TIDMEML

RNS Number : 1087X

Emmerson PLC

31 December 2021

Emmerson Plc / Ticker: EML / Index: LSE / Sector: Mining

31 December 2021

Emmerson Plc ("Emmerson" or the "Company")

End of Year Newsletter

Emmerson Plc ("Emmerson" or "the Company"), the Moroccan focused

potash development company, is pleased to announce that a

Shareholder Newsletter has been uploaded to the Company's website

at www.emmersonplc.com. The letter, which reflects on the major

developments for the Company and the potash industry during 2021,

can be found using the following link

http://www.rns-pdf.londonstockexchange.com/rns/1087X_1-2021-12-30.pdf

, and also below.

Dear Shareholder,

2021 has been a successful year for Emmerson and major strides

have been made towards achieving our target of first production at

the Khemisset Potash Project ('Khemisset' or 'the Project') in

Morocco. The icing on the cake came in the form of a strategic

financing deal of up to $46.75 million in November 2021 and

accordingly, we look forward to 2022 with confidence as we

fast-track the development of Khemisset into a low cost, high

margin supplier of potash - the first primary producer on the

African continent.

2021 Key Milestones

-- In February, we received the Mining Licence ('ML') for

Khemisset from the Moroccan Ministry of Energy, Mines and the

Environment, providing the exclusive right to develop and mine the

potash deposit.

-- In April, we were delighted to join AIM to provide access to

a larger and more entrepreneurial market with an environment more

suited to our size and strategy.

-- In September, our Interim Results highlighted the strength of

the global potash market, which clearly improve the Project's

already outstanding economics: using current spot price

assumptions, our post-tax NPV is pushed from a very respectable

US$1.4 billion to US$3.9 billion and IRR of over 85.4%, while

average life of mine post tax cashflow increases to US$558 million

per annum for an initial 19-year life of mine(1) .

-- A major step to unlocking the full potential value of

Khemisset was achieved in November, when we announced a Strategic

Investment of up to US$46.75 million - the upfront cash injection

enables us to advance the next stage of the Project's development,

the basic engineering and operational developments, while the

remaining $40m is available for drawdown as necessary, potentially

as part of the project finance.

-- Finally, in December, the Project moved into the

pre-construction phase of development with the award of the primary

Basic Engineering contract to Barr Engineering for the Mineral

Processing Facility. We have also received bids for the balance of

the Basic Engineering packages of the Project, comprising highways

connection and site access; portal and declines; mine site

infrastructure; tailings storage facility; electrical power; and

water.

(1) Using the Dec 2021 spot price for granular MOP in Brazil,

with all other inputs the same as the 2020 Feasibility Study.

Strategic Investment

The strategic investment by Singaporean fund Global Sustainable

Minerals ("GSM") and Gold Quay Capital (the "Investors") is of

great value to the Company because of the significant financial and

strategic support it confers. GSM is funded by entities controlled

by Mr. Indra Widjaja and he, and his family, are among the

wealthiest people in South-East Asia, with significant investments

across many industries including, most importantly for Emmerson,

agriculture and mining. The Widjaja Family are best known as the

owners of the Sinar Mas Group ("Sinar Mas"), which is a very

well-known South-East Asian conglomerate and one of the largest

companies in Indonesia. Sinar Mas operates large, geographically

diverse, businesses across numerous verticals including real estate

and construction, financial services, telecoms and technology, food

and agribusiness and mining, with estimated group annual revenues

of more than US$30 billion in 2018.

The investment has been structured by way of an initial equity

investment and a second investment via a mandatory convertible

note. The mandatory convertible note can be drawn upon satisfaction

of certain conditions, most notably the completion of the project

financing for the Project. The mandatory convertible nature of the

investment means once the instrument is drawn it will always

convert to equity. Therefore, investors should consider this as a

form of deferred equity, at a significant premium to the current

share price, to support the development of Khemisset.

Having the backing of such a powerful investor group puts the

Company in a strong position as we move to the development of

Khemisset, in particular with the ongoing project finance

negotiations with a syndicate of banks. We welcome the Investors to

the register and look forward to continuing to strengthen our

partnership with them as we move to become the first MOP producer

in Africa.

Ongoing Work

The Environmental and Social Impact Assessment ('ESIA')

submission is awaiting the final approval and the Company has

completed various submissions to government agencies including the

water authority, l'Agence du Bassin Hydraulique de Sebou, Regional

Department of Environment, Regional Department of Forestry, and

Regional Centre of Investment, as well as the public enquiry

process with no objections and full support from local

stakeholders.

Work relating to the technical aspects of the design and

engineering to take the Project towards construction readiness such

as additional geophysical surveys and shallow drilling to further

characterise the near surface geology, decline alignment drilling

and further deep drilling for detailed mine design are underway.

Progress is also being made with developing the Project's execution

plan with constructive engagement with potential engineering and

EPCM partners. A contract has now been signed for the basic

engineering of the process plant with Barr Engineering, a

multi-award-winning engineering firm based in Minneapolis, USA.

Negotiations for the contracts covering the engineering of all

other work packages for the project are now at an advanced stage

and should be awarded shortly.

The land acquisition programme is advancing with relevant owners

and stakeholders identified in addition to engagement with the

relevant authorities in relation to the water and power supply

routes to site and the highways connection.

Project Finance Update

During 2021 in the various webinars and investor updates it has

been explained that we have been able to advance the project

finance in parallel with the other workstreams. As mentioned above,

the whole debt process has benefitted substantially from the

strategic equity investment. I am pleased to report that we have

not only engaged with a number of international and Moroccan banks,

but also that the initial due diligence has now been completed.

This means that we move to the next stage where we confirm the

Managing Lead Arrangers ("MLAs") - we expect to be in position to

update the market on this in the first quarter of 2022.

Team Appointments

As the Project moves into the construction phase, we have

strengthened the team at every level to support this transition. We

have hired a Project Controller, Josh Mitchell, who has hit the

ground running with the identification, budgeting and now

negotiation of the basic engineering contracts who is being

supported by our new Project Engineering Manager Haitam Ennadif who

is based in Morocco.

At board level, James Kelly replaced Mark Connelly, who retired

in April 2021. James has over 20 years of experience in the mining

sector, particularly in the areas of corporate finance and

financing strategy. Additionally, Rupert Joy, who has high level

international experience including seven years as a diplomat in

Morocco, joined as a Non-Executive Director.

Morocco

The Company has worked hard during 2021 to build the foundations

of a long-term partnership with Morocco, one of the region's most

dynamic economies and a welcoming environment for foreign direct

investment. The Kingdom's expertise in fertiliser production and

emerging position as an African leader in agriculture, water

management and renewables make it an ideal partner for Emmerson.

The Project is anticipated to bring substantial social and economic

benefits to the region of Khemisset, as identified in the

socio-economic study and based on both the significant investment

over the life of the mine and the creation of over 2,000 direct and

indirect jobs.

Potash Industry

As shareholders will be aware, potash is a widely used

fertiliser and plays a central role in feeding the world's growing

population. Potash has many benefits including increased crop

quality and yield, improved uptake of nitrogen and more efficient

use of water.

Potash (MOP) accounts for 95% of global demand for the vitally

important potassium fertilisers. There is no substitute for potash,

with MOP continuing to be the cheapest and most utilised source of

potassium for agricultural processes globally.

Annually, global potash (MOP) consumption in 2017 was 64m

tonnes, growing to 71.6m tonnes in 2020, with this figure forecast

to further increase over the next decade to 84m tonnes in 2029.

This is an average increase of 2.6% per annum for the consumption

of MOP globally. Improving yields to feed the growing population

are just a few of the drivers in this growth in demand for potash,

and these drivers are only going to grow in decades to come. These

factors have seen prices of fertilisers grow significantly over the

past 12 months, with potash doubling or tripling in price depending

on buyer. Tightened supply alongside robust demand and increasing

crop prices will see prices for MOP to remain at strong levels over

the next decade.

As the first commercial potash mine in Africa, Emmerson is

expected to benefit from the high growth forecasted for fertilisers

across the African continent.

Looking Ahead

We have some major targets to hit in 2022, not least the

successful receipt of our ESIA permit, and the project finance

facility to be finalised. However, with a mining licence secured,

strong balance sheet, very robust market fundamentals, supportive

shareholders and stakeholders, and an exceptional team, we expect

2022 to be a transformational year for Emmerson.

I would like to take this opportunity to thank our shareholders

for their ongoing support and wish you all a very happy and healthy

New Year.

Graham Clarke

CEO

**ENDS**

For further information, please visit www.emmersonplc.com ,

follow us on Twitter (@emmerson_plc), or contact:

Emmerson Plc +44 (0) 20 7236

Graham Clarke 1177

Shore Capital (Nominated Adviser and Joint Broker) +44 (0)20 7408

Toby Gibbs / John More 4090

Shard Capital (Joint Broker) +44 (0)20 7186

Damon Heath / Isabella Pierre 9927

St Brides Partners (Financial PR/IR) +44 (0)20 7236

Susie Geliher / Isabel de Salis 1177

Notes to Editors

Emmerson's primary focus is on developing the Khemisset project

("Khemisset" or the "Project") located in Northern Morocco. The

Project has a large JORC Resource Estimate (2012) of 537Mt @ 9.24%

K2O and significant exploration potential with an accelerated

development pathway targeting a low capex, high margin mine.

Khemisset is perfectly located to capitalise on the expected growth

of African fertiliser consumption whilst also being located on the

doorstep of European markets. This unique positioning means the

Project will receive a premium netback price compared to existing

potash producers. The need to feed the world's rapidly increasing

population is driving demand for potash and Emmerson is well placed

to benefit from the opportunities this presents. The Feasibility

Study released in June 2020 indicated Khemisset has the potential

to be among the lowest capital cost development stage potash

projects in the world and also, as a result of its location, one of

the highest margin projects. This delivered outstanding economics

including a post-tax NPV10 of approximately US$1.4 billion using

industry expert, Argus', price forecasts.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFSDFFLIVIL

(END) Dow Jones Newswires

December 31, 2021 01:59 ET (06:59 GMT)

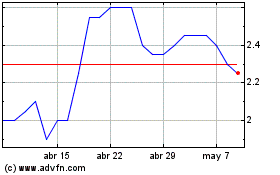

Emmerson (LSE:EML)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Emmerson (LSE:EML)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024