Elementis PLC Trading Update (1883N)

19 Enero 2023 - 1:00AM

UK Regulatory

TIDMELM

RNS Number : 1883N

Elementis PLC

19 January 2023

Elementis plc

Trading Update

Full-year results in line with expectations; leverage reduction

on track

Elementis plc ("Elementis" or the "Group"), a global specialty

chemicals company, today issues a trading update for the three

months and year ended 31 December 2022(1) .

Business performance

The Group delivered a solid performance during the fourth

quarter, despite experiencing weaker trading conditions as the

macro-economic environment deteriorated through the period.

Underlying operating profit for 2022 (including Discontinued

Operations) is expected to be in the range $120-123m, in line with

market expectations(2) and significantly ahead of the prior

year.

-- Coatings performed well, with pro-active pricing actions and

product mix improvement offsetting weaker demand in European and

Asian markets and customer destocking.

-- Personal Care continued to perform strongly. In Cosmetics,

pricing actions more than offset continuing cost inflation and some

weakening of demand in certain regions. AP Actives demand remained

robust.

-- Talc performance remained materially below the prior year,

due to continued volume weakness in its European markets, in

particular automotive, and higher energy and logistics costs.

Balance Sheet

Net debt at the end of 2022 is anticipated to be approximately

$367m (excluding lease liabilities), representing a leverage ratio

of 2.2x net debt to EBITDA(3) , down from 2.6x at the start of the

year.

The sale of the Chromium business remains on track to complete

during the first quarter of 2023 and to deliver net cash proceeds

of approximately $107m, further reducing the Group's leverage

ratio.

Preliminary full-year 2022 Results will be released on 7 March

2023.

Enquiries :

Elementis plc

David Boyd, Investor Relations Tel: +44 7764 905135

Tulchan

Martin Robinson Tel: 020 7353 4200

Olivia Peters

(1) Including the Chromium business which will be reported in

2022 as "Asset Held for Sale" and "Discontinued Operation".

(2) Based on company compiled consensus, the Board believes the

average market forecast for 2022 adjusted operating profit

(including Discontinued Operations) to be $121m.

(3) Excluding IFRS 16 impact

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTMZGMMRRRGFZM

(END) Dow Jones Newswires

January 19, 2023 02:00 ET (07:00 GMT)

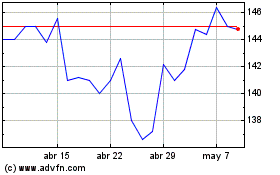

Elementis (LSE:ELM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Elementis (LSE:ELM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024