Cash flows from investing activities

Finance income 48 12 701

----

----------- ------------------------ ------------

Net cash used in investing activities 48 12 701

----------- ------------------------ ------------

Cash flows from financing activities

Repayment of convertible loan

notes - (432,226) (120,000)

Repayment of lease liabilities (14,078) (8,267) (30,214)

Lease interest (723) (2,589) (3,451)

Proceeds on issue of ordinary

shares - 3,375,000 3,375,000

Share issue costs - (217,059) (224,092)

Net cash generated from financing

activities (14,801) 2,714,859 2,997,243

----------- ------------------------ ------------

Net decrease in cash and cash

equivalents (752,754) 1,847,385 1,204,111

Cash and cash equivalents at beginning

of year 1,229,801 25,690 25,690

Exchange losses on cash and cash

equivalents 391 (3) -

Cash and cash equivalents at

end of year 477,438 1,873,072 1,229,801

=========== ======================== ============

NOTES TO THE INTERIM REPORT

1. Financial information and basis of preparation

The interim financial statements of Edenville Energy Plc are

unaudited consolidated financial statements for the six months

ended 30 June 2022 which have been prepared in accordance with UK

adopted international accounting standards. They include unaudited

comparatives for the six months ended 30 June 2021 together with

audited comparatives for the year ended 31 December 2021.

The interim financial statements do not constitute statutory

accounts within the meaning of section 434 of the Companies Act

2006. The statutory accounts for the year ended 31 December 2021

have been reported on by the company's auditors and have been filed

with the Registrar of Companies. The report of the auditors

contained an Emphasis of matter paragraph on going concern, the

recoverability of VAT in Tanzania and on the recoverability of

inventory. Aside from the Emphasis of matter paragraphs referred to

aboveabove, the auditor's report did not contain any statement

under section 498 of the Companies Act 2006.

The interim consolidated financial statements for the six months

ended 30 June 2022 have been prepared on the basis of accounting

policies expected to be adopted for the year ended 31 December

2022. These are anticipated to be consistent with those set out in

the Group's latest financial statements for the year ended 31

December 2021. These accounting policies are drawn up in accordance

with adopted International Accounting Standards ("IAS") and

International Financial Reporting Standards ("IFRS") as issued by

the International Accounting Standards Board.

2. Loss per share

The calculation of the basic and diluted loss per share is based

on the following data:

30 June 22 30 June 21 31 December

21

GBP GBP GBP

Loss after taxation (820,640) (587,354) (1,460,851)

Weighted average number

of shares in the period 21,645,575 13,270,575 18,144,205

Basic and diluted loss

per share (pence) (3.79) (4.43) (8.04)

The loss attributable to equity shareholders and weighted

average number of ordinary shares for the purposes of calculating

diluted earnings per ordinary share are identical to those used for

basic earnings per ordinary share. This is because the exercise of

share options and warrants would have the effect of reducing the

loss per ordinary share and is therefore anti-dilutive.

3. Dividends

No dividends are proposed for the six months ended 30 June 2022

(six months ended 30 June 2021: GBPnil, year ended 31 December

2021: GBPnil).

4. Property, plant and equipment

Coal Production Plant Fixtures Motor vehicles

assets & machinery & fittings Total

GBP GBP GBP GBP GBP

Cost or valuation

As at 1 January

2022 5,230,294 1,201,831 7,191 193,620 6,632,936

Foreign exchange

adjustment 574,580 131,210 334 19,437 725,561

At 30 June 2022 5,804,874 1,333,041 7,525 213,057 7,358,497

Accumulated depreciation

As at 1 January

2022 114,026 925,484 7,045 134,460 1,181,015

Depletion/Charge

for the year 3,587 132,234 18 8,200 144,039

Foreign exchange

adjustment 12,518 100,880 334 13,002 126,734

At 30 June 2022 130,131 1,158,598 7,397 155,662 1,451,788

Net book value

As at 30 June 2022 5,674,743 174,443 128 57,395 5,906,709

Coal Production Plant Fixtures Motor vehicles

assets & machinery & fittings Total

GBP GBP GBP GBP GBP

Cost or valuation

As at 1 January

2021 5,164,384 1,186,781 7,153 191,390 6,549,708

Foreign exchange

adjustment (58,917) (16,770) 318 (1,993) (77,362)

At 30 June 2021 5,105,467 1,170,011 7,471 189,397 6,472,346

Accumulated depreciation

As at 1 January

2021 106,209 678,472 6,958 113,494 905,133

Depletion/Charge

for the year - 103,800 44 9,576 113,420

Foreign exchange

adjustment (1,212) (10,260) 162 (1,062) (12,372)

At 30 June 2021 104,997 772,012 7,164 122,008 1,006,181

Net book value

As at 30 June 2021 5,000,470 397,999 307 67,389 5,466,165

4. Property, plant and equipment (continued)

Coal Production Plant Fixtures Motor vehicles

assets & machinery & fittings Total

GBP GBP GBP GBP GBP

Cost or valuation

As at 1 January

2021 5,164,392 1,186,781 7,153 191,390 6,549,716

Foreign exchange

adjustment 65,902 15,050 38 2,230 83,220

At 31 December

2021 5,230,294 1,201,831 7,191 193,620 6,632,936

Accumulated depreciation

As at 1 January

2021 106,215 678,472 6,958 113,494 905,139

Depletion/Charge

for the year 6,464 238,444 49 19,720 264,677

Foreign exchange

adjustment 1,347 8,568 38 1,246 11,199

At 31 December

2021 114,026 925,484 7,045 134,460 1,181,015

Net book value

As at 31 December

2021 5,116,268 276,347 146 59,160 5,451,921

5. Intangible assets

Mining Licences Total

GBP GBP

Cost or valuation

As at 1 January 2022 1,489,604 1,489,604

Foreign exchange

adjustment 163,644 163,644

At 30 June 2022 1,653,248 1,653,248

Accumulated amortisation

and impairment

As at 1 January 2022 1,174,602 1,174,602

Foreign exchange

adjustment 129,039 129,039

At 30 June 2022 1,303,641 1,303,641

Net book value

As at 30 June 2022 349,607 349,607

5. Intangible assets (continued)

Mining Licences Total

GBP GBP

Cost or valuation

As at 1 January 2021 1,470,833 1,470,833

Foreign exchange adjustment (17,185) (17,185)

At 30 June 2021 1,453,648 1,453,648

Accumulated amortisation

and impairment

As at 1 January 2021 1,159,801 1,159,801

Foreign exchange adjustment (13,233) (13,233)

At 30 June 2021 1,146,568 1,146,568

Net book value

As at 30 June 2021 307,080 307,080

Mining Licences Total

GBP GBP

Cost or valuation

As at 1 January 2021 1,470,833 1,470,833

Foreign exchange adjustment 18,771 18,771

At 31 December 2021 1,489,604 1,489,604

Accumulated amortisation

and impairment

As at 1 January 2021 1,159,801 1,159,801

Foreign exchange adjustment 14,801 14,801

At 31 December 2021 1,174,602 1,174,602

Net book value

As at 31 December 2021 315,002 315,002

6. Share capital

No No GBP No GBP GBP

Ordinary Ordinary Ordinary Deferred Deferred Total

shares shares of shares shares of shares share

of 1p each 0.02p each of 0.02p/1p 0.001p each of 0.001p capital

each each

Issued and fully

paid

At 1 January 2021 - 8,145,575,094 1,629,116 241,248,512,346 2,412,485 4,041,601

On 5 January the

company consolidated

and then subdivided

the brought forward

shares* 8,145,575 (8,145,575,094) (1,547,659) 154,765,925,000 1,547,659 -

On 21 January

the company issued

3,600,000 1p shares

at 0.25p 3,600,000 - 36,000 - - 36,000

On 26 May the

company issued

9,900,000 1p shares

at 0.25p 9,900,000 - 99,000 - - 99,000

As at 30 June

2021,31 December

2021 and 30 June

2022 21,645,575 - 216,457 396,014,437,346 3,960,144 4,176,601

============ ================ ============= ================ =========== ==========

*On 5 January 2021 the Company reduced the number of issued

ordinary shares of GBP0.0002 each in the Company by a multiple of

1,000 (the "Consolidation"), Following the Consolidation the

Company sub-divided each consolidated ordinary share of GBP0.20

each in the capital of the Company, into 1 ordinary share of

GBP0.01 each in the capital of the Company and 19,000 new deferred

shares of GBP0.00001 each in the capital of the Company.

7. Distribution of interim report to shareholders

The interim report will be available for inspection by the

public at the registered office of the company during normal

business hours on any weekday and from the Company's website

http://www.edenville-energy.com/ . Further copies are available on

request.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GIGDCCXDDGDC

(END) Dow Jones Newswires

September 29, 2022 04:48 ET (08:48 GMT)

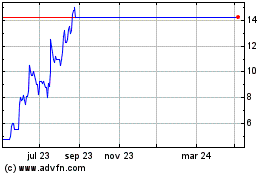

Edenville Energy (LSE:EDL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Edenville Energy (LSE:EDL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024