Emmerson PLC Mandated Lead Arrangers Appointed for Financing (7901P)

14 Febrero 2023 - 1:00AM

UK Regulatory

TIDMEML

RNS Number : 7901P

Emmerson PLC

14 February 2023

Emmerson PLC / Ticker: EML / Index: AIM / Sector: Mining

14 February 2023

Emmerson PLC ("Emmerson" or the "Company") appoints Mandated

Lead Arrangers

for Khemisset Mine Project Financing

Emmerson, the Moroccan focused potash development company, is

pleased to announce the appointment of a syndicate of leading

international and Moroccan banks as initial mandated lead arrangers

("MLAs") to co-ordinate and fund dual-tranche debt financing

facilities for the development of the Company's Khemisset Potash

Project in Morocco (the "Project").

The four MLAs selected are ING Bank , Banque Centrale Populaire,

Bank of Africa (Groupe BMCE) and one further international European

Bank. ING Bank is mandated to act as Export Credit Agency ("ECA")

Co-ordinator and Documentation Bank. Based on current discussions,

the US$310 million dual-tranche project financing will be split

between an ECA covered tranche led by UK Export Finance ("UKEF") of

US$230 million and a dual currency (US$ and Moroccan Dirham)

commercial tranche of US$80 million.

Graham Clarke, CEO of Emmerson commented: "We are delighted to

have received strong demand for the project financing from both

lenders and ECAs, and our selection of MLAs with significant

international and domestic expertise in natural resources project

financing reflects the quality of the Khemisset Project, Morocco as

an investment jurisdiction, and market recognition of the critical

importance of potash in the context of international food security.

The appointment of the MLAs represents an important milestone in

the Company's progress towards establishing Africa's first

commercial potash mine for nearly 50 years."

Sender International Ltd and Colosseum Development (Morocco) are

advising Emmerson on the debt financing of the Project, working

alongside Tamesis Partners LLP as the Company's financial adviser

for the financing of the Project. The Company has also appointed

Pillsbury Winthrop Shaw Pittman LLP as legal counsel in respect of

the debt financing.

**ENDS**

For further information, please visit www.emmersonplc.com ,

follow us on Twitter (@emmerson_plc), or contact:

Emmerson PLC +44 (0) 20 7236

Graham Clarke / Jim Wynn / Charles Vaughan 1177

Liberum Capital Limited ( Nominated Adviser

and Joint Broker) +44 (0)20 3100

Scott Mathieson / W illiam King 2000

Shard Capital Partners (Joint Broker) +44 (0)20 7186

Damon Heath / Isabella Pierre 9927

St Brides Partners (Financial PR/IR) +44 (0)20 7236

Susie Geliher / Isabelle Morris 1177

Notes to Editors

Emmerson is focused on advancing the Khemisset project

("Khemisset" or the "Project") in Morocco into a low cost, high

margin supplier of potash, and the first primary producer on the

African continent. With an initial 19-year life of mine, the

development of Khemisset is expected to deliver long-term

investment and financial contributions to Morocco including the

creation of permanent employment, taxation and a plethora of

ancillary benefits. As a UK-Moroccan partnership, the Company is

committed to bringing in significant international investment over

the life of the mine.

Morocco is widely recognised as one of the leading phosphate

producers globally, ranking second in the world in terms of tonnes

produced annually, and the development of this mine is set to

consolidate its position as the most important fertiliser producer

in Africa. The Project has a large JORC Resource Estimate (2012) of

537Mt @ 9.24% K2O, with significant exploration potential, and is

perfectly located to support the expected growth of African

fertiliser consumption whilst also being located on the doorstep of

European markets. The need to feed the world's rapidly increasing

population is driving demand for potash and Khemisset is well

placed to benefit from the opportunities this presents. The

Feasibility Study released in June 2020 indicated the Project has

the potential to be among the lowest capital cost development stage

potash projects in the world and also, as a result of its location,

one of the highest margin projects. This delivered outstanding

economics, including a post-tax NPV(8) of approximately US$1.4

billion using industry expert Argus' price forecasts, and the spot

price for granular MOP fertiliser has since risen, further

enhancing the valuations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAEADFDADEAA

(END) Dow Jones Newswires

February 14, 2023 02:00 ET (07:00 GMT)

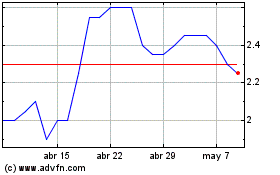

Emmerson (LSE:EML)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Emmerson (LSE:EML)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024