TIDMEJFI TIDMTTM

RNS Number : 5424U

EJF Investments Ltd

29 March 2023

FOR IMMEDIATE RELEASE

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES,

ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA (OTHER THAN THE

REPUBLIC OF IRELAND), AUSTRALIA, CANADA, SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE IT IS UNLAWFUL TO DO SO.

29 March 2023

EJF Investments Ltd

(the "Company" or "EJFI")

Exposure to Regional Banks

In response to recent events in the US and European banking

markets, the Board of the Company believe it appropriate that

additional disclosure on the Company's underlying positions in its

Risk Retention exposures and market background be provided by EJF

Investments Manager LLC (the "Manager"). Accordingly, the Company

notes the following information from the Manager:

-- The Company has no exposure to SVB Financial Group ("SVB") or

Signature Bank ("Signature"), the two US Regional Banks that

regulators put into receivership earlier this month ("US Regional

Banks" being those US banks with assets between USD50bn and

USD250bn).

-- The Company has no exposure to debt issued by European banks.

-- The Company holds cash balances with BNP Paribas and Citi.

-- Of the Risk Retention exposure within the collateral, which

represents approximately 70% of the gross asset value of the

Company as at 28 February 2023, there were 260 US banks and 113

insurance companies, of which 162 US banks and 41 insurance

companies were unique issuers.

-- The largest exposure to any single bank is approximately 3%

of the total outstanding underlying principal across all seven Risk

Retention deals in which the Company is invested.

-- As published on 15 March, 2023, the Company's combined

exposure to Silvergate Capital Corporation ("Silvergate"), which

went into voluntary liquidation on 8 March, 2023, is equivalent to

less than 2.5% of the Company's most recently published NAV on a

look through basis, prior to any recoveries. The Manager currently

believes there may be a recoverable value noting that both

Silvergate's equity and preferred equity are currently trading with

a positive economic value in the market, and that the Company's

position is structurally senior to both of these.

-- With respect to EJFI's remaining exposures, the Manager has

identified three US Regional Banks, within the collateral, which

may share some of the attributes of SVB and Signature: (1) a

relatively concentrated deposit base; (2) a greater than average

level of uninsured deposits; and (3) a greater than average held to

maturity and/or available for sale securities portfolio that has

unrealised losses as a result of the steep rise in interest rates.

In combination, the exposure of the banks identified by the Manager

of this nature is less than 9% of the Company's most recently

published NAV on a look through basis. It is important to

emphasise, however, that notwithstanding this identification, these

banks remain operational.

-- In addition, it is the Manager's belief that a distinction

should be drawn between the business models of community banks and

those of SVB, Signature, Silvergate and the three US Regional Banks

discussed above. In general, community banks with less than USD50bn

in assets have more secure and less monoline deposit bases.

-- The Manager believes that the recent events will result in

more regulatory changes and, in the long term, those changes will

accelerate consolidation in the industry as risk and compliance

costs increase. Although consolidation will continue, the Manager

believes that community banks will continue to play an integral

part of the US economic system.

-- Furthermore, the Manager expects that these potential

regulatory enhancements will serve to further buttress the strength

of smaller, i.e. community banks, and medium sized banks in the US.

Community banks represent a significant portion of total lending in

the US: approximately 55% of commercial real estate loans; 29% of

residential real estate loans; 24% of commercial and industrial

loans; and 14% of consumer loans.

-- Community banks also enjoy broad bipartisan political

support, this sentiment being clearly articulated by the US

Treasury Secretary, Janet Yellen, on 21 March 2023 in her testimony

before Congress: "Large banks play an important role in our

society, but so do small and mid-sized banks. These banks are

heavily engaged in traditional banking services that provide vital

credit and financial support to families and small businesses. They

also increase competition in the banking sector and often have

specialized knowledge and expertise in the communities they invest

in. Indeed, many of these banks have played an important role in

supporting our economic recovery."

ENQUIRIES

For the Manager

EJF Investments Manager LLC

Peter Stage / Jay Ghatalia

pstage@ejfcap.com / jghatalia@ejfcap.com

+44 203 752 6775 / +44 203 752 6776

For the Company Secretary and Administrator

BNP Paribas S.A., Jersey Branch

jersey.bp2s.ejf.cosec@bnpparibas.com

+44 1534 813 967 / +44 1534 709 189

For the Broker

Liberum Capital Limited

Darren Vickers / Owen Matthews

+44 (0) 20 3100 2218 / +44 (0) 20 3100 2223

About EJF Investments Ltd

EJFI is a registered closed-ended limited liability company

incorporated in Jersey under the Companies (Jersey) Law 1991, as

amended, on 20 October 2016 with registered number 122353. The

Company is regulated by the Jersey Financial Services Commission

(the "JFSC"). The JFSC is protected by both the Collective

Investment Funds (Jersey) Law 1988 and the Financial Services

(Jersey) Law 1998, as amended, against liability arising from the

discharge of its functions under such laws.

The JFSC has not reviewed or approved this announcement.

LEI: 549300XZYEQCLA1ZAT25

Investor information & warnings

The latest available information on the Company can be accessed

via its website at www.ejfi.com .

This communication has been issued by, and is the sole

responsibility of, the Company and is for information purposes

only. It is not, and is not intended to be an invitation,

inducement, offer or solicitation to deal in the shares of the

Company. The price and value of shares in the Company and the

income from them may go down as well as up and investors may not

get back the full amount invested on disposal of shares in the

Company. An investment in the Company should be considered only as

part of a balanced portfolio of which it should not form a

disproportionate part. Prospective investors are advised to seek

expert legal, financial, tax and other professional advice before

making any investment decision.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUDGGDXSUDDGXI

(END) Dow Jones Newswires

March 29, 2023 02:00 ET (06:00 GMT)

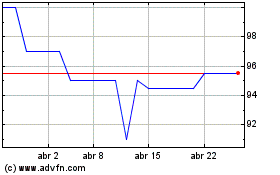

Ejf Investments (LSE:EJFI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ejf Investments (LSE:EJFI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024