TIDMENOG

RNS Number : 3141I

Energean PLC

01 December 2022

Energean Israel Limited

Unaudited interim condensed consolidated financial statements

30 September 2022

ENERGEAN ISRAEL LIMITED

Unaudited interim condensed consolidated financial

statements

AS OF 30 SEPTEMBER 2022

INDEX

Page

-----

Interim condensed consolidated statement of financial

position 1

Interim condensed consolidated statement of comprehensive

income 2

Interim condensed consolidated statement of changes

in equity 3

Interim condensed consolidated statement of cash

flows 4

Notes to the interim condensed consolidated financial

statements 5-16

- - - - - - - - - - - - - - - - - - - -

ENERGEAN ISRAEL LIMITED

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Amounts in thousands US Dollars, unless otherwise stated)

30

September 31 December

2022 2021

----------- ------------

Unaudited Audited

----------- ------------

Note

--------

ASSETS:

NON-CURRENT ASSETS:

Property, plant and equipment 3(A) 2,738,532 2,245,267

Intangible assets 3(B) 85,083 20,141

Other accounts receivable 6(B) 81 6,463

Loan to related party 6(B) - 346,000

Restricted cash 3(D)(2) - 100,000

Deferred expenses 3(C) - 22,958

Deferred tax asset 5 14,528 11,575

----------- ------------

2,838,224 2,838,224

----------- ------------

CURRENT ASSETS:

Trade and other receivables 30,945 22,769

Deferred expenses 3(C) 22,958 -

Restricted cash 3(D)(2) 71,784 99,729

Cash and cash equivalents 103,966 349,827

----------- ------------

229,653 472,325

----------- ------------

TOTAL ASSETS 3,067,877 3,224,729

=========== ============

EQUITY AND LIABILITIES:

EQUITY:

Share capital 1,708 1,708

Share premium 6(B) 212,539 572,539

Retained losses (40,573) (35,946)

----------- ------------

TOTAL EQUITY 173,674 538,301

----------- ------------

NON-CURRENT LIABILITIES:

Senior secured notes 3(D) 2,469,349 2,463,524

Provision for decommissioning 26,834 35,525

Trade and other payables 3(F) 149,404 113,264

----------- ------------

2,645,587 2,612,313

----------- ------------

CURRENT LIABILITIES:

Trade and other payables 3(F) 248,616 74,115

----------- ------------

TOTAL LIABILITIES 2,894,203 2,686,428

----------- ------------

TOTAL EQUITY AND LIABILITIES 3,067,877 3,224,729

=========== ============

December 1, 2022

----------------- ----------------- ----------------

Panagiotis Benos Matthaios Rigas

Director Director

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

ENERGEAN ISRAEL LIMITED

INTERIM CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

Nine months ended 30 September 2022

(Amounts in thousands US Dollars, unless otherwise stated)

30 September (Unaudited)

-----------------------------

2022 2021

--------------- ------------

Note

-----

Administrative expenses 4(A) (7,218) (2,717)

Exploration and evaluation expenses 4(A) (1,277) -

Other expenses 4(A) (1,079) (28)

Other income 4(A) 53 3

--------------- ------------

Operating loss (9,521) (2,742)

Finance income 4(B) 5,757 4,524

Finance expenses 4(B) (4,931) (14,388)

Foreign exchange gain (loss) 4(B) 1,405 (1,140)

--------------- ------------

2,231 (11,004)

Loss for the period before tax (7,290) (13,746)

Taxation income 5 2,663 3,909

--------------- ------------

Net loss for the period (4,627) (9,837)

--------------- ------------

Other comprehensive income:

Items that may be reclassified subsequently

to profit or loss:

Gain on cash flow hedge for the period - 2,278

Reclassification adjustment for items included

in loss on realisation - 4,641

Tax relating to items that may be

reclassified subsequently to profit

or loss - (1,591)

--------------- ------------

Other comprehensive income for the

period - 5,328

--------------- ------------

Total comprehensive loss for the period (4,627) (4,509)

=============== ============

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

ENERGEAN ISRAEL LIMITED

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

Nine months ended 30 September 2022

(Amounts in thousands US Dollars, unless otherwise stated)

For the period of nine months ended 30 September 2022

(Unaudited):

Share Share Retained Total

capital premium losses equity

--------- ---------- --------- ----------

Balance as of 1 January 2022 1,708 572,539 (35,946) 538,301

Changes during period:

Transactions with shareholders

Share premium reduction, see

note 6(B) - (360,000) - (360,000)

Comprehensive loss:

Loss for the period - - (4,627) (4,627)

--------- ---------- --------- ----------

Balance as of 30 September 2022 1,708 212,539 (40,573) 173,674

========= ========== ========= ==========

For the period of nine months ended 30 September 2021

(Unaudited):

Share Share Other Retained Total

capital Premium reserves losses equity

--------- --------- ---------- --------- --------

Balance as of 1 January 2021 1,708 572,539 (5,328) (25,114) 543,805

Changes during period:

Comprehensive income (loss):

Loss for the period - - - (9,837) (9,837)

Other comprehensive income,

net of tax - - 5,328 - 5,328

--------- --------- ---------- --------- --------

Balance as of 30 September

2021 1,708 572,539 - (34,951) 539,296

========= ========= ========== ========= ========

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

ENERGEAN ISRAEL LIMITED

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Nine months ended 30 September 2022

(Amounts in thousands US Dollars, unless otherwise stated)

30 September (Unaudited)

---------------------------

2022 2021

------------ -------------

Operating activities :

Loss for the period before tax (7, 290 ) (13,746)

------------ -------------

Adjustments to reconcile loss before

taxation:

Depreciation, depletion and amortisation 232 71

Loss from disposal on property, plant

and equipment 1,079 23

Exploration and evaluation expenses 1,277 -

Other expenses - 5

Other income - (3)

Finance income (5,757) (4,524)

Finance expenses 4,932 14,388

Net foreign exchange (gain) loss (1,405) 1,140

------------ -------------

(6,932) (2,646)

Changes in working capital:

Decrease (increase) in other receivables 906 (29)

Decrease in trade and other payables (665) (6 6 0)

------------ -------------

241 ( 6 89)

Income taxes paid (572) (32)

------------ -------------

Net cash used in operating activities (7,263) (3,3 6 7)

------------ -------------

Investing activities :

Payment for purchase of oil & gas leases (10,850) (10,850)

Payment for purchase of property, plant

and equipment (221,187) (253,775)

Payment for exploration and evaluation,

and other intangible assets (18,823) (3,972)

Proceeds from disposals of property,

plant and equipment 188 -

Payments for buyers compensation - (13,271)

Amounts received from INGL related

to the future transfer disposals of

property, plant and equipment 17,371 5,673

Movement in restricted cash 127,945 (199,738)

Interest received 2,863 264

------------ -------------

Net cash used in investing activities (102,493) (475,669)

------------ -------------

Financing activities :

Senior secured notes issuance - 2,500,000

Transaction cost due to senior secured

notes issuance - (37,931)

Interest paid due to senior secured

notes (128,906) (66,600)

Drawdown of borrowings - 118,000

Repayment of borrowings - (1,268,000)

Loan to related party (*) - (346,000)

Repayment of loan from related parties - (16,000)

Finance cost paid (2,359) (43,854)

Finance costs paid for deferred license

payments (1,501) (3,494)

Repayment of obligations under leases (683) (366)

------------ -------------

Net cash generated (used) from financing

activities (133,449) 835,755

------------ -------------

Net increase (decrease) in cash and

cash equivalents (243,205) 356,719

Cash and cash equivalents at the beginning

of the period 349,827 37,421

Effect of exchange rate fluctuations

on cash held (2,656) (766)

------------ -------------

Cash and cash equivalents at the end

of the period 103,966 393,374

============ =============

(*) The loan to related party was repaid as part of the Share

Premium Capital reduction, see note 6(B).

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

ENERGEAN ISRAEL LIMITED

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(Amounts in thousands US Dollars, unless otherwise stated)

NOTE 1: GENERAL

A. Energean Israel Limited (the "Company") was incorporated in

Cyprus on 22 July 2014 as a private company with limited liability

under the Companies Law, Cap. 113. Its registered office is at

Lefkonos 22, 1(st) Floor, 2064, Nicosia, Cyprus.

B. The Company and its subsidiaries (the "Group") was

established with the objective of exploration, production and

commercialisation of natural gas and crude oil. The Group's main

activities are performed in Israel by the Company's Israeli

Branch.

C. The Group's core assets as of 30 September 2022 are composed of:

Country Asset Working interest Field phase

--------- ---------------------------------- ----------------- ------------

Israel Karish (including Karish North) 100% Development

Israel Tanin 100% Development

Israel Blocks 12, 21, 23, 31 100% Exploration

Israel Four licences Zone D (1) 80% Exploration

(1) As of 30 September 2022, the Company held an 80% interest in

four licences, blocks 55, 56, 61 and 62 (together, "Zone D"), in

Israel's Exclusive Economic Zone ("EEZ"). Following Energean's

submission of a formal notice of relinquishment to the Ministry of

Energy, the licences expired at the end of their term on 27 October

2022. See note 6(K).

D. The Energean Power FPSO arrived on location in Israel on 5

June 2022 and first gas from the Karish project was achieved on 26

October 2022.

NOTE 2: ACCOUNTING POLICIES AND BASIS OF PREPARATION

These unaudited interim condensed consolidated financial

statements for the nine months ended 30 September 2022 have been

prepared in accordance with the International Financial Reporting

Standards ("IFRS") as adopted by United Kingdom (UK). The unaudited

interim condensed consolidated financial statements do not include

all the information and disclosures that are required for the

annual financial statements and must be read in conjunction with

the Group's annual consolidated financial statements for the year

ended 31 December 2021.

These unaudited interim financial statements have been prepared

on a going concern basis.

ENERGEAN ISRAEL LIMITED

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(Amounts in thousands US Dollars, unless otherwise stated)

NOTE 3: FINANCIAL POSITION

A. Property, Plant and Equipment:

1) Composition:

Furniture,

Oil & gas Leased fixtures

properties assets and equipment Total

----------- ------- -------------- ---------

Cost:

At 1 January 2021 1,812,758 604 635 1,813,997

Additions (*) 243,346 3,405 194 246,945

Disposals (23) - - (23)

Capitalised borrowing cost

(**) 188,889 - - 188,889

Capitalised depreciation 362 - - 362

Change in decommissioning

provision (3,549) - - (3,549)

----------- ------- -------------- ---------

Total cost at 31 December

2021 2,241,783 4,009 829 2,246,621

Additions (*) 390,075 198 2,104 392,377

Disposals (900) - - (900)

Capitalised borrowing cost

(**) 111,096 - - 111,096

Capitalised depreciation 656 - - 656

Change in decommissioning

provision (9,259) - - (9,259)

----------- ------- -------------- ---------

Total cost at 3 0 September

2022 2,733,451 4,207 2,933 2,740,591

----------- ------- -------------- ---------

Depreciation:

At 1 January 2021 - 331 143 474

Charge for the year - - 85 85

Capitalised to petroleum

and gas assets - 362 - 362

Write down of the assets 433 - - 433

----------- ------- -------------- ---------

Total Depreciation at 31

December 2021 433 693 228 1,354

Expensed for the period - - 232 232

Disposals (433) - - (433)

Write down of the assets 250 - - 250

Capitalised to petroleum

and gas assets - 656 - 656

----------- ------- -------------- ---------

Total Depreciation at 30

September 2022 250 1,349 460 2,059

----------- ------- -------------- ---------

Net property, plant and

equipment at 31 December

2021 2,241,350 3,316 601 2,245,267

=========== ======= ============== =========

Net property, plant and

equipment at 30 September

2022 2,733,201 2,858 2,473 2,738,532

=========== ======= ============== =========

(*) The additions to oil & gas properties are primarily due

to development costs for the Karish field, incurred under the EPCIC

contract. Works relate primarily to the FPSO, subsea and onshore

construction.

(**) Capitalised borrowing costs relate primarily to the secured

senior notes.

ENERGEAN ISRAEL LIMITED

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(Amounts in thousands US Dollars, unless otherwise stated)

NOTE 3: FINANCIAL POSITION (Cont.)

2) Cash flow statement reconciliations:

30 September (Unaudited)

-----------------------------------

2022 2021

------------------------ ---------

Additions to property, plant and equipment 493,970 349,182

Associated cash flows

Payment for additions to property,

plant and equipment (*) (214,666) (264,625)

Non-cash movements/presented in other

cash flow lines

Capitalised borrowing costs (111,096) (154,921)

Right-of-use asset additions (198) (3,258)

Capitalised share-based payment charge (174) (156)

Capitalised depreciation (656) (197)

Change in decommissioning provision 9,259 4,034

Movement in working capital (176,439) 69,941

(*) This amount includes US$10.85 million which was paid to the

sellers of the Karish and Tanin leases during 2021 and 2022.

B. Intangible Assets:

1) Composition:

Exploration

and evaluation Software

assets license Total

--------------- -------- -------

Cost:

At 1 January 2021 13,799 255 14,054

Additions 6,342 - 6,342

--------------- -------- -------

At 31 December 2021 20,141 255 20,396

--------------- -------- -------

Additions (*) 66,219 - 66,219

Write off of exploration and

evaluation costs (**) (1,277) - (1,277)

--------------- -------- -------

At 30 September 2022 85,083 255 85,338

--------------- -------- -------

Amortisation:

At 1 January 2021 - 247 247

Charge for the year - 8 8

--------------- -------- -------

Total Amortisation at 31 December

2021 - 255 255

--------------- -------- -------

Charge for the period - - -

--------------- -------- -------

Total Amortisation at 30 September

2022 - 255 255

--------------- -------- -------

Net intangible assets at 31

December 2021 20,141 - 20,141

=============== ======== =======

Net intangible assets at 30

September 2022 85,083 - 85,083

=============== ======== =======

(*) Additions to exploration and evaluation assets are primarily

due to drilling activities. See also notes 6(E), 6(F).

(**) See note 6(K).

(1)

ENERGEAN ISRAEL LIMITED

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(Amounts in thousands US Dollars, unless otherwise stated)

NOTE 3: FINANCIAL POSITION (Cont.)

2) Cash flow statement reconciliations:

30 September (Unaudited)

---------------------------------

2022 2021

------------------------ -------

Additions to intangible assets 66,219 5,073

Associated cash flows

Payment for additions to intangible

assets (18,823) (3,972)

Non-cash movements/presented in other

cash flow lines

Movement in working capital (47,396) (1,101)

C. Deferred expenses

Deferred expenses relate to compensation of US$22.9 million that

was accrued in 2021 following delays to the supply of gas from the

Karish project. It is presented on the balance sheet as a current

asset as it will be treated as variable consideration under IFRS

15, offsetting gas sales once gas delivery commences. First gas

from the Karish project was achieved on 26 October 2022.

D. Senior secured notes:

1) Issuance of US$2,500,000,000 senior secured notes:

On 24 March 2021 (the "Issue Date"), Energean Israel Finance Ltd

(a 100% subsidiary of the Company) issued US$2,500,000,000 of

senior secured notes.

The Notes were issued in four equal tranches as follows:

30 31 December

September 2021

2022

--------------- ---------------

Series Maturity Annual fixed

Interest

rate Carrying value Carrying value

------------------ --------------- ------------- --------------- ---------------

US$ 625 million 30 March 2024 4.500% 619,640 617,060

US$ 625 million 30 March 2026 4.875% 617,467 615,966

US$ 625 million 30 March 2028 5.375% 616,493 615,451

US$ 625 million 30 March 2031 5.875% 615,749 615,047

------------------ --------------- ---------------

US$2,500 million 2,469,349 2,463,524

=================================== =============== ===============

The interest on each series of the Notes is paid semi-annually,

on 30 March and on 30 September of each year starting 30 September

2021.

The Notes are listed on the TACT Institutional of the Tel Aviv

Stock Exchange Ltd. (the "TASE").

With regards to the indenture document, signed on 24 March 2021

with HSBC BANK USA, N.A (the "Trustee"), no Indenture default or

Indenture event of default has occurred and is continuing.

ENERGEAN ISRAEL LIMITED

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(Amounts in thousands US Dollars, unless otherwise stated)

NOTE 3: FINANCIAL POSITION (Cont.)

2) Restricted cash:

As of 30 September 2022, the Company had short-term restricted

cash of US$71.8 million for the debt payment fund which will be

partly used for the March 2023 coupon payment. The remainder will

be released during 2023, upon achieving six months of production at

an annualized rate of 3.8 bcm/year.

3) Credit rating:

The senior secured notes have been assigned a Ba3 rating by

Moody's and a BB- rating by S&P Global.

E. Fair value measurements:

The information set out below provides information about how the

Group determines the fair values of various financial assets and

liabilities.

The fair values of the Group's non-current liabilities measured

at amortised cost are considered to approximate their carrying

amounts at the reporting date; with the exception of the Senior

secured notes for which the fair value is set out below.

The carrying value less any estimated credit adjustments for

financial assets and financial liabilities with a maturity of less

than one year are assumed to approximate their fair values due to

their short term-nature.

The fair value hierarchy of financial assets and financial

liabilities that are not measured at fair value (but fair value

disclosure is required) is as follows:

Fair value hierarchy as of

30 September 2022

-----------------------------------

Unaudited

-----------------------------------

Level Level Total

1 2

----------- --------- -----------

Financial assets

Short term restricted cash 71,784 - 71,784

Short term trade and other receivables - 30,477 30,477

Cash and cash equivalents 103,966 - 103,966

----------- --------- -----------

Total 175,750 30,477 206,227

----------- --------- -----------

Financial liabilities

Senior

secured

notes

(*) 2,201,875 - 2,201,875

Trade and other payables - long

term - 149,404 149,404

Trade and other payables - short

term - 157,130 157,130

----------- --------- -----------

Total 2,201,875 306,534 2,508,409

----------- --------- -----------

ENERGEAN ISRAEL LIMITED

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(Amounts in thousands US Dollars, unless otherwise stated)

NOTE 3: FINANCIAL POSITION (Cont.)

Fair value hierarchy as of 31 December

2021

------------------------------------------

Audited

------------------------------------------

Level 1 Level 2 Total

-------------- ----------- -------------

Financial assets

Long term trade and other

receivables - 6,402 6,402

Loan to related party - 346,000 346,000

Long term restricted cash 100,000 - 100,000

Short term restricted cash 99,729 - 99,729

Short term trade and other

receivables - 22,176 22,176

Cash and cash equivalents 349,827 - 349,827

-------------- ----------- -------------

Total 549,556 374,578 924,134

-------------- ----------- -------------

Financial liabilities

Senior secured notes (*) 2,483,750 - 2,483,750

Trade and other payables

- long term - 59,727 59,727

Trade and other payables

- short term - 35,918 35,918

-------------- ----------- -------------

Total 2,483,750 95,645 2,579,395

-------------- ----------- -------------

(*) The senior secured notes are measured at amortised cost in

the Company's financial statements. The notes are listed for

trading on the TACT Institutional of the Tel Aviv Stock Exchange

Ltd. (the "TASE"). The carrying amount as of 30 September 2022 was

US$2,469 million and as of 31 December 2021 was US$2,463

million.

F. Trade and other payables:

30 September 31 December

2022 2021

------------ -----------

Unaudited Audited

------------ -----------

Current

Financial items

Trade accounts payable (1) 132,480 32,611

Payables to related parties 11,680 1,079

Deferred license payments (2) 12,101 -

Value added tax payable - 1,217

Current lease liabilities 869 1,011

------------ -----------

157,130 35,918

Non-Financial items

Accrued expenses (1) 35,719 5,611

Interest payable - 32,227

Sales consideration received in advance

(4) 55,468 -

Social insurance and other taxes 299 132

Income taxes - 227

------------ -----------

91,486 38,197

248,616 74,115

============ ===========

ENERGEAN ISRAEL LIMITED

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(Amounts in thousands US Dollars, unless otherwise stated)

NOTE 3: FINANCIAL POSITION (Cont.)

30 September 31 December

2022 2021

------------ -----------

Unaudited Audited

------------ -----------

Non-current

Financial items

Accrued expenses to related parties 281 294

Long term lease liabilities 2,123 2,203

Trade and other payables (3) 109,994 -

Deferred license payments (2) 37,006 57,230

------------ -----------

149,404 59,727

Non-Financial items

Contract Liability (4) - 53,537

149,404 113,264

============ ===========

(1) Trade payables and accrued expenses relate primarily to

development expenditure on the Karish project, with the main

contributors being FPSO and subsea construction costs. Trade

payables are non-interest bearing.

(2) In December 2016, the Company acquired the Karish and Tanin

leases for US$40 million of up front consideration plus contingent

consideration of US$108.5 million (paid over 10 equal instalments)

bearing interest at an annual rate of 4.6%. As at 30 September

2022, the total discounted deferred consideration was US$49 million

(31 December 2021: US$57million).

The Sale and Purchase Agreement ("SPA") includes provisions in

the event of Force Majeure that prevents or delays the

implementation of the development plan as approved under one lease

for a period of more than ninety (90) days in any year following

the final investment decision ("FID") date. In the event of Force

Majeure, the applicable annual payment of the remaining

consideration will be postponed by an equivalent period of time,

and no interest will be accrued in that period of time as well.

Due to the effects of the COVID-19 pandemic which constitute a

Force Majeure event, the deferred payment due in March 2022 was

postponed accordingly and payment thereof was made in September

2022

(3) Amount payable to Technip in respect of the EPCIC contract.

The amount is payable in eight equal instalments commencing

nine-months following practical completion of the project and

therefore has been discounted at 5.831% per annum.

(4) The sales consideration received in advance relates to the

agreement with Israel Natural Gas Lines ("INGL") for the transfer

of title (the "Hand Over") of the near shore and onshore part of

the infrastructure that will deliver gas from the Energean Power

FPSO into the Israeli national gas transmission grid. It is

intended that the hand over to INGL will become effective at least

90 days after the delivery of first gas from the Karish field,

which was achieved on 26 October 2022. Following Hand Over, INGL

will be responsible for the operation and maintenance of this part

of the infrastructure.

ENERGEAN ISRAEL LIMITED

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(Amounts in thousands US Dollars, unless otherwise stated)

NOTE 4: COMPREHENSIVE INCOME

30 September (Unaudited)

------------------------------

2022 2021

------------- -------------

General & administration expenses

Staff costs 1,115 946

Share-based payment charge included in

administrative expenses 128 129

Depreciation, depletion and amortisation

(Notes 3(A) and 3(B)) 352 71

Auditor fees 200 156

Other general & administration expenses 5,423 1,415

------------- -------------

Total administrative expenses 7,218 2,717

Exploration and evaluation expenses

Exploration costs written off (Note 6(K)). 1,277 -

------------- -------------

Total exploration and evaluation expenses 1,277 -

------------- -------------

Other expenses

Reversal of prior period provision - 5

Loss from property, plant and equipment

disposal 1,079 23

------------- -------------

Total other expenses 1,079 28

------------- -------------

Other income

Gain from disposal 53 3

------------- -------------

Total other income 53 3

------------- -------------

A. Operating loss:

.

ENERGEAN ISRAEL LIMITED

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(Amounts in thousands US Dollars, unless otherwise stated)

NOTE 4: COMPREHENSIVE INCOME (Cont.)

B. Net finance income (expenses):

30 September) Unaudited)

----------------------------

2022 2021

------------ ------------

Interest on bank borrowings - 76,890

Interest on senior secured notes (1) 102,505 68,047

Interest expense on long terms payables 8,716 2,267

Interest on shareholders loan - 9

Less amounts included in the cost of

qualifying assets (2) (107,177) (138,147)

------------ ------------

4,044 9,066

Finance and arrangement fees 3,681 14,383

Other finance costs and bank charges 319 53

Interest expenses from Hedging - 7,002

Unwinding of discount on decommissioning

liabilities 568 516

Interest on obligations for leases 238 142

Less amounts included in the cost of

qualifying assets (2) (3,919) (16,774)

------------ ------------

887 5,322

Total finance costs 4,931 14,388

Interest income from time deposits 2,543 965

Interest income from loans to related

parties 3,214 3,559

------------

Total finance income 5,757 4,524

Net foreign exchange gain (loss) 1,405 (1,140)

Net finance gain (loss) 2,231 (11,004)

------------ ------------

(1) See also Note 3(D)(1).

(2) See also Note 3(A).

NOTE 5: TAXATION

A. Tax income:

30 September (Unaudited)

----------------------------

2022 2021

Corporation tax - current year (290) (193)

Deferred tax income 2,953 4,102

------------ ------------

Total taxation income 2,663 3,909

============ ============

ENERGEAN ISRAEL LIMITED

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(Amounts in thousands US Dollars, unless otherwise stated)

NOTE 5: TAXATION (Cont.)

B. Deferred tax:

Deferred taxes, driven by the activity in Israel by the Israeli

Branch of the Company, are computed at an average tax rate of 23%,

based on the tax rates that are expected to apply upon reversal.

The deferred taxes are presented in the statement of financial

position as non-current assets. Below are the items for which

deferred taxes were recognised:

Accrued

expenses

Property, Right and other

plant and of short--term

equipment use liabilities

& asset Deferred Staff and other Provisions

intangible IFRS Tax expenses leaving long--term Derivative for

asset 16 losses for tax indemnities liabilities liability decommissioning Total

---------- ----- ------- -------- ----------- ----------- ---------- --------------- -------

At 1 January 2021 (12,140) (62) 9,325 - 63 293 1,591 8,769 7,839

Increase

(decrease) for

the year through:

Profit or loss (492) (700) 1,436 5,020 31 630 - (598) 5,327

Reclassification

for the

current year - - (6,011) 6,011 - - - - -

Other

comprehensive

income - - - - - - (1,591) - (1,591)

---------- ----- ------- -------- ----------- ----------- ---------- --------------- -------

At 31 December

2021 (12,632) (762) 4,750 11,031 94 923 - 8,171 11,575

========== ===== ======= ======== =========== =========== ========== =============== =======

Increase

(decrease) for

the period

through :

Profit or loss (12,743) (159) 22,448 (4,648) 43 11 - (1,999) 2,953

---------- ----- ------- -------- ----------- ----------- ---------- --------------- -------

At 30 September

2022 (25,375) (921) 27,198 6,383 137 934 - 6,172 14,528

========== ===== ======= ======== =========== =========== ========== =============== =======

ENERGEAN ISRAEL LIMITED

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(Amounts in thousands US Dollars, unless otherwise stated)

NOTE 6: SIGNIFICANTS EVENTS AND TRANSACTIONS DURING THE REPORTING PERIOD

A. Gas supply agreement with the Israel Electric Company

In March 2022, Energean signed a gas supply agreement with the

Israel Electric Company.

The gas price will be determined in each period, with volumes

determined on a daily basis.

The agreement is valid for an initial one-year period starting

from first gas from Karish, and includes an option to extend

subject to ratification by both parties.

B. Share Premium Capital reduction:

In April 2022 the Company reduced its share premium capital by

US$360 million and credited US$346 million against the shareholder

loan account plus accrued interest.

C. Termination of contract with Gas Buyer

In May 2022, further to the claims raised by the parties in the

related arbitration proceedings with Dalia Power Energies LTD

("Dalia") (including the counterclaim filed by the Company seeking

a declaration that Company is entitled to terminate the GSPA),

Dalia and the Company agreed to end all claims and disputes between

the parties. Both sides agreed that the Dalia GSPA (which

represented up to 0.8 bcm/year) was lawfully terminated, that the

arbitration proceedings were terminated, and that neither party

owes or will be liable to the other for any payment in connection

with and due to the Dalia GSPA, the arbitration proceedings and the

facts subject thereof. This was agreed to be final and

unappealable.

D. Contract signed with East Hagit Power Plant

In May 2022, the Company signed a new GSPA, representing up to

0.8 bcm/year, to supply gas to the East Hagit Power Plant Limited

Partnership ("EH Partnership"), a partnership between the Edeltech

Group and Shikun & Binui Energy. The GSPA is for a term of

approximately 15 years, for a total contract quantity of up to 12

bcm. The contract contains provisions regarding floor pricing,

offtake exclusivity and a price indexation mechanism (not Brent

price linked).

E. Drilling campaign offshore Israel:

The Company started its 2022 drilling campaign in March 2022,

which originally included three firm wells. In June 2022, the

Company exercised its contractual option to drill two further

wells. Subsequently, in October 2022 Energean exercised its option

to drill a sixth well, Hercules (located on block 23, offshore

Israel), which spudded in November 2022.

F. Athena Gas Discovery

In May 2022, a commercial discovery was made by the Athena

exploration well, located in block 12, in the A, B and C sands.

Subsequently in November 2022, Energean's reserve auditor, D&M,

certified contingent resources of 11.75 bcm in the Athena

discovery, an increase of 3.75 bcm on the Company's 8 bcm

preliminary estimate.

G. Claim submitted under the Karish-Tanin SPA

On 31 May 2022, NewMed Energy LP (previously Delek Drilling LP)

("NewMed") filed a lawsuit against the Company before the Tel Aviv

District Court. NewMed claimed that the remaining US$48 million

(US$65.1 million as of 31 May 2022) of outstanding contingent

consideration due under the SPA for the Karish and Tanin leases

(see Note 3(E)(2)) plus interest and indexation, should be

accelerated. The residual remedy requested is US$10.85 million plus

interest and indexation, reflecting the annual payment for the year

2021. The claim is purportedly based on a payment acceleration

mechanism set in the SPA, combined with NewMed's rejection of the

Company's Force Majeure claim.

ENERGEAN ISRAEL LIMITED

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(Amounts in thousands US Dollars, unless otherwise stated)

NOTE 6: SIGNIFICANTS EVENTS AND TRANSACTIONS DURING THE REPORTING PERIOD (Cont.)

In September 2022, the Company paid the annual installment and

filed its Statement of Defence with the court. NewMed then filed a

Reply in October 2022.

H. The FPSO sailed away from Singapore and arrived on location in Israel on 5 June 2022.

J. Bank Guarantee Facility:

On 8 June 2022 the Company's guarantee facility was extended and

amended to a total of NIS355 million instead of NIS250 million. The

facility is secured by Energean PLC parent company guarantee of

US$112 million. This facility is valid until 30 April 2023.

K. Zone D:

On 27 July 2022, the Company sent a formal notice to the

Ministry of Energy notifying the relinquishment of Zone D and

discontinuation of related work. As such, the licences subsequently

expired on 27 October 2022.

NOTE 7: SIGNIFICANTS EVENTS AND TRANSACTIONS AFTER THE REPORTING PERIOD

A. Hermes Gas Discovery:

In October 2022, the Hermes exploration well, block 31, offshore

Israel, made a commercial gas discovery. Preliminary estimates

indicate that the structure contains 7-15 bcm of recoverable

natural gas resources.

B. Liquids Contract:

In October 2022, Energean signed a sale and purchase agreement

with Vitol for the marketing of a number of cargoes of Karish blend

hydrocarbon liquids. Energean expects, based on analysis of

individual well test samples, that the Karish blend will trade at a

similar price point to Asgard blend, given the similarity in their

characteristics. The realised price will be market price less

certain freight, logistics and marketing costs.

C. First gas from Karish:

On 26 October 2022, first gas was delivered at the Karish field,

offshore Israel.

D. Zeus Gas Discovery:

In November 2022, the Zeus exploration well, block 12, offshore

Israel, made a commercial discovery with preliminary estimates

indicating that the structure contains 13.3 bcm of recoverable

natural gas resources.

The results from the Zeus well and the Athena post-well analysis

provide Energean with additional confidence about the volumes and

commerciality of the Olympus area, and the Company is now

progressing its field development plan. Energean now has discovered

resource volumes of 25 bcm and a further 42 bcm has been de-risked

in the Olympus Area. Energean expects to update the market on the

total resource volumes within the Olympus area in early 2023. This

update will be based upon a Competent Persons Report that is being

undertaken by D&M.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFSSFLLLIIF

(END) Dow Jones Newswires

December 01, 2022 10:30 ET (15:30 GMT)

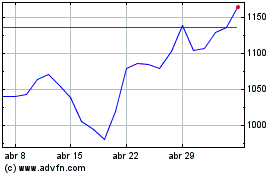

Energean (LSE:ENOG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Energean (LSE:ENOG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024