TIDMELIX

RNS Number : 2102F

Elixirr International PLC

18 March 2022

ELIXIRR INTERNATIONAL PLC

("Elixirr", the "Company" or the "Group")

Acquisition of iOLAP Incorporated and FY22 Earnings

Elixirr International plc (AIM:ELIX), the established, global

award-winning challenger consultancy, is pleased to announce the

acquisition of the entire issued share capital of technology and

data firm, iOLAP Incorporated ("iOLAP"), for a maximum total

consideration payable of US$40.0 million (GBP30.4 million) (the

"Acquisition").

The Board is also pleased to update its guidance for the

financial year ending 31 December 2022 ("FY22") to reflect its

current expectation including c.9 months' impact of the

Acquisition. The Board's current expectation is that full year FY22

revenue will be in the range of GBP70 million - GBP75 million with

an Adjusted EBITDA margin in the range of 27-28%.

Highlights

-- iOLAP is a US-headquartered technology services firm with 239

full-time employees specialising in provision of end-to-end data

and advanced analytics services

-- Elixirr's third acquisition since IPO in July 2020 and the

first in the USA, marking another step forward in the Group's

growth strategy

-- The business being acquired recorded revenue in 2021 of

US$22.3 million (GBP16.9 million), normalised adjusted EBITDA of

US$4.2 million (GBP3.2 million) and normalised profit before tax of

US$3.8 million (GBP2.9 million)

-- The initial consideration represents a multiple of 6x 2021 EBITDA

-- The Acquisition brings specialist data and analytics

capabilities, including artificial intelligence (AI) and machine

learning (ML), into Elixirr where there is existing demand for

these services. This will enable Elixirr to form even stronger and

longer-term relationships with its existing clients as they work

together on their toughest business challenges

-- iOLAP generated 94% of its 2021 revenue from US clients with

a similar profile expected this year, resulting in a significant

expansion of Elixirr's US footprint, and delivers work with teams

in the US and Europe

-- The data consulting market is forecast to grow by 32% a year

on average to US$4.2 billion by 2026(1) , meaning this Acquisition

positions Elixirr to maximise its share of that opportunity

-- iOLAP has a very strong reputation in the market - it

outperformed competitors in 93% of the categories measured and

scored by their clients during due diligence, with its main

strengths attributed to technical capability and ability to deliver

proactive insights during client engagements

-- Elixirr has already worked alongside iOLAP on several client

engagements over the past six months, validating the forthcoming

success of this partnership. iOLAP has worked with both Elixirr

consulting clients as well as clients of the other brands within

the Group. Likewise, Elixirr has sold its other brands into current

iOLAP clients. It is a proven relationship where the Group is

particularly excited by the cross-selling opportunity

-- Immediately earnings enhancing

-- Prior to acquisition, certain products were carved out of

iOLAP. All numbers presented in this announcement are reflective of

the acquired ongoing business of iOLAP.

(1)

https://www.industryarc.com/Report/17928/big-data-consulting-market.html

Consideration for the Acquisition

The maximum total consideration payable is US$40.0 million. This

consists of initial cash consideration of US$25.2 million, plus

earn out payments of up to US$14.8 million. The initial cash

consideration will be financed from Elixirr's existing cash

balances, which totalled GBP33.8m at 28 February 2022.

Of the US$25.2 million initial cash consideration, US$14.0

million has been paid to the sellers from Elixirr's existing cash

resources, free of restrictions. The remaining balance of US$11.2

million is subject to a contractual commitment with the sellers to

use the after-tax amount (US$8.5 million) to purchase Ordinary

Shares in Elixirr at a price per share of GBP6.425 by 29 April

2022. The Ordinary Shares will be purchased, at Elixirr's option,

either from the Elixirr International Employee Benefit Trust,

subject to sufficient available supply, or otherwise by way of a

subscription for new Ordinary Shares from Elixirr, or a combination

of both. The balance of this element of the cash consideration

(US$2.7 million) has been paid to the sellers to settle their tax

obligations relating to it.

The remaining consideration is potential earn out payments of

Elixirr Ordinary Shares at the prevailing market price of up to

US$14.8 million, contingent on iOLAP achieving revenue growth and

EBITDA margin growth targets in periods up to 31st December 2024.

This consideration will be satisfied at Elixirr's option to use

either one or a combination of both approaches set out above in

relation to the initial consideration.

The Ordinary Shares purchased pursuant to the Acquisition will

be subject to a one-year lock-in arrangement and limitations on the

Ordinary Shares that each seller can sell in each of the following

three years.

As part of the transaction, iOLAP's largest shareholder has

agreed to sign up to a bonus and commitment agreement through which

he will share a portion of the value of his received consideration

to a further six senior leaders in the firm. The sellers have also

agreed to 3-year restrictive covenant agreements.

Reasons for the Acquisition

iOLAP is a US-based provider of technology solutions, delivering

innovative outcomes with cutting-edge data expertise that brings

efficiency, security, and scale to clients. Its capabilities range

from data science and advanced analytics to modern application

development and AI and ML. The Board believes that combining

Elixirr's deep strategic expertise with the depth of iOLAP's

capabilities presents a unique market opportunity, adding depth to

Elixirr's existing capabilities and enabling the strategy of

acquiring companies with specialism in strategic Board-level

issues.

The combination of Elixirr and iOLAP presents a significant

global opportunity for both companies, with the addition of iOLAP

materially increasing Elixirr's US footprint and team size. Both

firms can work in new industries, due to complementary and additive

client profiles - adding 50+ clients to Elixirr's large and

ever-growing client base and providing access to hundreds of new

clients for iOLAP. Elixirr will also be able to leverage iOLAP's

European delivery team across its global clients, creating further

opportunity to add value to clients and shareholders alike.

In a recent client survey iOLAP was rated 23% higher than their

competition. It outperformed the competition in 93% of the

categories measured, with its main strengths attributed to

technical capability and proactive insights.

iOLAP was co-founded by Chris Jordan (CEO and President), and

together with Chris is currently led by Craig Rich (Managing

Partner) and Don Mettica (Managing Partner). Chris, Craig and Don

will continue to lead the business from Dallas, Texas following the

Acquisition.

Founder & CEO of Elixirr, Stephen Newton said:

"I'm delighted to welcome iOLAP as the latest addition to

Elixirr, one of the most significant growth milestones in our

firm's history.

As organisations continue to embark on digital transformation

and operate in an increasingly customer-centric world, it is

crucial for business leaders to put data at the heart of their

strategy in order to stay ahead. iOLAP's offering in this space,

combined with the scale at which they operate in both the US and

European markets makes this acquisition incredibly exciting.

Combining iOLAP's expertise in data and analytics with Elixirr's

deep strategic and business consulting experience will ensure we

continue to stay at the heart of key boardroom challenges. In iOLAP

we see a group of culturally aligned entrepreneurs, who are driven

by intellectual curiosity and a desire to solve problems for their

clients and I truly believe that our combined proposition offers

something unique in the market.

I can't wait to see what the future holds for Elixirr with the

addition of iOLAP, as we continue in our quest to truly redefine

our industry and be the best consulting firm in the world.

CEO of iOLAP, Chris Jordan said:

"After growing significantly over the last few years, we were

looking for a model to ensure we maintain momentum and Elixirr is

the perfect partner for this. Combining our technical expertise

with Elixirr's strategic competencies allows us to satisfy greater

demands from our existing and future client bases, and the

respective client bases our companies hold in different geographies

present significant growth opportunities.

We have already proven the power of our partnership, having

worked together on several client projects over the last six

months, and it's clear that there is an appetite from our clients

for a combined proposition. Joining Elixirr will also provide

opportunities for our employees to further develop their careers

and take on more of an owner mentality, through the various equity

incentive schemes that the firm has in place.

We are excited for the future, and look forward to delivering

more value for our combined client base, as part of Elixirr!"

Elixirr International plc

Stephen Newton, CEO

Graham Busby, CFO

Public and Investor Relations contacts:

Caroline Pitt

investor-relations@elixirr.com

finnCap Ltd (Nominated Adviser & Sole

Broker)

Christopher Raggett, Kate Bannatyne +44 (0) 20 7220

(Corporate Finance) 0500

Alice Lane, Sunila De Silva (ECM)

For further Information please contact:

About Elixirr International plc

Elixirr is an established global award-winning management

consultancy, challenging the larger consultancies by delivering

innovative and bespoke solutions to a repeat, globally-recognised

client base.

Elixirr was founded in 2009, by Stephen Newton, Graham Busby,

Ian Ferguson, Andy Curtis and Mark Goodyear, experienced business

advisors who identified a market opportunity to provide bespoke,

personal services as a 'challenger' to the traditional consultancy

businesses in the market. Elixirr guides its clients to overcome

challenges such as: future-proofing against technological

disruption; development and roll-out of new propositions, products

and services; incubating new businesses; navigating a more complex

and multinational regulatory environment; and project management

and implementation of major change programmes.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQMZGMFMNNGZZZ

(END) Dow Jones Newswires

March 18, 2022 03:01 ET (07:01 GMT)

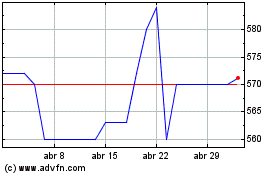

Elixirr (LSE:ELIX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Elixirr (LSE:ELIX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024