TIDMEMR

RNS Number : 8924N

Empresaria Group PLC

26 January 2023

26 January 2023

Empresaria Group plc

("Empresaria" or the "Group")

Trading Update and Notice of Results

Solid net fee income growth with full year profits expected to

be in line with market forecasts

Empresaria (AIM: EMR), the global specialist staffing group,

today provides a trading update for the financial year ended 31

December 2022 ahead of announcing its full year results on 28 March

2023.

Trading update

-- Net fee income up 10% to GBP65.4m (up 8% in constant currency)

-- Adjusted profit before tax and diluted earnings per share

expected to be in line with market expectations

-- Adjusted net debt of GBP7.9m, significantly better than market expectations

-- Very strong performance from APAC and Offshore Services with

net fee income up 75%, outweighing reductions in UK & Europe

and Americas

-- Communicated roadmap to deliver our ambition to double

adjusted operating profit in the medium term

The first half of the year saw greater growth (+15%) reflecting

a strong recovery in client demand particularly for permanent

placements. While solid growth continued into the third quarter,

growth eased in the fourth quarter reflecting a strong prior year

comparative and some reduction in demand from specific clients in

key sectors such as IT.

The Group has continued to invest for the future and

communicated its roadmap to double adjusted operating profit to

GBP20m in the medium term at a capital markets day in October 2022.

The actions outlined remain on track and delivery against this plan

continues to be a key focus.

Financial position

Adjusted net debt has significantly reduced at 31 December 2022

to GBP7.9m, GBP6.1m lower than 31 December 2021 and GBP2.9m lower

than 30 June 2022. This reflects the profits generated by the Group

in the year, along with a reduction in working capital requirements

driven by a move in the weighting of revenue from temporary and

contract to permanent placements. Headroom, excluding invoice

financing, has increased to GBP17.9m.

Performance by sector

Net fee income by sector for the year ended 31 December was as

follows:

% change

(constant

GBPm 2022 2021 % change currency)*

------------------- ------ ------ --------- ------------

UK & Europe 28.4 29.0 -2% -2%

APAC 15.8 14.1 +12% +12%

Americas 8.7 9.9 -12% -19%

Offshore Services 13.5 7.7 +75% +67%

Intragroup (1.0) (1.2) -17% -17%

------------------- ------ ------ --------- ------------

Total 65.4 59.5 +10% +8%

------------------- ------ ------ --------- ------------

* The constant currency movement is calculated by translating

the 2021 results at the 2022 exchange rates.

The UK & Europe saw mixed performances in 2022 with net fee

income falling by 2%. In the UK, net fee income was up by 3% with

strong growth in Professional, driven by increased permanent

placement demand, offset by a weaker performance in IT. In our

blue-collar Commercial businesses in Germany, we saw good recovery

in our logistics operation which returned to growth after a

challenging 2021, however, our temporary business was adversely

impacted by client supply chain issues earlier in the year and

higher sickness levels resulting in net fee income falling year on

year.

In APAC, year-on-year net fee income growth of 12% reflected

strong performances across most of the region with record net fee

income in Singapore, Indonesia, Philippines, Thailand and Japan

driven by growth in our Professional and IT sectors. Aviation

failed to improve significantly in 2022, with recovery in our core

Asia market lagging behind that in the US and Europe, reflecting

the continued closure of China throughout 2022 and significant

restrictions on travel to Japan.

In the Americas, net fee income fell by 12% with the main driver

being the expected reduction in Healthcare in the US following an

extremely strong 2021 that was driven by COVID-19 vaccination and

testing related demand. Our US IT business also had a challenging

year, particularly in the second half where our permanent

recruitment offering was impacted by significant technology

lay-offs at key clients.

Offshore Services had a very strong 2022 with net fee income up

75% year-on-year. UK demand, driven by healthcare, remained very

strong and continued to grow throughout the year. The US was more

challenging primarily driven by reduced demand from the IT

sector.

Rhona Driggs, CEO of Empresaria, commented:

"We are pleased with our overall progress and performance in the

year. As we move into 2023, we look ahead with some caution given

the wider economic environment, however, we are continuing to see

strong demand in many of our markets largely driven by ongoing

skills and labour shortages.

The transformation of the Group in recent years, along with the

proven benefits from our diversification by geography and sector,

improves our resilience and provides us with a strong foundation

for growth. Executing our 'Roadmap to GBP20m' remains our key focus

and we are confident we are well placed to deliver on our

medium-term ambition to double our adjusted operating profit."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the UK version of the EU Market Abuse Regulation (2014/596) which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended and supplemented from time to time.

- Ends -

Enquiries:

Empresaria Group plc via Alma PR

Rhona Driggs, Chief Executive Officer

Tim Anderson, Chief Financial Officer

Singer Capital Markets (Nominated

Adviser and Broker)

Shaun Dobson / James Moat 020 7496 3000

Cenkos Securities plc (Joint Broker)

Katy Birkin / Charlie Combe (Corporate

Finance)

Michael Johnson / Jasper Berry (Sales) 020 7397 3900

Alma PR (Financial PR) 020 3405 0205

Sam Modlin empresaria@almapr.com

Hilary Buchanan

Pippa Crabtree

Notes for editors:

-- Empresaria Group plc is a global specialist staffing group.

We are driven by our purpose to positively impact the lives of

people, while delivering exceptional talent to our clients

globally. We offer temporary and contract recruitment, permanent

recruitment and offshore services across six sectors: Professional,

IT, Healthcare, Property, Construction & Engineering,

Commercial and Offshore Services.

-- Empresaria is structured in four regions (UK & Europe,

APAC, Americas and Offshore Services) and operates from locations

across the world including the four largest staffing markets of the

US, Japan, UK and Germany along with a strong presence elsewhere in

Asia Pacific and Latin America.

-- Empresaria is listed on AIM under ticker EMR. For more

information visit empresaria.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFIALRIEFIV

(END) Dow Jones Newswires

January 26, 2023 02:00 ET (07:00 GMT)

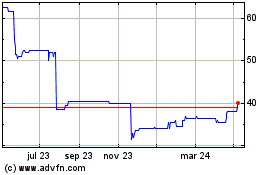

Empresaria (LSE:EMR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

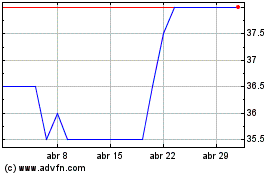

Empresaria (LSE:EMR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024