TIDMENET

RNS Number : 8997M

Ethernity Networks Ltd

17 January 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the UK version of the Market Abuse Regulations (EU) No. 596/2014

("MAR"). With the publication of this announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN, INTO OR FROM, AUSTRALIA, NEW

ZEALAND, CANADA, JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH THE SAME WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN OFFER TO BUY, ACQUIRE

OR SUBSCRIBE FOR (OR THE SOLICITATION OF AN OFFER TO BUY, ACQUIRE

OR SUBSCRIBE FOR) ORDINARY SHARES TO ANY PERSON WITH A REGISTERED

ADDRESS IN, LOCATED IN, OR WHO IS A RESIDENT OF, THE UNITED STATES,

AUSTRALIA, NEW ZEALAND, CANADA, JAPAN OR THE REPUBLIC OF SOUTH

AFRICA OR IN ANY OTHER JURISDICTION IN WHICH SUCH OFFER,

SOLICITATION OR SALE WOULD BE UNLAWFUL OR CONTRAVENE ANY

REGISTRATION OR QUALIFICATION REQUIREMENTS UNDER THE SECURITIES

LAWS OF ANY SUCH JURISDICTION.

17 January 2023

ETHERNITY NETWORKS LTD

("Ethernity" or the "Company")

Placing, Broker Option and Trading Update

Ethernity Networks (AIM: ENET.L; OTCQB: ENETF), a leading

supplier of data processing semiconductor technology for

virtualized networking appliances, is pleased to announce a placing

(the "Placing") to raise GBP1.55 million (gross) through the issue

of 22,142,858 new ordinary shares of NIS 0.001 each ("Ordinary

Shares") at 7 p per share (the "Issue Price"). Peterhouse Capital

Limited ("Peterhouse") is acting as placing agent to the Placing.

The Placing has not been underwritten.

Highlights

-- Placing to raise GBP1.55 million through the issue of

22,142,858 new Ordinary Shares (the "Placing Shares") at the Issue

Price

-- David Levi, Director and CEO, in support of the Placing has

subscribed for 3,028,571 Placing Shares for an aggregate sum of

GBP212,000

-- Participants in the Placing to receive one warrant for every

Placing Share subscribed for, exercisable at 15p, subject to the

passing of the relevant resolutions at an extraordinary general

meeting of the Company

-- Broker option (the "Broker Option") for a further 2,142,857

new Ordinary Shares which will raise up to a further GBP150,000

enabling existing shareholders to participate in the Placing via

Peterhouse

-- Shavit Baruch, Director and VP R&D, has indicated that he

intends to participate in the Broker Option up to an amount of

GBP46,814

-- Net proceeds of approximately GBP1.46 million will strengthen

the balance sheet, to allow the Company to support the growing

number of engagements for its offerings towards successful

developments, field deployments, and for general working capital

purposes

-- In addition to the Placing, various service providers to the

Company have agreed to subscribe for 2,388,771 new Ordinary Shares

in lieu of outstanding fees (the "Fee Shares") totalling GBP167,214

(the Fee Shares and the Placing Shares are, together, the "New

Ordinary Shares")

-- Admission of the New Ordinary Shares is expected to occur on

or around 20 January 2023 ("Admission")

David Levi, CEO, commented: "Ethernity continues to progress its

current strategy, and advance the opportunities being presented by

the components shortages to leverage our data processing SoC

technology and IP, as well as our PON semiconductor technology. The

Placing allows the Company to be financially positioned for the

next stage of its development to service anticipated mass

deployment growth on existing contracts and capitalise on new

opportunities."

Trading Update

The Company has made significant progress during 2022 in the

development and commercialisation of its Data Processing Unit (DPU)

System-on-Chip (SoC) devices, Passive Optical Networks (PON) SoC

devices, and Universal Edge Platform (UEP) offerings and

anticipates further growth from the Company's progress for its FPGA

SmartNIC data plane offload.

2022 trading update

Subject to completion of the audit, the Company anticipates that

revenues for 2022 will be not less than $2.9 million, an increase

of 10% (2021: $2.64 million). Approximately $600,000 of revenue

that was expected to be recorded in 2022 is now expected to be

reported in 2023 as a result of delays in projects resulting from

component shortages, and certain customers informing the Company

that they were not ready to receive milestone deliveries as had

previously been anticipated.

During 2022, the following highlights were achieved that are

expected to support revenue growth in 2023:

-- the Company completed the delivery of all the FPGA SoC orders

planned for 2022 to its U.S. fixed wireless system provider

customer;

-- FPGA SoC sales increased by 200% compared to 2021;

-- the Company signed with its U.S. fixed wireless OEM customer

a contract for a second-generation platform based on a scaled-up

version of the Company's DPU SoC offering;

-- the Company progressed with the delivery of the $3 million

GPON and XGS-PON OLT SoC contract for its Chinese/Indian OEM, and

is currently working with the customer to complete the hardware

integration of the customer platform, to be ready for

deployment;

-- the Company signed a follow-on contract of $4.6 million with

that customer for delivery of a PON device for Fiber-to-the-Room

deployment; and

-- the Company delivered a UEP2025 for testing and integration

with an existing prominent microwave wireless OEM customer and is

working with the customer on joint go-to-market plans for the U.S.

wireless internet service provider (WISP) market.

2023 outlook

The Company will continue to focus its resources towards either

existing or new contracts that produce revenues and cash flows for

the Company in the short and medium term, be that the revenues in

the form of licensing fees or sale of devices and systems. To this

end, development resources will only be added on the basis of

further contracts that contribute towards the generation of such

revenue streams. Given the opportunities that are presenting

themselves to the Company for further expanded or new engagements

on PON, SoC and other system product expansion, the resources will

be best utilised in these areas that will produce revenues and cash

flows in the short and medium term. With this in mind, the Company

is currently re-evaluating whether to continue the work with an

Indian OEM customer, the contract of which was announced on 22

September 2020, as the customer continues to experience repeated

delays from their side, and the Company does not wish to

continually apply resources where no progress is being made with

the customer.

The Company has good revenue visibility for 2023 and, based on

contracted orders and conservative estimates of the potential

orders that are under discussion with prospective customers, the

Directors believe that revenues of $9 million for 2023 are

achievable. The contracted revenues for 2023 include:

-- continued supply of FPGA SoC devices for its U.S. fixed

wireless OEM customer and expected initial revenues for the

deployment of the second-generation product;

-- commencement of shipment of FPGA PON SoC devices under the

$7.6 million of contracts signed with the Chinese/Indian broadband

network OEM customer; and

-- other royalties, maintenance, licensing fees and payments due

under existing contracts for various DPU SoC projects, including

second generation products from a U.S. fixed wireless OEM customer,

a U.S. Tier 1 broadband provider, a U.S. based aviation company,

and various Israeli OEMs for 4G cellular base stations, Ethernet

Access devices and a European OEM bonding SoC project.

On top of the contracted revenues above, the Company anticipates

further modest revenue from:

-- discussions with four new OEMs for the potential deployment

of the Company's PON OLT (optical line termination) SoC for

optimised SFP (small form-factor pluggable), and remote low power

PON OLT complete system solutions that would result in licensing

revenue towards further deployment of SoC or systems during 2024

and beyond;

-- the Company's existing prominent microwave wireless OEM

customer contract for the sale of the Company's wireless link

bonding UEP system offering, with sales targeted for 2023 with

focus on U.S. WISPs; and

-- anticipated sales of the complete OLT product manufactured by

the Company's Chinese/Indian OEM customer that is based on the

Company's PON SoC devices into the WISPs U.S. market in conjunction

with the UEP2025 wireless link bonding, targeting the same

market.

Reasons for the Placing and Use of Proceeds

As Ethernity continues to implement its strategy of becoming a

supplier of customised and differentiated solutions and technology,

the Placing will serve to place the Company in a stronger position

for the next stage of its development and growth towards successful

developments and field deployments.

The net proceeds of the Placing, along with any funds raised via

the Broker Option, will be applied to strengthen the balance sheet,

providing additional working capital to allow the Company to

support the delivery of recently secured contracts and

engagements.

Details of the Placing

The Company has resolved to issue 22,142,858 Placing Shares at

the Issue Price raising gross proceeds of GBP1.55 million. In

addition, conditional on the approval of shareholders of

resolutions granting the necessary share capital authorities under

Israeli law at an Extra General Meeting ("EGM") of the Company,

investors in the Placing will receive one warrant for every Placing

Share subscribed for, exercisable at a price of 15p per share (the

"Warrants"). The Warrants will be exercisable for a period of 24

months from the date of grant. The Warrants are not transferable

and will not be traded on an exchange. The Warrants contain an

accelerator clause such that the Company may serve notice

("Notice") on the Warrant holders to exercise their Warrants in the

event that the closing mid-market share price of the Company's

Ordinary Shares trade at 20p or more over a consecutive five-day

trading period from date of Admission. In the event the Company

serves Notice, any Warrants remaining unexercised after seven

calendar days following the issue of the Notice will be

cancelled.

The Company will shortly be convening the EGM to seek

shareholder approval for an increase in the authorised share

capital and disapplication of pre-emption rights, details of which

are set out below.

The Company has entered into a placing agreement pursuant to

which Peterhouse, as agent for the Company, has agreed to use its

reasonable endeavours to procure placees for the Placing at the

Issue Price. The placing agreement contains warranties from the

Company in favour of Peterhouse in relation to, inter alia, the

accuracy of the information contained in the documents relating to

the Placing and also certain other matters relating to the Company

and its affairs. In addition, the Company has agreed to indemnify

Peterhouse in relation to certain liabilities that they may incur

in respect of the Placing.

Peterhouse may terminate the placing agreement in certain

circumstances, including for breach of warranty at any time prior

to Admission, if such breach is reasonably considered by Peterhouse

to be material in the context of the Placing, and in the event of a

force majeure event or material adverse change occurring at any

time prior to Admission.

The Placing Shares are being issued under the Company's existing

share authorities and are not conditional on the passing of the

resolutions at the EGM. Should the resolutions at the EGM not be

passed, the Placing will still proceed but the Company will not be

able to grant the Warrants to participants in the Placing.

Broker Option

In order to provide qualified Ethernity shareholders ("Existing

Shareholders") and other qualified investors with an opportunity to

participate on the same basis as the investors in the Placing, the

Company has granted Peterhouse a Broker Option over 2,142,857 new

Ordinary Shares (or such other number of Ordinary Shares as agreed

between the Company and Peterhouse) ("Broker Option Shares"). Full

take up of this number of new Ordinary Shares under the Broker

Option would raise a further GBP150,000 for the Company, before

expenses.

Existing Shareholders who hold shares in the Company and are on

the register of members as at the close of business on 16 January

2023, will be given a priority right to participate in the Broker

Option and all orders from such Existing Shareholders will be

accepted and processed by Peterhouse, subject to scale-back in the

event of over-subscription under the Broker Option. The Broker

Option has not been underwritten. Peterhouse is entitled to

participate in the Broker Option as principal.

The Broker Option is exercisable by Peterhouse on more than one

occasion, at any time from the time of this announcement to 4.45

p.m. UK time on 18 January 2023, at its absolute discretion,

following consultation with the Company. There is no obligation on

Peterhouse to exercise the Broker Option or to seek to procure

subscribers for the Broker Option. Peterhouse may also, subject to

prior consent of the Company, allocate new shares after the time of

any initial allocation to any person submitting a bid after that

time.

The Broker Option Shares are not being made available to the

public and none of the Broker Option Shares are being offered or

sold in any jurisdiction where it would be unlawful to do so. No

Prospectus will be issued in connection with the Broker Option.

To subscribe for Broker Option Shares, Existing Shareholders and

other qualified investors should communicate their bid to

Peterhouse via their stockbroker as Peterhouse cannot take direct

orders from individual private investors. Existing Shareholders or

other interested parties who wish to register their interest in

participating in the Broker Option Shares should instruct their

stockbroker to call Peterhouse on STX: 76086 or 020 7469 0938 or

020 7469 0936 or 020 7220 9797. Each bid should state the number of

Broker Option Shares the Existing Shareholder wishes to subscribe

for at the Issue Price.

Director dealings

David Levi, CEO, has subscribed for 3,028,571 Placing Shares. On

Admission, David Levi's interest in the Company's Ordinary Shares

shall comprise 12,615,731 Ordinary Shares representing

approximately 12.29% of the Company issued share capital as

enlarged by issue of the New Ordinary Shares. Further details of

David Levi's share purchase are set out in the table at the end of

this announcement.

Shavit Baruch has notified the Company of his intention to apply

for 668,771 Ordinary Shares pursuant to the Broker Option and a

further update will be provided once the Broker Option has

closed.

Related party transaction

As a Director and substantial shareholder of Ethernity, David

Levi is a related party of the Company pursuant to the AIM Rules

for Companies. The Directors of the Company (excluding David Levi

and Shavit Baruch, who may be participating in the Broker Option),

having consulted with the Company's Nominated Adviser, Allenby

Capital Limited, consider that the terms of David Levi's

participation in the Placing are fair and reasonable in so far as

the Company's shareholders are concerned.

Broker warrant

In connection with the Placing, Peterhouse will be granted

warrants to subscribe for new ordinary shares in the capital of the

Company, exercisable at the Issue Price (the "Broker Warrants").

The number of Broker Warrants granted to Peterhouse will be

determined following the closing of the Broker Option. The Broker

Warrants can be exercised for a period of 24 months from the date

of Admission.

Fee Shares

In addition to the Placing, service providers to the Company

have agreed to receive 2,388,771 Fee Shares at the Issue Price in

satisfaction of GBP167,214 of outstanding fees due to them. The Fee

Shares are subject to a one-year lock-in period. There are no

Warrants attached to the Fee Shares.

Admission to trading

The New Ordinary Shares (comprising the Placing Shares and the

Fee Shares) will rank pari passu with the Company's existing

Ordinary Shares. Application is being made to for the admission of

the 24,531,629 New Ordinary Shares to trading on AIM and Admission

is expected to occur at 8.00 a.m. on or around 20 January 2023.

Total voting rights

Following Admission (and prior to the issue of any new Ordinary

Shares pursuant to the Broker Option) the Company's enlarged issued

share capital will be 102,616,066 Ordinary Shares. The Company

holds no Ordinary Shares in Treasury. This figure of 102,616,066

Ordinary Shares may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interest in, the share capital of the Company under the FCA's

Disclosure Guidance and Transparency Rules.

Notice of EGM

The Company will shortly be posting to shareholders a notice

convening the EGM to seek approval for the dis-application of the

pre-emption rights required to be able to issue the Warrants. The

EGM will be held at 3rd Floor Beit Golan, 1 Golan St. Corner

HaNegev, Airport City 7019900, Israel at 11.00 a.m. Israel time

(9.00 a.m. UK time) on 9 February 2023. A copy of the EGM notice

will be made available on the Company's website,

www.ethernitynet.com .

For further information, please contact:

Ethernity Networks Ltd Tel: +972 8 915 0392

David Levi, Chief Executive Officer

Mark Reichenberg, Chief Financial Officer

Allenby Capital Limited (Nominated Adviser Tel: +44 (0)20 3328

and Joint Broker) 5656

James Reeve / Piers Shimwell (Corporate

Finance)

Amrit Nahal (Sales and Corporate Broking)

Peterhouse Capital Limited (Joint Broker) Tel: +44 (0)20 7562

0930

Lucy Williams / Duncan Vasey / Eran Zucker

Harbor Access Inc (US Investor Relations) Tel: +1 (475) 477

Jonathan Paterson 9401

About Ethernity ( www.ethernitynet.com )

Ethernity Networks (AIM: ENET.L OTCQB: ENETF) provides

innovative, comprehensive networking and security solutions on

programmable hardware for accelerating telco/cloud networks.

Ethernity's semiconductor logic offers complete Carrier Ethernet

Switch Router data plane processing and control software with a

rich set of networking features, robust security, and a wide range

of virtual function accelerations to optimize telecommunications

networks. Ethernity's complete solutions quickly adapt to

customers' changing needs, improving time-to-market, and

facilitating the deployment of 5G, edge computing, and NFV.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name David Levi

2 Reason for the notification

a) Position/status CEO

b) Initial notification Initial notification

/Amendment

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer

or auction monitor

a) Name Ethernity Networks Ltd.

b) LEI 213800LZJO33QBNXU496

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument;

(ii) each type of transaction; (iii) each date; and (iv)

each place where transactions have been conducted

a) Description of the ordinary shares of NIS 0.001 nominal value

financial instrument, each

type of instrument ISIN: IL0011410359

Identification code

b) Nature of the transaction Placing for new ordinary shares

c) Price(s) and volume(s)

Price(s) Volume(s)

7p 3,028,571

d) Aggregated information N/A - single transaction

e) Date of the transaction 16 January 2023 to be completed on 20 January

2023

f) Place of the transaction Outside a trading venue

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEEAPFKFDLDEFA

(END) Dow Jones Newswires

January 17, 2023 02:00 ET (07:00 GMT)

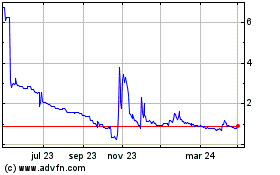

Ethernity Networks (LSE:ENET)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

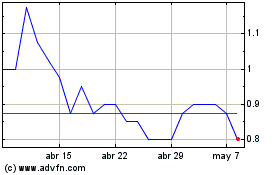

Ethernity Networks (LSE:ENET)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024