TIDMEKF

RNS Number : 3845P

EKF Diagnostics Holdings PLC

20 June 2022

EKF Diagnostics Holdings plc

("EKF", the "Company" or the "Group")

Distribution of shares in Verici Dx plc

Approval of dividend in specie of investment in Verici Dx

plc

EKF Diagnostics Holdings plc (AIM: EKF), the AIM listed global

diagnostics business, declares the distribution of shares in its

investment, Verici Dx plc ("Verici") via a distribution in specie

of shares to the Company's shareholders.

In March 2022, EKF confirmed its intention to distribute, to its

own shareholders, the Verici ordinary shares it would receive as a

result of the Company's participation in the recent fundraising by

Verici, in addition to its existing shareholding in Verici

(together the "Investment Shares"), as soon as reasonably

practicable and subject to appropriate arrangements to maintain an

orderly market in Verici's shares following such distribution(1) .

Shareholder approval was granted at EKF's Annual General Meeting

held on 18 May 2022, to distribute the Investment Shares by way of

a dividend in specie to EKF shareholders ("Relevant EKF

Shareholders") on the register at the close of business on 24 June

2022 (the "Record Date").

On 17 June 2022, the board of EKF (the "Board") convened and

declared a dividend in specie of the Investment Shares to trustees,

to be held on trust for the Company's shareholders (the

"Dividend"). The Investment Shares comprise a total of 9,098,611

ordinary shares in Verici of GBP0.001 each. Relevant EKF

Shareholders will receive one Investment Share for every 50

ordinary shares held in the Company.

Relevant EKF Shareholders will become the beneficial owners of

their respective Investment Shares upon completion of the transfer

of the Investment Shares to Broadway Nominees Limited ("Broadway"),

at which time an 'omnibus' share certificate in respect of the

Investment Shares will be issued and held by Broadway, on trust on

behalf of the Relevant EKF Shareholders for a period of 365 days

from the date of transfer (the "Lock-up Period"). Relevant EKF

Shareholders will receive a letter informing them of their

beneficial holdings of Investment Shares shortly after the transfer

of the Investment Shares to Broadway.

During the Lock-up Period, Relevant EKF Shareholders will not be

permitted to transfer the legal or beneficial ownership of their

Investment Shares.

All ordinary shares in Verici, including the Investment Shares,

will rank equally in respect of voting and dividend rights.

The legal title to the Investment Shares will be held by

Broadway as trustee during the Lock-Up Period. During the Lock-up

Period, Broadway will request that Verici's registrar seeks the

voting instructions of the Relevant EKF Shareholders in relation to

any shareholder resolution of Verici and will vote those Investment

Shares in accordance with such instructions as it receives.

Within 28 days of the expiry of the Lock-up Period, Relevant EKF

Shareholders will be sent a certificate for the number of

Investment Verici Shares indicated above, which shareholders will

then have the option to dematerialise and hold via CREST.

Should a Relevant EKF Shareholder holding their qualifying

interest in EKF via CREST wish to receive their Investment Shares

(i.e. Verici shares from this distribution) in due course directly

into the same account, an announcement will be issued 30 days prior

to end of the Lock-up Period setting out the details of how the

legal title in the Investment Shares can be transferred to you at

the end of the Lock-up Period.

The anticipated timetable for the Dividend is:

EKF ordinary shares marked as ex dividend Start of trading on 23 June

2022

Record Date for the distribution of the Close of business on 24 June

Investment Shares 2022

Transfer of Investment Shares in Verici 27 June 2022

to Broadway as trustee

Lock-up Period ends 26 June 2023

Notes:

1 The following links are the relevant previous announcements in relation to EKF's intentions:

a. Proposed Fundraise (RNS 6654D, 07:10, 4 March 2022)

https://www.londonstockexchange.com/news-article/VRCI/proposed-fundraise/15353841

b. Result of Fundraise (RNS 7473D, 16:13, 4 March 2022)

https://www.londonstockexchange.com/news-article/VRCI/result-of-fundraise/15355048

EKF Diagnostics Holdings plc www.ekfdiagnostics.com

Mike Salter, CEO Tel: +44 (0)29 2071 0570

Marc Davies, CFO

Singer Capital Markets (Nominated Adviser Tel: +44 (0)20 7496 3000

& Joint Broker)

Aubrey Powell / George Tzimas

Investec Bank plc (Joint Broker) Tel: +44 (0)20 7597 4000

Gary Clarence / Daniel Adams / Ben

Farrow

Walbrook PR Limited Tel: +44 (0)20 7933 8780 or ekf@walbrookpr.com

Paul McManus / Lianne Applegarth Mob: +44 (0)7980 541 893 / +44

(0)7584 391 303

About EKF Diagnostics Holdings plc ( www.ekfdiagnostics.com

)

EKF is a leading global diagnostics business with custom

manufacturing facilities across sites in the US, UK and Europe for

a variety of life science products. EKF is focussed on the

following areas:

Point-of-Care Providing a portfolio of Point-of-Care analysers

and consumables, particularly for use in the area

of Hematology and Diabetes, for use in hospital

and research laboratories, doctor's offices, blood

banks and for in-field anaemia screening programmes.

EKF has an estimated 80,000 hemoglobin, hematocrit,

HbA1c, glucose and lactate analysers in regular

use across more than 100 countries.

Central Laboratory Clinical chemistry, Small lab analysers, Centrifuges

Beta-Hydroxybutyrate (<BETA>-HB) LiquiColor,

Glycates Albumin, Glycated Serum Protein, Nitro-tab,

Procalcitonin

Life Sciences Enzyme fermentation, Custom products and Bulk

fermentation

Contract Manufacturing Bulk formulation, Sample collection kits, Private

labelling, Molecular and forensic kits

Laboratory Services In September 2021, EKF completed the acquisition

of Advanced Diagnostic Laboratory LLC ("ADL Health"),

a Texas based testing laboratory certified under

the Clinical Laboratory Improvement Amendments

("CLIA") for high complexity testing. The laboratory

provides testing for a variety of clinical, forensic

and microbiological sample types using a range

of analytical techniques. This acquisition positions

EKF as a leading 'one stop' provider of diagnostic

products and services from sample collection to

results.

EKF's growth strategy to 2024 and beyond can be summarised

as:

-- continuing innovation in products and services in Point-of-Care,

Central Laboratory and Life Sciences leveraging new and existing

routes to market and relationships;

-- investment in expanded production and kitting capabilities to

offer a suite of diagnostic Contract Manufacturing solutions to

third party businesses;

-- expansion of CLIA Laboratories Testing offering, building on the

acquired capabilities in ADL Health; and

-- concluding complementary earnings-enhancing acquisitions with

key strategic value.

EKF will also continue to generate enhanced shareholder value

through:

-- a progressive dividend policy; and

-- its agreement with Mount Sinai Innovation Partners ("MSIP"), which

allows us advanced access to innovative commercial opportunities

and where we can build on the ongoing successes of Renalytix plc,

Verici Dx plc and Trellus Health plc.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAEKNFALAEFA

(END) Dow Jones Newswires

June 20, 2022 02:00 ET (06:00 GMT)

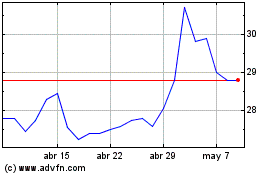

Ekf Diagnostics (LSE:EKF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ekf Diagnostics (LSE:EKF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024