TIDMEEE

RNS Number : 3249Z

Empire Metals Limited

14 September 2022

Empire Metals Ltd / AIM: EEE / Sector: Natural Resources

14 September 2022

Empire Metals Limited ('EEE' or the 'Company')

Interim Results

Empire Metals Ltd ('EEE', the 'Company' or the 'Group'), the

AIM-quoted resource exploration and development company, is pleased

to announce its interim results for the six-month period ended 30

June 2022.

Chairman's Statement

Empire is establishing itself as a leading metals explorer

focussed on Australia, and the activities undertaken during this

period have had a profound impact both on the current profile of

the Company, and also our long-term value prospects. We have

successfully grown our exploration footprint from 3.1km(2) to over

1,728km(2) , across four key geologically and geographically

diverse projects. This portfolio expansion will substantially

de-risk our exploration strategy, and also broaden our commodity

exposure and considerably enlarge our global resource inventory

potential.

This expansion strategy began in January, with the Tribute

Agreement signed with Maher Mining Contractors Pty Ltd, giving

Empire the right to explore, develop and mine within a granted area

on mining lease M27/158, known as the Gindalbie Project.

Importantly, Gindalbie is adjacent to Empire's established and most

advanced asset, the Eclipse Gold Project, and extended the area for

exploration targets a further 2km along the Eclipse lodes trend,

plus 1km to the north and 3km to the south.

However, we had our sights set on a much larger suite of assets,

and in April Empire acquired a 70% interest in three highly

prospective Australian-based copper-gold projects from Century

Minerals Pty Ltd. Two of the projects, the Pitfield Copper-Gold

Project and the Walton Copper-Gold Project are in Western Australia

whilst the Stavely Copper-Gold Project lies within the Stavely Arc

region of Victoria.

The acquisition of these assets, which combined, cover an area

considerably larger than Greater London, provides Empire with an

exceptional mineralised footprint within several mining regions

well known for world-class and significant copper and/or gold

discoveries.

Our initial focus has been on the Pitfield Project and

exploration activities began in earnest in June. By way of

geological background, the Pitfield Project is hosted by

Neoproterozoic rocks coinciding with a globally important copper

mineralisation era known for major copper-gold deposits such as

Newcrest Mining Ltd's Telfer Mine, Rio Tinto's Winu Project and the

Havieron project (a joint venture between Newcrest Mining Ltd and

Greatland Gold). Further evidence of the high prospectivity and

productivity of the area can be seen from the multiple proximal

historical copper mines and prospects including the historical

Baxters copper mine at Arrino, which lies along strike, and

produced 106 tonnes of copper at a grade between 20-30% Cu.

Empire's exploration programme at Pitfield was launched with

airborne magnetic and electromagnetic surveys across the Pitfield

tenement area. Results from the airborne magnetic survey were

presented to the market post period end, and reported the

identification of a significant structure along the western

boundary of the magnetic anomaly that closely aligns with a surface

copper anomaly stretching over 7km in length, previously identified

by CRA (which became part of Rio Tinto Group) when conducting

surface sampling in the early 1990s. As reported in August, this

strong magnetic anomaly, which extends for over 20km, was the

source of significant excitement for our exploration teams, as it

indicates potential for a regional scale alteration event involving

hydrothermal magnetite which could be associated with copper

mineralisation that are the source for the prominent copper

anomalies at surface.

Full analysis of the electromagnetic survey is expected shortly

and will be presented to the market as we look to deepen our

understanding of the geological source for the extensive copper

anomaly in order to generate high priority drill targets for our

first drilling campaign at Pitfield in the coming months. Although

we are early on in our exploration work at Pitfield, this asset is

already displaying characteristics of a significant copper mineral

system and we believe there is good potential to make a major

copper discovery here.

Similarly, both the Walton and Stavely projects provide Empire

with significant discovery potential and we are co-ordinating our

exploration strategy across these two further projects to ensure we

maintain an active schedule of work across our entire portfolio. We

expect work at Walton and/or Stavely to begin towards the end of

this year or early 2023, at which point we expect to be drilling at

Pitfield, and conducting further work at the Eclipse-Gindalbie

Project, building on the work conducted during H1 2022 and in Q3

2022.

The recent work at Eclipse-Gindalbie has centred on two drilling

campaigns, the first commencing in February, and comprising a round

of exploratory drilling at Eclipse, utilising both reverse

circulation ("RC") and diamond drill holes, designed to gather

further geological and structural information around the Eclipse

shaft and Jack's Dream shaft and to prove continuity of the gold

mineralisation below the gold-depleted zone of weathering. In

conjunction with this drilling, Empire also commenced an RC

drilling campaign at Gindalbie, looking to not only extend the

mineralised trend a further 2km to the southeast of Eclipse but

also to understand the extent and origin of what the Company

believes to be a much larger gold system.

Our work at Eclipse-Gindalbie started again just before the

period end, and consisted of 26 RC holes, for a total of 3,360m,

and focused mainly on extending the known mineralised trends, along

strike and at depth, around some of the historical gold mines such

as Homeward Bound, Bulletin, Eclipse and Jack's Dream as well as

the small pit at Budd's Find.

These drill campaigns delivered some very positive results, with

multiple significant intercepts, which provided further

encouragement that the combined Eclipse-Gindalbie project has the

potential to support a significant gold resource. Our energies now

will centre on modelling this geological data ahead of further

field work in Q4 2022.

Financial

For the six-month period ended 30 June 2022 the Group is

reporting a pre-tax loss of GBP588,808 (six months ended 30 June

2021: pre-tax profit of GBP682,770 arising as a result of the gain

on the sale of the Company's investment in Georgian Copper &

Gold JSC ("GCG") of GBP1,775,129).

The Group's net cash balance as at 30 June 2022 was GBP2.4

million and as at the date of this report is GBP2.15 million.

Outlook

I look now to the future with a sense of renewed optimism and

excitement. Empire is in many respects in an enviable position

compared to many of its peers, able to deliver meaningful discovery

value to shareholders. We now benefit from both a comfortable cash

position and also a portfolio of high-quality exploration projects,

all of which have the potential to deliver value on a scale that is

multiples of the current market capitalisation of the company.

We have de-risked growth by spreading our geological footprint

and implemented a strategy to bring all of the assets through the

exploration process in a coordinated approach to maximise

efficiency and negate periods of relative inactivity on the ground.

As well as providing momentum to operational activities, this will

also generate regular news announcements to keep the market engaged

as to our progress.

It is with this in mind that I look forward to providing updates

to shareholders over the coming months as we systematically execute

our exploration campaigns across our four key project areas. Once

again, I would like to thank our shareholders, both new and

long-standing, as we move Empire into this next, exciting phase of

development and look to deliver multiple successful discoveries

from our exceptional portfolio of assets.

Neil O'Brien

Non-Executive Chairman

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

**S**

For further information please visit

https://www.empiremetals.co.uk or contact:

Shaun Bunn Empire Metals Ltd Company Tel: 020 7907 9327

Greg Kuenzel Empire Metals Ltd Company Tel: 020 7907 9327

Ewan Leggat S. P. Angel Corporate Finance LLP Nomad & Broker Tel: 020 3470 0470

Adam Cowl S. P. Angel Corporate Finance LLP Nomad & Broker Tel: 020 3470 0470

Damon Heath Shard Capital Partners LLP Joint Broker Tel: 020 7186 9950

Susie Geliher St Brides Partners Ltd PR Tel: 020 7236 1177

Max Bennett St Brides Partners Ltd PR Tel: 020 7236 1177

About Empire Metals Limited

Empire Metals is an AIM-listed (LON: EEE) exploration and

resource development company with a project portfolio comprising

gold and copper interests in Australia and Austria.

The Company's strategy is to develop a pipeline of projects at

different stages in the development curve. The Company expanded its

exploration licence area in April 2022 from 9.5km2 to 1,728km2 with

the acquisition of the Pitfield Copper-Gold Project and the Walton

Copper-Gold Project in Western Australia, and the Stavely

Copper-Gold Project in the Stavely Arc region of Victoria. The

Company also continues resource definition work at its high-grade

Eclipse-Gindalbie Gold Project in Western Australia.

Empire also holds a portfolio of three precious metals projects

located in a historically high-grade gold production region

comprising the Rotgulden, Schonberg and Walchen prospects in

central-southern Austria.

The Board continues to evaluate opportunities through which to

realise the value of its wider portfolio and reviews further assets

which meet the Company's investment criteria.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months

to 30 June to 30 June

2022 Unaudited 2021 Unaudited

Notes GBP GBP

---------------------------------------------- ------- ----------------- -----------------

Continuing operations

Administration expenses 4 (550,169) (913,009)

Share option expense (54,267) (214,336)

Foreign exchange 38,810 58,579

Operating Loss (565,626) (1,068,766)

---------------------------------------------- ------- ----------------- -----------------

Share of profit from joint venture - (23,593)

Other net gains/(losses) 5 (23,182) 1,775,129

Profit/(Loss) Before Interest and Income

Tax (588,808) 682,770

---------------------------------------------- ------- ----------------- -----------------

Net finance Income 173 -

Corporation tax expense (44,474) (759)

---------------------------------------------- ------- ----------------- -----------------

Profit/(Loss) for the period (633,109) 682,011

---------------------------------------------- ------- ----------------- -----------------

Profit/(Loss) attributable to:

* owners of the Parent (633,109) 682,011

Profit/(Loss) for the period (633,109) 682,011

---------------------------------------------- ------- ----------------- -----------------

Other comprehensive income

Items that may be subsequently reclassified

to profit or loss

Currency translation differences 18,485 -

---------------------------------------------- ------- ----------------- -----------------

( 599,067

Total comprehensive income ) 682,011

---------------------------------------------- ------- ----------------- -----------------

Attributable to:

( 599,067

* owners of the Parent ) 682,011

( 599,067

Total comprehensive income ) 682,011

---------------------------------------------- ------- ----------------- -----------------

Earnings/(loss) per share (pence) from

continuing operations attributable to

owners of the Parent - Basic and diluted 9 (0.170) 0.190

---------------------------------------------- ------- ----------------- -----------------

CONDENSED CONSOLIDATED BALANCE SHEET

30 June 2022 30 June 2021

Unaudited Unaudited

Notes GBP GBP

-------------------------------- ------- -------------- --------------

Non-Current Assets

Property, plant and equipment - 341

Intangible assets 7 2,814,981 2,034,499

2,814,981 2,034,840

-------------------------------- ------- -------------- --------------

Current Assets

Trade and other receivables 185,673 104,632

Cash and cash equivalents 2,379,338 2,943,807

2,565,011 3,048,439

-------------------------------- ------- -------------- --------------

Total Assets 5,379,992 5,083,279

-------------------------------- ------- -------------- --------------

Current Liabilities

Trade and other payables 131,787 27,220

Income tax payable (3,723) -

-------------------------------- ------- -------------- --------------

Total Liabilities 128,064 27,220

-------------------------------- ------- -------------- --------------

Net Assets 5,251,928 5,056,059

-------------------------------- ------- -------------- --------------

Equity Attributable to owners

of the Parent

Share premium account 8 45,523,695 43,836,224

Reverse acquisition reserve (18,845,147) (18,845,147)

Other Reserves 572,820 368,962

Retained losses (21,999,440) (20,303,980)

-------------------------------- ------- -------------- --------------

Total equity attributable to

owners of the Parent 5,251,928 5,056,059

-------------------------------- ------- -------------- --------------

Total Equity 5,251,928 5,056,059

-------------------------------- ------- -------------- --------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS'

EQUITY

Reverse

acquisition Other Retained Total

Share premium reserve Reserves losses equity

GBP GBP GBP GBP GBP

------------------------------ ----------------- -------------- ------------- -------------- -----------

As at 1 January 2021 43,065,981 (18,845,147) 152,793 (20,985,991) 3,387,636

------------------------------

Comprehensive income

Profit/(Loss) for the

period - - - 682,011 682,011

------------------------------ ----------------- -------------- ------------- -------------- -----------

Other comprehensive

income

Currency translation

differences - - 1,833 - 1,833

------------------------------ ----------------- -------------- ------------- -------------- -----------

Total comprehensive

income - - 1,833 - 683,844

------------------------------ ----------------- -------------- ------------- -------------- -----------

Issue of ordinary shares 770,243 - - - 770,243

Share option charge - - 214,336 - 214,336

Total transactions

with owners 770,243 - 214,336 - 984,579

As at 30 June 2021 43,836,224 (18,845,147) 368,962 (20,303,980) 5,056,059

------------------------------ ----------------- -------------- ------------- -------------- -----------

Reverse

acquisition Other Retained Total

Share premium reserve reserves losses equity

GBP GBP GBP GBP GBP

------------------------------ ----------------- -------------- ------------- -------------- -----------

As at 1 January 2022 43,836,855 (18,845,147) 520,293 (21,386,556) 4,125,445

------------------------------

Comprehensive income

Profit/(Loss) for the

period - - - (633,109) (633,109)

------------------------------ ----------------- -------------- ------------- -------------- -----------

Other comprehensive

income

Currency translation

differences - - 18,485 - 18,485

------------------------------ ----------------- -------------- ------------- -------------- -----------

Total comprehensive

income - - 18,485 (633,109) (599,067)

------------------------------ ----------------- -------------- ------------- -------------- -----------

Issue of ordinary shares 1,686,840 - - - 1,686,840

Share option charge - -

Options granted - - 54,267 54,267

Expired options - - (20,225) 20,225 -

Total transactions

with owners 1,686,840 - 34,042 20,225 1,665,347

As at 30 June 2022 45,523,695 (18,845,147) 572,820 (21,999,440) 5,251,928

------------------------------ ----------------- -------------- ------------- -------------- -----------

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

30 June 30 June

2022 Unaudited 2021 Unaudited

Note GBP GBP

--------------------------------------------- -------- ----------------- -----------------

Cash flows from operating activities

Profit/(Loss) before taxation (633,109) 682,011

Adjustments for:

Depreciation 361 1,082

Impairments 23,182 -

Share based payments 54,267 554,197

Gain on sale of investments - (1,775,129)

Net finance costs (173) (1)

Income tax expense 44,474 759

Share of profit on joint venture - 23,593

Increase in trade and other receivables (26,770) (39,990)

Increase/(Decrease) in trade and other

payables 26,876 (51,318)

Income tax paid (44,786) -

Net cash used in operations (555,678) (604,796)

--------------------------------------------- -------- ----------------- -----------------

Cash flows from investing activities

Loans granted to joint venture partners - (44,647)

Purchase of intangible assets 7 (792,605) (1,271,837)

Sale of investments - 2,327,944

Net cash used in investing activities (792,605) 1,011,460

--------------------------------------------- -------- ----------------- -----------------

Cash flows from financing activities

Proceeds from issue of shares 8 1,606,170 118,000

Cost of issue (88,920) -

--------------------------------------------- -------- ----------------- -----------------

Net cash from financing activities 1,517,250 118,000

--------------------------------------------- -------- ----------------- -----------------

Net (decrease) / increase in cash and

cash equivalents 168,967 524,664

Cash and cash equivalents at beginning

of period 2,210,371 2,289,637

Exchange differences on cash - 129,506

--------------------------------------------- -------- ----------------- -----------------

Cash and cash equivalents at end of period 2,379,338 2,943,807

--------------------------------------------- -------- ----------------- -----------------

Major non-cash transactions

5,611,863 ordinary shares were issued at 1.35p as non-cash

consideration for the acquisition of the Pitfield Copper-Gold

Project.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. General Information

The principal activity of Empire Metals Limited ('the Company')

and its subsidiaries (together 'the Group') is the exploration and

development of precious and base metals. The Company's shares are

listed on the AIM Market of the London Stock Exchange. The Company

is incorporated in the British Virgin Islands and domiciled in the

United Kingdom. The Company was incorporated on 10 February 2010

under the name Gold Mining Company Limited. On 10 October 2016 the

Company changed its name from Noricum Gold Limited to Georgian

Mining Corporation and subsequently on 10 February 2020 changed its

name from Georgian Mining Corporation to Empire Metals Limited.

The address of the Company's registered office is Trident

Chambers, PO Box 146, Road Town, Tortola BVI.

2. Basis of Preparation

The condensed consolidated interim financial statements have

been prepared in accordance with the requirements of the AIM Rules

for Companies. As permitted, the Company has chosen not to adopt

IAS 34 "Interim Financial Statements" in preparing this interim

financial information. The condensed interim financial statements

should be read in conjunction with the annual financial statements

for the year ended 31 December 2021, which have been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union.

The interim financial information set out above does not

constitute statutory accounts. They have been prepared on a going

concern basis in accordance with the recognition and measurement

criteria of International Financial Reporting Standards (IFRS) as

adopted by the European Union. Statutory financial statements for

the year ended 31 December 2021 were approved by the Board of

Directors on 16 April 2021. The report of the auditors on those

financial statements was unqualified but included a material

uncertainty relating to going concern paragraph.

Going concern

The Directors, having made appropriate enquiries, consider that

adequate resources exist for the Group to continue in operational

existence for the foreseeable future and that, therefore, it is

appropriate to adopt the going concern basis in preparing the

condensed interim financial statements for the period ended 30 June

2022.

The factors that were extant at the 31 December 2021 are still

relevant to this report and as such reference should be made to the

going concern note and disclosures in the 2021 Annual Report.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of

the business. The key risks that could affect the Group's

medium-term performance and the factors that mitigate those risks

have not substantially changed from those set out in the Group's

2021 Annual Report and Financial Statements, a copy of which is

available on the Group's website: https://www.empiremetals.co.uk .

The key financial risks are liquidity risk, foreign exchange risk,

credit risk, price risk and interest rate risk.

Critical accounting estimates

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities, income and

expenses, and disclosure of contingent assets and liabilities at

the end of the reporting period. Significant items subject to such

estimates are set out in note 4 of the Group's 2021 Annual Report

and Financial Statements. Actual amounts may differ from these

estimates. The nature and amounts of such estimates have not

changed significantly during the interim period.

3. Accounting Policies

The same accounting policies, presentation and methods of

computation have been followed in these condensed interim financial

statements as were applied in the preparation of the Group's annual

financial statements for the year ended 31 December 2021 except for

the impact of the adoption of the Standards and interpretations

described below and new accounting policies adopted as a result of

changes in the Group.

3.1 Changes in accounting policy and disclosures

(a) New and amended standards mandatory for the first time for

the financial periods beginning on or after 1 January 2022

The International Accounting Standards Board (IASB) issued

various amendments and revisions to International Financial

Reporting Standards and IFRIC interpretations. The amendments and

revisions were applicable for the period ended 30 June 2022 but did

not result in any material changes to the Financial Statements of

the Group.

b) New standards, amendments and interpretations in issue but

not yet effective or not yet endorsed and not early adopted

Standards, amendments and interpretations that are not yet

effective and have not been early adopted are as follows:

Standard Impact on initial application Effective date

--------------------------- ----------------------------------- ----------------

IAS 1 (Amendments) Classification of Liabilities as *1 January

Current or Non-Current 2023

----------------------------------- ----------------

IAS 1 and IFRS Practice Disclosure of Accounting Policies 1 January

Statement 2 (Amendments) 2023

----------------------------------- ----------------

IAS 8 (Amendments) Accounting estimates 1 January

2023

----------------------------------- ----------------

* Subject to endorsement

The Group is evaluating the impact of the new and amended

standards above which are not expected to have a material impact on

future Group Financial Statements.

4. Administrative expenses

30 June 30 June

2022 2021

GBP GBP

------------------------------------- --------- ----------

Office expenses 24,111 27,797

Insurance 18,342 21,765

IT & software services 10,817 11,801

Directors, Employees & Contractors 226,090 105,444

Professional advisors 206,030 383,794

Travel & accommodation 42,015 4,301

Depreciation & amortisation 361 1,082

Finders fees - 339,861

Other admin expenses 22,403 17,165

550,169 913,009

------------------------------------- --------- ----------

5. Other (losses)/gains - Net

30 June 2022 30 June

GBP 2021

GBP

-------------------------------------------------- -------------- -----------

Profit on sale of property, plant and equipment - 1,775,129

Impairments of financial assets (23,182)

-------------------------------------------------- -------------- -----------

(23,182) 1,775,129

-------------------------------------------------- -------------- -----------

6. Dividends

No dividend has been declared or paid by the Company during the

six months ended 30 June 2022 (2021: nil).

7. Intangible Assets

Exploration & Evaluation Assets at Cost 30 June 2022 30 June 2021

and Net Book Value GBP GBP

------------------------------------------ -------------- --------------

Balance as at 1 January 1,952,419 31,673

Additions 856,076 2,002,826

Foreign currency differences 6,486 -

As at 30 June 2,814,981 2,034,499

------------------------------------------ -------------- --------------

The Exploration & Evaluation additions in the current period

relates to work performed at the Company's Eclipse and Gindalbie

licence areas as well as the newly acquired Pitfield project. At

Gindalbie, the Company entered into a Tribute Agreement that gives

Empire the exclusive right to explore, develop and mine within a

granted area. The latest drilling program provided multiple

significant gold intercepts which will require further analysis and

structural interpretation, and should greatly assist Empire's

technical team in building a more robust structural model for the

overall project area.

The Company acquired a 70% interest in three projects, Pitfield,

Stavely and Walton, from Century Minerals Pty Ltd. The

consideration for the projects will be satisfied by the issue of

16,835,588 new ordinary shares in the Company, apportioned equally

between each Project and issued upon the grant of the relevant

Tenement comprising each project, which in the case of Pitfield is

the already granted Exploration Licence E70/5465. Following

completion on Pitfield, 5,611,863, Consideration Shares have been

issued.

The Directors do not consider the asset to be impaired.

8. Share capital and share premium

Group Number of Share premium Total

shares GBP GBP

------------------------------------------ ------------- --------------- ------------

At 1 January 2021 314,683,361 43,065,981 43,065,981

------------------------------------------ ------------- --------------- ------------

Issue of Ordinary Shares - 22 February

2021 7,095,510 277,434 277,434

Issue of Ordinary Shares - 22 February

2021 7,095,510 277,434 277,434

Issue of Ordinary Shares - 20 May

2021 1,921,068 54,750 54,750

Issue of Ordinary Shares - 20 May

2021 1,921,068 54,750 54,750

Issue of Ordinary Shares - 10 June

2021 3,995,238 106,506 106,506

------------------------------------------ ------------- --------------- ------------

At 31 December 2021 336,711,755 43,836,855 43,836,855

------------------------------------------ ------------- --------------- ------------

At 1 January 2022 336,711,755 43,836,855 43,836,855

------------------------------------------ ------------- --------------- ------------

Issue of Ordinary Shares - 13 April

2022 5,611,863 75,760 75,760

Issue of Ordinary Shares - 28 April

2022 85,000,000 1,700,000 1,700,000

------------------------------------------ ------------- --------------- ------------

90,611,863 1,775,760 1,775,760

Cost of capital - (88,920) (88,920)

------------------------------------------ ------------- --------------- ------------

At 30 June 2022 427,323,618 45,523,695 45,523,695

------------------------------------------ ------------- --------------- ------------

9. Earnings per share

The calculation of the total basic loss per share of 0.170 pence

(30 June 2021: 0.190 pence profit) is based on the loss

attributable to equity owners of the parent company of GBP633,109

(30 June 2021: GBP682,011 profit) and on the weighted average

number of ordinary shares of 369,216,381 (30 June 2021:

351,606,291) in issue during the period.

Details of share options that could potentially dilute earnings

per share in future periods are disclosed in the notes to the

Group's Annual Report and Financial Statements for the year ended

31 December 2021.

10. Fair value of financial assets and liabilities measured at

amortised costs

Financial assets and liabilities comprise the following:

-- Trade and other receivables

-- Cash and cash equivalents

-- Trade and other payables

The fair values of these items equate to their carrying values

as at the reporting date.

11. Commitments

a) Tribute Agreement

As part of the Tribute Agreement with Maher Mining Contractors

Pty Ltd for the Gindalbie Gold Project, Empire has agreed to a

minimum expenditure commitment during the two stages of exploration

of A$250,000 for each period.

b) Century Minerals

The Company has agreed to spend a minimum of A$1,400,000 on

exploration within 24 months of the date of acquisition of the

Century acquisition, and this may be extended by a further 12

months should either the Walton or Stavely tenements not be granted

within 12 months of acquisition.

In addition, commitments stated in the Group's Annual Financial

Statements for the year ended 31 December 2021 remain.

12. Events after the balance sheet date

There have been no events after the reporting date of a material

nature.

13. Approval of interim financial statements

The condensed interim financial statements were approved by the

Board of Directors on 13 September 2022.

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKNBDPBKDNCD

(END) Dow Jones Newswires

September 14, 2022 02:00 ET (06:00 GMT)

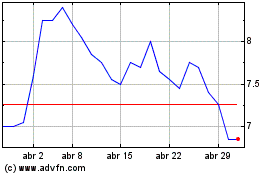

Empire Metals (LSE:EEE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Empire Metals (LSE:EEE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024