TIDMENET

RNS Number : 2047A

Ethernity Networks Ltd

22 September 2022

22 September 2022

ETHERNITY NETWORKS LTD

("Ethernity" or the "Company" or the "Group")

Interim results for the six months ended 30 June 2022

Ethernity Networks Ltd (AIM: ENET.L; OTCQB: ENETF), a leading

supplier of networking processing semiconductor technology ported

on FPGA (field programmable gate array) for virtualised networking

appliances, announces its interim results for the six months ended

30 June 2022.

Financial summary

-- Revenues lower than the comparable period by 26.22% to $704,853 (H1 2021: $955,371).

-- Gross margin lower by 29.23% at $428,761 over the comparable

period (H1 2021: $605,852) due to mix of product sales.

-- Gross margin percentage of 60.83% (H1 2021: 63.42%).

-- Net Comprehensive Loss for the period reduced by $897,216 to

$3,502,733 (H1 2021: $4,399,949).

-- Research and Development, General and Administrative, and

Marketing expenses (before amortisation, depreciation and IFRS

adjustments) increased by an overall 29.94% due mainly to the

planned increase in Research and Development resources.

-- EBITDA loss increased by 46.35% to $3,620,171 (H1 2021:

$2,473,686), driven by the increase in the planned Research and

Development costs.

-- Component inventories increased by $520,000 to $646,000 (H1

2021: $124,000) as the Company increased inventories on hand to

meet deliveries due to the effects of the ongoing worldwide

component shortages.

Current trading

Revenues to 31 August 2022 were 36% higher than the comparable

period of 2021, as a result of an increase in activity in the

second half of the year to date, with the July and August 2022

revenues being similar in value to the entire H1 2022 revenue.

The Company signed a new $4.6 million contract with an existing

customer, a broadband network OEM as a follow-on to a prior

contract, to supply system-on-chip (SoC) devices with support for

Gigabit Passive Optical Networking (GPON) Optical Line Termination

(OLT), adapted to enable Fiber-to-the-Room (FTTR) deployments.

Fiber-to-the-Room is a disruptive trend that is built on top of

the Fiber-to-the-Home market estimated by Global Industry Analysts

Inc. to reach $29.7 billion by 2026) and that uses passive optical

fiber to reach residential, retail and enterprise deployments.

Passive fiber optic deployments provide greater reliability and

performance than Wi-Fi and a greener and more power efficient

solution than traditional copper cabling. By bringing fiber into

the individual rooms of an apartment or small office, end users can

benefit from higher throughput with an unmatched level of service

to enable today's most data-hungry applications without

experiencing lags.

On 8 September 2022, the Company announced the commencement of

trading in the Company's ordinary shares ("Ordinary Shares") on the

OTCQB Venture Market ("OTCQB"), in the United States, under the

ticker symbol "ENETF". Cross trading on the OTCQB allows the

Company access to one of the world's largest investment markets to

expand its reach into a broader pool of investors. Ethernity's

shares are available to US investors during US working hours and

priced in US dollars, which has the potential to enable greater

liquidity in the Company's Ordinary Shares on AIM by easing

cross-border trading for potential US investors.

Company Strategy

The Company is operating in the competitive and growing Telecom

industry offering and delivering innovative semiconductor

technology, system platforms and differentiated offerings related

to the 5G infrastructure market all based on the Company's

semiconductor data processing technology, as patented programmable

technical innovations to accelerate the telco/cloud network, each

with its own set of rich networking and security features, to

address the requirements of various markets.

As they do not detract from our continued strategy, the

opportunities that are arising for the Company from the worldwide

component shortages as outlined further in this report will be

pursued, as they remain within the overall strategy.

The Management believes that the current signed contracts and

orders received and expected, along with the many other ongoing

customer discussions and potential opportunities, show that our

unique and value-added offerings can capture significant interest

in this market. With our main goal of becoming a supplier of

customised and differentiated system and SoC solutions, we have

elevated our offerings in the value chain. This focused and

comprehensive strategy allows us to capture multiple times more

revenue per unit as compared to that which can be derived from only

selling FPGA code.

Whilst historically most of the Company's principal revenues

have been generated from licensing and royalties, in H1 2022, 59%

of revenues were derived from the change in the mix towards supply

of our data processing FPGA SoC and Devices.

Half Year Review

The worldwide component shortage

The first half of 2022 was a challenging period for the Company

as, subsequent to the Company having concluded a number of systems

contracts, the worldwide component shortage and the unforeseen

effects thereof started to impact on the Company and its customers.

The Company was proactive in this area by procuring and investing

in component inventory where it could, to ensure it was capable of

delivering on various contracts. This is evidenced by the

significant increase of inventories as shown in the balance

sheet.

Impact on the Company

As the Company faced the components challenges, while

progressing talks with new and existing customers, we could not

commit to new possible contracts and opportunities because of the

uncertainty of component supply. Along with this, the components

shortages not only delayed deliveries to customers, but our

customer orders were also extended by them as they felt the effects

of the shortages on their own operations and deployments.

Furthermore, the situation resulted in exponential increases in

the price of components, bringing the costs of the systems

solutions and their economic viability for the customers into

question.

Opportunities for the Company due to the worldwide shortages

During the period under review, supply chain issues created

opportunities for the Company. As component shortages continued, we

experienced a slight impact, as did larger system vendors.

This has created opportunities for the Company in that the

system vendor customers are searching for alternative solutions,

which include evaluating options to design their own Application

Specific Integrated Circuit (ASIC) so as to allow them to overcome

and control the critical components of their solutions and to

control their costs. Therefore, the vendors have started looking to

development of ASICs as an alternative, as these allow for a

significantly lower cost alternative for them.

This has built new industry verticals and market opportunities

for the Company to leverage our existing semiconductor technology

and IP for use on potentially larger volume ASICs. To this end, the

Company is currently in advanced discussions with existing and

potential customers. There is significant interest in both our data

processing SoC technology and our PON MAC SoC technology.

Operational highlights

During H1 2022 our activities have progressed in multiple

domains:

-- Continued deliveries and growth in our fixed wireless OEM

business, expecting to complete shipment by the end of 2022 of the

entire $2.2 million order for our Data processing SoC on FPGA as

planned for 2021 and 2022.

-- Further development on a 2(nd) generation FPGA product based on Ethernity's advanced offering.

-- Progress in the development of our UEP2025 product, in

preparation for supply as a completed product towards the end of

the year to potential customers.

-- Significant progress on the PON devices for current contracts

and for offerings to potential customers, to expand significantly

over and above the current $3 million delivery contract for PON,

where the first 10G PON (XGS-PON platform) completed development by

our Customer, with planned deployment during Q1/23.

-- The Company continues with engagements and discussions on our

groundbreaking offering based on the ACE-NIC100 for Distribution

Unit (DU) vRouter offload for 5G private networks.

Outlook for 2022 and 2023

2022

-- The shortage of components, including the current schedule of

FGPA deliveries from suppliers, as well as the cancelled customer

contract announced on 1 September 2022, has reduced the Company's

previously notified revenue expectations for 2022.

-- Based on the current contract pipeline and component delivery

schedule, the Management expect full year revenue to be in the

region of $3.6 million

-- Further discussions anticipated with customers for the Company's offerings of the UEP2025.

-- New discussions for a second generation (Gen2) product and

development for the fixed wireless customer.

-- Our PON technology offering is now creating great interest

for use on low port count OLT platforms, as well as for optical SFP

with single-port XGS-PON and GPON.

-- Currently in discussions with large companies for channel

market and sales of our UEP2025 and its variants for the WISPs

(wireless internet service providers) in the USA.

2023

-- Outlook remains as previously noted, with increased

visibility based on the PON and XGS-PON contracts signed and $6

million in orders under current contracts.

-- Potential for further revenue contribution, over and above the contracted orders, from:

-- Anticipated contract wins from existing customers of FPGA

SoC, which would lead to growth over 2022 with upside opportunities

from follow-on platform deployments.

-- New discussions progressing for UEP cell site routers and

ACE-NICs for the 5G and vRouter markets.

-- Continued positive engagements and discussions with current

and potential new customers on the UEP2025.

-- Continued positive engagements and discussions for our

existing semiconductor technology and IP for use on a potentially

larger volume ASIC.

The Board remains confident that, based on the current

contracts, continued increased customer engagements, focus on

delivery of solutions and the anticipated customer deployments now

being realised, Ethernity will meet its long-term objectives and is

well positioned to become one of the key solutions providers in its

marketplace. The Company continues to experience an increase in the

outreach by OEMs and operators interested in Ethernity's solutions,

where these solutions are proving increasingly aligned with

operators' strategy with their customers in their marketplaces.

Network service providers are requiring more flexible solutions to

their technology and network needs for offloading support of new

data appliances introduced by the market. Ethernity believes it has

the best-in-class system solutions to address these needs.

In summary, the business, engagements and new opportunities

remain positive and intact, however the Company recognises possible

effects due to customer and component delays.

During 2023 and beyond, the Company anticipates generating

further revenues from its FPGA SoC, UEP cell site routers and

ACE-NICs for the 5G and vRouter markets, PON devices, and advances

on ASIC developments with significant year-on-year revenue growth

anticipated from product orders and contracts already signed, in

particular our long-term contracts for Fixed Wireless Access and

PON business. Resulting from the new contracts and orders, and

notwithstanding the delays as mentioned above, the Company is

satisfied that is has sufficient financial resources to meet its

ongoing obligations and operating requirements for 2022.

David Levi, Chief Executive Officer of Ethernity Networks Ltd,

commented:

"The positive mix of product, royalties and licensing revenues

reflects the progress in our current strategy and are pleased to be

continuing the evolution of the Company, with our strategy to focus

on product and system revenue business. We do, however, continue to

be mindful of the fact that delays from the component shortage

situation experienced by our customers could defer planned Q3 and

Q4 2022 revenues into the latter portions of Q1 and Q2 2023. We are

excited by the opportunities being presented by the components

shortages to leverage our data processing SoC technology and IP, as

well as our PON semiconductor technology.

"The product contracts already signed, the product orders

received (which are expected to grow), and the good progress in the

PON devices business will all fuel our revenue growth to position

us not just as a technology company, but as a validated

semiconductor and system product supplier with differentiated

offerings, resulting in growing revenue streams that will allow us

to be considered for larger scale deployments."

For further information, please contact:

Ethernity Networks Ltd Tel: +972 8 915 0392

David Levi, Chief Executive Officer

Mark Reichenberg, Chief Financial Officer

Allenby Capital Limited (Nominated Adviser Tel: +44 (0)20 3328

and Joint Broker) 5656

James Reeve / Piers Shimwell (Corporate

Finance)

Amrit Nahal (Sales and Corporate Broking)

Peterhouse Capital Limited (Joint Broker) Tel: +44 (0)20 7562

0930

Lucy Williams / Duncan Vasey / Eran Zucker

Harbor Access Inc (US Investor Relations) Tel: +1 (475) 477

Jonathan Paterson 9401

MARKET ABUSE REGULATION

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse (amendment) (EU Exit) Regulations 2019/310

("MAR"). With the publication of this announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

OPERATIONAL and financial REVIEW

Over the past six-month reporting period we continued with our

goals to progress and diversify the Company's offerings to include

systems solutions in addition to IP licensing and services, and

this has been evidenced in the accomplishments and engagements

attained over the 18 months.

During the period under review, the Company delivered revenues

of $704,853 (H1 2021: $955,371) and a gross profit of $428,761 (H1

2021 $605,852). Revenues, while lower than the comparable period,

are a reflection of the timing on deliveries as per the orders. In

July and August 2022, revenues were similar in value to that of the

entire H1 2022 period. As in the past, the greater majority of

revenues are expected to be earned in the second half of the

financial year. Booked revenues for the year to 31 August 2022 were

36% higher than the comparable period of 2021.

The gross profit margin of 60.83% is similar in range to H1 2021

of 63.42%, due to the different product mix within the revenue. In

the past, design wins and royalty revenue contributed

proportionately significantly more to revenues, however the focus

on being a solutions provider has resulted in the mix of revenues

trending toward the supply of product with lower margins albeit

higher unit sales values.

EBITDA

The EBITDA for the period under review for the six months ended

30 June 2022 is presented as follows:

EBITDA US Dollar Increase %

(Decrease)

For the 6 months 31 December

ended

30 June

------------------------ ------------

2022 2021 2021

----------- ----------- ------------

Revenues 704,853 955,371 2,635,420 -250,518 -26.22%

----------- ----------- ------------ ------------ ---------

Gross Margin as presented 428,761 605,852 1,944,903 -177,091 -29.23%

----------- ----------- ------------ ------------ ---------

Gross Margin % 60.83% 63.42% 73.80% - -

----------- ----------- ------------ ------------ ---------

Operating Loss as presented -4,478,031 -3,097,078 -6,327,475 -1,380,953 44.59%

----------- ----------- ------------ ------------ ---------

Add back Amortisation of

Intangible Assets 480,690 480,690 961,380 - -

----------- ----------- ------------ ------------ ---------

Add back Share based compensation

charges 127,444 36,969 77,583 90,475 244.73%

----------- ----------- ------------ ------------ ---------

Add back vacation accrual

charges 22,782 -18,154 -27,519 40,936 -225.49%

----------- ----------- ------------ ------------ ---------

Add back depreciation charges

on fixed assets 53,052 48,793 87,586 4,259 8.73%

----------- ----------- ------------ ------------ ---------

Add back IFRS operating

leases depreciation 173,892 75,094 173,675 98,798 131.57%

----------- ----------- ------------ ------------ ---------

EBITDA -3,620,171 -2,473,686 -5,054,770 -1,146,485 46.35%

----------- ----------- ------------ ------------ ---------

EBITDA loss in the first six months of the year widened to

$3,620,171 (H1 2021 loss: $2,473,686), which was anticipated over

the previously reported comparable period. This loss is impacted by

the planned increase in the Research and Development resource

costs. As previously stated, the margin percentage is a direct

result of the revenues mix and it is anticipated that the current

margin percentage levels will continue.

Operating Costs

Operating expenses (before amortisation, depreciation and IFRS

adjustments), increased by 29.9% in the current period against the

same period in 2021 from $3,100,340 to $4,028,732.

Within the R&D division, as planned resource recruitment

continued, the majority of the increased operating costs of

$707,116 were made up of staffing resources increases of

approximately $594,000.

General and Administration costs (before amortisation,

depreciation and IFRS adjustments), increased by approximately

$84,000, driven by the once off costs related to the required

take-on of a new Nominated Advisor, planned increases in audit

fees, and costs relating to the new premises.

The increase in the Marketing expenses (before amortisation,

depreciation and IFRS adjustments) are a direct result of the

increase in planned resources and attendance at worldwide

conferences and exhibitions.

After adjusting for the capitalised Research and Development

Costs, amortisation costs of the Development Intangible asset,

Depreciation and Share Based Compensation adjustments, the

resultant increases (decreases) in Operating costs, as adjusted

would have been:

US Dollar Increase

(Decrease)

June

For the 6 months 31 December

ended

30 June

---------------------- ------------

Operating Costs 2022 2021 2021 %

---------- ---------- ------------

Research and Development Costs

net of amortisation, Share

Based Compensation, IFRS adjustments

and Vacation accruals 2,689,191 1,982,075 4,568,491 707,116 35.68%

---------- ---------- ------------ ------------ -------

General and Administrative

expenses, net of depreciation,

Share Based Compensation, IFRS

adjustments, Vacation accruals

and impairments. 726,893 642,685 1,372,043 84,208 13.10%

---------- ---------- ------------ ------------ -------

Marketing expenses, net of

Share Based Compensation and

Vacation accruals. 612,648 475,580 1,024,451 137,068 28.82%

---------- ---------- ------------ ------------ -------

Total 4,028,732 3,100,340 6,964,985 928,392 29.94%

---------- ---------- ------------ ------------ -------

Summarised trading results

Summarised Trading Results US Dollar Increase %

(Decrease)

For the 6 months ended 31 December

30 June

------------------------- ------------

2022 2021 2021

------------ ----------- ------------

Revenues 704,853 955,371 2,635,420 -250,518 -26.22%

------------ ----------- ------------ ------------ --------

Gross Margin 428,761 605,852 1,944,903 -177,091 -29.23%

------------ ----------- ------------ ------------ --------

Gross Margin % 60.83% 63.42% 73.80% - -

------------ ----------- ------------ ------------ --------

Operating Loss Profit -4,478,031 -3,097,078 -6,327,475 -1,380,953 44.59%

------------ ----------- ------------ ------------ --------

Financing costs -274,565 -1,419,468 -3,074,452 1,144,903 -80.66%

------------ ----------- ------------ ------------ --------

Financing income (expenses) 1,249,863 116,597 228,404 1,133,266 971.95%

------------ ----------- ------------ ------------ --------

(Loss) Profit before tax -3,502,733 -4,399,949 -9,173,523 897,216 -20.39%

------------ ----------- ------------ ------------ --------

Tax benefit (reversal of previous

deferred tax benefit) 0 0 -186,772 - -

------------ ----------- ------------ ------------ --------

Net comprehensive loss for the year -3,502,733 -4,399,949 -9,360,295 897,216 -20.39%

------------ ----------- ------------ ------------ --------

Basic and Diluted earnings per ordinary

share -0.05 -0.09 -0.14 0.09

------------ ----------- ------------ ------------ --------

Weighted average number of ordinary

shares for basic earnings per share 75,367,394 51,347,740 67,492,412

------------ ----------- ------------ ----------------------

Revenue Analysis

Revenues for the six months ended 30 June 2022 of $704,853

(2021: $955,371) reflect the timing of deliveries as laid out in

the various contracts.

The revenue mix will continue to evolve as the Company

progresses in achieving the desired mix of the revenue streams from

network solutions in addition to IP licenses and services.

Segment Reporting

The geographic mix is represented by the makeup of the products

supplied, where in the first half of the current financial year the

revenues were weighted towards foreign design wins while royalty

revenues were earned in Israel. The trend is expected to continue

during the second half of the year as design wins and product

supply focussing on the Tier-1 OEMs outside of Israel continues to

grow.

SEGMENT REPORT sector analysis

---------- ------- ----------- -------

Region Six months ended Six months ended Year ended

30 June 2022 30 June 2021 31 December 2021

------------------- ------------------- --------------------

US$ % US$ % US$ %

---------- ------- ---------- ------- ----------- -------

United States 512,650 72.7% 765,075 80.1% 1,146,003 43.5%

---------- ------- ---------- ------- ----------- -------

Israel 149,403 21.2% 161,796 16.9% 760,559 28.9%

---------- ------- ---------- ------- ----------- -------

Asia 42,800 6.1% 28,500 3.0% 598,858 22.7%

---------- ------- ---------- ------- ----------- -------

Europe 0 0.0% 0 0.0% 130,000 4.9%

---------- ------- ---------- ------- ----------- -------

Total 704,853 100.0% 955,371 100.0% 2,635,420 100.0%

---------- ------- ---------- ------- ----------- -------

Margins

Gross margins were line with Company expectations based on the

product sales strategy focus, and the 2022 gross margin for the

period was 60.83%. The gross margin will vary according to the

revenue mix and as the revenue mix as noted above evolves, this

will have a downward pressure on gross margin percentages as

revenues from 100% margin sources become less prominent in the mix,

being replaced by cost active product sales.

Financing Costs

As noted in the Annual Results for the year ended 31 December

2021, the financing costs have come about due to the two equity

events referred to below and under the section "Balance Sheet".

It is to be noted that these two equity events, albeit in

essence based on raising funds via equity issues, are nonstandard

equity arrangements and have been dealt with in terms of the

guidance in IFRS9-Financial Instruments. This guidance, albeit that

it is not based on the actual cash cost of the financing

arrangements to the Company, is significantly complex in its

application, forces the recognition of the fair value of the equity

issues, and essentially creates a recognition in differences

between the market price of the shares issued at time of issue

versus the actual price at which the equity is allotted. It is not

a reflection of the cash inflows and outflows of the transactions.

It is this differential or "derivative style instrument" that needs

to be subject to a fair value analysis, and the instruments, the

values received and outstanding values due being separated into

equity, assets, finance income and finance charges in terms of the

IFRS-9 guidance.

Referring to the two fundraise deals the Company completed

during the year of 2021 and the first half of 2022 being;

a. Issuance of the Share and Warrants bundle (Peterhouse Capital Limited) in September 2021

b. Share Subscription Agreement (5G Innovation Leaders Fund) in

February 2022

It has been determined that in terms of IFRS-9, both

transactions are to be recognised as equity and a liability of the

Company and all adjustments to the liability value are to be

recognised through the Income Statement. In both cases the equity

differential based on allotment price and fair value at time of

allotment charges to the income statement.

The liability in respect of deal a. above represents the

outstanding 60p Warrants which had not been exercised as of 30 June

2022.

The liability in respect of deal b. represents the cash the

Company has received during in February 2022 and that as of 30 June

2022 still has not allotted shares against the advance in

settlement of the debt.

The above outlined treatment results in a significant

adjustments to finance incomes and expenses charged to the Income

Statement, however it should be noted that the expense is not an

actual cash expense, rather an expense due to the accounting

treatment and recognition of an expense instead of an asset in

terms of IFRS guidance.

The Financing Expenses and Finance Income in the Income

Statement are thus summarised as follows:

Financing expenses for period ended June 30 2022

5G Innovation Leaders $60,000 Face value premium of $60,000 on $2,000,000 funded to the Company

Fund in February 2022.

--------- ------------------------------------------------------------------

$80,000 Facility fee for the funding received by the Company in February

2022.

--------- ------------------------------------------------------------------

$140,000

--------- ------------------------------------------------------------------

Financing Income for the period ended June 30 2022

Peterhouse September $1,209,960 Updating value of warrants issued, to fair value as at 30

2021 placing June 2022.

----------- ----------------------------------------------------------

Liability at 30 June 2022

5G Innovation Leaders $2,060,000 Liability to 5G representing the $2,000,000 funded to the

Fund Company in February 2022, together with a $60,000 premium.

This was not revalued as there was no material difference

between market price and conversion price at 30 June 2022.

----------- -------------------------------------------------------------

$53,333 Liability to 5G for balance of $80,000 facility fee for the

funding received by the Company in February 2022.

----------- -------------------------------------------------------------

Peterhouse September $5,033 Warrants liability in regard to September 2021 placing deal,

2021 placing short term and long term (60p. Warrants)

----------- -------------------------------------------------------------

$2,118,366

----------- -------------------------------------------------------------

The cash resources during the period under review were further

bolstered following further investment from the Share Subscription

Agreement of $2m.

COVID-19 Impact and Going Concern

Currently, with the impact of COVID-19 in Israel and worldwide

having been reduced significantly, we remain acutely aware that the

ongoing effects of COVID-19 and potential for further outbreaks is

something that can neither be predicted nor negated, not only in

Israel but in the geographies that we trade and have development

engagements. As such, we do realise the risk of an impact in

current and possible further delays in the timing of revenues as

well as delays in supplies not only to the Company but its

customers, whose product deployment could be materially impacted,

as evidenced by the ongoing worldwide component shortage which is a

direct result of the COVID-19 pandemic.

Based on the abovementioned cash position and signed contracts,

and in the light of enquiries made by the Directors as to the

current liquidity position of the Company, as well as bearing in

mind the ability and success of the Company to raise funds

previously, the Directors have a reasonable expectation that the

Company will have access to adequate resources to continue in

operational existence for the foreseeable future and therefore have

adopted the going concern basis of preparation in the financial

statements.

Other than the points outlined above, there are no items on the

Balance Sheet that warrant further discussion outside of the

disclosures made in the Interim Unaudited Financial Statements

presented below.

FORWARD LOOKING STATEMENTS

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". By their nature,

forward-looking statements involve risk and uncertainty since they

relate to future events and circumstances. Actual results may, and

often do, differ materially from any forward-looking statements.

Any forward-looking statements in this announcement reflect

Ethernity's view with respect to future events as at the date of

this announcement. Save as required by law or by the AIM Rules for

Companies, Ethernity undertakes no obligation to publicly revise

any forward-looking statements in this announcement, following any

change in its expectations or to reflect events or circumstances

after the date of this announcement.

By order of the Board

Mark Reichenberg

Company Secretary

21 September 2022

Interim Unaudited Financial Statements

as at 30 June 2022

STATEMENTS OF FINANCIAL POSITION

US dollars

----------------------------------------

30 June 31 December

2022 2021 2021

------------ ------------ ------------

Unaudited Audited

-------------------------- ------------

ASSETS

Current

Cash and cash equivalents 4,164,415 3,442,309 7,060,824

Trade receivables 1,273,328 769,919 1,545,598

Inventories 5 771,122 255,269 284,810

Other current assets 234,263 290,103 240,964

Current assets 6,443,128 4,757,600 9,132,196

Non-Current

Property and equipment 800,194 516,611 660,069

Deferred tax assets - 186,772 -

Intangible asset 5,943,490 6,904,870 6,424,180

Right-of-use asset 2,982,310 199,160 3,156,202

Other long term assets 35,767 10,338 38,956

Non-current assets 9,761,761 7,817,751 10,279,407

Total assets 16,204,889 12,575,351 19,411,603

============ ============ ============

LIABILITIES AND EQUITY

Current

Short Term Borrowings 74,286 253,988 422,633

Trade payables 739,258 508,434 651,758

Liability related to share subscription agreement 2,060,000 1,619,509 -

Warrants liability 5,033 - 1,214,993

Other current liabilities 1,100,706 1,002,185 1,097,359

Current liabilities 3,979,283 3,384,116 3,386,743

Non-Current

Lease liability 2,625,598 59,403 3,069,721

------------ ------------ ------------

Non-current liabilities 2,625,598 59,403 3,069,721

Total liabilities 6,604,881 3,443,519 6,456,464

Equity

Share capital 21,152 14,910 21,140

Share premium 40,402,890 31,759,125 40,382,744

Other components of equity 1,131,473 850,225 1,004,029

Accumulated deficit (31,955,507) (23,492,428) (28,452,774)

------------ ------------ ------------

Total equity 9,600,008 9,131,832 12,955,139

Total liabilities and equity 16,204,889 12,575,351 19,411,603

============ ============ ============

The accompanying notes are an integral part of the interim

financial statements.

STATEMENTS OF COMPREHENSIVE LOSS

US dollars

--------------------------------------

Six months ended For the

30 June year ended

31 December

2022 2021 202 1

----------- ----------- ------------

Note Unaudited Audited

------------------------ ------------

Revenue 8 704,853 955,371 2,635,420

Cost of sales 276,092 349,519 690,517

----------- ----------- ------------

Gross profit 428,761 605,852 1,944,903

Research and development expenses 3,276,067 2,496,084 5,550,912

General and administrative expenses 1,001,705 779,149 1,721,873

Marketing expenses 629,020 448,499 1,044,905

Other income - (20,802) (45,312)

----------- ----------- ------------

Operating loss (4,478,031) (3,097,078) (6,327,475)

Financing costs 6 (274,565) (1,419,468) (3,074,452)

Financing income 7 1,249,863 116,597 228,404

----------- ----------- ------------

Loss before tax (3,502,733) (4,399,949) (9,173,523)

Tax expense - - (186,772)

----------- ----------- ------------

Net comprehensive loss for the period (3,502,733) (4,399,949) (9,360,295)

=========== =========== ============

Basic and diluted loss per ordinary

share (0.05) (0.09) (0.14)

=========== =========== ============

Weighted average number of ordinary

shares for basic and diluted loss

per share 75,367,394 51,347,740 67,492,412

=========== =========== ============

The accompanying notes are an integral part of the interim

financial statements.

STATEMENTS OF CHANGES IN EQUITY

Amounts in US dollars (except number of shares)

------------------------------------------------------------------------

Other

Number Share Share components Accumulated Total

of shares Capital premium of equity deficit equity

---------- ------- ----------- ----------- ------------ -----------

Balance at 1 January 2022 1,004

(Audited) 75,351,738 21,140 40,382,744 ,029 (28,452,774) 12,955,139

Employee share-based compensation - - - 127,444 - 127,444

Expenses paid in shares 37,106 12 20,146 - - 20,158

Net comprehensive loss for the

period - - - - (3,502,733) (3,502,733)

---------- ------- ----------- ----------- ------------ -----------

Balance at 30 June 2022

(Unaudited) 75,388,844 21,152 40,402,890 1,131,473 (31,955,507) 9,600,008

========== ======= =========== =========== ============ ===========

Balance at 1 January 2021

(Audited) 47,468,497 12,495 27,197,792 813,256 (19,092,479) 8,931,064

Employee share-based compensation - - - 36,969 - 36,969

Exercise of employee options 226,667 71 23,041 - - 23,112

Exercise of options 3,500,010 1,072 2,007,606 - - 2,008,678

Shares issued pursuant to share

subscription agreement 3,838,952 1,176 2,447,346 - - 2,448,522

Expenses paid in shares 305,000 96 83,340 - - 83,436

Net comprehensive loss for the

period - - - - (4,399,949) (4,399,949)

---------- ------- ----------- ----------- ------------ -----------

Balance at 30 June 2021

(Unaudited) 55,339,126 14,910 31,759,125 850,225 (23,492,428) 9,131,832

========== ======= =========== =========== ============ ===========

Balance at 1 January 2021 12,49

(Audited) 47,468,497 5 27 ,197,792 813,256 (19,092,479) 8 ,931,064

Employee share-based compensation - - - 77,583 - 77,583

Exercise of employee options 706,667 220 70,893 - - 71,113

Net proceeds allocated to the

issuance

of ordinary shares 13,149,943 4,053 4,280,265 - - 4,284,318

Exercise of warrants 3,500,010 1,072 2,007,606 - - 2,008,678

Shares issued pursuant to share

subscription agreement 10,221,621 3 ,204 6 ,742,848 - - 6 ,746,052

Expenses paid in shares and

warrants 305,000 96 83,340 113,190 - 196 ,626

Net comprehensive loss for the

year - - - - (9,360,295) (9,360,295)

---------- ------- ----------- ----------- ------------ -----------

Balance at 31 December 2021 1,004

(Audited) 75,351,738 21,140 40,382,744 ,029 (28,452,774) 12,955,139

The accompanying notes are an integral part of the interim

financial statements.

STATEMENTS OF CASH FLOWS

US dollars

--------------------------------------

Six months ended Year ended

30 June 31 December

2022 2021 2021

----------- ----------- ------------

Unaudited Audited

------------------------ ------------

Operating activities

Net comprehensive loss for the period (3,502,733) (4,399,949) (9,360,295)

Non-cash adjustments

Depreciation of property and equipment 53,052 48,531 86,168

Depreciation of operating lease right of use asset 173,892 75,094 173,675

Share-based compensation 127,444 36,969 77,583

Amortisation of intangible assets 480,690 480,690 961,380

Amortisation of liabilities (206,755) (5,717) 39,042

Deferred tax expenses - - 186,772

Foreign exchange losses on cash balances 369,053 50,733 30,214

Capital loss - - 70

Income from change of lease terms - (442) (8,929)

Revaluation of financial instruments, net (1,149,960) 1,279,477 2,691,145

Expenses paid in shares and options 20,158 83,436 196 ,626

Net changes in working capital

Decrease (increase) in trade receivables 272,270 8,142 (767,537)

Increase in inventories (486,312) (81,775) (111,316)

Decrease in other current assets 6,701 34,929 84,068

Increase (decrease) in other long-term assets 3,189 (2,831) (2,831)

Increase in trade payables 87,500 218,260 361,583

Decrease in other liabilities (17,733) (101,184) (24,071)

Net cash used in operating activities (3,769,544) (2,275,637) (5,386,653)

Investing activities

Proceeds from other short-term financial assets - (28,618)

Purchase of property and equipment (193,177) (13,030) (194,195)

Net cash used in investing activities (193,177) (13,030) (222,813)

Financing activities

Proceeds from share subscription agreement 2,000,000 2,153,856 3,177,306

Proceeds allocated to ordinary shares, net - 356,443 5,016,494

Proceeds allocated to warrants - - 1,472,561

Issuance costs - - (390,398)

Proceeds from exercise of warrants and options - 1,319,387 1,367,388

Proceeds from short term borrowings 100,283 398,656 900,192

Repayment of short-term borrowings (448,630) (550,676) (887,585)

Repayment of lease liability (216,288) (76,683) (136,180)

Net cash provided by financing activities 1,435,365 3,600,983 10,519,778

Net change in cash and cash equivalents (2,527,356) 1,312,316 4,910,312

Cash and cash equivalents, beginning of year 7,060,824 2,180,726 2,180,726

Exchange differences on cash and cash equivalents (369,053) (50,733) (30,214)

Cash and cash equivalents, end of period 4,164,415 3,442,309 7,060,824

=========== =========== ============

Supplementary information:

Interest paid during the period 6,049 8,376 13,468

=========== =========== ============

Interest received during the period 1,418 - 41

=========== =========== ============

Supplementary information on non-cash activities:

Recognition of right-of-use asset and lease liability - - 3,776,886

=========== =========== ============

Shares issued pursuant to share subscription agreement - 2,448,522 6,746,052

=========== =========== ============

Expenses paid in shares and warrants 20,158 83,436 83,436

=========== =========== ============

The accompanying notes are an integral part of the interim

financial statements.

NOTES TO THE FINANCIAL STATEMENTS

NOTE 1 - NATURE OF OPERATIONS

ETHERNITY NETWORKS LTD. (hereinafter: the "Company"), was

incorporated in Israel on the 15th of December 2003 as Neracore

Ltd. The Company changed its name to ETHERNITY NETWORKS LTD. on the

10th of August 2004.

The Company provides innovative, comprehensive networking and

security solutions on programmable hardware for accelerating

telco/cloud networks performance. Ethernity's FPGA logic offers

complete Carrier Ethernet Switch Router data plane processing and

control software with a rich set of networking features, robust

security, and a wide range of virtual function accelerations to

optimise telecommunications networks. Ethernity's complete

solutions quickly adapt to customers' changing needs, improving

time-to-market and facilitating the deployment of 5G, edge

computing, and different NFV appliances including 5G UPF, SD-WAN,

vCMTS and vBNG with the current focus on 5G emerging appliances.

The Company's customers are situated worldwide.

NOTE 2 - SUMMARY OF ACCOUNTING POLICIES

Basis of presentation of the financial statements and statement

of compliance with IFRS

The interim condensed financial statements for the six months

ended 30 June 2022 have been prepared in accordance with IAS 34,

Interim Financial Reporting. The interim condensed financial

statements do not include all the information and disclosures

required in the annual financial statements in accordance with IFRS

and should be read in conjunction with the Company's annual

financial statements as at 31 December 2021. The accounting

policies applied in the preparation of the interim condensed

financial statements are consistent with those followed in the

preparation of the Company's annual financial statements for the

year ended 31 December 2021.

The interim condensed financial statements for the half-year

ended 30 June 2022 (including comparative amounts) were approved

and authorized for issue by the board of directors on 21 September

2022.

NOTE 3 - GOING CONCERN

The financial statements have been prepared assuming that the

Company will continue as a going concern. Under this assumption, an

entity is ordinarily viewed as continuing in business for the

foreseeable future unless management intends or has no realistic

alternative other than to liquidate the entity or to stop trading

for at least, but not limited to, 12 months from the reporting

date. The assessment has been made of the Company's prospects,

considering all available information about the future, which have

been included in the financial budget, from managing working

capital and among other factors such as debt repayment schedules.

Consideration has been given inter alia to the significant values

of funds raised during the year ended 31 December 2021 and to date,

the current stage of the Company's life cycle, its losses and cash

outflows, including with respect to the development of the

Company's products, the expected timing and amounts of future

revenues.

At 30 June 2022 the Company noted that its cash reserves were

approximately $4.2m.

During the latter portion of 2020 and through 2021, the Company

entered into new contracts for supply of the Company solutions and

products along with deployment orders from existing customers, all

of which including customer indications for significant amounts of

revenue billings for the 2022,2023 financial years and onwards.

Based on the abovementioned cash position and signed contracts,

and in the light of enquiries made by the Directors as to the

current liquidity position of the Company, as well as bearing in

mind the ability and success of the Company to raise funds

previously, the Directors have a reasonable expectation that the

Company will have access to adequate resources to continue in

operational existence for the foreseeable future and therefore have

adopted the going concern basis of preparation in the financial

statements, and that there is no material uncertainty that may cast

doubt on the Company's ability to continue as a going concern and

fulfil its obligations and liabilities in the normal course of

business in the near future.

NOTE 4 - SIGNIFICANT EVENTS

EQUITY RELATED TRANSACTIONS DURING THE ACCOUNTING PERIOD

a. During the six month period ended 30 June 2022, ordinary

shares of the Company were issued, as follows:

Number of

ordinary

shares

----------

Expenses paid for in shares 37,106

----------

37,106

==========

b. On 25 February 2022 the Company entered into an agreement

with 5G Innovation Leaders Fund, LLC ("5G Fund") to invest

US$2,000,000 into the Company in exchange for new Shares

("Subscription Shares") valued at US$2,060,000. The Subscription

Shares, will be issued, at 5G Fund's request, within 18 months of

the date of the investment at a price per share determined by

dividing the subscription value by the settlement price.

The Settlement Price will be equal to the sum of:

- the Reference Price (The Reference Price will be the average

of 3 daily volume-weighted average prices ("VWAPs") of Shares

selected by 5G Fund during a 15-trading day period immediately

prior to the date of notice of their issue, rounded down to the

next one tenth of a penny) and

- the Additional Price (The Additional Price will be equal to

half of the excess of 85% of the average of the daily VWAPs of the

Shares during the three consecutive trading days immediately prior

to the date of notice of their issue over the Reference Price). As

of 30 June 2022, no amounts have been converted into shares.

NOTE 5 - INVENTORIES

US dollars

-----------------------------

30 June 31 December

2022 2021 2021

------- ------- -----------

Unaudited Audited

---------------- -----------

Components and raw materials 645,852 124,354 165,095

Finished cards 125,270 130,915 119,715

Total inventories 771,122 255,269 284,810

======= ======= ===========

NOTE 6 - FINANCING COSTS

US dollars

--------------------------------

Six months ended Year ended

30 June 31 December

2022 2021 2021

------- --------- ------------

Unaudited Audited

------------------ ------------

Bank fees and interest 20,321 19,092 32,147

Lease liability financial expenses 114,244 5,349 30 ,195

Revaluation of liability related

to share subscription agreement

measured at FVTPL 60,000 1,132,992 2,884,254

Revaluation of warrant derivative

liability - 262,035 -

Expenses allocated to issuing

warrants - - 127,856

Expenses allocated to share subscription

agreement 80,000 - -

Total financing costs 274,565 1,419,468 3,074,452

======= ========= ============

NOTE 7 - FINANCING INCOME

US dollars

--------------------------------------

Six months ended Year ended

30 June 31 December

2022 2021 2021

------------ ---------- ------------

Unaudited Audited

------------------------ ------------

Revaluation of proceeds due on

account of shares (financial

asset measured at FVTPL) - 49,723 49,723

Revaluation of warrant derivative

liability 1,209,960 - 108,723

Lease liability financial income - - 8,929

Interest received 1,418 - 41

Exchange rate differences 38,485 66,874 60 ,988

------------ ---------- ------------

Total financing income 1,249,863 116,597 228,404

============ ========== ============

NOTE 8 - SEGMENT REPORTING

The Company has implemented the principles of IFRS 8, in respect

of reporting segmented activities. In terms of IFRS 8, the

management has determined that the Company has a single area of

business, being the development and delivery of high-end network

processing technology.

The Company's revenues are divided into the following

geographical areas:

US dollars

--------------------------------

Six months ended Year ended

30 June 31 December

2022 2021 2021

-------- -------- ------------

Unaudited Audited

------------------ ------------

Asia 42,800 28,500 598,858

Europe - - 130,000

Israel 149,403 161,796 760,559

United States 512,650 765,075 1,146,003

-------- -------- ------------

704,853 955,371 2,635,420

======== ======== ============

The Company's revenues are divided into the following

geographical areas:

%

--------------------------------

Six months ended Year ended

30 June 31 December

2022 2021 202 1

-------- -------- ------------

Unaudited Audited

------------------ ------------

Asia 6.1% 3.0% 22.7%

Europe 0.0% 0.0% 4.9%

Israel 21.2% 16.9% 28.9%

United States 72.7% 80.1% 43.5%

-------- -------- ------------

100.0% 100.0% 100.0%

======== ======== ============

Revenue from customers in the Company's domicile, Israel, as

well as its major market, the United States and Asia, have been

identified on the basis of the customer's geographical

locations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEFFIFEESEIU

(END) Dow Jones Newswires

September 22, 2022 02:00 ET (06:00 GMT)

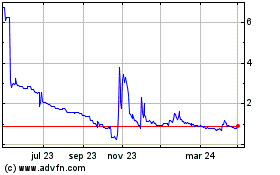

Ethernity Networks (LSE:ENET)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

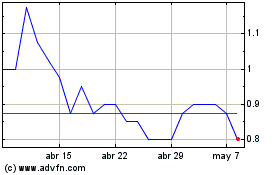

Ethernity Networks (LSE:ENET)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024